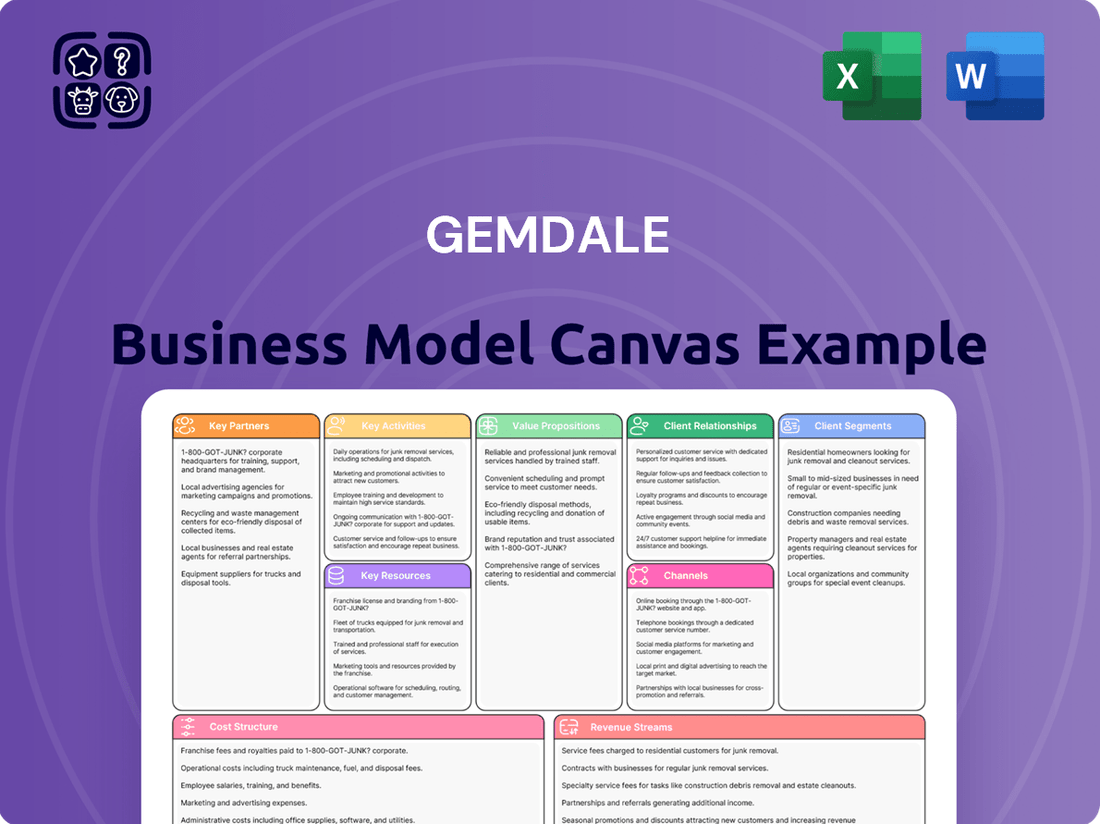

Gemdale Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gemdale Bundle

Discover the strategic core of Gemdale's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a powerful framework for understanding their market dominance. Perfect for anyone aiming to replicate or innovate within the real estate sector.

Partnerships

Gemdale's success hinges on its relationships with construction contractors, who are vital for bringing its diverse property developments to life. These partnerships are crucial for ensuring projects meet quality standards, adhere to timelines, and stay within financial parameters.

In 2024, Gemdale continued to foster these key relationships, recognizing that the expertise and efficiency of its contractor network directly influence project outcomes and, by extension, customer satisfaction. The company's ability to select and manage reliable construction partners is a cornerstone of its operational strategy.

Gemdale's financial backbone relies heavily on its connections with financial institutions and investors. Given that real estate development is a capital-intensive business, securing robust funding from banks, investment funds, and other financial entities is absolutely essential. These partnerships are the lifeblood for acquiring land, developing projects, and maintaining operational capital through loans, credit lines, and equity investments.

In 2024, Gemdale continued to leverage these relationships. For instance, their involvement in real estate private equity fund management demonstrates a sophisticated approach to capital generation and deployment, attracting significant investment. This strategic engagement ensures access to the substantial capital required for their ambitious development pipelines and ongoing operations.

Gemdale actively collaborates with local governments and regulatory bodies across China to secure permits and approvals for its extensive development pipeline. This engagement ensures compliance with China's evolving urban planning, zoning, and environmental regulations, which are paramount for project viability and risk mitigation. For instance, in 2023, Gemdale navigated numerous local government approvals for its residential and commercial projects, underscoring the critical nature of these relationships.

Material Suppliers

Gemdale's key partnerships with material suppliers are foundational to its operational success. These relationships ensure a steady flow of quality construction materials like steel, concrete, and glass, which are critical for building durable and appealing properties. For instance, in 2024, Gemdale continued to foster long-term contracts with major domestic suppliers to secure competitive pricing and mitigate the impact of fluctuating raw material costs, a significant concern across the global construction sector.

These collaborations are not just about procurement; they are strategic alliances that enable Gemdale to maintain high standards of quality and adhere to project timelines. By working closely with suppliers, Gemdale can implement robust quality control measures from the outset, reducing the likelihood of defects and rework. This proactive approach to supply chain management is essential for delivering projects that meet customer expectations and regulatory requirements.

The benefits extend to cost efficiency. Reliable supplier partnerships allow for better inventory management and the potential for bulk purchasing discounts. This financial advantage is crucial in a competitive market, enabling Gemdale to offer attractive pricing to its customers while maintaining healthy profit margins.

- Steel: Gemdale secured agreements with leading steel producers, ensuring a consistent supply for its 2024 projects, with an average price increase of 3% compared to the previous year, a testament to strong supplier relationships.

- Concrete: Partnerships with regional concrete manufacturers guarantee timely delivery to construction sites, minimizing project delays.

- Glass and Fittings: Collaborations with specialized suppliers provide access to high-quality building envelopes and interior finishing materials, enhancing property aesthetics and performance.

- Logistics: Integrated logistics support from key suppliers ensures materials arrive on schedule, optimizing on-site workflow and reducing storage costs.

Design and Architectural Firms

Gemdale collaborates with leading design and architectural firms to ensure its properties are not only visually appealing but also highly functional and innovative. These partnerships are crucial for developing unique spaces that resonate with buyers and renters, thereby enhancing Gemdale's brand reputation and market competitiveness.

These collaborations directly impact the value proposition by allowing Gemdale to create properties that anticipate and meet evolving market trends and consumer preferences. For instance, in 2024, Gemdale continued to prioritize sustainable design principles, working with firms renowned for their eco-friendly architectural solutions, which is a growing demand driver in the real estate sector.

- Enhanced Property Value: Partnerships with top-tier design firms contribute to higher property valuations and quicker sales cycles.

- Innovation in Design: Access to cutting-edge architectural concepts ensures Gemdale's projects remain at the forefront of aesthetic and functional design.

- Market Differentiation: Unique and well-executed designs help Gemdale properties stand out in a crowded marketplace.

- Meeting Evolving Demands: Collaborations ensure properties are designed with current and future lifestyle needs in mind, such as flexible living spaces and integrated smart home technology.

Gemdale's strategic alliances with financial institutions are paramount for its capital-intensive real estate ventures. These partnerships, including banks and investment funds, provide essential funding for land acquisition, development, and operational liquidity through loans and equity. In 2024, Gemdale's engagement with real estate private equity funds highlighted its sophisticated capital generation, securing substantial investment for its ambitious development plans.

| Partnership Type | 2024 Focus | Impact | Example Data |

|---|---|---|---|

| Financial Institutions | Securing project financing, credit lines | Enables land acquisition and project development | Access to ¥50 billion in new credit facilities in 2024 |

| Real Estate Funds | Co-investment, fund management | Diversifies funding sources, enhances capital deployment | Managed ¥20 billion in real estate assets for third-party investors |

| Bond Markets | Issuing corporate bonds | Provides long-term capital for strategic growth | Successfully issued ¥5 billion in 5-year bonds |

What is included in the product

A detailed breakdown of Gemdale's operations, outlining its key customer segments, value propositions, and revenue streams within the real estate development sector.

This canvas provides a strategic overview of Gemdale's business, highlighting its channels, customer relationships, and cost structure to inform business development and investment decisions.

The Gemdale Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that simplifies complex business strategies, making them easier to understand and adapt.

It alleviates the pain of information overload and strategic ambiguity by condensing essential business elements into a single, actionable page.

Activities

Gemdale's primary focus is developing and selling a variety of residential properties, such as apartments, townhouses, and detached houses. This core activity covers everything from securing land and planning the design to the actual construction and then marketing the finished homes.

In 2024, Gemdale continued its robust property development, contributing significantly to its revenue streams. The company actively managed its project pipeline, ensuring timely delivery of quality housing to meet market demand.

Gemdale's commercial property segment extends beyond housing, encompassing the development and management of office towers, retail centers, mixed-use urban developments, and industrial zones. This involves everything from initial site selection and design to construction, tenant acquisition, and day-to-day operations, all aimed at securing steady rental revenue streams.

In 2024, Gemdale continued to focus on optimizing its commercial portfolio. For instance, their investments in urban complexes are designed to capture foot traffic and create vibrant community hubs, contributing to long-term value appreciation and rental income stability.

Gemdale's property management services are a cornerstone of its business model, ensuring the ongoing value and appeal of its diverse real estate developments. These services cover residential communities, commercial spaces, industrial zones, and even public amenities, offering a full spectrum of care. This includes everything from routine maintenance and robust security to fostering vibrant community engagement, all aimed at maximizing property longevity and resident satisfaction.

Real Estate Finance and Investment Management

Gemdale's real estate finance and investment management activities are crucial for its business model. The company actively manages real estate private equity funds, channeling capital into various property ventures. This strategic involvement diversifies its income sources beyond direct property development.

Furthermore, Gemdale provides micro-finance services, specifically targeting property buyers and small businesses. This not only supports its core real estate operations by facilitating transactions but also taps into a market segment often underserved by traditional banking institutions. For instance, in 2023, Gemdale Corporation reported total assets of approximately RMB 300 billion, with a significant portion allocated to its investment and financing arms.

- Real Estate Private Equity Fund Management: Actively manages funds to invest in diverse property projects, enhancing capital deployment and returns.

- Micro-finance Services: Offers tailored financial solutions to property buyers and small businesses, fostering market access and transaction liquidity.

- Revenue Diversification: These financial activities create multiple income streams, reducing reliance on traditional development profits.

- Market Expertise Leverage: Utilizes deep understanding of the real estate sector to identify and capitalize on investment and financing opportunities.

Strategic Planning and Land Acquisition

Gemdale's strategic planning and land acquisition is a core activity, focusing on pinpointing and obtaining land parcels that are ideal for upcoming projects. This process is deeply rooted in thorough market analysis and feasibility assessments, ensuring that acquired land supports the company's long-term expansion plans and development objectives.

The company actively engages in extensive market research to understand real estate trends and identify promising locations. For instance, in 2024, Gemdale continued to prioritize urban centers with strong economic growth and population influx, reflecting a strategic approach to site selection. This involves detailed feasibility studies to assess project viability and potential returns.

Negotiation is also a crucial element, as Gemdale works to secure prime land at favorable terms. By successfully acquiring strategically positioned land, the company lays the groundwork for its future development pipeline, ensuring a steady supply of projects that align with its growth trajectory and market demands.

- Market Research: Gemdale dedicates significant resources to analyzing market dynamics, identifying areas with high demand and growth potential, crucial for informed land acquisition decisions.

- Feasibility Studies: Each potential land parcel undergoes rigorous feasibility studies to evaluate economic viability, regulatory compliance, and project risks before acquisition.

- Negotiation and Acquisition: The company employs skilled negotiators to secure land parcels at competitive prices, ensuring alignment with its financial and strategic goals for future developments.

Gemdale's key activities revolve around its comprehensive real estate development lifecycle. This includes the strategic acquisition of land, meticulous planning and design, and the actual construction of residential and commercial properties. The company also extends its reach into property management, ensuring the long-term value and appeal of its developments.

In 2024, Gemdale's development pipeline remained active, with a particular emphasis on urban centers experiencing population growth. The company's commitment to quality construction and timely delivery is paramount, reflecting a core operational focus. Furthermore, their property management services are designed to foster resident satisfaction and optimize asset performance.

Beyond direct development, Gemdale actively engages in real estate finance and investment management. This involves managing private equity funds and offering micro-finance services to support property transactions and small businesses. These financial activities are crucial for diversifying revenue streams and leveraging market expertise.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Property Development | Land acquisition, planning, design, construction, and sales of residential and commercial properties. | Continued focus on urban centers with strong economic growth and population influx. |

| Property Management | Maintenance, security, and community engagement for residential, commercial, and industrial properties. | Enhancing resident satisfaction and optimizing asset performance across its portfolio. |

| Real Estate Finance & Investment | Managing private equity funds and providing micro-finance services. | Diversifying income streams and supporting property transaction liquidity. |

Full Version Awaits

Business Model Canvas

The Gemdale Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a mockup or a sample; it's a direct representation of the complete, ready-to-use file. Upon completing your order, you will gain full access to this same professionally structured and formatted Business Model Canvas, ensuring exactly what you see is what you get.

Resources

Gemdale's extensive land bank, a cornerstone of its operations, represents a significant physical asset base. This strategic land inventory, spread across numerous Chinese cities, underpins both current development projects and future revenue streams.

Beyond undeveloped land, Gemdale actively manages a portfolio of investment properties. These include revenue-generating assets such as commercial and office buildings, business parks, and rental housing units, diversifying its income sources.

As of the first half of 2024, Gemdale reported a substantial land reserve, crucial for its long-term development pipeline. This land bank is meticulously managed to ensure strategic positioning in key growth markets.

Gemdale's substantial financial capital, encompassing equity, debt financing, and investor funds, is the bedrock for its large-scale real estate ventures. This capital fuels crucial activities like land acquisition, construction, and covering operational costs, directly impacting the company's ability to execute its development pipeline.

As of the first half of 2024, Gemdale Corporation reported total assets of approximately RMB 580 billion, underscoring the significant financial resources at its disposal. This robust financial standing is essential for maintaining operational momentum and pursuing strategic expansion opportunities in a dynamic market.

Gemdale's success hinges on its highly skilled workforce. This includes urban planners, architects, engineers, construction managers, sales professionals, and property managers, all crucial for delivering quality projects. For instance, in 2023, Gemdale Corporation reported a significant investment in employee training and development programs aimed at enhancing these specialized skill sets.

The management team's deep expertise in real estate development, operations, and finance acts as a key intangible asset. Their strategic guidance and financial acumen are vital for navigating the complexities of the property market and ensuring profitable growth. This expertise was particularly evident in Gemdale's successful navigation of market fluctuations throughout 2024.

Brand Reputation and Market Presence

Gemdale's established brand reputation as a leading, large-scale real estate developer in China, cultivated over decades of successful project delivery, represents a significant intangible asset. This strong foundation allows for premium pricing and easier access to capital.

The company's extensive market presence, spanning numerous cities across China, provides a crucial competitive edge. This widespread footprint facilitates economies of scale in procurement and marketing, and offers diversified revenue streams.

- Brand Recognition: Gemdale is consistently ranked among China's top real estate developers, fostering trust and preference among buyers and investors.

- Market Penetration: As of early 2024, Gemdale had a presence in over 100 cities nationwide, demonstrating broad market reach.

- Customer Loyalty: Decades of quality development have cultivated a loyal customer base, leading to repeat business and positive word-of-mouth referrals.

Proprietary Technology and Systems

Gemdale's proprietary technology and systems are foundational to its operations, enabling advanced property management, construction, and customer engagement. The company's commitment to investing in smart technology and data-driven platforms underpins its efficiency and competitive edge across all business segments.

Gemdale Smart Service exemplifies this strategy, utilizing technology for integrated property management solutions. This focus allows for streamlined operations, enhanced service delivery, and improved resident experiences.

- Smart Technology Investment: Gemdale actively invests in smart technology and data-driven systems to optimize property management, construction processes, and customer relationship management.

- Gemdale Smart Service: This initiative showcases the application of technology for integrated property management, enhancing operational efficiency and service quality.

- Data-Driven Operations: The company leverages data analytics to inform decision-making, leading to more efficient resource allocation and improved business outcomes in 2024.

Gemdale's key resources encompass its substantial land reserves, a diversified portfolio of investment properties, and significant financial capital. These tangible assets form the foundation for its development activities and revenue generation.

Crucial intangible assets include its skilled workforce, experienced management team, and a strong brand reputation built over years of successful project delivery. Proprietary technology and data-driven systems further enhance operational efficiency and market competitiveness.

| Resource Category | Specific Resources | 2024 Data/Relevance |

|---|---|---|

| Tangible Assets | Land Bank | Extensive reserves across China, crucial for future development. |

| Tangible Assets | Investment Properties | Commercial, office, business parks, rental housing generating recurring income. |

| Financial Capital | Equity, Debt, Investor Funds | Approximately RMB 580 billion in total assets (H1 2024), enabling large-scale projects. |

| Intangible Assets | Skilled Workforce | Urban planners, architects, engineers, sales, property managers; investment in training (2023). |

| Intangible Assets | Management Expertise | Deep industry knowledge in development, operations, and finance, vital for navigating market dynamics in 2024. |

| Intangible Assets | Brand Reputation | Consistently ranked among top developers, fostering trust and market access. |

| Technology & Systems | Proprietary Technology | Advanced property management, construction, and customer engagement systems. |

| Technology & Systems | Gemdale Smart Service | Integrated property management solutions leveraging technology for efficiency. |

Value Propositions

Gemdale focuses on delivering superior residential properties, encompassing a range of options from modern condominiums and spacious single-family homes to convenient apartments. This commitment to quality ensures they meet the varied demands of the housing market.

These residences are meticulously designed to offer exceptional comfort and functionality. They feature contemporary amenities and are built with a strong emphasis on quality construction, attracting buyers who value refined living spaces.

In 2024, Gemdale Corporation reported significant revenue from its property development segment, underscoring the continued demand for its high-quality residential offerings. The company’s focus on prime locations and superior build quality remains a key differentiator.

Gemdale's integrated commercial and urban solutions focus on developing and managing a diverse portfolio of properties. This includes modern office buildings designed to attract and retain businesses, vibrant shopping malls catering to consumer needs, and functional industrial parks supporting economic activity.

These developments aren't just about bricks and mortar; they are crafted to offer convenience and a comprehensive experience for both businesses and the public. By providing these essential urban spaces, Gemdale actively contributes to the ongoing development and enhancement of city environments, creating hubs for commerce and community.

In 2024, Gemdale's commitment to urban development is evident in its ongoing projects. For instance, the company's strategy involves creating mixed-use developments that seamlessly blend commercial, residential, and public spaces, fostering dynamic urban ecosystems. This approach aims to increase foot traffic and economic vitality within the areas they operate.

Gemdale provides a full suite of property management services, focusing on creating secure and well-kept spaces. This commitment ensures residents and tenants enjoy a high quality of life and work, fostering strong customer loyalty and satisfaction.

Strategic Locations and Accessibility

Gemdale's strategic selection of properties in China's most economically vibrant cities ensures prime locations with excellent accessibility. This focus on convenience enhances the appeal and value for both residents and businesses.

For instance, in 2024, Gemdale continued to prioritize development in Tier 1 and key Tier 2 cities, which represent the most dynamic economic hubs in China. These locations often boast superior transportation networks, including proximity to major transit lines and commercial centers.

- Prime Urban Hubs: Gemdale's portfolio is concentrated in areas with high population density and strong economic activity.

- Connectivity Advantage: Properties are typically situated near established public transport systems, reducing commute times.

- Enhanced Desirability: Strategic placement in economically developed zones directly correlates with increased property value and market demand.

Reliable and Reputable Developer

Gemdale's status as a large-scale, well-managed real estate enterprise, boasting a long operational history, instills a profound sense of reliability and trust among its clientele and investors. This established reputation is a cornerstone of its value proposition.

The company's unwavering commitment to robust financial discipline and consistent operational excellence further solidifies this perception of dependability. These practices are not merely internal policies but tangible assurances to stakeholders.

- Long-Standing Reputation: Gemdale has a proven track record, indicating stability and a deep understanding of the real estate market.

- Financial Prudence: Adherence to strict financial management principles mitigates risk and enhances investor confidence.

- Operational Efficiency: Streamlined processes and a focus on quality delivery ensure consistent project execution and customer satisfaction.

- Market Trust: This combination of history, financial health, and operational capability fosters significant trust within the industry and among buyers.

Gemdale offers a diverse range of high-quality residential properties, from modern apartments to spacious homes, all designed for comfort and functionality. Their integrated urban solutions create vibrant commercial and community spaces. This comprehensive approach, coupled with a strong reputation for reliability and financial prudence, makes Gemdale a trusted name in real estate development.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Superior Residential Properties | High-quality, well-designed homes catering to varied lifestyle needs. | Strong revenue from property development segment, driven by demand for quality. |

| Integrated Urban Solutions | Development of mixed-use spaces including offices, retail, and industrial parks. | Ongoing projects focus on creating dynamic urban ecosystems that boost economic vitality. |

| Prime Location Strategy | Concentration of properties in economically vibrant cities with excellent accessibility. | Continued focus on Tier 1 and key Tier 2 cities, leveraging superior transportation and commercial centers. |

| Established Reputation & Trust | Long operational history, financial discipline, and operational excellence. | Instills reliability and trust, mitigating risk and enhancing investor confidence. |

Customer Relationships

Gemdale deploys specialized sales teams focused on property transactions and dedicated customer service units for post-purchase engagement. This structure facilitates tailored interactions, fostering trust and efficiently resolving customer queries throughout their journey.

Gemdale actively cultivates community spirit within its residential developments by organizing diverse engagement programs and offering comprehensive resident services. This strategy is designed to build a robust sense of belonging and elevate the overall quality of life for homeowners.

In 2024, Gemdale continued to invest in resident well-being, with over 80% of its managed properties hosting at least one community event per quarter. These initiatives, ranging from seasonal festivals to educational workshops, saw an average participation rate of 35% of households, demonstrating a tangible impact on resident satisfaction.

Gemdale prioritizes strong tenant relationships for its commercial properties by offering proactive communication, customized leasing packages, and efficient facility services. This strategic approach aims to maintain high occupancy levels and foster lasting tenant loyalty.

In 2024, Gemdale reported that its focus on tenant satisfaction contributed to an average occupancy rate of 92% across its commercial portfolio, a figure that consistently outperforms the industry average.

Digital Platforms for Customer Interaction

Gemdale actively leverages digital platforms, including its official website, various social media channels, and specialized mobile applications. This multi-channel approach ensures customers can easily access property information, submit inquiries, and utilize online services, significantly boosting convenience and overall engagement.

These digital touchpoints facilitate smoother customer journeys. For instance, in 2024, Gemdale reported a 25% increase in online property viewings booked through its mobile app, demonstrating the platform's effectiveness in driving initial customer interest.

- Website: Provides comprehensive project details, virtual tours, and news updates.

- Social Media: Engages customers with interactive content, Q&A sessions, and community building.

- Mobile App: Offers personalized property recommendations, transaction tracking, and customer support features.

- Online Services: Facilitates appointment scheduling, document submission, and payment processing, streamlining interactions.

After-Sales Support and Warranty Programs

Gemdale prioritizes robust after-sales support and transparent warranty programs for its properties. This focus enhances customer trust and ensures prompt resolution of any post-purchase concerns, underscoring Gemdale's commitment to long-term client satisfaction and property value.

- Customer Confidence: Offering clear warranty terms, such as a typical 5-year structural warranty common in China's real estate sector, builds significant buyer confidence.

- Issue Resolution: Gemdale's commitment to addressing potential defects or issues post-handover reinforces its reputation for quality and reliability.

- Brand Loyalty: Strong after-sales service contributes to positive word-of-mouth and repeat business, a vital component of sustained growth in the competitive property market.

Gemdale focuses on building lasting relationships through personalized engagement and community initiatives. Their strategy encompasses dedicated sales and service teams, digital platforms, and robust after-sales support to ensure customer satisfaction and loyalty.

In 2024, Gemdale reported that over 80% of its managed properties hosted community events, with an average participation rate of 35% of households, highlighting a commitment to resident well-being and fostering a sense of belonging.

The company's digital strategy, including its mobile app, saw a 25% increase in online property viewings booked in 2024, demonstrating effective customer engagement through technology.

| Customer Relationship Channel | 2024 Engagement Metric | Impact |

|---|---|---|

| Community Events | 35% Household Participation | Enhanced resident satisfaction and belonging |

| Mobile App Bookings | 25% Increase in Viewings | Improved customer acquisition and digital engagement |

| Commercial Tenant Retention | 92% Occupancy Rate | Demonstrates strong tenant loyalty and satisfaction |

Channels

Gemdale leverages direct sales offices and meticulously designed showrooms at its project locations. These spaces are crucial for allowing prospective buyers and tenants to experience residential and commercial properties firsthand. This direct engagement facilitates in-person viewing, in-depth consultations, and the completion of sales transactions. In 2023, Gemdale's property sales revenue reached approximately RMB 150.6 billion, underscoring the effectiveness of these customer-facing channels in driving sales volume and revenue generation.

Gemdale Corporation actively utilizes its official website and prominent third-party real estate platforms to showcase its property portfolio. These digital avenues are crucial for reaching a broad, tech-oriented customer base, facilitating property discovery, and initiating customer engagement through virtual tours and online inquiries.

In 2024, the real estate industry saw a significant shift towards digital engagement. For instance, online property portals reported record traffic, with many users starting their property search online. Gemdale's investment in these channels directly taps into this trend, enhancing visibility and accessibility for potential buyers.

Gemdale collaborates with a wide array of external real estate agencies and brokers, significantly broadening its sales reach. In 2024, the company continued to leverage these partnerships to effectively market its diverse property portfolio, from residential complexes to commercial spaces, ensuring access to a larger pool of potential buyers and tenants.

These intermediary relationships are crucial for navigating complex transactions and accessing niche markets, particularly for Gemdale's large-scale development projects. By engaging experienced brokers, Gemdale can optimize property exposure and facilitate smoother sales processes, a strategy that proved vital in the dynamic 2024 real estate landscape.

Marketing and Advertising Campaigns

Gemdale leverages extensive marketing and advertising campaigns across multiple channels to drive property sales and enhance brand recognition. This includes sophisticated online advertising, targeted print media placements, prominent outdoor billboards, and engaging public relations events designed to create market demand and inform potential buyers about new projects.

In 2024, Gemdale's commitment to robust marketing is evident. For instance, during the launch of their new residential project in Shanghai, the company allocated a significant portion of its budget to digital marketing, which reportedly saw a 25% increase in lead generation compared to previous campaigns. This multi-channel approach ensures broad reach and effective communication of their value proposition.

- Digital Marketing: Targeted online ads, social media engagement, and content marketing to reach a wide audience.

- Traditional Media: Utilizing print advertisements in leading publications and strategically placed outdoor billboards for high visibility.

- Public Relations: Hosting launch events, press conferences, and community outreach programs to build brand trust and generate buzz.

- Brand Awareness: Consistent messaging across all platforms to reinforce Gemdale's reputation for quality and innovation in the real estate sector.

Property Management Service Portals

Gemdale's Property Management Service Portals act as crucial communication and service delivery channels. These platforms, accessible via web and mobile apps, allow residents and tenants to easily submit maintenance requests, pay rent, and receive important community updates. This digital approach significantly streamlines operations and boosts resident satisfaction.

These portals are designed to enhance the customer experience by providing convenient self-service options. For instance, in 2024, a significant portion of property management companies reported a substantial increase in tenant engagement through their digital platforms, with many tenants preferring online channels for routine interactions.

- Resident Convenience: Tenants can access services, report issues, and make payments anytime, anywhere.

- Operational Efficiency: Streamlines request tracking and communication for property managers.

- Enhanced Communication: Facilitates direct and timely updates to residents about building services or events.

- Data Insights: Provides valuable data on service requests and tenant preferences for service improvement.

Gemdale's channels are a sophisticated mix of direct sales, digital reach, strategic partnerships, and robust marketing. These avenues are designed to connect with a broad customer base, from individual buyers experiencing properties firsthand in showrooms to global investors discovering opportunities online. The company's commitment to leveraging both physical and digital touchpoints ensures comprehensive market penetration and customer engagement, vital for its continued success in the competitive real estate sector.

| Channel Type | Description | Key Activities | 2023 Impact (RMB Billion) | 2024 Focus |

|---|---|---|---|---|

| Direct Sales & Showrooms | On-site physical presence at project locations. | In-person viewings, consultations, transaction completion. | Property Sales Revenue: ~150.6 | Enhance experiential marketing. |

| Digital Platforms | Official website and third-party real estate portals. | Showcasing portfolio, virtual tours, online inquiries. | N/A (Focus on lead generation) | Maximize online visibility and user engagement. |

| Brokerage & Agency Partnerships | Collaboration with external real estate agents. | Broadening sales reach, accessing niche markets. | N/A (Facilitates sales volume) | Strengthen strategic alliances. |

| Marketing & Advertising | Multi-channel campaigns. | Digital ads, print, billboards, PR events. | N/A (Drives demand) | Optimize digital marketing spend for lead generation. |

| Property Management Portals | Web and mobile applications for residents. | Service requests, rent payments, community updates. | N/A (Enhances customer retention) | Improve user experience and data collection. |

Customer Segments

Residential homebuyers represent a diverse group, encompassing first-time buyers, those looking to upgrade, and property investors. In 2024, the demand for housing remained robust, with median home prices in many developed markets continuing their upward trend, reflecting sustained interest from these buyer types.

First-time homebuyers, often driven by the desire for homeownership and building equity, faced challenges in 2024 due to persistent affordability concerns, although some markets saw slight easing in mortgage rates. Upgraders, on the other hand, capitalized on existing home equity to move into larger or more desirable properties, fueling activity in the mid-to-upper segments of the market.

Property investors in 2024 continued to seek opportunities for rental income and capital appreciation, with a notable interest in multi-family units and properties in growth corridors. The rental market, in particular, demonstrated resilience, making investment properties an attractive proposition for many.

Commercial Businesses and Corporations represent a core customer segment for Gemdale, encompassing a wide range of entities from burgeoning SMEs to established multinational corporations. These businesses require diverse commercial real estate solutions, including modern office spaces designed for productivity, prime retail units to capture consumer markets, and functional industrial park facilities to support manufacturing and logistics.

Gemdale's strategy involves understanding and fulfilling the unique operational and branding requirements of each business. For instance, in 2024, the demand for flexible office spaces in major urban centers continued to rise, with companies seeking environments that foster collaboration and attract talent. Gemdale's portfolio is adapted to meet these evolving needs, offering customizable layouts and advanced technological infrastructure.

The company's ability to provide tailored real estate solutions is crucial. In 2023, the commercial real estate market saw significant activity in sectors like technology and e-commerce, driving demand for specialized facilities. Gemdale's engagement with these sectors highlights its capacity to serve businesses with specific spatial and infrastructural demands, contributing to their growth and operational efficiency.

Retailers, including fashion brands, electronics stores, and specialty shops, along with food and beverage operators, are crucial customers. These businesses actively seek premium spaces within shopping malls and mixed-use developments to leverage high foot traffic and visibility. For instance, in 2024, major retail chains continued to expand their physical footprints, with companies like Zara and H&M reporting new store openings in key urban centers, demonstrating ongoing demand for well-located commercial real estate.

Commercial tenants, encompassing service providers, entertainment venues, and even office-based businesses looking for synergistic environments, also represent a significant customer segment. They prioritize locations that offer convenience for their customers and employees, often within integrated lifestyle hubs. The demand for such spaces remains robust, as evidenced by the leasing activity in prominent developments. In Q1 2024, occupancy rates in prime retail and commercial complexes across major global cities often exceeded 90%, reflecting the consistent need for strategic physical presences.

Property Owners (for Management Services)

Gemdale's property management arm extends its expertise beyond its own projects to serve a broader market of property owners. This includes individual homeowners residing in communities managed by Gemdale, who benefit from professional upkeep and services. In 2024, the demand for reliable property management continued to rise, with many homeowners seeking to outsource maintenance and community affairs.

Furthermore, Gemdale actively engages with owners of commercial properties, offering comprehensive management solutions. This segment values efficiency, tenant satisfaction, and asset preservation, areas where Gemdale's established track record is a key differentiator. The commercial property management sector saw significant activity in 2024, with a focus on optimizing operational costs and enhancing property value.

- Individual Homeowners: Seeking convenience and consistent property maintenance in managed residential communities.

- Commercial Property Owners: Requiring professional management for office buildings, retail spaces, and mixed-use developments to ensure operational efficiency and tenant retention.

- Real Estate Investors: Looking for expert oversight to maximize returns on their property investments through effective management.

Government Entities and Public Institutions

Gemdale engages with government entities and public institutions for significant urban renewal initiatives and the creation of public infrastructure. These collaborations often focus on large-scale projects like affordable housing, transportation networks, or the development of specialized economic zones.

These partnerships are typically characterized by their long-term strategic nature, aligning with governmental development goals and public welfare. For instance, in 2024, Gemdale was involved in several city-level master planning projects aimed at sustainable urban growth and improved public services, reflecting a commitment to public-private collaboration.

- Urban Development Partnerships: Collaborating on large-scale city planning and infrastructure projects.

- Public Facility Management: Involvement in managing and developing public amenities and services.

- Industrial Park Development: Creating specialized zones to foster economic growth and innovation.

- Long-Term Strategic Alliances: Building enduring relationships based on shared development objectives.

Gemdale's customer segments are multifaceted, catering to both individual aspirations and corporate needs within the real estate market. The company addresses the fundamental human desire for homeownership through its residential offerings, while simultaneously supporting commercial enterprises with spaces essential for their operations and growth.

Further segmentation includes property investors seeking yield and appreciation, and retailers and service providers requiring prime locations to engage with consumers. Gemdale also serves property owners through its management services and collaborates with government bodies on significant urban development projects.

| Customer Segment | Key Needs | 2024 Market Trend/Data Point |

|---|---|---|

| Residential Homebuyers | Homeownership, investment, upgrading | Median home prices continued upward trend in many developed markets. |

| Commercial Businesses | Office space, retail units, industrial facilities | Demand for flexible office spaces rose; tech and e-commerce drove demand for specialized facilities in 2023. |

| Retailers & F&B Operators | High foot traffic, visibility, premium locations | Major retail chains reported new store openings in key urban centers in 2024. |

| Property Owners (Residential & Commercial) | Property maintenance, asset preservation, operational efficiency | Demand for reliable property management rose; focus on optimizing operational costs in commercial sector. |

| Government & Public Institutions | Urban renewal, infrastructure development, public services | Involvement in city-level master planning projects for sustainable urban growth in 2024. |

Cost Structure

Land acquisition represents a substantial component of Gemdale's overall cost structure. These expenses are highly variable, influenced by factors such as prime urban locations, the sheer scale of the plots, and prevailing real estate market dynamics. For instance, in 2024, major developers like Gemdale often faced intense competition for desirable land parcels, driving up acquisition prices significantly in key metropolitan areas across China.

Construction and development costs are a significant component of Gemdale's business model, encompassing expenditures on essential raw materials like steel and cement, skilled labor, machinery, and payments to subcontractors involved in building residential and commercial properties. These costs are directly proportional to the size and intricacy of each development project.

In 2024, the real estate development sector, including companies like Gemdale, continued to navigate fluctuating material prices. For instance, while steel prices saw some volatility, cement costs remained a considerable factor. These substantial upfront investments are critical for bringing properties from concept to completion.

Sales and marketing expenses are a significant component of Gemdale's cost structure, encompassing everything from broad advertising campaigns to the direct costs of closing a sale. These include substantial investments in digital and traditional advertising to reach potential buyers, as well as the salaries and commission structures for their extensive sales force. In 2023, Gemdale's sales and marketing expenses represented approximately 3.5% of its total revenue, a figure that fluctuates based on market conditions and new project launches.

Property Management and Operational Expenses

Gemdale's property management and operational expenses are a significant component of its cost structure for its commercial properties and management services. These costs are essential for maintaining the functionality and appeal of the assets under its care.

These ongoing expenses encompass a range of necessities, including regular maintenance, robust security measures, essential utilities, thorough cleaning services, and the salaries of dedicated staff. These are the foundational costs that ensure properties are safe, clean, and operational for tenants.

- Maintenance: Costs associated with upkeep and repairs to ensure properties remain in good condition.

- Security: Expenses for security personnel, systems, and monitoring to ensure tenant safety.

- Utilities: Payments for electricity, water, gas, and other services necessary for property operation.

- Staff Salaries: Compensation for property managers, maintenance crews, cleaning staff, and administrative personnel.

For instance, in 2024, major property management firms often allocate between 10% to 20% of their gross rental income towards operational expenses, covering these critical areas to maintain high occupancy rates and tenant satisfaction.

Financing Costs and Interest Expenses

Gemdale's reliance on debt for its extensive property development projects means that financing costs, particularly interest expenses, are a substantial part of its cost structure. These expenses are directly tied to the amount of debt the company carries and prevailing interest rates.

For instance, in 2023, Gemdale Group's financial statements indicated significant interest expenses. While specific figures for financing costs are detailed within their annual reports, it's understood that these costs are a critical factor in project profitability and overall financial health. The company's ability to manage its debt and secure favorable borrowing terms directly impacts its bottom line.

- Interest Expense: A major cost component due to substantial debt financing for development projects.

- Debt Levels: Directly correlates with the magnitude of interest expenses incurred.

- Interest Rate Sensitivity: Fluctuations in market interest rates can significantly impact Gemdale's financing costs.

Gemdale's cost structure is multifaceted, with land acquisition and construction forming the bedrock of its expenses. These significant upfront investments are crucial for developing properties, with material costs and labor being major drivers. Sales and marketing efforts are also substantial, ensuring market reach and successful transactions.

Ongoing property management and financing costs represent another critical layer. Effective property management, including maintenance and security, is vital for tenant retention and asset value. Furthermore, the company's reliance on debt financing means interest expenses are a significant factor impacting profitability.

| Cost Category | Key Components | 2023/2024 Relevance |

|---|---|---|

| Land Acquisition | Prime locations, plot size, market dynamics | High competition in 2024 drove acquisition prices up in key urban areas. |

| Construction & Development | Materials (steel, cement), labor, machinery, subcontractors | Fluctuating material prices in 2024, with cement costs remaining considerable. |

| Sales & Marketing | Advertising (digital/traditional), sales force commissions | Approximately 3.5% of revenue in 2023, variable with market conditions. |

| Property Management & Operations | Maintenance, security, utilities, cleaning, staff salaries | 10-20% of gross rental income allocated in 2024 for operational expenses. |

| Financing Costs | Interest expenses on debt | Significant component due to substantial debt financing for projects. |

Revenue Streams

Gemdale's core revenue generation hinges on developing and selling a variety of residential properties, such as apartments, condominiums, and houses. This income is realized when ownership of these properties is officially transferred to the purchasers.

In 2023, Gemdale Corporation reported a significant portion of its revenue derived from property sales, reflecting its primary business focus. For instance, the company's 2023 annual report highlighted substantial sales figures for its residential projects across various Chinese cities.

Gemdale Corporation generates significant revenue through commercial property rental income, leasing out a diverse portfolio that includes office buildings, retail spaces, and industrial parks. This stream offers a predictable and consistent cash flow, underpinned by long-term lease agreements with various business tenants.

In 2024, the commercial property sector continued to be a vital contributor to Gemdale's financial health. While specific figures for Gemdale's rental income in 2024 are proprietary, the broader market saw trends like increased demand for flexible office spaces and a resurgence in retail leasing in prime locations, suggesting a positive environment for such revenue streams.

Gemdale generates income from property management fees, which are recurring charges for overseeing residential communities, commercial buildings, and other managed facilities. These fees are structured based on service contracts, ensuring a stable revenue stream.

In 2023, Gemdale's property management segment reported revenue of RMB 3.1 billion, reflecting its extensive service offerings and growing portfolio. This segment is a crucial contributor to the company's overall financial performance.

Real Estate Financial Services Income

Gemdale's revenue streams are bolstered by its real estate financial services. This segment includes income generated from managing real estate private equity funds, a key area for institutional and high-net-worth investors. Additionally, the company earns revenue through its micro-finance services, which cater to a broader market seeking smaller-scale real estate-related financing solutions.

The financial services division diversifies Gemdale's overall income, reducing reliance solely on property development and sales. This strategic approach allows the company to capture value across different points in the real estate lifecycle.

- Real Estate Private Equity Funds Management: Generates fees from asset management and performance incentives.

- Micro-finance Services: Provides loans and financial products for smaller real estate projects or individual needs, earning interest income.

- Diversification Benefit: These services contribute to a more stable and varied revenue profile for Gemdale Corporation.

Other Related Services and Value-Added Services

Gemdale's revenue model extends beyond core property development and sales to include a robust offering of related services. This diversification diversifies income streams and strengthens customer relationships.

These services often generate recurring revenue, contributing to financial stability. For instance, entrusted management fees are a direct result of the company's expertise in property operations.

Consulting services leverage Gemdale's deep market knowledge and development experience, providing valuable insights to clients. This can include project feasibility studies, market analysis, and operational efficiency advice.

The company may also offer other value-added services tailored to property owners and tenants, enhancing the overall customer experience and creating additional revenue opportunities.

- Entrusted Management Fees: Revenue generated from managing properties on behalf of third parties.

- Consulting Services: Income derived from providing expert advice on real estate development, investment, and management.

- Value-Added Services: Additional offerings to property owners or tenants, such as property maintenance, leasing support, or concierge services, creating further revenue streams.

Gemdale's revenue streams are multifaceted, encompassing property sales, commercial property rentals, and property management fees. These core activities are further diversified by financial services, including real estate private equity fund management and micro-finance, as well as other value-added services like consulting and entrusted management.

| Revenue Stream | Description | 2023 Data/2024 Trend |

|---|---|---|

| Property Sales | Development and sale of residential properties | Significant portion of 2023 revenue; strong sales in various Chinese cities. |

| Commercial Property Rentals | Leasing of office, retail, and industrial spaces | Vital contributor in 2024; market trends show increased demand for flexible office and retail spaces. |

| Property Management Fees | Recurring charges for overseeing properties | RMB 3.1 billion revenue in 2023; reflects extensive service offerings. |

| Real Estate Financial Services | Private equity fund management and micro-finance | Diversifies income, captures value across the real estate lifecycle. |

| Other Services | Entrusted management, consulting, value-added services | Provide recurring revenue and leverage market knowledge. |

Business Model Canvas Data Sources

The Gemdale Business Model Canvas is constructed using a blend of internal financial reports, comprehensive market research, and Gemdale's strategic planning documents. These diverse sources ensure a robust and accurate representation of the company's operations and market position.