Geberit Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Geberit Bundle

Curious about Geberit's product portfolio strength? This glimpse into their BCG Matrix reveals the strategic positioning of their offerings, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture; purchase the complete BCG Matrix for actionable insights and a clear roadmap to optimizing Geberit's market performance.

Stars

The Geberit AquaClean range, particularly the 2024 introduction of the AquaClean Alba, is classified as a Star within the BCG Matrix. This product line leverages advanced shower toilet technology, featuring innovations like TurboFlush and WhirlSpray, to meet increasing consumer demand for enhanced bathroom hygiene and comfort.

The AquaClean Alba's competitive pricing strategy is designed to attract new customer demographics, capitalizing on a market trend that seeks both cutting-edge features and value. This positioning suggests significant potential for market share growth in a segment experiencing rapid expansion.

Geberit's FlowFit and Mapress Therm piping systems are considered Stars in the BCG matrix. This classification stems from their robust growth trajectory and significant strategic value to the company. These systems, bolstered by innovations like the new SuperTube, underscore Geberit's commitment to expanding its presence in the piping sector.

The success of these piping solutions is directly linked to continuous product development and effective market strategies. Even amidst challenging economic environments, these initiatives have consistently contributed to Geberit's overall sales performance, demonstrating their market strength and customer appeal.

Geberit’s commitment to innovation is evident in its installation and flushing systems, with a focus on new products introduced in 2024 and planned for 2025. These advancements, such as upgraded Duofix elements and the new Renova/Selnova urinal series (S, M, L), are designed to capture market share. The integration of TurboFlush technology across an expanded range of WCs further solidifies Geberit's position in driving volume and enhancing functionality.

Digitalization and IT Projects

Geberit's commitment to digitalization and IT projects is a significant driver of its future growth, positioning it as a potential Star in the BCG Matrix. These investments are designed to enhance customer experience and streamline internal processes, fostering a competitive advantage. For instance, in 2024, Geberit continued to invest heavily in its digital infrastructure, aiming to improve data analytics capabilities for better market insights and personalized customer engagement.

These initiatives are vital for maintaining and expanding Geberit's market share. By leveraging technology, the company can introduce innovative solutions and optimize its supply chain, ensuring efficient delivery and customer satisfaction. The focus on digital transformation directly supports the launch of new products and services, a key characteristic of Star businesses.

While digitalization itself isn't a tangible product, its strategic importance cannot be overstated. Geberit's ongoing expenditure in this area, with significant allocations in 2024 for cloud migration and AI-powered customer service tools, underscores its role as a future growth engine. This forward-thinking approach is crucial for navigating the evolving demands of the building materials sector.

- Digitalization Investment: Geberit's strategic allocation of capital towards IT and digital transformation in 2024 aims to bolster market position and operational efficiency.

- Market Strengthening: These projects are critical for enhancing customer interaction and supporting the introduction of new, technologically advanced products.

- Competitive Edge: The ongoing focus on digital innovation helps Geberit maintain a strong competitive stance in a dynamic and evolving industry landscape.

- Future Growth Driver: Investments in areas like data analytics and AI are foundational to Geberit's strategy for sustained future growth and market leadership.

Expansion in Emerging Markets (India and Gulf Region)

Geberit is strategically expanding its footprint beyond its traditional European strongholds, with a particular focus on high-growth emerging markets like India and the Gulf region. These areas represent significant opportunities due to robust demand for modern sanitary solutions.

The company's investment in these regions reflects a clear understanding of their potential. For instance, the Gulf Cooperation Council (GCC) countries are projected to see continued infrastructure development and a rising middle class, driving demand for quality building materials. India, with its rapidly urbanizing population and increasing disposable incomes, presents a vast untapped market for Geberit's innovative products.

- India's construction market is expected to reach $1.4 trillion by 2025, presenting substantial opportunities for sanitary product suppliers.

- The GCC construction sector, valued at over $2.5 trillion in 2023, continues to invest heavily in residential and commercial projects, boosting demand for bathroom fittings.

- Geberit's increased market presence in these regions signifies a proactive approach to capturing market share in areas poised for significant long-term growth.

The Geberit AquaClean range, exemplified by the 2024 AquaClean Alba, is a prime example of a Star product. Its innovative features like TurboFlush and WhirlSpray cater to growing consumer demand for enhanced bathroom hygiene and comfort, driving significant market penetration. The strategic pricing of the Alba further broadens its appeal, targeting new customer segments within an expanding market.

Geberit's FlowFit and Mapress Therm piping systems, enhanced by innovations like SuperTube, are also classified as Stars. These systems demonstrate strong growth and strategic importance, consistently contributing to sales even in challenging economic conditions. Their success highlights Geberit's commitment to product development and effective market strategies in the piping sector.

Geberit's investment in digitalization, including cloud migration and AI tools in 2024, positions its IT and digital projects as potential Stars. These initiatives aim to improve customer experience and internal efficiency, fostering a competitive edge. This focus on digital transformation is crucial for launching new products and maintaining market leadership.

Geberit's strategic expansion into high-growth markets like India and the Gulf region, driven by increasing demand for modern sanitary solutions, also signifies Star potential. India's construction market is projected to reach $1.4 trillion by 2025, while the GCC construction sector was valued at over $2.5 trillion in 2023, indicating substantial opportunities for Geberit's product offerings.

| Product/Initiative | BCG Category | Rationale | Key Data Point |

| AquaClean Range (incl. Alba) | Star | High growth, strong market share driven by innovation and demand for hygiene. | 2024 introduction of Alba targets new demographics. |

| FlowFit & Mapress Therm Piping | Star | Robust growth and strategic value, supported by innovations like SuperTube. | Consistent sales contribution despite economic challenges. |

| Digitalization & IT Projects | Potential Star | Strategic investments in 2024 for enhanced customer experience and efficiency. | Focus on cloud migration and AI tools for future growth. |

| Emerging Market Expansion (India, Gulf) | Potential Star | Targeting high-growth regions with increasing demand for sanitary solutions. | India's construction market forecast at $1.4 trillion by 2025. |

What is included in the product

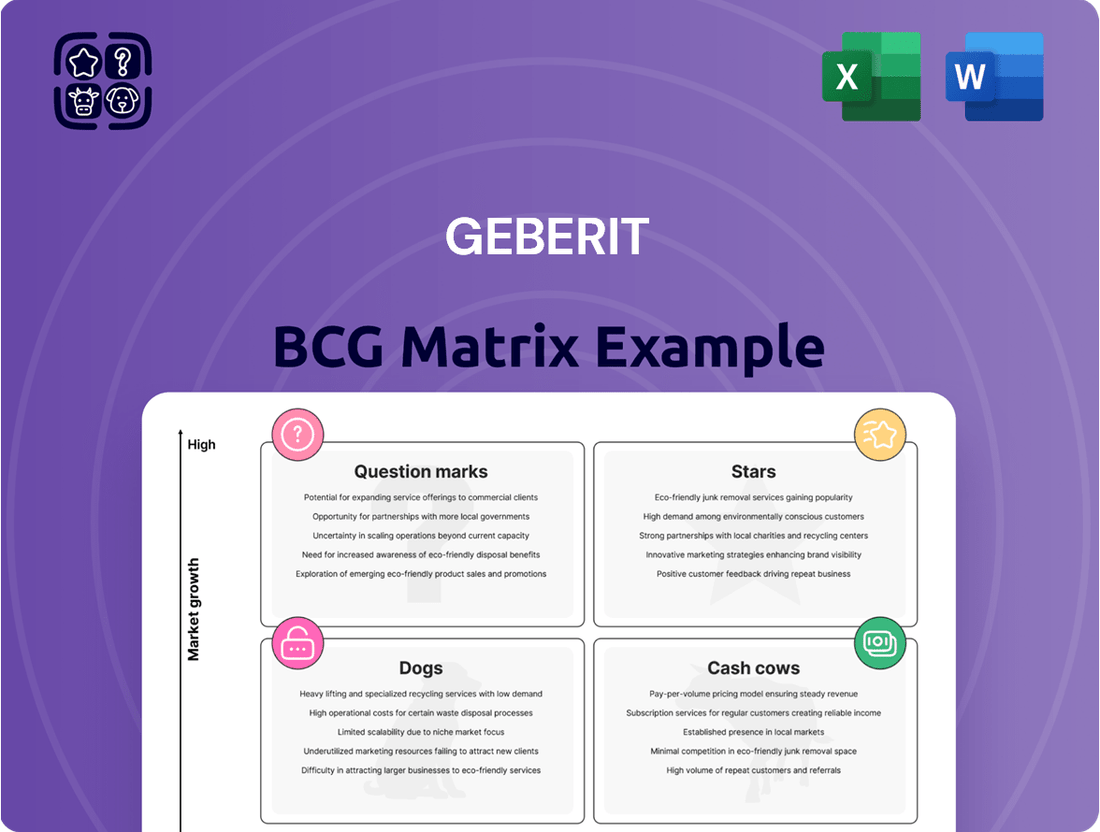

The Geberit BCG Matrix categorizes products into Stars, Cash Cows, Question Marks, and Dogs.

It guides investment decisions by identifying high-growth, high-share products (Stars) and stable, high-share products (Cash Cows).

The Geberit BCG Matrix provides clarity on business unit performance, easing the pain of resource allocation decisions.

Cash Cows

Geberit's concealed cistern systems, a product line dating back to 1964, are a prime example of a Cash Cow within the company's portfolio. These systems hold a significant market share in the mature bathroom fixtures segment, consistently generating substantial cash flow. Their established reliability and integration into modern bathroom designs mean they require minimal ongoing marketing expenditure.

Geberit's established standard piping systems represent a significant cash cow. These mature products, including long-standing offerings beyond newer innovations like FlowFit and Mapress Therm, cater to a stable market demanding dependable water supply and drainage. Their extensive use and proven reliability translate into consistent, high profit margins.

Geberit's core bathroom ceramics, encompassing toilets, washbasins, and bathtubs, represent a classic Cash Cow within its product portfolio. These foundational offerings have long secured a substantial market share in a mature and steady market.

Despite ongoing innovation in the broader bathroom sector, this core range consistently generates robust revenue and healthy profit margins. While growth prospects are more modest compared to newer, high-tech solutions, their reliability makes them a stable income stream for Geberit.

Renovation Market Focus in Europe

The renovation market in Europe is a cornerstone of Geberit's operations, representing about 60% of its total business. This segment is classified as a Cash Cow due to its consistent revenue generation and stable performance, even when the broader construction landscape faces headwinds.

Signs of a healthy recovery are particularly evident in key European markets like Germany and the Nordic countries. Despite a challenging environment for new construction projects, the renovation sector continues to demonstrate stable, and in some areas, slightly positive development, underscoring its resilience.

- Renovation Market Dominance: Approximately 60% of Geberit's revenue stems from the European renovation market.

- Market Resilience: This segment shows stable and slightly positive development, even with challenges in new construction.

- Geographic Strength: Recovery signals are particularly strong in Germany and Nordic countries.

- Consistent Demand: Geberit's established presence and solutions ensure reliable cash flow from renovations.

European Market Dominance

Geberit's commanding presence across Europe firmly places its core plumbing and bathroom solutions in the Cash Cow quadrant of the BCG Matrix. This strong local leadership, particularly in established markets, allows the company to consistently generate significant profits.

Even with headwinds in the European building construction sector, Geberit has demonstrated remarkable resilience, successfully defending its market share and sustaining profitability. For instance, in 2023, Geberit reported a net sales growth of 4.4% to CHF 3,448 million, underscoring its stable performance in mature markets.

- Market Leadership: Geberit holds leading positions in many European countries for its sanitary technology.

- Profitability: Despite mature market conditions, the company maintains strong profitability in its core European operations.

- Cash Generation: This stable cash flow from European dominance provides crucial funding for innovation and expansion into new markets or product lines.

- Resilience: Geberit's ability to maintain market share and profitability in a challenging construction environment highlights the strength of its Cash Cow status.

Geberit's established concealed cistern systems, a product line with a legacy dating back to 1964, are a quintessential Cash Cow. These systems command a significant market share in the mature bathroom fixtures segment, consistently yielding substantial cash flow with minimal marketing investment due to their inherent reliability and widespread adoption in modern bathroom designs.

Geberit's core bathroom ceramics, including toilets and washbasins, also represent a classic Cash Cow. These foundational products maintain a substantial market share in a stable, mature market, consistently generating robust revenue and healthy profit margins despite more modest growth prospects compared to newer, innovative solutions.

The European renovation market, accounting for roughly 60% of Geberit's business, functions as a significant Cash Cow. This segment demonstrates consistent revenue generation and stable performance, even amidst challenges in the broader construction sector, with particular resilience noted in Germany and the Nordic countries.

| Product Category | BCG Matrix Status | Key Characteristics | 2023 Performance Indicator |

| Concealed Cistern Systems | Cash Cow | High Market Share, Mature Market, Low Investment Needs | Consistent Revenue Generation |

| Core Bathroom Ceramics | Cash Cow | Established Brand, Stable Demand, Strong Profitability | Robust Revenue and Healthy Margins |

| European Renovation Market | Cash Cow | Dominant Market Position, Resilient Demand, Stable Cash Flow | 4.4% Net Sales Growth (Overall Company) |

Preview = Final Product

Geberit BCG Matrix

The Geberit BCG Matrix document you are currently previewing is the exact, fully formatted report you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises—just the comprehensive strategic analysis ready for your immediate use. You can confidently assess Geberit's product portfolio, understanding their Stars, Cash Cows, Question Marks, and Dogs, with the assurance that the purchased file is identical to this preview. This allows for immediate integration into your business planning, competitive analysis, or strategic decision-making processes without any need for further refinement.

Dogs

Older, less efficient urinal models, lacking advanced water-saving and hygiene features, are likely positioned as Dogs in the Geberit BCG Matrix. These products, while potentially still generating some revenue, face declining market share and limited growth prospects as newer, more sustainable alternatives gain traction. For instance, models predating significant water efficiency mandates might represent a shrinking segment of the market.

Certain legacy bathroom furniture lines, particularly those not incorporating current design aesthetics or smart home functionalities, could be classified as Dogs in the BCG Matrix. These products may struggle to gain traction in a market increasingly demanding innovation and connectivity.

If these older furniture collections hold a low market share within a slow-growing segment of the bathroom furnishings market, they risk becoming resource drains. Geberit's strategic emphasis on advanced bathroom systems and digital solutions indicates a potential move to de-emphasize less competitive, older product lines that do not align with future growth strategies.

Products facing declining sales in Western and Northern Europe, as observed in 2024, might be categorized as Dogs within the Geberit BCG Matrix. Despite Geberit's overall European sales growth, these specific regions experienced downturns, suggesting certain products or segments are losing ground in a sluggish market.

Non-Strategic or Divested Business Units (e.g., Shower Enclosure Business)

Geberit's divestiture of its shower enclosure business in 2024 exemplifies a strategic move away from segments with limited growth potential or a suboptimal strategic fit.

This decision likely stemmed from the business unit's performance, potentially characterized by a low market share within a competitive landscape or a lack of synergy with Geberit's main plumbing and sanitary ware offerings.

Such divestitures are common when a business unit is perceived as a cash trap, consuming resources without generating sufficient returns or contributing to the company's long-term strategic objectives.

For instance, in 2023, Geberit's net sales reached CHF 3,444 million, with a focus on core areas like sanitary systems and the bathroom ceramics division, highlighting where the company directs its strategic investments.

Niche Products with Limited Market Appeal

Niche products within Geberit's extensive range that serve a very small market and show no indication of growth could be classified as Dogs. These specialized offerings might manage to cover their costs but do not significantly boost Geberit's overall growth or profitability. They can also tie up valuable resources that could be more effectively utilized in other areas.

Without specific product data, this category represents underperforming, highly specialized items within Geberit's portfolio. For instance, a particular type of niche plumbing fitting designed for a very specific, outdated building code might fall into this group. Such products, while potentially still functional, lack the broad market appeal necessary for significant revenue generation.

- Limited Market Reach: Products catering to extremely small or specialized customer segments.

- Stagnant Growth: Little to no projected expansion in demand or sales volume.

- Resource Drain: Potential for tying up capital and operational capacity without substantial returns.

Products in the Dogs category for Geberit represent offerings with low market share in slow-growing segments, potentially consuming resources without significant returns. For example, older urinal models lacking modern water-saving features or legacy bathroom furniture lines not aligned with current design trends fit this profile. Geberit's strategic divestment of its shower enclosure business in 2024 highlights a move away from such underperforming or strategically misaligned units.

| Product Category Example | Market Share | Market Growth | Strategic Implication |

|---|---|---|---|

| Legacy Urinal Models | Low | Declining | Potential divestment or phase-out |

| Outdated Bathroom Furniture | Low | Slow | Focus on modernization or discontinuation |

| Niche, Low-Demand Fittings | Very Low | Stagnant | Resource reallocation |

Question Marks

Geberit's broader smart bathroom solutions, extending beyond their well-known shower toilets, could be classified as Question Marks in the BCG matrix. While the overall smart bathroom market is experiencing robust growth, projected to reach over $12 billion globally by 2025, Geberit's penetration into adjacent smart product categories like faucets, mirrors, and bathtubs may currently be limited.

These emerging smart bathroom segments demand substantial investment in research, development, and marketing to capture significant market share. Without this dedicated focus, these product lines risk remaining Question Marks, requiring careful strategic decisions to either invest heavily to transition them into Stars or divest if they fail to gain traction.

Newly introduced products in their very early stages, where market adoption is still uncertain, represent Geberit's Question Marks. These innovations, such as their advanced smart bathroom solutions, are in a high-growth market segment but currently hold a low market share. Geberit's R&D spending in 2023 was CHF 194 million, reflecting significant investment in these nascent product lines.

Products heavily reliant on new residential construction in markets like China, which is currently experiencing a downturn, would be classified as Question Marks for Geberit. Despite Geberit's global presence, the specific segment targeting new builds in China faces considerable headwinds.

While these products could see substantial growth if the Chinese construction market rebounds, their current market share is low due to these challenging conditions. For instance, China's property investment saw a significant decline of 9.8% year-on-year in the first four months of 2024, impacting demand for construction materials.

Sustainable or Eco-Design Focused Products (New Initiatives)

Geberit's new initiatives in sustainable and eco-design focused products, while strategically vital for future growth and aligning with their strong commitment to environmental responsibility, are likely positioned as Question Marks in the BCG Matrix. These products, though innovative, are in nascent stages of market development. For instance, Geberit's focus on water-saving technologies and recycled materials in their product lines represents this category. In 2024, the global market for green building materials was projected to reach over $300 billion, indicating a growing but still evolving demand for eco-conscious solutions.

The challenge for these new eco-design products lies in building market awareness and adoption. Geberit's investment in research and development for these lines is significant, but the competitive landscape for highly specialized sustainable products is still maturing. This necessitates substantial marketing efforts and capital expenditure to carve out market share. For example, the company might be investing in advanced manufacturing processes for biodegradable components, a field where consumer understanding and preference are still being cultivated.

- Early Market Adoption: New eco-design products face the hurdle of consumer education and acceptance, impacting initial sales volumes.

- High Investment Needs: Significant R&D and marketing expenditure are required to establish these sustainable offerings in the market.

- Developing Competitive Landscape: The market for highly specialized eco-friendly building products is still forming, presenting both opportunities and uncertainties.

- Strategic Importance: Despite early challenges, these initiatives are crucial for Geberit's long-term sustainability goals and brand positioning.

Advanced Digital Services for Installers/End-Users

Geberit's advanced digital services for installers and end-users represent a classic Question Mark in the BCG matrix. While the company is actively investing in digitalization, the market's full embrace and revenue generation from these specific offerings are still in their formative stages. This segment shows promise for high growth, but its current market share is relatively small, reflecting the evolving adoption curve.

The potential for these digital tools, such as augmented reality for installation guidance or smart home integration for end-users, is substantial. However, the challenge lies in achieving critical mass and demonstrating clear value propositions that drive widespread uptake. For instance, while Geberit has been a leader in sustainable building solutions, the digital integration into the installer workflow is a newer frontier. By 2024, the digital services market within the construction sector, including sanitary installations, is seeing increased investment, but specific market share data for Geberit's digital offerings in this niche remains under development.

- High Growth Potential: The increasing demand for smart building solutions and efficient installation processes fuels the growth prospects for Geberit's digital services.

- Nascent Market Share: Despite investment, widespread adoption and significant revenue generation from these advanced digital services are still developing, indicating a low current market share.

- Investment Focus: Geberit's commitment to digitalization means continued resource allocation to enhance and promote these services, aiming to shift them towards Stars.

- Evolving Market Adoption: The success hinges on installers and end-users recognizing the tangible benefits, such as time savings and improved accuracy, which will drive future market penetration.

Geberit's new product lines in smart home integration and advanced digital services for installers are prime examples of Question Marks. These areas represent high-growth markets, but Geberit's current market share within them is still developing. Significant investment in research, development, and market penetration is required to elevate these offerings.

The company's strategic focus on these nascent technologies, such as augmented reality installation aids and smart bathroom connectivity, underscores their potential. However, the success of these ventures hinges on consumer adoption and the competitive landscape, which is still solidifying. Geberit's 2023 R&D expenditure of CHF 194 million highlights their commitment to nurturing these emerging product categories.

These innovative segments require substantial capital to mature, facing the classic dilemma of Question Marks: either become Stars through aggressive investment or be divested if they fail to gain traction. The global smart home market, for instance, is projected for substantial growth, but specific niches like smart bathroom controls are still capturing market share.

Geberit's expansion into new geographic markets with existing, but not yet dominant, product lines can also be viewed as Question Marks. While the company has a strong global presence, entering or expanding in regions where brand recognition or product acceptance is still building necessitates focused marketing and distribution efforts.

| Product Category | Market Growth | Geberit Market Share | BCG Classification | Strategic Implication |

| Smart Bathroom Solutions | High | Low to Medium | Question Mark | Invest for growth or divest |

| Digital Installer Services | High | Low | Question Mark | Develop and promote |

| New Geographic Market Entry | Varies | Low | Question Mark | Market penetration strategy |

BCG Matrix Data Sources

Our Geberit BCG Matrix is constructed using a blend of internal financial reports, comprehensive market research, and competitor sales data to accurately assess product performance and market share.