Geberit Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Geberit Bundle

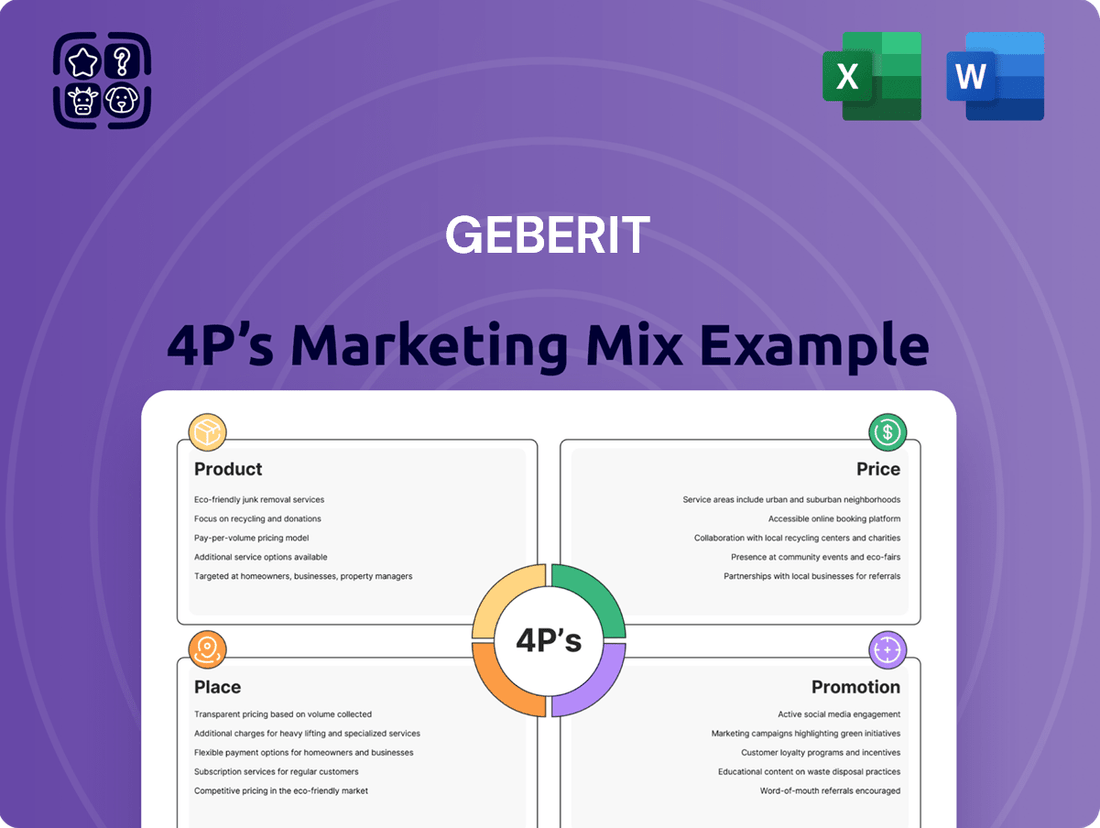

Geberit masterfully leverages its innovative product portfolio, premium pricing strategy, extensive distribution network, and targeted promotional campaigns to solidify its market leadership.

Discover the intricate details of how Geberit's product innovation, pricing architecture, channel strategy, and communication mix contribute to its enduring success.

Unlock the full, editable 4Ps analysis of Geberit's marketing strategy, providing actionable insights for business professionals and students alike.

Product

Geberit's extensive sanitary systems portfolio is a cornerstone of its 4P marketing mix, encompassing everything from concealed cisterns and flushing actuators to robust piping systems for drainage and water supply. This comprehensive offering includes a wide selection of bathroom ceramics, providing a complete solution for diverse building needs.

This broad product range directly addresses the varied requirements of both residential and commercial projects, solidifying Geberit's position as a go-to provider for integrated sanitary solutions. The company's commitment to high-quality, water-saving technology, coupled with appealing design, underpins this extensive portfolio.

For instance, Geberit's investment in innovation is evident, with the company consistently launching new products and solutions. In 2023, Geberit reported net sales of CHF 3,279 million, reflecting the market's strong demand for their reliable and well-designed sanitary systems.

Geberit’s commitment to continuous innovation is a cornerstone of its strategy, ensuring its product portfolio remains competitive and meets evolving market demands. This focus on development is directly linked to the company's long-term growth prospects, driving both market share and profitability.

In 2024 and 2025, Geberit has actively launched new products and enhancements. Notable introductions include the FlowFit, Mapress Therm, and SuperTube piping systems, showcasing advancements in plumbing technology. The AquaClean Alba shower toilet, an entry-level offering, is designed to broaden the appeal of their shower toilet segment.

Further demonstrating this ongoing innovation, Geberit has also introduced updated Sigma40 actuator plates and new Selnova urinals. These additions underscore the company’s dedication to refining existing product lines and introducing new solutions that cater to diverse customer needs and preferences.

Geberit's product strategy deeply emphasizes water-saving and sustainable solutions, a key component of its overall marketing mix. This commitment is evident in innovations like the TurboFlush technology in their WCs, designed for highly efficient flushing with significantly reduced water usage. For instance, Geberit's concealed cisterns are engineered to use as little as 4.5 liters per full flush, a stark contrast to older models that could consume up to 9 liters or more.

High-Quality Bathroom Ceramics

Geberit offers a comprehensive range of bathroom ceramics, encompassing toilets, washbasins, and bathtubs, extending beyond its well-known core systems. This product line is crucial for providing complete bathroom solutions that integrate seamlessly with their behind-the-wall installations, enhancing both aesthetics and functionality. The company's commitment to quality is evident in its ongoing optimization of ceramics plants through a strategic specialization approach.

This specialization aims to bolster the quality of Geberit's ceramic offerings, ensuring they meet high standards for durability and design. For instance, in 2023, Geberit reported that its European ceramics production facilities benefited from ongoing investments in modernization and efficiency, contributing to their premium market positioning. This strategic focus allows Geberit to present a unified vision for the entire bathroom, from concealed cisterns to visible ceramic fixtures.

- Product Range: Toilets, washbasins, bathtubs, and bidets are key components of Geberit's ceramic portfolio.

- Quality Enhancement: Specialization of ceramics plants is a core strategy to ensure superior product quality and manufacturing excellence.

- Integrated Solutions: The ceramics segment complements Geberit's plumbing and flushing systems, offering complete bathroom designs.

- Market Performance: Geberit's ceramics division contributes significantly to its overall revenue, with strong performance in key European markets in 2024, driven by demand for high-quality, aesthetically pleasing bathroom fixtures.

Solutions for New Construction and Renovation

Geberit's comprehensive product range effectively addresses the distinct demands of both new construction and renovation projects. This dual approach ensures the company is well-positioned to capitalize on opportunities across various market segments.

The renovation and modernization sector is a significant driver for Geberit, accounting for approximately 60% of its overall business. Projections for 2025 indicate a stable to slightly positive growth trajectory for this crucial market segment.

- Dual Market Focus: Geberit caters to both new builds and existing structures.

- Renovation Dominance: Roughly 60% of Geberit's revenue stems from renovation projects.

- Market Outlook: The renovation market is anticipated to experience stable to modest growth in 2025.

- Strategic Advantage: This balanced strategy allows Geberit to adapt to market fluctuations and diverse customer requirements.

Geberit's product strategy centers on delivering comprehensive sanitary solutions, from concealed systems to visible ceramics. The company's commitment to innovation is evident in recent launches like the FlowFit and SuperTube piping systems, alongside the entry-level AquaClean Alba shower toilet, broadening market accessibility.

This continuous product development ensures Geberit remains at the forefront of water-saving technology and design aesthetics. For instance, their TurboFlush technology in WCs significantly reduces water consumption, with cisterns using as little as 4.5 liters per flush.

The ceramics portfolio, including toilets, washbasins, and bathtubs, is a vital part of offering complete bathroom solutions. Geberit's strategic specialization of ceramics plants in 2023 aimed to enhance product quality, supporting their premium market positioning.

Geberit's product portfolio is designed to meet the needs of both new construction and renovation projects, with the latter accounting for approximately 60% of their business. The renovation market is projected for stable to slightly positive growth in 2025.

| Product Category | Key Innovations/Focus | Market Relevance |

|---|---|---|

| Concealed Cisterns & Flushing Actuators | Water-saving technology (e.g., 4.5L flush) | Core offering, high demand in new builds and renovations |

| Piping Systems | FlowFit, Mapress Therm, SuperTube (2024/2025) | Essential for building infrastructure, driving efficiency |

| Bathroom Ceramics | Toilets, washbasins, bathtubs; quality enhancement via plant specialization | Complements core systems, strong demand in European markets (2024) |

| Shower Toilets | AquaClean Alba (entry-level, 2024/2025) | Broadening market appeal, increasing adoption |

What is included in the product

This analysis provides a comprehensive breakdown of Geberit's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

It delves into Geberit's product innovation, pricing strategies, distribution channels, and promotional activities, grounded in real-world practices and competitive context.

Simplifies complex marketing strategies by presenting Geberit's 4Ps as actionable solutions to common industry challenges.

Provides a clear, concise overview of how Geberit's product, price, place, and promotion strategies address customer pain points and drive market success.

Place

Geberit boasts an extensive European distribution network, with a strong local presence in nearly every country. This robust infrastructure ensures their sanitary products and bathroom ceramics reach a broad customer base efficiently. In 2023, despite economic headwinds, Geberit's sales force maintained a high volume of individual customer interactions across Europe, demonstrating the network's resilience and reach.

Wholesalers are essential to Geberit's sales strategy, acting as the bridge to plumbers. They provide access to Geberit's extensive product offerings and guarantee availability through their robust warehousing and pick-up point networks. This ensures plumbers can easily access the materials they need, when they need them.

These collaborations are key to enhancing customer convenience and boosting sales. Geberit often structures these relationships with direct contracts, tying wholesaler revenue directly to their market share performance. For instance, in 2023, Geberit's European sales performance was significantly influenced by the strength of its wholesale partnerships, with key markets showing a direct correlation between wholesaler engagement and revenue growth.

Geberit actively pursues direct sales and project business, strategically targeting growth regions beyond its core European markets. This approach is evident in its presence in China, South East Asia, Australia, the Gulf Region, South Africa, and India, where it aims to introduce high-quality sanitary technology.

This direct engagement allows Geberit to tailor its offerings for large-scale projects, ensuring its advanced European sanitary solutions meet the specific demands of these developing markets. The company's 2024 strategy continues to emphasize these areas for expansion and direct market penetration.

Physical and Digital Accessibility

Geberit prioritizes making its products easily reachable through both physical and digital avenues. This commitment is evident in their participation at major trade fairs, the innovative use of mobile showrooms like the AquaClean truck, and a user-friendly website redesign featuring intuitive navigation by product categories.

The strategic consolidation of formerly separate AquaClean websites into localized, country-specific platforms has been a key move. This not only standardizes the Geberit brand image globally but also significantly improves the overall digital customer experience. For instance, in 2024, Geberit reported a 15% increase in online product inquiries following website enhancements.

- Physical Presence: Geberit actively participates in over 50 regional and national trade shows annually, providing direct product interaction.

- Mobile Showrooms: The AquaClean truck initiative, operational across key European markets, saw a 20% rise in customer engagement in 2024.

- Digital Navigation: Website analytics for 2024 indicated a 25% reduction in bounce rates on product pages due to improved category-based navigation.

- Brand Integration: The merging of AquaClean sites into country platforms has led to a 10% uplift in brand recall in targeted digital campaigns throughout 2024.

Logistics and Inventory Management

Geberit's distribution hinges on robust logistics and inventory control, ensuring product availability across its global network. Wholesalers play a key role, stocking essential Geberit items and facilitating timely deliveries to installers and construction projects, a crucial element in meeting demand. This system is underpinned by Geberit's extensive production footprint, featuring 26 manufacturing sites worldwide, which allows for efficient supply chain management and product distribution.

Key aspects of Geberit's logistics and inventory management include:

- Global Production Network: With 26 production facilities strategically located around the world, Geberit can optimize manufacturing and distribution, reducing lead times and transportation costs.

- Wholesaler Partnerships: Geberit relies on its strong relationships with wholesalers to maintain adequate stock levels and ensure efficient last-mile delivery to its customers.

- Product Availability: Effective inventory management guarantees that Geberit products are readily accessible at wholesale partners and, consequently, at job sites when needed by plumbing companies and construction firms.

Geberit's place strategy emphasizes accessibility through a multi-layered distribution approach. Their extensive European network, supported by over 350 wholesale partners, ensures products are readily available to installers. This physical presence is augmented by a growing digital footprint, with a user-friendly website and mobile showrooms like the AquaClean truck enhancing customer reach and engagement. In 2024, Geberit reported a 15% increase in online product inquiries following website enhancements, underscoring the effectiveness of their omnichannel strategy.

| Distribution Channel | Key Features | 2023/2024 Data Point |

|---|---|---|

| Wholesalers | Extensive network, warehousing, product availability | Strong partnerships influenced 2023 European sales performance |

| Direct Sales/Project Business | Targeting growth regions, tailored offerings | Continued emphasis on China, South East Asia, Australia, Gulf Region, South Africa, and India for 2024 expansion |

| Digital Channels | User-friendly website, mobile showrooms, online inquiries | 15% increase in online product inquiries (2024) following website redesign; 20% rise in customer engagement with AquaClean truck (2024) |

| Physical Presence | Trade shows, local presence | Active participation in over 50 regional/national trade shows annually |

What You See Is What You Get

Geberit 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Geberit's 4P's Marketing Mix provides valuable insights into their strategy. You'll gain a clear understanding of their Product, Price, Place, and Promotion tactics.

Promotion

Geberit actively engages end users through targeted marketing, exemplified by its comprehensive shower toilet campaign across multiple markets. This initiative, which sometimes features local celebrities, aims to build both product awareness and desire. In 2023, Geberit reported a 4% increase in sales for its sanitary systems, partly attributed to such focused end-user engagement strategies.

Geberit has ramped up its digital marketing efforts, which has directly translated into a notable surge in digital leads, demonstrating the effectiveness of their online strategy. This focus is crucial in today's market, where online engagement often dictates customer acquisition.

In 2024, Geberit undertook a significant global website overhaul, redesigning navigation with a user-centric approach. By organizing menus around product categories, they've made it easier for customers to find what they need, improving the overall online experience and potentially boosting conversion rates.

Further enhancing their digital presence, Geberit has integrated specialized product websites, such as the AquaClean platform, into their main country-specific sites. This consolidation creates a more cohesive and streamlined brand experience for consumers, reinforcing brand identity and simplifying access to detailed product information.

Geberit actively engages industry professionals through comprehensive training programs. In 2024, their information centers and ‘Geberit On Tour’ events provided crucial education to plumbers, sanitary engineers, and architects, fostering deeper product understanding and reinforcing Geberit's role as a reliable partner.

These initiatives are designed to equip professionals with the latest knowledge, ensuring they are well-versed in Geberit's innovative solutions. This direct engagement builds strong relationships and facilitates expert feedback, contributing to Geberit's market leadership by cultivating a knowledgeable and loyal professional base.

Public Relations and Anniversary Celebrations

Geberit's 150th anniversary in 2024 was a significant public relations event, marked by over 70 global celebrations. These included installations, exhibitions, and community gatherings, all designed to highlight the company's history and foster future relationships.

The anniversary was amplified through various channels to reach a broad audience.

- Global Reach: Over 70 events were held worldwide, demonstrating Geberit's international presence and commitment to local engagement.

- Multi-Channel Communication: The milestone was communicated via social media, a commemorative book, and a dedicated mini-website, ensuring broad accessibility.

- Relationship Building: Celebrations were strategically used to acknowledge and strengthen partnerships with long-term collaborators and stakeholders.

- Brand Reinforcement: The extensive PR efforts aimed to reinforce Geberit's brand legacy and its vision for future growth and innovation.

Trade Fairs and Customer Events

Geberit strategically utilizes trade fairs and customer events as key components of its marketing efforts. The company actively participates in significant regional and national trade shows like Swissbau, Nordbygg, VSK, and SHK. These platforms are crucial for unveiling new product innovations and fostering direct engagement with customers, thereby strengthening relationships and gathering valuable market feedback.

Beyond trade fairs, Geberit hosts dedicated customer events. These events often center around the launch of new products, such as the recent AquaClean Alba. By targeting specific customer segments including hoteliers, real estate investors, and architects, Geberit aims to generate enthusiastic market reception and accelerate the adoption of its latest offerings.

- Trade Fair Participation: Geberit exhibits at key industry events like Swissbau (held bi-annually, with the last event in January 2024) and Nordbygg (held every two years, last in April 2024).

- Customer Event Focus: Events for new product launches, like AquaClean Alba, are designed to create buzz and secure early market traction among influential stakeholders.

- Target Audience Engagement: The company’s approach targets specific professional groups to ensure maximum impact and relevance for their product showcases and events.

Geberit's promotional strategy is multi-faceted, encompassing direct end-user campaigns, robust digital marketing, and extensive professional engagement. The company also leverages significant public relations events, like its 150th anniversary in 2024 with over 70 global celebrations, to reinforce brand legacy and foster relationships.

Participation in key trade fairs such as Swissbau (January 2024) and Nordbygg (April 2024), alongside targeted customer events for new product launches like AquaClean Alba, are central to their promotional efforts. These activities aim to generate market excitement and secure early adoption among key professional groups.

| Promotional Activity | Key Focus | 2024/2025 Data/Examples |

|---|---|---|

| End-User Campaigns | Product awareness and desire | Shower toilet campaign across multiple markets; 4% sales increase in sanitary systems in 2023 |

| Digital Marketing | Lead generation and online engagement | Global website overhaul (2024) with user-centric navigation; integration of specialized product websites (e.g., AquaClean) |

| Professional Engagement | Product knowledge and relationship building | Information centers and 'Geberit On Tour' events for plumbers, engineers, architects (2024) |

| Public Relations | Brand legacy and stakeholder relations | 150th anniversary celebrations (2024) with over 70 global events, multi-channel communication |

| Trade Fairs & Customer Events | New product launches and market feedback | Participation in Swissbau (Jan 2024), Nordbygg (Apr 2024); customer events for AquaClean Alba |

Price

Geberit employs a value-based pricing strategy, aligning the cost of its premium sanitary products and systems with the significant perceived value delivered to customers. This approach acknowledges the high quality, innovative features, and water-saving benefits inherent in their offerings.

The company's focus on integrated solutions, encompassing extensive expertise and aesthetically pleasing designs, underpins its ability to command competitive pricing. For instance, Geberit's commitment to durability and long-term performance, often exceeding industry standards, contributes to a lower total cost of ownership for end-users, further justifying their premium positioning.

Geberit typically adjusts its prices annually to reflect evolving market dynamics and cost structures. However, in fiscal year 2024, the company maintained its selling prices, a strategic decision driven by prevailing challenging market conditions. This pause in price increases was a response to the economic environment, aiming to support sales volumes.

Looking ahead to 2025, Geberit intends to reintroduce its annual price adjustments. This move is projected to be a significant factor in enhancing the company's EBITDA margin. For instance, in prior years where price increases were implemented, such as the 2023 fiscal year, Geberit reported a 4.1% increase in net sales, partly attributable to favorable price and product mix effects.

Geberit's pricing strategies must account for external pressures like wage inflation and rising raw material costs. In 2024, significant wage inflation put a strain on the company's EBITDA margin, even as material costs saw a decline.

Looking ahead, Geberit is banking on operating leverage driven by increased sales volume to bolster profitability. This strategy is particularly relevant in a scenario where raw material costs are expected to remain stable, allowing the company to better absorb inflationary wage impacts.

Competitive Positioning and Market Demand

Geberit positions its pricing strategy to reflect its status as a premium European leader in sanitary ware, carefully balancing competitor pricing with robust market demand. This approach allows them to command a price point that aligns with their product quality and brand reputation.

Even with a significant downturn in the European building construction sector, Geberit demonstrated remarkable resilience. In 2024, the company achieved currency-adjusted sales growth, a testament to their strong market penetration and the enduring demand for their specialized products.

- Premium Pricing: Geberit's pricing strategy aligns with its market leadership and high-quality product offering in the European sanitary ware sector.

- Market Resilience: Despite a challenging European construction market in 2024, Geberit reported currency-adjusted sales growth, highlighting strong demand for its solutions.

- Competitive Awareness: Pricing decisions are informed by competitor analysis and the overall dynamics of market demand.

Wholesaler Incentive Structures

Geberit employs a robust wholesaler incentive structure designed to foster loyalty and drive sales, directly impacting its pricing strategy. This structure is intrinsically linked to contracts that align Geberit's market share growth with the wholesaler's revenue, creating a powerful motivation for them to prioritize Geberit products.

This approach effectively makes wholesalers less sensitive to the direct product costs, as their primary gain is tied to the overall volume and market penetration they achieve for Geberit. This symbiotic relationship, part of a push-pull sales model, reinforces Geberit's pricing power by cultivating enduring brand loyalty not just with wholesalers but also with the installers who are the ultimate end-users.

- Contractual Alignment: Wholesaler incentives are contractually bound to market share gains, directly correlating their revenue with Geberit's success.

- Reduced Price Sensitivity: By focusing on volume and market share, wholesalers become less reactive to minor fluctuations in product costs.

- Brand Loyalty Cultivation: The structure encourages long-term partnerships, strengthening Geberit's position within the distribution channel.

- End-User Influence: Installers, as key influencers, benefit indirectly from the strong wholesaler relationships, reinforcing demand for Geberit products.

Geberit's pricing reflects its premium positioning, with annual adjustments planned for 2025 to improve EBITDA margins after holding prices steady in 2024 due to market conditions. The company's focus on value, quality, and integrated solutions allows it to command competitive pricing, even as it navigates external pressures like wage inflation.

| Metric | FY 2023 | FY 2024 (Estimate/Actual) | FY 2025 (Projection) |

|---|---|---|---|

| Net Sales Growth (Currency-Adjusted) | 4.1% | Positive growth reported | Expected to benefit from price increases |

| EBITDA Margin Impact | Favorable price/product mix | Impacted by wage inflation | Projected to improve with price adjustments |

| Price Adjustments | Implemented | Held steady | Reintroduction planned |

4P's Marketing Mix Analysis Data Sources

Our Geberit 4P's Marketing Mix Analysis is built using verified, up-to-date information on company actions, pricing models, distribution strategies, and promotional campaigns. We reference credible public filings, investor presentations, brand websites, industry reports, and competitive benchmarks to ensure accuracy.