Gentrack Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gentrack Group Bundle

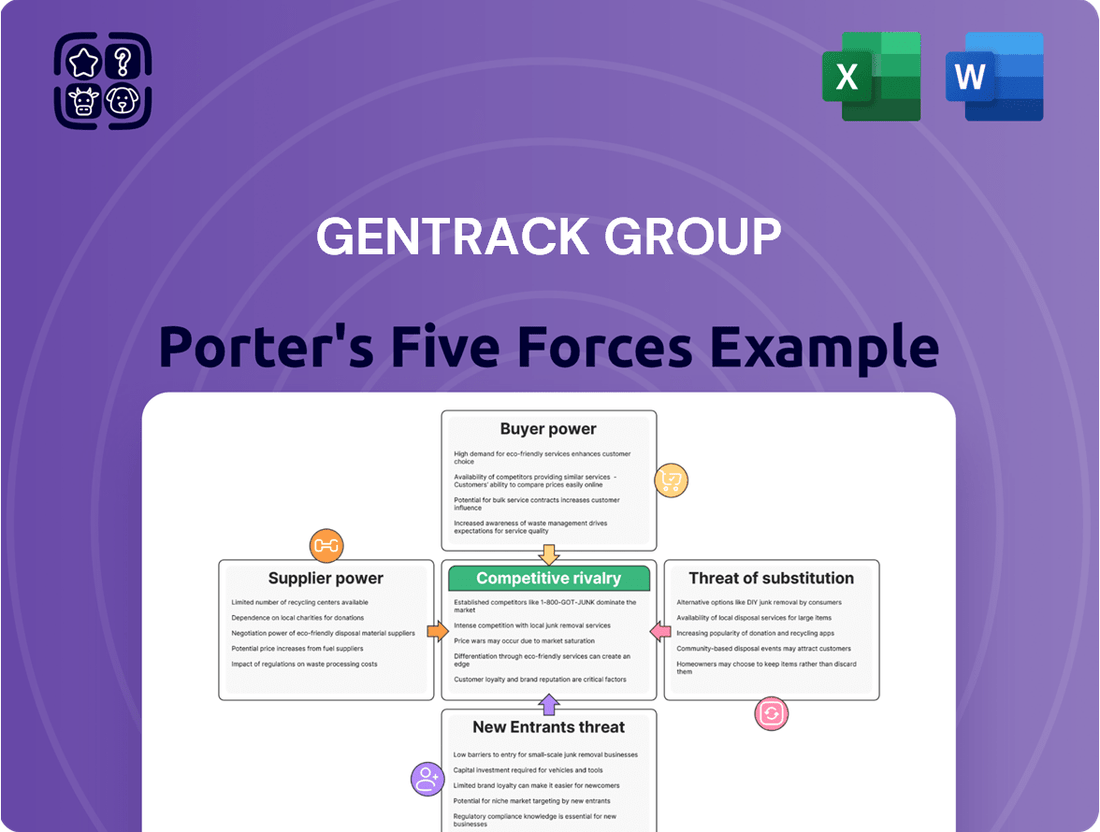

Gentrack Group navigates a complex competitive landscape, where the bargaining power of buyers and suppliers significantly shapes its strategic options. The threat of new entrants and the intensity of rivalry among existing players are critical considerations for understanding Gentrack's market position.

The availability of substitutes presents another key force, potentially impacting Gentrack's revenue streams and market share. A thorough understanding of these dynamics is crucial for any stakeholder looking to assess Gentrack's long-term viability and growth potential.

The complete report reveals the real forces shaping Gentrack Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of core technologies, such as cloud infrastructure from partners like Amazon Web Services (AWS) and CRM systems from Salesforce, hold considerable bargaining power over Gentrack. Gentrack’s solutions are deeply integrated with these platforms, making it highly reliant on their technology, pricing models, and future innovation roadmaps. For example, AWS continues to dominate the cloud market with a 31% share as of early 2024, reflecting its strong position. This dependency is a strategic choice for Gentrack to leverage best-in-class technology, but it also concentrates power with a few key, dominant suppliers.

The market for skilled software developers and engineers, especially those with specific expertise in utility and airport operational environments, is intensely competitive, driving up talent acquisition costs. This specialized talent pool, crucial for Gentrack Group’s core business, represents a significant supplier group wielding strong bargaining power. Companies globally, including those in New Zealand where Gentrack has a significant presence, face a talent shortage; for instance, the 2024 Hays Salary Guide indicated continued high demand for tech professionals. The critical need for professionals who understand the nuances of energy markets, water regulations, and airport logistics makes their skills a scarce and highly valued resource, directly impacting project timelines and budgets.

Gentrack’s Veovo airport division relies on a limited pool of niche suppliers for specialized hardware, including advanced sensors and IoT devices critical for airport operational management. These high-performance components, essential for data collection and system functionality, often come from vendors with proprietary technology. This concentration grants significant leverage to these hardware providers, as Gentrack's system performance is directly tied to their unique offerings. For instance, the global IoT sensor market, valued at approximately $28.7 billion in 2024, highlights the specialized nature and potential supplier power in this segment.

Strategic Partnerships for Innovation

Gentrack actively forms strategic partnerships with innovative companies, such as Amber Electric, to drive advancements in areas like renewable energy management and dynamic pricing, crucial for its utility software solutions. While these collaborations are mutually beneficial, the unique capabilities and intellectual property contributed by these specialized partners can grant them significant bargaining power. Gentrack's reliance on such collaborations, particularly as the energy sector rapidly evolves with smart grid and decarbonization initiatives, underscores the influence these suppliers hold. This is evident as Gentrack continues to invest in R&D, with operational expenditure for the first half of FY2024 showing continued investment in product development.

- Gentrack's strategic partnerships, like with Amber Electric, are vital for innovation in utility tech.

- These partners possess unique intellectual property, giving them considerable influence over Gentrack.

- Gentrack relies on these collaborations to maintain its industry leadership and product relevance.

- The specialized nature of these innovations enhances supplier power within the evolving energy market.

Limited Supplier Diversification

Gentrack's 2024 annual report indicates a significant reliance on key technology partners like Salesforce and AWS for its g2.0 solution, which is central to its utility offerings. This strategic dependency, while enabling advanced capabilities, inherently limits Gentrack's supplier diversification. The concentration of critical technology components in the hands of a few major suppliers enhances their bargaining power considerably, potentially impacting operational costs and flexibility.

- Gentrack's g2.0 solution, central to its utility offerings, relies on platforms like Salesforce and AWS.

- This reliance creates limited supplier diversification for core technology components.

- Concentration of critical technology with a few major suppliers increases their bargaining leverage.

Gentrack faces high supplier power from dominant tech platforms like AWS and Salesforce, essential for its core solutions. The competitive market for specialized tech talent, particularly in utility and airport domains, also gives significant leverage to skilled professionals. Niche hardware suppliers for Veovo and strategic innovation partners further exert influence through unique technology and intellectual property.

| Supplier Type | Source of Power | 2024 Impact |

|---|---|---|

| Cloud/CRM Platforms | Market Dominance | AWS 31% market share |

| Skilled Talent | Specialized Expertise | High demand for tech pros |

| Niche Hardware | Proprietary Tech | IoT sensor market $28.7B |

What is included in the product

This analysis dissects the competitive forces impacting Gentrack Group, evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the utilities software market.

Navigate competitive pressures with a dynamic Porter's Five Forces model, allowing for easy scenario planning and strategic adaptation.

Customers Bargaining Power

Gentrack Group's utility and airport clients face extremely high switching costs when considering new core billing and operational software. These mission-critical systems are deeply embedded, making migration to a new platform a significant undertaking involving substantial financial outlay, often millions of dollars over several years. The process also entails considerable operational disruption, complex data migration risks, and extensive employee retraining, potentially impacting thousands of staff. This complexity creates a strong vendor lock-in effect, severely reducing customers' bargaining power against Gentrack in 2024.

Gentrack has historically faced significant customer concentration risks, where a limited number of large utility clients account for a substantial portion of its revenue. For instance, in fiscal year 2024, the reliance on top-tier customers remained a key strategic consideration. The potential loss of even one major customer could severely impact Gentrack's financial performance and revenue stability. This concentration grants these large, strategic customers considerable bargaining power in contract negotiations and service agreements. Their ability to influence terms directly affects Gentrack's profitability.

Customers increasingly demand flexible, modern, and composable solutions that integrate with existing systems and adapt quickly to market changes. This empowers customers to seek providers offering advanced, adaptable technology, like Gentrack's g2.0 low-code platform. This pressure means Gentrack must continuously innovate to meet evolving expectations for utility software. The global composable enterprise applications market is projected to grow significantly, reflecting this customer-driven shift. Gentrack's investment in R&D, reaching NZ$20.7 million in the first half of fiscal year 2024, directly addresses this need for cutting-edge, adaptable solutions.

Regulatory and Market Pressures on Clients

Gentrack's utility customers navigate an environment of intense regulatory scrutiny and market pressures, including strict price caps and mandates to fund energy transition initiatives. These external forces significantly constrain customer budgets for essential IT projects, evidenced by a reported 2024 average IT budget growth for utilities remaining modest, often below inflation. This financial pressure compels them to negotiate aggressively on pricing and contract terms for software solutions, thereby enhancing their bargaining power.

- Utility IT spending growth in 2024 is projected at approximately 3-5%, constrained by regulatory limits.

- Government-mandated energy transition targets, like the UK's 2035 decarbonized power system goal, increase operational costs for utilities.

- Price control mechanisms, such as Ofgem's RIIO framework in the UK, directly limit revenue for energy network companies.

- Increased budget scrutiny leads to more demanding procurement processes for technology vendors like Gentrack.

Consolidation in Customer Base

Consolidation within the energy sector, notably in the UK, has significantly amplified the bargaining power of Gentrack's utility customers. As larger players acquire smaller ones, the remaining combined entities represent a substantial portion of the market, reducing the overall customer base. These fewer, larger utility companies possess greater leverage to negotiate more favorable terms and pricing for Gentrack's software and services. This trend forces Gentrack to be highly competitive to retain and attract these powerful clients, directly impacting profit margins and contract conditions.

- In 2024, the UK energy market continues to be dominated by a handful of major suppliers, limiting Gentrack's customer pool.

- The number of large energy suppliers in the UK has decreased over time due to mergers and acquisitions.

- Larger utility groups can dictate terms, influencing Gentrack's revenue predictability.

- This market structure means Gentrack faces intense pressure to offer competitive pricing and tailored solutions.

Gentrack's customers face high switching costs for mission-critical software, which generally limits their bargaining power. However, significant customer concentration and ongoing industry consolidation, especially in the UK energy market in 2024, empower a reduced number of large clients to negotiate aggressively. Tight regulatory budgets and a strong demand for modern, composable solutions further amplify customer leverage. This creates a complex dynamic where customer power is influenced by both high lock-in and market pressures.

| Factor | Impact on Customer Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Switching Costs | Lowers customer power | Migration costs often millions of dollars; high operational disruption. |

| Customer Concentration | Increases power of large customers | Reliance on top-tier customers remains a key strategic consideration for Gentrack. |

| Regulatory/Budget Constraints | Increases customer power | Utility IT spending growth projected 3-5%; intense budget scrutiny. |

| Industry Consolidation | Increases power of fewer, larger customers | UK energy market dominated by handful of major suppliers in 2024. |

Preview Before You Purchase

Gentrack Group Porter's Five Forces Analysis

You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, detailing Gentrack Group's Porter's Five Forces analysis. This comprehensive breakdown will illuminate the competitive landscape, covering the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products or services, and the intensity of rivalry within the industry. Understanding these forces is crucial for strategizing Gentrack Group's market position and future growth. The preview you see is precisely the detailed analysis you will receive, ready for immediate application.

Rivalry Among Competitors

The utility and airport software market remains notably fragmented, featuring a diverse mix of large, established IT service providers like Tata Consultancy Services and IBM, alongside numerous smaller, specialized competitors. While Gentrack maintains a significant position, it faces fierce competition from many firms offering comparable billing, customer information systems, and operational management solutions. This landscape intensifies rivalry for new contracts and market share, especially as companies vie for a slice of the projected $1.5 trillion global IT services market in 2024. This variety of players ensures a highly competitive environment for securing new client engagements.

Competitive rivalry for Gentrack is intensely driven by technological innovation, as rivals vie to support clients' digital transformation and sustainability objectives. Companies compete to offer the most advanced features, including AI-driven analytics and cloud-native platforms, crucial for emerging energy models like dynamic pricing. This dynamic compels continuous investment in research and development; for instance, Gentrack's H1 2024 R&D investment stood at NZ$17.1 million, up from NZ$14.3 million in H1 2023, underscoring the necessity to maintain a competitive edge and drive new solutions.

Competitive rivalry is intense, with firms vigorously pursuing strategic new customer acquisitions across both emerging and established markets. Gentrack Group's expansion into regions like Saudi Arabia and the Philippines in 2024 underscores this fierce competition for market penetration. Each new client win by a competitor directly translates into a lost revenue opportunity for Gentrack, highlighting the critical importance of a robust sales pipeline. For example, the battle for new utility contracts, valued at millions, makes the sales process a key battleground for market share.

Price and Total Cost of Ownership

While Gentrack emphasizes innovation, price and total cost of ownership remain critical competitive factors. Customers, particularly in the regulated utility sector, are highly cost-sensitive, meticulously comparing long-term value and operational savings from different vendors. Competitors often employ aggressive pricing strategies to secure deals, which directly pressures Gentrack's profit margins.

- Utility sector customers prioritize solutions that lower operational expenditure.

- Gentrack's 2024 financial reporting indicates focus on recurring revenue streams, which are sensitive to initial pricing.

- Competitors leverage lower upfront costs or extended payment terms.

- The total cost includes implementation, maintenance, and future upgrades.

Incumbent Legacy Systems

A significant competitive challenge for Gentrack stems from the widespread use of deeply embedded legacy systems within utilities and airports. Many potential customers operate on older, in-house or competitor platforms, making the status quo their primary rival. The substantial cost and complexity involved in replacing these long-standing systems create a formidable barrier to entry for new solutions. For instance, in 2024, the average lifespan of critical operational technology systems in utilities often exceeds 15-20 years, reflecting this inertia. Gentrack must therefore present an exceptionally compelling value proposition to overcome this ingrained resistance.

- High switching costs: Enterprises face significant financial and operational hurdles to migrate data and processes.

- Operational disruption: Changing core systems can cause temporary service interruptions and employee retraining needs.

- Data migration complexity: Moving vast amounts of historical data accurately and securely is a major undertaking.

- Risk aversion: Organizations often prioritize stability over the perceived risks of large-scale system overhauls.

Gentrack faces intense rivalry in a fragmented utility and airport software market, competing with large IT providers and specialized firms for a slice of the $1.5 trillion global IT services market in 2024. Competition is fueled by technological innovation, with rivals offering advanced AI and cloud solutions, compelling Gentrack's H1 2024 R&D investment of NZ$17.1 million. Price and total cost of ownership are critical, as competitors employ aggressive strategies against deeply embedded legacy systems, which present high switching costs for customers.

| Metric | 2024 Data | Impact |

|---|---|---|

| Global IT Market | $1.5 Trillion | High Competition |

| Gentrack H1 R&D | NZ$17.1M | Innovation Pressure |

| Legacy System Life | 15-20 Years | High Switching Costs |

SSubstitutes Threaten

Large utility companies and airport operators, especially those with significant capital budgets like many major European energy firms, often consider developing their own proprietary IT solutions. This in-house approach offers a direct substitute for Gentrack's software, providing complete control and tailored customization to their specific operational needs. The build-versus-buy decision remains a continuous threat, driven by factors such as the desire for unique system integration and the significant internal expertise available within these large entities. For instance, a 2024 industry trend indicates increasing investments in internal digital transformation initiatives by major infrastructure players.

Generic, large-scale Enterprise Resource Planning (ERP) systems from vendors such as SAP and Oracle present a notable substitute threat to Gentrack. These systems, holding significant market share in 2024 with the global ERP market valued at over $50 billion, offer modules for billing and customer management. While often less specialized than Gentrack's tailored utility solutions, their appeal lies in providing a single, integrated platform for diverse business functions. This comprehensive integration is particularly attractive to clients prioritizing IT landscape standardization. Consequently, companies seeking unified operational control might opt for these broader ERP solutions over niche providers.

Instead of licensing software from Gentrack, some utility companies are increasingly choosing to outsource their entire billing and customer service operations to Managed Service Providers. These MSPs utilize their proprietary platforms and dedicated staff to manage these functions, presenting a direct service-based substitute to Gentrack's traditional software-licensing model. This alternative appeals to companies aiming to offload significant operational complexity and capital expenditure, especially given the global IT outsourcing market reached an estimated $520 billion in 2024. For instance, the growing trend of utilities seeking OpEx over CapEx models further empowers MSPs as a viable, attractive substitute.

Modular, Best-of-Breed Approach

The threat of substitutes for Gentrack, particularly from a modular, best-of-breed approach, is significant. Instead of purchasing a comprehensive utility software suite, customers can now assemble specialized solutions from multiple vendors. For example, a utility might use a dedicated billing system from one provider, a CRM from another, and advanced analytics from a third. This unbundling of services directly challenges integrated solution providers like Gentrack, as clients seek optimized functionalities and potentially lower costs for specific components.

- The global utility software market is valued at over $15 billion in 2024, with increasing demand for flexible, specialized modules.

- Many utilities are shifting towards composable architectures, allowing them to integrate best-in-class solutions for functions like smart grid management or customer engagement.

- This trend is driven by a desire for greater agility and avoiding vendor lock-in, impacting revenue streams for traditional end-to-end providers.

- Gentrack's 2024 financial reports indicate continued investment in cloud-native platforms, aiming to offer more modular components to counter this substitute threat.

Emerging Tech Giants

Emerging tech giants like Google and Amazon are increasingly entering the energy sector, focusing on smart home devices and advanced data analytics platforms. While not direct substitutes for Gentrack's core utility billing systems today, their growing influence on customer relationships and energy data management poses a significant future threat. Their ability to leverage vast consumer data and AI presents a long-term substitution risk for Gentrack's traditional offerings. For example, the global smart home market, heavily influenced by these players, is projected to reach approximately $150 billion in 2024.

- Google Nest devices manage over 60 billion kWh of energy annually globally.

- Amazon's energy initiatives include smart grid integration and demand response programs.

- Their combined R&D spending vastly surpasses Gentrack's annual revenue, enabling rapid innovation.

- These firms control a substantial portion of consumer data invaluable for energy personalization.

Gentrack faces significant substitute threats from in-house IT development, especially as large utilities invest in 2024 digital transformation initiatives. Generic ERP systems like SAP and Oracle, part of a global ERP market exceeding $50 billion in 2024, offer integrated alternatives, while Managed Service Providers, leveraging the $520 billion 2024 IT outsourcing market, present service-based substitutes. The shift towards composable architectures, seen in the $15 billion 2024 utility software market, allows clients to unbundle solutions, directly challenging Gentrack's integrated offerings.

| Substitute Type | 2024 Market Impact | Gentrack Impact |

|---|---|---|

| In-house IT | Increased internal investment | Loss of software sales |

| Generic ERPs | >$50B global market | Reduced solution adoption |

| Managed Services | >$520B outsourcing market | Shift from licensing to OpEx |

| Modular Solutions | $15B utility software market | Demand for unbundled components |

| Tech Giants (Future) | $150B smart home market | Long-term disruption of core services |

Entrants Threaten

The utility and airport software markets Gentrack operates in present high barriers to entry. New entrants face significant hurdles due to the complexity of mission-critical systems and the deep domain knowledge required. Customers incur substantial switching costs, making it difficult for them to change providers, as seen with Gentrack's consistent customer retention rates reported in their H1 2024 results. Consequently, new companies need considerable R&D investment and a proven track record of reliability to compete effectively.

New entrants into the utility and aviation sectors face significant regulatory and compliance hurdles, acting as a formidable barrier. Navigating the intricate web of national and regional regulations governing data security, billing accuracy, and market-specific rules, such as those evolving in 2024 for energy market liberalization across Europe and North America, demands substantial legal and technical expertise. Gentrack, with its robust, established compliance frameworks and decades of experience serving over 200 utilities and airports globally, possesses a strong competitive advantage. This deep-seated understanding and adherence to complex standards significantly deter potential newcomers from entering these highly regulated markets.

A new entrant aiming to compete with Gentrack in 2024 would face the significant hurdle of establishing robust partnerships. They would need to align with major cloud providers like AWS or CRM leaders like Salesforce, mirroring Gentrack’s existing deep integrations. Building these crucial relationships and achieving seamless platform interoperability demands substantial time and investment, a considerable barrier for new market players. Gentrack's well-established ecosystem, honed over years, offers a powerful defensive advantage against such new competition.

Emergence of Niche, Agile Startups

While broad market entry into Gentrack's core markets remains challenging, smaller, agile startups pose a persistent, low-level threat. These new entrants often target niche segments, leveraging disruptive technologies like AI-driven analytics for utility optimization or specialized modules for airport operations. For instance, in 2024, the utility tech startup ecosystem saw significant investment, with firms securing funding to develop solutions addressing specific pain points such as smart grid management or enhanced customer engagement, areas Gentrack also serves. Such focused entrants can gain a foothold by offering tailored, cost-effective solutions that incumbents may overlook. This dynamic ensures a continuous, albeit manageable, pressure on established players.

- Global utility tech startup funding reached over $3 billion in 2023, with continued growth projected for 2024.

- Specialized airport operation software startups are emerging, focusing on areas like predictive maintenance or real-time baggage tracking.

- New entrants often offer cloud-native, API-first solutions, enabling faster deployment and integration.

- Venture capital interest in AI-powered analytics for infrastructure management increased by 15% in early 2024.

Tech Giants as Potential Entrants

The most significant, though currently indirect, threat to Gentrack Group comes from major technology companies. While these tech giants like Google Cloud or Microsoft Azure currently serve as partners or providers of cloud infrastructure, their vast resources and brand recognition pose a formidable future threat. Their deep expertise in data analytics and cloud computing means they could potentially enter the core utility software market directly. This potential direct entry represents a substantial long-term risk, leveraging their existing market power and technological advancements.

- Tech giants possess immense capital and R&D budgets, significantly outpacing traditional utility software vendors.

- Their established cloud platforms, like those Gentrack uses, could be extended to offer competing utility solutions.

- Brand recognition and customer trust from these companies could quickly disrupt the market.

- Expertise in AI and data analytics allows for rapid development of sophisticated utility management tools.

The threat of new entrants for Gentrack Group remains low due to high barriers like complex systems, substantial switching costs, and intricate 2024 regulatory demands. While major tech companies pose a long-term, indirect threat, agile startups target niche segments. These smaller firms, backed by over $3 billion in utility tech funding in 2023 and continued 2024 investment, offer specialized, cloud-native solutions. However, Gentrack's established market position and deep integrations limit broad market disruption.

| Threat Level | Primary Barriers | Emerging Threats (2024) |

|---|---|---|

| Low to Moderate | High switching costs, regulatory complexity, deep domain knowledge | Niche startups (AI/IoT), potential large tech company entry |

| Impact on Gentrack | Strong competitive advantage, continuous innovation pressure | Market share erosion in specific segments |

| Key Data Points | H1 2024 retention rates, $3B+ utility tech funding (2023/2024) | Increased VC interest in AI for infrastructure (+15% early 2024) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Gentrack Group leverages a robust dataset including Gentrack's annual reports, investor presentations, and market research from firms specializing in utility software and energy management. We also incorporate insights from regulatory filings and industry-specific news outlets to provide a comprehensive view of the competitive landscape.