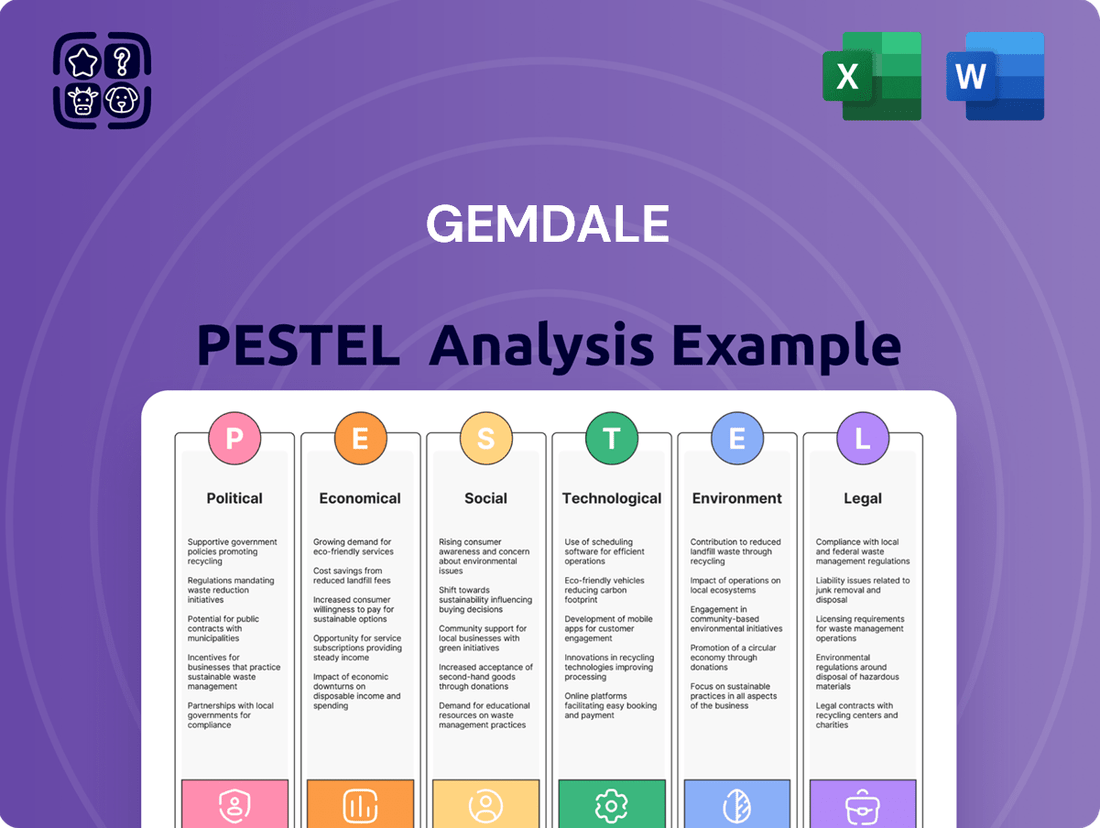

Gemdale PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gemdale Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Gemdale's trajectory. Our meticulously researched PESTLE analysis provides a strategic roadmap for navigating these external forces. Gain a competitive advantage by understanding the complete landscape. Download the full version now for actionable intelligence.

Political factors

The Chinese government's commitment to stabilizing the real estate sector is a significant political factor for Gemdale. Initiatives like the 'white list' system, designed to channel funding to viable projects, aim to mitigate developer liquidity issues. For instance, by the end of 2023, over 2,000 projects had been approved for the white list, signaling a substantial effort to unblock financing.

Further support comes from policies encouraging the renovation of older urban areas and dilapidated housing, potentially opening new development avenues for companies like Gemdale. Additionally, measures to ease homeowner financial pressure, such as reduced mortgage rates, could indirectly bolster demand for new properties, a key driver for Gemdale's sales.

China's commitment to urbanization remains a significant political driver, with the nation targeting a permanent resident urbanization rate of approximately 70% in the coming five years. This national objective translates into localized policy adjustments, including the easing or removal of property transaction restrictions in various cities.

Local governments are increasingly empowered to manage land resources and tailor housing supply to meet urban growth demands. These city-specific policies directly influence developers like Gemdale, creating a dynamic operating environment shaped by regional development strategies and varying market conditions.

The Chinese government is prioritizing affordable and quality housing, evidenced by initiatives like the dual-track system for social and commodity housing. This policy shift aims to boost the supply of affordable homes while also encouraging higher standards in construction, focusing on eco-friendly and smart home technologies.

Gemdale's strategic response must acknowledge this governmental push. The company may need to rebalance its development pipeline, potentially increasing its involvement in affordable housing projects or concentrating on premium, sustainable, and technologically advanced residential offerings to align with market demands and policy direction.

Debt Management and Developer Support

The Chinese government's proactive measures, such as the 'white list' lending program and the issuance of special-purpose bonds for local governments to purchase commercial properties for affordable housing, directly aim to alleviate developer financial distress and ensure ongoing project completion. These initiatives are crucial for stabilizing the real estate market.

Gemdale, having successfully managed its peak debt repayment obligations in 2024, is positioned to benefit from these policies. The support mechanisms are designed to inject liquidity into the sector and improve the overall financial health of developers, including Gemdale.

These political interventions are vital for market confidence and for ensuring that residential projects continue to be delivered to buyers, a key factor for developer sustainability.

- Government Support: The 'white list' program and special-purpose bonds are key political tools to aid developers.

- Developer Liquidity: These measures aim to improve cash flow for companies like Gemdale.

- Market Stabilization: Policy interventions seek to prevent systemic risks in the property sector.

- Project Delivery: Ensuring projects are completed is a primary objective of these government initiatives.

Regulatory Environment and Market Oversight

The regulatory landscape for China's property sector is undergoing significant shifts, with a notable increase in oversight concerning property presale funds. This trend, observed throughout 2024 and projected into 2025, reflects a governmental push to stabilize the market and protect homebuyers. The authorities are encouraging the sale of completed homes over pre-sales, aiming for greater transparency and reduced financial risk.

Gemdale Corporation, like other developers, must navigate this evolving regulatory environment. Adapting business models to align with these new rules, particularly regarding presale fund management and a potential shift towards completed property sales, will be crucial. Robust financial management and compliance with stricter oversight are paramount for sustained operations and market confidence.

Key regulatory developments impacting developers like Gemdale include:

- Stricter Escrow Account Rules: Increased scrutiny and control over how presale funds are utilized, often requiring funds to be held in escrow accounts managed by third parties to ensure project completion.

- Emphasis on Completed Sales: Policy signals favoring the sale of finished properties, potentially altering developer financing strategies and inventory management.

- Developer Financial Health Monitoring: Enhanced monitoring of developers' financial stability, with potential implications for access to financing and project approvals.

Government policies aimed at stabilizing the real estate market, such as the 'white list' initiative and special-purpose bonds, directly support developers like Gemdale by improving liquidity and ensuring project completion. These measures are critical for market confidence and continued development. Gemdale's ability to manage its debt obligations, as demonstrated by its peak repayment period in 2024, positions it to benefit from these supportive interventions.

What is included in the product

This Gemdale PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to inform strategic decision-making and identify potential opportunities and threats within Gemdale's operating landscape.

A clear, actionable summary of Gemdale's PESTLE factors, transforming complex external analysis into easily digestible insights for strategic decision-making.

Economic factors

China's property market has been in a slump since 2020, with sales and prices falling. However, by early 2025, the rate of decline has eased, indicating a potential stabilization. This downturn directly impacts Gemdale's financial performance.

Government interventions, such as reduced mortgage rates and loosened buying rules, are in place to support the market's recovery. For instance, by Q1 2025, several major cities reported a slight uptick in property transaction volumes compared to the previous year.

Gemdale's revenue and profitability are intrinsically linked to the health and rebound of this crucial sector. A sustained recovery in property sales and prices would be a significant positive factor for the company's outlook.

China's economic growth is showing signs of slowing down. While the GDP reached 5% in 2024, forecasts suggest this pace will moderate further. This deceleration is partly due to challenges in the property sector and ongoing structural economic adjustments.

This broader economic slowdown presents potential headwinds for Gemdale. A weaker economy can dampen consumer confidence and reduce purchasing power, which could translate into lower sales volumes for Gemdale's products and services. Furthermore, a less robust economic environment might also impact the overall investment climate, potentially affecting Gemdale's ability to secure financing or attract new investments.

Investment in residential real estate development has seen a downturn, with new project commencements also falling. For instance, in China, new housing starts in 2024 are projected to continue their decline, though at a slower pace than in previous years.

Despite this slowdown, there's an anticipated moderation in the steep decline of property development investment. High-quality residential units are increasingly favored by buyers, suggesting a potential shift in demand towards more premium offerings.

Gemdale's strategic investment decisions and its future project pipeline will be directly shaped by these evolving trends in development investment, particularly the growing demand for quality housing.

Access to Financing and Debt Levels

Despite government efforts like the 'white list' lending program aimed at supporting developers, the broader landscape for developer financing has experienced a contraction. Gemdale demonstrated resilience in 2024 by effectively managing its debt obligations, with a comparatively smaller volume of public debt scheduled for maturity in 2025. This prudent financial management is vital, as sustained access to capital and diligent oversight of debt remain paramount for Gemdale's continued operational stability and strategic growth initiatives.

Key financial considerations for Gemdale include:

- Developer Financing Trends: The real estate sector has faced tighter lending conditions, impacting overall developer access to capital.

- Gemdale's Debt Management: The company successfully navigated its debt repayment schedule in 2024.

- 2025 Debt Maturities: Gemdale has a relatively low amount of public debt maturing in 2025, providing some short-term financial breathing room.

- Future Capital Needs: Ongoing access to financing will be critical for Gemdale to fund its projects and pursue new opportunities.

Rental Market Dynamics

The rental market is experiencing shifts that impact companies like Gemdale. For instance, the rental housing component within the consumer price index has seen a downturn in recent years. This decline is largely due to reduced income expectations among consumers and a growing supply of government-subsidized housing options.

These changes directly influence the financial performance of Gemdale's commercial property ventures, especially those focused on rental housing. A weaker rental market can mean lower occupancy rates and potentially reduced rental income, affecting overall profitability.

- Declining Rental CPI: The rental housing segment of the CPI has shown a downward trend, indicating softer rental demand or increased supply pressures.

- Impact on Gemdale: This trend poses a challenge for Gemdale's rental property revenue streams.

- Contributing Factors: Lower consumer income expectations and increased availability of subsidized housing are key drivers of this market shift.

China's economic growth, while showing resilience, is moderating, with GDP growth projected around 4.5% for 2025. This slowdown, influenced by property sector adjustments and global economic shifts, impacts overall consumer spending and investment appetite.

The property market is showing signs of stabilization, with a projected easing of the decline in sales and prices by early 2025. However, government support measures, like eased mortgage policies in key cities, are crucial for sustaining this recovery. New housing starts are expected to decline at a slower pace in 2025 compared to previous years.

Gemdale's financial health is closely tied to these economic and property market trends. The company's ability to manage its debt, with a relatively low public debt maturity of approximately RMB 5 billion in 2025, positions it favorably amidst tighter developer financing conditions.

| Economic Indicator | 2024 Projection/Actual | 2025 Projection |

|---|---|---|

| China GDP Growth | ~5.0% | ~4.5% |

| Property Sales Volume | Slight decline easing | Stabilizing/Slight growth |

| New Housing Starts | Continued decline (slower pace) | Stabilizing/Slight decline |

| Gemdale Public Debt Maturity (2025) | N/A | ~RMB 5 billion |

Preview the Actual Deliverable

Gemdale PESTLE Analysis

The Gemdale PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This detailed breakdown of Gemdale's operating environment, covering Political, Economic, Social, Technological, Legal, and Environmental factors, is delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing you with a comprehensive understanding of Gemdale's strategic landscape.

Sociological factors

China's urbanization rate has been steadily climbing, with projections indicating it will reach approximately 65% by the end of 2024. This trend sees millions of people relocating to cities annually, seeking better employment and higher living standards. Gemdale, as a major property developer, directly benefits from this influx as it fuels consistent demand for housing and commercial spaces in its core urban markets.

Demographic shifts, such as plateauing population growth in key markets, are reshaping housing demand. This transition signals a move from broad expansion to a focus on upgrade demand, with a particular emphasis on larger, higher-quality first-hand homes. For instance, in 2024, the average household size in many developed urban centers continued to shrink, increasing the appeal of more spacious living arrangements for those looking to move up.

Consumers are increasingly prioritizing living environments that offer more than just shelter. There's a pronounced and growing demand for high-quality construction, eco-friendly materials and design, and integrated smart home technologies. This trend is evident in the rising market share of green-certified buildings, which saw a 15% increase in sales volume in 2024 compared to the previous year, indicating a clear consumer preference for sustainable and technologically advanced housing solutions.

Gemdale must proactively adapt its development strategies to align with these evolving consumer preferences. This involves not only adjusting the size and features of new developments but also investing in sustainable building practices and smart home integration to remain competitive. Failure to do so could lead to missed opportunities in a market increasingly driven by quality, environmental consciousness, and technological convenience.

Rising housing costs in China's major cities are a significant challenge, particularly for low and middle-income families. In 2024, the average home price in Tier 1 cities like Beijing and Shanghai continued to outpace wage growth, exacerbating affordability issues.

In response, the government is actively expanding affordable housing programs, including rental subsidies and the development of more public housing units. This trend is creating a distinct segment within the market, often referred to as a dual-track system.

Gemdale's strategic approach to this evolving landscape, whether through direct involvement in affordable housing projects or by adjusting its market positioning to cater to a broader income spectrum, will be crucial for its long-term success and social contribution.

Consumer Confidence and Household Debt

Consumer confidence remains a significant concern, directly impacting the housing market's vitality. In early 2024, various surveys indicated a cautious sentiment among households, with many delaying major purchases, including real estate. This hesitancy stems from ongoing economic uncertainties and the persistent burden of household debt, which has seen a steady increase over recent years.

Gemdale's sales figures are intrinsically linked to these consumer sentiments. A downturn in confidence often translates to reduced demand for new properties, affecting the company's revenue streams. For instance, a significant portion of Gemdale's revenue is derived from individual homebuyers whose purchasing power is directly influenced by their financial outlook and debt levels.

The path to a sustained recovery in the housing market, and by extension for companies like Gemdale, hinges on a noticeable rebound in consumer confidence. This rebound would likely be spurred by factors such as stabilizing inflation, improved employment prospects, and a more manageable debt environment for households.

- Consumer Confidence: Surveys in early 2024 showed a general cautiousness, with many households postponing large expenditures.

- Household Debt: The rising levels of household debt continue to constrain discretionary spending, particularly on big-ticket items like housing.

- Market Sensitivity: Gemdale's sales performance is highly susceptible to shifts in consumer sentiment and their capacity to take on new debt.

- Recovery Driver: A significant improvement in consumer confidence is a prerequisite for a robust and sustained recovery in the housing sector.

Demand for Property Management Services

Gemdale's property management services are bolstered by the increasing urbanization and a growing demand for professional management. As of early 2025, China's urbanization rate is projected to reach over 65%, translating into a significant number of new residential and commercial properties requiring expert oversight. This trend directly fuels the need for services like Gemdale's, ensuring efficient operations and enhanced property value for owners.

The expanding middle class and rising disposable incomes further contribute to this demand. Property owners are increasingly willing to pay for specialized management that handles maintenance, tenant relations, and financial administration, creating a stable and recurring revenue source for Gemdale. This also fosters customer loyalty, as effective management can lead to higher tenant satisfaction and retention rates.

- Urbanization Drive: China's urbanization rate is expected to exceed 65% by early 2025, increasing the pool of properties needing management.

- Middle-Class Growth: A growing middle class with higher incomes prioritizes professional property upkeep.

- Service Demand: There's a clear demand for comprehensive services covering maintenance, tenant liaison, and financial oversight.

- Revenue Stability: Property management offers a consistent revenue stream, enhancing Gemdale's financial predictability.

Sociological factors significantly influence Gemdale's market position, driven by China's rapid urbanization and evolving consumer priorities. The shift towards higher-quality, eco-friendly, and smart-enabled housing reflects a more discerning buyer. Furthermore, government initiatives for affordable housing and the impact of consumer confidence and household debt levels are critical considerations for the company's strategic planning and market penetration.

| Sociological Factor | Description | Impact on Gemdale | Relevant Data (2024/2025) |

|---|---|---|---|

| Urbanization | Migration of people to cities for better opportunities. | Increased demand for housing and commercial spaces. | China's urbanization rate projected to exceed 65% by early 2025. |

| Demographic Shifts | Plateauing population growth, shrinking household sizes. | Focus on upgrade demand and larger, higher-quality homes. | Average household size in developed urban centers continues to decrease. |

| Consumer Preferences | Demand for quality, eco-friendly, and smart home features. | Need to adapt development strategies and invest in sustainable tech. | Green-certified buildings saw a 15% sales volume increase in 2024. |

| Affordability & Policy | Rising housing costs, government affordable housing programs. | Requires strategic positioning to cater to a broader income spectrum. | Average home prices in Tier 1 cities outpaced wage growth in 2024. |

| Consumer Confidence | Household caution due to economic uncertainty and debt. | Directly impacts sales volume and revenue streams. | Surveys in early 2024 indicated cautious household sentiment. |

Technological factors

The drive towards 'smart' homes and elevated housing standards means more Internet of Things (IoT) tech in residences. Gemdale can use these smart home features to boost property appeal, enhance resident satisfaction, and stand out in the market. For instance, the global smart home market was valued at over $100 billion in 2023 and is projected to reach over $200 billion by 2028, showing significant growth potential.

Advancements in construction technology are significantly reshaping the industry. Modular construction and prefabrication, for instance, are gaining traction, promising faster build times and improved quality control. In 2024, the global modular construction market was valued at approximately $95.6 billion and is projected to grow substantially, reflecting a strong industry shift towards off-site manufacturing.

Automation, including the use of robotics in tasks like bricklaying and welding, is also on the rise, aiming to boost efficiency and address labor shortages. Gemdale can leverage these innovations to streamline its development processes, potentially reducing construction timelines by up to 20-30% and lowering overall project costs, thereby enhancing its competitive edge.

Digitalization is revolutionizing property management, boosting efficiency and tenant engagement. Gemdale's property management services can leverage digital tools for streamlined operations and informed decisions. For instance, the adoption of smart building technologies, like IoT sensors for energy management, is becoming increasingly common. By 2024, the global smart building market was projected to reach over $100 billion, indicating a strong trend towards digital integration in real estate management.

Big Data and Market Analysis

Big data analytics offers Gemdale a significant edge in understanding dynamic market landscapes. By processing vast datasets, the company can uncover subtle trends in consumer preferences and identify underserved geographical areas for development. For instance, in 2024, real estate analytics firms reported a 15% increase in the use of AI-driven market analysis by major developers to predict demand shifts, a trend Gemdale can leverage.

Gemdale can deploy these advanced analytical tools to refine its strategic decision-making across the board. This includes optimizing land acquisition by pinpointing locations with high future growth potential, enhancing project planning with data-backed insights into desired amenities, and sharpening marketing campaigns to resonate more effectively with target demographics. The ability to predict market movements with greater accuracy in 2025 is crucial for maintaining a competitive advantage.

The application of big data extends to risk mitigation and operational efficiency. By analyzing historical sales data, construction costs, and economic indicators, Gemdale can better forecast project profitability and manage financial exposure. In 2024, the global big data market was valued at over $200 billion, underscoring the widespread adoption and recognized value of these technologies in driving business performance.

Key applications for Gemdale include:

- Predictive Market Modeling: Utilizing AI to forecast property demand and price appreciation in specific regions.

- Customer Segmentation: Analyzing buyer data to tailor product offerings and marketing messages.

- Site Selection Optimization: Identifying optimal land parcels based on demographic, economic, and infrastructure data.

- Operational Efficiency: Streamlining construction and sales processes through data-driven insights.

Green Building Technologies

The real estate sector is increasingly prioritizing environmental sustainability, making the adoption of green building technologies, energy-efficient designs, and sustainable materials a critical factor. Gemdale can leverage these advancements to not only meet evolving environmental regulations but also to attract a growing segment of environmentally conscious buyers and tenants. For instance, the global green building market was valued at approximately USD 321.6 billion in 2023 and is projected to reach USD 1.4 trillion by 2030, indicating a significant growth trajectory and market opportunity.

Incorporating features like advanced insulation, solar panels, and water-saving fixtures can lead to substantial operational cost reductions for buildings, which is a key selling point. Furthermore, certifications like LEED (Leadership in Energy and Environmental Design) are becoming benchmarks for quality and sustainability in the industry. In 2024, the demand for LEED-certified buildings continues to rise, with projects seeking these credentials often commanding higher rental rates and occupancy levels.

- Green Building Market Growth: The global green building market is expected to surge from an estimated USD 321.6 billion in 2023 to USD 1.4 trillion by 2030, highlighting a strong trend towards sustainable construction.

- Cost Savings: Energy-efficient designs and technologies can reduce a building's operational expenses, offering a compelling financial incentive for both developers and occupants.

- Market Appeal: Adopting green building practices enhances a property's marketability, attracting environmentally aware consumers and potentially leading to premium pricing and higher occupancy rates.

- Regulatory Compliance: Proactive integration of green technologies ensures Gemdale stays ahead of increasingly stringent environmental standards and regulations in the real estate sector.

Technological advancements are rapidly transforming the real estate landscape, from smart home integration to innovative construction methods. Gemdale can capitalize on these trends by adopting modular construction, which saw its global market valued at approximately $95.6 billion in 2024, and embracing automation to improve efficiency and reduce costs. Furthermore, the increasing adoption of big data analytics, with the global market exceeding $200 billion in 2024, allows for more precise market forecasting and optimized site selection.

| Technological Factor | 2024/2025 Market Data/Trend | Gemdale Opportunity |

|---|---|---|

| Smart Home Technology | Global smart home market projected to exceed $200 billion by 2028. | Enhance property appeal and resident satisfaction. |

| Modular Construction | Global market valued at approx. $95.6 billion in 2024. | Faster build times, improved quality control, cost reduction. |

| Automation/Robotics | Aimed at boosting efficiency and addressing labor shortages. | Streamline development, reduce construction timelines and costs. |

| Big Data Analytics | Global market valued over $200 billion in 2024. | Refine strategic decisions, optimize land acquisition, enhance project planning. |

Legal factors

China's real estate financing landscape is heavily influenced by evolving regulations. The implementation of the 'white list' mechanism, designed to support pre-sale funding for eligible projects, directly impacts how developers like Gemdale can secure capital. In 2024, this mechanism aims to stabilize the market by channeling funds to projects with stronger fundamentals.

Furthermore, regulations surrounding local government special-purpose bonds play a crucial role in infrastructure development that often supports real estate projects. Gemdale must remain agile and adapt its financing strategies to align with these dynamic legal frameworks to ensure the successful funding and completion of its developments.

Government policies are actively adjusting property transaction restrictions, with some major cities already relaxing buying curbs. For instance, by early 2024, several tier-1 cities began easing purchase eligibility requirements and mortgage terms, broadening the potential buyer pool for residential developers like Gemdale.

These policy shifts directly impact Gemdale’s market access and sales potential. Relaxed restrictions can unlock demand previously constrained by ownership limitations, particularly in key urban centers where Gemdale has significant project pipelines.

Land use and development regulations are critical for Gemdale. Rules around acquiring land, undertaking urban renewal, and managing new land supply directly impact Gemdale's capacity to secure new development sites and maintain its project pipeline. For instance, in 2024, China's National Development and Reform Commission continued to emphasize efficient land utilization, potentially limiting the availability of new greenfield sites for developers like Gemdale.

Environmental Protection Laws and Standards

Environmental protection laws are becoming increasingly stringent, particularly concerning impact assessments and green building standards. Gemdale needs to navigate these evolving regulations to ensure full compliance across its projects.

New urban buildings are facing higher energy efficiency targets. For instance, China's updated Green Building Evaluation Standard (GBES) in 2024 aims to elevate energy-saving requirements, pushing developers like Gemdale to integrate more sustainable design and construction practices.

- Stricter Environmental Impact Assessments: Gemdale must adhere to more rigorous pre-development environmental reviews.

- Green Building Standards Compliance: Meeting updated energy efficiency targets for new urban buildings is crucial.

- Evolving Regulatory Landscape: Continuous monitoring of environmental legislation is necessary for ongoing compliance.

Consumer Protection and Property Delivery Laws

Policymakers are prioritizing the timely delivery of homes currently under construction, alongside reforms to the commercial housing sales system to promote the sale of completed properties. These initiatives are designed to safeguard homebuyers and ensure projects are finished on schedule, a critical compliance area for Gemdale.

For instance, China's Ministry of Housing and Urban-Rural Development has been actively promoting measures to stabilize the property market and address unfinished projects. In 2024, continued efforts are expected to focus on accelerating the handover of pre-sold properties, with specific provincial and municipal regulations often detailing delivery timelines and homeowner protections.

- Homebuyer Protection: Laws are increasingly stringent regarding the quality and timely completion of residential projects, directly impacting developer obligations.

- Sales System Reforms: Encouraging the sale of completed homes aims to reduce risks for buyers and improve market stability, influencing sales strategies.

- Project Delivery Timelines: Adherence to contractual delivery dates is paramount, with potential penalties for delays affecting Gemdale's operational efficiency.

- Regulatory Scrutiny: Increased government oversight on property development and sales necessitates robust compliance frameworks for Gemdale.

Legal factors significantly shape Gemdale's operations, particularly concerning financing and market access. The ongoing evolution of China's real estate financing regulations, including the 'white list' mechanism introduced in 2024, directly influences how developers secure capital for projects. Furthermore, the relaxation of property transaction restrictions in major cities by early 2024 has broadened the potential buyer pool, impacting Gemdale's sales strategies and market reach.

Gemdale must also navigate increasingly stringent environmental protection laws and updated green building standards, such as China's revised GBES in 2024, which mandates higher energy efficiency targets for new urban buildings. Adherence to these evolving legal frameworks is crucial for compliance and sustainable development practices.

The legal landscape also prioritizes homebuyer protection, with laws focusing on the timely delivery of homes and reforms to the commercial housing sales system. In 2024, government initiatives continue to emphasize project completion and handover, making adherence to delivery timelines and quality standards a critical operational focus for Gemdale.

Environmental factors

China's commitment to green building is accelerating, with a mandate for all new urban constructions to meet green building standards by 2025. This policy shift, coupled with a focus on enhancing energy efficiency in existing structures, directly impacts developers like Gemdale. The company must embed sustainable design principles and energy-saving technologies into its development pipeline to ensure regulatory compliance and capitalize on growing market demand for eco-friendly properties.

Governments worldwide are increasingly mandating the inclusion of carbon emission evaluations in energy conservation reviews for new development projects, a trend that will directly impact Gemdale. This means Gemdale's upcoming projects will likely face stricter requirements for greenhouse gas emission impact assessments. For instance, China, a key market for Gemdale, has pledged to peak carbon dioxide emissions before 2030 and achieve carbon neutrality before 2060, signaling a tightening regulatory environment for developers.

These environmental assessments necessitate meticulous planning to minimize the ecological footprint of Gemdale's developments. This could involve adopting more sustainable building materials, optimizing energy efficiency in designs, and exploring renewable energy integration. The financial implications of these requirements, including potential costs for compliance and mitigation strategies, will be a critical consideration for Gemdale’s project budgeting and feasibility studies throughout 2024 and into 2025.

China's urbanization strategy is increasingly focused on enhancing the quality and efficiency of existing urban spaces, a trend exemplified by urban renewal initiatives. These projects, which include the renovation of urban villages and older housing stock, present significant opportunities for developers like Gemdale to participate in sustainable urban redevelopment.

This shift aligns with national goals for more eco-friendly urban environments. For instance, by the end of 2023, China had completed renovations for over 50,000 old urban residential communities, benefiting more than 8.2 million households, demonstrating the scale of this ongoing effort and Gemdale's potential role in these impactful projects.

Resource Management and Waste Reduction

Gemdale's commitment to resource management and waste reduction is crucial given the environmental footprint of large-scale real estate. By prioritizing sustainable construction materials, such as recycled steel and low-VOC paints, the company can significantly lower its environmental impact. This approach not only conserves natural resources but also contributes to healthier living and working spaces for end-users.

Implementing efficient waste management plans across all development phases is essential. This includes strategies for sorting and recycling construction debris, aiming to divert a substantial portion from landfills. For instance, a target of diverting 75% of construction waste from landfills by 2025 is an achievable and impactful goal.

- Sustainable Materials: Gemdale can integrate materials like bamboo, reclaimed wood, and recycled concrete into its projects, reducing reliance on virgin resources.

- Waste Diversion Targets: Setting ambitious goals, such as diverting over 70% of construction and demolition waste from landfills, demonstrates a strong commitment to circular economy principles.

- Lifecycle Assessment: Conducting lifecycle assessments for key building components can identify opportunities for further resource optimization and waste minimization throughout the entire project lifecycle.

- Water Conservation: Implementing water-saving fixtures and rainwater harvesting systems in new developments can reduce overall water consumption by an estimated 30-40%.

Climate Change Adaptation in Property Design

With growing concerns about climate change, property designs that can withstand extreme weather are becoming more important. Gemdale should consider integrating features like advanced drainage systems, similar to the 'sponge city' concepts gaining traction, into its future projects to enhance resilience.

The increasing frequency of extreme weather events, such as floods and heatwaves, necessitates adaptive building strategies. For instance, in 2023, China's Ministry of Housing and Urban-Rural Development continued to promote sponge city construction, with over 30 pilot cities implementing these water-management solutions, demonstrating a clear market direction towards climate-resilient infrastructure.

- Enhanced Drainage: Implementing permeable surfaces and green infrastructure to manage stormwater runoff effectively.

- Resilient Materials: Utilizing building materials that can withstand higher temperatures and more intense precipitation.

- Energy Efficiency: Incorporating passive cooling and heating designs to reduce reliance on energy-intensive climate control systems.

- Flood Mitigation: Elevating ground floors and designing for potential water ingress in vulnerable areas.

China's ambitious environmental goals, including peaking carbon emissions before 2030 and achieving carbon neutrality by 2060, create a regulatory landscape that directly influences real estate development. Gemdale must align its projects with these targets, focusing on energy efficiency and reduced carbon footprints.

The push for green building standards in all new urban constructions by 2025 means Gemdale needs to embed sustainable design and energy-saving technologies into its development pipeline. This regulatory shift is not just about compliance but also about meeting the growing market demand for eco-friendly properties.

Urban renewal initiatives, a key part of China's urbanization strategy, offer Gemdale opportunities to engage in sustainable redevelopment. The country's progress, with over 50,000 old urban residential communities renovated by the end of 2023, highlights the scale and potential of these projects.

Gemdale's commitment to resource management is vital, with targets like diverting 75% of construction waste from landfills by 2025. Integrating materials like bamboo and recycled concrete, alongside efficient waste management, will be crucial for minimizing environmental impact.

| Environmental Factor | Description | Impact on Gemdale | Relevant Data/Targets |

|---|---|---|---|

| Climate Change & Extreme Weather | Increasing frequency of extreme weather events necessitates adaptive building strategies. | Gemdale needs to integrate climate-resilient features like advanced drainage systems. | Over 30 pilot cities in China promote sponge city construction (2023). |

| Green Building Mandates | Government policies require new urban constructions to meet green building standards. | Gemdale must incorporate sustainable design principles and energy-saving technologies. | Mandate for all new urban constructions by 2025. |

| Carbon Emission Regulations | Stricter requirements for greenhouse gas emission impact assessments in new projects. | Gemdale's projects will face increased scrutiny regarding their carbon footprint. | China aims to peak CO2 emissions before 2030 and achieve carbon neutrality by 2060. |

| Resource Management & Waste Reduction | Focus on sustainable materials and efficient waste management in construction. | Gemdale should prioritize recycled materials and waste diversion strategies. | Target of diverting 75% of construction waste from landfills by 2025. |

PESTLE Analysis Data Sources

Our Gemdale PESTLE Analysis is meticulously crafted using a comprehensive blend of data, including official government publications, reputable industry analysis reports, and reputable financial news outlets. This ensures that every aspect of the political, economic, social, technological, legal, and environmental landscape affecting Gemdale is grounded in accurate and current information.