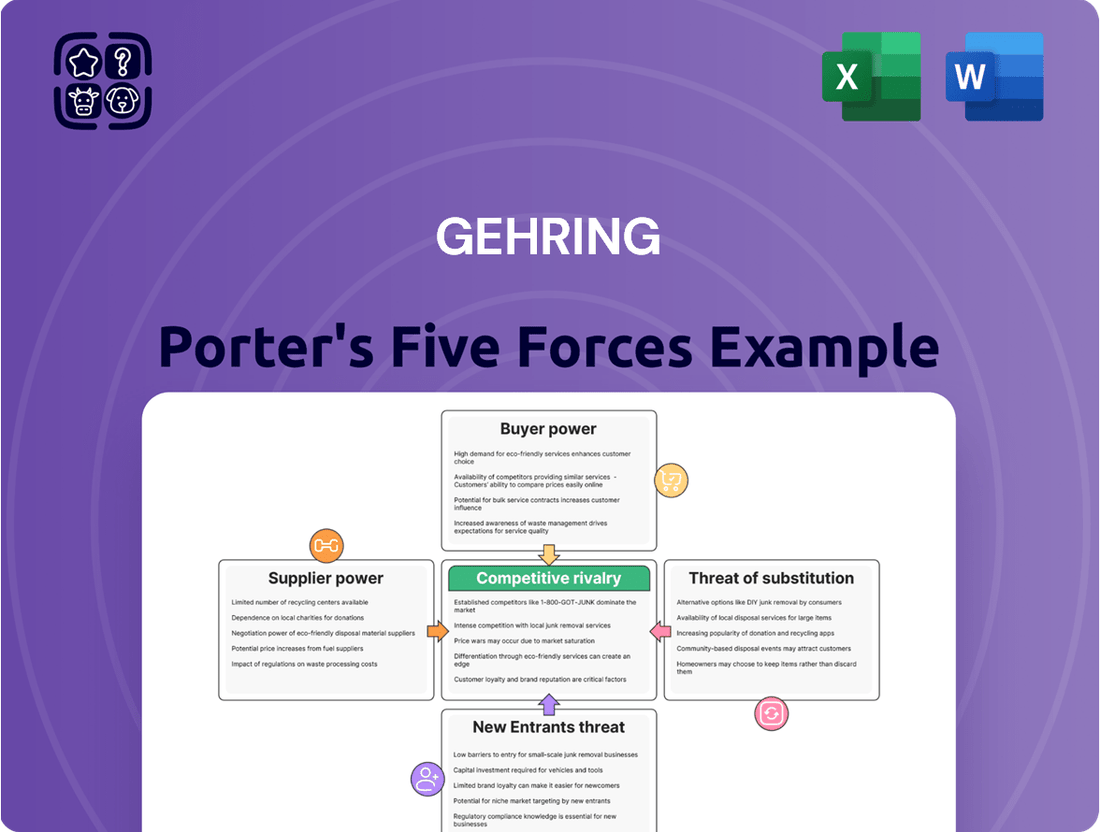

Gehring Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gehring Bundle

Gehring's Porter's Five Forces Analysis reveals the intense competitive landscape they navigate, from the bargaining power of their suppliers to the ever-present threat of new entrants. Understanding these forces is crucial for any business aiming to thrive in a dynamic market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Gehring’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Gehring's reliance on highly specialized abrasives and honing tools means that suppliers with unique intellectual property or manufacturing capabilities for these critical components could wield significant power. This is particularly true if these suppliers are few in number or difficult to replace.

The market for honing abrasives is experiencing robust growth, with projections indicating continued expansion through 2024 and beyond. This growth is fueled by the increasing demand for enhanced surface finishes in high-precision components across industries like automotive and aerospace. Continuous advancements in abrasive materials and honing processes further underscore the specialized nature of these inputs.

Suppliers providing proprietary software, AI-driven control systems, and specialized automation components are a significant factor in Gehring's bargaining power of suppliers. These advanced technologies are essential for Gehring's modern honing machines, particularly those integrating Industry 4.0 capabilities.

The manufacturing sector's increasing embrace of automation, AI, and the Internet of Things (IoT) directly fuels the demand for sophisticated honing machines. This trend amplifies the leverage of suppliers who can deliver these critical, cutting-edge technological solutions.

The bargaining power of suppliers for Gehring Porter is significantly influenced by the availability and pricing of key raw materials and components. Specialized steels, high-precision mechanical parts, and critical electronic components are essential for their manufacturing processes.

In 2024 and continuing into 2025, the automotive sector, including suppliers like Gehring, faces ongoing supply chain disruptions. These disruptions, coupled with rising raw material costs, exert considerable pressure, potentially increasing input expenses for Gehring.

Limited Number of Qualified Suppliers

In specialized industrial sectors such as precision honing technology, the availability of suppliers who can consistently meet Gehring's demanding quality and technical requirements for essential components can be quite restricted. This limited pool of qualified providers naturally elevates their leverage in negotiations.

For instance, in the automotive sector, a key market for honing equipment, the supply chain for highly specialized materials or precision-engineered parts often features only a handful of manufacturers capable of delivering to automotive industry standards. This scarcity means suppliers of these critical inputs hold significant bargaining power, as Gehring may have few viable alternatives for sourcing these essential items.

- Limited Supplier Pool: In niche markets, the number of suppliers meeting Gehring's exact specifications for critical components is often small.

- Increased Supplier Leverage: This scarcity directly translates to greater bargaining power for those few qualified suppliers.

- Impact on Costs: For highly specialized parts, this can lead to higher procurement costs for Gehring, impacting overall profitability.

- Strategic Sourcing Challenges: Gehring must carefully manage relationships with these limited suppliers to ensure continuity and favorable terms.

Switching Costs for Gehring

For Gehring, the bargaining power of suppliers is significantly influenced by the switching costs associated with critical components and software. If transitioning to a new supplier necessitates extensive redesign, rigorous testing, or complex integration processes, these high switching costs empower existing suppliers. For instance, the intricate nature of integrating advanced manufacturing technologies often demands substantial upfront investment and meticulous planning, further solidifying the supplier's leverage.

These switching costs can manifest in several ways:

- High Integration Expenses: The technical complexity of incorporating new software or hardware into Gehring's existing manufacturing ecosystem can lead to substantial integration costs, potentially running into millions of dollars depending on the scale of operations.

- Extended Testing and Validation Periods: Ensuring new components meet Gehring's stringent quality and performance standards requires thorough testing, which can delay production and incur significant labor and resource costs.

- Potential for Production Downtime: A poorly managed supplier transition could lead to unexpected production halts, resulting in lost revenue and damage to Gehring's reputation.

The bargaining power of suppliers for Gehring is substantial due to the specialized nature of their components and the limited number of qualified providers. This is exacerbated by ongoing supply chain disruptions and rising raw material costs, particularly evident in the automotive sector, a key market for Gehring.

High switching costs for critical components and software further empower existing suppliers. These costs include significant integration expenses, extended testing periods, and the potential for production downtime, making it challenging for Gehring to find and implement alternative sources.

The market for honing abrasives is projected for continued growth through 2024 and beyond, driven by demand for precision components. This expansion, coupled with technological advancements, reinforces the specialized expertise of suppliers.

Suppliers of proprietary software and AI-driven systems are critical for Gehring's Industry 4.0-enabled machines. The manufacturing sector's increasing adoption of automation and AI amplifies the leverage of these technology providers.

| Factor | Impact on Gehring | Supporting Data (2024/2025 Outlook) |

|---|---|---|

| Supplier Specialization | High bargaining power for suppliers of unique abrasives, honing tools, and precision parts. | Limited pool of manufacturers meeting automotive industry standards for specialized components. |

| Switching Costs | Empowers existing suppliers due to high integration, testing, and potential downtime expenses. | Integration costs for advanced manufacturing tech can reach millions; extended validation periods delay production. |

| Market Growth | Increased demand for precision components fuels growth in abrasive markets. | Honing abrasive market showing robust expansion through 2024, driven by automotive and aerospace sectors. |

| Technological Dependence | Suppliers of AI, IoT, and automation systems hold significant leverage. | Manufacturing sector's increasing embrace of Industry 4.0 capabilities increases reliance on cutting-edge tech suppliers. |

| Supply Chain Disruptions | Exacerbates supplier power through rising raw material costs and component scarcity. | Automotive sector facing ongoing supply chain disruptions and increased input expenses in 2024. |

What is included in the product

Gehring Porter's Five Forces Analysis provides a comprehensive examination of the competitive landscape, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on Gehring's market position and profitability.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces on a single, intuitive dashboard.

Customers Bargaining Power

Gehring's honing machines represent significant capital outlays for its clientele, often substantial manufacturers within the automotive, aerospace, and broader industrial segments. These automatic honing machines are not casual purchases; they are critical, high-value assets.

The substantial initial investment required for these sophisticated machines can act as a barrier, potentially limiting the pace of market expansion as customers carefully consider the long-term financial commitment. For instance, a single advanced honing system can easily cost hundreds of thousands, if not millions, of dollars.

Consolidation within major customer industries, such as the automotive sector, significantly amplifies buyer power. As fewer, larger entities emerge, these consolidated customers can leverage their increased scale to negotiate more favorable terms, including lower prices and bespoke product configurations. This trend is particularly evident as the automotive industry navigates structural shifts and heightened competition, directly impacting supplier leverage.

Gehring's primary customers, particularly within the demanding automotive and aerospace sectors, place a significant emphasis on enhancing component performance, operational efficiency, and long-term durability. This intense focus translates into a strong preference for suppliers capable of providing high-precision, top-quality parts, pushing customers to prioritize those offering advanced technology and a track record of delivering exceptional results.

Customization Requirements

Gehring's specialization in precision surface finishing means customers often need highly customized machines. This tailoring, while fostering strong relationships, also empowers customers. They can leverage their unique requirements to negotiate terms, demand extensive after-sales support, and influence pricing, as the cost and complexity of retooling or adapting standard solutions are significant.

The need for specialized process development and training further amplifies customer bargaining power. When a customer requires unique solutions, they often dictate the terms of engagement, including service level agreements and ongoing support, which can be costly for Gehring to provide. For example, in the automotive sector, where Gehring is a key player, a major OEM demanding a bespoke finishing process for a new engine component might have considerable sway over delivery schedules and pricing due to the sheer volume and strategic importance of the contract.

- Customization Drives Leverage: Gehring's ability to tailor solutions to specific customer needs, particularly in precision finishing, inherently increases customer bargaining power.

- After-Sales Demands: The complexity of customized machinery often leads to customer demands for extensive after-sales support, process development, and training, enhancing their negotiating position.

- Industry Examples: In sectors like automotive, where Gehring supplies critical finishing equipment, major clients can leverage their volume and strategic importance to secure favorable terms.

- Cost of Adaptation: The significant cost and time involved for Gehring to adapt standard machines to unique customer specifications provide customers with a strong basis for negotiation.

Global Sourcing and Competition

Customers in the honing technology sector benefit from a vast global supplier network. This broad access allows them to compare offerings from numerous manufacturers worldwide, intensifying pressure on companies like Gehring to deliver competitive pricing, cutting-edge technology, and superior customer service. For instance, as of 2024, the global industrial honing machine market was estimated to be worth approximately $1.2 billion, with projected growth driven by advancements in manufacturing across various sectors.

The bargaining power of customers is further amplified by the increasing availability of specialized honing solutions and the ease of international trade. Customers can leverage this global competition to negotiate better terms, driving down prices and demanding higher quality standards. This dynamic is particularly evident in industries requiring precision engineering, where sourcing the optimal technology is paramount.

- Global Supplier Access: Customers can source honing technology from a wide array of international suppliers.

- Competitive Pricing Pressure: This global competition forces providers like Gehring to offer competitive pricing.

- Technology and Service Demands: Customers expect continuous innovation and high-quality service to maintain their own competitive edge.

- Market Growth Dynamics: The global industrial honing machine market, valued around $1.2 billion in 2024, exhibits significant regional growth variations, offering customers diverse sourcing opportunities.

Gehring's customers, especially large manufacturers in sectors like automotive and aerospace, wield considerable bargaining power. This is due to the high cost of honing machines, which are significant capital investments, and the trend of consolidation within these customer industries. For example, a single advanced honing system can cost hundreds of thousands to millions of dollars.

Customers' ability to negotiate is further strengthened by Gehring's need to customize machines for specific client requirements. This specialization means customers can dictate terms for pricing, after-sales support, and even delivery schedules, particularly when their business is strategically vital to Gehring. The global availability of honing solutions also intensifies this pressure, as customers can easily compare offerings from numerous international suppliers.

| Factor | Impact on Customer Bargaining Power | Example/Data (2024) |

|---|---|---|

| Capital Outlay for Machines | High initial cost increases customer scrutiny and negotiation leverage. | Honing machines can cost $100,000s to $1M+. |

| Industry Consolidation | Larger, consolidated buyers have greater scale and negotiation power. | Automotive sector consolidation amplifies buyer leverage. |

| Customization Needs | Bespoke requirements give customers significant influence over terms. | Specific process development for new engine parts dictates terms. |

| Global Supplier Network | Broad access to international suppliers intensifies price and quality competition. | Global industrial honing machine market valued at ~$1.2 billion in 2024. |

Same Document Delivered

Gehring Porter's Five Forces Analysis

The document you see here is the complete, ready-to-use Gehring Porter's Five Forces Analysis you'll receive. This comprehensive breakdown, detailing the competitive landscape of the industry, is precisely what you'll download immediately after purchase. You're previewing the final version, ensuring no surprises and full immediate access to this professionally formatted strategic tool.

Rivalry Among Competitors

The industrial honing machine market is quite dynamic, featuring major global manufacturers like Nagel and Sunnen, alongside Gehring itself. These large players compete fiercely, but the landscape also includes specialized regional competitors who often cater to specific market niches or geographic demands, adding another layer of rivalry.

A significant development in this competitive arena was the acquisition of Gehring by the Nagel Group in 2020. This strategic move signals a trend towards market consolidation, as companies aim to strengthen their competitive standing and expand their offerings. For Gehring, this integration likely provides access to broader resources and a larger market reach.

The pace of technological innovation in this sector is truly staggering. We're seeing a significant push towards integrating automation, artificial intelligence, the Internet of Things, and novel materials. For instance, the global industrial automation market was projected to reach over $300 billion by 2024, highlighting the massive investment in these areas.

This constant evolution means companies are locked in a fierce R&D battle. To stay competitive, they absolutely must develop advanced solutions that offer greater precision, boost efficiency, and improve sustainability. Failure to do so quickly renders products obsolete, forcing continuous, high-stakes investment in research and development.

Gehring's significant exposure to the automotive sector, particularly its pivot towards e-mobility, intensifies competitive rivalry. Many players are channeling resources into developing and optimizing solutions for electric vehicles and related infrastructure, creating a direct battleground for market share and technological leadership.

This concentrated focus means competitors are not just vying for general market presence but are specifically targeting advancements in battery technology, charging solutions, and electric powertrain components. For instance, in 2024, the global electric vehicle market continued its rapid expansion, with sales projected to reach over 16 million units, a substantial increase from previous years, highlighting the lucrative yet fiercely contested nature of this segment.

After-Sales Service and Support

Competitive rivalry in the machinery sector significantly intensifies through robust after-sales service and support offerings. Beyond the initial sale of equipment, companies differentiate themselves by providing crucial services such as process development, specialized training for operators, and ongoing technical assistance. This focus on comprehensive support fosters stronger customer loyalty and can be a key differentiator in a crowded market.

For instance, in 2024, machinery manufacturers are increasingly investing in digital service platforms and remote diagnostics to enhance customer support. Companies like Siemens reported a significant increase in revenue from their Digital Industries segment, which includes services and software, underscoring the growing importance of these offerings. This trend suggests that superior service delivery is becoming as critical as product innovation for maintaining a competitive edge.

- Enhanced Customer Relationships: Strong after-sales support builds trust and loyalty, leading to repeat business and positive word-of-mouth referrals.

- Value-Added Services: Offering process development and training transforms a simple transaction into a partnership, increasing the perceived value of the machinery.

- Competitive Differentiation: In markets with similar product offerings, exceptional service can be the primary factor influencing a customer's purchasing decision.

- Reduced Downtime: Efficient technical support and readily available spare parts minimize operational disruptions for clients, a critical consideration in industrial settings.

Market Size and Growth

The global industrial honing machine market is a significant arena, reaching an estimated USD 5162.5 million in 2024. This robust market size indicates a healthy demand for these specialized manufacturing tools.

The projected growth within this sector is a key driver for competitive dynamics. As the market expands, it naturally attracts new entrants and encourages existing players to innovate and capture a larger share, intensifying rivalry.

- Market Value: USD 5162.5 million in 2024.

- Growth Potential: The market is expected to see continued expansion, fueling competition.

- Opportunity for Leaders: Established companies can leverage growth to solidify their market positions.

Competitive rivalry within the industrial honing machine market is intense, driven by a mix of large global players like Nagel and Sunnen, alongside specialized regional competitors. This dynamic is further amplified by ongoing market consolidation, as seen with the Nagel Group's acquisition of Gehring in 2020, aiming to bolster market presence and service offerings.

Technological advancements, particularly in automation and AI, are fueling a fierce research and development race, with companies investing heavily to enhance precision, efficiency, and sustainability. The automotive sector's shift to e-mobility has created a specific battleground, with manufacturers focusing on solutions for electric vehicles, a market projected to exceed 16 million unit sales in 2024.

Beyond product innovation, robust after-sales service and support are critical differentiators, with companies increasingly leveraging digital platforms for diagnostics and customer assistance. The global industrial honing machine market itself is substantial, valued at an estimated USD 5162.5 million in 2024, indicating significant growth potential that further intensifies competition as firms strive to capture market share.

| Key Competitor/Factor | 2024 Market Relevance | Impact on Rivalry |

|---|---|---|

| Nagel Group | Major global player, acquired Gehring in 2020 | Increased consolidation, expanded resources and market reach |

| Sunnen | Major global player | Direct competition with Nagel/Gehring on product innovation and market share |

| Specialized Regional Competitors | Cater to niche markets/geographies | Fragment competition, drive innovation in specific segments |

| Technological Advancements (AI, Automation) | High investment across industry | Intensified R&D race for precision, efficiency, and sustainability |

| E-mobility Focus | Significant resource allocation | Direct competition for market share in EV component manufacturing solutions |

| After-Sales Service & Support | Growing emphasis on digital platforms | Key differentiator for customer loyalty and perceived value |

| Global Industrial Honing Machine Market Value | USD 5162.5 million (2024) | Indicates strong demand and opportunity, fueling competitive efforts |

SSubstitutes Threaten

While honing is a specialized process, other surface finishing techniques can act as substitutes. Grinding, superfinishing, and lapping offer alternative ways to achieve desired surface characteristics, potentially reducing the need for honing in certain applications. The global surface treatment market, valued at approximately $140 billion in 2023, is expanding, driven by innovations in areas like nanotechnology and advanced coatings, further highlighting the competitive landscape.

Emerging manufacturing technologies, particularly advanced 3D printing, pose a significant threat of substitution. These processes, capable of producing near-net-shape components with high surface quality, can bypass traditional steps like honing in specific applications. For instance, the global 3D printing market was valued at approximately USD 19.8 billion in 2023 and is projected to grow substantially, indicating a rising adoption rate that could displace conventional manufacturing methods.

Innovations in material science present a significant threat to traditional honing processes. For instance, the development of self-healing surfaces or materials requiring less aggressive finishing could directly reduce the need for honing. Smart coatings that self-heal or provide real-time wear data are emerging as alternatives, offering integrated functionality that bypasses the need for post-manufacturing surface treatments.

Supplier-Integrated Solutions

The threat of substitutes for Gehring's honing machines is heightened by supplier-integrated solutions. Some component suppliers are increasingly incorporating finishing processes, like honing, directly into their own manufacturing. This means they can offer customers pre-finished parts, bypassing the need for customers to purchase and operate their own honing equipment.

This trend directly impacts the market for new honing machines. For instance, in the automotive sector, which is a key market for honing technology, suppliers who can provide ready-to-install engine blocks or cylinder liners with the required surface finish reduce the demand for standalone honing machinery. This shift towards service-based offerings rather than capital equipment sales presents a significant substitute for Gehring's core product. The global automotive market, valued at trillions of dollars, sees continuous pressure for cost reduction and efficiency, making integrated solutions attractive.

- Supplier Integration: Component manufacturers are moving towards offering finished parts, including honed surfaces.

- Reduced Capital Expenditure for Customers: This eliminates the need for customers to invest in and maintain specialized honing machinery.

- Market Shift: The demand for standalone honing machines may decrease as integrated solutions become more prevalent, particularly in cost-sensitive industries like automotive manufacturing.

Cost-Effectiveness of Alternatives

If alternative finishing methods or new manufacturing processes become significantly more cost-effective for achieving the required precision and surface quality, customers may opt for these substitutes, even if they don't perfectly replicate honing's unique benefits. The automotive industry, for instance, faces cost pressures and seeks efficient production methods.

For example, advancements in abrasive technologies or new machining techniques could offer comparable surface finishes at a lower operational cost. This could erode demand for traditional honing services if the price differential becomes substantial.

- Cost Pressure in Automotive: In 2024, the automotive sector continued to grapple with rising material and labor costs, pushing manufacturers to scrutinize every component of their production expenses.

- Emerging Technologies: Innovations in areas like additive manufacturing and advanced grinding techniques are presenting viable alternatives for achieving precise surface finishes.

- Price Sensitivity: A 10% reduction in the cost of an alternative finishing process could trigger a significant shift in customer preference, especially for high-volume production runs.

The threat of substitutes for honing processes is significant, driven by alternative surface finishing techniques and emerging manufacturing technologies. Innovations in areas like 3D printing and advanced grinding offer comparable surface qualities, potentially bypassing traditional steps. For example, the global additive manufacturing market was valued at approximately USD 23.7 billion in 2024, showcasing its growing influence.

Furthermore, supplier integration, where component manufacturers offer pre-finished parts, directly substitutes the need for customers to own and operate honing machinery. This trend is particularly pronounced in cost-sensitive sectors like automotive manufacturing, where efficiency and reduced capital expenditure are paramount. The automotive industry's ongoing focus on cost optimization in 2024 further amplifies this substitution threat.

The increasing cost-effectiveness of these alternative methods presents a clear challenge. If new technologies can achieve the required precision and surface finish at a lower operational cost, customers will likely shift their preferences. A notable 10% cost reduction in an alternative finishing process could prompt a substantial migration away from traditional honing, especially in high-volume production environments.

| Substitute Technology | Key Benefit | Market Relevance (2024 Estimate) |

|---|---|---|

| Advanced Grinding | High precision, cost-effective for certain materials | Part of the global abrasives market, projected to reach over USD 60 billion |

| Additive Manufacturing (3D Printing) | Near-net-shape production, complex geometries, reduced waste | Market expected to exceed USD 30 billion |

| Supplier-Integrated Finishing | Eliminates customer capital expenditure, streamlined supply chain | Significant trend in automotive and aerospace component supply |

Entrants Threaten

Entering the precision honing machine market demands significant upfront capital. Companies need to invest heavily in research and development to create sophisticated machinery, establish specialized manufacturing facilities, and acquire advanced equipment. This substantial financial barrier acts as a major deterrent for potential new competitors looking to enter the automatic honing machine sector.

The threat of new entrants due to advanced technological expertise is significantly mitigated by the highly specialized knowledge required. Developing or acquiring deep expertise in fields like mechanical engineering, material science, automation, and sophisticated software development presents a substantial barrier. For instance, a company like NVIDIA, a leader in AI hardware and software, invests billions annually in R&D, with their 2024 fiscal year R&D spending reaching $10.4 billion, highlighting the immense resources needed to compete at the forefront.

Gehring, alongside competitors like Nagel and Sunnen, benefits from deeply entrenched relationships with key automotive and industrial clients. These aren't just transactional ties; they are built on decades of proven reliability and a reputation for exceptional quality and precision in their machining solutions. For instance, Gehring's long history means they've been a trusted partner through multiple product cycles for major manufacturers, fostering loyalty that's hard for newcomers to break.

New entrants face a significant hurdle in replicating this level of trust and market penetration. Building a comparable reputation and securing market share against such established players requires substantial investment in time, quality assurance, and customer service. Without this established credibility, new companies will find it difficult to displace the incumbent's strong position and attract the business of major industrial clients who prioritize proven performance.

Intellectual Property and Patents

Existing companies in the honing sector, like Gehring Technologies, possess a significant portfolio of patents covering critical areas such as honing processes, machine designs, and specialized tooling. This intellectual property acts as a formidable barrier to entry, compelling new competitors to either invest heavily in developing their own unique technologies or incur licensing fees for existing patented innovations.

For instance, in 2024, the global intellectual property market saw continued growth, with patent filings in advanced manufacturing technologies remaining robust. Companies that have proactively secured patents for their core competencies in honing can command premium pricing and maintain a competitive edge, making it challenging for new entrants to establish a foothold without infringing on existing rights or incurring substantial R&D costs.

- Patent Barriers: Existing players hold patents on honing processes and machinery, creating hurdles for new entrants.

- R&D Investment: New companies must either develop proprietary technology or license existing patents, both requiring significant investment.

- Competitive Advantage: Patented technology allows established firms to maintain higher prices and market share.

Supply Chain Integration

New entrants would find it difficult to establish robust supply chains for the specialized components and raw materials required in this sector. Building a comprehensive global service and support network also presents a significant hurdle, both of which are vital for market entry and sustained success.

The automotive sector, for instance, grappled with significant supply chain disruptions throughout 2023 and into early 2024, impacting production schedules and component availability. Companies like Stellantis reported production losses due to semiconductor shortages, highlighting the sensitivity of the industry to supply chain vulnerabilities.

- Supply Chain Complexity: Establishing reliable sourcing for specialized automotive parts, such as advanced battery components or sophisticated sensor arrays, requires extensive supplier relationships and quality control, a process that takes years to develop.

- Global Service Network: A critical barrier for new entrants is the immense investment and time needed to build a widespread service and support infrastructure, encompassing dealerships, repair centers, and parts distribution across key global markets.

- Industry Vulnerability to Disruptions: The automotive industry experienced an average of 15% production delays in 2023 attributed to supply chain issues, underscoring the risk new players would face in securing consistent material flow.

The threat of new entrants into the precision honing machine market is considerably low due to several formidable barriers. High capital requirements for R&D and manufacturing facilities, coupled with the need for extensive technological expertise, deter many potential competitors. Furthermore, established players benefit from strong customer loyalty and a robust portfolio of patents, making market entry exceptionally challenging.

Building reliable supply chains and a global service network also presents a significant hurdle for newcomers. For example, the automotive industry, a key market for honing machines, faced persistent supply chain disruptions in 2023-2024, impacting production. New entrants must overcome these complexities to compete effectively.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Significant investment needed for R&D, manufacturing, and equipment. | High barrier, requiring substantial funding. |

| Technological Expertise | Deep knowledge in engineering, material science, and software is crucial. | Deters firms lacking specialized talent. |

| Customer Relationships | Long-standing trust and proven reliability with key clients. | Makes it difficult for new entrants to gain market share. |

| Intellectual Property | Patents on processes, designs, and tooling. | Forces new entrants to innovate or license, increasing costs. |

| Supply Chain & Service | Establishing global networks for components and support. | Requires extensive time and investment to replicate. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, including publicly available financial statements, industry-specific market research reports, and expert commentary from financial analysts. This comprehensive approach ensures an accurate assessment of competitive intensity and strategic positioning within the industry.