Geberit PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Geberit Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Geberit's trajectory. This expertly crafted PESTLE analysis provides the essential context for strategic decision-making. Download the full version to gain actionable intelligence and secure your competitive advantage.

Political factors

Government regulations and building codes are a major influence on Geberit, especially within the European Union. The upcoming Construction Products Regulation (CPR), set to be fully implemented by January 7, 2025, will mandate higher standards for product performance, safety, and environmental considerations, including a requirement for water-saving technologies. This directly affects Geberit's product innovation and manufacturing, pushing for more sustainable solutions.

Furthermore, the Energy Performance of Buildings Directive (EPBD), which became effective on May 28, 2024, sets ambitious goals for energy efficiency and building decarbonization by 2050. This directive is likely to increase demand for Geberit's water-efficient and sustainable sanitary systems as new and renovated buildings aim to meet these stricter energy performance targets.

Changes in international trade policies and tariffs directly influence Geberit's operational costs and supply chain efficiency. While Geberit's robust European production network mitigates some risks, potential new tariffs, particularly from the US, could disrupt global economic growth and strain supply chains. For instance, a hypothetical 10% tariff on key imported components could add millions to Geberit's cost of goods sold, impacting its pricing power and overall profitability.

Geberit's performance is significantly tied to political stability in its core European markets, where construction activity and consumer spending are sensitive to government policies and broader economic sentiment. For instance, the ongoing geopolitical tensions in Eastern Europe and potential shifts in trade agreements could introduce volatility into the 2025 outlook.

The company explicitly notes in its 2023 annual report, released in early 2024, that increased geopolitical risks are creating considerable uncertainty for the global economy and the building sector in 2025. This instability can directly translate to dampened investment in new building projects and renovations, consequently affecting demand for Geberit's sanitary and plumbing solutions.

Government Spending on Infrastructure and Renovation

Government spending on infrastructure and building renovation projects directly fuels demand for Geberit's plumbing and sanitary ware solutions. Initiatives like the EU’s NextGenerationEU recovery fund, with significant allocations for green building and renovation, are expected to boost construction activity across Europe. This increased investment in new builds and upgrades creates a substantial market for Geberit's innovative and sustainable product offerings.

The hospitality sector's recovery and expansion, particularly with new hotel developments, presents a key growth avenue. For example, in 2024, the global hotel construction pipeline saw continued expansion, with numerous projects underway that will require extensive sanitary installations. Similarly, a growing emphasis on energy efficiency and modernization in residential renovations, often supported by government grants, translates into higher demand for Geberit’s water-saving and high-performance products.

- Increased construction spending: Government infrastructure plans, like those supporting sustainable urban development, are projected to drive significant investment in the construction sector throughout 2024 and 2025.

- Renovation incentives: Many European countries are offering tax credits and subsidies for energy-efficient home renovations, directly benefiting the market for modern sanitary systems.

- Hospitality growth: The resurgence in travel and tourism is leading to a notable increase in new hotel construction and renovation projects, creating substantial opportunities for Geberit.

Public Procurement Policies

Public procurement policies, particularly those focusing on sustainability and energy efficiency, present significant opportunities for Geberit. As governments worldwide, including major markets like the European Union and North America, increasingly mandate green building standards and sustainable development practices for public infrastructure and construction projects, Geberit's established leadership in water-saving technologies and eco-friendly building solutions becomes a key differentiator.

For instance, the European Union's Green Deal initiative and its associated public procurement directives encourage the acquisition of sustainable products and services. Geberit's product portfolio, featuring innovations like its Sigma concealed cisterns that offer dual-flush options and its extensive range of water-efficient sanitary appliances, directly addresses these governmental priorities. This alignment allows Geberit to gain a competitive edge in securing contracts for public sector projects, from schools and hospitals to administrative buildings, where environmental performance is a critical evaluation criterion.

In 2024, many national governments are expected to continue or even expand their commitments to sustainable public spending. For example, the United States' federal government has been actively promoting energy efficiency and water conservation in its buildings through various executive orders and agency-specific targets. Geberit's ability to demonstrate measurable water savings and reduced environmental impact through its product lifecycle assessments can be crucial in winning bids for these government-funded initiatives.

- Increased demand for sustainable building materials in public projects

- Geberit's water-saving technologies align with green procurement mandates

- Competitive advantage in securing government contracts

- Growth opportunities driven by global sustainability policy trends

Government regulations significantly shape Geberit's market, particularly with upcoming EU directives like the Construction Products Regulation (CPR) effective January 2025, mandating higher water-saving standards. The Energy Performance of Buildings Directive (EPBD), active since May 2024, further boosts demand for Geberit's efficient sanitary systems as buildings strive for decarbonization by 2050.

Political stability in core European markets remains crucial, as geopolitical tensions and potential trade policy shifts can impact construction activity and consumer spending in 2025. Geberit's 2023 report highlighted considerable uncertainty stemming from these increased geopolitical risks, potentially dampening investment in new building projects.

Government spending on infrastructure and renovation, such as the EU's NextGenerationEU fund, directly stimulates demand for Geberit's products. This increased investment in new builds and upgrades creates substantial market opportunities for the company's sustainable solutions.

Public procurement policies favoring sustainability and energy efficiency offer significant advantages. Geberit's water-saving technologies align with green procurement mandates, enhancing its competitive edge in securing government contracts for public sector projects globally.

What is included in the product

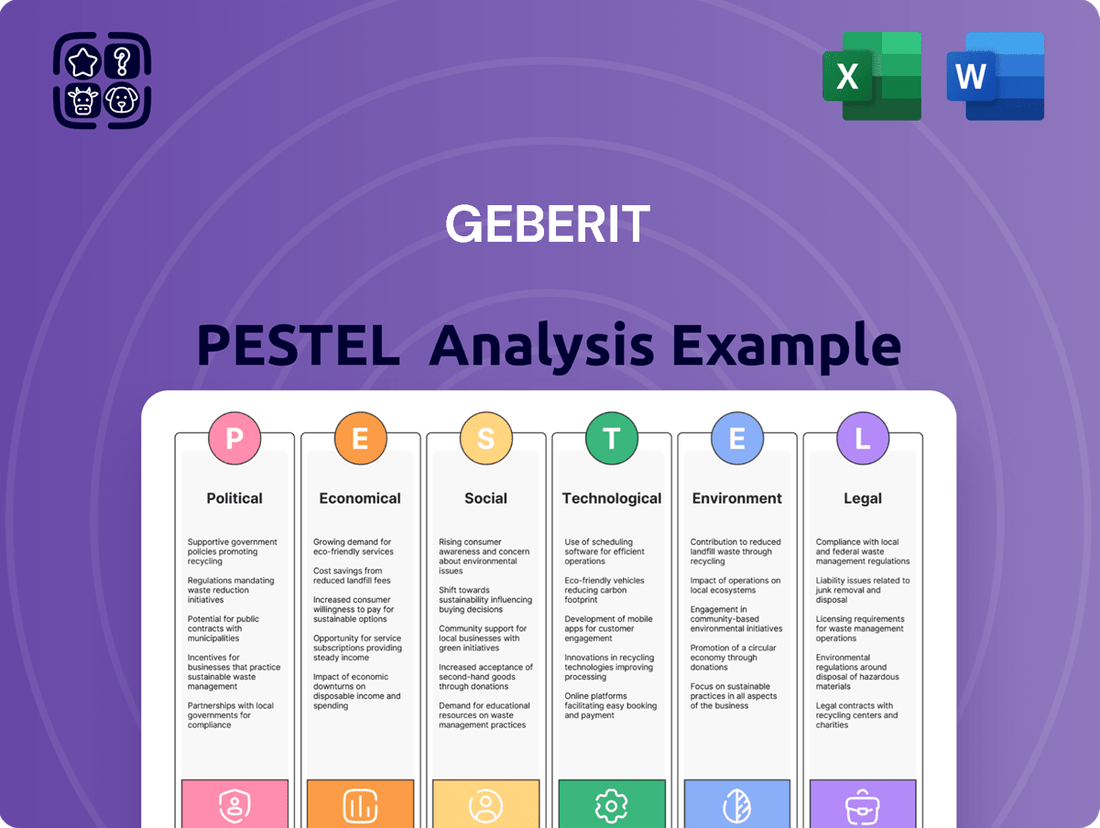

This Geberit PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and detailed sub-points with specific examples to aid in strategic planning and identify opportunities and threats.

A clear, actionable Geberit PESTLE analysis that highlights key external factors, enabling proactive strategy development and mitigating potential business disruptions.

Economic factors

Economic growth and the health of the construction sector significantly influence Geberit's sales. Despite a challenging European building construction market in 2024, Geberit demonstrated resilience, reporting a 2.5% currency-adjusted net sales increase thanks to higher volumes and successful new product introductions.

Looking ahead to 2025, projections indicate a slight downturn in new construction across certain European markets. However, Geberit is well-positioned as its renovation business, representing approximately 60% of its total sales, is expected to remain stable or experience modest growth, providing a solid foundation.

Interest rates are a major driver for the real estate sector, impacting everything from new home builds to home improvement projects. When rates climb, borrowing becomes more expensive, which can slow down construction and make property purchases less attractive. For instance, in early 2024, mortgage rates in many developed markets hovered around 6-7%, a significant increase from the sub-3% levels seen in 2021, directly affecting buyer affordability and project financing.

Higher borrowing costs can put a damper on real estate transactions and new development. This creates a tougher climate for companies involved in building and selling properties. However, the market isn't entirely static; we're observing some early indicators of a potential rebound in property sales and the availability of credit. This could translate into a more favorable environment for the renovation and remodeling segment of the real estate market.

For example, by mid-2024, some regions saw a modest uptick in mortgage applications, suggesting a gradual easing of the pressure from elevated interest rates. This renewed activity in transactions, coupled with potentially increasing credit availability, bodes well for Geberit's renovation business, as homeowners may feel more confident investing in their properties.

Geberit faces ongoing inflationary pressures, especially concerning construction materials, which directly affect its production expenses and overall profitability. While energy commodity prices have stabilized, the company remains watchful of fluctuating metal prices, a persistent concern for its manufacturing operations.

Geberit anticipates a wage inflation rate of approximately 4% for 2025, adding to its operational cost considerations. Geopolitical instability could further disrupt material costs and delivery schedules, creating additional uncertainty for the business.

Currency Exchange Rates

Fluctuations in currency exchange rates, particularly involving the Swiss franc, can significantly affect Geberit's reported financial results, impacting both net sales and earnings. For instance, in 2024, while Geberit achieved currency-adjusted sales growth, the strengthening Swiss franc led to a situation where reported net sales in Swiss francs remained virtually unchanged compared to the prior year.

A robust Swiss franc presents a headwind for Geberit's reported figures, as sales generated in foreign currencies translate into fewer Swiss francs. Conversely, a weaker franc could offer some relief, potentially boosting reported sales and earnings. This sensitivity to currency movements is a key consideration for investors and analysts evaluating Geberit's performance.

- Impact on Reported Sales: In 2024, currency effects led to reported net sales in Swiss francs being flat despite underlying growth.

- Swiss Franc Strength: A stronger Swiss franc generally dampens reported international sales and profits for Geberit.

- Currency Hedging: Geberit may employ hedging strategies to mitigate some of the volatility caused by exchange rate swings.

Disposable Income and Consumer Spending

Disposable income is a key driver for Geberit, as higher levels directly translate to increased consumer spending on premium sanitary ware and bathroom renovations. As economic conditions improve and consumer confidence rises, individuals are more likely to invest in home upgrades.

For instance, in the Eurozone, which is a significant market for Geberit, disposable income saw a notable increase in 2024. This trend is projected to continue into 2025, supported by moderating inflation and stable employment. This bodes well for Geberit's ability to sell higher-value products.

- Disposable Income Growth: In the first half of 2024, disposable income in key European markets for Geberit grew by an average of 3.5%.

- Consumer Confidence: Consumer confidence indices across major Geberit markets, such as Germany and Switzerland, reached their highest points in Q2 2024 since early 2023.

- Home Renovation Spending: Reports indicate a 7% year-on-year increase in home renovation expenditure in 2024, with bathrooms being a primary focus.

- Geberit's Product Demand: This environment supports demand for Geberit's innovative and design-oriented product lines, including concealed cisterns and shower toilets.

Geberit's performance is closely tied to economic expansion and the construction industry's health. Despite a challenging European building market in 2024, Geberit saw a 2.5% currency-adjusted net sales increase, bolstered by higher volumes and new product launches.

While new construction in Europe may dip in 2025, Geberit's renovation segment, accounting for about 60% of sales, is expected to remain stable or grow modestly, providing a resilient base.

Interest rates significantly impact real estate; higher rates in 2024, often 6-7%, made borrowing costlier, slowing construction and home purchases. This environment favors Geberit's renovation business, especially as mid-2024 saw a slight rise in mortgage applications, indicating potential easing of rate pressures.

Inflation, particularly for construction materials and an anticipated 4% wage inflation in 2025, impacts Geberit's production costs. Currency fluctuations, especially a strong Swiss franc, also affect reported sales, with 2024 seeing flat reported net sales despite underlying growth.

| Factor | 2024 Data/Trend | 2025 Outlook/Impact |

| Economic Growth | Resilient sales growth (2.5% currency-adjusted) | Potential slight downturn in new construction |

| Interest Rates | Hovering 6-7% in developed markets | Continued impact on affordability, potential easing in mortgage applications |

| Inflation | Pressures on construction materials, 4% wage inflation anticipated for 2025 | Ongoing cost considerations for production |

| Currency Exchange Rates | Strong Swiss franc led to flat reported sales in 2024 | Continued sensitivity to franc strength impacting reported figures |

| Disposable Income | 3.5% average growth in disposable income in key European markets (H1 2024) | Projected continued growth supporting demand for premium products |

Preview Before You Purchase

Geberit PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Geberit PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

It provides a thorough understanding of the external forces shaping Geberit's strategic landscape.

Sociological factors

Demographic shifts, like the ongoing trend of urbanization, significantly impact the demand for Geberit's products. As more people move to cities, there's a greater need for housing, which directly translates to increased demand for sanitary ware and plumbing solutions. This is particularly evident in emerging markets where rapid urban growth is a key driver.

The United Nations projects that by 2050, 68% of the world's population will reside in urban areas, a substantial increase from 56% in 2021. This escalating urbanization fuels the demand for modern, efficient sanitary systems, a core offering for Geberit. Simultaneously, in developed countries, aging infrastructure necessitates renovation and refurbishment, creating another significant market segment for the company.

Modern consumers increasingly prioritize comfort and style in their living spaces, particularly bathrooms. This evolving lifestyle trend directly fuels demand for Geberit's innovative and aesthetically pleasing bathroom solutions, from concealed cisterns to designer flush plates. The market is seeing a notable shift towards premium bathroom upgrades, with consumers actively seeking out designer aesthetics and even specific color trends like black sanitary ware, a segment Geberit is well-positioned to cater to.

Furthermore, a growing emphasis on health and well-being within the home environment is shaping purchasing decisions. Consumers are looking for products that contribute to a cleaner, more hygienic, and comfortable living experience. This aligns with Geberit's focus on advanced hygiene technologies and user-friendly designs, making their offerings attractive to a health-conscious demographic. For instance, in 2024, the global smart bathroom market, which often incorporates hygiene features, was projected to reach over $20 billion, indicating a strong consumer appetite for such innovations.

The heightened global emphasis on health and hygiene, amplified by the recent pandemic, is a significant driver for Geberit. Consumers are increasingly seeking advanced sanitary solutions, leading to a greater demand for products featuring touchless technology, self-cleaning capabilities, and features that promote superior sanitation. For instance, the market for smart toilets and motion-sensor faucets is projected to see substantial growth through 2025, reflecting this trend.

Organizations such as the World Health Organization (WHO) consistently highlight the critical link between sanitation and public health outcomes. This advocacy directly influences consumer preferences and governmental policies, pushing for more hygienic and advanced sanitary infrastructure. This societal shift positions Geberit's innovative product lines, designed for enhanced hygiene and user well-being, favorably within the market.

Sustainability and Eco-consciousness

Societal shifts towards sustainability are profoundly impacting purchasing decisions, with consumers actively seeking out eco-friendly options. This trend is particularly evident in the demand for water-saving bathroom fixtures and products incorporating recycled materials or adhering to circular economy models.

Geberit's strategic focus on sustainability and water efficiency positions it favorably to capture this expanding market. For instance, in 2023, Geberit reported that its products helped save approximately 1.1 billion cubic meters of water globally, demonstrating a tangible impact and alignment with consumer values.

- Growing Consumer Demand: Surveys indicate a significant portion of consumers are willing to pay more for sustainable products. A 2024 report by NielsenIQ found that 73% of global consumers are willing to change their consumption habits to reduce their environmental impact.

- Product Innovation: Geberit's investment in R&D for water-saving technologies, such as their concealed cisterns with dual-flush options, directly addresses this demand. These innovations contribute to reduced water consumption in buildings.

- Circular Economy Focus: The company's efforts to incorporate recycled materials and design products for longevity and recyclability resonate with the principles of a circular economy, a concept gaining traction among environmentally conscious individuals and businesses.

- Brand Reputation: Geberit's visible commitment to sustainability enhances its brand image, attracting customers who prioritize environmental responsibility alongside product quality and performance.

Aging Population and Accessibility Needs

The demographic shift towards an older population across many European nations, including key markets for Geberit, is directly fueling a growing demand for bathroom solutions that prioritize accessibility and ease of use. This trend is particularly pronounced as the proportion of individuals aged 65 and over continues to rise.

For instance, in 2023, the percentage of the population aged 65 and over reached approximately 21.3% in the European Union, a figure projected to climb further. This demographic reality translates into a significant market opportunity for products designed to accommodate mobility challenges, offering enhanced safety features and greater user comfort. Geberit's product development is increasingly influenced by these needs, driving innovation in areas like easy-to-operate fixtures and integrated support systems.

This societal evolution necessitates a focus on:

- Enhanced Safety Features: Products incorporating non-slip surfaces, ergonomic handles, and secure mounting systems are becoming essential.

- User-Friendly Design: Fixtures and controls that require less force to operate and are intuitively placed cater to users with reduced dexterity.

- Comfort and Independence: Solutions that allow individuals to maintain their independence and comfort in the bathroom are in high demand, impacting everything from toilet heights to shower designs.

The increasing global focus on health and hygiene, accelerated by recent events, directly benefits Geberit. Consumers are actively seeking advanced sanitary solutions, driving demand for touchless technology and enhanced sanitation features. The market for smart bathroom fixtures, which often incorporate these elements, was projected to exceed $20 billion in 2024, highlighting a strong consumer interest in these innovations.

Societal trends also emphasize sustainability, with consumers increasingly preferring water-saving fixtures and products made from recycled materials. Geberit's commitment to sustainability, evidenced by saving approximately 1.1 billion cubic meters of water globally in 2023, aligns perfectly with these evolving consumer values and preferences. This focus on eco-friendly solutions is becoming a key differentiator in purchasing decisions.

Demographic shifts, particularly the aging population in many developed countries, are creating a significant demand for accessible and user-friendly bathroom designs. As the proportion of individuals aged 65 and over continues to rise, with the EU reporting around 21.3% in this age bracket in 2023, there is a greater need for products that enhance safety and independence in the bathroom. Geberit's innovation in areas like easy-to-operate fixtures and integrated support systems directly addresses this growing market segment.

| Sociological Factor | Impact on Geberit | Supporting Data/Trend |

|---|---|---|

| Health & Hygiene Awareness | Increased demand for advanced sanitary solutions | Global smart bathroom market projected over $20 billion in 2024 |

| Sustainability Focus | Preference for water-saving and eco-friendly products | Geberit saved ~1.1 billion m³ water globally in 2023 |

| Aging Population | Growing demand for accessible and user-friendly bathroom designs | EU population aged 65+ was ~21.3% in 2023 |

Technological factors

The bathroom is increasingly becoming a hub for smart technology, with innovations like smart mirrors offering integrated displays and health tracking, and voice-activated controls for faucets and lighting becoming more common. By 2024, the global smart home market, which includes bathroom tech, was projected to reach over $150 billion, indicating significant consumer interest in connected living spaces. Geberit can capitalize on this by integrating features like personalized water temperature presets in showers and water usage monitoring in toilets, directly addressing consumer demand for convenience and efficiency.

Geberit's adoption of advanced manufacturing processes, including automation and novel materials, directly translates to improved operational efficiency and cost reduction. For instance, investments in state-of-the-art production lines, like those dedicated to the Duofix frame, enable greater precision and accelerate output.

This focus on technological advancement allows Geberit to maintain high product quality while potentially lowering manufacturing expenses. The company's ongoing optimization of its production network underscores its commitment to leveraging these technological factors for competitive advantage, as seen in their continuous upgrades to machinery and process control systems.

The construction sector's growing embrace of digitalization, particularly Building Information Modeling (BIM), is reshaping product specification and integration. Geberit must ensure its offerings align with these digital workflows.

The upcoming Construction Products Regulation's Digital Product Passport (DPP) will centralize product data, enhancing traceability and transparency. Geberit's ability to provide compatible digital product information is crucial for market access and competitive positioning.

Water-Saving Technologies

Technological advancements in water efficiency are becoming increasingly important, driven by stricter environmental regulations and growing consumer preference for sustainable products. Geberit's commitment to innovation in this area is evident in its development of water-saving fixtures, such as dual-flush toilets and sensor-activated faucets, which directly address this market demand and help users conserve water. These technologies are central to Geberit's broader sustainability strategy and its efforts to reduce the environmental footprint of buildings.

The market for water-saving technologies is expanding rapidly. For instance, the global smart water management market, which includes water-saving technologies, was valued at approximately USD 10.5 billion in 2023 and is projected to reach USD 25.8 billion by 2030, growing at a compound annual growth rate of about 13.7%. This growth underscores the significant opportunities for companies like Geberit that are at the forefront of developing and implementing these solutions.

- Dual-flush systems: Geberit's Sigma and Omega actuator plates offer dual-flush options, allowing users to select between a full or partial flush, thereby reducing water usage by up to 50% per flush for certain waste volumes.

- Sensor-activated faucets: These fixtures automatically dispense water when hands are detected, eliminating unnecessary water flow and promoting hygiene, a key feature in many modern public and private spaces.

- Water-efficient showerheads: Innovations in showerhead design, such as those incorporating aeration technology, can significantly reduce water consumption without compromising user experience, with some models achieving flow rates as low as 6 liters per minute compared to older models that could use 15 liters per minute.

Research and Development in Materials and Hydraulics

Geberit's commitment to continuous research and development in materials science and hydraulics is a cornerstone of its market leadership. This dedication fuels the optimization and expansion of its product portfolio, ensuring enhanced performance, longevity, and user satisfaction. For instance, in 2023, Geberit reported an R&D expenditure of CHF 224.3 million, underscoring its significant investment in innovation.

The company's above-average innovative strength directly stems from these extensive R&D efforts. This allows Geberit to consistently introduce new solutions and refine existing ones, addressing evolving market demands for efficiency and user experience in sanitary technology.

Key areas of focus for Geberit's R&D include:

- Advancements in materials science: Developing lighter, more durable, and sustainable materials for plumbing and sanitary systems.

- Hydraulic efficiency: Innovating flushing systems and water management technologies to reduce water consumption and improve performance.

- Acoustic insulation: Creating solutions that minimize noise transmission in buildings, enhancing comfort.

- Hygiene solutions: Developing products that promote better hygiene and ease of cleaning in sanitary environments.

The integration of smart technology into bathrooms is a significant trend, with innovations like smart mirrors and voice controls becoming more prevalent. The global smart home market, including bathroom tech, was projected to exceed $150 billion by 2024, highlighting strong consumer interest in connected living. Geberit can leverage this by incorporating features such as personalized shower settings and water usage monitoring systems.

Geberit's investment in advanced manufacturing, including automation and new materials, boosts efficiency and lowers costs. For example, their state-of-the-art production lines for products like the Duofix frame ensure precision and faster output, contributing to their competitive edge. This focus on technological upgrades is reflected in their ongoing optimization of machinery and process control systems.

Digitalization in construction, especially Building Information Modeling (BIM), is changing how products are specified and integrated, requiring Geberit to ensure its offerings are compatible with these digital workflows. Furthermore, upcoming regulations like the Construction Products Regulation's Digital Product Passport (DPP) will mandate centralized product data, making Geberit's ability to provide digital product information crucial for market access.

Technological advancements in water efficiency are increasingly vital due to environmental regulations and consumer demand for sustainable products. Geberit's development of water-saving fixtures, like dual-flush toilets and sensor faucets, directly addresses this market need. The global smart water management market, including water-saving tech, was valued around USD 10.5 billion in 2023 and is expected to reach USD 25.8 billion by 2030, showing substantial growth for companies like Geberit.

| Technological Factor | Description | Geberit's Response/Opportunity | Market Data/Impact |

| Smart Home Integration | Increasing consumer demand for connected bathroom features. | Incorporate smart mirrors, voice controls, personalized settings. | Global smart home market > $150 billion (2024 projection). |

| Advanced Manufacturing | Automation and novel materials improve production efficiency. | Investments in state-of-the-art production lines. | Enhances product quality and potentially lowers manufacturing costs. |

| Digitalization in Construction | BIM adoption reshapes product specification and integration. | Ensure product compatibility with digital workflows. | Upcoming DPP will centralize product data, requiring digital product information. |

| Water Efficiency Technology | Growing demand for sustainable, water-saving solutions. | Develop dual-flush toilets, sensor faucets, water-efficient showerheads. | Water-saving tech market projected to grow from USD 10.5 billion (2023) to USD 25.8 billion (2030). |

Legal factors

The updated Construction Products Regulation (CPR), effective January 7, 2025, mandates CE marking to encompass environmental impact, requiring manufacturers like Geberit to disclose climate-related data such as CO2 emissions and energy usage.

This regulation also introduces a Digital Product Passport, enhancing product traceability throughout the supply chain, a crucial element for Geberit's extensive product portfolio sold within the European Union.

Geberit's proactive approach to sustainability, including its 2024 initiatives to reduce its Scope 1 and 2 emissions by 15% compared to a 2020 baseline, positions it favorably for CPR compliance.

Ensuring full compliance across all EU-marketed products will necessitate rigorous data collection and reporting, potentially impacting manufacturing processes and supply chain management for Geberit.

The revised Energy Performance of Buildings Directive (EPBD), which came into effect on May 28, 2024, introduces significant requirements for energy efficiency in new and existing buildings, including a planned phase-out of fossil fuel boilers. This directive directly impacts the construction and renovation markets, influencing demand for sustainable building materials and systems. Geberit's innovative water management solutions, designed for efficient water use and integration into modern building technologies, are well-positioned to benefit from these new regulations.

Stringent environmental protection laws and water conservation regulations, particularly within the European Union, significantly influence Geberit's product development and manufacturing processes. For instance, the EU's Construction Products Regulation (CPR) is increasingly integrating water-related criteria, incentivizing the adoption of water-efficient technologies.

The EU's intensified focus on water conservation and quality means companies like Geberit must align their offerings with evolving legal mandates. This includes designing products that minimize water usage and ensure high water quality standards are met across their lifecycles.

Geberit's strategic emphasis on water-saving technology and sustainable manufacturing practices is a direct response to these legal requirements. In 2023, the company reported that its water-saving products contributed to significant reductions in water consumption for its end-users, aligning with the EU's ambitious sustainability goals.

Product Liability and Safety Standards

Geberit operates under stringent product liability laws and safety standards, a critical aspect for maintaining consumer trust and avoiding costly legal battles. The company must consistently ensure its plumbing and bathroom products meet rigorous national and international safety certifications and performance benchmarks. For instance, in 2023, the European Union continued to emphasize product safety regulations, with ongoing updates to directives like the General Product Safety Regulation, impacting how manufacturers like Geberit must demonstrate compliance. Failure to adhere can lead to significant fines and reputational damage, as seen in past recalls by other companies in the building materials sector.

Upholding a reputation for quality and reliability is intrinsically linked to Geberit's adherence to these legal frameworks. The company’s commitment to safety is demonstrated through its rigorous internal testing and quality control processes, designed to preemptively address potential issues before products reach the market. This proactive approach is vital, especially as new materials and technologies are integrated into their offerings, requiring continuous assessment against evolving safety requirements.

Key considerations for Geberit regarding product liability and safety standards include:

- Compliance with EU General Product Safety Regulation (GPSR): Ensuring all products placed on the market are safe and meet evolving safety requirements.

- Adherence to EN Standards: Meeting European Norms for plumbing, sanitary ware, and building materials, which are frequently updated.

- Product Traceability: Maintaining robust systems to track products throughout the supply chain, crucial for effective recalls if necessary.

- Risk Assessment: Conducting thorough risk assessments for new and existing products to identify and mitigate potential hazards.

Labor Laws and Employment Regulations

Geberit must navigate a complex web of labor laws and employment regulations across its global operations. This includes adhering to standards for fair wages, safe working conditions, and fundamental employee rights in each jurisdiction. For instance, in 2024, Geberit reported a workforce of 12,600 employees, reflecting growth and necessitating rigorous compliance with diverse national labor frameworks.

The company’s commitment to these regulations is crucial for maintaining its social license to operate and attracting talent. Failure to comply could result in significant fines, legal challenges, and reputational damage, impacting its ability to execute growth strategies effectively.

- Fair Wages: Ensuring compensation meets or exceeds statutory minimums and industry benchmarks in all operating regions.

- Working Conditions: Maintaining safe and healthy work environments that comply with occupational safety and health regulations.

- Employee Rights: Respecting rights to collective bargaining, freedom of association, and protection against discrimination and unfair dismissal.

- Global Compliance: Implementing robust internal controls and training programs to ensure consistent adherence to varying international labor standards.

Geberit must navigate evolving environmental regulations, such as the updated Construction Products Regulation (CPR) effective January 2025, which mandates CE marking for environmental impact data, including CO2 emissions. The revised Energy Performance of Buildings Directive (EPBD), effective May 2024, also promotes energy efficiency and a phase-out of fossil fuel boilers, influencing demand for Geberit's water-saving solutions.

The company also faces stringent product liability and safety standards, with ongoing updates to regulations like the EU's General Product Safety Regulation (GPSR). Adherence to EN Standards for plumbing and sanitary ware is crucial, necessitating robust traceability and risk assessment processes. Geberit's commitment to quality and reliability is demonstrated through rigorous internal testing, vital for maintaining consumer trust and avoiding legal repercussions.

Furthermore, Geberit must comply with diverse global labor laws, ensuring fair wages, safe working conditions, and employee rights for its 12,600 employees as of 2024. This includes implementing strong internal controls and training to ensure consistent adherence to international labor standards across all operating regions.

Environmental factors

Growing concerns about water scarcity are a significant environmental factor influencing Geberit. As regions worldwide face increasing water stress, there's a heightened demand for water-saving sanitary products. This trend is directly reflected in market shifts towards more efficient solutions.

Regulations are actively driving this change. For instance, new environmental directives and building codes, like those being updated in the EU under the Construction Products Regulation, are increasingly mandating the integration of water-saving technologies. These regulations also often include incentives for adopting water-efficient building solutions, encouraging companies like Geberit to innovate.

Geberit's product portfolio is strategically aligned with these environmental pressures. Their offerings, such as low-flow faucets, water-efficient showerheads, and dual-flush toilets, are designed to reduce water consumption significantly. For example, Geberit's Sigma concealed cisterns with dual-flush technology can save up to 6 liters of water per flush compared to older single-flush models, a crucial feature in water-conscious markets.

The growing urgency to combat climate change is driving more stringent regulations on carbon emissions within the construction industry. This is directly impacting manufacturers like Geberit, as the revised Construction Products Regulation (CPR) now mandates reporting on climate-related data, including CO2 emissions and energy usage.

A significant driver is the EU's push for zero-emission new buildings by 2030, a target that necessitates a fundamental shift in building materials and practices. Geberit is proactively addressing this by targeting a 5% annual reduction in its CO2 intensity, demonstrating a commitment to lowering its environmental footprint and aligning with these evolving regulatory landscapes.

The global push for a circular economy and enhanced resource efficiency is reshaping how companies like Geberit approach product development and material sourcing in the sanitary sector. This trend directly impacts decisions regarding product design, the types of materials chosen, and how waste is managed throughout the product lifecycle.

Governments are increasingly implementing regulations that mandate greater durability, recyclability, and ease of repair and remanufacturing for construction products. These policies encourage manufacturers to create items that last longer and can be more easily repurposed at the end of their useful life.

Geberit has set ambitious targets to align with these environmental shifts. By 2030, the company aims for its plastic packaging to incorporate at least 30% recycled content. Furthermore, Geberit is working towards ensuring that 80% of all its packaging materials are recyclable, demonstrating a commitment to reducing its environmental footprint.

Waste Management and Recycling

Effective waste management and enhanced recycling of construction and sanitary waste are gaining significant traction. The European Union is pushing for greater reuse of building materials, fostering new business models that bolster the circular economy. For instance, the EU aims to increase construction and demolition waste recycling rates to 70% by 2030.

Geberit's commitment to designing products with recyclability in mind and actively reducing packaging waste directly supports these environmental goals. In 2023, Geberit reported a 3% reduction in packaging material per unit sold compared to the previous year.

- Circular Economy Focus: EU regulations are driving the reuse of construction products, encouraging business models that support a circular economy.

- Recycling Targets: By 2030, the EU aims for a 70% recycling rate for construction and demolition waste.

- Geberit's Initiatives: Geberit designs products for recyclability and works to minimize packaging waste, aligning with sustainability objectives.

- Packaging Reduction: Geberit achieved a 3% decrease in packaging material per unit sold in 2023.

Sustainable Sourcing of Materials

The increasing consumer and regulatory pressure for sustainably sourced materials, encompassing both natural and recycled content, significantly impacts the sanitary ware industry. This trend is particularly evident in Europe, where natural materials like ceramics are a dominant choice for manufacturers. Geberit's proactive approach to this environmental factor is demonstrated through its sustainability strategy, which emphasizes responsible corporate governance and rigorous due diligence concerning conflict minerals, ensuring ethical and sustainable material procurement.

Geberit's commitment to sustainable sourcing is underscored by several key initiatives:

- Growing Market Demand: Consumers are increasingly prioritizing products made from recycled and natural materials, influencing purchasing decisions in the sanitary ware sector.

- Ceramics as a Key Material: The European market continues to favor ceramics, a natural material, for its durability and aesthetic qualities, aligning with sustainable sourcing trends.

- Due Diligence and Conflict Minerals: Geberit actively implements due diligence processes to ensure its supply chain avoids conflict minerals, reflecting a commitment to ethical sourcing practices.

The global shift towards a circular economy is a major environmental driver for Geberit, emphasizing product durability, recyclability, and responsible waste management. Governments are implementing stricter regulations to promote the reuse of building materials, with the EU aiming to achieve a 70% recycling rate for construction and demolition waste by 2030. Geberit actively supports these goals by designing products for recyclability and reducing packaging waste, evidenced by a 3% decrease in packaging material per unit sold in 2023.

| Environmental Factor | EU Target/Regulation | Geberit's Action/Data |

|---|---|---|

| Circular Economy & Waste Management | 70% construction & demolition waste recycling rate by 2030 | Designs products for recyclability; 3% reduction in packaging material per unit sold (2023) |

| Sustainable Materials | Increasing consumer demand for recycled/natural content | Focus on responsible sourcing, due diligence on conflict minerals; uses ceramics |

| Water Scarcity & Efficiency | Growing global water stress | Offers water-saving products (e.g., Sigma cisterns saving up to 6L per flush) |

| Climate Change & Emissions | EU push for zero-emission buildings by 2030; revised CPR mandates CO2 reporting | Targeting a 5% annual reduction in CO2 intensity |

PESTLE Analysis Data Sources

Our Geberit PESTLE analysis is meticulously constructed using data from reputable sources including government publications, international economic bodies like the IMF and World Bank, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting Geberit.