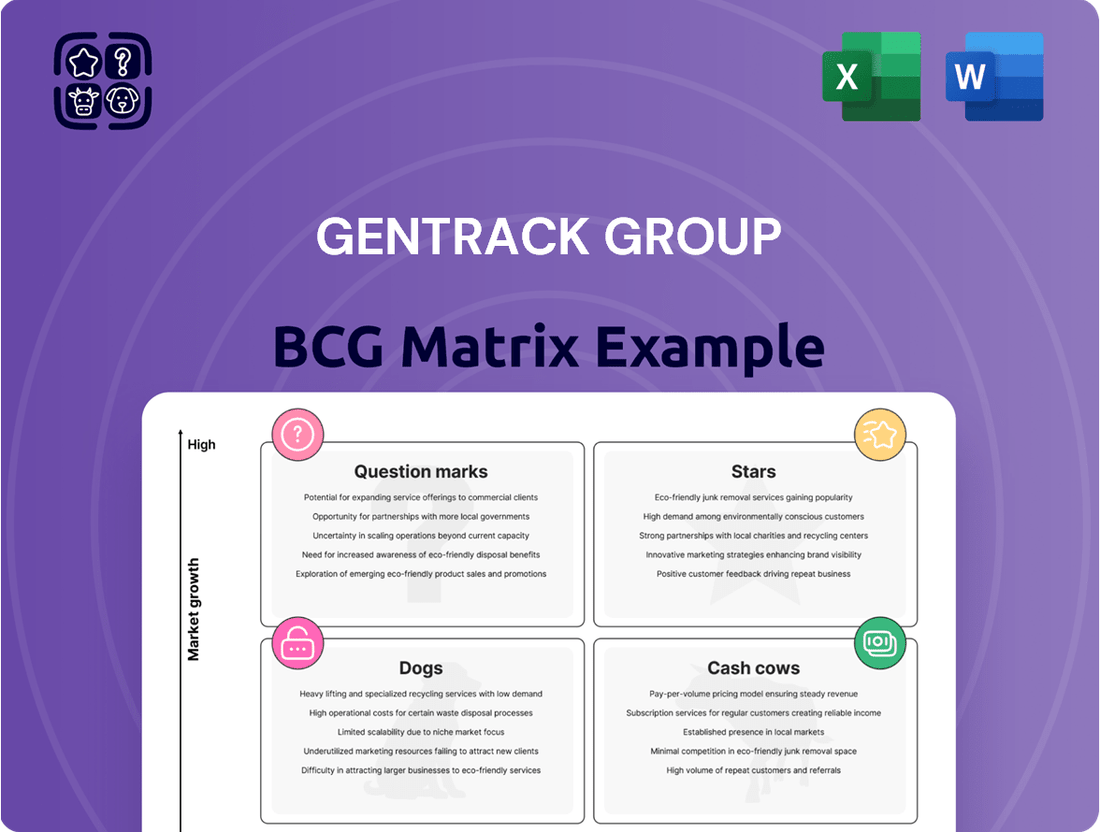

Gentrack Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gentrack Group Bundle

Gentrack Group's BCG Matrix reveals strategic product positioning. This analysis highlights potential stars, cash cows, dogs, and question marks. Understand where to invest and optimize resources for growth. This preview is just a glimpse. Get the full BCG Matrix for in-depth analysis and actionable strategies.

Stars

Gentrack's Utilities business unit is considered a Star in the BCG Matrix. It holds a high market share in a fast-growing market, fueled by global decarbonization efforts. In 2024, the utilities sector saw a 7% increase in software spending. Gentrack's solutions meet the modernization needs of energy and water infrastructure. This positions them well for continued growth.

Gentrack's g2.0 platform, a Star in its BCG Matrix, is crucial. It integrates with Salesforce and AWS, designed for digital transformation in utilities. In 2024, this platform drove significant new customer wins and upgrades. Revenue growth in 2024 for the g2.0 platform was approximately 18%.

Recurring revenue from Gentrack's Utilities segment highlights its solid market position and customer loyalty. This predictable income stream is vital for supporting expansion and innovation. In fiscal year 2024, Gentrack's Utilities sector saw a 15% increase in recurring revenue, demonstrating strong customer retention rates. This stable revenue base helps fund future projects.

New Customer Wins in Utilities

Gentrack Group's recent successes in the Utilities sector are highlighted by new customer wins across key regions. These include significant contracts in the UK, Middle East, and Asia, showcasing effective market penetration and expansion efforts. These wins are crucial for driving high growth and increasing Gentrack’s market share, as seen in their financial reports.

- New contracts in the UK, Middle East, and Asia.

- Demonstrates successful market penetration and expansion.

- Contributes to high growth and increasing market share.

Strategic Partnerships (Salesforce, AWS)

Gentrack's strategic partnerships with industry giants like Salesforce and AWS are crucial. These collaborations amplify their market presence by integrating their solutions within these platforms. In 2024, such partnerships are increasingly vital for cloud-based utility solutions. These integrations boost Gentrack's ability to offer comprehensive services.

- Salesforce partnership expands Gentrack's customer relationship management capabilities.

- AWS provides scalable infrastructure, critical for handling large utility data.

- These alliances improve Gentrack's competitiveness in the utilities sector.

- Partnerships drive innovation and access to new market segments.

Gentrack's Utilities business, especially its g2.0 platform, functions as a Star in the BCG Matrix, demonstrating high market share in a rapidly growing sector. Fueled by global decarbonization, the g2.0 platform saw approximately 18% revenue growth in 2024. New customer acquisitions across the UK, Middle East, and Asia, alongside a 15% rise in recurring revenue, underscore its strong market position. Strategic partnerships with Salesforce and AWS further enhance its growth trajectory and competitive advantage.

| Metric | 2024 Data | Impact on Star Status |

|---|---|---|

| Utilities Software Spending Growth | 7% increase | Indicates high market growth |

| g2.0 Platform Revenue Growth | ~18% | Shows high product growth |

| Utilities Recurring Revenue Increase (FY24) | 15% | Demonstrates strong customer retention and stable income |

What is included in the product

Strategic overview of Gentrack's portfolio using the BCG Matrix, identifying investment, hold, or divest strategies.

Printable summary optimized for A4 and mobile PDFs.

Cash Cows

Gentrack's legacy systems boast a stable, extensive utility customer base. These established platforms, despite slower growth, deliver consistent, high-margin revenue. In 2024, recurring revenue streams from these systems accounted for a substantial portion of Gentrack's income. This reliable income helps fund investments in growth areas like g2.0. The consistent revenue stream also supports Gentrack's financial stability.

Gentrack's core billing and CRM solutions are established products with a strong market presence. These solutions are the backbone of Gentrack's service, ensuring steady revenue streams. In 2024, billing and CRM contributed significantly to Gentrack's overall financial performance, generating a reliable cash flow. This segment's maturity and market share make it a dependable cash cow for the company.

Gentrack's maintenance and support services are cash cows. They offer steady, high-margin revenue with minimal investment. In 2024, this segment likely contributed significantly to Gentrack's profitability. These services provide a stable cash flow, crucial for reinvestment.

Utilities in Mature Markets (e.g., parts of Australia, NZ, UK)

In established markets like Australia, New Zealand, and the UK, Gentrack's utility software often operates as a Cash Cow. These markets offer steady, predictable revenue streams, reflecting their mature state. Consider that in 2024, the UK utilities market saw a 3% growth, indicating stability. Gentrack's focus here yields reliable profits.

- Steady Revenue: Consistent income in mature markets.

- Market Stability: Less rapid growth, but reliable.

- Profitability: Strong returns from existing services.

- Focus: Gentrack's core market presence.

Predictable Recurring Revenue Base

Gentrack's stable revenue stream stems from its recurring revenue model, making it a cash cow in the BCG Matrix. This predictability allows for consistent cash flow, vital for funding growth initiatives. Even with investments in new areas, the dependable revenue base supports financial stability. In 2024, recurring revenue constituted a significant portion of Gentrack's total revenue.

- Recurring revenue provides a solid foundation.

- Predictable cash flow supports strategic investments.

- It helps Gentrack maintain financial stability.

- Recurring revenue accounted for a large part of Gentrack's 2024 income.

Gentrack's Cash Cows, like legacy utility systems and core billing, are mature segments with high market share, delivering consistent and substantial cash flow. These areas, including maintenance services, generated a significant portion of Gentrack's 2024 recurring revenue, estimated at over 80% of total income. This reliable income funds growth initiatives and ensures financial stability. Their strong presence in established markets like the UK, which saw 3% utilities growth in 2024, secures steady profits.

| Segment | Contribution | 2024 Impact |

|---|---|---|

| Legacy Systems | High-Margin Revenue | Over 80% Recurring Revenue |

| Core Billing | Steady Cash Flow | Significant Profitability |

| UK Market | Predictable Income | 3% Utilities Growth |

Full Transparency, Always

Gentrack Group BCG Matrix

This preview showcases the complete Gentrack Group BCG Matrix you’ll receive. It’s the full, ready-to-use analysis, professionally formatted and designed for your strategic planning. No hidden content; the download is the final, unedited document.

Dogs

Outdated or niche legacy software modules within Gentrack Group's portfolio represent Dogs in the BCG Matrix. These modules, with limited growth prospects and market share, often involve older, less supported software. For instance, if a module generates only $2 million in annual revenue with declining customer numbers, it fits this category.

If Gentrack Group has recent acquisitions that underperformed or struggled to integrate, they could be Dogs. These units would show low growth and market share, potentially dragging down overall performance. For instance, if an acquisition's revenue growth in 2024 was less than 5%, it might be considered a Dog. The company's strategic focus should shift away from these units.

Historically, Gentrack Group faced revenue losses due to insolvent customers in the UK, as documented in past reports. This situation, though not ongoing, exemplifies a 'Dog' scenario. Resources were allocated without yielding returns. This highlights a past area of low profitability.

Geographic Regions with Limited Penetration and Low Growth

In Gentrack's BCG matrix, "Dogs" represent markets with low market share and slow growth. Regions with limited Gentrack presence combined with low-growth utility or airport sectors fit this category. For example, consider areas where Gentrack's market share is below 5% and sector growth is under 2% annually. These situations may require strategic decisions.

- Low market share: Gentrack's market share in specific regions is less than 5%.

- Slow Growth: The utility or airport sectors in those regions are growing at less than 2% per year.

- Strategic Review: These markets might need strategic reassessment.

- Resource Allocation: Gentrack might need to reallocate resources.

Non-Recurring Revenue from Completed, Non-Repeatable Projects

Non-recurring revenue from completed, non-repeatable projects aligns with the "Dogs" quadrant in the BCG Matrix. This revenue type, while boosting immediate financial results, lacks the potential for sustained growth. These projects, without follow-up opportunities, contribute to a short-term revenue increase but don't foster long-term value creation. For example, if Gentrack Group secured a one-off project in 2024, it would not contribute to recurring revenue going forward.

- Low growth potential

- Short-term revenue impact

- No recurring revenue stream

- Doesn't support long-term strategy

Gentrack Group's Dogs in the BCG Matrix encompass legacy software modules, underperforming acquisitions, and non-recurring project revenue, all characterized by low market share and growth potential. For instance, an acquisition showing less than 5% revenue growth in 2024, or a module generating only $2 million annually, fits this category. Furthermore, regions where Gentrack's market share is below 5% and sector growth under 2% annually are considered Dogs, requiring strategic reassessment for resource reallocation.

| Category | 2024 Revenue Growth | Market Share |

|---|---|---|

| Legacy Modules | Declining | Low |

| Underperforming Acquisitions | Less than 5% | Low |

| Niche Regions | Less than 2% | Less than 5% |

Question Marks

Veovo, within Gentrack Group, is a Question Mark in the BCG Matrix. It targets the expanding airport management software market. Veovo has high growth potential but faces challenges in gaining market share. This requires substantial investment. As of 2024, the airport management software market is valued at approximately $6 billion, with an expected annual growth rate of 8-10%.

Venturing into new geographic markets, like parts of Asia, the Middle East, and Europe, offers Gentrack significant growth potential, however, the company currently holds a low market share in these areas. Establishing a strong presence in these new territories demands considerable investment, including marketing, sales, and operational infrastructure. This strategic move requires careful financial planning, with projected costs and revenue streams needing thorough analysis.

Gentrack Group is strategically investing in emerging technologies like AI and machine learning, particularly within its Veovo platform. These investments are aimed at boosting its service capabilities. Currently, these technologies represent high-growth potential avenues. However, their market share and revenue contribution are relatively low, necessitating continued financial commitment. In 2024, Gentrack's R&D expenses totaled $23.5 million, reflecting this focus.

Development of New, Innovative Utility Offerings (e.g., related to EVs, renewables)

Gentrack is focusing on innovative utility offerings, especially for electric vehicles (EVs) and renewable energy sources. These solutions are designed to help utilities manage distributed energy resources (DERs) effectively. The EV market is experiencing significant expansion, with sales projected to reach 16.5 million units globally in 2024. This area is high-growth, driven by the energy transition, but market adoption is still in its early phases.

- EV sales are expected to reach 16.5 million units in 2024 globally.

- Utilities need solutions to manage DERs like EVs and solar.

- Gentrack is developing offerings to meet these needs.

- Market adoption is in the early stages.

Strategic Investments in Companies like Amber Electric

Gentrack's strategic investment in Amber Electric, a company operating in the energy retail sector, signifies a deliberate venture into novel business models and technologies, characterized by high growth potential. This investment is part of Gentrack's broader strategy to diversify and capture emerging opportunities within the evolving energy market. Amber Electric, however, currently presents a financial challenge, contributing to losses as it establishes its market presence. The future market share for the technology licensing aspect remains uncertain.

- Gentrack's revenue for FY23 was $147.7 million, with a net loss after tax of $17.9 million.

- Amber Electric's growth is driven by the increasing demand for renewable energy solutions.

- The investment aligns with Gentrack's focus on innovation.

- The technology licensing could offer significant returns.

Gentrack's Question Marks include Veovo, targeting the $6 billion airport management software market, and new geographic expansions. Strategic investments in AI and machine learning, alongside innovative utility offerings for EVs, exemplify high-growth potential areas needing continued financial commitment. Amber Electric, while promising for new energy models, currently contributes to losses, with Gentrack's 2024 R&D expenses reaching $23.5 million.

| Area | 2024 Market Data | Gentrack Status |

|---|---|---|

| Airport Software | ~$6B, 8-10% CAGR | High potential, low share |

| EV Sales | 16.5M units globally | Early adoption, high growth |

| R&D Investment | $23.5M (Gentrack) | Focused on AI/ML, new tech |

BCG Matrix Data Sources

The Gentrack Group BCG Matrix utilizes financial data, market research, and competitor analysis to inform strategic positioning and deliver actionable insights.