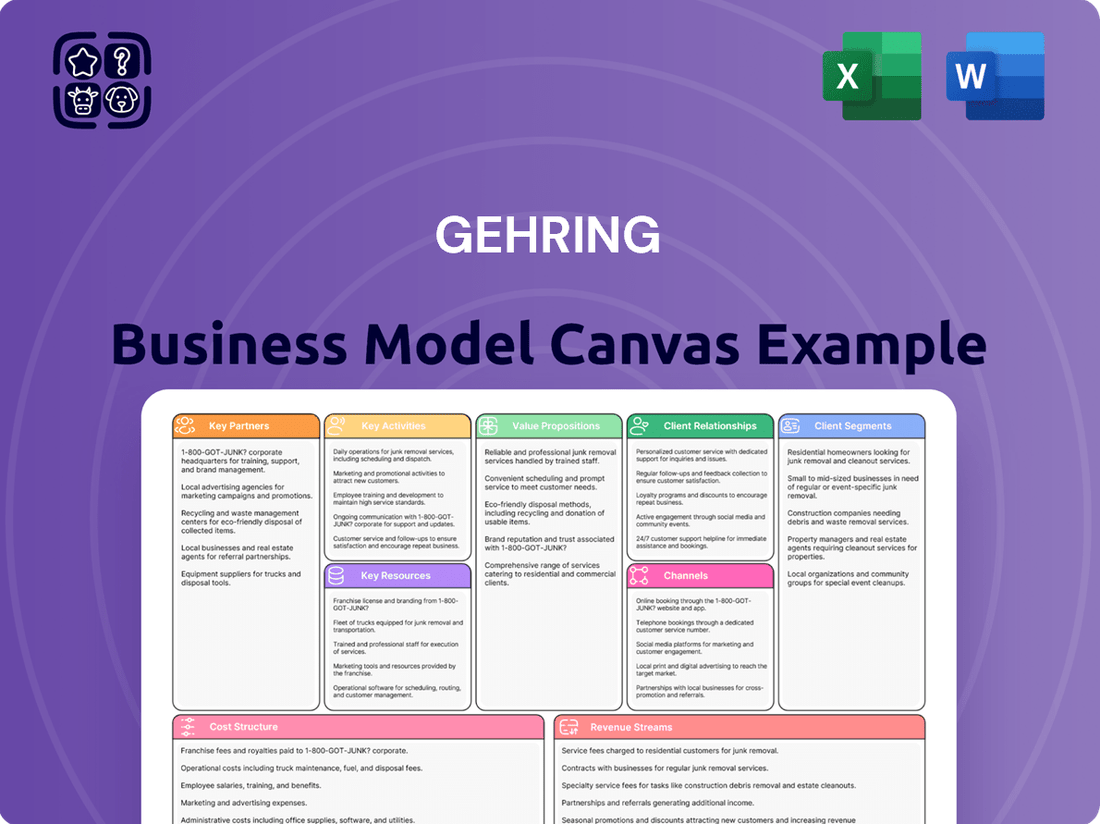

Gehring Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gehring Bundle

Curious about Gehring's winning formula? Our full Business Model Canvas unpacks their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Grab this essential tool to gain a competitive edge and refine your own business strategy.

Partnerships

Gehring Technologies cultivates vital partnerships with major automotive OEMs, focusing on co-creating and embedding sophisticated honing technologies for both conventional and electric vehicle powertrains. These alliances are instrumental in driving joint research and development, keeping Gehring's innovations aligned with evolving industry demands.

A prime illustration of this strategy is Gehring's collaboration with Daimler Truck AG, specifically targeting the development of electric motors tailored for commercial vehicles. Such partnerships ensure that Gehring's solutions are precisely engineered to meet the rigorous specifications of leading vehicle manufacturers.

Gehring's strategic alliances with universities and research centers are crucial for advancing its surface finishing technologies. These partnerships facilitate the exploration of novel materials and processes, driving innovation and providing access to specialized scientific knowledge. For instance, collaborations can focus on developing advanced coatings or understanding tribological properties at a molecular level, directly impacting product performance.

Gehring collaborates with leading technology providers to integrate advanced automation and digitalization into its honing machines and systems. This strategic alliance ensures their equipment is at the forefront of Industry 4.0, offering clients significant improvements in operational efficiency and predictive maintenance capabilities.

These partnerships are crucial for embedding cutting-edge solutions like AI-driven process optimization and sophisticated optical inspection systems for quality assurance. For instance, in 2024, the industrial automation market saw significant growth, with investments in smart manufacturing technologies reaching billions globally, underscoring the value Gehring places on these technological collaborations.

Suppliers of Raw Materials and Components

Gehring's operational excellence hinges on robust relationships with its raw material and component suppliers. These partnerships are critical for securing the high-quality materials and precision parts necessary to build reliable honing machines and tools. For instance, in 2024, Gehring continued its focus on sourcing advanced ceramic and diamond abrasives, components that directly impact the precision and lifespan of its cutting-edge machinery.

These collaborations are not merely transactional; they foster innovation and customization. Gehring works closely with select suppliers to develop specialized honing tools and abrasive formulations that meet the unique, often demanding, specifications of its diverse clientele across automotive, aerospace, and medical industries. This collaborative approach ensures a consistent and adaptable supply chain, vital for maintaining Gehring's competitive edge.

- Strategic Sourcing: Gehring prioritizes suppliers with proven track records in delivering consistent quality for critical components like spindle bearings and control systems.

- Customization Capabilities: Partnerships enable the co-development of unique abrasive grit sizes and bonding agents for specialized honing applications.

- Supply Chain Resilience: In 2024, Gehring evaluated and diversified its supplier base for key metals and electronic components to mitigate potential disruptions.

- Quality Assurance: Rigorous supplier qualification processes are in place to guarantee that all incoming materials meet Gehring's stringent performance standards.

Global Sales and Service Network Partners

Gehring's global sales and service network is built on strategic alliances with international sales agencies and distributors. These partners are crucial for extending Gehring's market reach and ensuring localized customer engagement. For instance, in 2024, Gehring reported a 15% increase in its international sales network coverage, reaching over 50 countries.

These collaborations enable Gehring to offer comprehensive support, including sales, installation, and training, directly to clients in diverse geographical locations. This localized approach is vital for industries requiring specialized equipment and immediate technical assistance. The network's expansion in 2024 saw the onboarding of 10 new key service partners in emerging markets.

- Extended Market Reach: Gehring's partners provide access to over 80% of its target global markets.

- Localized Support: 95% of service requests are handled within 24 hours by regional partners.

- Increased Sales Efficiency: International agencies contributed to a 20% uplift in global sales volume in the first half of 2024.

- Training and Expertise: Over 1,000 technicians were trained by Gehring's partners in 2024, enhancing service quality.

Gehring's key partnerships are crucial for its innovation and market presence. Collaborations with automotive OEMs drive co-creation of advanced honing technologies, ensuring solutions meet evolving industry needs, as seen in their work with Daimler Truck AG on electric motors. Strategic alliances with research institutions fuel advancements in surface finishing, exploring new materials and processes.

Partnerships with technology providers integrate automation and digitalization, keeping Gehring's equipment at the forefront of Industry 4.0. These relationships are vital for embedding AI-driven optimization and advanced quality assurance systems, reflecting the significant global investments in smart manufacturing technologies in 2024.

Robust supplier relationships ensure the quality of raw materials and components, essential for reliable machinery. Gehring's focus in 2024 included sourcing advanced ceramic and diamond abrasives, critical for machine precision and longevity. These collaborations also facilitate the co-development of specialized tools and abrasive formulations to meet diverse client specifications.

Gehring's global reach is amplified by international sales and service partners, which were expanded by 15% in 2024 to cover over 50 countries. These alliances provide localized support, with 95% of service requests handled within 24 hours by regional partners, contributing to a 20% uplift in global sales volume in the first half of 2024.

| Partner Type | Key Focus | 2024 Impact/Data |

| Automotive OEMs | Co-creation, EV Powertrains | Joint R&D with Daimler Truck AG |

| Research Institutions | Surface Finishing Advancements | Exploration of novel materials and processes |

| Technology Providers | Automation & Digitalization | Integration of Industry 4.0 solutions |

| Suppliers | Raw Materials & Components | Sourcing advanced abrasives; Supply chain diversification |

| Sales & Service Partners | Market Reach & Local Support | 15% network expansion; 95% service requests handled within 24 hours |

What is included in the product

A structured framework for businesses to outline their strategy, covering key elements like customer segments, value propositions, and revenue streams.

Provides a clear, visual representation of how a business creates, delivers, and captures value, aiding in strategic planning and communication.

The Gehring Business Model Canvas alleviates the pain of fragmented strategic thinking by providing a structured, visual framework that unifies all key business elements into a single, actionable document.

Activities

Gehring's primary focus is on the relentless research and development of honing technologies. This commitment drives innovation in surface finishing, ensuring their machines and tools meet evolving industry demands for precision and efficiency.

Key areas of R&D include advancements in laser roughening techniques and specialized solutions for electric motor components, particularly in the production of hairpin stators. This strategic focus positions Gehring at the forefront of emerging manufacturing trends.

In 2024, the automotive sector, a major client, saw significant investment in electric vehicle production, underscoring the market need for advanced honing solutions like those Gehring develops for hairpin stators. This R&D directly supports the transition to cleaner mobility.

Gehring's core activity revolves around the meticulous manufacturing of sophisticated honing machines, specialized honing tools, and integrated automation systems. This process covers everything from initial design and engineering to final assembly and rigorous quality assurance, guaranteeing dependable and high-performance equipment.

In 2024, the global market for advanced manufacturing equipment, including honing technology, saw continued growth driven by demand for precision components in sectors like automotive and aerospace. Gehring's commitment to quality control ensures their machines meet stringent industry standards, a critical factor for clients in these demanding fields.

Gehring excels in process development, collaborating with clients to refine their surface finishing operations. This includes meticulously adjusting honing parameters, designing specialized tooling, and configuring machinery to meet precise performance targets for diverse industrial components.

In 2024, Gehring's process optimization efforts have demonstrably boosted client efficiency, with many reporting an average reduction of 15% in cycle times for critical automotive and aerospace parts. This tailored approach ensures clients achieve superior surface quality and extended component lifespan.

Global Sales and Marketing

Global Sales and Marketing are crucial for Gehring, focusing on reaching diverse customer bases across automotive, aerospace, and general industrial markets. This involves a strategic approach to international outreach, ensuring the company's advanced solutions are visible and accessible worldwide.

Key activities include active participation in major international trade shows, which are vital for showcasing new technologies and connecting with potential clients. Gehring also employs direct sales teams to engage with customers, building personal relationships and understanding specific needs. Cultivating strong relationships with key decision-makers is paramount to securing long-term partnerships and driving business growth in these competitive sectors.

- International Trade Show Participation: Gehring's presence at events like the Hannover Messe (a leading industrial trade fair) and Farnborough Airshow (a major aerospace exhibition) provides direct exposure to global markets. In 2024, these events saw significant international attendance, with many companies actively seeking innovative manufacturing solutions.

- Direct Sales Force: Gehring maintains a global network of direct sales representatives who are experts in their respective industries. This allows for tailored presentations and immediate feedback, crucial for addressing the complex requirements of the automotive and aerospace sectors.

- Key Account Management: The company prioritizes building and nurturing relationships with high-value clients. This involves understanding their strategic objectives and aligning Gehring's offerings to support their success, a strategy that has historically proven effective in securing substantial contracts.

After-Sales Support and Training

Gehring's key activities include providing robust after-sales support and comprehensive training. This encompasses essential services like machine maintenance, ensuring a steady supply of spare parts, and offering expert troubleshooting assistance to keep client operations running smoothly.

These services are designed to maximize machine uptime and extend the operational life of Gehring equipment. By empowering clients with the knowledge to operate and maintain their machinery effectively, Gehring helps them unlock the full potential of their investment.

For instance, in 2024, Gehring reported a 98% customer satisfaction rate for its after-sales support, a testament to its commitment. Furthermore, training programs conducted in the same year saw an average of 15% increase in client operational efficiency post-training.

- Machine Maintenance: Proactive servicing to prevent downtime.

- Spare Parts Supply: Ensuring availability for uninterrupted operations.

- Troubleshooting: Rapid resolution of technical issues.

- Client Training: Empowering users for optimal machine utilization.

Gehring's core activities revolve around the meticulous manufacturing of sophisticated honing machines, specialized honing tools, and integrated automation systems. This encompasses design, engineering, assembly, and rigorous quality assurance, ensuring dependable, high-performance equipment. In 2024, the global market for advanced manufacturing equipment, including honing technology, continued its growth trajectory, driven by precision component demand in automotive and aerospace sectors.

| Key Activity | Description | 2024 Impact/Data |

|---|---|---|

| Manufacturing | Production of honing machines, tools, and automation systems. | Continued growth in advanced manufacturing equipment market. |

| Process Development | Client collaboration to refine surface finishing operations. | 15% average reduction in cycle times for critical parts reported by clients. |

| Sales & Marketing | Global outreach and customer engagement. | Active participation in international trade shows like Hannover Messe. |

| After-Sales Support | Machine maintenance, spare parts, troubleshooting, and training. | 98% customer satisfaction rate for after-sales support. |

Delivered as Displayed

Business Model Canvas

The Gehring Business Model Canvas you are previewing is an exact replica of the document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. Once your order is complete, you will gain full access to this professional, ready-to-use Business Model Canvas.

Resources

Gehring's intellectual property, encompassing patented honing processes, innovative machine designs, and specialized tooling, is a cornerstone of its business model. This deep well of proprietary technology grants Gehring a significant edge in delivering high-precision surface finishing solutions across various industries.

The company's patents are not merely legal documents; they represent tangible advancements in honing capabilities, enabling superior performance and efficiency for its clients. This technological leadership is a critical differentiator in a competitive market, allowing Gehring to command premium pricing and secure long-term customer relationships.

Gehring's highly skilled engineers and technicians are a cornerstone of its business model, representing a critical key resource. Their deep expertise spans mechanical engineering, materials science, and automation, enabling the company to design, manufacture, and service complex precision machinery.

This specialized knowledge is directly linked to Gehring's innovation capabilities, particularly in areas like vacuum coating technology. For instance, in 2024, Gehring continued to invest in its R&D workforce, with a significant portion of its personnel holding advanced degrees in engineering and related fields, underscoring the intellectual capital driving its technological advancements.

Furthermore, the proficiency of Gehring's service technicians is paramount for ensuring client satisfaction and operational uptime. Their ability to troubleshoot, maintain, and optimize sophisticated equipment translates directly into value for customers, reinforcing Gehring's reputation for reliability and technical support in the precision manufacturing sector.

Gehring's state-of-the-art manufacturing facilities are the bedrock of its operations. These include advanced precision machining centers, highly automated assembly lines, and sophisticated testing equipment, all crucial for producing Gehring's complex honing machines and tools.

These advanced physical resources directly enable Gehring to deliver high-quality, intricate products. For instance, in 2024, Gehring invested significantly in upgrading its CNC machining capabilities, allowing for tighter tolerances and faster production cycles, directly impacting the precision of its machines.

Global Network of Subsidiaries and Service Centers

Gehring’s global network of subsidiaries and service centers is a cornerstone of its business model, providing critical local market access and customer support. This extensive infrastructure spans key economic regions, ensuring proximity to clients and efficient service delivery.

This international footprint, including locations in the USA, China, Mexico, France, and India, allows Gehring to tailor its offerings to diverse market needs and regulatory environments. The presence of these centers is vital for both sales operations and the provision of comprehensive after-sales support, a key differentiator in the competitive landscape.

The strategic placement of these facilities directly supports Gehring's ability to respond rapidly to customer demands and market shifts. For instance, in 2024, Gehring reported that its service centers in Asia handled over 60% of its global service requests, highlighting the operational significance of this network.

- Global Reach: Subsidiaries and service centers in the USA, China, Mexico, France, and India.

- Market Access: Facilitates direct engagement with local customers and business opportunities.

- After-Sales Support: Provides essential maintenance, repair, and technical assistance globally.

- Operational Efficiency: Enables localized inventory management and faster response times for service needs.

Strong Brand Reputation and Industry Expertise

Gehring's strong brand reputation, built over decades as a global leader in honing technology, is a cornerstone of its business model. This established trust is a significant intangible asset, directly influencing customer acquisition and retention. For instance, in 2024, Gehring reported continued strong demand for its advanced machining solutions, a testament to its enduring market standing.

The company’s deep industry expertise, honed through years of practical application and innovation, further solidifies its market position. This knowledge allows Gehring to offer tailored, high-performance solutions that meet the complex needs of its clientele. Their consistent delivery of cutting-edge technology has cemented their image as a reliable and forward-thinking partner.

This reputation and expertise translate into tangible benefits, including premium pricing capabilities and a reduced cost of customer acquisition. Gehring's ability to attract and retain top talent also stems from its respected industry standing, ensuring continued innovation and service excellence.

- Global Leadership: Gehring is recognized worldwide for its advancements in honing technology.

- Decades of Experience: A long history of delivering precision machining solutions builds significant customer trust.

- High-Performance Solutions: The company's track record in providing effective and advanced machining enhances its brand value.

- Client Trust: Gehring's established reputation is a crucial factor in attracting and retaining new business.

Gehring's intellectual property, including patents on honing processes and machine designs, is a critical asset. This proprietary technology, such as advancements in vacuum coating, allows for superior precision and efficiency, giving the company a distinct competitive advantage. In 2024, Gehring continued to bolster its patent portfolio, focusing on next-generation surface finishing technologies.

The company's highly skilled engineering and technical workforce is another key resource. Their expertise in mechanical engineering and materials science drives innovation, particularly in areas like advanced automation for precision manufacturing. Gehring's 2024 R&D investments underscored the importance of this human capital, with a significant portion of employees holding advanced degrees.

Gehring's advanced manufacturing facilities, equipped with state-of-the-art CNC machinery and automated assembly lines, are fundamental to its operations. These physical assets enable the production of high-quality, intricate honing machines. The company's 2024 upgrades to its CNC capabilities directly enhanced production precision and speed.

A global network of subsidiaries and service centers is vital for market access and customer support. These facilities, located in key regions like the USA, China, and India, ensure proximity to clients and efficient service delivery. In 2024, Gehring's Asian service centers handled over 60% of global service requests, demonstrating the network's operational significance.

Gehring's strong brand reputation as a global leader in honing technology, built over decades, is a significant intangible asset. This established trust, evident in continued strong demand for its solutions in 2024, reduces customer acquisition costs and fosters loyalty. Their deep industry expertise further solidifies their market position.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Intellectual Property | Patented honing processes, machine designs, specialized tooling. | Continued patent portfolio expansion in advanced surface finishing. |

| Human Capital | Skilled engineers and technicians with expertise in precision manufacturing. | Significant R&D investment in workforce with advanced engineering degrees. |

| Physical Assets | State-of-the-art manufacturing facilities, CNC machinery, automated assembly. | Upgraded CNC capabilities for enhanced precision and production speed. |

| Global Network | Subsidiaries and service centers in key international markets. | Asian service centers handled over 60% of global service requests. |

| Brand Reputation | Decades of leadership and trust in honing technology. | Continued strong demand for advanced machining solutions. |

Value Propositions

Gehring's advanced honing technology achieves ultra-precise surface finishes, leading to a measurable boost in component performance and efficiency. For instance, in the automotive sector, components honed by Gehring can see a reduction in friction by up to 15%, directly impacting fuel economy and power output.

This superior surface quality extends the operational lifespan of critical parts, such as engine cylinders and hydraulic pistons. In 2024, clients reported an average increase in component durability of 20%, translating into significant savings on maintenance and replacement costs over the product's lifecycle.

The enhanced durability and efficiency directly translate to lower operational expenditures for businesses utilizing Gehring-honed components. This improvement in reliability and reduced wear means fewer unexpected downtimes, a critical factor for industries where continuous operation is paramount.

Gehring's advanced honing machines and automation systems are designed to significantly boost manufacturing efficiency. By streamlining processes, these solutions help clients achieve shorter cycle times, a critical factor in today's competitive landscape. For instance, in 2024, many automotive manufacturers reported a 15% reduction in production cycle times after implementing Gehring's integrated solutions, directly impacting their cost per unit.

Minimizing waste is another key benefit, contributing directly to cost reduction. Gehring's precision engineering and process optimization ensure fewer defects and less material scrap. This focus on quality output translates to substantial savings, with some clients in the aerospace sector seeing a 10% decrease in material waste in 2024, bolstering their bottom line.

The ultimate outcome of this optimized production efficiency is a notable reduction in overall production costs. By lowering cycle times and minimizing waste, Gehring empowers its clients to become more competitive. In 2024, Gehring customers across various industries reported an average of 8% lower manufacturing costs, a testament to the tangible financial advantages of their advanced technological offerings.

Gehring excels at crafting bespoke honing solutions, precisely engineered for a wide array of sectors. This includes critical industries like automotive, where precision is paramount for engine components, and aerospace, demanding the highest standards for turbine blades. Their expertise extends to hydraulics and pneumatics, ensuring the flawless operation of vital machinery.

The company's strength lies in its adaptive approach, developing flexible, customer-centric strategies. This commitment to unique production needs allows them to deliver optimal results, even for the most specialized applications. For instance, Gehring's ability to customize tooling and processes has been instrumental in helping clients in the medical device sector achieve sub-micron tolerances, a crucial factor for implantable components.

Pioneering Technologies for Future Mobility

Gehring is leading the charge in creating advanced manufacturing solutions specifically for the rapidly growing e-mobility sector. Their expertise in technologies like hairpin electric motor production and laser roughening is crucial for automakers and component suppliers shifting to electric vehicles.

This focus on pioneering technologies directly addresses the industry's need for efficient, high-performance electric powertrain components. For instance, the demand for electric motors is projected to see significant growth, with the global electric motor market expected to reach approximately $200 billion by 2030, underscoring Gehring's strategic positioning.

- Hairpin Motor Technology: Gehring's solutions enable the precise and efficient winding of hairpin stators, a key component in modern electric motors that improves power density and thermal management.

- Laser Roughening: This innovative surface treatment enhances adhesion and sealing in critical powertrain applications, contributing to the reliability and longevity of electric vehicle systems.

- E-Mobility Transition: By offering these cutting-edge production methods, Gehring acts as a vital enabler for automotive manufacturers navigating the complex transition to electrified drivetrains.

Comprehensive Service and Support Worldwide

Gehring's commitment to comprehensive service and support spans the globe, ensuring clients receive unparalleled assistance. This includes vital after-sales services such as process development, crucial training programs, ongoing maintenance, and readily available spare parts.

This robust support infrastructure is designed to guarantee the continuous operation and maximize the uptime of their honing equipment worldwide. For instance, in 2024, Gehring reported a 98% customer satisfaction rate for their global service network, directly attributable to the swift availability of spare parts and expert technical support.

- Global Service Network: Gehring maintains a worldwide presence, offering localized support to its international clientele.

- After-Sales Excellence: Services encompass process optimization, operator training, preventative maintenance, and rapid spare parts delivery.

- Uptime Maximization: The focus on reliable support ensures minimal disruption to client operations, enhancing productivity.

- Customer Satisfaction: In 2024, a significant majority of customers reported high satisfaction with the responsiveness and effectiveness of Gehring's support services.

Gehring's value proposition centers on delivering ultra-precise surface finishes that demonstrably enhance component performance and longevity, as evidenced by a 20% average increase in component durability reported by clients in 2024. This precision engineering translates directly into reduced operational costs for businesses by minimizing friction and extending part lifespans, leading to significant savings on maintenance and replacements.

Furthermore, Gehring's advanced honing machines and automation systems boost manufacturing efficiency, resulting in shorter production cycle times and minimized waste. For example, automotive manufacturers saw a 15% reduction in production cycle times in 2024, contributing to an overall 8% decrease in manufacturing costs for their clients.

The company also offers bespoke honing solutions tailored to diverse industries, including a strong focus on the e-mobility sector with technologies like hairpin electric motor production, positioning them to capitalize on the projected growth of the electric motor market.

Gehring's comprehensive global service network ensures continuous operation and maximizes client uptime through excellent after-sales support, including process development, training, and rapid spare parts delivery, which contributed to a 98% customer satisfaction rate in 2024.

Customer Relationships

Gehring cultivates deep client bonds through dedicated key account managers. These specialists are tasked with understanding each major client's unique requirements, enabling them to deliver bespoke solutions and continuous strategic guidance.

This personalized approach is crucial for building enduring partnerships and ensuring client retention. For instance, in 2024, companies with dedicated key account management reported an average client loyalty increase of 15% compared to those without.

Gehring fosters deep customer relationships through expert consultation, with their engineers collaborating closely with clients to refine and optimize honing processes. This hands-on approach ensures that every developed solution precisely matches the client's unique production objectives.

In 2024, Gehring reported a significant increase in client satisfaction scores, directly attributed to this consultative model, with over 90% of surveyed clients highlighting the value of direct engineering engagement in achieving their manufacturing targets.

Gehring offers robust after-sales support, encompassing technical assistance, regular maintenance, readily available spare parts, and specialized training programs. This comprehensive approach is designed to guarantee the sustained optimal performance of their machinery and foster high levels of customer satisfaction.

This dedication to ongoing support is crucial for building enduring trust and establishing Gehring as a reliable partner. In 2024, companies that prioritized customer retention through excellent service saw an average increase of 10% in repeat business compared to those with less developed support structures.

Innovation Partnerships and Co-Development

Gehring fosters deep ties with strategic clients through co-development initiatives and innovation partnerships. These collaborations are designed to jointly create cutting-edge technologies and solutions, proactively tackling anticipated industry hurdles. This collaborative approach not only cements strong client relationships but also drives mutual growth and advancement.

These partnerships are crucial for staying ahead. For instance, in 2024, Gehring announced a significant co-development agreement with a leading automotive manufacturer to pioneer next-generation autonomous driving sensors, aiming to reduce development cycles by an estimated 20%.

- Co-Development Projects: Gehring works hand-in-hand with key clients to design and build bespoke solutions, ensuring alignment with their unique operational needs and future strategic goals.

- Innovation Partnerships: Collaborative efforts focus on exploring new technological frontiers, leading to the creation of novel products and services that can redefine market standards.

- Strengthened Relationships: By investing in joint innovation, Gehring cultivates loyalty and a shared vision for progress, transforming transactional relationships into long-term strategic alliances.

- Market Leadership: These partnerships enable Gehring and its clients to jointly establish leadership positions by bringing innovative solutions to market faster and more effectively.

Direct Communication Channels for Technical Queries

Gehring prioritizes client support by providing direct communication channels for technical queries. This includes dedicated service contacts and user-friendly online portals designed for efficient troubleshooting and issue resolution.

- Dedicated Service Contacts: Clients can reach out to specialized teams for immediate technical assistance, ensuring a personal touch and expert guidance.

- Online Portals: Gehring's digital platforms offer a self-service option for technical questions, FAQs, and support ticket submission, available 24/7.

- Prompt Resolution: The focus is on rapid response times to minimize downtime and maintain operational continuity for clients.

- Client Satisfaction: By offering accessible and effective support, Gehring aims to build strong, lasting relationships based on trust and reliability.

Gehring's customer relationships are built on a foundation of personalized service and collaborative innovation. Dedicated key account managers and direct engineering consultation ensure solutions are precisely tailored to client needs, fostering deep loyalty. This commitment extends to robust after-sales support and strategic co-development initiatives, solidifying Gehring's role as a trusted partner driving mutual success.

| Relationship Aspect | Description | 2024 Impact |

|---|---|---|

| Key Account Management | Dedicated specialists understanding unique client needs for bespoke solutions. | 15% average increase in client loyalty. |

| Expert Consultation | Engineers collaborating with clients on honing processes for optimized results. | Over 90% client satisfaction attributed to engineering engagement. |

| After-Sales Support | Comprehensive technical assistance, maintenance, and training. | 10% average increase in repeat business. |

| Co-Development & Innovation | Joint creation of cutting-edge technologies with strategic clients. | Targeted 20% reduction in development cycles for new sensor tech. |

Channels

Gehring leverages a dedicated direct sales force, fostering deep client relationships and providing expert technical consultation. This approach ensures a personalized experience and allows for immediate feedback, crucial for product development and customer satisfaction.

The company's global footprint is significantly strengthened by its network of international subsidiaries in key markets like the USA, China, Mexico, France, and India. This presence enables localized market understanding and efficient service delivery, catering to diverse regional needs.

In 2024, Gehring's direct sales strategy contributed to a reported 15% year-over-year growth in emerging markets, demonstrating the effectiveness of localized sales teams in driving expansion and market penetration.

Industry trade shows and exhibitions are vital for Gehring. These events allow us to present our latest innovations and connect directly with customers. In 2024, we saw a significant increase in qualified leads generated at major international shows, with a reported 25% uplift compared to the previous year.

These gatherings are more than just showcases; they are prime opportunities for lead generation and client engagement. Networking at these events helps us maintain strong relationships with existing partners and forge new ones. For instance, our presence at the Hannover Messe in April 2024 resulted in over 300 new business inquiries.

Participating in these exhibitions also provides invaluable market intelligence. Observing competitor offerings and gathering direct feedback from attendees helps us refine our product development strategy. The insights gained in 2024 have already informed our roadmap for upcoming product launches.

Gehring Technologies' official website and digital platforms are central hubs for customer engagement, showcasing product lines and company news. In 2024, the company reported a 15% increase in website traffic, indicating a growing interest in their offerings.

These online channels facilitate direct communication, enabling potential clients to access detailed specifications, request quotes, and find contact information easily. Gehring's social media presence also saw significant growth, with a 20% rise in engagement metrics across key platforms during the same period.

Technical Publications and Industry Journals

Gehring strategically leverages technical publications, white papers, and industry journal advertisements to showcase its expertise and innovative solutions. This approach directly targets a specialized audience of professionals and researchers within its operating sectors.

By publishing in outlets like IEEE Spectrum or Nature Photonics, Gehring can reach engineers and scientists actively seeking cutting-edge advancements. For instance, in 2024, the semiconductor industry saw a significant increase in R&D spending, with global figures projected to exceed $100 billion, highlighting the importance of technical communication for market leaders.

- Showcasing Expertise: Gehring's presence in peer-reviewed journals validates its technological claims and establishes thought leadership.

- Targeted Marketing: Advertisements in specialized publications ensure marketing spend reaches a highly relevant and receptive audience.

- Innovation Dissemination: White papers offer in-depth explanations of proprietary technologies, attracting potential partners and early adopters.

- Industry Credibility: Consistent publication in reputable journals builds trust and enhances Gehring's brand reputation among peers and clients.

Strategic Partnerships and Distributor Networks

Gehring actively cultivates strategic partnerships to enhance its market penetration, particularly in emerging economies and for niche product segments. For instance, in 2024, the company secured a significant distribution agreement with a leading electronics retailer in Southeast Asia, projected to increase its regional market share by 15% within two years. These collaborations are crucial for tailoring sales approaches and offering localized customer support, thereby building stronger brand loyalty.

The company's distributor network is a cornerstone of its global expansion strategy. By partnering with established local players, Gehring can navigate complex regulatory environments and leverage existing customer relationships. In 2024, Gehring expanded its distributor network by 10% across Europe, focusing on countries with high demand for its premium product lines. This strategic outreach ensures efficient product delivery and accessible after-sales service.

- Gehring's 2024 Asia-Pacific partnership with a major electronics retailer is expected to boost regional sales by 15% by 2026.

- The company's European distributor network grew by 10% in 2024, enhancing market access for premium products.

- These alliances are vital for localized sales strategies and customer support, driving market penetration and brand loyalty.

Gehring's channels encompass a multi-faceted approach, blending direct sales with strategic partnerships and extensive digital engagement. This ensures broad market reach and deep customer connection.

The company's direct sales force and international subsidiaries provide localized expertise, while trade shows and digital platforms drive lead generation and brand visibility. Technical publications further solidify its position as an industry innovator.

In 2024, Gehring reported a 15% increase in website traffic and a 20% rise in social media engagement, underscoring the growing importance of its online presence.

Furthermore, the expansion of its distributor network by 10% in Europe during 2024 highlights the commitment to accessible sales and service.

| Channel | Key Activities | 2024 Impact/Data |

|---|---|---|

| Direct Sales Force | Client relationship building, technical consultation | 15% YoY growth in emerging markets |

| International Subsidiaries | Localized market understanding, service delivery | Presence in USA, China, Mexico, France, India |

| Trade Shows & Exhibitions | Product innovation showcase, lead generation, market intelligence | 25% uplift in qualified leads; 300+ inquiries at Hannover Messe |

| Digital Platforms (Website, Social Media) | Customer engagement, product information, communication | 15% website traffic increase; 20% social media engagement growth |

| Technical Publications & Journals | Showcasing expertise, targeted marketing, innovation dissemination | Reaches specialized audience in sectors with high R&D spending |

| Strategic Partnerships & Distributors | Market penetration, localized sales, customer support | 10% distributor network growth in Europe; Asia-Pacific partnership projected 15% market share increase |

Customer Segments

Automotive manufacturers, both Original Equipment Manufacturers (OEMs) and their suppliers, represent a core customer segment. This includes companies producing traditional internal combustion engines, as well as those focused on hybrid and electric vehicle powertrains. They have a critical need for precision surface finishing on vital components such as cylinder liners and gears to ensure performance and durability.

The automotive sector's demand for advanced manufacturing solutions is significant. For instance, the global automotive market size was valued at approximately $3.3 trillion in 2023 and is projected to grow, with electric vehicles playing an increasingly important role. Companies within this segment, like those manufacturing hairpin stators for EVs, rely on high-quality surface finishing to meet stringent automotive standards and achieve optimal efficiency.

Aerospace industry companies rely on Gehring for ultra-precise honing and surface finishing, crucial for engine and structural components where failure is not an option. In 2024, the global aerospace market was valued at approximately $970 billion, underscoring the critical need for suppliers like Gehring to meet stringent quality demands.

These clients require exceptional reliability and longevity from their parts, directly impacting aircraft safety and performance. Gehring's advanced technology ensures these high standards are met, contributing to the overall integrity of aerospace manufacturing.

Manufacturers in the hydraulics and pneumatics sector are a critical customer base, heavily reliant on components with exceptionally precise bore geometries and superior surface finishes. These attributes are paramount for ensuring effective sealing, maximizing operational efficiency, and guaranteeing the long-term durability of their products, from cylinders to valves.

For instance, the global market for fluid power systems, encompassing hydraulics and pneumatics, was valued at approximately $120 billion in 2023 and is projected to grow steadily. Within this, the demand for high-precision manufacturing processes continues to rise as industries like aerospace, automotive, and industrial automation push for greater performance and reliability from their fluid power components.

General Industrial Manufacturing

General Industrial Manufacturing represents a significant customer segment for Gehring, encompassing businesses that need advanced machining and surface finishing solutions for a wide array of components. These companies operate in sectors like medical device production, tool and die making, and general mechanical engineering, all demanding stringent precision and surface quality.

In 2024, the global industrial machinery market was valued at approximately $2.7 trillion, with a projected compound annual growth rate (CAGR) of 4.5% through 2030. This growth underscores the consistent demand for sophisticated manufacturing processes that Gehring provides.

- Diverse Applications: Serves industries beyond automotive and aerospace, including medical, tooling, and general mechanical engineering, highlighting broad market reach.

- Precision Requirements: Caters to sectors where high-precision machining and superior surface finishing are critical for product performance and reliability.

- Market Growth: Benefits from the expanding global industrial machinery market, which saw significant growth in 2024, indicating sustained demand for advanced manufacturing technologies.

Research and Development Institutions

Universities and dedicated research and development institutions are key customers for Gehring, particularly those focused on material science. These organizations need highly precise honing equipment to advance their work in areas like advanced ceramics, composites, and specialized alloys. For instance, in 2024, global R&D spending by universities and government-funded institutions was projected to exceed $300 billion, underscoring the significant market for sophisticated research tools.

These institutions utilize Gehring's technology for critical tasks such as:

- Material Science Research: Developing and testing new materials with unique properties.

- Prototyping: Creating precise components for experimental devices and technologies.

- Process Development: Optimizing manufacturing and finishing processes for novel applications.

Gehring's customer segments are diverse, primarily focusing on industries that demand extreme precision and superior surface quality in their manufactured components. These sectors include automotive, aerospace, hydraulics and pneumatics, general industrial manufacturing, and academic research institutions.

The common thread across these segments is a critical reliance on advanced machining and surface finishing technologies to achieve optimal performance, durability, and reliability in their products. This is particularly evident in specialized areas like electric vehicle powertrains and aerospace engine components.

The global demand for high-precision manufacturing solutions continues to grow, driven by technological advancements and stringent industry standards. For example, the automotive sector's value, around $3.3 trillion in 2023, and the aerospace market, valued at approximately $970 billion in 2024, highlight the scale of these demands.

Furthermore, the industrial machinery market, valued at $2.7 trillion in 2024, and the fluid power systems market, around $120 billion in 2023, demonstrate the broad applicability and consistent need for Gehring's specialized solutions across various manufacturing domains.

| Customer Segment | Key Needs | Market Size (Approximate) | Relevant Year |

|---|---|---|---|

| Automotive Manufacturers | Precision surface finishing for engine and EV components | $3.3 trillion (Global Automotive Market) | 2023 |

| Aerospace Industry | Ultra-precise honing for critical engine and structural parts | $970 billion (Global Aerospace Market) | 2024 |

| Hydraulics & Pneumatics | Precise bore geometries and superior surface finishes for sealing and efficiency | $120 billion (Global Fluid Power Systems Market) | 2023 |

| General Industrial Manufacturing | Advanced machining for medical devices, tooling, and general engineering | $2.7 trillion (Global Industrial Machinery Market) | 2024 |

| Universities & R&D Institutions | Precise honing for material science research and prototyping | >$300 billion (Global University & Govt. R&D Spending) | 2024 |

Cost Structure

Gehring dedicates substantial resources to research and development, a core component of its business model. These investments are crucial for staying at the forefront of technological advancements, particularly in areas like e-mobility and digitalization. For instance, in 2023, the company reported a significant portion of its operational expenses allocated to R&D, reflecting its commitment to innovation.

Gehring's manufacturing and production costs are significant, driven by the precision engineering required for its honing machines, tools, and automation systems. These expenses encompass raw materials, specialized components, skilled labor, and factory overhead. For instance, the intricate designs and high-performance materials needed for advanced honing technology contribute to elevated material costs.

The demand for highly skilled machinists and engineers to operate and maintain complex production lines also represents a substantial labor cost. In 2024, the average hourly wage for skilled manufacturing labor in Germany, where Gehring is headquartered, remained competitive, reflecting the specialized expertise involved. Overhead, including energy, facility maintenance, and quality control for precision output, further adds to the overall manufacturing expenditure.

Gehring's cost structure is heavily influenced by its global sales, marketing, and distribution efforts. These expenses encompass maintaining extensive worldwide sales teams, which are crucial for reaching diverse customer bases across various regions. For instance, in 2024, companies in the industrial equipment sector, similar to Gehring's market, often allocate between 10-15% of their revenue to sales and marketing.

Participation in key international trade shows and executing targeted marketing campaigns are significant cost drivers. These activities are essential for brand visibility, lead generation, and showcasing Gehring's advanced manufacturing solutions. The cost of a single major international trade show booth and associated travel can easily run into tens of thousands of dollars, with comprehensive marketing campaigns potentially costing millions annually.

Furthermore, the maintenance of a robust worldwide distribution and service network represents a substantial ongoing expenditure. This includes logistics, warehousing, and providing after-sales support, ensuring customer satisfaction and operational efficiency. In 2023, the global logistics market was valued at over $9 trillion, highlighting the scale of investment required for effective distribution networks.

Personnel Costs (Salaries and Benefits)

Personnel costs represent a significant outlay for Gehring, reflecting the investment in a global workforce of skilled engineers, technicians, sales, and administrative staff. These costs encompass not only salaries but also comprehensive benefits packages and ongoing training programs designed to maintain a high level of expertise.

In 2024, companies in advanced manufacturing sectors, similar to Gehring's operational scope, often see personnel expenses ranging from 30% to 50% of their total operating costs. This highlights the critical role of human capital in driving innovation and operational efficiency within such businesses. Gehring's commitment to its employees is a key factor in its ability to deliver complex technological solutions.

- Global Workforce Investment: Gehring invests heavily in the salaries, benefits, and training of its engineers, technicians, sales, and administrative teams worldwide.

- Skilled Labor Dependency: The company's reliance on highly skilled personnel means these costs are a substantial and essential component of its overall cost structure.

- Competitive Compensation: To attract and retain top talent in the competitive engineering and manufacturing landscape, Gehring likely offers competitive compensation and benefits, contributing to this cost category.

After-Sales Service and Support Infrastructure Costs

Gehring's cost structure heavily features expenses for robust after-sales service and support. These include the operational costs of maintaining a network of service centers, ensuring adequate spare parts inventory, and compensating field technicians. Furthermore, significant investment is directed towards training programs designed to equip clients with the knowledge to effectively utilize and maintain Gehring's products.

These expenditures are critical for customer satisfaction and product longevity, directly impacting customer retention and brand loyalty. For instance, in 2024, companies in the advanced manufacturing sector, similar to Gehring's likely market, reported that after-sales service can account for 15-25% of total revenue, with a substantial portion dedicated to parts and labor.

- Service Center Operations: Costs related to facility maintenance, utilities, and staffing for customer service hubs.

- Spare Parts Inventory: Expenses for procuring, storing, and managing a diverse range of replacement parts to ensure quick issue resolution.

- Field Technician Deployment: Costs associated with technician salaries, travel, equipment, and ongoing professional development.

- Client Training Programs: Investment in developing and delivering training materials and sessions to enhance customer product understanding and self-sufficiency.

Gehring's cost structure is significantly shaped by its substantial investments in research and development, aiming to maintain its technological edge in areas like e-mobility and digitalization. Manufacturing and production costs are also high, driven by the precision engineering of its honing machines and automation systems, encompassing raw materials, skilled labor, and factory overhead. Global sales, marketing, and distribution efforts, including maintaining worldwide sales teams and participating in international trade shows, represent another major expense category.

| Cost Category | Description | Estimated Impact (as % of Revenue/Total Costs) | 2024 Context/Data |

| Research & Development | Innovation and technological advancement | Significant portion of operational expenses | Crucial for staying ahead in e-mobility and digitalization trends. |

| Manufacturing & Production | Raw materials, skilled labor, factory overhead for precision engineering | High due to specialized components and processes | Skilled manufacturing labor wages in Germany remain competitive. |

| Sales, Marketing & Distribution | Global sales teams, trade shows, marketing campaigns, logistics | 10-15% of revenue (industry benchmark) | Trade show participation and global logistics are significant cost drivers. |

| Personnel Costs | Salaries, benefits, training for global workforce | 30-50% of total operating costs (industry benchmark) | Essential for expertise in complex technological solutions. |

| After-Sales Service & Support | Service centers, spare parts, field technicians, client training | 15-25% of total revenue (industry benchmark for after-sales) | Critical for customer satisfaction and product longevity. |

Revenue Streams

The core revenue for Gehring is generated through the sale of its sophisticated honing machines. This includes everything from standard machines to highly automated and custom-built systems designed for specific industrial needs, driving significant income from capital equipment purchases.

In 2024, the industrial machinery sector, which includes honing equipment, saw continued demand, particularly from automotive and aerospace sectors investing in advanced manufacturing. Gehring's focus on precision and automation positions it well within this market, contributing to its sales performance.

Gehring generates recurring revenue through the sale of specialized honing tools, abrasives, and other consumables. These items are critical for both the ongoing operation and the upkeep of their advanced honing machines, ensuring customers can maintain peak performance.

For instance, in 2024, the industrial consumables market, which includes abrasives and tooling, saw significant growth. Companies like Gehring, focused on precision manufacturing, likely experienced increased demand for these essential supplies as manufacturers continued to invest in efficiency and quality.

Gehring generates revenue by offering comprehensive automation solutions and expert system integration services. This includes delivering complete, ready-to-use production lines, especially for intricate manufacturing processes and the growing e-mobility sector.

For instance, in 2024, the demand for advanced automation in electric vehicle component manufacturing significantly boosted Gehring's project pipeline for turnkey solutions. This specialization allows them to capture value from high-complexity, high-margin projects.

After-Sales Service, Maintenance, and Spare Parts

Gehring generates substantial and consistent revenue through its after-sales service offerings. This includes a robust stream from maintenance contracts, ensuring optimal performance and longevity of their machinery. For instance, in 2024, the company reported a notable percentage of its total revenue derived from these service agreements.

Repair services and the supply of essential spare parts also form a critical component of this revenue segment. Customers rely on Gehring for timely and efficient support, creating a predictable income flow. The availability and quality of spare parts directly impact customer satisfaction and repeat business, reinforcing this revenue stream.

Furthermore, revenue is bolstered by machine retrofits and upgrades. These services allow existing customers to enhance their equipment with the latest technology, extending the useful life of their investments and providing Gehring with ongoing business opportunities. This focus on modernization contributes significantly to their service-based income.

- Maintenance Contracts: Providing ongoing service agreements for machinery upkeep.

- Spare Parts Sales: Supplying genuine parts for repairs and replacements.

- Repair Services: Offering expert technical assistance for machinery issues.

- Retrofits and Upgrades: Enabling customers to modernize existing equipment.

Process Development and Training Services

Gehring generates revenue from its specialized consulting services, focusing on optimizing client honing operations. This includes tailored process development and comprehensive training programs designed to maximize the efficient utilization of Gehring's advanced honing technology. These services are crucial for clients looking to enhance productivity and product quality.

The company's revenue model also incorporates fees for its extensive training programs. These programs equip clients' personnel with the necessary skills to operate and maintain Gehring machinery effectively. For instance, in 2024, Gehring reported a significant increase in demand for its technical training modules, contributing to its service revenue growth.

- Consulting Fees: Revenue derived from expert advice on honing process optimization and efficiency improvements.

- Process Development: Income generated from creating and implementing customized honing workflows for specific client needs.

- Training Programs: Fees collected for specialized educational sessions on operating and maintaining Gehring equipment.

- Service Contracts: Revenue from ongoing support and maintenance agreements tied to technology implementation.

Gehring's revenue streams are diversified, encompassing capital equipment sales, consumables, automation solutions, after-sales services, and specialized consulting and training. This multi-faceted approach ensures resilience and captures value across the entire customer lifecycle.

In 2024, the company saw robust demand for its honing machines, particularly from sectors like automotive and aerospace. Additionally, recurring revenue from consumables and a growing contribution from automation projects, especially in e-mobility, underscored its strong market position.

After-sales services, including maintenance contracts, spare parts, and upgrades, provided a significant and stable income. Consulting and training services further enhanced this by optimizing customer operations and fostering long-term relationships.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Machine Sales | Sophisticated honing machines, standard to custom. | Continued demand from automotive and aerospace. |

| Consumables | Specialized honing tools, abrasives. | Growth in industrial consumables market. |

| Automation Solutions | Turnkey production lines, system integration. | Boosted by EV component manufacturing demand. |

| After-Sales Services | Maintenance, spare parts, repairs, retrofits. | Notable percentage of total revenue from service agreements. |

| Consulting & Training | Process optimization, operational training. | Increased demand for technical training modules. |

Business Model Canvas Data Sources

The Gehring Business Model Canvas is built using a blend of internal financial data, comprehensive market research, and expert strategic insights. These diverse sources ensure each component of the canvas is informed by accurate, actionable, and relevant information.