Gemdale Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gemdale Bundle

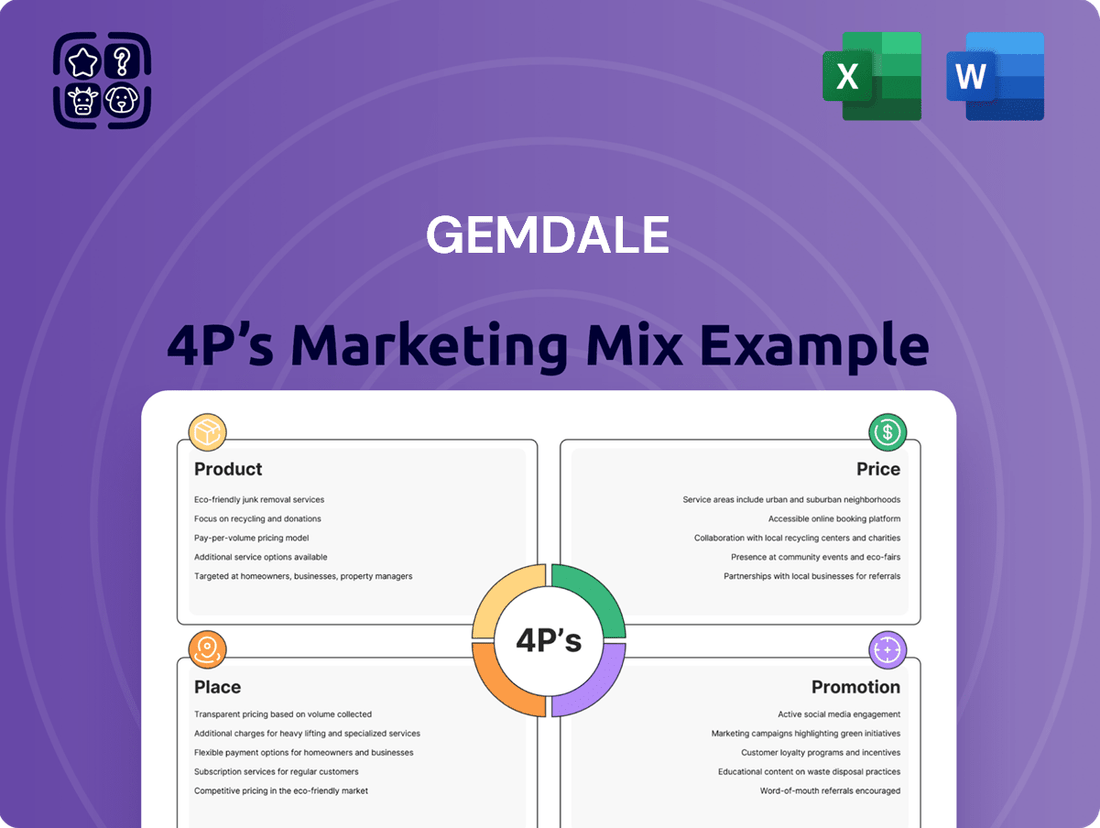

Discover how Gemdale leverages its product innovation, strategic pricing, expansive distribution, and targeted promotions to dominate the real estate market. This analysis offers a glimpse into their winning formula.

Ready to unlock the full potential of a successful marketing strategy? Gain instant access to a comprehensive, editable 4Ps Marketing Mix Analysis for Gemdale, designed to provide actionable insights for your own business endeavors.

Product

Gemdale Corporation's primary focus is the development and sale of residential properties, serving a wide range of customer requirements in cities throughout China. Their portfolio encompasses high-quality residential communities, apartments, condominiums, and various housing types. This commitment to diverse housing options underscores their strategy to meet varied market demands.

In 2023, Gemdale reported significant revenue from its property development segment, demonstrating its core strength. The company's sales performance across its residential projects in key Tier 1 and Tier 2 cities highlights its ability to cater to evolving consumer preferences for modern living spaces and community amenities.

Gemdale's commercial property segment extends beyond housing, encompassing a diverse range of assets like office buildings, retail centers, and industrial parks. These developments aim to create synergistic environments for both businesses and residents, strategically located in burgeoning urban areas.

The company's commitment to quality and functionality is evident in its business park investments. For instance, projects such as the Shanghai Songjiang Life Science Park and Shenzhen Business Park highlight Gemdale's strategic focus on creating valuable commercial infrastructure. As of the first half of 2024, Gemdale's commercial property portfolio contributed significantly to its overall revenue, showcasing its importance in the company's diversified business strategy.

Gemdale's property management services are a cornerstone of its offering, providing comprehensive care for its developed residential, commercial, and even city-level projects. This integrated approach ensures a high standard of living and operational efficiency for all stakeholders.

Through its Gemdale Smart Service Group, the corporation extends its expertise across China and into the U.S. This platform manages a vast array of properties, demonstrating significant scale and reach in the property management sector.

The services provided by Gemdale Smart Service Group are not limited to traditional residential and commercial spaces. They also encompass management of public facilities, support for real estate developers, and services for large enterprise headquarters, highlighting a diversified portfolio in 2024.

Integrated Real Estate Solutions

Gemdale's Product strategy centers on Integrated Real Estate Solutions, positioning them as a comprehensive developer and asset management platform. This approach goes beyond simple construction, encompassing development, investment, property management, and operational services across diverse asset classes. Their goal is to create integrated spaces that not only add value to urban environments but also meet the multifaceted needs of businesses and individuals.

This integrated model allows Gemdale to capture value across the entire real estate lifecycle. For instance, in 2024, Gemdale Corporation reported a significant presence in key urban centers, demonstrating their commitment to developing and managing a wide array of properties, from residential communities to commercial complexes and industrial parks. Their focus on holistic solutions aims to foster sustainable urban development and provide enhanced living and working experiences.

- Holistic Property Lifecycle Management: Development, investment, management, and operation are all core components.

- Value Enhancement for Cities: Focus on creating integrated spaces that contribute to urban vitality.

- Diverse Stakeholder Needs: Catering to both enterprise requirements and individual preferences.

- 2024 Performance Indicator: Gemdale's continued expansion in major metropolitan areas underscores the demand for their integrated solutions.

Value-Added Services and Community Operations

Gemdale's marketing mix extends beyond traditional property sales to encompass value-added services and robust community operations. This strategic pivot aims to deepen customer engagement and create recurring revenue streams, differentiating Gemdale in a competitive market. The company is actively developing integrated living experiences that cater to diverse needs.

A prime example of this is the Gemdale Strongberry Community, an initiative focused on providing affordable rental housing solutions. This segment addresses a growing demand for accessible urban living. Beyond housing, Gemdale is exploring complementary services, potentially including real estate financing options and international education programs with a focus on sports business, such as tennis, to enrich the lifestyle within its developments.

By integrating these services, Gemdale seeks to build stronger, more connected communities. This approach not only enhances the value proposition for residents but also fosters long-term loyalty. The company's investment in these areas reflects a forward-thinking strategy to capture evolving market trends and consumer preferences in the real estate sector.

Gemdale's product strategy is centered on delivering integrated real estate solutions, moving beyond basic development to encompass the entire property lifecycle. This includes investment, management, and operational services across residential, commercial, and industrial assets. Their aim is to create synergistic urban environments that cater to a broad spectrum of needs, from individual living preferences to enterprise requirements.

This holistic approach is exemplified by their diverse portfolio, which includes high-quality residential communities, modern office buildings, and functional business parks. For instance, in the first half of 2024, Gemdale's commercial property segment demonstrated significant revenue contribution, underscoring the success of this integrated strategy. The company is also expanding into value-added services, such as affordable rental housing through initiatives like Gemdale Strongberry Community, and exploring lifestyle enrichment programs.

| Product Offering | Key Features | Target Market | 2024 Focus/Data Point |

|---|---|---|---|

| Residential Properties | High-quality communities, apartments, condominiums | Homebuyers seeking modern living, community amenities | Continued development in Tier 1 and Tier 2 cities |

| Commercial Properties | Office buildings, retail centers, industrial parks | Businesses, enterprises seeking strategic locations | Significant revenue contribution in H1 2024 |

| Integrated Solutions | Development, investment, property management, operations | Diverse stakeholders (individuals, businesses, cities) | Expansion in major metropolitan areas |

| Value-Added Services | Affordable rental housing (Strongberry), potential lifestyle programs | Urban dwellers seeking accessible living, enriched experiences | Exploration of real estate financing and international education programs |

What is included in the product

This analysis provides a comprehensive breakdown of Gemdale's marketing strategies, examining its Product offerings, Pricing tactics, Place distribution, and Promotion efforts.

It offers actionable insights into Gemdale's market positioning and competitive advantages, making it a valuable resource for strategic decision-making.

Streamlines the often complex Gemdale 4Ps analysis into a clear, actionable framework, eliminating confusion and saving valuable time for marketing teams.

Place

Gemdale Corporation's extensive presence in China is a cornerstone of its strategy, with operations spanning over 280 first-tier and second-tier cities. This broad reach ensures accessibility to its residential and commercial developments in crucial urban centers experiencing robust demand. The company's focus on economically developed cities and urban agglomerations positions it to capitalize on significant growth opportunities.

Gemdale's distribution strategy hinges on shrewd land acquisitions in desirable urban areas. By actively resuming land purchases in early 2025, targeting major hubs like Shanghai and Hangzhou, the company is proactively securing prime development opportunities. This focus on first- and second-tier cities ensures a pipeline of new projects in markets poised for significant growth.

Gemdale's primary sales and marketing strategy centers on direct engagement, focusing on the development and sale of residential and commercial properties. This approach typically involves on-site sales centers at their project locations, offering a tangible experience for potential buyers. In 2023, Gemdale reported contracted sales of RMB 130.3 billion, underscoring the effectiveness of this direct distribution model.

Property Management Network

Gemdale Smart Service Group leverages its extensive property management network, a cornerstone of its marketing mix, to deliver comprehensive services. This network spans a significant geographical footprint, covering numerous cities across Mainland China and extending into several U.S. locations. This broad reach is critical for both managing Gemdale's own developed projects and serving a growing base of third-party clients, ensuring efficient and high-quality service delivery.

The scale of Gemdale's operations is substantial, reflecting its position in the market. As of the first half of 2024, the group managed a total contracted area of approximately 640 million square meters, with a significant portion, around 330 million square meters, under management contracts. This vast operational scale allows for economies of scale in service provision and a deep understanding of diverse market needs.

- Geographic Reach: Operates in numerous cities across Mainland China and in several U.S. cities, demonstrating a wide operational footprint.

- Managed Area: As of H1 2024, Gemdale Smart Service Group managed approximately 330 million square meters of property.

- Contracted Area: The total contracted area managed by the group reached around 640 million square meters in H1 2024.

International Expansion (Gemdale USA)

Gemdale's international strategy is prominently represented by Gemdale USA, established to tap into the lucrative U.S. real estate market. This expansion diversifies their geographical footprint beyond China, focusing on strategic urban centers known for their development potential.

Headquartered in Pasadena, California, Gemdale USA also maintains a presence in other key U.S. cities, including New York City, San Francisco, and Seattle. This network allows Gemdale to effectively target and manage commercial and residential development projects in these high-growth gateway markets.

- Strategic Market Entry: Gemdale USA targets major U.S. cities for commercial and residential development.

- Geographic Diversification: The U.S. presence extends Gemdale's reach beyond its primary operations in China.

- Key Office Locations: Pasadena (HQ), New York City, San Francisco, and Seattle are central to their U.S. operations.

Gemdale's place strategy is defined by its deep penetration into China's urban landscape, targeting first- and second-tier cities with strong economic fundamentals. This geographic concentration, evident in its operations across over 280 cities, ensures proximity to high-demand markets. The company's proactive land acquisition strategy in early 2025, focusing on hubs like Shanghai and Hangzhou, further solidifies its presence in prime locations. This strategic placement is crucial for its direct sales model, enabling tangible engagement with potential buyers at project sites.

| Market Focus | Geographic Spread (China) | International Presence | Key U.S. Locations |

|---|---|---|---|

| First- and Second-Tier Cities | Over 280 cities | Gemdale USA | Pasadena (HQ), New York, San Francisco, Seattle |

| Economic Hubs Targeted | Shanghai, Hangzhou (2025 acquisitions) | Diversification beyond China | Gateway markets for development |

| Distribution Strategy Alignment | Proximity to demand centers | Access to U.S. real estate market | Targeting high-growth urban centers |

Same Document Delivered

Gemdale 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Gemdale 4P's Marketing Mix Analysis covers all essential elements, ensuring you have the complete picture. You're viewing the exact version of the analysis you'll receive, fully complete and ready to use.

Promotion

Gemdale leverages corporate announcements and financial reports as a key component of its marketing mix, specifically within the Promotion element. These communications are designed to reach a sophisticated audience of investors, analysts, and business strategists, offering a transparent view of the company's operational and financial health.

The company regularly publishes detailed annual reports, interim financial statements, and unaudited operating statistics. For instance, Gemdale's 2024 interim report highlighted a significant increase in contracted sales, reaching RMB 150 billion, reflecting strong market performance and effective strategic execution.

These reports provide crucial data on sales figures, the company's financial standing, and its forward-looking strategies, enabling stakeholders to make informed investment and business decisions. The commitment to transparency in reporting, including detailed breakdowns of revenue streams and profitability metrics, underpins investor confidence.

Gemdale actively manages its investor relations to ensure transparency with shareholders and attract new investment. This involves disseminating crucial information through investor presentations and direct engagement, detailing the company's financial performance and strategic direction.

Key discussions often revolve around Gemdale's commitment to debt reduction, a critical factor for financial stability. For instance, as of the first half of 2024, the company reported a net debt to equity ratio of 75%, a figure they are actively working to improve.

Furthermore, the company provides insights into its growth strategies, including detailed land acquisition plans. In 2023, Gemdale secured new land reserves totaling 5.2 million square meters, signaling a proactive approach to expanding its development pipeline and future revenue streams.

Gemdale prioritizes building a robust brand and a solid reputation, showcasing its identity as a financially sound and well-managed real estate developer. This focus on integrity and stability is crucial for investor confidence and customer trust.

The company's property management subsidiary, Gemdale Smart Service, plays a significant role in this brand building. It consistently garners accolades for its high-quality services and overall strength in the industry. For instance, in 2023, Gemdale Smart Service was recognized among the top property management companies in China, reflecting its sustained commitment to excellence and customer satisfaction.

Industry Recognition and Awards

Gemdale's promotion strategy leverages industry recognition and awards to build credibility and attract customers. This includes showcasing accolades for their diverse projects, such as their industrial parks. For instance, in 2024, several of Gemdale's industrial park developments received prestigious industry awards for innovation and sustainability, reinforcing their market leadership.

Furthermore, their commitment to quality and service in the rental housing sector is highlighted by significant achievements. Gemdale's rental housing business was recognized in 2024 as one of the Top 10 Comprehensive Strength of Housing Rental Enterprises in China, a testament to their operational excellence and market impact. This recognition is a key component of their promotional efforts, aiming to differentiate them in a competitive landscape.

- Industry Awards for Industrial Parks: Gemdale's industrial park projects have consistently garnered industry accolades in 2024 for their design, infrastructure, and contribution to economic development.

- Top 10 Rental Housing Enterprise Recognition: The company's rental housing division was ranked among the Top 10 Comprehensive Strength of Housing Rental Enterprises in China in 2024, underscoring its market dominance and operational efficiency.

- Enhanced Brand Reputation: Highlighting these awards in promotional materials directly enhances Gemdale's brand reputation, signaling quality and reliability to potential investors and tenants.

- Competitive Differentiation: Such recognition serves as a powerful differentiator, setting Gemdale apart from competitors by providing tangible proof of their superior performance and market standing.

Corporate Social Responsibility (CSR) Initiatives

Gemdale actively showcases its dedication to social responsibility through a range of Corporate Social Responsibility (CSR) initiatives. These efforts, frequently spotlighted by Gemdale USA, aim to foster goodwill and enhance its brand reputation.

These activities often involve deep community engagement, strategic collaborations with non-profit organizations, and active participation in key industry events. Such involvement not only strengthens Gemdale's public image but also aligns with broader societal expectations for corporate citizenship.

- Community Engagement: Gemdale USA has been involved in local community development projects, contributing to urban revitalization efforts. For instance, in 2024, Gemdale supported local park improvements in a key operating city, enhancing public spaces for residents.

- Non-profit Partnerships: The company partners with various charitable organizations. In late 2024, Gemdale announced a significant contribution to a housing assistance program aimed at low-income families, reflecting a commitment to social welfare.

- Industry Event Participation: Gemdale regularly participates in sustainability and urban development forums, sharing best practices and demonstrating its commitment to responsible business operations. Their presence at the 2024 Urban Land Institute (ULI) Fall Meeting underscored their focus on sustainable development.

- Positive Public Image: These CSR actions collectively contribute to a positive public perception, positioning Gemdale as a socially conscious and community-oriented developer. This focus on social impact is a key differentiator in the competitive real estate market.

Gemdale's promotional strategy heavily relies on transparent financial reporting and active investor relations. The company disseminates detailed annual reports, interim statements, and operational statistics to a sophisticated audience, aiming to build investor confidence and attract capital. For example, their 2024 interim report showcased RMB 150 billion in contracted sales, highlighting market performance.

Gemdale also emphasizes its brand strength through industry recognition and awards, particularly for its industrial parks and rental housing services. In 2024, several industrial park developments received innovation and sustainability awards, while their rental housing business was recognized among the Top 10 Comprehensive Strength of Housing Rental Enterprises in China. These accolades serve as powerful differentiators in a competitive market.

Furthermore, Gemdale actively engages in Corporate Social Responsibility (CSR) initiatives, such as community development projects and non-profit partnerships. In 2024, Gemdale supported local park improvements and announced a significant contribution to a housing assistance program, reinforcing its image as a socially conscious developer.

| Key Promotional Activities | 2023/2024 Data Point | Impact on Promotion |

| Contracted Sales (Interim 2024) | RMB 150 billion | Demonstrates market strength and operational success. |

| Industrial Park Awards (2024) | Multiple prestigious industry awards | Enhances brand reputation for innovation and sustainability. |

| Rental Housing Ranking (2024) | Top 10 Comprehensive Strength | Validates operational excellence and market leadership. |

| CSR Initiative (2024) | Support for local park improvements | Builds goodwill and a positive public image. |

Price

Gemdale's residential property pricing is deeply rooted in market dynamics across China's diverse urban landscapes. This strategy ensures their offerings remain competitive and aligned with local demand. For instance, in the first half of 2024, Gemdale reported an average selling price per square meter of RMB 15,800, reflecting an adaptive approach to varying economic conditions and buyer sentiment in key cities.

For Gemdale's commercial properties, like office spaces and business parks, pricing is deeply tied to the value tenants perceive. This means factors such as being in a prime location, the high quality of the buildings and amenities, and the range of services provided are key drivers. For instance, in 2024, prime office rents in major Chinese cities like Shanghai and Beijing continued to command premiums, reflecting these value-added elements.

The revenue stream for these investment properties is largely built upon rental income. However, it's not just the base rent; the associated services, such as property management, maintenance, and even shared amenities, are bundled in, contributing significantly to the overall financial return for Gemdale. This integrated approach ensures consistent cash flow and enhances the attractiveness of their commercial portfolio.

Gemdale Smart Service Group likely employs a flexible pricing strategy for its property management offerings, recognizing the diverse needs of its clientele. This approach could manifest as tiered service packages, allowing clients to select the level of support that best suits their budget and requirements, from basic maintenance to full-service management.

The pricing structure might also incorporate customized agreements, particularly for large enterprises or specialized public facilities. This allows Gemdale to tailor its services, and consequently its pricing, to the unique scale, complexity, and specific demands of each property, ensuring value for a broad spectrum of clients.

Consideration of Economic Conditions and Competitor Pricing

Gemdale's pricing decisions are closely tied to the broader economic climate in China. For instance, during periods of economic slowdown, the company might adopt more flexible pricing to stimulate demand. Conversely, in a recovering market, pricing could reflect increased buyer confidence and potentially higher development costs.

Competitor pricing is a critical benchmark for Gemdale. Analyzing what rivals charge for similar properties allows Gemdale to position its offerings effectively, ensuring competitiveness without compromising its value proposition. This dynamic interplay helps shape Gemdale's market share and profitability.

Looking ahead to 2025, Gemdale anticipates a mild recovery in China's property market. This outlook suggests a pricing strategy that is both responsive to market upticks and mindful of any lingering economic uncertainties. The company aims to balance capturing new demand with maintaining financial prudence.

- Economic Sensitivity: Gemdale's pricing adjusts based on China's economic performance, with flexibility during downturns and potential for upward adjustments during recoveries.

- Competitive Benchmarking: Pricing strategies are informed by competitor offerings to ensure market relevance and attract buyers.

- 2025 Outlook: The projected mild property market recovery in 2025 indicates a pricing approach designed to capitalize on improving conditions while remaining adaptable.

Financial Prudence and Debt Management Impact on Pricing

Gemdale's commitment to financial prudence and actively managing its debt load can significantly impact its pricing. By focusing on a strong balance sheet, the company gains the flexibility to set more competitive prices, knowing its operational costs are well-controlled and its financial health is robust.

This disciplined approach allows Gemdale to absorb market fluctuations and potentially offer attractive pricing to customers, thereby enhancing its market position. A stable financial footing, evidenced by a manageable debt-to-equity ratio, underpins the ability to make strategic pricing decisions that balance market share goals with long-term profitability.

- Financial Discipline: Gemdale's focus on reducing leverage, aiming for a net gearing ratio below a certain threshold, provides pricing stability.

- Strategic Pricing: A sound financial position enables competitive pricing without compromising profit margins.

- Market Competitiveness: Lower debt servicing costs can translate into more attractive product pricing for consumers.

- Profitability Maintenance: Financial prudence ensures that pricing strategies remain sustainable and contribute to overall profitability.

Gemdale's pricing strategy is a dynamic blend of market responsiveness and value perception. For residential properties, average selling prices per square meter in the first half of 2024 stood at RMB 15,800, reflecting adaptation to diverse urban economic conditions.

Commercial property pricing, particularly for office spaces, hinges on location, quality, and services, with prime rents in cities like Shanghai and Beijing commanding premiums throughout 2024. This value-based approach underpins rental income, a primary revenue stream for these assets.

Gemdale Smart Service Group likely employs tiered pricing for its management services, allowing for customization based on client needs and property complexity. This flexibility ensures competitive positioning and caters to a broad client base, from individual homeowners to large commercial entities.

| Property Type | Key Pricing Driver | 2024 Data Point | Pricing Strategy Aspect |

|---|---|---|---|

| Residential | Market Dynamics, Local Demand | Avg. Selling Price: RMB 15,800/sqm (H1 2024) | Market-responsive, competitive |

| Commercial (Office) | Location, Quality, Services | Prime rents in major cities command premiums | Value-based, premium positioning |

| Property Management | Service Tiers, Customization | Flexible packages, tailored agreements | Client-centric, adaptable |

4P's Marketing Mix Analysis Data Sources

Our Gemdale 4P's Marketing Mix Analysis leverages a comprehensive blend of official company disclosures, including annual reports and investor presentations, alongside granular market data from real estate databases and competitor benchmarking. This ensures a robust understanding of Gemdale's product offerings, pricing strategies, distribution channels, and promotional activities.