Geberit Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Geberit Bundle

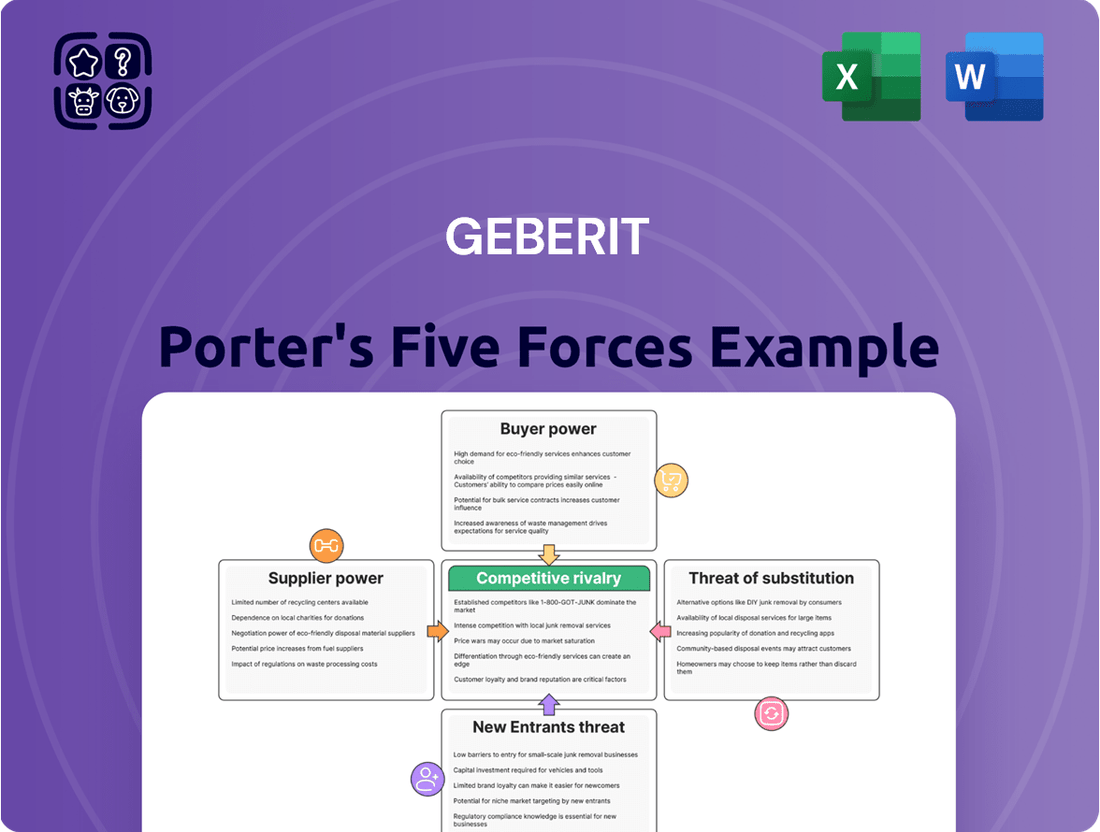

Geberit's competitive landscape is shaped by intense rivalry, the bargaining power of buyers, and the influence of suppliers. Understanding these forces is crucial for navigating the plumbing and bathroom fixture industry. The threat of new entrants and substitutes also plays a significant role in shaping their strategic decisions.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Geberit’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Geberit sources a vast array of materials globally, and while 2024 saw a return to normal availability and delivery times for many inputs, the company still faces potential supplier leverage. When a small number of suppliers control specialized components or proprietary technologies crucial to Geberit's production, their individual bargaining power increases significantly.

This concentration means Geberit might encounter less favorable pricing or terms if these select suppliers hold a dominant market share for essential inputs. For instance, if a unique ceramic glaze or a specialized valve component is only available from one or two manufacturers, Geberit's ability to negotiate lower prices is diminished, directly impacting its cost of goods sold.

In 2024, Geberit experienced a welcome easing of input cost pressures, with direct material prices generally moving sideways and showing a decrease compared to 2023. Despite this relief from inflation, historical price levels for these materials remain elevated.

Looking ahead to 2025, the outlook suggests a potential resurgence in material costs. Anticipated inflation, coupled with global supply shortages and the impact of tariffs, is projected to drive up prices for key plumbing materials such as copper, PVC, and PEX pipes. This trend could strengthen the bargaining power of Geberit's suppliers.

Energy prices presented a mixed picture throughout 2024. The first half of the year saw lower energy costs, offering some cost savings. However, the latter half of 2024 experienced a slight increase in energy prices, surpassing the levels seen in the previous year.

Switching suppliers for critical components or materials presents significant hurdles for Geberit. These include the substantial costs associated with retooling production lines, undertaking rigorous new quality control assessments, and establishing entirely new logistical arrangements. For instance, in 2023, major industrial manufacturers often reported switching costs in the millions of euros for complex component changes.

These inherent switching costs inherently limit Geberit's flexibility in supplier selection. This reduced flexibility, in turn, empowers existing suppliers to exert greater influence over pricing and contract terms, potentially leading to less favorable outcomes for Geberit.

The intricate nature of sanitary systems further amplifies these switching costs. Any change in suppliers for key components could negatively impact product performance, requiring extensive re-testing and potentially jeopardizing existing certifications, which are crucial for market access and brand reputation.

Threat of Forward Integration by Suppliers

The threat of suppliers moving into manufacturing sanitary products, known as forward integration, could significantly bolster their bargaining power. This scenario, while less prevalent in the sanitary ware sector, would transform suppliers into direct competitors.

If major suppliers of essential components or raw materials started producing finished sanitary systems or ceramic bathroom fixtures, they would gain leverage. This would fundamentally alter existing supply dynamics and likely escalate market competition.

- Increased Competition: Suppliers becoming manufacturers would directly vie for market share against established sanitary product companies.

- Supply Chain Disruption: Existing supply agreements could be jeopardized as suppliers prioritize their own product lines.

- Pricing Pressure: New competitive entrants could introduce pricing pressures, impacting the profitability of incumbent firms.

Importance of Supplier Relationships and Audits

Geberit actively manages its supplier relationships to counter potential supplier power, ensuring a stable supply of materials and controlling costs. This proactive approach is crucial for maintaining operational efficiency and profitability. In 2023, Geberit continued its focus on robust supplier management, a strategy that has historically helped it navigate supply chain complexities.

The company mandates that all its business partners and suppliers adhere to stringent standards encompassing quality, environmental stewardship, and social responsibility. This commitment to ethical and sustainable sourcing is a cornerstone of Geberit's operational philosophy. For instance, Geberit’s sustainability report highlights ongoing efforts to ensure compliance across its supplier network.

To verify adherence to these standards and mitigate risks, Geberit conducts regular on-site audits of its suppliers. These audits cover critical areas such as product quality, environmental impact, and occupational health and safety. Such rigorous checks not only ensure compliance but also strengthen Geberit's negotiating position with suppliers, thereby diminishing their bargaining power.

- Supplier Compliance: Geberit requires all suppliers to meet comprehensive standards for quality, environmental, and social responsibility.

- Risk Mitigation: Regular on-site audits in quality, environment, and health and safety help manage supplier-related risks.

- Cost Control: Effective supplier management contributes to minimizing material costs and safeguarding supply chains.

- Strategic Advantage: By enforcing its standards, Geberit enhances its leverage in supplier negotiations.

Geberit faces moderate bargaining power from its suppliers, particularly for specialized components where supplier concentration is high. While 2024 saw easing input costs, a potential resurgence in material prices in 2025 could strengthen supplier leverage. High switching costs and the risk of supplier forward integration further amplify this power.

Geberit's proactive supplier management, including stringent compliance standards and regular audits, aims to mitigate these pressures. This strategic approach helps maintain supply chain stability and control costs, reinforcing Geberit's negotiating position.

| Factor | Impact on Geberit | Mitigation Strategy |

|---|---|---|

| Supplier Concentration | Moderate to High (for specialized inputs) | Diversification, long-term contracts |

| Switching Costs | High | Supplier relationship management, standardization |

| Potential Forward Integration | Low to Moderate | Strategic partnerships, continuous market monitoring |

| Input Cost Volatility (2024-2025) | Moderate | Hedging, cost optimization initiatives |

What is included in the product

This Geberit Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes.

Instantly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Streamline strategic planning by clearly mapping out the forces impacting profitability and market position.

Customers Bargaining Power

Geberit's customer base is quite varied, encompassing wholesalers, professional plumbers and sanitary engineers, and the final consumers in both homes and businesses. While individual homeowners typically have little sway, large-scale buyers like major plumbing supply wholesalers or significant commercial property developers who purchase in bulk can indeed influence Geberit's pricing and contract conditions. For instance, in 2024, the top 10 plumbing wholesalers in Europe accounted for approximately 40% of Geberit's sales in the region, giving them substantial bargaining leverage.

However, the overall power of customers is somewhat diluted by the sheer number of smaller plumbing businesses and individual contractors that make up a significant portion of Geberit's market. This fragmentation means that no single small customer can exert much pressure. Geberit's strategy often involves catering to these smaller segments with accessible product lines and reliable distribution, balancing the power dynamics.

Wholesalers are crucial gatekeepers for Geberit, offering extensive product lines, warehousing, and delivery services directly to plumbing businesses and construction projects. Their ability to bundle products and manage inventory significantly impacts Geberit's market reach.

Plumbers and sanitary engineers hold considerable sway as they are the primary specifiers and installers of Geberit's products. Their preference for certain brands or systems directly influences purchasing decisions at the wholesale level.

Geberit's commitment to extensive cooperation, including training programs and technical support for these professionals, underscores their vital role in securing sales and market share. In 2023, Geberit continued to invest heavily in its professional customer channels, with a reported 7.5% increase in sales to the trade segment across Europe.

Customer switching costs are a significant factor in the building materials industry. For professional customers, such as plumbers and installers, the effort involved in learning new product lines, adapting installation techniques, and ensuring compatibility with existing systems can be substantial, making them hesitant to switch from trusted brands like Geberit. This reluctance to change, driven by the need for retraining and potential integration challenges, effectively raises the cost of switching for these key intermediaries.

While individual end-users might perceive a low direct cost for switching a single fixture, the indirect costs associated with potential installation complexities and the general inconvenience of dealing with unfamiliar products can deter them from exploring alternative brands. This perceived hassle, even if not a direct monetary outlay, grants companies like Geberit a degree of bargaining power by making the switching process less attractive for the average consumer.

Price Sensitivity and Market Conditions

Customer price sensitivity is a key factor in the bargaining power of customers. For instance, large commercial construction projects tend to be more focused on cost than smaller residential renovations.

The European construction sector faced challenges, with new residential construction seeing a downturn in 2023-2024. This economic climate can heighten customer price sensitivity as demand softens.

However, the renovation segment, a significant contributor to Geberit's revenue, is showing signs of improvement. This recovery could help to stabilize demand and lessen intense price competition.

- Price Sensitivity Varies: Commercial projects often exhibit higher price sensitivity than residential renovations.

- European Market Downturn: A decline in new residential construction in Europe during 2023-2024 likely increased customer price sensitivity.

- Renovation Market Resilience: Signs of recovery in the renovation market, a core area for Geberit, may mitigate extreme price pressures.

Information Availability and Product Differentiation

Customers today have unprecedented access to product information and comparative reviews, significantly boosting their ability to make informed purchasing decisions. Geberit actively engages in digital marketing and customer relationship management to further empower these buyers. For instance, by mid-2024, Geberit's website provided detailed specifications and installation guides for its extensive product range, allowing consumers to easily compare features and benefits.

Despite this increased transparency, Geberit maintains a strong position through its commitment to innovation and quality. The company’s focus on advanced solutions like smart toilets and water-saving technologies differentiates its offerings. This differentiation moves the competition beyond mere price, appealing to customers who value premium performance and sustainability. By mid-2024, Geberit reported that its innovative product lines, such as the AquaClean smart toilets, contributed a significant portion of its revenue growth, indicating customer willingness to pay a premium for these advanced features.

- Increased Information Access: End-users can readily compare products and read reviews online, empowering their purchasing choices.

- Geberit's Digital Strategy: The company utilizes digital marketing and CRM to enhance customer engagement and provide accessible product data.

- Product Differentiation: Geberit's emphasis on innovative, high-quality, and technologically advanced products (e.g., smart toilets, water-saving systems) sets it apart.

- Reduced Price Sensitivity: Differentiation allows Geberit to mitigate direct price competition, especially with customers seeking premium solutions.

Geberit's customer bargaining power is moderated by several factors. While large wholesalers and developers can exert pressure due to bulk purchasing, the fragmented nature of the installer base limits individual customer leverage. High switching costs for professionals, stemming from training and integration needs, further strengthen Geberit's position. The company's focus on innovation and quality also reduces price sensitivity, particularly for its advanced product lines.

| Customer Segment | Bargaining Power Factors | Geberit's Mitigation Strategies |

| Large Wholesalers/Developers | Bulk purchasing, potential to bundle products | Focus on long-term relationships, tiered pricing structures |

| Plumbers/Installers | Product specification, brand preference | Extensive training and technical support, loyalty programs |

| End Consumers (Residential) | Price sensitivity, information access | Product differentiation, focus on quality and innovation |

| End Consumers (Commercial) | High price sensitivity, project-focused | Value engineering, cost-effective solutions for large projects |

Preview Before You Purchase

Geberit Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Geberit's competitive landscape through Porter's Five Forces, analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. Understanding these forces is crucial for strategic decision-making in the plumbing and bathroom fixtures industry.

Rivalry Among Competitors

Geberit's position as a dominant European sanitary product manufacturer grants it substantial market leadership and scale. This scale translates into significant advantages, including enhanced brand recognition across key European markets, well-established and efficient distribution networks, and considerable economies of scale in its manufacturing processes. For instance, in 2024, Geberit demonstrated its strength by increasing sales and volumes despite a demanding market environment, further solidifying its competitive standing.

The European construction industry, a significant market for Geberit, experienced a downturn in 2024, especially in new residential building. This decline naturally heightened competitive pressures as companies fought for a shrinking pool of projects.

Looking ahead, the broader European construction sector is showing signs of a modest recovery, with projections indicating accelerated growth from 2025 onwards. This anticipated upturn should ease some of the competitive intensity.

Furthermore, the global sanitary ware market itself is on an upward trajectory, forecasting a more robust and potentially less cutthroat environment for players like Geberit in the coming years.

Geberit operates in a highly competitive arena, contending with global giants such as Kohler, TOTO, and Grohe, alongside numerous specialized regional manufacturers. These rivals are equally invested in innovation, premium design, and sustainable practices, creating a demanding landscape where consistent product advancement is non-negotiable.

This intense rivalry is fueled by a persistent drive for market share, particularly in a sector that has experienced recent growth headwinds. For instance, in 2023, the global plumbing fixtures market, a key segment for Geberit, saw a modest growth rate, intensifying the competition among established players to capture a larger slice of the available demand.

Product Differentiation and Innovation

Geberit actively pursues product differentiation and innovation across its core business segments, including installation systems, piping, and bathroom solutions. This strategy is crucial for maintaining its competitive standing.

The company's success in launching new products, like the AquaClean Alba shower toilet and its advanced piping systems, directly bolsters its competitive advantage. These innovations are key to its market position.

Geberit’s commitment to developing unique, high-value solutions allows it to differentiate itself in a market that increasingly demands smart, sustainable, and aesthetically pleasing products. This focus on innovation is a significant driver of its competitive rivalry.

- Innovation Focus: Geberit consistently invests in R&D to create differentiated products.

- Product Success: Launches like the AquaClean Alba highlight successful innovation.

- Market Trends: Geberit aligns its product development with demand for smart, eco-friendly, and design-led solutions.

- Competitive Edge: Product differentiation is a primary tool for standing out against rivals.

Brand Loyalty and Reputation

Geberit, celebrating 150 years in 2024, leverages its deeply ingrained brand loyalty and a robust reputation for quality and reliability. This strong standing, particularly among plumbing professionals and discerning end-users, creates a significant hurdle for new entrants and existing rivals. Customers often demonstrate a pronounced reluctance to deviate from Geberit, especially when dealing with essential building systems where performance is paramount.

This established trust translates into a competitive advantage, as switching costs, both perceived and actual, can deter customers from exploring alternative suppliers. Geberit's consistent delivery of high-performance products and dedicated customer support are key drivers of this loyalty, reinforcing its market position.

- Established Reputation: Geberit's 150-year legacy in 2024 underpins a strong brand image associated with quality and dependability.

- Customer Loyalty: Professionals and end-users exhibit a preference for Geberit, making them less inclined to switch to competitors for critical infrastructure needs.

- Barrier to Entry: The deep-seated trust in Geberit’s brand acts as a deterrent for new market participants seeking to gain market share.

- Competitive Advantage: Consistent product excellence and reliable customer service are crucial for maintaining Geberit's loyal customer base against competitive pressures.

Competitive rivalry within Geberit's market is intense, driven by global players like Kohler and Grohe, as well as specialized regional manufacturers. This competition necessitates continuous innovation in product design and sustainability, as seen in Geberit's successful launches in 2024. The market, while facing some headwinds in new residential construction in 2024, is projected for recovery from 2025, potentially easing some competitive pressures.

Geberit's strong brand loyalty, built over 150 years as of 2024, creates a significant barrier for competitors. This trust, particularly among professionals, translates to high switching costs, reinforcing Geberit's market position against rivals seeking to capture market share in a sector that saw modest global growth in 2023.

The company actively differentiates itself through product innovation, focusing on smart, sustainable, and aesthetically pleasing solutions. This strategy is vital for maintaining its competitive edge against rivals who are also investing heavily in similar areas.

Geberit's scale and market leadership in Europe provide further advantages, including efficient distribution and manufacturing economies of scale, which help it navigate the demanding competitive landscape.

SSubstitutes Threaten

Sanitary products, such as toilets, washbasins, and essential piping systems, are deeply ingrained as functional necessities in both residential and commercial construction. Their role in water supply and waste removal is so fundamental that finding a direct, viable substitute for this core functionality is virtually impossible.

This inherent indispensability of sanitary ware significantly curtails the threat of outright substitution for the product category as a whole. For instance, global construction spending, a key driver for sanitary product demand, was projected to reach approximately $14.5 trillion in 2024, underscoring the persistent need for these essential building components.

Technological advancements are introducing new ways to achieve hygiene, potentially substituting traditional sanitary products. For instance, smart toilets, featuring sensors for optimized flushing and integrated bidet functions, offer a more comprehensive hygiene experience than standard fixtures. The global smart toilet market was valued at approximately $1.8 billion in 2023 and is projected to grow significantly, indicating a clear trend towards these advanced solutions.

Touchless faucets and soap dispensers, driven by a desire for improved sanitation and reduced germ transmission, are also gaining traction. These innovations directly compete with traditional manual faucets and dispensers by offering a more hygienic and convenient user experience. The market for touchless faucets alone was estimated to be over $2.5 billion in 2023, showcasing their growing adoption.

Furthermore, the development of self-cleaning or antimicrobial surfaces for bathrooms and kitchens presents another layer of substitution. These materials can reduce the need for frequent manual cleaning and offer a higher baseline level of hygiene. Companies are investing in research and development for these materials, aiming to integrate them into building materials and fixtures, thereby altering consumer expectations for sanitary environments.

Growing environmental consciousness and increasingly stringent regulations are fueling a significant demand for sanitary products that are both eco-friendly and conserve water. This trend is making features like dual-flush systems, low-flow faucets, and smart water management in toilets increasingly common, signaling a clear shift in what consumers expect and prefer. For instance, by 2024, many new construction projects globally are mandated to meet specific water efficiency standards, impacting product selection.

While Geberit is well-positioned with its own range of water-saving technologies, the emergence of niche manufacturers focused solely on ultra-low water consumption or innovative alternative waste treatment systems presents a potential threat. If these specialized companies achieve breakthrough, highly cost-effective innovations that capture widespread market adoption, they could disrupt the established market share of larger players like Geberit.

Modular and Prefabricated Bathroom Solutions

The increasing adoption of modular and prefabricated bathroom solutions presents a potential threat of substitutes for Geberit. These integrated units, assembled off-site, can offer a complete bathroom solution, potentially bypassing the need for individual component installations traditionally supplied by Geberit. While Geberit's high-quality components could still be incorporated, the shift towards these all-in-one modules could fragment the market and alter how bathroom fixtures are specified and purchased.

This trend is gaining momentum, particularly in sectors like hospitality and multi-unit residential construction, where efficiency and speed are paramount. For instance, the global prefabricated bathroom market was valued at approximately USD 4.5 billion in 2023 and is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 6% through 2030. This growth indicates a tangible shift in construction methodologies that could impact demand for traditional, site-built bathroom components.

- Shift in Construction: Modular bathrooms reduce reliance on on-site assembly of individual fixtures.

- Market Fragmentation: Integrated solutions may consolidate demand, potentially reducing direct sales of individual Geberit components.

- Efficiency Drivers: Prefabrication appeals to developers seeking faster project completion and cost predictability.

- Market Growth: The prefabricated bathroom sector is experiencing robust growth, highlighting its increasing viability as an alternative.

Non-Traditional Sanitation Approaches

While currently a niche concern in developed markets, the long-term threat of substitutes for traditional sanitation systems, like those offered by Geberit, is emerging from non-traditional approaches. These include advanced composting toilets and waterless urinals, which significantly reduce or eliminate the need for conventional plumbing infrastructure.

Although these solutions are not yet widespread in Geberit's core markets, ongoing innovation in sustainable building practices could foster their adoption. For instance, the global market for waterless urinals is projected to grow, with some estimates suggesting a compound annual growth rate (CAGR) of over 5% in the coming years, indicating a potential shift in consumer and regulatory preferences.

- Emerging Technologies: Advanced composting toilets and waterless urinals represent direct substitutes by bypassing traditional water-based flushing systems.

- Market Potential: While currently small, the growing emphasis on water conservation and sustainable infrastructure could drive demand for these alternatives.

- Innovation Impact: Continuous advancements in material science and design for these non-traditional systems could make them more appealing and cost-effective, posing a greater threat to established plumbing manufacturers.

While core sanitary functions are indispensable, technological advancements and changing consumer preferences introduce substitutes. Smart toilets and touchless fixtures offer enhanced hygiene and convenience, with the smart toilet market valued at approximately $1.8 billion in 2023 and touchless faucets exceeding $2.5 billion in the same year. These innovations directly compete with traditional offerings by providing superior user experiences.

The rise of modular and prefabricated bathrooms is another significant threat. These integrated units, with the prefabricated bathroom market valued at around USD 4.5 billion in 2023 and projected to grow, can bypass the need for individual component installations, potentially fragmenting the market for companies like Geberit.

Furthermore, non-traditional sanitation systems such as waterless urinals and composting toilets are emerging as substitutes. The market for waterless urinals, for instance, is expected to grow at a CAGR exceeding 5%, indicating a potential shift towards water-saving and infrastructure-light solutions.

| Substitute Type | Key Features | 2023 Market Value (Approx.) | Growth Indicator |

| Smart Toilets | Enhanced hygiene, integrated features | $1.8 billion | Significant projected growth |

| Touchless Faucets | Improved sanitation, convenience | >$2.5 billion | Growing adoption |

| Modular Bathrooms | Off-site assembly, integrated solutions | USD 4.5 billion | CAGR > 6% (projected) |

| Waterless Urinals | Water conservation, reduced plumbing | Niche (growing) | CAGR > 5% (projected) |

Entrants Threaten

The sanitary products manufacturing sector demands significant upfront capital for state-of-the-art production facilities, advanced machinery, and cutting-edge technology. Geberit's extensive network of 26 production plants underscores the sheer scale of investment needed to operate effectively.

Aspiring new entrants must secure substantial financial backing to even begin competing. Without considerable resources, achieving the economies of scale crucial for cost-competitive production becomes an insurmountable hurdle, thus acting as a formidable barrier to entry.

Geberit's formidable presence is significantly bolstered by its deeply entrenched distribution channels and long-standing relationships with wholesalers, plumbers, and sanitary engineers. These partnerships are not merely transactional; they represent a critical nexus for product delivery, expert installation, and overall market penetration. For instance, in 2024, Geberit continued to leverage its extensive network, which is the result of decades of cultivation and trust-building, a significant barrier for any newcomer.

Establishing a similarly robust and reliable distribution network requires immense time, substantial financial investment, and a consistent demonstration of value and dependability. New entrants would face considerable hurdles in replicating the breadth and depth of Geberit's existing relationships, let alone earning the trust of key intermediaries who are vital for product adoption and market access. This established infrastructure acts as a powerful deterrent, making it exceptionally difficult for new players to gain a foothold.

Geberit's formidable brand reputation, built over 150 years, presents a significant barrier to new entrants. This deep-seated trust in quality, reliability, and innovation translates into strong customer loyalty, particularly among plumbing professionals and discerning end-users who rely on Geberit's consistent performance.

For any newcomer, replicating this ingrained preference would demand substantial investment in marketing and a lengthy period to establish a comparable track record. Consider that in 2023, Geberit reported net sales of CHF 3,446 million, underscoring its market presence and the financial resources it commands, which a new entrant would struggle to match initially.

Technological Expertise and R&D Investment

The sanitary products market is evolving rapidly, with innovation in smart technologies, water efficiency, and advanced materials becoming key differentiators. Geberit's significant and consistent investment in research and development, which amounted to CHF 162.3 million in 2023, is a testament to this trend. This focus on innovation allows Geberit to continuously develop new products and maintain its competitive advantage.

For potential new entrants, overcoming this barrier requires substantial capital outlay for research and development. They must be prepared to invest heavily to match or surpass Geberit's existing technological capabilities and product offerings. Without this commitment, new players would struggle to compete effectively in an innovation-led market.

- High R&D Expenditure: Geberit's 2023 R&D investment of CHF 162.3 million highlights the significant financial commitment required to innovate in the sanitary sector.

- Technological Sophistication: The market demands advanced solutions, from smart toilets to water-saving mechanisms, necessitating deep technical expertise.

- Intellectual Property: Established players like Geberit often hold patents and proprietary technologies, creating an additional hurdle for newcomers.

- Innovation Pace: Continuous product development and the rapid adoption of new materials and digital integrations mean new entrants must match this pace from the outset.

Regulatory Hurdles and Compliance

The sanitary industry faces significant regulatory hurdles that act as a barrier to new entrants. Companies must comply with a complex web of building codes, health, safety, and environmental regulations that vary by region. For instance, in 2024, the European Union continued to enforce stringent REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations, impacting the materials used in sanitary products. Navigating these requirements demands substantial investment in product testing and certification, a process that can delay market entry and increase initial operational costs considerably.

These stringent compliance standards can be a major deterrent for potential new competitors. For example, obtaining certifications like NSF/ANSI 61 for drinking water system components in North America involves rigorous testing and documentation. The sheer cost and time associated with meeting these diverse regulatory demands can make it difficult for smaller or less capitalized companies to enter the market, thereby protecting established players like Geberit.

- Regulatory Complexity: Sanitary products must meet diverse regional building codes, health, safety, and environmental standards.

- Compliance Costs: Meeting these standards involves significant investment in testing, certification, and legal expertise.

- Time to Market: The lengthy approval processes can delay product launches, a critical factor for new entrants.

- Established Player Advantage: Existing companies have already invested in and understand these regulatory frameworks.

The threat of new entrants for Geberit is generally low due to substantial capital requirements, established brand loyalty, and complex regulatory landscapes. These factors create significant hurdles for newcomers aiming to penetrate the sanitary products market.

New companies face immense upfront costs for manufacturing facilities and advanced technology, as evidenced by Geberit's 26 production plants. Furthermore, replicating Geberit's extensive distribution network, built over decades, requires considerable time and financial investment, making market access challenging.

Geberit's strong brand reputation, cultivated over 150 years, fosters customer loyalty, particularly among professionals. In 2023, Geberit's net sales of CHF 3,446 million illustrate its market dominance, which is difficult for new entrants to challenge initially.

The industry's rapid innovation, supported by Geberit's 2023 R&D investment of CHF 162.3 million, necessitates significant technological expertise and ongoing development. Additionally, navigating diverse and stringent regulatory requirements, such as REACH in the EU in 2024, adds substantial costs and time delays for new entrants.

Porter's Five Forces Analysis Data Sources

Our Geberit Porter's Five Forces analysis is built upon a foundation of credible data, including Geberit's annual reports, investor presentations, and industry-specific market research reports. This ensures a comprehensive understanding of the competitive landscape.