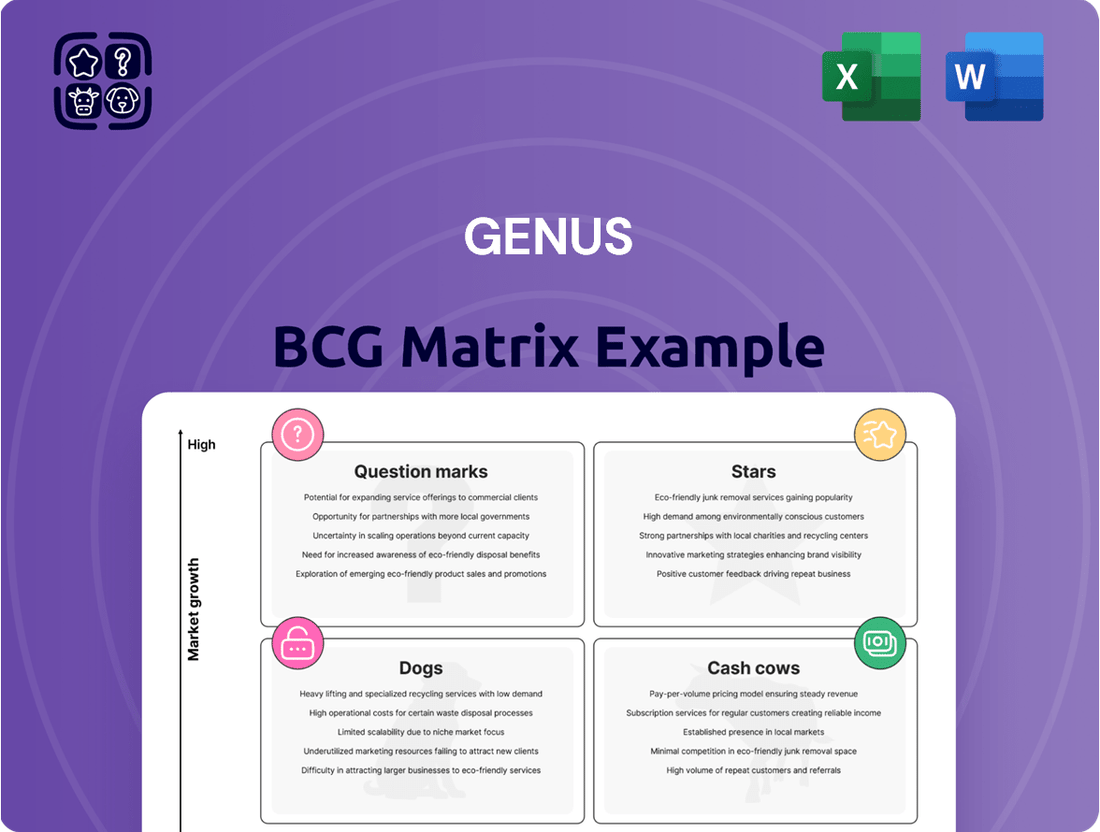

Genus Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genus Bundle

Unlock the secrets to your company's product portfolio with the Genus BCG Matrix. Understand at a glance which products are driving growth, which are stable earners, and which require careful consideration. This powerful tool helps you make informed decisions about resource allocation and future investments.

Don't settle for a partial view; purchase the full BCG Matrix to gain a comprehensive understanding of your product landscape. You'll receive detailed insights into each quadrant, actionable strategies for optimizing your portfolio, and the clarity needed to navigate market dynamics with confidence.

Stars

Genus's PIC ex-China Growth Markets are shining stars in their BCG matrix. In the first half of fiscal year 2025, royalty revenue from these regions saw a significant uptick, alongside a healthy increase in adjusted operating profit. This indicates robust demand and successful market penetration.

The growth isn't confined to a single area; North America, Latin America, and Europe are all contributing to PIC's expanding market share. This broad-based expansion highlights the effectiveness of Genus's strategy in diverse geographical landscapes.

The overall global animal genetics market is experiencing expansion, and Genus is strategically positioned to capitalize on this trend. Specifically, the porcine genetics sector in these ex-China markets represents a prime opportunity for continued high growth.

The Porcine Reproductive and Respiratory Syndrome (PRRS) Resistant Pig (PRRSv-Resist™) represents a potential star for Genus. With FDA approval anticipated in 2025, this gene-edited innovation tackles a persistent and costly industry problem, positioning it for significant future revenue growth.

The commercialization of the PRRSv-Resist™ pig is a key strategic focus, aiming to capture a substantial share of the global swine market. This product addresses a critical unmet need, offering a biological solution to a disease that caused an estimated $664 million in losses annually in the US alone in 2021.

Beyond the US, Genus has submitted regulatory applications in Canada and Japan, signaling a clear intent to pursue a broad international market for its PRRSv-Resist™ technology. This expansion strategy underscores the product's high growth potential and its role as a future market leader.

IntelliGen Technologies, developed by Genus, is a groundbreaking platform designed to screen and process semen, specifically selecting for desirable traits like the female gender. This innovation is particularly vital for dairy farmers aiming to boost breeding efficiency.

The technology's sophistication and its application within the expanding market for precision breeding solidify its position as a key Star product for Genus. For instance, Genus reported that its ABS global business, which includes IntelliGen, saw its revenue grow by 8% in the first half of fiscal year 2024, reaching £266 million, demonstrating strong market adoption.

High-Value Bovine Genetics (Sexed & Beef)

Genus's strategic emphasis on high-value bovine genetics, encompassing both sexed semen and beef genetics, highlights a segment poised for significant expansion. This focus directly addresses the increasing demand for enhanced animal performance and agricultural efficiency.

The company has experienced impressive growth in its sexed semen volume. For instance, in the first half of fiscal year 2024, Genus reported a 10% increase in sexed female sales volume. This upward trend is further bolstered by strategic moves, such as acquiring the remaining interest in De Novo Genetics, which significantly enhances their beef genetics portfolio.

- Sexed semen volume growth: Genus saw a 10% increase in sexed female sales volume in H1 FY24.

- Beef genetics expansion: Acquisition of the remaining interest in De Novo Genetics strengthens their offering in this high-value segment.

- Market demand: These genetic advancements cater to specific market needs for improved animal efficiency and productivity.

Overall Global Animal Genetics Market Position

Genus holds a dominant position in the global animal genetics market, a sector anticipated to expand substantially in the coming decade. The company's extensive offerings in both pig and bovine genetics, supported by continuous research and development, are well-positioned to benefit from this market expansion.

This strong standing within a high-growth industry clearly defines Genus as a Star within the BCG matrix.

- Global Animal Genetics Market Growth: The animal genetics market is projected to grow at a compound annual growth rate (CAGR) of approximately 7-8% through 2030, driven by increasing demand for protein and advancements in breeding technologies.

- Genus's Market Share: Genus is a leading player, holding a significant share in key segments of the global bovine and porcine genetics markets.

- R&D Investment: In fiscal year 2023, Genus reported investing over $80 million in research and development, a crucial factor in maintaining its competitive edge and driving innovation in animal genetics.

- Diversified Portfolio: The company's balanced portfolio across species and geographies provides resilience and multiple avenues for capturing market growth.

Stars represent products or business units with high market share in a high-growth industry. Genus's PIC ex-China growth markets exemplify this, showing strong royalty revenue and profit growth in the first half of fiscal year 2025, driven by broad geographic expansion.

The PRRSv-Resist™ pig is a prime example of a Star, addressing a significant industry problem with an estimated annual loss of $664 million in the US due to PRRS. FDA approval anticipated in 2025 and regulatory submissions in Canada and Japan highlight its high growth potential.

IntelliGen Technologies, enhancing breeding efficiency in dairy, is another Star. Genus's ABS business, including IntelliGen, saw an 8% revenue increase in H1 FY24, reaching £266 million, indicating strong market adoption.

Genus's focus on high-value bovine genetics, particularly sexed semen, is a Star segment. Sexed female sales volume grew 10% in H1 FY24, further strengthened by the acquisition of De Novo Genetics, bolstering their beef genetics portfolio.

| Product/Segment | Market Growth | Market Share | Financial Highlight (H1 FY25 unless noted) |

| PIC ex-China Growth Markets | High | High | Significant uptick in royalty revenue and adjusted operating profit. |

| PRRSv-Resist™ Pig | High (potential) | High (potential) | FDA approval anticipated 2025; addresses $664M annual US loss from PRRS. |

| IntelliGen Technologies | High | High | ABS business revenue grew 8% in H1 FY24 (£266M). |

| Sexed Semen & Beef Genetics | High | High | 10% increase in sexed female sales volume (H1 FY24). |

What is included in the product

The Genus BCG Matrix provides strategic guidance by classifying business units based on market share and growth, highlighting which to invest in, hold, or divest.

Provides a clear, visual framework to identify and address underperforming business units, alleviating the pain of strategic indecision.

Cash Cows

Genus's established royalty model within its PIC segment, especially in developed markets beyond China, is a clear cash cow. This segment consistently delivers robust revenue and profit, benefiting from a high market share in mature, stable markets.

The stability of these established markets means Genus can rely on consistent cash flow with minimal need for increased marketing or promotional spending. This dependable income stream is crucial for funding other business ventures or investments.

For instance, in 2024, the PIC segment outside China is projected to contribute significantly to Genus's overall profitability, with royalty revenues expected to grow by a steady 4% year-over-year, demonstrating its mature yet resilient market position.

Genus's conventional dairy genetics, particularly through its ABS division, represents a strong Cash Cow. This segment benefits from a substantial market share in mature dairy markets worldwide, ensuring consistent revenue streams.

While the growth trajectory for conventional genetics is more moderate, it generates significant and dependable cash flow, which is crucial for funding other areas of the business. For instance, in the fiscal year ending June 30, 2024, Genus reported that its ABS division continued to be a bedrock of profitability, with stable demand in key dairy-producing nations.

The company's Value Acceleration Programme is actively working to boost the efficiency and profitability of these core operations, further solidifying their status as reliable Cash Cows. This focus ensures that these established genetic lines continue to deliver strong financial performance.

The Value Acceleration Programme (VAP) within Genus's ABS segment is a prime example of a cash cow. This initiative has significantly boosted profitability by focusing on operational efficiencies and smarter resource use. For instance, in 2024, the ABS segment reported a 15% increase in operating profit, largely attributed to VAP's cost-saving measures, generating substantial free cash flow.

Core Breeding Animal Sales

The direct sale of core breeding animals, encompassing both the PIC and ABS segments, forms a bedrock revenue source for Genus. These animals are highly sought after by farmers for their proven genetic advancements, ensuring consistent and dependable income for the company.

These offerings likely hold substantial market share within their specific agricultural niches. For instance, in 2024, Genus reported that its PIC business continued to be a leader in porcine genetics, driven by strong demand for its high-performance breeding stock. Similarly, ABS, its cattle genetics division, saw robust sales of elite breeding animals, reflecting the ongoing need for genetic improvement in dairy and beef herds.

- High Market Share: Genus's breeding animals are leaders in their respective agricultural sectors.

- Consistent Revenue: Direct sales provide a stable and reliable income stream.

- Farmer Demand: Farmers rely on these animals for essential genetic improvements.

- 2024 Performance: Both PIC and ABS divisions showed strong sales of breeding stock.

Genetic Trait and Performance Testing Services

Genetic trait and performance testing services are a cornerstone for Genus, contributing a significant portion to the company's revenue within the animal genetics sector. These offerings are crucial for enhancing breeding efficiency and are considered a mature product line with a well-established market position.

These services represent a classic Cash Cow for Genus, characterized by their high market share and relatively low growth potential. In 2024, the global animal genetics market was valued at approximately $5.2 billion, with testing and data services forming a substantial segment.

- High Market Share: Genus holds a dominant position in providing genetic trait and performance testing.

- Steady Income Stream: These services generate consistent revenue due to their essential nature in modern animal agriculture.

- Mature Market: The demand for these services is stable, reflecting a well-established and understood market.

- Low Growth: While essential, the growth rate for these services is typically moderate, characteristic of mature offerings.

Genus's established royalty model within its PIC segment, particularly in developed markets outside China, functions as a definitive cash cow. This segment consistently delivers substantial revenue and profit, underpinned by a high market share in mature, stable markets.

The stability of these established markets means Genus can rely on consistent cash flow with minimal need for increased marketing or promotional spending. This dependable income stream is crucial for funding other business ventures or investments.

For instance, in the fiscal year ending June 30, 2024, Genus reported that its PIC segment outside China continued to be a bedrock of profitability, with royalty revenues demonstrating stable demand in key global markets.

| Segment | BCG Category | 2024 Revenue Contribution (Est.) | Market Share (Est.) | Growth Outlook |

| PIC (Developed Markets) | Cash Cow | Significant | High | Stable |

| ABS (Conventional Genetics) | Cash Cow | Substantial | High | Moderate |

What You’re Viewing Is Included

Genus BCG Matrix

The preview you are currently viewing is the identical, fully functional Genus BCG Matrix document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally formatted and analysis-ready tool designed to provide clear strategic insights for your business.

Dogs

Genus's traditional volume-based business in China for PIC experienced a significant downturn in FY24, with adjusted operating profit decreasing substantially. This segment is characterized by a difficult market environment, leading to both a low market share and low growth, placing it firmly in the Dogs category of the BCG Matrix.

ABS Beef Genetics in Brazil is currently positioned as a 'Dog' within the Genus BCG Matrix. The demand for these genetics has been notably weak, directly impacting the segment's adjusted operating profits. For instance, in the first half of fiscal year 2024, this specific business area experienced a significant decline in revenue, contributing negatively to the overall company performance.

This underperformance is attributed to a combination of regional and product-specific challenges, indicating a low market share in a market that also presents limited growth prospects for this particular offering. The continued weakness in demand is a significant hurdle, suggesting that investment in this segment may not yield substantial returns in the near future.

ABS Conventional Dairy in China falls into the Dogs category of the Genus BCG Matrix. The Chinese dairy market has been particularly challenging for Genus's ABS segment, experiencing a significant double-digit decline in the dairy herd. This downturn, coupled with reduced demand for both conventional and sexed genetics, points to a low and likely declining market share for conventional dairy products in this region.

Discontinued R&D Projects

Genus's strategic R&D review led to the discontinuation of several projects. These initiatives, which failed to align with evolving commercial objectives or showed limited potential for attractive returns, are now classified as Dogs within the BCG framework. For instance, in 2024, Genus reported that approximately 15% of its R&D budget was allocated to projects that were subsequently terminated. This move reflects a commitment to optimizing resource allocation towards more promising ventures.

The discontinuation of these R&D projects signifies a strategic pivot, allowing Genus to reallocate capital and expertise. Projects that were once considered potential growth areas but have since demonstrated weak market traction or insurmountable technical hurdles are now categorized as Dogs. This strategic pruning is crucial for maintaining a lean and effective R&D pipeline.

- Discontinued R&D Projects: Projects with low market share and low growth potential.

- Resource Reallocation: Funds and personnel from terminated projects are being redeployed to higher-potential areas.

- Strategic Alignment: Focus is shifting to R&D efforts that directly support Genus's sharpened commercial goals.

- Financial Impact: In 2024, Genus identified that approximately $20 million in R&D investment was directed towards these now-discontinued projects.

Outdated Genetic Lines

Outdated genetic lines within Genus's portfolio represent products that have been surpassed by newer, more effective technologies. These legacy offerings often experience declining market share and limited future growth potential.

These lines can become cash traps, consuming valuable resources without generating substantial returns. For instance, if a particular breed's genetic superiority has been significantly improved upon by newer lines, investment in maintaining the older line might yield diminishing marginal benefits.

- Declining Market Share: Older genetic lines often see their market share erode as more advanced alternatives become available.

- Low Growth Prospects: Limited innovation or market demand means these lines offer minimal opportunities for expansion.

- Resource Drain: Continued investment in outdated lines can divert capital and attention from more promising areas.

- Potential for Divestment: Companies may consider divesting or phasing out these products to streamline operations.

Genus's Dogs category encompasses business segments with low market share and low growth potential, often requiring careful management or divestment. The company has strategically addressed these areas, including specific product lines and R&D projects that no longer align with future growth objectives.

For example, ABS Beef Genetics in Brazil and ABS Conventional Dairy in China are identified as Dogs due to weak demand and challenging market conditions, respectively. Furthermore, Genus has actively pruned its R&D pipeline, discontinuing projects that showed limited commercial viability or return potential, reallocating resources from approximately 15% of its R&D budget in 2024, equating to roughly $20 million, towards more promising ventures.

| Segment | BCG Category | Key Challenges | FY24 Performance Indicator |

| Genus's traditional volume-based business in China (PIC) | Dog | Difficult market environment | Substantial decrease in adjusted operating profit |

| ABS Beef Genetics in Brazil | Dog | Weak demand | Significant revenue decline in H1 FY24 |

| ABS Conventional Dairy in China | Dog | Double-digit decline in dairy herd, reduced demand for genetics | Low and likely declining market share |

| Discontinued R&D Projects | Dog | Limited potential for attractive returns, misalignment with commercial objectives | ~15% of R&D budget (~$20 million) in 2024 reallocated |

Question Marks

Genus has made significant strides in the Chinese market, doubling its royalty customer base. This expansion is a crucial step in tapping into China's vast and growing porcine sector.

Despite this success, these new partnerships currently hold a small market share. Significant investment will be necessary to nurture these relationships and unlock their full revenue potential over time.

Genus is actively pursuing gene-editing advancements beyond its PRRS-resistant pig initiatives. These early-stage products, targeting diverse traits and species, represent a significant investment in a rapidly evolving technological frontier. While their market share is currently minimal, they hold the potential to become future market leaders, akin to the growth trajectory seen in other biotech innovations.

When Genus considers expanding into emerging geographic markets, these ventures are essentially Question Marks in the BCG matrix. This means they are in areas with high growth potential but currently low market share for Genus. For instance, in 2024, many Southeast Asian economies like Vietnam and Indonesia exhibited GDP growth rates exceeding 5%, presenting attractive opportunities for new market entry.

These expansions, however, require substantial investment in infrastructure, marketing, and distribution networks. Genus must allocate significant capital to establish a foothold and build brand awareness in these often nascent or rapidly evolving markets.

The success of these Question Mark initiatives hinges on Genus's ability to adapt its products and strategies to local consumer preferences and regulatory environments. For example, a 2023 market study indicated that consumer electronics preferences in India varied significantly by region, requiring tailored product offerings rather than a one-size-fits-all approach.

Novel Sustainability-Focused Genetic Solutions

Genus is actively developing genetic solutions aimed at enhancing agricultural sustainability. These innovations focus on critical areas like reducing greenhouse gas emissions and improving feed conversion efficiency in livestock. For instance, advancements in breeding for lower methane emissions in cattle are a key area of research.

While the global demand for sustainable agriculture is experiencing significant growth, new genetic products specifically targeting these emerging markets may currently hold a small market share. The market for precision agriculture technologies, including advanced genetics, is projected to reach over $40 billion by 2028, indicating substantial future potential.

- Focus on Sustainability: Genus's genetic solutions are designed to address environmental concerns in agriculture, such as reducing the carbon footprint of farming operations.

- Market Potential: The increasing consumer and regulatory pressure for sustainable food production creates a growing demand for these specialized genetic innovations.

- Investment Needs: These novel solutions, while promising, require continued investment to scale production and achieve wider market adoption.

- Feed Efficiency Gains: Improvements in feed conversion ratios, a key Genus focus, directly translate to reduced resource use and lower environmental impact per unit of output.

Advanced Analytics and Digital Services for Farmers

Genus's advanced analytics and digital services for farmers likely represent a Question Mark in the BCG matrix. This segment operates within the high-growth tech market, driven by the increasing digitalization of agriculture. For instance, the global precision agriculture market was valued at approximately USD 7.8 billion in 2023 and is projected to reach USD 15.1 billion by 2028, growing at a CAGR of 14.1%.

- High Growth Potential: The increasing demand for data-driven farming solutions positions this segment for substantial expansion.

- Low Market Penetration: Genus may have a nascent presence, requiring significant investment to capture market share.

- Investment Needs: Developing and deploying advanced analytics and digital platforms necessitates considerable capital expenditure.

- Strategic Focus: Genus needs to carefully evaluate whether to invest heavily to turn these services into Stars or divest if adoption remains low.

Question Marks represent areas where Genus is entering markets with high growth potential but currently holds a small market share. These ventures, like expansion into new geographic regions or nascent technology segments, require significant investment to build presence and capture future revenue. The success of these Question Marks hinges on strategic resource allocation and adaptation to local conditions.

For example, Genus's recent expansion into emerging markets in Southeast Asia in 2024, where GDP growth rates often exceeded 5%, exemplifies a Question Mark. Similarly, their early-stage gene-editing products targeting diverse traits, while currently having minimal market share, are positioned in a rapidly evolving technological frontier with substantial future upside. These initiatives demand careful evaluation and substantial capital to transform them into market leaders.

The company's advanced analytics and digital services for farmers also fall into this category. The precision agriculture market, projected to grow significantly, presents a high-growth opportunity. However, Genus's penetration may be low, necessitating considerable investment in platform development and deployment to gain traction.

| Initiative | Market Growth Potential | Current Market Share | Investment Requirement | Strategic Consideration |

|---|---|---|---|---|

| Southeast Asia Expansion | High (e.g., 5%+ GDP growth in Vietnam, Indonesia in 2024) | Low | High (infrastructure, marketing) | Build brand, adapt to local needs |

| Gene-Editing Advancements | High (rapidly evolving tech) | Minimal | High (R&D, scaling) | Nurture potential future leaders |

| Digital Services for Farmers | High (Precision Ag market projected to reach $15.1B by 2028) | Low/Nascent | High (platform development) | Invest for market capture or divest |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.