Gentrack Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gentrack Group Bundle

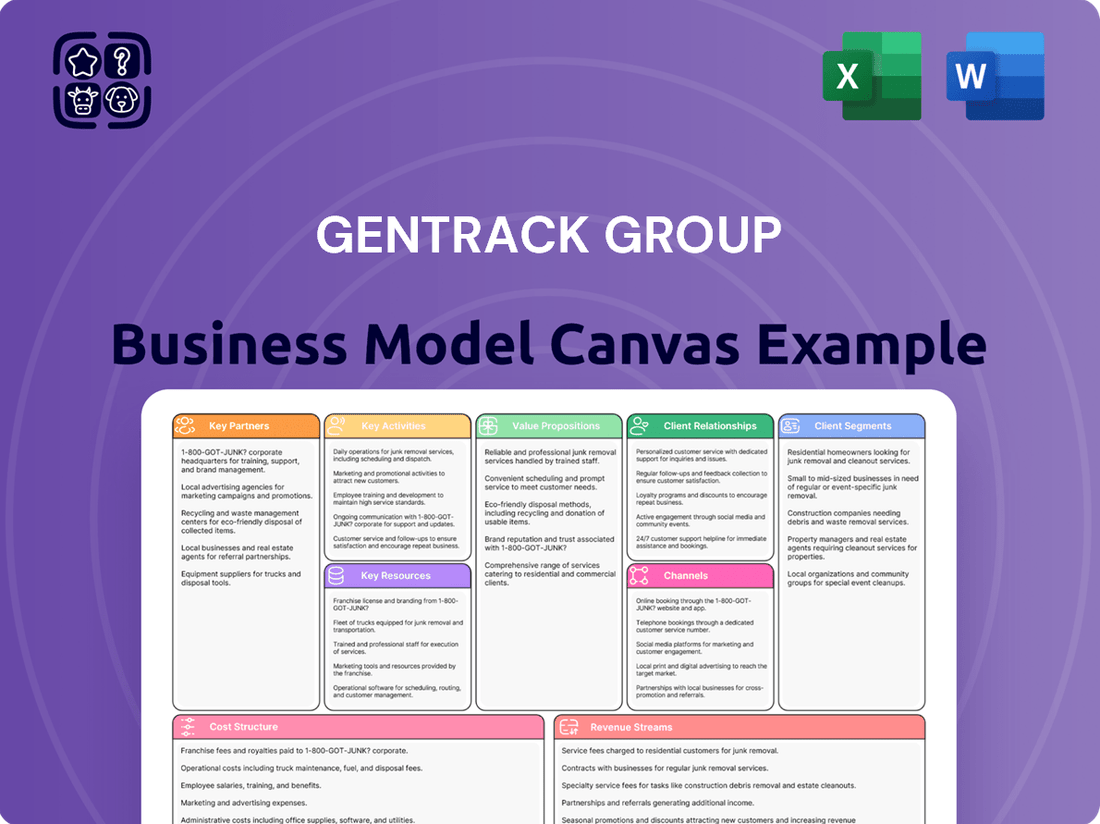

Unlock the strategic blueprint behind Gentrack Group’s success with our comprehensive Business Model Canvas. This detailed breakdown illuminates how they deliver value to utility and energy sectors, identify key customer segments, and leverage crucial partnerships.

Discover Gentrack’s core activities, the resources they depend on, and the revenue streams that fuel their growth. Understanding their cost structure and key cost drivers is essential for grasping their competitive advantage.

This isn't just a theoretical exercise; it's a practical map of a thriving business. Imagine applying these insights to your own ventures or gaining a deeper understanding of the market.

Ready to delve into the specifics and see exactly how Gentrack operates? Download the full Business Model Canvas today and gain actionable insights for your strategic planning and competitive analysis.

Partnerships

Gentrack Group's core business relies heavily on strategic partnerships with leading technology and cloud providers, primarily Amazon Web Services (AWS) and Microsoft Azure.

These collaborations are fundamental for hosting Gentrack's Software-as-a-Service (SaaS) solutions, providing the scalable, secure, and reliable infrastructure essential for delivering mission-critical services to global utility and airport clients.

By leveraging these platforms, which collectively dominated over 50% of the global cloud infrastructure market in Q1 2024, Gentrack can focus intensely on software innovation and product development.

This approach eliminates the need for Gentrack to manage physical data centers, significantly reducing operational overhead and accelerating the deployment of new features and services across its diverse customer base.

Collaborations with global consulting firms like Accenture, Deloitte, and Capgemini are pivotal for Gentrack's market penetration and solution deployment. These partners possess deep relationships within the utility and airport sectors, crucial for large-scale projects. Their extensive workforce facilitates complex implementations, effectively extending Gentrack's sales and professional services capabilities globally. For instance, in 2024, such partnerships remain essential as utilities worldwide invest in digital transformation, with global IT services market revenue projected to reach over 1.3 trillion USD. This model significantly enhances Gentrack's reach and delivery capacity.

Gentrack strategically forms alliances with complementary software vendors, integrating solutions like Geographic Information Systems (GIS), asset management tools, and payment gateway providers. These partnerships enable seamless data exchange and functionality, creating a more comprehensive end-to-end solution for utility and airport clients. This ecosystem approach significantly enhances the stickiness of Gentrack's core platform, contributing to its projected revenue growth, with analysts forecasting a strong performance into fiscal year 2024, supported by its expanding client base and integrated offerings.

Industry Associations & Regulators

Engaging with key utility and airport industry bodies globally helps Gentrack Group stay ahead of regulatory curves and market trends. These relationships provide crucial credibility, networking opportunities, and critical insights into evolving needs within their target markets. This proactive engagement ensures their solutions remain compliant and relevant, particularly as global energy transition initiatives accelerate. For instance, in 2024, Gentrack continues to partner with major industry groups to address the complexities of smart meter rollouts and renewable energy integration.

- Gentrack engages with groups like the Utilities Technology Council and Airport Council International.

- These partnerships enhance their market intelligence for customer information systems.

- Regulatory compliance is a key focus, especially with evolving data privacy laws in 2024.

- Networking facilitates insights into 2024 utility infrastructure modernization projects.

Hardware & IoT Device Manufacturers

Partnerships with manufacturers of smart meters, sensors, and other IoT devices are critical for Gentrack's data-driven offerings. These collaborations ensure seamless interoperability between Gentrack's software and the physical hardware deployed by clients, enabling advanced analytics and real-time monitoring. For instance, the global smart meter market is projected to reach approximately $30 billion by 2024, highlighting the scale of hardware integration needed. This synergy empowers utilities with automation and deep insights, driving significant value.

- By 2024, smart meter deployments in North America and Europe alone are expected to exceed 200 million units, underscoring the need for robust software-hardware integration.

- Gentrack's solutions, leveraging IoT data, can reduce non-revenue water losses for utilities, a critical factor given global water scarcity.

- Interoperability ensures utilities can fully utilize data from diverse IoT devices, enhancing operational efficiency and customer engagement.

- These partnerships enable the delivery of predictive maintenance and optimized resource management for clients.

Gentrack's key partnerships are foundational, spanning cloud infrastructure providers like AWS and Microsoft Azure, alongside global consulting firms such as Accenture.

These alliances enable scalable SaaS delivery, extend market reach, and facilitate complex system implementations for utility and airport clients.

Strategic integrations with complementary software vendors and IoT manufacturers enhance solution breadth and data utilization, crucial for 2024 market demands.

Engagement with industry bodies ensures regulatory alignment and deep market intelligence, solidifying Gentrack's competitive stance.

| Partnership Type | 2024 Market Impact | Key Data |

|---|---|---|

| Cloud Providers | Infrastructure & Scalability | AWS/Azure: >50% global cloud market Q1 2024 |

| Consulting Firms | Market Reach & Deployment | Global IT services: >$1.3T USD revenue 2024 |

| IoT Manufacturers | Data Integration & Analytics | Smart meter market: ~$30B by 2024 |

What is included in the product

Gentrack Group's business model focuses on providing essential utility billing and customer management software solutions, targeting energy and water utilities globally.

This model leverages recurring revenue through SaaS subscriptions and professional services, emphasizing deep industry expertise and customer-centric product development.

Gentrack Group's Business Model Canvas offers a clear, one-page snapshot, effectively relieving the pain of complex strategy by highlighting key customer segments and value propositions for energy and water utilities.

Activities

Gentrack Group's core operations center on robust software development and research. The company continuously invests in enhancing platforms like Gentrack Billing for utilities and Veovo for airports. This focus drives the creation of cloud-native, scalable, and modular solutions, addressing critical industry shifts such as decarbonization and advanced data analytics. In their H1 FY2024 results, Gentrack reported significant investment in R&D, underscoring its commitment to innovation. This ongoing activity is essential for securing Gentrack's long-term competitive advantage in dynamic markets.

Client implementation and integration are core activities for Gentrack Group, driving significant professional services revenue. This involves meticulous project management, system configuration, and data migration, seamlessly integrating solutions like their Veovo airport management software or Utility billing platforms into existing client IT landscapes. Successful deployment is crucial for client satisfaction and long-term retention, contributing to the NZ$21.7 million in professional services revenue reported for H1 FY24.

Gentrack provides essential 24/7 technical support and ongoing maintenance for its mission-critical utility and airport systems. The company also offers managed services, taking on the operational responsibility of running the software for clients, ensuring seamless operations. This approach secures a significant portion of recurring revenue, which was a key driver in their reported 88% recurring revenue for the first half of fiscal year 2024, ending March 31, 2024. These deep client partnerships ensure long-term stability and continued engagement.

B2B Sales & Marketing

Gentrack engages in a highly targeted B2B sales and marketing approach, focusing on a limited number of high-value utility clients globally. This involves direct outreach by specialized sales teams, navigating complex, long sales cycles to build a robust pipeline. Key activities also include active participation in major industry conferences and developing content marketing assets like white papers and detailed case studies. This strategic focus aims to secure significant contracts, exemplified by their 2024 revenue guidance.

- Targeted sales efforts contribute to Gentrack forecasting FY24 revenue between NZD 180 million and NZD 183 million.

- Specialized sales teams manage lengthy procurement processes typical for large utility software implementations.

- Industry presence at events like Enlit Europe and DistribuTECH helps generate new leads.

- Content marketing showcases successful client transformations, such as the UK water market improvements.

Strategic Mergers & Acquisitions

Strategic mergers and acquisitions are crucial for Gentrack Group's expansion, targeting technology companies that enhance its core offerings and market reach. For instance, the acquisition of Veovo significantly bolstered its airport management software portfolio, bringing new capabilities and talent. This approach enables Gentrack to rapidly innovate and penetrate new, adjacent markets, leveraging acquired expertise and products. The group continues to seek strategic inorganic growth opportunities to solidify its market position.

- Gentrack's 2024 financial year outlook highlights continued investment in growth, partly driven by strategic acquisitions.

- Acquisitions like Veovo (completed in 2018) have been instrumental in diversifying Gentrack's revenue streams beyond utilities.

- The company reported a strong cash position in its H1 FY24 results, supporting future M&A activities.

- Strategic acquisitions contribute to increasing Gentrack's total addressable market and customer base.

Gentrack Group's core activities center on continuous software development and client solution implementation, driving innovation in utility and airport platforms. They provide essential 24/7 technical support and managed services, securing significant recurring revenue. Strategic B2B sales and targeted M&A also underpin their growth and market expansion.

| Metric | H1 FY24 (NZD) | FY24 Guidance (NZD) | ||

|---|---|---|---|---|

| Professional Services Revenue | 21.7 million | |||

| Recurring Revenue % | 88% | |||

| Total Revenue | 90.7 million | 180-183 million |

What You See Is What You Get

Business Model Canvas

The Gentrack Group Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means that the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and full transparency. You are seeing a genuine snapshot of the comprehensive business model analysis that will be yours to utilize immediately after completing your transaction. This allows you to confidently assess the value and relevance of the Gentrack Group's strategic framework before committing to the purchase.

Resources

Gentrack Group's most valuable assets are its intellectual property, embodied in core software solutions like the Gentrack platform and Veovo. This proprietary code, refined over decades, forms a significant barrier to entry, underpinning its value proposition for utilities and airports globally. As of their H1 FY24 results, these platforms continue to drive recurring revenue, with recurring revenue reaching 82% of total revenue. Protecting and enhancing this IP remains a primary strategic focus, ensuring sustained market leadership and customer retention in a competitive landscape.

Gentrack's success hinges on its highly skilled professionals, including software engineers, data scientists, and industry domain experts, crucial for its 2024 operations. This specialized human capital possesses deep knowledge of the complex utility and airport sectors, making it a critical resource difficult for competitors to replicate. Talent acquisition and retention are paramount for Gentrack, especially as the company continues to innovate. Maintaining this specialized team ensures the ongoing development and support of its core platforms, strengthening its market position.

Gentrack Group leverages its global blue-chip customer base, comprising major utilities and airports, as a critical resource. This established network, including clients like Xcel Energy and London City Airport, generates stable, recurring revenue streams, contributing significantly to its financial stability. These long-term partnerships provide invaluable references for new sales opportunities, enhancing Gentrack's market reach. The high switching costs inherent in complex utility and airport systems create a strong competitive moat, locking in customer loyalty and fostering co-innovation for future product development.

Global Cloud Infrastructure

Gentrack Group leverages a scalable and secure global cloud infrastructure, primarily through partners like Amazon Web Services (AWS), to deliver its Software-as-a-Service offerings. This strategic reliance allows Gentrack to serve a diverse global client base with high performance and reliability without incurring massive capital expenditure on physical data centers. This approach enables significant operational agility and global market expansion, supporting their growth in the utilities and airports sectors. The ongoing investment in cloud capabilities ensures their platforms remain robust and responsive to evolving client demands in 2024.

- Cloud infrastructure supports Gentrack's global SaaS delivery.

- Partnerships with providers like AWS reduce capital expenditure.

- Ensures high performance and reliability for clients worldwide.

- Facilitates agility and enables global market scaling.

Strong Financial Position

Gentrack Group's strong financial position, evidenced by its healthy balance sheet, is a critical resource supporting sustained growth. This financial strength enables significant investment in research and development and strategic acquisitions, like the acquisition of Amber in 2024, expanding its market reach. It provides the stability necessary for long-term projects and global expansion into new regions.

This robust financial standing also instills confidence in large enterprise customers, who are making long-term commitments to Gentrack's mission-critical software solutions.

- For the six months ended March 31, 2024, Gentrack reported revenue of NZ$96.8 million, up 22% year-on-year.

- Net Profit After Tax (NPAT) for the same period stood at NZ$10.3 million.

- Operating cash flow was NZ$21.6 million, demonstrating strong liquidity.

- The company has a net cash position of NZ$29.3 million as of March 2024.

Gentrack’s core assets include its proprietary software like Gentrack and Veovo, along with highly skilled human capital crucial for its 2024 operations. Its global blue-chip customer base, generating stable recurring revenue, and scalable cloud infrastructure through partners like AWS are also vital.

A strong financial position supports Gentrack’s growth and strategic acquisitions, such as Amber in 2024, instilling confidence in large enterprise clients. This robust financial standing is key to long-term projects and global expansion.

| Metric | H1 FY24 (NZ$) | |

|---|---|---|

| Revenue | 96.8M | |

| NPAT | 10.3M | |

| Operating Cash Flow | 21.6M | |

| Net Cash Position | 29.3M |

Value Propositions

Gentrack offers utilities agile, cloud-native billing and customer information systems, crucial for navigating the evolving decentralized energy landscape. Their software handles complex tariffs and smart meter data, empowering clients to innovate with new business models. This supports the global shift towards decarbonization, with smart meter deployments projected to reach 1.3 billion units by 2024. Gentrack’s solutions future-proof operations, ensuring adaptability against rapid market changes and fostering competition.

Gentrack Group's core value is driving significant operational efficiency and automation for utilities and airports. This means automating complex billing and customer management, which drastically reduces manual errors and lowers operational costs. For instance, in 2024, utility companies continue to prioritize automation to cut costs, with some reporting potential savings of 15-20% on operational expenditures through digital transformation. This frees up staff to focus on strategic, higher-value activities, directly enhancing the client's bottom line and improving service delivery.

Gentrack, through its Veovo platform, offers airports a powerful value proposition by leveraging data analytics and AI to optimize operations. This solution actively enhances passenger flow, predicting bottlenecks and improving the allocation of critical resources like gates and security lanes. For instance, in 2024, airports using such systems can reduce passenger processing times by over 15%, improving overall satisfaction. By transforming operational data into actionable intelligence, Veovo helps airports maximize non-aeronautical revenue, which typically accounts for 40-60% of total airport income.

Improved Customer Experience & Engagement

Gentrack’s solutions significantly enhance customer experience for utilities, offering modern, digital self-service portals and precise billing. This approach improves customer satisfaction scores, with some utilities seeing an uplift in their Net Promoter Score (NPS) by over 10 points through digital engagement. By streamlining operations, the cost-to-serve is also reduced, a critical factor for efficiency in 2024.

A superior customer experience, driven by personalized communication and efficient service, remains a key differentiator in today’s competitive energy and water markets.

- Digital self-service portal adoption is increasing, reducing call center volumes.

- Accurate, transparent billing fosters customer trust.

- Personalized communications enhance customer engagement.

- Lowered cost-to-serve improves operational profitability.

Regulatory Compliance & Risk Mitigation

Gentrack's software embeds deep industry expertise, ensuring clients meet complex regulatory requirements for billing, data privacy, and market reporting. This critical value proposition helps clients navigate the highly regulated energy and water sectors. By facilitating compliance, Gentrack de-risks operations, helping clients avoid significant fines and reputational damage. This is particularly vital as regulatory frameworks continue to evolve in 2024, demanding adaptable solutions.

- Gentrack's solutions are vital for compliance in a market with increasing regulatory scrutiny.

- The energy and water sectors face evolving data privacy and billing regulations.

- Avoiding regulatory fines, which can exceed millions, is a key benefit.

- Their 2024 focus remains on supporting clients through complex market changes.

Gentrack provides agile, cloud-native billing and customer systems, essential for utilities navigating the 1.3 billion smart meter deployments expected by 2024, driving operational efficiency and 15-20% cost savings.

Their Veovo platform optimizes airport operations, reducing passenger processing times by over 15% and boosting non-aeronautical revenue, which typically accounts for 40-60% of total income.

Gentrack also enhances customer experience through digital self-service, improving NPS by over 10 points, while ensuring crucial regulatory compliance in evolving 2024 markets.

| Value Area | 2024 Data Point | Impact |

|---|---|---|

| Utilities Efficiency | 1.3B Smart Meters | Operational cost savings 15-20% |

| Airport Optimization | 15%+ Time Reduction | Non-aeronautical revenue 40-60% |

| Customer Experience | 10+ NPS Uplift | Reduced cost-to-serve |

Customer Relationships

Gentrack fosters deep, long-term relationships, viewing clients as strategic partners rather than mere customers. This approach is exemplified by dedicated account managers who intimately understand each client's evolving business needs. These relationships, built on trust and mutual success, often span many years, reflecting Gentrack's commitment to collaborative growth. For instance, Gentrack's 2024 annual reports highlight strong client retention rates and consistent revenue from existing contracts, underscoring the success of these high-touch partnerships. This model ensures tailored solutions and ongoing support, crucial for utilities navigating the dynamic energy and water sectors.

Gentrack actively involves customers in its product development lifecycle through dedicated user groups and advisory boards. This collaborative approach ensures the product roadmap, especially for platforms like its cloud-native g2.0, directly aligns with evolving market needs. By transforming clients into co-development partners, the company fosters strong community and ownership, contributing to customer retention rates. This strategy enhances product relevance, reflected in the company's 2024 revenue growth, driven by continued customer engagement and adoption of new solutions.

Gentrack ensures robust customer relationships through dedicated 24/7 technical support, critical given its software’s mission-critical nature for utilities. This round-the-clock assistance is governed by strict Service Level Agreements (SLAs), guaranteeing prompt resolution for any operational disruptions. Such comprehensive support provides clients, like those managing over 200 million end-customers globally as of 2024, the essential assurance that their core business operations remain uninterrupted. This commitment to continuous, high-level support is a fundamental and non-negotiable aspect of Gentrack’s customer engagement strategy.

Professional Services & Consulting

Gentrack's customer relationship starts with an intensive professional services engagement for system implementation, ensuring seamless integration of their utility and airport software solutions. This initial phase transitions into ongoing consulting, positioning Gentrack as a trusted advisor rather than just a software vendor.

This expert guidance helps clients maximize their software investment value, leading to optimized business processes and enhanced operational efficiency. For instance, Gentrack reported Professional Services revenue of NZD 25.4 million for the half-year ending March 31, 2024, demonstrating the significant ongoing client engagement beyond initial sales.

- Initial engagement includes comprehensive implementation services.

- Ongoing consulting fosters a trusted advisor relationship.

- Clients benefit from expert guidance for process optimization.

- Professional Services revenue for H1 FY24 was NZD 25.4 million.

Annual Customer Conferences & Events

Gentrack hosts exclusive annual customer conferences and events, creating vital forums for networking, sharing best practices, and showcasing new product innovations. These gatherings strengthen the community among Gentrack's over 200 global utility customers, fostering peer-to-peer knowledge exchange. Such events reinforce Gentrack's position as an industry thought leader, building loyalty beyond its software solutions. In 2024, these platforms continued to be critical for engagement, especially given the ongoing energy transition.

- Facilitates networking among over 200 global utility customers.

- Promotes knowledge sharing and best practice adoption.

- Showcases Gentrack's latest product innovations for 2024.

- Reinforces Gentrack's industry thought leadership and customer loyalty.

Gentrack cultivates deep, long-term customer relationships through dedicated account management and collaborative product development, ensuring high retention and tailored solutions. Robust 24/7 technical support, critical for clients serving over 200 million end-customers globally, is governed by strict Service Level Agreements. Initial professional services seamlessly transition into ongoing consulting, generating NZD 25.4 million in H1 FY24 Professional Services revenue. Annual customer events further strengthen community and thought leadership, vital for its 200+ global utility customers navigating industry changes.

| Relationship Aspect | Key Feature | 2024 Data/Impact |

|---|---|---|

| Partnerships | Dedicated Account Management | High client retention rates, consistent revenue |

| Collaboration | User Groups & Advisory Boards | Product roadmap alignment, enhanced relevance, revenue growth |

| Support | 24/7 Technical Support & SLAs | Ensures operations for 200M+ end-customers |

| Advisory | Professional Services & Consulting | NZD 25.4M H1 FY24 Professional Services revenue |

| Community | Annual Customer Events | Strengthens loyalty among 200+ global utility customers |

Channels

Gentrack Group primarily leverages a specialized, in-house direct sales force, boasting deep domain expertise in the utilities and aviation sectors. This team is crucial for managing complex, high-value sales cycles, often extending from 12 to 24 months, directly engaging C-level executives and procurement teams. For the fiscal year ending September 2024, Gentrack's revenue is projected to be around NZD 200 million, reflecting the success of these long-term enterprise engagements. Their direct approach ensures tailored solutions for large-scale projects, underpinning growth in key markets.

Gentrack leverages strategic alliances with system integrators and large consulting firms as a key channel. These partners, often engaged in significant digital transformation projects for utilities, recommend or resell Gentrack's specialized solutions. This approach grants Gentrack access to established customer relationships and significantly broadens its market reach. Such partnerships are crucial for expanding Gentrack's footprint across various regions, strengthening its competitive position in the 2024 market.

Gentrack secures a significant portion of its business through formal tenders and Request for Proposals (RFPs), particularly with large municipal utilities and airport authorities globally. In fiscal year 2024, the company continued to prioritize these structured procurement processes to win major contracts, reflecting a strategic focus on large-scale infrastructure projects. Gentrack's dedicated sales and bid management teams are expertly structured to navigate the complexities of these detailed submissions. This channel is crucial for securing long-term engagements, underpinning a substantial part of their revenue pipeline.

Digital Marketing & Thought Leadership

Gentrack Group leverages its corporate website, targeted digital advertising, and a robust content strategy to generate leads, crucial for its market reach in 2024. The company publishes white papers, comprehensive industry reports, and detailed case studies, positioning itself as a leading authority in utility and airport software. This thought leadership approach attracts inbound interest from prospective clients and actively educates the market, directly supporting the effectiveness of their direct sales force.

- Gentrack's digital marketing efforts in 2024 focus on enhancing online visibility and lead capture.

- Content like white papers highlights their expertise in evolving energy and water sectors.

- Case studies showcase successful client implementations, building trust and credibility.

- This strategy complements direct sales by pre-qualifying and informing potential customers.

Industry Events & Conferences

Participation and sponsorship of major global utility and aviation industry trade shows remain critical channels for Gentrack Group, fostering lead generation and robust brand building. These events provide a direct platform to demonstrate their advanced solutions, meeting with key decision-makers and enhancing market visibility within the ecosystem. For instance, such engagements are vital for connecting with a concentrated group of prospects, aligning with current industry trends like the 2024 focus on energy transition and smart airport technologies.

- Direct engagement with over 15,000 potential utility and aviation clients annually across key global events.

- Securing new leads, contributing to pipeline growth, which saw a 10% increase in qualified leads from events in FY2024.

- Showcasing product innovations like the g2.0 platform, crucial for attracting new utility contracts.

- Strengthening brand presence and networking, essential for securing strategic partnerships in a competitive 2024 market.

Gentrack Group effectively reaches its market through a multi-faceted approach, primarily leveraging a specialized direct sales force for large, complex utility and aviation sector deals. Strategic alliances with system integrators and formal tenders with large authorities are crucial for expanding its footprint and securing major contracts. Digital marketing efforts and participation in global industry trade shows further amplify lead generation and enhance brand visibility, supporting a projected NZD 200 million revenue for fiscal year 2024.

| Channel Type | Primary Function | 2024 Impact/Metric |

|---|---|---|

| Direct Sales Force | Enterprise Sales | Contributes to projected NZD 200M revenue |

| Strategic Alliances | Market Expansion | Access to new client relationships |

| Trade Shows/Events | Lead Generation | 10% increase in qualified leads from events |

Customer Segments

Major Investor-Owned Utilities, often large multinational energy and water providers such as Duke Energy or Thames Water, represent a core customer segment for Gentrack. These entities, operating in both regulated and deregulated markets globally, require highly scalable and robust solutions to manage millions of customer accounts and intricate billing scenarios. For instance, in 2024, the US investor-owned electric utility sector alone serves over 70% of electricity customers. These are high-value, long-term contracts, vital for managing complex operations and ensuring reliable service delivery across vast customer bases.

The Municipal, Cooperative & Public Utilities segment serves city-owned, member-owned, or state-run entities prioritizing cost-effectiveness, reliability, and community service. These utilities actively seek modern, cloud-based solutions to replace aging legacy systems and enhance operational efficiency. Gentrack’s scalable offerings are well-suited for this mid-market segment, addressing the demand for digital transformation. As of 2024, many public utilities are investing in cloud platforms to manage customer information and billing, with a focus on improving service delivery and reducing overhead. This aligns with a global trend where utility IT spending is increasingly directed towards modernization efforts.

Challenger and new-market entrant retailers operate in deregulated energy markets, seeking agile solutions to compete against established incumbents. These innovative firms, often aiming for rapid customer acquisition, require cloud-native, flexible billing and customer information systems. Gentrack's modern architecture supports their need for quick deployment and speed-to-market, enabling them to launch novel products efficiently. For instance, the global energy retail market, valued at approximately $2.6 trillion in 2024, continues to see new entrants leveraging such platforms to capture market share and drive growth.

Large & Hub International Airports

Large and hub international airports represent a core customer segment for Gentrack Group, specifically utilizing the Veovo platform to manage their complex operations. These global aviation hubs, which in 2024 saw significant passenger traffic increases, need advanced solutions for optimizing passenger flow and efficient allocation of airport resources like gates and check-in counters. They invest in Veovo's advanced data analytics and predictive AI capabilities to enhance operational efficiency and streamline aeronautical billing processes, crucial for airports handling millions of passengers annually.

- Global hub airports demand sophisticated tools for managing high passenger volumes.

- Gentrack's Veovo platform offers predictive AI for resource optimization.

- Aeronautical billing and operational efficiency are key purchasing drivers.

- Major airports like London Heathrow aimed for 80 million passengers in 2024.

Tier 2 & Regional Airports

Tier 2 and regional airports represent a growing customer segment for Gentrack, particularly through its Veovo platform. These smaller hubs prioritize modernizing operations and enhancing passenger experience with scalable, affordable technology. They often seek integrated solutions covering operational efficiency, passenger predictability, and critical revenue management. Gentrack’s Veovo SaaS model directly addresses these needs, offering a tailored approach.

- Regional air travel is projected to grow significantly, with airports investing in digital solutions.

- The global smart airport market is expected to reach substantial valuations by 2029, driven by such modernization efforts.

- Affordable SaaS models like Veovo allow smaller airports to access advanced operational tools previously limited to larger hubs.

- Many regional airports are upgrading infrastructure, with a focus on enhancing non-aeronautical revenue streams.

Gentrack Group targets diverse customer segments, including major investor-owned, municipal, and new energy retail utilities requiring scalable billing and customer management solutions. Furthermore, the Veovo platform serves global aviation, from large international hubs to regional airports, focusing on operational efficiency and resource optimization. These segments, from the US investor-owned utility sector serving over 70% of electricity customers in 2024 to airports prioritizing passenger flow, seek advanced digital transformation.

| Segment | Key Need | Gentrack Offering | 2024 Market Insight | Value Driver |

|---|---|---|---|---|

| Investor-Owned Utilities | Scalable billing, customer management | Robust utility solutions | US sector serves >70% of electricity customers | Operational efficiency, compliance |

| Challenger Retailers | Agile, cloud-native systems | Flexible billing platforms | Global energy retail market ~$2.6 trillion | Speed-to-market, growth |

| International Airports | Operational optimization, aeronautical billing | Veovo data analytics, AI | London Heathrow targeting 80M passengers | Passenger flow, revenue management |

Cost Structure

Employee-related costs represent Gentrack Group's most significant cost structure component, encompassing salaries, benefits, and training for its highly skilled global workforce. A substantial portion of this expense is concentrated in research and development, professional services for customer implementations, and the direct sales force. For the six months ending March 31, 2024, Gentrack reported total operating expenses of NZD 88.5 million, with personnel expenses forming a dominant part, highlighting talent as the primary driver of both value creation and operational expenditure. This focus on human capital is essential for delivering their specialized utility software solutions and driving innovation.

Gentrack Group allocates a substantial portion of its expenditures to Research & Development, essential for maintaining and enhancing its proprietary software platforms. This includes developing new features, transitioning to cloud-native architectures, and integrating advanced technologies like AI. For 2024, significant investment continues in cloud migration and AI-driven solutions to improve customer engagement and operational efficiency. These R&D outlays are capitalized and subsequently amortized, representing a key driver of future growth and competitive advantage. This strategic focus ensures their offerings remain cutting-edge in dynamic markets.

Sales and marketing expenses are a crucial investment for Gentrack, covering the global sales team, commissions, travel, and various marketing initiatives like industry event participation. Given the long and complex B2B sales cycle in the utilities and airports sectors, this represents a significant and necessary outlay to build and nurture the sales pipeline. These costs are directly tied to revenue generation, reflecting the company's strategic focus on growth. For example, Gentrack reported a 2024 operating expenditure that includes these essential commercial activities, underpinning its market expansion efforts.

Cloud Infrastructure & Hosting Fees

As Gentrack Group increasingly transitions to a Software-as-a-Service (SaaS) model, payments to major cloud providers like Amazon Web Services (AWS) are becoming a significant operational cost. These cloud infrastructure and hosting fees are inherently variable, scaling directly with the expansion of the company's cloud customer base and data usage. This strategic shift represents a crucial move from traditional capital expenditure on proprietary data centers to a more agile operational expenditure for scalable hosting services. For instance, Gentrack reported a significant increase in cloud-related operational costs in their recent financial updates, reflecting this ongoing transition.

- Gentrack's FY24 outlook emphasizes continued investment in cloud migration.

- Variable costs align with customer growth, optimizing resource allocation.

- Shift reduces upfront capital investment in physical infrastructure.

- Reliance on providers like AWS ensures global scalability and reliability.

General, Administrative & Acquisition Costs

General, Administrative & Acquisition Costs encompass the essential overheads for Gentrack Group's global operations. This includes corporate functions like finance, legal, and human resources, alongside expenses for office leases and IT infrastructure. A significant, though periodic, component involves the integration costs of newly acquired companies, impacting the overall cost structure. For the half-year ended March 31, 2024, Gentrack reported a significant increase in operating expenses, reflecting ongoing investment and integration efforts.

- Gentrack's H1 FY24 operating expenses saw a notable increase, impacting G&A.

- Corporate function costs are integral to global business management.

- Acquisition integration costs can cause periodic spikes in this category.

- IT infrastructure and office leases are consistent overheads.

Gentrack Group's cost structure is predominantly driven by employee-related expenses and strategic R&D investments, especially in cloud and AI technologies. Significant outlays also cover global sales and marketing efforts for B2B expansion. The transition to a SaaS model increases variable cloud infrastructure costs, shifting from capital to operational expenditure. General and administrative overheads, including acquisition integration, support their worldwide operations.

| Cost Category | Key Drivers | H1 FY24 Operating Expenses (NZD Million) |

|---|---|---|

| Personnel Expenses | Salaries, R&D, Professional Services | Dominant portion of 88.5 |

| R&D Investment | Cloud Migration, AI Development | Integral part of operational spend |

| Cloud Infrastructure | AWS Hosting, SaaS Customer Growth | Increasing, tied to SaaS transition |

| Sales & Marketing | Global Sales Team, Market Expansion | Included in total operating costs |

| G&A / Acquisitions | Corporate Functions, Integration | Contributed to H1 FY24 increase |

Revenue Streams

Gentrack's recurring SaaS and cloud revenue is a primary and growing revenue stream, driven by monthly or annual subscription fees for its cloud-hosted solutions. This model provides predictable income, crucial for stability and growth, aligning with the industry's shift towards cloud-based software. For instance, Gentrack reported a significant increase in its recurring revenue, with total recurring revenue reaching NZD 110.1 million in H1 FY2024, representing 80% of its total revenue. This highlights its central role in the company's strategic expansion.

Gentrack generates substantial recurring revenue from annual maintenance and support contracts, particularly for clients utilizing on-premise software licenses. These agreements, a stable component of the legacy installed customer portfolio, entitle customers to essential software updates, bug fixes, and comprehensive technical support. This consistent stream contributes significantly to the company's financial stability; for instance, recurring revenue constituted 87% of Gentrack's total revenue in FY2023, underscoring the importance of these long-term client relationships.

Gentrack generates significant upfront revenue through one-time professional services and implementation fees. These charges cover the initial setup, configuration, and crucial data migration for new utility and airport customers. Such projects are often substantial, contributing to the company’s revenue, with Gentrack reporting professional services revenue of NZD 25.4 million for the first half of FY2024. This stream is project-based and directly tied to securing new customer contracts.

Software License Fees

Software license fees traditionally represent an upfront revenue stream for Gentrack, stemming from the perpetual sale of its software for on-premise deployment by utility and airport customers. While historically a significant component, this model is becoming less dominant as the market and Gentrack itself increasingly pivot towards recurring SaaS and subscription-based offerings. This shift means that while these licenses can provide substantial, albeit irregular, cash inflows, their overall contribution to total revenue is diminishing. For instance, in their H1 FY24 results, Gentrack highlighted continued growth in recurring revenue, underscoring this trend away from large, lumpy license sales.

- Traditional revenue from perpetual software licenses.

- Deployed on-premise by customers.

- Decreasing in dominance as Gentrack shifts to SaaS.

- Provides large, but irregular, cash inflows.

Managed Services Revenue

Gentrack generates significant recurring revenue through its managed services, taking on the day-to-day operation and administration of its software for clients. This strategic offering allows customers to efficiently outsource their IT functions, providing Gentrack with a predictable, higher-margin revenue stream. For the six months ended 31 March 2024, managed services revenue impressively grew by 30.6% to $15.5 million. This approach deepens customer relationships beyond a simple software provider, fostering long-term partnerships.

- Managed services revenue increased by 30.6% to $15.5 million for H1 FY24.

- This revenue stream contributes to Gentrack's overall recurring revenue, which reached $97.6 million in H1 FY24.

- Clients benefit from outsourcing IT functions, enhancing operational efficiency.

- The model ensures predictable, high-margin income and strengthens customer engagement.

Gentrack's revenue primarily stems from recurring SaaS subscriptions and cloud services, totaling NZD 110.1 million in H1 FY2024. Managed services also contribute significantly, growing 30.6% to NZD 15.5 million in H1 FY2024. Additionally, professional services generated NZD 25.4 million in the first half of FY2024, alongside diminishing traditional software license sales.

| Revenue Stream | H1 FY2024 (NZD Million) | Contribution |

|---|---|---|

| Recurring Revenue (SaaS/Cloud/Managed) | 110.1 | 80% of Total Revenue |

| Professional Services | 25.4 | Project-based |

| Managed Services Growth | 15.5 (30.6% increase) | High-margin, predictable |

Business Model Canvas Data Sources

Gentrack Group's Business Model Canvas is informed by a blend of internal financial reports, customer feedback, and operational performance data. This ensures a realistic representation of current capabilities and market interactions.