Gehring SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gehring Bundle

Gehring's current market position is a complex interplay of robust operational strengths and emerging market challenges. Understanding these dynamics is crucial for anyone looking to capitalize on their opportunities or mitigate their risks.

Want to truly grasp Gehring's competitive edge and potential vulnerabilities? Purchase the complete SWOT analysis to unlock a comprehensive, professionally crafted report that provides actionable intelligence for strategic decision-making.

Strengths

Gehring Technologies GmbH boasts unparalleled expertise in honing technology, a legacy stretching back to 1926. This deep-rooted knowledge translates into the development of cutting-edge honing machines, tools, and automation solutions that are crucial for achieving superior surface finishes. Their commitment to innovation ensures components achieve enhanced performance, greater efficiency, and improved durability across diverse industrial sectors.

Gehring's strength lies in its exceptionally comprehensive product and service portfolio, catering to a wide spectrum of honing needs. The company provides everything from individual honing tools to sophisticated, fully automated honing systems and even entire production lines, demonstrating a deep understanding of diverse manufacturing requirements.

This extensive range includes highly specialized tooling systems, such as the PT series designed for larger bore diameters and the L-series engineered for ultra-high precision in small bores. Such targeted solutions highlight Gehring's commitment to addressing niche and demanding applications within the industry.

Beyond its hardware offerings, Gehring distinguishes itself with robust service capabilities. These include crucial areas like process development, comprehensive customer training, and reliable global after-sales support, enabling them to deliver complete turnkey solutions that ensure client success from start to finish.

Gehring's strength lies in its dedicated focus on the automotive sector, a market undergoing significant transformation. This strategic positioning allows them to serve both established internal combustion engine (ICE) vehicles and the burgeoning electric vehicle (EV) segment.

Their Formhone technology is a key asset, demonstrably reducing friction and enhancing the lifespan of components in traditional and hybrid powertrains. This directly addresses the ongoing need for efficiency and durability in a large portion of the current automotive market.

Furthermore, Gehring's E-Motive technology is crucial for the EV revolution, providing complete production lines for hairpin stators. These stators are essential for the efficient operation of electric motors, placing Gehring at the forefront of EV manufacturing solutions.

Global Presence and Strategic Partnerships

Gehring's extensive global footprint, with operations in key automotive, supplier, hydraulics, pneumatics, and aerospace markets, is a significant strength. This international presence, including numerous overseas branches, allows them to serve a diverse customer base and adapt to regional market demands effectively.

Strategic partnerships, such as the alliance with WAFIOS AG for complete hairpin stator production lines, enhance Gehring's competitive edge. These collaborations not only broaden their technological capabilities but also expand their market reach, offering integrated solutions that meet evolving industry needs.

- Global Market Penetration: Gehring operates in over 20 countries, providing localized support and expertise to its international clientele.

- Industry Diversification: The company's presence across automotive, aerospace, and industrial sectors mitigates risk and opens multiple avenues for growth.

- Alliance Synergies: The WAFIOS AG partnership, for instance, positions Gehring as a key player in the burgeoning electric vehicle component manufacturing sector.

- Enhanced Solution Offering: Strategic collaborations allow Gehring to bundle advanced technologies and services, creating a more compelling value proposition for customers.

Commitment to Innovation and Quality

Gehring's dedication to innovation is clear through its substantial investment in research and development, leading to advancements like the GHC 3.0 control technology introduced in May 2025. This commitment extends to their continuous refinement of sophisticated honing tools and integrated systems, ensuring cutting-edge solutions for their clientele.

Their unwavering focus on quality control and precision manufacturing is a cornerstone of their operations, guaranteeing that clients receive components meeting the highest industry standards. This emphasis on excellence was further validated by their recognition as a Top Training Company in 2024, underscoring their investment in a highly skilled workforce and superior operational practices.

- Investment in R&D: Launched GHC 3.0 control technology in May 2025.

- Product Development: Continuous advancement in honing tools and systems.

- Quality Assurance: Inherent focus on precision and high standards.

- Talent Development: Recognized as a 'Top Training Company 2024'.

Gehring's deep-seated expertise in honing technology, cultivated since 1926, provides a significant competitive advantage, enabling the creation of advanced machines and tools for superior surface finishes. Their comprehensive product and service range, from individual tools to fully automated systems, addresses diverse manufacturing needs effectively.

The company's strategic focus on the automotive sector, particularly its E-Motive technology for EV hairpin stators and Formhone for ICE powertrains, positions it well for industry transformations. Gehring's global presence across key industrial markets and its strategic alliances, such as with WAFIOS AG, further bolster its market reach and solution offerings.

A strong commitment to innovation, evidenced by the May 2025 launch of GHC 3.0 control technology and continuous product development, ensures Gehring remains at the forefront of technological advancements. This dedication to quality, coupled with their recognition as a Top Training Company in 2024, highlights a commitment to operational excellence and skilled workforce development.

| Strength Category | Key Aspect | Supporting Fact/Data |

|---|---|---|

| Technical Expertise | Honing Legacy | Expertise since 1926 |

| Product Portfolio | Comprehensive Solutions | Individual tools to full production lines |

| Market Focus | Automotive Sector | Formhone for ICE, E-Motive for EV |

| Global Reach | International Operations | Presence in over 20 countries |

| Innovation | R&D Investment | GHC 3.0 control technology (May 2025) |

| Quality & Talent | Operational Excellence | 'Top Training Company 2024' |

What is included in the product

Analyzes Gehring’s competitive position by examining its internal strengths and weaknesses alongside external market opportunities and threats.

Simplifies complex SWOT data into a clear, actionable framework for immediate problem-solving.

Weaknesses

Gehring's deep roots in traditional internal combustion engine (ICE) technology represent a significant weakness. While the company is actively pursuing diversification into e-mobility, a substantial part of its current business and historical expertise remains tied to ICE components. This reliance creates vulnerability as the automotive sector pivots towards electrification.

The global automotive market is experiencing a rapid and undeniable shift towards electric vehicles (EVs). If Gehring's transition away from ICE technology is slower than this market evolution, it could face substantial risks. A sharp decline in demand for traditional honing applications, which are core to ICE manufacturing, could significantly impact revenue and market position.

Developing and manufacturing advanced honing machines and automation systems, particularly those integrating AI and robotics, demands significant upfront capital. Gehring's commitment to cutting-edge technology means substantial investments in research, development, and the latest manufacturing equipment.

This continuous need for technological upgrades, driven by market demand for more sophisticated and customized solutions, can place a considerable strain on the company's financial resources. For instance, the integration of advanced AI capabilities into their machinery often requires specialized hardware and software development, adding to the overall expenditure.

The advanced manufacturing landscape, including precision machining, is grappling with a significant talent deficit, particularly in niche areas like honing technology and the implementation of AI and robotics. This shortage impacts companies like Gehring, even those with strong training initiatives, as securing individuals with expertise in these rapidly evolving, high-tech fields presents a persistent hurdle.

Market Competition in Precision Machining

The precision machining sector is intensely competitive, featuring both large, established corporations and nimble, specialized manufacturers. While Gehring holds a strong position in honing technology, other firms provide sophisticated machining alternatives. These include advanced CNC machining, Electrical Discharge Machining (EDM), and laser machining, all of which can address comparable applications or offer different fabrication methods.

The market landscape is dynamic, with companies constantly innovating to capture market share. For instance, the global precision machining market was valued at approximately $100 billion in 2023 and is projected to grow steadily. However, this growth is accompanied by intense rivalry, where companies like DMG MORI, Haas Automation, and Makino Inc. are significant players, offering a broad range of machining solutions that can challenge Gehring's specialized focus in certain segments.

- Intense Competition: Many established and niche players offer advanced machining solutions.

- Alternative Technologies: CNC, EDM, and laser machining present viable alternatives for similar applications.

- Market Value: The global precision machining market reached roughly $100 billion in 2023, indicating significant competitive pressure.

- Key Competitors: Companies such as DMG MORI, Haas Automation, and Makino Inc. are major players in the broader machining market.

Vulnerability to Supply Chain Disruptions

Gehring's reliance on specialized components and advanced materials makes it particularly vulnerable to global supply chain disruptions. Recent events, like the semiconductor shortage that affected numerous industries in 2022-2023, highlight the potential for production delays and cost escalations. For instance, the global manufacturing sector saw an average increase of 10-15% in input costs due to these disruptions in 2023.

These vulnerabilities can directly impact Gehring's ability to meet customer demand and maintain its production timelines. Complex machinery often requires unique parts that may have limited suppliers, amplifying the risk of bottlenecks. The ongoing geopolitical tensions and trade policy shifts also add layers of uncertainty to the sourcing of critical raw materials and manufactured goods.

- Component Scarcity: Difficulty in procuring high-precision parts, such as specialized bearings or advanced electronic controls, can halt assembly lines.

- Material Cost Volatility: Fluctuations in the prices of rare earth metals or specialized alloys, essential for advanced machinery, can significantly impact profitability.

- Logistical Bottlenecks: Shipping delays and increased freight costs, a persistent issue since 2021, can further strain production schedules and inflate overall project expenses.

Gehring's deep reliance on internal combustion engine (ICE) technology presents a significant weakness as the automotive industry rapidly transitions to electric vehicles (EVs). This historical strength in ICE components makes the company vulnerable to declining demand for traditional honing applications.

The substantial capital required for research, development, and upgrading manufacturing equipment to meet evolving technological demands, particularly in AI and robotics integration, can strain financial resources. This continuous investment is necessary to remain competitive in the precision machining sector.

A persistent talent deficit in specialized areas like honing technology and advanced automation poses a challenge for Gehring in securing skilled personnel. This shortage impacts the company's ability to implement and innovate with cutting-edge technologies.

The precision machining market is highly competitive, with numerous established players and specialized manufacturers offering alternative solutions such as advanced CNC, EDM, and laser machining. The global precision machining market's valuation of approximately $100 billion in 2023 underscores the intense rivalry.

Gehring's dependence on specialized components and advanced materials makes it susceptible to global supply chain disruptions, which can lead to production delays and increased costs. For example, input costs in the manufacturing sector saw an average increase of 10-15% in 2023 due to these disruptions.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| ICE Technology Reliance | Historical expertise tied to traditional engine components. | Vulnerability to declining demand as the automotive sector electrifies. | The global automotive market shift towards EVs is accelerating. |

| High R&D and Capital Expenditure | Significant investment needed for technological upgrades and AI/robotics integration. | Strain on financial resources due to continuous need for cutting-edge equipment. | Integration of AI often requires specialized hardware and software development. |

| Talent Shortage in Niche Areas | Difficulty in finding skilled professionals for honing technology and automation. | Hurdle in implementing and innovating with advanced, high-tech fields. | The advanced manufacturing sector faces a significant talent deficit. |

| Intense Market Competition | Presence of numerous competitors offering alternative machining solutions. | Challenges in maintaining market share against established players and specialized firms. | Global precision machining market valued at ~$100 billion in 2023, with key competitors like DMG MORI. |

| Supply Chain Vulnerability | Dependence on specialized components and materials. | Risk of production delays and cost escalations due to global disruptions. | Input costs increased by 10-15% in 2023 due to supply chain issues. |

What You See Is What You Get

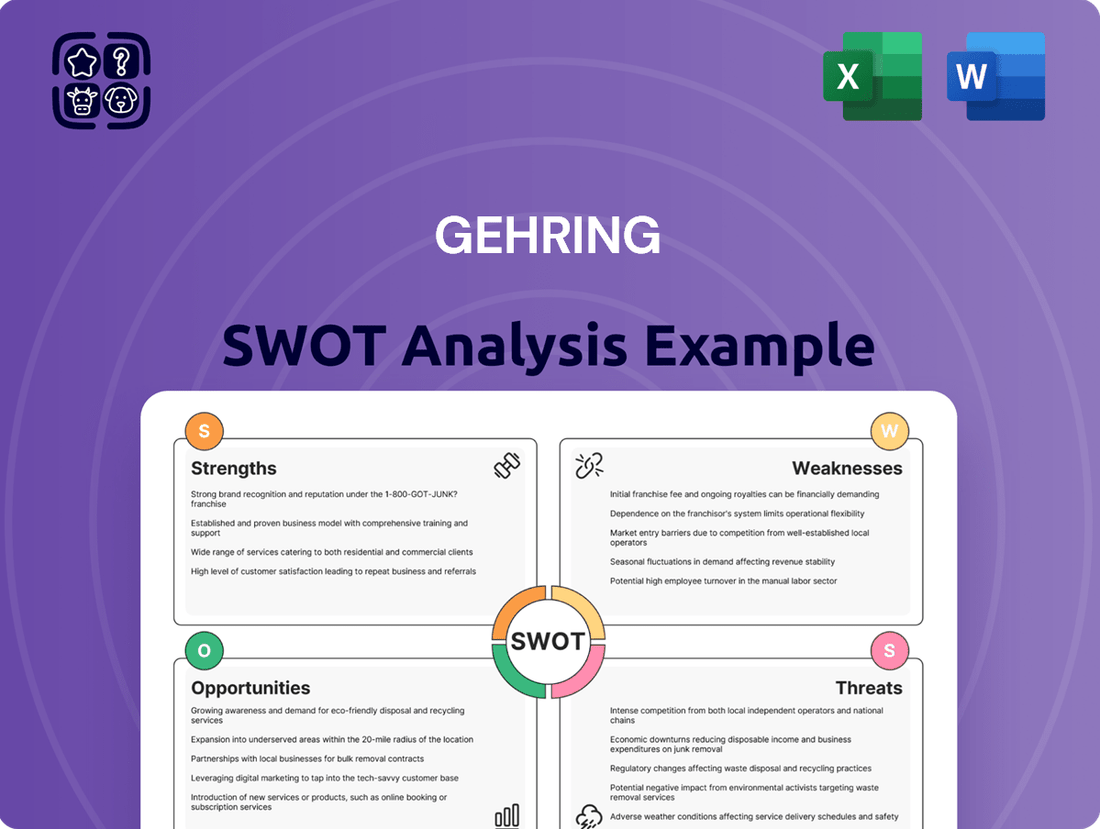

Gehring SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Gehring SWOT analysis, ensuring transparency and quality. Once purchased, the complete, detailed report will be yours to download.

Opportunities

The burgeoning electric vehicle (EV) market offers a prime growth avenue for Gehring, especially leveraging their E-Motive technology for hairpin stators and electric motor production solutions. Global EV sales are anticipated to see robust expansion through 2025, fueling substantial demand for Gehring's precision finishing expertise.

Gehring can leverage the growing trend of Industry 4.0 and AI adoption in manufacturing to significantly improve its honing machines. This integration allows for enhanced automation, precision, and quality control, directly boosting machine performance.

By embedding AI-driven inspection systems and smart manufacturing principles, Gehring can optimize its production processes, leading to reduced waste and the development of more sophisticated solutions for its clientele. For example, the global AI in manufacturing market was valued at approximately $10.1 billion in 2023 and is projected to reach $40.8 billion by 2028, indicating a substantial growth opportunity.

Gehring's precision honing expertise presents a significant growth avenue beyond its automotive base. The increasing demand for highly precise and durable components in aerospace, medical devices, and electronics, where tight tolerances are paramount, directly aligns with Gehring's core technological strengths.

These advanced sectors, including the global medical device market projected to reach $710.1 billion by 2027 according to Grand View Research, increasingly rely on sophisticated machining for novel materials. Gehring's ability to deliver exceptional surface finish and dimensional accuracy makes it well-positioned to capture market share in these high-value industries.

Focus on Sustainable Manufacturing Practices

Gehring can capitalize on the growing demand for sustainable manufacturing by highlighting how its friction-reducing and efficiency-boosting technologies directly contribute to clients' environmental goals. This aligns with global trends, as the manufacturing sector is increasingly targeted for emissions reduction; for instance, the European Union's Green Deal aims for climate neutrality by 2050, impacting supply chains significantly.

By showcasing its commitment to energy-efficient processes and the adoption of recyclable materials within its own operations and product development, Gehring can establish a distinct competitive advantage. This focus can attract environmentally conscious clients and investors, especially as corporate sustainability reporting becomes more rigorous and data-driven, with many companies now setting ambitious targets for reducing their Scope 1 and Scope 2 emissions.

- Leverage technology for client sustainability: Gehring's core competencies in friction reduction and efficiency can be marketed as solutions for clients aiming to lower their carbon footprint.

- Emphasize internal green practices: Demonstrating energy efficiency and use of recycled materials in Gehring's own manufacturing processes builds credibility.

- Align with regulatory trends: The increasing global focus on environmental regulations, such as those pushing for reduced industrial emissions, creates a favorable market for sustainable solutions.

- Attract ESG-focused clients: Companies with strong Environmental, Social, and Governance (ESG) mandates are actively seeking suppliers who share their commitment to sustainability.

Aftermarket Services and Retrofit

Gehring is well-positioned to leverage its expertise in the aftermarket services and retrofit sector. The company can tap into the ongoing demand for maintenance, upgrades, and modernization of installed honing machines, ensuring longevity and enhanced performance for its customers' existing equipment. This creates a consistent revenue stream and fosters deeper customer loyalty.

A key opportunity lies in offering advanced retrofit solutions, such as the integration of their GHC 3.0 control technology into older machine models. This not only extends the operational life of these machines but also brings them up to current technological standards, improving efficiency and precision. Such upgrades can significantly boost customer satisfaction and create new sales avenues.

- Revenue Diversification: Aftermarket services and retrofits provide a stable, recurring revenue source independent of new machine sales cycles.

- Customer Retention: Offering upgrades and maintenance strengthens relationships with existing clients, increasing their lifetime value.

- Technological Advancement: Retrofitting with newer control systems like GHC 3.0 enhances machine performance and competitiveness.

- Market Reach: This segment allows Gehring to serve a broader customer base, including those who may not be ready for a full machine replacement.

The expanding electric vehicle (EV) market presents a significant opportunity for Gehring. With global EV sales projected for strong growth through 2025, Gehring's E-Motive technology for hairpin stators and electric motor production is well-positioned to meet increasing demand.

Gehring can also capitalize on the integration of Industry 4.0 and AI in manufacturing. This allows for enhanced automation and precision in their honing machines, improving overall performance and quality control. The global AI in manufacturing market, valued at around $10.1 billion in 2023, is expected to reach $40.8 billion by 2028, underscoring this growth potential.

Beyond automotive, Gehring's precision honing expertise is highly valuable in sectors like aerospace, medical devices, and electronics, where extremely tight tolerances are essential. The medical device market alone, projected to reach $710.1 billion by 2027, increasingly requires sophisticated machining for advanced materials.

Gehring's focus on efficiency and friction reduction aligns with the growing demand for sustainable manufacturing. By highlighting how its technologies contribute to clients' environmental goals, Gehring can attract environmentally conscious customers, especially as regulatory pressures for emissions reduction intensify globally.

Threats

The accelerated global shift towards electric vehicles (EVs) and alternative powertrains presents a significant threat to Gehring. As the automotive industry pivots away from internal combustion engines (ICE), the demand for honing solutions critical for ICE components, like cylinder liners and crankshafts, is projected to decline. For instance, by 2024, it's estimated that EVs will account for over 15% of global new car sales, a figure expected to climb sharply in the coming years, directly impacting the market for traditional honing technologies.

The burgeoning e-mobility sector is witnessing a significant influx of new entrants, intensifying competition for companies like Gehring that specialize in production technologies. This surge includes both established automotive suppliers and innovative startups offering advanced solutions for electric motor and battery component manufacturing. For instance, the global electric vehicle market size was valued at approximately USD 380 billion in 2023 and is projected to reach over USD 1.5 trillion by 2030, indicating substantial growth and attracting numerous competitors.

Gehring is experiencing heightened pressure, particularly in providing production lines for critical EV components such as hairpin stators. Established players are expanding their offerings, while new companies are emerging with novel manufacturing approaches, challenging existing market dynamics and potentially impacting Gehring's market share and pricing power.

Gehring's reliance on capital expenditure from manufacturing sectors, especially automotive, makes it vulnerable to economic downturns. A significant slowdown in industrial activity, potentially triggered by factors like inflation or supply chain disruptions, could lead to delayed or canceled investment in new equipment. For instance, a projected global GDP growth slowdown in 2024-2025 could directly translate into reduced demand for Gehring's advanced machinery, impacting its revenue streams.

Technological Disruption from Alternative Finishing Methods

While honing remains a key precision finishing technique, the rapid evolution of alternative machining technologies presents a significant long-term threat. Advanced laser machining and additive manufacturing (3D printing) are increasingly capable of achieving high-quality surface finishes and complex component geometries, potentially reducing the reliance on traditional honing processes. For instance, the global additive manufacturing market, valued at approximately $20 billion in 2023, is projected to reach over $100 billion by 2030, indicating a substantial shift in manufacturing capabilities.

These disruptive technologies offer advantages such as faster processing times, reduced material waste, and the ability to create intricate designs not feasible with honing. As these methods mature and become more cost-effective, they could capture market share from specialized finishing processes like honing, particularly in sectors seeking greater design freedom and streamlined production. The automotive industry, a major user of honing, is actively exploring additive manufacturing for prototyping and even end-use parts, with investments in this area surging.

- Laser Machining Advancements: New laser technologies offer sub-micron surface roughness, challenging honing's precision advantage.

- Additive Manufacturing Integration: 3D printing is evolving to produce near-net-shape components, lessening the need for post-processing like honing.

- Market Share Erosion: The growing efficiency and capability of these alternatives could gradually erode the demand for traditional honing services.

- Cost-Competitiveness: As additive manufacturing costs decrease, they become a more viable alternative for a wider range of applications previously dominated by honing.

Intellectual Property Infringement and Copycat Technologies

Gehring's position as a pioneer in advanced honing technology makes its proprietary processes and innovative solutions a target for intellectual property infringement. This risk is amplified in the highly competitive international landscape where reverse engineering of their sophisticated machinery and techniques is a real concern. Such infringement could significantly erode Gehring's market share and impact its profitability, as competitors might offer similar, albeit lower-quality, solutions without the R&D investment. For instance, the global machine tool market, valued at approximately $100 billion in 2023 and projected to grow, presents numerous opportunities for such illicit activities.

The threat of copycat technologies is particularly acute given the increasing accessibility of advanced manufacturing techniques. Competitors could attempt to replicate Gehring's patented designs or develop similar functionalities through reverse engineering, thereby diluting the value proposition of Gehring's unique offerings. This could lead to price wars and a general commoditization of the technology, ultimately harming Gehring's brand reputation and financial performance. The automotive sector, a key market for honing technology, saw significant global production figures in 2024, highlighting the scale of potential infringement.

- Vulnerability to IP Theft: Gehring's cutting-edge honing technologies are susceptible to patent infringement and unauthorized replication by rivals.

- Market Share Erosion: Copycat technologies can directly compete, potentially reducing Gehring's market dominance and pricing power.

- Profitability Impact: Successful infringement can lead to lost sales and increased marketing costs to combat counterfeit products.

- Global Market Risks: The international nature of the machine tool industry increases the challenge of enforcing intellectual property rights.

Gehring faces significant competition from emerging players in the electric vehicle (EV) component manufacturing space, particularly in areas like hairpin stator production. The rapid growth of the EV market, projected to exceed USD 1.5 trillion by 2030 from USD 380 billion in 2023, attracts numerous competitors. This intensified competition could impact Gehring's market share and pricing power as new technologies and established players adapt their offerings.

The increasing sophistication of alternative machining technologies, such as additive manufacturing, poses a long-term threat. The global additive manufacturing market, expected to grow from approximately $20 billion in 2023 to over $100 billion by 2030, offers faster processing and material efficiency. These advancements could reduce the demand for traditional honing processes, especially as they become more cost-effective for a wider range of applications.

Gehring's intellectual property is vulnerable to infringement in the competitive global machine tool market, valued around $100 billion in 2023. Competitors may attempt to replicate proprietary designs, leading to market share erosion and potential price wars. Protecting its advanced honing technologies against unauthorized replication is crucial for maintaining its competitive edge and profitability.

SWOT Analysis Data Sources

This Gehring SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial reports, detailed market intelligence, and insightful expert opinions to provide a well-rounded strategic perspective.