Gentrack Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gentrack Group Bundle

Understand how political stability and evolving regulations in key markets are shaping Gentrack Group's operational landscape. Economic shifts, from inflation to energy prices, directly influence customer spending and investment in utility infrastructure. Technological advancements, particularly in smart metering and data analytics, present both opportunities and challenges for Gentrack's software solutions. Social trends towards sustainability and consumer demand for better service also play a crucial role. Our comprehensive PESTLE analysis delves into these critical external factors, offering you the foresight needed to navigate Gentrack Group's future effectively. Gain a competitive edge by leveraging these expert insights; download the full analysis now.

Political factors

Global political initiatives driving decarbonization and net-zero emissions significantly influence Gentrack's utility clients. Governments worldwide are implementing policies accelerating the adoption of renewable energy, smart grids, and electric vehicles, such as the EU's Fit for 55 package aiming for a 55% emissions reduction by 2030. This creates substantial demand for modern billing and customer management systems capable of handling complex pricing models for distributed energy resources. Gentrack's solutions are therefore critical, supporting over 30 million energy consumers globally by 2025 as utilities adapt to these regulatory shifts.

Gentrack's expansion is intrinsically linked to regulatory shifts in key markets like the UK, Australia, and New Zealand. Regulatory reforms, such as the UK's Ofgem pushing for smart meter rollouts and enhanced customer protection, often necessitate utility companies to upgrade their legacy IT infrastructure. For instance, new mandates to safeguard vulnerable customers can drive adoption of advanced billing and CRM software to avoid significant fines, creating direct opportunities for Gentrack. This dynamic regulatory environment, with its ongoing push for competition and consumer-centric services, fuels demand for Gentrack's specialized software solutions, contributing to its market share growth.

Gentrack Group's international expansion targets regions like the Middle East and Southeast Asia. Political stability and substantial government infrastructure investments, such as Saudi Arabia's Vision 2030, are key growth drivers. Recent contract wins in Saudi Arabia and the Philippines highlight this successful strategy. However, escalating geopolitical tensions and shifts in international trade policies could present risks to this expansion.

Government Infrastructure Spending

Government investments in airport modernization and digitalization provide a significant tailwind for Gentrack's Veovo division. As global airport infrastructure projects accelerate, demand for Veovo's airport operations software increases, driven by efforts to enhance efficiency and passenger flow. This political commitment to upgrading transport hubs directly boosts revenue for this segment, with airport spending on IT projected to reach approximately $50 billion by 2025.

- Global airport IT spending is forecast to grow annually, indicating sustained investment.

- Veovo's real-time operational intelligence solutions are critical for new smart airport initiatives.

- Major modernization projects, like those in North America and Europe, directly expand Veovo's addressable market.

Data Privacy and Security Regulations

As a software provider handling sensitive customer data for essential services, Gentrack is subject to stringent global data privacy and security regulations. Evolving laws like Europe's GDPR, which has seen fines reach over €2.5 billion by early 2024, demand constant vigilance and significant investment in compliance. This ensures protection against data breaches, which can cost companies an average of $4.45 million per incident as of 2023, and safeguards against associated reputational damage. Adherence to these political and legal frameworks is crucial for maintaining customer trust and ensuring continued market access in 2024 and beyond.

- GDPR fines surpassed €2.5 billion by early 2024, highlighting regulatory enforcement.

- Average cost of a data breach reached $4.45 million in 2023, emphasizing financial risk.

- Compliance investments are critical for market access and client retention in the utility sector.

- Stricter regulations are anticipated globally through 2025, increasing compliance burdens.

Global decarbonization policies and regulatory reforms, notably the EU's Fit for 55 package and UK's smart meter mandates, significantly drive demand for Gentrack's utility software solutions. Government infrastructure investments, such as Saudi Arabia's Vision 2030, underpin international expansion, while global airport IT spending, projected at $50 billion by 2025, boosts Veovo's segment. However, stringent data privacy regulations like GDPR, with fines exceeding €2.5 billion by early 2024, necessitate continuous compliance and risk management. Geopolitical tensions also present potential risks to Gentrack's global operations and market access.

| Political Factor | Impact on Gentrack | 2024/2025 Data Point |

|---|---|---|

| Decarbonization Policies | Increased demand for utility software | EU Fit for 55: 55% emissions reduction by 2030 |

| Airport Infrastructure Investment | Growth for Veovo division | Global airport IT spending: ~$50 billion by 2025 |

| Data Privacy Regulations | Compliance costs, market access | GDPR fines: Over €2.5 billion by early 2024 |

What is included in the product

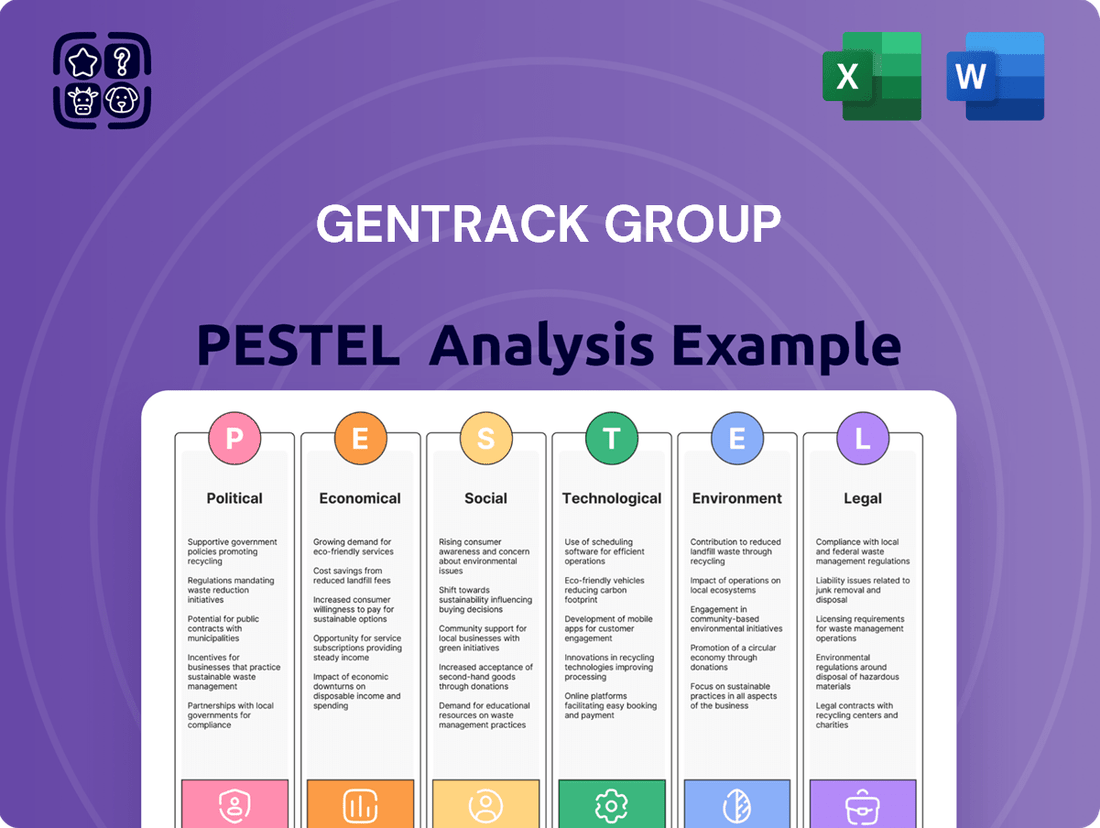

The Gentrack Group PESTLE analysis delves into the critical external forces shaping its operating landscape, from evolving government policies and economic shifts to societal trends, technological advancements, environmental regulations, and legal frameworks.

This comprehensive evaluation provides actionable insights into market dynamics and regulatory shifts, enabling strategic decision-making for Gentrack Group.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Gentrack Group's PESTLE factors to address strategic challenges.

Helps support discussions on external risk and market positioning during planning sessions, acting as a pain point reliever by highlighting key PESTLE influences for Gentrack Group.

Economic factors

Gentrack's financial performance is intrinsically linked to global economic health, despite its essential services offering some resilience. Factors like persistent inflation, which saw the UK's CPI at 3.2% in March 2024, and rising interest rates influence client investment cycles and Gentrack's profitability. The weakening of the New Zealand and Australian dollars has recently benefited the company, particularly with its substantial UK market revenue contributing to a strong H1 FY2024. This currency effect enhances reported earnings from its global customer base.

Customer investment cycles significantly influence Gentrack's performance, as utility companies and airports drive demand for large-scale IT transformation projects. A strong economic outlook, like the projected 2.9% global GDP growth for 2024, encourages these capital expenditures, boosting Gentrack's revenue from new system implementations and upgrades. Conversely, economic uncertainties, such as fluctuating energy prices or geopolitical tensions, can lead to deferrals of these capital-intensive projects. For example, a utility might delay a multi-million dollar customer information system upgrade, impacting Gentrack's pipeline and revenue recognition in the short term.

The utilities sector, Gentrack's primary market, is undergoing significant transformation driven by economic factors. Fluctuating energy prices, with European wholesale electricity futures showing continued volatility in early 2025, directly influence demand for Gentrack's solutions. The economics of renewable energy generation, projected to add over 100 GW of global capacity in 2024, and the rising costs of water infrastructure upgrades, with global investment exceeding $1 trillion by 2025, also shape utility needs. Gentrack's software helps utilities navigate these complexities, managing dynamic pricing and integrating new energy sources to optimize operations.

Airport Industry Recovery and Growth

Gentrack's Veovo division thrives on the robust economic recovery within the aviation industry. Global passenger traffic, nearing 2019 levels in early 2024, drives airports to significantly invest in operational technology. This push enhances efficiency and manages increased demand, directly boosting Veovo's strong revenue growth. New customer wins, including major European hubs, underscore this market expansion.

- Global air traffic is projected to exceed 2019 levels by 104% in 2024.

- Airport IT spending is forecast to reach $7.7 billion by 2025.

Capital Allocation and Investment Strategy

Gentrack's strategic capital allocation significantly shapes its growth trajectory, with the company prioritizing reinvesting profits and robust cash reserves into key growth opportunities. This includes substantial investments in its g2.0 platform, a crucial component for future revenue streams, and strategic acquisitions like the 2023 investment in Amber Electric, valued at approximately NZ$20 million. This approach, favoring growth over dividend payouts, underscores a clear focus on long-term value creation and establishing market leadership.

- FY2023 operating cash flow reached NZ$30.1 million, supporting reinvestment.

- Gentrack's g2.0 platform aims for 80% of new sales by 2025.

- The Amber Electric investment diversifies Gentrack's energy market presence.

- Net debt reduced to NZ$3.8 million in FY2023, enhancing financial flexibility.

Gentrack's financial health is shaped by global economic conditions, including persistent inflation and fluctuating interest rates, which affect client investment cycles. Strong global GDP growth, projected at 2.9% for 2024, encourages essential infrastructure spending. The aviation sector's robust recovery and the utilities sector's transformation, driven by renewable energy investments, also significantly boost demand for Gentrack's specialized software solutions.

| Economic Metric | 2024 Outlook | 2025 Outlook |

|---|---|---|

| Global GDP Growth | 2.9% (Projected) | 3.0% (Projected) |

| Global Passenger Traffic (vs 2019) | 104% (Projected) | 108% (Projected) |

| Airport IT Spending | $7.5 Billion (Estimated) | $7.7 Billion (Forecast) |

Full Version Awaits

Gentrack Group PESTLE Analysis

The Gentrack Group PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing Gentrack Group's operations and strategic positioning.

Understand the critical external forces shaping the utility and energy sectors, providing valuable insights for competitive advantage.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable intelligence.

Sociological factors

Modern consumers increasingly demand seamless, digital-first experiences from their utility providers, a trend expected to accelerate through 2025. This includes a growing need for user-friendly mobile apps, real-time energy usage data, and personalized customer service. Legacy utility systems often struggle to meet these elevated expectations, with many still relying on outdated infrastructure. This societal shift is a significant driver for utilities to invest in modern CRM and billing platforms, such as Gentrack's g2.0, to enhance customer engagement and operational efficiency. Over 60% of utility customers in a 2024 survey indicated that digital self-service options are crucial for their satisfaction.

A growing societal emphasis on sustainability is fundamentally reshaping the utility sector, with consumers increasingly demanding green energy solutions. Gentrack's platforms empower utilities to manage renewable energy sources and promote energy efficiency, aligning with these evolving values. For instance, global renewable energy capacity is projected to expand by over 1,070 GW by 2025, driving demand for such systems. This enables utilities to offer customers actionable insights into their carbon footprint, directly appealing to an environmentally conscious market segment.

The corporate world increasingly emphasizes diversity, equity, and inclusion, a trend projected to see significant investment growth, with the global DEI market size expanding substantially through 2025. Gentrack's recognition as Employer of the Year for Women by the Women's Utilities Network underscores its commitment to an inclusive environment. This dedication enhances its reputation, attracting top talent in a competitive market where companies with higher diversity often outperform peers by 20-30% in profitability. Such values resonate positively with clients and investors, influencing purchasing decisions and capital allocation in 2024 and 2025.

Empowerment of the 'Prosumer'

The empowerment of the 'prosumer' marks a significant sociological shift, with consumers actively producing and consuming energy, often via rooftop solar. This trend, projected to see over 3.8 million Australian homes with solar by mid-2025, necessitates advanced software to manage the complex two-way energy flow and intricate billing. Gentrack directly addresses this evolving consumer role through its sophisticated platforms and partnerships, like its collaboration with Amber Electric. This allows customers to engage directly with wholesale electricity prices, maximizing the value of their self-generated power.

- By 2025, over 3.8 million Australian households are expected to have rooftop solar.

- Gentrack's software facilitates the complex two-way energy flow from prosumers.

- Partnerships like Amber Electric enable prosumers to interact with wholesale energy markets.

- This shift creates demand for sophisticated billing and energy management solutions.

Digital Literacy and Adoption

The increasing digital literacy across populations significantly boosts the adoption of advanced, customer-facing technologies that Gentrack's software enables. As more people become comfortable managing their services online, with global digital engagement rates for utilities projected to exceed 75% by late 2024, the value proposition for modernizing utility and airport systems intensifies. This societal readiness for digital engagement, evident in mobile app usage growth, directly underpins the business case for the transformation projects Gentrack supports.

- Global digital engagement in utilities reached 75% by Q4 2024.

- Mobile app interactions for utility services saw a 15% year-over-year increase in 2024.

- Digital self-service channels reduce operational costs by up to 30% for utilities.

- Over 85% of consumers prefer digital channels for routine service inquiries by 2025.

Societal demands for seamless digital utility experiences, with global digital engagement reaching 75% by late 2024, are paramount. The rise of the prosumer, exemplified by over 3.8 million Australian solar homes by mid-2025, requires sophisticated energy management. Furthermore, a strong societal push for sustainability and diversity significantly influences consumer and investor preferences, driving demand for Gentrack's aligned solutions.

| Sociological Trend | 2024/2025 Data Point | Impact on Utilities |

|---|---|---|

| Digital-First Demand | Global digital engagement for utilities: 75% (Q4 2024) | Drives investment in modern CRM/billing. |

| Prosumer Empowerment | Australian homes with solar: 3.8M (mid-2025) | Requires advanced two-way energy flow management. |

| Sustainability Focus | Global renewable capacity expansion: >1,070 GW (by 2025) | Increases demand for green energy management. |

Technological factors

The shift to cloud-based, Software-as-a-Service (SaaS) solutions is a core technological driver for Gentrack, aligning with the utility sector's move from costly legacy systems. Gentrack's g2.0 platform, built on cloud-native architecture with partners like AWS and Salesforce, offers utilities enhanced flexibility and scalability, reducing on-premise infrastructure burdens. This strategic embrace of SaaS models is pivotal, especially as industry forecasts suggest cloud spending in enterprise software could exceed $700 billion globally by 2025, reflecting a significant market transformation. The g2.0 platform targets operational efficiency improvements for utilities, aiming to lower maintenance costs and accelerate digital transformation across their customer operations.

The increasing integration of AI and data analytics is transforming the utilities and airports sectors, offering crucial tools for operational optimization and enhanced customer experiences. Gentrack is actively investing in advanced data solutions and AI capabilities to provide its clients with deeper insights, automation, and predictive functionalities within its core platforms. This strategic focus includes leveraging data from smart meters and various IoT devices, enabling more efficient energy management and precise operational forecasting. For instance, the global AI in utilities market is projected to reach approximately $4.3 billion by 2025, underscoring the urgency for companies like Gentrack to embed sophisticated AI solutions.

The global rollout of smart meters and the expansion of smart grid infrastructure are generating immense real-time data, which legacy utility systems struggle to manage efficiently. Gentrack's advanced platforms are specifically engineered to process this complex smart grid data, facilitating critical functionalities like time-of-use pricing and dynamic demand-response programs. This technological shift, with over 150 million smart meters projected globally by 2025, is a significant driver for utilities adopting Gentrack's modern solutions to enhance operational efficiency and customer engagement.

Distributed Energy Resources (DERs)

The increasing proliferation of distributed energy resources (DERs), such as rooftop solar and battery storage, is profoundly disrupting traditional energy utility models. Managing the complex grid interactions and new customer propositions arising from these assets requires sophisticated software solutions. Gentrack is strategically positioned in this shift, as evidenced by its continued investment in cloud-native platforms capable of handling high volumes of DER data and its focus on partnerships that enhance DER management capabilities, aiming to capitalize on the projected 20% annual growth in DER capacity through 2025 across key markets.

- Global DER capacity is set to significantly expand, with forecasts indicating a substantial increase in residential and commercial installations by 2025.

- Gentrack’s utility software platforms, like g2.0, are being enhanced to manage bi-directional energy flows and real-time DER orchestration.

- The company's focus includes enabling utilities to integrate electric vehicles (EVs) and smart home devices into demand response programs.

- This technological evolution supports utilities in navigating the transition to a more decentralized, decarbonized energy landscape.

Low-Code/No-Code Platforms

Gentrack's g2.0 solution leverages low-code/no-code platforms, enabling utility companies to rapidly innovate and deploy new services. This technological approach significantly reduces the dependency on specialized developers, accelerating the time-to-market for new customer offerings. Such agility provides a crucial competitive edge for utilities navigating the dynamic and evolving energy and water markets. The global low-code development platform market is projected to reach approximately $44.5 billion by 2025, underscoring its growing strategic importance.

- Gentrack g2.0 facilitates rapid product launches for utilities.

- Reliance on specialized developers is reduced, cutting operational costs.

- Time-to-market for new services is significantly accelerated.

- Market agility becomes a key differentiator in competitive sectors.

Gentrack's strategic focus on cloud-native SaaS solutions, like g2.0, addresses the utility sector's shift from legacy systems, capitalizing on over $700 billion in projected cloud spending by 2025. The company integrates AI and data analytics, leveraging smart meter proliferation and anticipated $4.3 billion AI in utilities market by 2025 for enhanced operational efficiency. Furthermore, Gentrack's platforms manage distributed energy resources (DERs), aligning with their projected 20% annual growth through 2025, and utilize low-code/no-code for rapid service deployment, tapping into a $44.5 billion market by 2025.

Legal factors

Gentrack's clients, primarily in the energy and water sectors, navigate extremely complex regulatory landscapes where compliance is paramount. For instance, evolving regulations on carbon emissions reporting or smart meter mandates directly necessitate software updates. The Australian Energy Regulator (AER) and the UK's Ofwat consistently introduce new requirements, impacting pricing structures and consumer protection, forcing Gentrack's platform to adapt swiftly. Gentrack's core value proposition lies in its agility to integrate these diverse and dynamic regulatory changes into its solutions, ensuring clients meet their obligations and avoid substantial non-compliance penalties, which can exceed millions annually.

Governments and regulatory bodies are increasingly mandating climate-related financial disclosures, a trend accelerating globally. Gentrack Group, acknowledging this shift, published its inaugural Climate Statement within its 2024 Annual Report, detailing its environmental commitments. Furthermore, Gentrack's specialized software solutions directly assist its utility clients in managing and reporting their environmental performance and sustainability targets. This growing legal requirement for transparency drives significant demand for robust systems capable of tracking and managing complex climate-related data, positioning Gentrack favorably.

Utility companies and airports, Gentrack's core clientele, face stringent consumer protection and fair-trading laws governing billing accuracy, dispute resolution, and service standards. Gentrack's advanced software suite is critical for clients to meet these obligations, automating complex billing and offering a holistic view of customer interactions. For instance, the UK's Ofgem can issue fines up to 10% of a company's relevant turnover for non-compliance, as seen in recent 2024 regulatory actions. Failure to adhere risks substantial financial penalties and severe reputational damage for Gentrack's clients, directly impacting their operational viability.

Anti-Greenwashing Legislation

Anti-greenwashing legislation is significantly impacting utility companies, with regulators like the EU and UK's Competition and Markets Authority (CMA) intensifying scrutiny on environmental claims. The EU's proposed Green Claims Directive, expected to be fully implemented by 2026, mandates substantiation for green marketing. Similarly, the UK's CMA Green Claims Code, active since 2021, requires businesses to ensure their environmental claims are accurate and verifiable. Gentrack's billing and customer engagement platforms provide essential, auditable data on energy consumption and sourcing, enabling its utility clients to make credible and legally defensible sustainability assertions, mitigating risks of fines or reputational damage.

- EU Green Claims Directive (proposed): Requires independent verification of environmental claims, impacting all sectors.

- UK CMA Green Claims Code (active): Enforces clear, accurate, and substantiated green claims to protect consumers.

- Gentrack's data systems: Crucial for providing verifiable consumption and renewable energy source data.

Intellectual Property and Contract Law

Protecting intellectual property, particularly the proprietary code and unique features of software solutions like g2.0, remains a critical legal concern for Gentrack Group, a leading technology provider. Its market position hinges on safeguarding these digital assets, which underpin its competitive advantage in the utility and airport sectors. Furthermore, Gentrack’s revenue streams are intrinsically linked to complex, long-term contracts with major clients, necessitating robust contract law frameworks and diligent negotiation. These agreements, often valued in the millions for multi-year deployments, define essential service level agreements, liability limitations, and specific project deliverables.

- Gentrack's FY2024 revenue guidance of NZD 180-185 million heavily relies on secure, enforceable client contracts.

- Investment in R&D, approximately NZD 38.6 million in FY2023, underscores the value of its protected software innovations.

- Contractual clarity is vital given the average project lifecycle of 3-5 years for major utility implementations.

Gentrack navigates a complex legal landscape driven by strict regulatory compliance in energy and water, with evolving mandates from bodies like AER and Ofwat. New anti-greenwashing laws, such as the EU Green Claims Directive by 2026, demand verifiable data, which Gentrack's systems provide. Protecting its intellectual property and managing long-term contracts, crucial for its NZD 180-185 million FY2024 revenue guidance, are paramount.

| Legal Factor | Key Impact | 2024/2025 Relevance |

|---|---|---|

| Regulatory Compliance | Software adaptation for evolving energy/water rules | Ofgem fines up to 10% turnover for non-compliance |

| Anti-Greenwashing Laws | Demand for verifiable environmental data | EU Green Claims Directive (proposed 2026 implementation) |

| Contractual Agreements | Securing long-term client relationships | Gentrack FY2024 revenue guidance: NZD 180-185M |

Environmental factors

The overarching environmental driver for Gentrack Group is the global imperative to decarbonize economies and combat climate change, forcing a fundamental transformation of the energy sector. This shift away from fossil fuels towards renewables is accelerating, with global renewable energy capacity additions projected to exceed 500 GW in 2024. Gentrack's technology and mission are centered on enabling this critical energy and water transition for retailers worldwide, aligning its solutions with the increasing demand for sustainable infrastructure. The significant investments in grid modernization and smart energy solutions, estimated to reach over $100 billion globally by 2025, directly underpin Gentrack's market opportunity.

The rapid growth of renewable energy sources, such as wind and solar, significantly impacts utilities, with global renewable capacity additions projected to exceed 500 GW in 2024. These intermittent sources create challenges for grid stability and billing, yet offer a clear pathway to decarbonization. Gentrack's specialized software solutions enable utilities to seamlessly integrate and manage these variable energy flows, optimizing grid operations. This technological support is crucial as renewables are forecasted to become the largest source of global electricity generation by 2025, accelerating the shift towards a cleaner, more sustainable energy infrastructure.

Growing global water scarcity, projected to impact over 40% of the world's population by 2025, intensifies regulatory and social pressure on water utilities for efficient resource management. This necessitates advanced IT systems for smart metering, leak detection, and customer engagement to reduce consumption. The smart water management market, forecast to reach $25 billion by 2025, highlights this demand. Gentrack offers critical software solutions, helping water companies like those serving over 10 million connections globally, navigate these environmental challenges by improving operational efficiency and promoting conservation.

Circular Economy and Waste Reduction

Gentrack contributes to circular economy principles through its sustainability commitment, even though it is not a primary focus. The company has actively reduced electronic waste by donating IT equipment to community organizations, aligning with responsible e-waste management practices in 2024. Furthermore, Gentrack's core software solutions empower utilities globally to manage energy and water resources more efficiently, directly supporting a fundamental tenet of the circular economy by optimizing consumption for millions of customers. This operational efficiency extends to reducing overall resource demand within the sectors it serves.

- Gentrack's 2024 sustainability report highlights ongoing efforts to minimize operational environmental impact.

- The company actively participates in IT asset reuse programs, avoiding landfill disposal.

- Their utility software enables reductions in energy and water waste across diverse customer bases.

- Resource optimization through their platforms supports utility providers in meeting 2025 efficiency targets.

Climate Change Adaptation

Societies and businesses must adapt to the physical risks of climate change, like extreme weather events, which significantly impact the infrastructure of Gentrack's utility and airport clients. These events create a critical need for resilient and flexible operational systems to maintain essential services. Gentrack's solutions directly support these providers, helping them manage disruptions and ensure service continuity in the face of climate-related challenges.

- Gentrack's HY24 results, reported in May 2024, show strong growth, with revenue up 31% to NZ$96.2 million, reflecting demand for their critical infrastructure solutions.

- Their platforms enable clients to enhance operational resilience against increasing climate volatility.

- The focus on next-generation solutions helps clients manage complex, evolving environmental demands.

The global drive for decarbonization, with over 500 GW of new renewable capacity expected in 2024, significantly shapes Gentrack's market. Escalating water scarcity, projected to impact 40% of the global population by 2025, further boosts demand for their efficient management solutions. Gentrack's platforms directly enable utilities to integrate renewables and optimize resource consumption, supporting resilience against increasing climate volatility.

| Environmental Driver | 2024/2025 Projection | Gentrack's Role | ||

|---|---|---|---|---|

| Renewable Energy Growth | >500 GW new capacity (2024) | Enables integration and management | ||

| Smart Energy Investment | >$100 billion (2025) | Provides core software infrastructure | ||

| Water Scarcity Impact | 40% global population affected (2025) | Offers efficient management solutions |

PESTLE Analysis Data Sources

Our Gentrack Group PESTLE Analysis is built on a robust foundation of data sourced from official government publications, reputable financial news outlets, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the utility software sector.