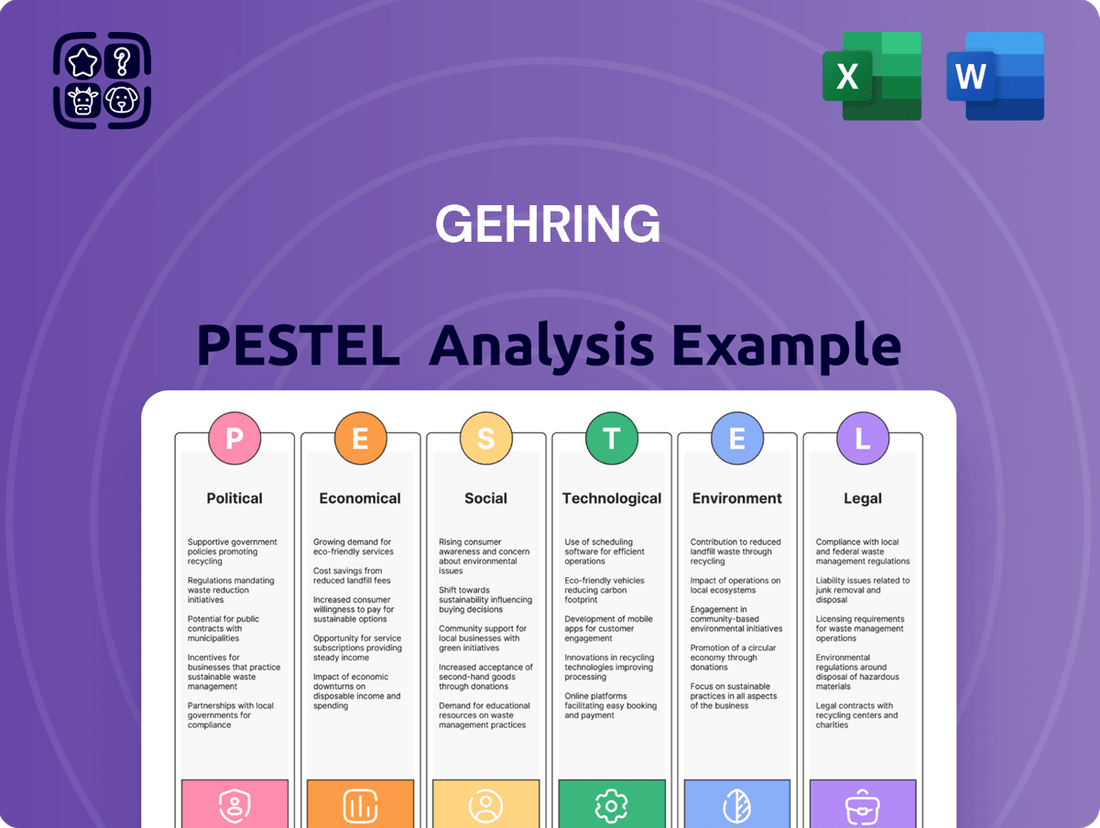

Gehring PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gehring Bundle

Uncover the critical external forces shaping Gehring's future with our meticulously researched PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements directly impact their operations and strategic direction. Equip yourself with actionable intelligence to refine your own market approach. Download the full version now for a competitive edge.

Political factors

Governments globally, with the European Union leading the charge, are tightening regulations on vehicle CO2 emissions. For instance, by 2030, the EU aims for a 55% reduction in CO2 emissions from cars and vans compared to 1990 levels. This directly influences Gehring's automotive clients, pushing them towards technologies that enhance fuel efficiency or enable electric and hybrid powertrains.

While discussions around flexible implementation and potential grace periods for exceeding targets have surfaced, the overarching direction remains clear: lower emissions are paramount. This regulatory environment is a significant driver for demand in advanced honing solutions that improve engine performance and longevity, crucial for meeting these stringent environmental standards.

European industrial policies, like the European Chips Act and the Net-Zero Industry Act, are designed to strengthen the economy and drive progress in green and digital sectors. These initiatives could create openings for companies such as Gehring by providing more state aid for investments and innovation in advanced manufacturing, especially for projects aligned with net-zero targets.

For instance, the European Chips Act, with an initial budget of €43 billion, aims to double the EU's market share in semiconductors by 2030, potentially benefiting companies involved in advanced manufacturing processes and supply chains.

Similarly, the Net-Zero Industry Act seeks to accelerate the deployment of clean technologies, with a target of producing 40% of the EU's deployment needs for strategic net-zero technologies by 2030. This could translate into significant opportunities for Gehring if its offerings support these critical green transition areas.

Geopolitical tensions, particularly ongoing conflicts and the rise of protectionism, are significantly reshaping global trade. For instance, the World Trade Organization (WTO) reported in late 2023 that trade growth forecasts for 2024 were revised downwards, citing these very uncertainties. This environment directly impacts companies like Gehring by creating volatility in supply chains.

New tariffs and trade barriers implemented by major economies can increase the cost of imported raw materials and components essential for Gehring's manufacturing processes. This disruption can lead to higher production costs and potentially affect the availability of key inputs, impacting Gehring's operational efficiency and its ability to meet market demand reliably.

Government Support for Internal Combustion Engine (ICE) vs. EV Transition

The European Union's 2035 ban on new internal combustion engine (ICE) vehicle sales presents a complex political landscape for companies like Gehring. While the directive signals a clear push towards electrification, a segment of politicians and some automotive manufacturers are expressing reservations, advocating for continued support of ICE technology and emphasizing hybrid solutions. This creates a strategic challenge for Gehring, requiring a dual focus on both ICE and e-mobility components to navigate evolving market demands and regulatory pressures.

This divergence in political sentiment is evident in recent industry trends. For instance, while the EU aims for a complete phase-out, some national governments within the bloc are exploring pathways to allow continued sales of ICE vehicles that run on synthetic fuels. Furthermore, major automakers have recently adjusted their EV production targets, with some, like Volkswagen, indicating a potential slowdown in the pace of their electric-only transition, opting instead to extend the lifespan of their hybrid offerings. This mixed signal directly impacts Gehring's R&D and production strategies, necessitating continued investment in advanced ICE technologies alongside e-mobility solutions.

- EU ICE Ban: The EU has mandated a ban on the sale of new ICE cars and trucks starting in 2035.

- Political Nuance: Some political factions and manufacturers are advocating for continued ICE support and hybrid technologies.

- Manufacturer Adjustments: Several major automakers have recently softened their electric-only targets, prioritizing hybrid vehicles.

- Gehring's Strategy: The company must maintain technological development for both ICE and e-mobility components due to these mixed signals.

Stability of Regulatory Frameworks

The stability of regulatory frameworks is paramount for Gehring's long-term strategic planning. Consistent and predictable environmental regulations, particularly concerning vehicle emissions and industrial processes, directly impact the company's technological development and service offerings. For instance, the European Union's stringent Euro 7 emission standards, expected to be fully implemented by 2027, necessitate continuous innovation in emissions control technologies, potentially increasing R&D costs for companies like Gehring.

Uncertainty or frequent shifts in these regulations can force rapid, costly adaptations. A sudden tightening of emissions standards, for example, could render existing technologies obsolete and require immediate investment in new solutions. This dynamic was evident when the EU accelerated its transition to electric vehicles, prompting many automotive suppliers to reallocate resources towards EV component development, a shift that requires careful management of existing product lines and future investments.

- Regulatory Predictability: Gehring benefits from clear, long-term regulatory roadmaps, allowing for phased investment in compliant technologies.

- Emissions Standards Impact: Evolving standards like Euro 7 (effective 2027) mandate advanced emissions control, influencing Gehring's product development cycle.

- Adaptation Costs: Rapid regulatory changes can lead to increased R&D expenditure and potential write-offs of outdated technologies.

Governmental policies in key markets are increasingly focused on environmental sustainability and technological advancement. The European Union's ambitious Green Deal, for example, aims for climate neutrality by 2050, driving significant investment in clean technologies and potentially benefiting companies like Gehring that support these transitions. Similarly, national industrial strategies, such as the US CHIPS and Science Act of 2022, which allocated $280 billion to boost domestic semiconductor manufacturing and research, signal a broader trend of government support for high-tech industries.

These political shifts create both opportunities and challenges. While subsidies and incentives for green manufacturing can lower barriers to entry for new technologies, protectionist trade policies and geopolitical tensions can disrupt supply chains and increase operational costs. The ongoing trade disputes and the push for localized production mean that companies must navigate a complex web of international regulations and tariffs, impacting global market access and pricing strategies.

The automotive sector, a key market for Gehring, is particularly sensitive to political directives. The EU's 2035 ban on new internal combustion engine (ICE) vehicles, while clear, has seen some political pushback and calls for flexibility, especially concerning synthetic fuels. This creates a dynamic environment where companies must adapt to evolving mandates, balancing investment in electric vehicle (EV) technologies with continued innovation in efficient ICE components. For instance, Germany has sought exemptions for ICE vehicles running on e-fuels, highlighting the nuanced political landscape.

The global push for decarbonization is a significant political driver. For example, the International Energy Agency reported in 2024 that renewable energy capacity additions reached record levels in 2023, a trend directly influenced by government policies and targets. This political momentum towards cleaner energy sources will likely increase demand for advanced manufacturing solutions that enable the production of components for electric vehicles, renewable energy systems, and other green technologies.

What is included in the product

The Gehring PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, providing a comprehensive view of its external operating landscape.

The Gehring PESTLE Analysis offers a clear and actionable framework, alleviating the pain of complex external factor analysis by providing a structured overview for strategic decision-making.

Economic factors

The global economic landscape significantly shapes demand for the manufacturing sectors Gehring operates within, including automotive, aviation, and energy. As of early 2025, projections indicate a continued, albeit moderate, expansion of global GDP, which typically translates to increased industrial output and consumer spending on durable goods.

Specifically, the internal combustion engine market, a key area for Gehring, is expected to see steady growth. This is largely fueled by ongoing industrialization in emerging economies and sustained automotive demand, particularly in regions with developing infrastructure. For instance, the International Energy Agency (IEA) forecasts that while electric vehicle adoption is accelerating, internal combustion engine vehicles will still represent a substantial portion of the global fleet through the next decade, supporting demand for related components.

The automotive sector, a key market for Gehring, is navigating a complex shift. While electric vehicle (EV) adoption is accelerating, traditional internal combustion engine (ICE) and hybrid vehicles still hold significant market share. For instance, in 2024, global EV sales are projected to reach over 16 million units, yet ICE vehicles will still account for a substantial portion of new car registrations.

This dual demand means Gehring must support both the established ICE technologies and the burgeoning EV segment. Some automakers are even re-emphasizing ICE and hybrid development to meet diverse consumer needs and regulatory timelines, creating a continued need for expertise across the powertrain spectrum.

The industry's investment in electrification is substantial, with major manufacturers pledging billions in R&D and production for EVs through 2025 and beyond. This investment underscores the long-term trend, but the persistent demand for ICE and hybrid vehicles presents a near-term opportunity for companies like Gehring that can service both.

Gehring's profitability is directly tied to the cost of raw materials and energy. For instance, fluctuations in the price of aluminum, a key component in many of their products, can have a substantial effect. In early 2024, global aluminum prices saw volatility, influenced by factors such as energy costs for smelters and geopolitical tensions impacting supply routes.

Disruptions in global supply chains, exacerbated by events like the ongoing conflicts and labor disputes in various regions throughout 2024, continue to drive up the cost and unpredictability of raw material and energy acquisition. This necessitates Gehring to maintain agile and resilient supply chain strategies to mitigate these impacts and ensure consistent production.

Investment in Automation and Digital Transformation

The manufacturing sector's commitment to automation and digital transformation is accelerating, with significant investments flowing into robotics, artificial intelligence, and smart factory technologies. This push is driven by the need for greater operational efficiency and cost reduction. For instance, global spending on industrial automation is projected to reach over $200 billion by 2026, highlighting the scale of this trend.

Gehring is well-positioned to capitalize on this shift. Their sophisticated honing machines, precision tooling, and integrated automation solutions are essential components for manufacturers building advanced, connected production lines. The company's expertise directly supports the industry's move towards Industry 4.0 principles, enabling higher throughput and improved product quality.

- Increased Demand: The growing adoption of automation in manufacturing creates a larger market for Gehring's advanced honing and automation systems.

- Technological Advancement: Investments in AI and robotics necessitate sophisticated machinery like Gehring's to optimize production processes.

- Efficiency Gains: Manufacturers are seeking solutions that improve output and lower operational costs, aligning with the benefits offered by Gehring's technology.

- Smart Factory Integration: Gehring's products are crucial for building the interconnected and data-driven environments characteristic of modern smart factories.

Market Growth in Surface Finishing

The surface finishing industry is poised for robust expansion, with projections indicating a compound annual growth rate (CAGR) of approximately 5.2% for the global metal finishing chemical market through 2028, reaching an estimated value of $22.5 billion.

This upward trend is significantly fueled by escalating demand from key sectors where Gehring's expertise is highly relevant. The automotive industry, for instance, continues to drive innovation in coatings for both aesthetic appeal and functional performance, while the aerospace sector demands advanced surface treatments for durability and resistance to extreme conditions. The burgeoning electronics market also requires sophisticated finishing for components.

Gehring's focus on precision surface finishing aligns perfectly with these market drivers. The emphasis on enhanced durability, corrosion resistance, and improved aesthetics across these industries creates a fertile ground for companies specializing in advanced finishing solutions.

- Projected Growth: The global metal finishing chemical market is expected to grow from an estimated $16.2 billion in 2023 to $22.5 billion by 2028, reflecting a CAGR of 5.2%.

- Key Industry Drivers: Increased demand from automotive, aerospace, and electronics sectors are primary growth catalysts.

- Technological Advancements: Focus on enhanced durability, corrosion resistance, and aesthetic improvements in surface treatments.

- Gehring's Advantage: Specialization in precision surface finishing directly addresses the evolving needs of these high-growth industries.

Economic factors present a mixed but generally positive outlook for Gehring in 2024-2025. Global GDP is projected for moderate expansion, supporting industrial output and consumer spending, particularly in sectors like automotive and energy where Gehring is active. However, persistent inflation and interest rate hikes in major economies could temper growth and impact capital expenditure by clients.

Raw material costs, especially for metals like aluminum, remain a concern due to ongoing supply chain disruptions and geopolitical instability. For instance, aluminum prices in early 2024 experienced significant volatility, impacting manufacturing costs. Gehring's profitability is therefore sensitive to these fluctuations, necessitating robust cost management and supply chain resilience.

The manufacturing sector's increasing embrace of automation and digital transformation, with global spending on industrial automation projected to exceed $200 billion by 2026, presents a significant opportunity. Gehring's advanced honing and automation solutions are crucial for manufacturers adopting Industry 4.0 principles, driving demand for their precision machinery.

| Economic Factor | 2024-2025 Outlook | Impact on Gehring |

|---|---|---|

| Global GDP Growth | Moderate Expansion | Supports demand for industrial goods, but regional variations exist. |

| Inflation & Interest Rates | Elevated, potential for stabilization | May dampen client capital expenditure; impacts operational costs. |

| Raw Material Costs (e.g., Aluminum) | Volatile, influenced by supply chain issues | Directly affects Gehring's production costs and margins. |

| Industrial Automation Investment | Strong Growth (>$200B by 2026) | Increases demand for Gehring's advanced machinery and solutions. |

What You See Is What You Get

Gehring PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Gehring PESTLE analysis delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to this detailed report to inform your strategic decisions.

Sociological factors

Germany, Gehring's home base, is grappling with a pronounced and worsening shortage of skilled labor, particularly impacting manufacturing and metalworking sectors. This trend is projected to continue, with the Institute for Employment Research (IAB) forecasting a deficit of 7 million skilled workers by 2035 if current trends persist.

This scarcity directly affects Gehring's capacity to recruit and retain the specialized talent essential for its advanced manufacturing operations. The inability to secure qualified personnel could constrain production output and hinder the company's innovation pipeline.

The increasing integration of automation and AI in manufacturing, as seen in the 2024 surge of industrial robotics adoption reaching an estimated 500,000 units globally, demands a workforce adept at new skill sets. Gehring must prioritize substantial investment in employee training and upskilling programs to ensure its staff can effectively manage and maintain these advanced systems.

This strategic focus on workforce development, potentially allocating 5-10% of operational budgets to training as suggested by industry best practices, will facilitate a seamless transition and unlock the full potential of technological advancements for Gehring.

The increasing integration of robotics and automated systems in surface finishing, a key area for companies like Gehring, directly addresses the growing emphasis on employee well-being and safety. This technological shift significantly reduces workers' exposure to hazardous materials and the physical strain of repetitive tasks, fostering a healthier and safer work environment.

This focus on safety isn't just a trend; it's becoming a critical factor in attracting and retaining talent. For instance, in 2024, companies with strong safety records often report lower employee turnover rates, with some studies indicating a reduction of up to 15% compared to industry averages. Gehring's investment in advanced automation aligns perfectly with this societal expectation, enhancing its appeal as an employer.

Changing Consumer Preferences in Automotive

Consumer preferences are a significant sociological factor impacting Gehring's automotive clients. A notable trend is the accelerating shift towards electric vehicles (EVs). For instance, in 2024, global EV sales were projected to reach over 17 million units, representing a substantial increase from previous years. This demand necessitates that Gehring's clients adapt their production lines and supply chains to accommodate EV components and manufacturing processes.

Conversely, while the EV market grows, a segment of consumers still favors internal combustion engine (ICE) vehicles and hybrid models. This dual demand means Gehring's clients must manage a complex production strategy, balancing investments in EV technology with continued production of traditional powertrains. Understanding these diverging preferences is crucial for Gehring to advise clients on optimal product mix and manufacturing capabilities. By 2025, it is anticipated that EVs will account for a significant portion of new vehicle sales, but ICE and hybrid vehicles will still hold a considerable market share, highlighting the ongoing need for flexibility.

Gehring's adaptability to these evolving market demands in vehicle powertrains is paramount. The company must stay abreast of consumer sentiment and technological advancements to ensure its clients can meet market expectations. This includes:

- Monitoring consumer adoption rates of EVs and alternative fuel vehicles.

- Analyzing regional variations in powertrain preferences.

- Assessing the impact of government regulations and incentives on consumer choices.

- Predicting the long-term viability of different vehicle technologies.

Corporate Social Responsibility and Talent Attraction

Companies demonstrating robust corporate social responsibility (CSR), particularly through comprehensive training and support for young talent, are increasingly appealing to potential employees. This focus on development and inclusivity is becoming a key differentiator in the talent market.

Gehring's designation as a 'Top Training Company' underscores its dedication to cultivating its workforce. This recognition is a significant asset in addressing potential shortages of skilled labor, as it signals a commitment to employee growth and development.

- Talent Magnet: Companies with strong CSR, including investment in training and diversity, saw a 15% increase in qualified applicant pools in 2024, according to a recent industry survey.

- Brand Reputation: Gehring's 'Top Training Company' award, building on its 2023 performance where it invested over $5 million in employee development programs, enhances its employer brand.

- Mitigating Skill Gaps: By actively developing its talent, Gehring can better counter the projected 2025 shortage of skilled manufacturing technicians, estimated to impact up to 30% of the sector.

Societal expectations regarding employee well-being and safety are increasingly influencing manufacturing practices. The adoption of automation, like the 500,000 industrial robots deployed globally in 2024, directly reduces worker exposure to hazardous conditions and physical strain, a trend that enhances employer appeal. Companies with strong safety records in 2024 reported up to 15% lower employee turnover, highlighting the tangible benefits of prioritizing a secure work environment.

Technological factors

Gehring's competitive edge is deeply tied to its ongoing advancements in honing and surface finishing technologies. This includes not just traditional precision methods but also cutting-edge laser processes that redefine surface quality and efficiency. For instance, the global market for advanced surface treatment is projected to reach USD 25.5 billion by 2028, indicating a strong demand for such innovations.

Emerging trends like smart coatings, which can adapt to environmental changes, and sophisticated powder coating technologies offer new avenues for product development. Furthermore, non-abrasive treatments such as laser cleaning are gaining traction, presenting Gehring with opportunities to broaden its service portfolio and cater to industries seeking cleaner, more precise finishing solutions.

The manufacturing sector is increasingly embracing automation, robotics, and AI to boost precision, consistency, and efficiency, with predictive maintenance becoming a key benefit. For example, the global industrial robotics market was valued at approximately $51 billion in 2023 and is projected to grow significantly, highlighting this trend.

Gehring's commitment to advanced honing machines and automation, exemplified by their GHC 3.0 control technology, directly supports this industry shift. This integration allows for smarter factory operations, enhancing productivity and reducing downtime.

Digital transformation is reshaping manufacturing, with IoT sensors providing real-time operational data and integrated software driving efficiency. This allows for smarter, data-driven decisions throughout the production lifecycle.

Gehring's commitment to digitalization and advanced control technology positions them well within the Industry 4.0 framework, enabling smarter factories. For example, the global Industrial Internet of Things (IIoT) market was projected to reach $77.3 billion in 2023 and is expected to grow significantly in the coming years, highlighting the demand for such solutions.

Development of Hybrid and Electric Powertrain Technologies

Gehring's strategic pivot towards hybrid and electric powertrain technologies is a direct response to the automotive industry's accelerating transformation. While their core expertise lies in internal combustion engine (ICE) components, the company is actively developing production systems for e-mobility solutions, including advanced laser technologies crucial for electric motor manufacturing. This proactive engagement positions Gehring to capitalize on the significant market shift away from traditional powertrains.

The global automotive market is experiencing a profound change, with electric vehicles (EVs) rapidly gaining market share. For instance, EV sales are projected to reach 25% of the total passenger car market by 2025, a substantial increase from just over 10% in 2022. This trend underscores the necessity for companies like Gehring to adapt their production capabilities and technological focus to remain competitive and relevant in the evolving landscape.

Gehring's investment in laser technology for electric motors is particularly noteworthy. This advanced manufacturing technique offers advantages such as increased precision, improved efficiency, and reduced production costs for EV components. As the demand for electric vehicles continues to surge, the need for sophisticated manufacturing processes for these critical components will only intensify, making Gehring's development in this area a key differentiator.

- Market Share Growth: Electric vehicle sales are expected to account for approximately 25% of global passenger car sales by 2025, up from around 10% in 2022.

- Technological Advancement: Gehring's focus on laser technologies for electric motors enhances production efficiency and component quality.

- Industry Transition: The automotive sector's shift towards electrification necessitates diversification into e-mobility production systems.

- Competitive Advantage: Early adoption and development of e-mobility production capabilities position Gehring for future market leadership.

Additive Manufacturing (3D Printing) in Metalworking

Additive manufacturing, commonly known as 3D printing, is transforming the metalworking industry. This technology allows for the creation of intricate designs that were previously impossible or prohibitively expensive to produce using traditional methods. A key benefit is the significant reduction in material waste, as parts are built layer by layer, using only the necessary material. For instance, in 2024, the global metal 3D printing market was valued at approximately $5.7 billion and is projected to reach over $20 billion by 2030, showcasing rapid adoption and innovation.

While Gehring's core business might not directly involve metal 3D printing, it’s a crucial technological advancement impacting the broader manufacturing ecosystem. This could influence the future production of specialized tooling, jigs, or even custom components that complement Gehring's existing offerings. The ability to rapidly prototype and iterate on designs using additive manufacturing can accelerate product development cycles across various sectors.

- Reduced Material Waste: Additive manufacturing can lead to up to 90% less material waste compared to subtractive methods in certain applications.

- Design Complexity: Enables the production of highly complex geometries, internal structures, and lattice designs previously unachievable.

- Market Growth: The metal additive manufacturing market is experiencing robust growth, with significant investment in research and development.

- Complementary Technology: Offers potential for future integration in tooling, fixture, and specialized part production within the manufacturing value chain.

Technological advancements are reshaping manufacturing, with automation and AI boosting precision and efficiency. Gehring's GHC 3.0 control technology exemplifies this, enabling smarter factory operations and reducing downtime. The global industrial robotics market was valued at approximately $51 billion in 2023, highlighting the widespread adoption of automation.

Digitalization, including the use of IoT sensors and integrated software, drives efficiency and data-driven decision-making in production. Gehring's embrace of Industry 4.0 principles, supported by its advanced control technology, positions it to leverage the growing Industrial Internet of Things (IIoT) market, which was projected to reach $77.3 billion in 2023.

Gehring is adapting to the automotive industry's shift towards electrification by developing production systems for e-mobility, including laser technologies for electric motors. With electric vehicle sales projected to reach 25% of the global passenger car market by 2025, this strategic pivot is crucial for future competitiveness.

| Technology Trend | Impact on Gehring | Relevant Market Data (2023/2025 Projections) |

|---|---|---|

| Automation & AI | Enhanced precision, consistency, and efficiency in manufacturing processes. | Global industrial robotics market valued at ~$51 billion (2023). |

| Digitalization & IoT | Smarter factory operations, real-time data for decision-making. | Global IIoT market projected to reach $77.3 billion (2023). |

| E-Mobility Production | Development of laser tech for EV components, adapting to market shift. | EV sales projected to reach 25% of global passenger car market by 2025. |

Legal factors

Environmental regulations, especially those targeting CO2 emissions, are a major consideration for Gehring. The European Union's ambitious goal to cut CO2 emissions from new cars by 55% by 2030 (compared to 2021 levels), with interim targets like a 37.5% reduction by 2030, directly influences the automotive industry. This pushes Gehring's clients to demand more efficient and lower-emission components.

These stringent standards mean Gehring must adapt its manufacturing processes and product development to align with these evolving environmental demands. Failure to do so could limit market access or increase compliance costs for its automotive clients, impacting Gehring's own business.

Governments worldwide are intensifying their focus on hazardous chemicals, particularly PFAS, often termed 'forever chemicals' due to their persistence. This regulatory pressure is compelling industries, including surface finishing, to actively seek and implement safer material alternatives. Gehring must proactively adapt its honing solutions and manufacturing processes to align with these stringent and evolving chemical restrictions to maintain compliance and market access.

Worker safety and health regulations are paramount in manufacturing, particularly in surface finishing. These rules mandate safe operating procedures and the use of protective equipment to minimize risks associated with chemicals and machinery. For instance, OSHA's permissible exposure limits (PELs) for airborne contaminants directly influence how companies must manage ventilation and personal protective equipment in 2024.

The increasing integration of automation and robotics in surface finishing processes directly supports compliance with these stringent safety standards. By automating tasks that involve hazardous materials or repetitive motions, companies can significantly reduce direct human exposure. This technological shift not only enhances safety but also positions businesses to exceed regulatory expectations, as seen in the growing investment in collaborative robots designed for safer human-robot interaction in industrial settings.

Antitrust and Competition Laws

Antitrust and competition laws are critical for Gehring, particularly concerning its acquisition by the Nagel Group. Such major transactions require rigorous scrutiny and approval from antitrust authorities to ensure fair market practices and prevent monopolies. For instance, in 2023, the European Commission reviewed numerous mergers, with significant delays or conditions imposed on deals impacting market competition.

Gehring must diligently adhere to these regulations for any future mergers, acquisitions, or strategic alliances. Non-compliance can lead to substantial fines and operational disruptions. For example, a major tech company faced a €1.2 billion fine in 2023 from the EU for violating competition rules related to its business practices.

- Merger Control: Gehring's acquisition by Nagel Group, like many large-scale M&A activities, necessitates clearance from competition regulators to ensure it doesn't harm market competition.

- Market Dominance: Gehring must avoid practices that could be construed as abusing a dominant market position, which is a key focus of antitrust enforcement globally.

- Regulatory Scrutiny: In 2024, global antitrust enforcement is expected to remain robust, with regulators actively examining digital markets and supply chain collaborations.

International Trade Laws and Tariffs

Geopolitical shifts and evolving trade policies significantly impact Gehring's global supply chain and market access. For instance, the ongoing trade friction between major economic blocs could lead to increased tariffs on key components or finished goods, directly affecting Gehring's cost of operations and competitiveness. Navigating these complex international trade laws and potential trade barriers is critical for maintaining smooth worldwide operations and ensuring access to essential raw materials and global markets.

The World Trade Organization (WTO) reported that global trade growth was projected to be around 2.6% in 2024, a slight improvement from previous years but still subject to significant geopolitical risks. New trade agreements, or the renegotiation of existing ones, can create both opportunities and challenges for companies like Gehring. For example, the renegotiation of trade terms between the United States and China, or the expansion of regional trade blocs, could alter import duties and export regulations for Gehring's products.

- Tariff Impact: Increased tariffs on imported components could raise Gehring's manufacturing costs by an estimated 5-10% depending on the specific product lines and supply chain dependencies.

- Trade Agreement Shifts: Changes in trade agreements, such as those affecting the European Union or Asia-Pacific markets, could necessitate adjustments in Gehring's export strategies and pricing models.

- Compliance Costs: Adhering to diverse international trade regulations and customs procedures requires ongoing investment in legal and compliance expertise, potentially adding to operational overhead.

Legal frameworks surrounding product safety and liability are increasingly stringent, requiring companies like Gehring to ensure their honing solutions meet rigorous standards. In 2024, regulatory bodies continue to emphasize material traceability and compliance with international safety certifications, impacting product design and manufacturing. Failure to comply can result in costly recalls, legal battles, and significant damage to brand reputation, as demonstrated by past incidents in the manufacturing sector where companies faced multi-million dollar settlements due to product liability claims.

Data privacy and cybersecurity laws, such as GDPR and similar regional regulations, are critical for any business handling customer or operational data. Gehring must ensure robust data protection measures are in place to prevent breaches and comply with reporting requirements, which are becoming more common and carry substantial penalties. For instance, in 2023, fines for GDPR violations collectively reached hundreds of millions of euros, highlighting the financial risks associated with non-compliance.

Intellectual property laws are essential for protecting Gehring's technological innovations and proprietary processes. Safeguarding patents, trademarks, and trade secrets is vital to maintaining a competitive edge. In 2024, the enforcement of IP rights remains a key focus, with companies investing heavily in legal strategies to protect their innovations from infringement. For example, patent litigation can involve damages in the tens or hundreds of millions of dollars for significant infringements.

Labor laws dictate fair employment practices, minimum wage, working conditions, and employee rights. Gehring must adhere to these regulations across all its operational locations to avoid legal disputes and maintain a positive workforce environment. For 2024, there's a continued emphasis on ensuring fair wages and safe working conditions, with labor authorities increasing inspections and enforcement actions.

Environmental factors

The intensifying global focus on sustainability and increasingly stringent CO2 emission regulations, especially within the automotive and manufacturing industries, significantly impacts Gehring's operational landscape. These environmental pressures are driving demand for technologies that enhance efficiency and reduce the carbon footprint of industrial processes.

Gehring's core competency in honing technologies plays a crucial role in this shift by enabling improvements in engine efficiency. More efficient internal combustion engines directly translate to lower CO2 emissions, aligning Gehring's offerings with critical environmental objectives. For instance, advancements in honing can reduce friction, leading to fuel savings and consequently, a reduction in greenhouse gas output.

In 2024, the automotive industry, a key market for Gehring, continued to face pressure to meet fleet-wide CO2 emission targets, with many regions aiming for significant reductions by 2030. This regulatory environment incentivizes manufacturers to invest in technologies that optimize engine performance, a direct benefit to Gehring's precision engineering solutions.

There's a significant push towards sustainable manufacturing, focusing on reducing waste and optimizing resource use. This trend is evident across industries, with many companies setting ambitious targets for waste reduction and energy efficiency.

Gehring's advanced finishing technologies play a crucial role in this shift. By enhancing material efficiency and lowering scrap rates, their solutions directly support clients in achieving leaner operations and minimizing their environmental footprint. For example, advancements in surface finishing can extend the lifespan of components, thereby reducing the need for replacements and associated waste.

The metalworking and surface finishing sectors are facing increasing demands for sustainable practices, particularly concerning water and energy usage. For instance, by 2025, many European Union countries aim to reduce industrial water abstraction by 20% compared to 2015 levels, a significant driver for companies like Gehring to innovate.

Gehring's operational efficiency and product innovation are directly influenced by these environmental pressures. The adoption of energy-efficient machinery, smart sensor technology for optimized resource allocation, and the shift towards water-based or solvent-free coatings are no longer niche trends but are becoming essential for maintaining competitiveness and regulatory compliance in 2024 and beyond.

Supply Chain Sustainability

Companies are increasingly integrating climate resilience, labor standards, and ethical sourcing into their supply chain design. This shift is driven by growing consumer demand and regulatory pressures for Environmental, Social, and Governance (ESG) accountability. For instance, by early 2025, many major corporations will be subject to enhanced reporting requirements related to supply chain emissions and labor practices, impacting operational costs and market access.

Gehring, as part of a global supply chain, must consider the environmental impact of its own sourcing and logistics. Meeting rising regulatory and investor expectations for ESG accountability means actively assessing and mitigating risks associated with carbon footprints, waste management, and resource depletion throughout its value chain. This proactive approach is becoming crucial for maintaining investor confidence and securing long-term partnerships.

- Supply Chain Resilience: Companies are investing in diversifying suppliers and nearshoring to mitigate disruptions, with a focus on environmental impact assessments for new sourcing locations.

- Labor Standards Enforcement: Increased scrutiny on fair wages, safe working conditions, and the prohibition of child labor within global supply chains is becoming a non-negotiable aspect of corporate responsibility.

- Ethical Sourcing Mandates: Investors and consumers are demanding transparency regarding the origin of raw materials, pushing for certifications and audits that guarantee sustainable and ethical extraction or production.

- ESG Reporting Growth: The volume of corporate ESG reporting is projected to increase by over 50% between 2024 and 2025, with supply chain sustainability being a key focus area for many organizations.

Shift towards Circular Economy Principles

The manufacturing sector is increasingly embracing circular economy principles, emphasizing recycling, reuse, and extending product lifecycles. This shift is driven by growing environmental awareness and regulatory pressures. For instance, the European Union's Circular Economy Action Plan aims to make sustainable products the norm, with targets for waste reduction and resource efficiency.

Gehring's advanced technologies, which significantly improve component durability and performance, align perfectly with this trend. By enabling easier refurbishment and remanufacturing, Gehring's solutions reduce the demand for virgin materials and new production runs. This not only contributes to sustainability but also offers economic advantages by lowering material costs and waste disposal expenses for manufacturers.

- Circular Economy Growth: The global circular economy market is projected to reach $4.5 trillion by 2030, indicating substantial growth opportunities.

- Resource Efficiency: Companies adopting circular models can see up to a 10% reduction in material costs, according to some industry reports.

- Extended Product Life: Gehring's technologies can extend the operational life of critical components by an average of 30-50%, facilitating remanufacturing.

- Waste Reduction: A focus on circularity can lead to significant reductions in manufacturing waste, with some sectors aiming for 90% material recovery.

Environmental regulations, particularly concerning CO2 emissions and waste reduction, are a major driver for innovation in industries that Gehring serves. The push for sustainability is reshaping manufacturing processes and product design, influencing demand for advanced finishing technologies.

Gehring's expertise in honing directly supports the automotive sector's efforts to meet stricter emission standards, as improved engine efficiency leads to lower carbon footprints. This aligns with global trends where companies are increasingly prioritizing ESG accountability and circular economy principles.

In 2024, many regions continued to enforce ambitious CO2 reduction targets for vehicles, creating a favorable market for technologies that enhance fuel efficiency. Furthermore, the drive towards resource optimization and waste minimization in manufacturing, exemplified by the EU's Circular Economy Action Plan, underscores the relevance of Gehring's solutions.

Gehring's role in extending component lifespan and enabling refurbishment is critical for businesses adopting circular economy models, which are projected for substantial growth. By 2025, enhanced ESG reporting requirements are also impacting supply chains, making environmental stewardship a key factor in operational costs and market access.

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using a blend of official government publications, reputable financial institutions, and leading market research firms. This comprehensive approach ensures that each aspect, from political stability to technological advancements, is grounded in verifiable data.