Gemdale Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gemdale Bundle

Gemdale's competitive landscape is shaped by the interplay of buyer power, supplier leverage, the threat of new entrants, the intensity of rivalry, and the availability of substitutes. Understanding these forces is crucial for navigating its market effectively.

This brief overview hints at the complexities. Unlock the full Porter's Five Forces Analysis to explore Gemdale’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The real estate sector, including developers like Gemdale, is heavily dependent on essential raw materials such as steel, cement, and various construction components. In 2024, China's construction materials market experienced price fluctuations, with steel prices, for instance, seeing a notable increase in the first half of the year due to production cuts and demand recovery.

If a limited number of major suppliers control the production and distribution of these critical materials within China, they gain substantial leverage to dictate prices to developers. This concentrated supplier base can translate into increased input costs for Gemdale, directly affecting the profitability margins on their development projects.

Labor costs and availability significantly impact Gemdale's operational expenses. In 2024, China's construction industry faced ongoing challenges with skilled labor shortages, particularly in specialized trades, which can drive up wages and project costs. A tight labor market can empower construction workers and unions, leading to increased wage demands that directly affect Gemdale's bottom line.

In China, the government's tight control over land supply significantly bolsters its bargaining power as a key supplier to developers like Gemdale. This centralized control means that the availability and pricing of land, a fundamental input for real estate projects, are heavily influenced by governmental policy and decisions.

Gemdale's success hinges on its capacity to secure prime land parcels at competitive prices, directly impacting its future project pipeline and overall profitability. For instance, in 2023, land acquisition costs remained a significant factor in the Chinese property market, with developers facing increased competition for limited, well-located sites, underscoring the government's leverage.

Financing and Lending Institutions

Financing and lending institutions hold significant sway over real estate developers like Gemdale. Access to capital is the lifeblood of any development project. If banks and financial institutions perceive the real estate market as risky, or if lending options are scarce, they can dictate terms. This often translates to higher interest rates and more stringent loan covenants, directly impacting Gemdale's cost of capital and its ability to undertake new projects.

In 2024, the global real estate sector has navigated a complex financial landscape. For instance, the average interest rate for commercial real estate loans in many developed markets hovered around 6-8%, a notable increase from previous years, reflecting tighter monetary policies and heightened economic uncertainty. This environment amplifies the bargaining power of lenders.

- Increased Cost of Capital: Higher interest rates directly increase the expense of financing development projects for Gemdale.

- Stricter Loan Covenants: Lenders may impose more restrictive conditions on how Gemdale can use borrowed funds, limiting operational flexibility.

- Reduced Development Capacity: Difficulty in securing favorable financing can constrain the number and scale of projects Gemdale can pursue.

Specialized Contractors and Technology Providers

Gemdale Corporation, like many real estate developers, faces significant bargaining power from specialized contractors and technology providers, particularly for advanced construction methods and smart building solutions. In 2024, the demand for sustainable and technologically integrated buildings continued to rise, giving these niche suppliers more leverage.

These specialized firms, possessing unique expertise or proprietary technology, can dictate terms and pricing, directly impacting Gemdale's project costs and timelines. For instance, a provider of advanced HVAC systems or innovative façade technologies might be one of only a few capable of delivering the required specifications, allowing them to charge a premium. This reliance can squeeze profit margins if not managed strategically.

Consider the market for smart home integration. As of early 2025, the market for integrated smart building technology in new residential developments is projected to grow by 15-20% annually. Gemdale's ability to secure competitive pricing from these providers is crucial for maintaining project profitability and offering attractive features to buyers.

- Limited Supplier Pool: For highly specialized construction techniques or cutting-edge smart building technologies, Gemdale may find itself dependent on a small number of qualified contractors or tech firms.

- Price Influence: The unique nature of their offerings allows these specialized suppliers to command higher prices, directly affecting the overall cost and quality of Gemdale's developments.

- Impact on Project Viability: Increased costs from powerful suppliers can strain project budgets, potentially impacting Gemdale's ability to maintain competitive pricing for its end-users or achieve desired profit margins.

- Strategic Sourcing Needs: Gemdale must develop strong relationships and explore alternative sourcing or in-house capabilities where feasible to mitigate the bargaining power of these critical suppliers.

The bargaining power of suppliers for Gemdale is a critical factor influencing its profitability. This power stems from the concentration of suppliers in key input markets, the uniqueness of their offerings, and the overall cost of these inputs to Gemdale.

In 2024, the construction materials sector, particularly for steel and cement, saw price volatility. For example, steel prices in China experienced an upward trend in the first half of the year due to production adjustments and recovering demand, directly increasing costs for developers like Gemdale.

Furthermore, the government's control over land supply in China represents a significant supplier power, dictating availability and pricing. In 2023, land acquisition costs remained high, with intense competition for prime locations, underscoring this leverage.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Gemdale (2024/2025 Outlook) |

|---|---|---|

| Construction Materials (Steel, Cement) | Supplier concentration, production capacity, raw material costs | Increased input costs, potential impact on project margins due to price hikes as seen in early 2024 steel prices. |

| Labor (Skilled Trades) | Labor shortages, unionization, wage demands | Higher project labor costs, potential delays if skilled workers are scarce, impacting overall project expense. |

| Land Suppliers (Government) | Governmental land policies, urban planning, land availability | Significant influence on acquisition costs and project pipeline feasibility; continued high costs expected for desirable locations. |

| Specialized Contractors & Tech Providers | Proprietary technology, unique expertise, limited qualified providers | Premium pricing for advanced systems, potential impact on project budgets and timelines if specialized solutions are critical. |

| Financing Institutions | Lending environment, interest rates, risk perception | Higher cost of capital, stricter loan terms, potentially limiting development scale and profitability due to elevated interest rates (e.g., 6-8% average for commercial real estate loans in many markets in 2024). |

What is included in the product

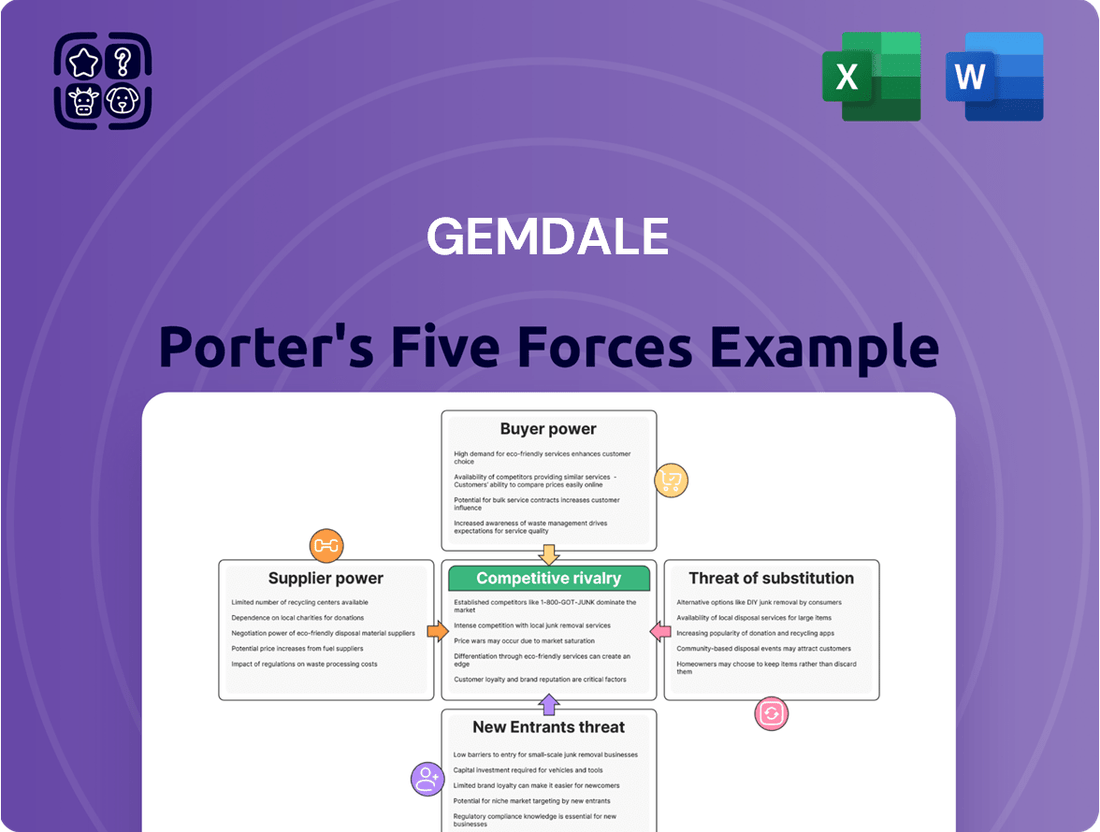

This Gemdale Porter's Five Forces analysis dissects the competitive landscape by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the real estate sector.

Instantly identify and mitigate competitive threats with a comprehensive, visual breakdown of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

The Chinese real estate market is grappling with a noticeable downturn, characterized by subdued consumer confidence and a substantial oversupply of housing. This situation significantly amplifies the bargaining power of customers.

With an abundance of available properties and hesitant buyers, developers like Gemdale are compelled to compete more aggressively. This often translates into price reductions or attractive incentive packages to stimulate sales, directly benefiting consumers.

Data from early 2024 indicates a slowdown in property sales growth across major Chinese cities. For instance, year-on-year sales volume in key Tier 1 cities saw a contraction in the first quarter, underscoring the buyer's market dynamic.

Government policies, like easing purchase restrictions, can significantly boost buyer sentiment and their ability to buy. For instance, in early 2024, several Chinese cities relaxed property purchase limits, aiming to invigorate the market. This can shift bargaining power towards consumers by increasing the pool of potential buyers and their confidence.

However, persistent economic uncertainty and high household debt levels, a concern in many global markets throughout 2024, can still temper buyer enthusiasm. Even with relaxed policies, consumers facing job insecurity or significant debt may remain hesitant to commit to large purchases, retaining considerable leverage when negotiating prices with sellers.

Gemdale's presence in numerous Chinese cities means it encounters varying levels of customer price sensitivity. In lower-tier cities, where economic conditions can be less robust and housing demand might be weaker, buyers often exhibit greater price sensitivity. This means they are more likely to shop around and compare prices, giving them more leverage when negotiating with developers like Gemdale.

This heightened price sensitivity in these markets directly translates to increased bargaining power for individual buyers. For instance, if a significant portion of potential buyers in a lower-tier city are highly concerned about price, they can collectively exert pressure on Gemdale to lower its selling prices. This dynamic was evident in some regional markets in 2024, where developers faced challenges in moving inventory without offering substantial discounts, impacting overall profit margins.

Availability of Alternative Housing Options

Customers considering new properties from developers like Gemdale also weigh renting or purchasing existing homes. In 2024, the rental market continued to offer flexibility, with average rents in major Chinese cities remaining relatively stable, providing a viable alternative to immediate homeownership. Similarly, the secondhand housing market, while experiencing some regional price adjustments, presented a significant volume of available properties, offering diverse price points and locations.

The availability and appeal of these alternatives directly impact a developer's pricing power. When renting or buying a pre-owned home is perceived as more attractive or affordable, it diminishes the buyer's urgency to commit to a new build. This increased choice empowers customers, allowing them to negotiate more effectively with developers on price, terms, and amenities.

- Rental Market Stability: In early 2024, rental yields in key urban centers showed resilience, offering a cost-effective alternative to purchasing new properties.

- Secondhand Market Volume: The resale housing market provided a substantial inventory of homes, offering buyers a wider range of options beyond new developments.

- Price Sensitivity: The relative affordability of rental or existing homes can make customers more sensitive to the pricing of new properties, increasing their bargaining leverage.

- Developer Negotiation: A strong alternative housing market allows buyers to push back more effectively on new property prices and contract terms.

Demand for Quality and Affordability

In today's competitive real estate landscape, customers are increasingly discerning, placing significant emphasis on factors like prime location, innovative design, strong investment potential, and, crucially, affordability. Gemdale, like its peers, must continually adapt to these evolving customer expectations to successfully attract and retain buyers.

When buyers perceive a disconnect between the price they are asked to pay and the perceived value or quality of a property, their bargaining power naturally increases. This heightened power can manifest in demands for price reductions, better payment terms, or additional amenities, directly impacting Gemdale's pricing strategies and profit margins.

- Customer Expectations: Buyers in 2024 are prioritizing not just the physical attributes of a property but also its long-term value proposition, including potential rental yields and capital appreciation.

- Affordability Concerns: Rising interest rates and economic uncertainties in 2024 have made affordability a paramount concern for a significant portion of the buyer pool, amplifying their negotiation leverage.

- Information Accessibility: The widespread availability of market data and competitor pricing online empowers customers to make more informed decisions and negotiate more effectively with developers like Gemdale.

The bargaining power of customers in China's real estate market, particularly concerning developers like Gemdale, is significantly elevated due to market conditions observed through early and mid-2024. A substantial housing oversupply coupled with cautious buyer sentiment means customers hold considerable sway. This is evidenced by the fact that in Q1 2024, property sales growth in major Chinese cities experienced a contraction year-on-year, pushing developers to offer incentives and price adjustments to attract buyers.

Buyers are also empowered by the availability of alternatives. The rental market remained stable in early 2024, offering a flexible option, while the secondhand housing market presented ample inventory. For instance, in many lower-tier cities, buyers demonstrated high price sensitivity in 2024, forcing developers to implement discounts to move inventory, directly impacting profit margins.

Customer expectations in 2024 also lean towards value, with affordability being a primary concern amidst economic uncertainties and potential interest rate shifts. This, combined with easy access to market data, allows buyers to negotiate more effectively on price and terms, increasing their overall leverage against developers.

| Factor | Impact on Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Housing Oversupply | High | Persistent issue in many Chinese cities. |

| Buyer Sentiment | High | Influenced by economic outlook and household debt. |

| Alternative Housing Options | Moderate to High | Stable rental market and active secondhand market. |

| Price Sensitivity | High in Lower-Tier Cities | Developers compelled to offer discounts. |

| Information Accessibility | High | Buyers well-informed on pricing and market trends. |

Preview Before You Purchase

Gemdale Porter's Five Forces Analysis

This preview showcases the complete Gemdale Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The Chinese real estate sector is characterized by a vast number of developers, creating a fragmented and intensely competitive landscape. Gemdale contends with a multitude of large, established corporations as well as agile regional players, all vying for market share.

This fierce competition translates into significant price pressures and can consequently squeeze profit margins for companies like Gemdale. For instance, in 2024, the average selling price of new homes in major Chinese cities saw fluctuations, with some regions experiencing a slight decline due to oversupply and aggressive marketing by developers.

China's property market is grappling with a significant oversupply of housing units, with millions of unsold homes contributing to a fierce competitive environment. This saturation, coupled with a slowdown in sales, forces developers like Gemdale to engage in aggressive tactics to move their inventory.

In 2024, the pressure to sell is immense. Developers are resorting to price cuts and enhanced marketing campaigns to capture the attention of a shrinking buyer pool. The focus shifts from new development to clearing existing stock, often prioritizing project completion to attract buyers with tangible assets.

Government intervention significantly shapes competitive rivalry in real estate. Policies designed to cool or stimulate the market, like China's tiered mortgage rate system introduced in 2024 to support first-time homebuyers while curbing speculation, directly alter demand and developer strategies. For instance, a tightening of credit conditions, as seen in some markets in early 2024, can disproportionately affect smaller developers with less access to capital, potentially leading to consolidation and increased market share for larger, more resilient players.

Brand Reputation and Project Quality

In the highly competitive real estate sector, a developer's brand reputation and the consistent quality of its projects are paramount. These factors directly influence buyer trust and loyalty, especially when market conditions become more challenging.

Gemdale, for instance, has cultivated a strong brand image through its commitment to delivering high-quality developments and robust after-sales service. This focus on quality acts as a significant differentiator, allowing developers with solid financial standing and a proven history of successful project execution to attract buyers and secure their market position against rivals.

- Brand Reputation: Strong brand recognition can command premium pricing and foster customer loyalty, reducing price sensitivity.

- Project Quality: Superior construction, design, and amenities contribute to higher customer satisfaction and resale values.

- After-Sales Service: Responsive and effective post-completion support builds long-term customer relationships and positive word-of-mouth referrals.

- Financial Health: Developers with strong financial backing are better positioned to weather market downturns and invest in quality, enhancing their competitive edge.

Diversification and Niche Market Focus

To counter the fierce competition in their primary residential development sector, companies like Gemdale are strategically diversifying. This often involves expanding into areas such as commercial property development, offering comprehensive property management services, or focusing on specialized, niche market segments.

This strategic shift aims to lessen direct competition within increasingly saturated residential markets and simultaneously unlock new avenues for revenue generation. However, it's important to note that this diversification also brings companies into competition within these newly entered segments.

- Diversification Strategy: Gemdale, like many in the industry, is exploring commercial real estate and property management to offset residential market pressures.

- Revenue Stream Expansion: Moving into new segments allows companies to tap into different customer bases and income sources, reducing reliance on a single market.

- New Competitive Landscapes: While diversification reduces rivalry in core areas, it inherently introduces new competitive challenges in the expanded business lines.

- Market Adaptation: This approach reflects a broader trend of real estate developers adapting to market dynamics by broadening their service offerings and target markets.

Competitive rivalry in China's real estate sector is intense, driven by a large number of developers, including major corporations and agile regional players, all vying for market share. This rivalry leads to price pressures, impacting profit margins, as seen in 2024 with fluctuating average selling prices in major cities due to oversupply and aggressive marketing.

The market's significant housing oversupply in 2024 forces developers like Gemdale into aggressive sales tactics, including price cuts and enhanced marketing, to clear existing inventory. Government policies, such as China's 2024 tiered mortgage rate system, also directly influence competition by altering demand and developer strategies, with tighter credit potentially benefiting larger, financially stable firms.

Brand reputation and project quality are crucial differentiators for Gemdale and its rivals, fostering buyer trust and loyalty amidst challenging market conditions. Developers with strong financial health and a history of successful execution are better positioned to attract buyers and maintain their market standing.

Strategic diversification into areas like commercial property and property management is a key strategy for companies like Gemdale to mitigate direct competition in saturated residential markets, though it introduces new competitive dynamics in these expanded segments.

| Metric | 2023 (Approx.) | 2024 (Projected/Early Data) | Impact on Rivalry |

|---|---|---|---|

| Number of Active Developers | Thousands | Slight decrease expected due to consolidation | Intensifies rivalry among survivors, potentially easing for those exiting. |

| Average Selling Price (Major Cities) | Varied, some regions stable, others slight decline | Continued fluctuations, potential for regional price wars | Increases price-based competition, squeezing margins. |

| Housing Oversupply (Unsold Units) | Millions | Remains a significant factor | Drives aggressive sales tactics and price competition. |

| Developer Consolidation | Ongoing trend | Expected to continue | Favors larger, well-capitalized firms, increasing their market power. |

SSubstitutes Threaten

The burgeoning rental market in China, especially among younger demographics and those with less stable incomes, poses a substantial threat of substitution to property ownership. As of late 2023, rental yields in major Chinese cities, while varying, have shown a steady upward trend, making renting a more appealing alternative for a growing segment of the population.

This shift towards renting, driven by factors like affordability concerns and increased job market volatility, directly impacts developers like Gemdale. If the perceived value and convenience of renting outweigh the long-term benefits of ownership, demand for new housing purchases could diminish, thereby weakening Gemdale's core market.

The availability and pricing of existing homes present a significant threat of substitution for Gemdale's new developments. In 2024, the resale property market continued to be a substantial alternative for many buyers, particularly in mature urban centers. If prices in the second-hand market become more attractive or stable compared to new builds, it can directly siphon demand away from Gemdale's projects.

Investors have a wide array of alternative investment vehicles to consider besides direct real estate, including stocks, bonds, and various financial products. For instance, in early 2024, the S&P 500 experienced significant gains, with some analysts projecting continued growth, potentially making equities more attractive than real estate for some capital allocators.

If these alternative options present superior risk-adjusted returns or perceived lower volatility, they can siphon investment capital away from the real estate sector. This diversion of funds can indirectly affect Gemdale's sales pipeline and the overall demand for its development projects.

Co-living and Shared Living Spaces

The rise of co-living and shared living spaces presents a significant threat of substitutes for traditional housing developers like Gemdale. These arrangements, especially popular in bustling urban areas, offer an alternative to outright homeownership, particularly appealing to younger generations and individuals prioritizing flexibility. This trend directly impacts the long-term demand for smaller residential units that Gemdale might typically develop.

The market for co-living is experiencing substantial growth. For instance, in 2023, the global co-living market was valued at approximately $3.6 billion and is projected to reach $13.2 billion by 2030, growing at a compound annual growth rate of 20.5%. This expansion indicates a growing preference for communal living over individual homeownership, potentially diverting a segment of Gemdale's target market.

- Growing Co-living Market: The global co-living market is expected to grow from $3.6 billion in 2023 to $13.2 billion by 2030, indicating a strong shift towards alternative living arrangements.

- Demographic Appeal: Co-living appeals to younger demographics and those seeking flexible living, directly competing with Gemdale's potential customer base for smaller residential units.

- Impact on Demand: The increasing adoption of co-living could reduce the long-term demand for traditional, smaller residential properties developed by companies like Gemdale.

Government-Provided Affordable Housing

Government-provided affordable housing presents a notable threat of substitution for Gemdale. Many governments worldwide are actively investing in affordable rental housing or offering subsidized options. For instance, in 2024, China continued its commitment to public rental housing, aiming to provide stable and affordable options for citizens, particularly in major urban centers where housing costs are high. This directly competes with Gemdale's commercially developed residential projects, especially those targeting lower to middle-income buyers and renters.

These government initiatives can significantly reduce the demand for private sector housing by offering a more accessible alternative. In 2023, China's central government allocated substantial funds towards urban affordable housing construction, with a focus on improving living conditions for low-income families. Such policies can divert potential customers away from market-rate properties, impacting Gemdale's sales volume and pricing power in specific segments.

The availability of government-supported housing can dampen the appeal of private developments, particularly for individuals and families prioritizing affordability over premium features or location.

- Government subsidies can lower the effective cost of housing for end-users.

- Public housing projects often focus on essential needs, making them a direct substitute for basic residential requirements.

- Increased supply of affordable housing through government programs can stabilize or reduce overall market rents and property values.

The rental market is a significant substitute, especially for younger demographics and those with less stable incomes. As of late 2023, rental yields in major Chinese cities showed a steady upward trend, making renting a more attractive alternative.

The resale property market in 2024 continued to offer a substantial alternative for buyers, particularly in established urban areas. If second-hand home prices become more appealing than new builds, it directly diverts demand from Gemdale's projects.

Alternative investments like stocks and bonds can siphon capital from real estate. For instance, the S&P 500's strong performance in early 2024 made equities a compelling option for some investors.

Co-living spaces are growing in popularity, appealing to those seeking flexibility. The global co-living market, valued at $3.6 billion in 2023, is projected to reach $13.2 billion by 2030, directly impacting demand for smaller residential units.

Government-provided affordable housing, like China's continued investment in public rental housing in 2024, offers a direct substitute for Gemdale's commercially developed projects, especially for lower to middle-income buyers.

| Substitute Type | Key Trend/Data Point | Impact on Gemdale |

|---|---|---|

| Rental Market | Rising rental yields in major Chinese cities (late 2023) | Reduces demand for homeownership, Gemdale's core market. |

| Resale Properties | Continued strong presence in urban centers (2024) | Siphons demand if prices are more attractive than new builds. |

| Alternative Investments | S&P 500 gains (early 2024) | Diverts investment capital from real estate sector. |

| Co-living Spaces | Global market projected to grow from $3.6B (2023) to $13.2B (2030) | Decreases long-term demand for smaller residential units. |

| Affordable Housing | China's ongoing investment in public rental housing (2024) | Competes directly for lower to middle-income buyers and renters. |

Entrants Threaten

The real estate development sector, particularly for a player of Gemdale's scale, presents a formidable barrier to entry due to exceptionally high capital requirements. Significant funding is essential for securing prime land, managing extensive construction projects, and executing comprehensive marketing campaigns, effectively pricing out many aspiring competitors.

The real estate sector in China, a key market for developers like Gemdale, is characterized by extensive regulatory hurdles. These include complex land use policies, stringent zoning laws, and a multi-layered approval process for construction permits. For instance, in 2024, China continued to emphasize housing market stability, with local governments implementing varying purchase restrictions and loan-to-value ratios, adding layers of complexity for any new player.

Successfully navigating these intricate regulations demands significant specialized expertise and substantial financial resources. This formidable barrier effectively deters many potential new entrants, thereby reducing the threat of new competition for established firms like Gemdale.

Established developers like Gemdale benefit from strong brand reputations and deep customer loyalty, built over years of consistent delivery and quality. Newcomers face a significant hurdle, needing to invest substantial resources in marketing and sales to even begin to chip away at this ingrained trust and preference. For instance, in 2024, the cost of acquiring a new customer in the highly competitive real estate sector often exceeds 15% of the property value, a figure that new entrants must absorb.

Access to Land and Financing Networks

The real estate sector, including companies like Gemdale, faces a significant barrier to entry stemming from the difficulty new companies encounter in accessing prime land and established financing networks. Securing desirable land plots is paramount for development, and this often requires deep local knowledge and pre-existing relationships that newcomers lack. For instance, in 2023, the average land acquisition cost for major developers in Tier-1 Chinese cities continued to be substantial, making it challenging for smaller, less capitalized firms to compete for premium sites.

Furthermore, building trust and strong relationships with financial institutions is crucial for securing the necessary capital for large-scale real estate projects. Gemdale, as a seasoned developer, benefits from its long-standing connections with banks and other lenders, which often translate into more favorable financing terms and quicker approvals. This established financial access is a hurdle for new entrants who may struggle to secure the same level of funding or face higher interest rates, impacting their ability to scale operations and compete effectively.

Consequently, the threat of new entrants is somewhat mitigated by these capital and network-related challenges. New players often find themselves at a disadvantage when bidding for prime development opportunities or securing the robust financial backing needed to execute large projects. This dynamic creates a more stable environment for established firms like Gemdale, as the cost and complexity of entry remain high.

- Land Acquisition Costs: In 2023, land acquisition accounted for a significant portion of development costs, with prime urban land prices remaining elevated, particularly in key economic hubs.

- Financing Accessibility: Established developers often enjoy preferential lending rates and terms due to their track record, a benefit not readily available to new market entrants.

- Network Effects: Existing relationships with banks, local governments, and suppliers provide a competitive edge for incumbent firms, making it harder for new entities to penetrate the market.

Market Saturation and Oversupply

The current real estate market in many parts of China is facing significant saturation and oversupply, making it a less appealing prospect for new entrants. Weak demand further exacerbates this situation, pushing down potential profit margins for developers.

This challenging environment, characterized by high inventory levels and subdued sales, acts as a substantial barrier to entry. For instance, in the first half of 2024, the total sales area for commercial housing across China saw a notable decline compared to the previous year, indicating a difficult market for all players, especially newcomers.

Consequently, the prospect of thin profit margins and the burden of managing unsold inventory deter many potential new real estate developers from entering the market.

- Market Saturation: Many Chinese cities are experiencing an oversupply of residential and commercial properties.

- Weak Demand: Consumer confidence and purchasing power have been impacted, leading to reduced demand for new housing.

- Low Profitability: Oversupply and competition compress profit margins, making new ventures less financially attractive.

- High Inventory: Developers face the risk of holding substantial unsold inventory, tying up capital and incurring carrying costs.

The threat of new entrants for a developer like Gemdale is significantly low due to substantial capital requirements, intricate regulatory landscapes, and the need for established networks. High land acquisition costs, as seen in 2023 where prime urban land prices remained elevated, coupled with the difficulty in securing favorable financing terms, present formidable obstacles. For instance, new entrants often face higher interest rates compared to established players with strong banking relationships.

| Factor | Impact on New Entrants | Example Data (2023-2024) |

|---|---|---|

| Capital Requirements | Very High | Land acquisition costs in Tier-1 Chinese cities substantial; customer acquisition costs can exceed 15% of property value. |

| Regulatory Hurdles | Complex & Costly | China's continued emphasis on housing market stability in 2024 led to localized purchase restrictions and LTV ratio adjustments. |

| Brand Reputation & Customer Loyalty | Difficult to Replicate | Established developers benefit from years of consistent delivery, a trust factor new entrants struggle to build quickly. |

| Access to Prime Land & Financing | Challenging | New entrants often lack the deep local knowledge and pre-existing relationships needed for prime land acquisition and favorable lending. |

| Market Saturation & Demand | Deterrent | First half of 2024 saw a notable decline in total sales area for commercial housing across China, indicating weak demand and compressed profit margins. |

Porter's Five Forces Analysis Data Sources

Our Gemdale Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Gemdale's official annual reports, investor presentations, and publicly available financial statements. We also leverage industry-specific market research reports and reputable real estate news outlets to capture broader market dynamics and competitive pressures.