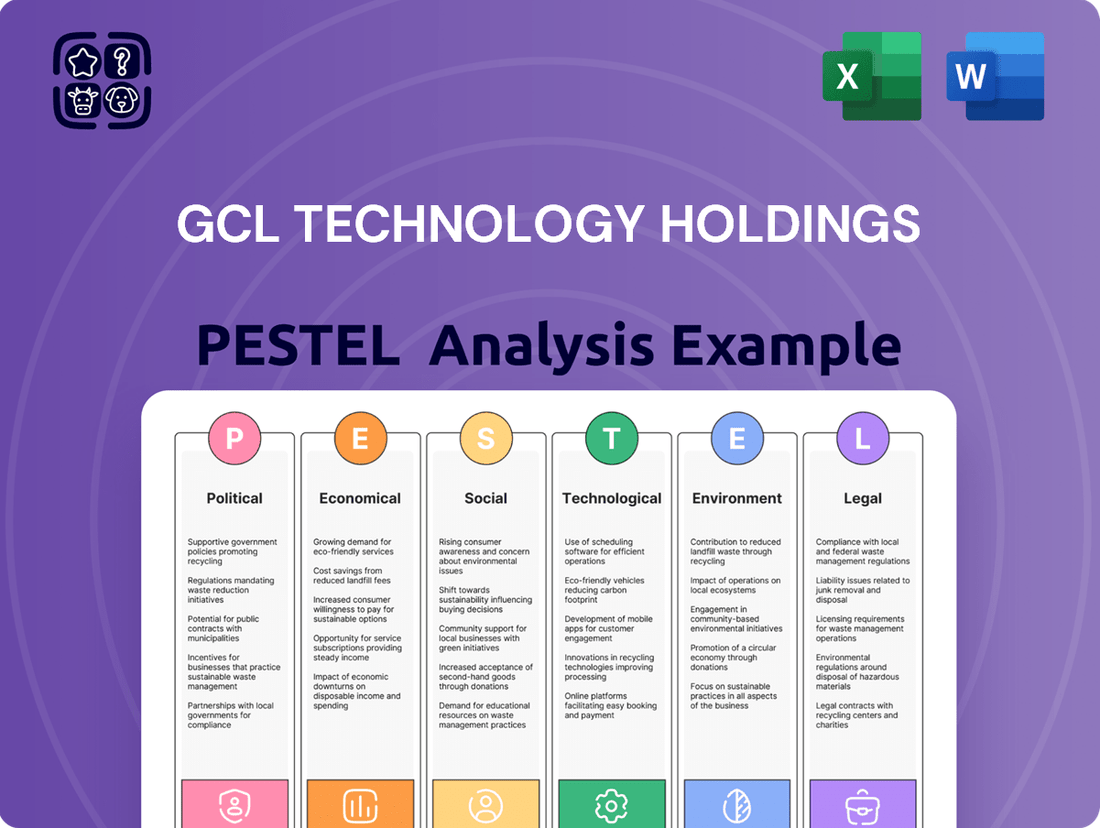

GCL Technology Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GCL Technology Holdings Bundle

Uncover the critical external factors influencing GCL Technology Holdings's trajectory with our comprehensive PESTLE analysis. From evolving governmental policies impacting renewable energy to shifting economic landscapes and technological advancements in solar, this analysis provides actionable intelligence. Equip yourself with the insights needed to anticipate challenges and capitalize on emerging opportunities. Download the full PESTLE analysis now and gain a strategic advantage.

Political factors

Government policies and incentives, especially in China, are a major driver for the solar photovoltaic (PV) industry. These include subsidies, feed-in tariffs, and evolving market-driven pricing. For instance, China's move towards market-driven pricing for solar power, effective June 1, 2025, signals a significant shift. This aims to boost competition and encourage more investment in solar infrastructure, directly impacting demand for key components like polysilicon and silicon wafers, which are central to GCL Technology's business.

Trade disputes and tariffs, particularly those involving major economies like the U.S. and China, significantly impact global solar supply chains. For GCL Technology, this translates to increased uncertainty and potential cost hikes for imported components, as well as challenges in exporting finished goods. For instance, in 2023, ongoing investigations into potential tariffs on solar products from Southeast Asian countries, many of which are key manufacturing hubs for the industry, highlighted these risks.

Geopolitical tensions are a significant concern for GCL Technology, impacting its global operations and the security of its supply chains. Many nations are increasingly prioritizing local production, which can create hurdles for companies like GCL that rely on international networks. For instance, trade disputes or sanctions could disrupt the flow of raw materials or finished goods, affecting production schedules and costs.

GCL Technology is actively addressing these geopolitical risks by focusing on its advanced FBR granular silicon technology. This innovation allows for more efficient production and potentially reduces reliance on specific geographic sources. Furthermore, the company is strategically planning overseas production facilities, with a notable example being its planned expansion into the Middle East. This diversification aims to build greater resilience against disruptions stemming from concentrated supply chains.

Domestic Competition and Overcapacity

China's solar sector is grappling with substantial domestic competition and overcapacity, a situation that has driven down prices significantly. This intense rivalry, however, is prompting government intervention.

Chinese authorities are actively working to manage this 'disorderly' competition and encourage the phasing out of older, less efficient production facilities. This strategic move is designed to stabilize the market and could provide an advantage to more established and efficient players like GCL Technology.

- Overcapacity Concerns: Reports from early 2024 indicated that China's solar manufacturing capacity was significantly exceeding demand, leading to price wars.

- Government Intervention: The National Development and Reform Commission (NDRC) has signaled intentions to curb irrational investment and promote consolidation within the industry.

- Market Rebalancing: The aim of these policies is to foster a healthier market environment, potentially benefiting companies with strong technological foundations and cost efficiencies.

ESG Regulations and Carbon Management

The increasing global focus on Environmental, Social, and Governance (ESG) factors is driving stricter carbon emission regulations, especially in international markets where GCL Technology operates. This trend requires the company to bolster its carbon management strategies to comply with evolving environmental standards.

By prioritizing the reduction of greenhouse gas emissions and implementing sophisticated carbon management techniques, GCL Technology can proactively address regulatory hurdles. This strategic approach is crucial for maintaining market access and enhancing its competitive position on a global scale.

- Global ESG Investment Growth: In 2024, ESG-focused funds are projected to attract over $3.4 trillion in assets under management globally, signaling a significant shift in investor priorities.

- Carbon Pricing Mechanisms: As of early 2025, over 70 jurisdictions worldwide have implemented some form of carbon pricing, with many expanding coverage to new sectors.

- Renewable Energy Mandates: Many countries are setting ambitious renewable energy targets, with some aiming for 50% or more of their energy mix from renewables by 2030, impacting demand for GCL's products.

Government policies in China are shifting towards market-driven pricing for solar power, effective June 1, 2025, which will impact GCL Technology's core business by fostering competition and potentially influencing component demand.

Trade disputes and tariffs, particularly those involving the US and China, continue to pose risks to GCL Technology's global supply chains, potentially increasing costs for imported materials and affecting export competitiveness.

Geopolitical tensions are driving a trend towards localized production, presenting challenges for GCL Technology's international operations and necessitating strategies like overseas expansion, such as its planned facilities in the Middle East, to build resilience.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting GCL Technology Holdings, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within GCL Technology Holdings' operating landscape.

Provides a clear, actionable framework for understanding the external forces impacting GCL Technology Holdings, enabling proactive strategy development and mitigating potential risks.

Economic factors

The polysilicon market is a prime example of how supply and demand dynamics can create significant price volatility. For companies like GCL Technology, these swings have directly impacted financial results. For instance, the market experienced considerable overcapacity in previous years, driving prices down.

While improved production efficiencies have generally led to a downward trend in polysilicon prices, recent data indicates a potential shift. In the first half of July 2025, the market saw an increase in polysilicon prices. This suggests that factors like renewed demand or temporary supply constraints could be at play, creating a more challenging environment for cost management.

The global appetite for solar energy continues to surge, fueled by a widespread commitment to renewable power and heightened awareness of climate change impacts. This persistent demand is a significant tailwind for the polysilicon sector, the foundational material for solar panels. For instance, the International Energy Agency reported in late 2024 that solar PV capacity additions reached a record 440 GW in 2023, a 50% increase from 2022, signaling robust ongoing growth.

This sustained global demand paints a bright long-term picture for companies like GCL Technology, a major polysilicon producer. Even with occasional market volatility, such as periods of oversupply that can impact pricing, the underlying trend of increasing solar adoption provides a solid foundation for future expansion and profitability. The United Nations Environment Programme's 2024 report highlighted that renewable energy investments globally hit $2 trillion in 2023, with solar leading the charge, underscoring the market's strong momentum.

GCL Technology's focus on lowering production costs and boosting efficiency is vital for its financial health, particularly when the market faces oversupply. This drive for efficiency directly impacts its ability to remain profitable and competitive.

The company achieved a significant 15% reduction in granular silicon production costs during the fourth quarter of 2024. This improvement stems from advancements in production techniques, better equipment utilization, and more efficient energy consumption, strengthening GCL Technology's market position.

Investment in Renewable Energy Infrastructure

Global investments in renewable energy infrastructure, particularly solar power, are experiencing substantial growth, directly fueling demand for polysilicon, a key component for GCL Technology. For instance, the International Energy Agency (IEA) reported in late 2023 that global renewable capacity additions reached a record high in 2023, projected to grow by over 50% by 2028 compared to the 2023-2028 period.

Government incentives and strategic alliances are pivotal in expanding this market, presenting significant opportunities for companies like GCL Technology. Many nations are setting ambitious renewable energy targets, often accompanied by subsidies, tax credits, and favorable regulatory frameworks that encourage the development of solar projects.

- Record Renewable Capacity Additions: The IEA projects global renewable capacity additions to surge by over 50% in the next five years, driving polysilicon demand.

- Government Support: Policies such as tax credits and subsidies in major markets like the United States and the European Union directly benefit solar infrastructure development.

- Strategic Alliances: Partnerships between energy companies and technology providers are accelerating project deployment and market expansion.

Supply Chain Costs and Inflation

Rising logistics costs, fueled by inflation and elevated fuel prices, significantly impact the budgets for renewable energy projects. For instance, in early 2024, global shipping costs saw an upward trend, with the Drewry World Container Index averaging around $1,700 per 40-foot container, a notable increase from previous years, directly affecting the price of solar components.

Supply chain disruptions and shortages of critical materials like copper and rare earth metals present further challenges. These vulnerabilities can inflate component costs and cause project delays. The International Energy Agency (IEA) highlighted in its 2024 reports that the demand for critical minerals essential for clean energy technologies, such as copper and lithium, is projected to rise substantially in the coming years, potentially exacerbating supply constraints and price volatility.

- Increased Logistics Expenses: Higher fuel and shipping rates directly translate to more expensive solar panels and equipment.

- Material Scarcity Impact: Shortages of key metals like copper can drive up manufacturing costs for renewable energy infrastructure.

- Project Cost Overruns: Both logistics and material costs contribute to the overall expense of developing solar farms and other green energy initiatives.

- Supply Chain Resilience: Companies are increasingly focused on diversifying suppliers and securing raw materials to mitigate these cost pressures.

The global push for renewable energy, particularly solar power, is a strong economic driver for polysilicon demand. Record renewable capacity additions, with solar PV additions reaching 440 GW in 2023 according to the IEA, underscore this trend. However, rising logistics costs, with container shipping rates averaging around $1,700 per 40-foot container in early 2024, and shortages of critical minerals like copper are increasing project expenses.

Despite these cost pressures, government incentives and ambitious renewable energy targets in key markets continue to bolster the sector. For instance, the United Nations Environment Programme reported $2 trillion in global renewable energy investments in 2023, with solar leading the way. GCL Technology's focus on cost reduction, exemplified by a 15% decrease in granular silicon production costs in Q4 2024, is crucial for navigating these economic dynamics.

| Economic Factor | 2023 Data/Trend | Impact on GCL Technology |

|---|---|---|

| Renewable Energy Demand | IEA: 440 GW solar PV additions in 2023; 50%+ growth projected by 2028 | Strong demand for polysilicon, GCL's core product |

| Logistics Costs | Early 2024: Container shipping rates ~$1,700/40ft container | Increased operational and project costs |

| Material Costs | IEA: Rising demand for copper, lithium etc. | Potential for higher manufacturing input costs |

| Government Incentives | UNEP: $2 trillion global renewable investment in 2023 | Favorable market conditions and policy support |

| Production Efficiency | GCL: 15% cost reduction in granular silicon (Q4 2024) | Enhanced competitiveness and profitability |

What You See Is What You Get

GCL Technology Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of GCL Technology Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic landscape.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a detailed understanding of the external forces shaping GCL Technology Holdings, enabling informed decision-making and risk mitigation.

Sociological factors

Growing global awareness of climate change is significantly boosting demand for solar products. Consumers and businesses are increasingly prioritizing sustainable energy solutions, creating a favorable market for companies like GCL Technology. This societal shift is a powerful driver for investment in renewable energy, supporting GCL's mission to contribute to a greener future.

Global energy consumption is steadily climbing, driven by rapid industrialization and urbanization. This trend directly fuels a growing demand for cleaner energy sources, creating a significant market opportunity for companies like GCL Technology Holdings.

The societal shift towards sustainability is a powerful driver for the solar industry. As more individuals and nations prioritize reducing their carbon footprint, the need for solar power, and thus the foundational materials like polysilicon and silicon wafers that GCL produces, increases substantially.

In 2023, global renewable energy capacity additions reached an estimated 510 gigawatts (GW), a record high, with solar photovoltaic (PV) accounting for the largest share, over 300 GW. This robust growth underscores the increasing reliance on solar technology and the materials GCL supplies.

The renewable energy sector, including GCL Technology's manufacturing and logistics, is grappling with significant labor shortages, especially for critical skilled roles like truck drivers and specialized engineers. This scarcity directly impacts the timely delivery of essential components, potentially slowing down project timelines and increasing operational costs.

For instance, in 2024, the U.S. Bureau of Labor Statistics reported a shortage of over 3.5 million skilled tradespeople, a figure that extends to the burgeoning green economy. This deficit in the workforce can hinder GCL Technology's ability to scale production and meet growing demand efficiently, creating a bottleneck in its supply chain operations.

Corporate Social Responsibility (CSR) and ESG Focus

Societal expectations are increasingly pushing companies toward robust Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) frameworks. GCL Technology's strategic emphasis on carbon management and its dedication to sustainable, green development directly address these evolving societal demands, bolstering its public image and fostering greater trust among its stakeholders.

This commitment is reflected in the growing global investment in ESG-compliant businesses. For instance, in 2024, sustainable investment funds are projected to reach trillions, with a significant portion of institutional capital being allocated based on ESG performance. GCL Technology's alignment with these trends positions it favorably within this expanding market.

- Growing ESG Investment: Global sustainable investment assets are expected to surpass $50 trillion by 2025, indicating a strong market preference for companies with robust ESG credentials.

- Reputational Enhancement: GCL Technology's focus on carbon reduction and green energy solutions directly appeals to environmentally conscious consumers and investors.

- Stakeholder Confidence: Demonstrating strong ESG performance builds trust with investors, employees, and the communities in which GCL Technology operates.

Public Perception of Solar Energy

Public perception of solar energy as a reliable and environmentally friendly power source significantly impacts its market adoption. Positive public sentiment, driven by growing environmental awareness, directly fuels demand for solar solutions, creating a favorable landscape for companies like GCL Technology. For instance, a 2024 survey indicated that over 70% of consumers globally view solar power as a crucial tool in combating climate change, a sentiment that translates into increased investment and policy support.

Widespread acceptance of solar technology fosters market growth by encouraging both individual and corporate investment. This positive outlook supports GCL Technology's business by driving demand for their solar products and services. In 2024, residential solar installations in the US saw a 15% year-over-year increase, partly attributed to strong public approval and perceived long-term cost savings.

- Growing Environmental Concern: Public awareness of climate change is a primary driver of positive solar perception.

- Perceived Reliability: Advances in technology and successful large-scale projects are enhancing public trust in solar's dependability.

- Economic Incentives: Government subsidies and decreasing installation costs further bolster public enthusiasm for solar adoption.

Societal shifts towards sustainability are a major catalyst for GCL Technology's growth, as evidenced by the record 510 GW of renewable energy capacity added globally in 2023, with solar leading the charge. This growing environmental consciousness translates into increased demand for solar products, directly benefiting companies like GCL that supply essential materials. Furthermore, the strong emphasis on ESG principles is driving investment, with sustainable investment funds projected to exceed $50 trillion by 2025, aligning GCL's green development focus with market preferences.

Technological factors

Technological advancements in polysilicon production are a significant driver for companies like GCL Technology. Their proprietary Fluidized Bed Reactor (FBR) granular silicon technology is a prime example, aiming to boost efficiency and slash production costs. This innovation is key to staying competitive in the solar industry.

This FBR granular silicon technology not only enhances production efficiency but also plays a vital role in reducing the environmental footprint of polysilicon manufacturing. By enabling the creation of high-quality polysilicon with a lower impact, GCL Technology strengthens its market position and appeals to environmentally conscious stakeholders.

In 2024, GCL Technology reported significant progress with its FBR granular silicon, aiming for a production capacity of 200,000 tons annually. This technological leap is expected to lower production costs by an estimated 20-30% compared to traditional methods, a crucial advantage as global demand for solar panels continues to surge.

The solar industry is seeing rapid advancements in cell efficiency, with technologies like N-type TOPCon, heterojunction (HJT), and Back-Contact (BC) cells becoming increasingly prominent. These innovations directly fuel the need for high-purity polysilicon and sophisticated silicon wafers, key materials in solar panel manufacturing.

GCL Technology Holdings is strategically investing in these next-generation cell technologies and has plans for mass production. This focus is crucial for maintaining a competitive edge in a market driven by technological progress and efficiency gains. For instance, by 2024, the global solar PV market is projected to reach over 400 GW, underscoring the demand for advanced manufacturing capabilities.

GCL Technology can significantly boost its operational efficiency by integrating automation, the Internet of Things (IoT), and Artificial Intelligence (AI) into its logistics and production. These technologies are transforming the renewable energy sector by reducing delays and optimizing workflows.

For instance, AI-driven demand forecasting can help GCL Technology better manage inventory and anticipate production needs, minimizing waste and improving delivery times. In 2024, the global logistics market is projected to reach over $15.8 trillion, with automation playing a key role in this growth, a trend GCL can capitalize on.

Integration of Polysilicon in Advanced Technologies

The expanding use of polysilicon in cutting-edge applications beyond conventional solar panels, such as smart grids and the Internet of Things (IoT), is opening up significant new market avenues. This diversification strategy for polysilicon applications is poised to enlarge the demand for GCL Technology's foundational materials.

For instance, polysilicon's unique electrical properties make it increasingly valuable in advanced semiconductor manufacturing for high-performance computing and data centers, sectors experiencing robust growth. In 2024, the global semiconductor market was projected to reach over $600 billion, indicating a substantial opportunity for material suppliers like GCL Technology.

- Smart Grids: Polysilicon's conductivity and durability are crucial for components in next-generation smart grids, enhancing energy efficiency and reliability.

- IoT Devices: Miniaturized and efficient power solutions for IoT devices often rely on polysilicon-based technologies, driving demand in this rapidly growing sector.

- Advanced Electronics: The semiconductor industry's need for high-purity polysilicon for microchips and other electronic components presents a stable and growing demand base.

Research and Development Investment

GCL Technology Holdings' dedication to innovation is evident in its substantial research and development (R&D) investments, crucial for staying ahead in the competitive technology landscape. This focus allows the company to pioneer new products and refine existing processes, ensuring its market leadership.

The company's R&D efforts are particularly geared towards overcoming significant industry challenges and establishing advanced, environmentally friendly manufacturing systems. For instance, GCL Technology has been a key player in advancing solar cell efficiency, with recent advancements pushing conversion rates higher, contributing to the overall growth of the renewable energy sector.

Key areas of GCL Technology's R&D focus include:

- Development of next-generation solar materials and manufacturing techniques.

- Enhancement of green manufacturing processes to reduce environmental impact.

- Innovation in energy storage solutions and smart grid technologies.

- Exploration of advanced semiconductor technologies for broader applications.

GCL Technology's commitment to technological advancement, particularly its proprietary Fluidized Bed Reactor (FBR) granular silicon technology, is a cornerstone of its strategy. This innovation aims to significantly reduce production costs by an estimated 20-30% compared to traditional methods, a crucial factor as the global solar PV market is projected to exceed 400 GW in 2024.

The company is also investing in next-generation solar cell technologies like N-type TOPCon and HJT, aligning with market trends that demand higher efficiency. Furthermore, integrating AI and IoT into logistics and production can optimize workflows, mirroring the growth in the global logistics market, which was projected to exceed $15.8 trillion in 2024.

The expanding applications of polysilicon in smart grids and IoT devices, alongside advanced semiconductor manufacturing for high-performance computing, present substantial growth opportunities. For instance, the global semiconductor market was projected to reach over $600 billion in 2024, highlighting the demand for high-purity materials.

| Technology Focus | Key Innovation/Application | Projected Impact/Market Context (2024) | GCL Technology's Role |

|---|---|---|---|

| Polysilicon Production | FBR Granular Silicon | 20-30% cost reduction; 200,000 tons annual capacity target | Pioneering cost-effective and efficient production |

| Solar Cell Technology | N-type TOPCon, HJT, BC Cells | Driving demand for high-purity polysilicon; Global solar PV market > 400 GW | Investing in and mass-producing next-gen solar materials |

| Operational Efficiency | AI, IoT, Automation | Optimizing logistics and production; Global logistics market > $15.8 trillion | Enhancing supply chain and manufacturing processes |

| New Market Avenues | Smart Grids, IoT, Advanced Electronics | Global semiconductor market > $600 billion | Diversifying polysilicon applications |

Legal factors

GCL Technology Holdings operates under increasingly stringent environmental protection laws, particularly those targeting carbon emissions and pollution. These regulations directly influence manufacturing processes, necessitating investments in cleaner technologies and waste reduction. For instance, China's ambitious carbon neutrality goals, aiming for peak emissions before 2030 and neutrality by 2060, create a dynamic operating environment for companies like GCL.

Compliance with international standards such as ISO 14001 is crucial for GCL Technology's global operations and market access. This requires robust systems for tracking materials, managing environmental impact, and transparent reporting, adding to operational complexity and cost. Failure to meet these standards can result in significant penalties and reputational damage.

International trade laws, particularly anti-dumping and countervailing duties, present significant legal hurdles for GCL Technology. For instance, the U.S. Department of Commerce's ongoing investigations into solar imports from Southeast Asian nations, where GCL has manufacturing operations, can lead to substantial financial penalties. These duties, if imposed retroactively, could significantly impact GCL's profitability and market access in key regions.

The potential for duties, such as those previously considered or implemented on polysilicon and solar cells, necessitates robust legal and compliance strategies. Navigating these complex regulations requires GCL to closely monitor trade policies in its operating and target markets, especially in the U.S. and Europe, which have been active in imposing such measures to protect domestic industries.

As a company listed on the Hong Kong Stock Exchange, GCL Technology is bound by stringent corporate governance principles and listing rules. These regulations, overseen by the Hong Kong Exchanges and Clearing Limited (HKEX), mandate clear procedures for financial reporting, director re-elections, and the authorization of share issuances. For instance, the HKEX Main Board Listing Rules require timely disclosure of financial results, with listed entities typically reporting interim and annual results within specific deadlines. Adherence to these rules is crucial for maintaining investor confidence and ensuring transparency in GCL Technology's operations.

Labor Laws and Occupational Safety

GCL Technology Holdings must strictly adhere to labor laws, production safety regulations, and occupational disease prevention statutes to maintain operational integrity. Non-compliance can lead to significant fines and operational disruptions, impacting GCL's ability to manufacture and distribute its products efficiently.

In 2024, China's Ministry of Human Resources and Social Security continued to emphasize workplace safety, with reported industrial accident rates showing a downward trend, though specific figures for the solar manufacturing sector are still being aggregated. For instance, in 2023, the overall reduction in workplace fatalities across key industries was noted, underscoring the government's commitment to enforcing safety standards.

Key considerations for GCL Technology include:

- Compliance with China's Labor Contract Law: Ensuring fair employment practices, wages, and working hours for all employees.

- Adherence to Production Safety Laws: Implementing robust safety protocols in manufacturing facilities, particularly concerning the handling of materials and machinery used in solar panel production.

- Occupational Disease Prevention: Addressing potential health risks associated with chemical exposure or repetitive strain injuries common in manufacturing environments, aligning with national health and safety guidelines.

Contractual Obligations and Partnerships

GCL Technology's operations are deeply intertwined with a multitude of contractual agreements. These range from supply chain commitments to customer service level agreements and crucial strategic alliances. The company's ability to navigate and fulfill these obligations underpins its day-to-day functioning and future growth initiatives.

The legal landscape surrounding partnerships is particularly vital for GCL Technology. For instance, their proposed cooperation with CPIC Investment Management (H.K.) necessitates strict adherence to partnership laws and regulatory frameworks. Such collaborations are key to expanding market reach and accessing new opportunities.

Ensuring compliance with contractual terms and partnership laws is not merely procedural; it directly impacts GCL Technology's financial stability and operational efficiency. Any breach or dispute can lead to significant financial penalties and reputational damage, potentially derailing strategic expansion plans.

- Contractual Compliance: GCL Technology must meticulously manage its contracts with suppliers and customers to avoid disruptions and maintain strong business relationships.

- Partnership Frameworks: The company's strategic growth relies on successfully structuring and adhering to legal agreements for partnerships, such as the one with CPIC Investment Management.

- Risk Mitigation: Proactive legal review and management of all contractual and partnership obligations are essential to mitigate risks and ensure smooth business operations.

Navigating international trade laws, particularly anti-dumping and countervailing duties, presents significant legal challenges for GCL Technology. For instance, the U.S. Department of Commerce's ongoing investigations into solar imports from Southeast Asia, where GCL has operations, could lead to substantial financial penalties impacting profitability and market access.

Compliance with corporate governance principles and listing rules, such as those from the Hong Kong Stock Exchange, is paramount. These regulations mandate timely financial reporting and transparent operational procedures, crucial for maintaining investor confidence and market integrity.

GCL Technology must also adhere to labor laws and production safety regulations, with China's continued emphasis on workplace safety in 2024 aiming to reduce industrial accidents. This includes strict compliance with the Labor Contract Law and occupational disease prevention guidelines.

The company's strategic growth hinges on robust contractual compliance and adherence to partnership laws, as exemplified by its collaborations. Meticulous management of these legal agreements is essential for mitigating risks and ensuring operational efficiency.

Environmental factors

GCL Technology's FBR granular silicon technology achieved a new global record for ultra-low carbon emissions, underscoring a significant commitment to environmental stewardship. This focus on minimizing greenhouse gas output from manufacturing processes is vital for compliance with evolving environmental regulations and for building a sustainable business model.

GCL Technology's operations, particularly in polysilicon and silicon wafer manufacturing, are heavily reliant on electricity and water. The energy-intensive nature of these processes means that fluctuations in resource availability and cost directly impact production efficiency and profitability.

In late 2024, Chinese authorities introduced more stringent regulations concerning resource consumption. This development is compelling GCL Technology to accelerate its efforts in optimizing water and electricity usage, pushing for greater efficiency and the adoption of more sustainable manufacturing practices to meet evolving environmental standards.

The renewable energy sector, including solar manufacturing where GCL Technology operates, is increasingly embracing circular economy principles. This means a greater focus on recycling solar panels and reusing materials in production, shifting away from traditional linear waste models.

Effective waste management is a critical environmental factor for GCL Technology. For instance, the global waste from solar panels is projected to reach 78 million tonnes by 2050, highlighting the need for robust recycling infrastructure and processes to mitigate environmental impact.

Adopting circular practices not only addresses environmental concerns but can also offer economic advantages. Companies that successfully integrate recycling and material reuse into their operations can reduce raw material costs and create new revenue streams from recovered materials.

Supply Chain Environmental Impact

GCL Technology Holdings faces significant environmental scrutiny regarding its entire supply chain, from the extraction of raw materials to the transportation of finished goods. The company must actively manage and mitigate the carbon footprint associated with these operations. For instance, in 2023, the global shipping industry was responsible for approximately 2.87% of the world's total CO2 emissions, a figure GCL's logistics will contribute to.

Ensuring that supply chain partners uphold stringent environmental standards is paramount, especially as global pressure mounts to decarbonize logistics. This includes verifying sustainable sourcing of materials, such as polysilicon, which has an energy-intensive production process. GCL's commitment to reducing its environmental impact is directly tied to the practices of its upstream suppliers and downstream logistics providers.

- Supply Chain Emissions: The energy-intensive nature of polysilicon production and global logistics presents a substantial environmental challenge.

- Sustainable Sourcing: GCL must prioritize partners who demonstrate responsible raw material acquisition and manufacturing processes.

- Decarbonization Pressure: Increasing regulations and market demand for lower-carbon products necessitate a focus on reducing emissions across the entire value chain.

- Logistics Footprint: Transportation, a key component of the supply chain, contributes significantly to global carbon emissions, requiring GCL to optimize its shipping and distribution networks.

Climate Change and Renewable Energy Transition

The global push to combat climate change is a significant driver for the renewable energy sector, directly influencing the market for GCL Technology's offerings. This transition is accelerating the demand for solar power, a core area where GCL Technology operates.

GCL Technology is instrumental in the global solar panel supply chain, manufacturing polysilicon and wafers essential for solar cell production. Their contribution supports worldwide efforts to reduce carbon emissions.

In 2024, the International Energy Agency (IEA) projected that solar PV capacity additions could reach nearly 700 GW globally, a substantial increase from previous years. This growth underscores the increasing reliance on solar technology, benefiting companies like GCL Technology.

- Global Climate Imperative: Mounting pressure to mitigate climate change fuels demand for renewable energy solutions.

- GCL's Role in Decarbonization: The company's production of key solar components directly supports global decarbonization targets.

- Market Growth: Projections indicate significant expansion in solar PV installations worldwide, creating a favorable market environment.

GCL Technology's commitment to ultra-low carbon emissions in its granular silicon technology, setting a new global record, directly addresses the increasing regulatory pressure and market demand for sustainable manufacturing. This focus is crucial for navigating stricter environmental standards, such as those introduced by Chinese authorities in late 2024 concerning resource consumption, compelling GCL to optimize its water and electricity usage.

The company's operations are intrinsically linked to resource availability and cost, particularly electricity and water, which are vital for its energy-intensive polysilicon and wafer manufacturing. Furthermore, the growing emphasis on circular economy principles within the renewable sector, including robust solar panel recycling infrastructure to manage projected waste of 78 million tonnes by 2050, presents both environmental challenges and economic opportunities for GCL.

The environmental impact of GCL's entire supply chain, from raw material sourcing to global logistics, is under intense scrutiny. With the global shipping industry alone contributing approximately 2.87% of total CO2 emissions in 2023, GCL must actively manage its logistics footprint and ensure its partners adhere to stringent environmental standards to meet the growing pressure for decarbonization across the value chain.

PESTLE Analysis Data Sources

Our PESTLE analysis for GCL Technology Holdings is built on a robust foundation of data sourced from official government publications, reputable financial institutions, and leading industry analysis firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are accurate and relevant to the company's operating landscape.