GCL Technology Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GCL Technology Holdings Bundle

GCL Technology Holdings operates in a dynamic landscape shaped by intense competition, significant supplier leverage, and the ever-present threat of substitutes. Understanding these forces is crucial for navigating its market effectively.

The complete report reveals the real forces shaping GCL Technology Holdings’s industry—from buyer power to the threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a key factor influencing GCL Technology Holdings' bargaining power. For critical inputs like industrial silicon and specialized chemicals, a limited number of suppliers can dictate terms and pricing. For instance, in 2023, the polysilicon market, a primary input for solar wafers, saw significant price volatility driven by supply chain dynamics and capacity expansions by a few major producers.

The bargaining power of suppliers for GCL Technology Holdings is significantly influenced by switching costs related to polysilicon and wafer manufacturing. High costs and complexities involved in changing suppliers for essential inputs like specialized chemicals or advanced manufacturing equipment can empower suppliers. For instance, if a new polysilicon supplier requires GCL to invest heavily in retooling its wafer production lines or undertaking extensive material requalification processes, that supplier gains leverage. This was evident in 2023, where disruptions in raw material supply chains led to increased input costs for many solar manufacturers, highlighting the impact of supplier dependence.

The uniqueness of input materials significantly influences the bargaining power of suppliers for GCL Technology Holdings. If suppliers provide highly specialized or proprietary materials that GCL cannot easily substitute, their leverage increases. For instance, if GCL relies on specific types of granular silicon with unique purity levels or manufacturing processes that are not widely available, those suppliers can command higher prices or more favorable terms.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into polysilicon and silicon wafer production for GCL Technology Holdings is a significant concern. If suppliers can readily become direct competitors by moving up the value chain, it directly erodes GCL's bargaining power and market position. This is a classic challenge in industries where vertical integration is feasible.

For instance, a major raw material supplier for GCL could potentially invest in its own polysilicon manufacturing facilities. This would allow them to capture more value and potentially dictate terms to GCL, or even bypass GCL altogether by selling directly to downstream customers. Such a move would transform a supplier relationship into a competitive one.

- Supplier Forward Integration Risk: Suppliers moving into polysilicon and wafer production directly challenges GCL's core business.

- Impact on Bargaining Power: If suppliers become competitors, GCL's ability to negotiate favorable terms on raw materials would decrease.

- Industry Dynamics: The solar industry's structure often sees players exploring vertical integration to control costs and capture more margin.

- Potential Market Disruption: Successful forward integration by suppliers could lead to increased competition and potentially lower prices for end products, squeezing GCL's profitability.

Importance of GCL to Suppliers

GCL Technology Holdings is a significant player in the solar industry, and its purchasing power directly impacts its suppliers. When GCL represents a large chunk of a supplier's overall sales, that supplier has a strong incentive to offer competitive pricing and favorable terms to keep GCL's business. For instance, in 2023, GCL's substantial orders for polysilicon and wafer production likely made them a key client for many raw material providers.

This reliance means suppliers may be less likely to exert significant upward pressure on prices or impose restrictive contract terms. The sheer volume GCL procures can give it considerable leverage in negotiations. This dynamic is crucial for GCL's cost management and overall profitability in the competitive solar market.

- GCL's substantial procurement volumes directly influence supplier willingness to negotiate.

- A significant portion of a supplier's revenue derived from GCL enhances GCL's bargaining position.

- This leverage allows GCL to secure favorable pricing and terms, impacting its cost structure.

- The 2023 financial year saw GCL's continued large-scale operations, underscoring its importance to its supply chain partners.

The bargaining power of suppliers for GCL Technology Holdings is influenced by the concentration of suppliers in key input markets. A limited number of suppliers for critical materials like industrial silicon and specialized chemicals can lead to price leverage. For example, in 2023, the polysilicon market experienced price fluctuations due to the dominance of a few major producers controlling significant capacity.

Switching costs for GCL Technology Holdings are also a factor. High expenses and complexities associated with changing suppliers for essential inputs, such as advanced manufacturing equipment or specialized chemicals, empower existing suppliers. If GCL needs to invest heavily in retooling or extensive material requalification to switch, suppliers gain leverage, as seen in 2023 when supply chain disruptions increased input costs for solar manufacturers.

The uniqueness of input materials further strengthens supplier bargaining power. When suppliers provide highly specialized or proprietary materials that GCL cannot easily substitute, their negotiating leverage increases. For instance, reliance on granular silicon with unique purity levels not widely available allows such suppliers to command higher prices or more favorable terms.

| Factor | Impact on GCL | 2023 Data/Trend |

|---|---|---|

| Supplier Concentration | Increased leverage for suppliers of critical inputs | Polysilicon market dominated by a few key players |

| Switching Costs | Empowers suppliers due to high transition expenses | Supply chain disruptions led to higher input costs |

| Input Uniqueness | Stronger negotiation position for suppliers of specialized materials | Demand for high-purity silicon remains strong |

| Supplier Forward Integration | Potential for suppliers to become competitors | Industry trend towards vertical integration |

What is included in the product

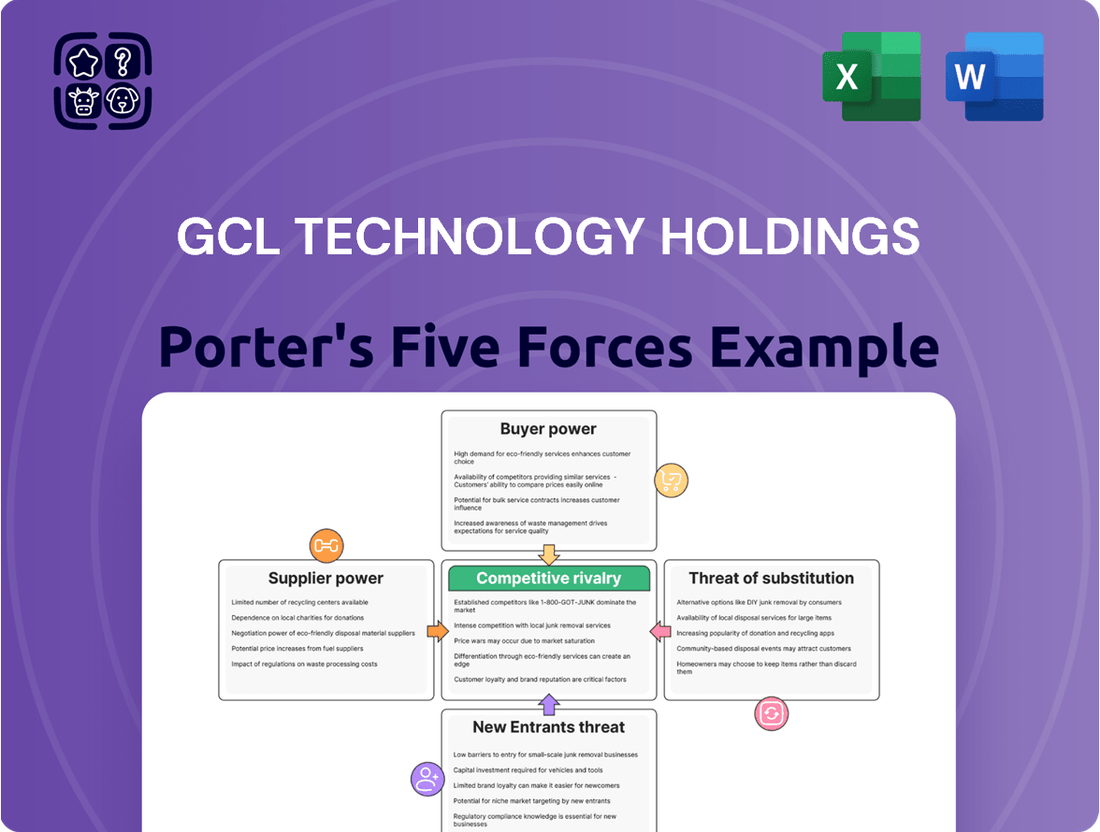

This analysis of GCL Technology Holdings' competitive environment reveals the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats posed by new entrants and substitutes, offering strategic insights into market dynamics.

Effortlessly identify and mitigate competitive threats with a visual breakdown of each force, empowering strategic adjustments.

Customers Bargaining Power

Customer concentration is a key factor influencing bargaining power, and for GCL Technology Holdings, this is particularly evident in its solar panel manufacturing clientele. When a few major customers represent a large share of sales, their ability to negotiate favorable pricing and terms increases significantly.

The data from 2024 starkly illustrates this dynamic: GCL's top five customers accounted for an impressive 71.2% of its granular silicon sales. This high concentration means these key buyers hold considerable sway, potentially pressuring GCL for concessions.

The ability of GCL Technology Holdings' customers to find alternative suppliers for polysilicon and silicon wafers significantly boosts their bargaining power. When customers have many choices, GCL's ability to dictate prices weakens. This is particularly relevant in 2024, as the polysilicon market has seen substantial overcapacity, giving buyers more leverage.

Customer price sensitivity is a critical factor in assessing their bargaining power with GCL Technology Holdings. In the intensely competitive solar panel industry, where cost reduction is paramount, buyers are highly attuned to the prices of essential components like polysilicon and wafers. This sensitivity directly impacts GCL's pricing strategies and profitability.

GCL's financial performance in 2024 clearly illustrates this dynamic. The company experienced a revenue decline during this period, largely attributable to a significant drop in polysilicon prices. This downturn highlights how fluctuations in raw material costs, driven by market demand and supply, can directly translate into reduced sales for GCL when customers are actively seeking lower-cost alternatives.

Threat of Backward Integration by Customers

The threat of backward integration by GCL Technology Holdings' customers is a significant concern. Major solar panel manufacturers, seeking greater control over their supply chains and cost structures, are increasingly exploring opportunities to produce their own polysilicon and silicon wafers. This move upstream would directly diminish GCL's customer base and bolster the bargaining power of these integrated entities.

Several leading solar panel manufacturers have already begun to invest in or acquire wafer production capabilities. For instance, in 2023, reports indicated that some of the largest solar module producers were actively looking to secure or build their own wafer manufacturing facilities. This trend is driven by the desire to mitigate supply chain disruptions and capture more value within the solar manufacturing process.

- Customer Integration Threat: Solar panel makers producing their own polysilicon and wafers reduces reliance on suppliers like GCL.

- Increased Bargaining Power: Upstream integration by customers strengthens their negotiating position, potentially driving down prices for GCL's products.

- Industry Trend: Major solar manufacturers are actively moving into upstream production, including wafer manufacturing, as seen in market analyses throughout 2023 and early 2024.

Information Availability to Customers

The degree to which customers can access comprehensive information about GCL Technology Holdings' pricing, production costs, and prevailing market conditions significantly influences their leverage. When customers possess detailed knowledge, they are better positioned to negotiate favorable terms, potentially driving down prices.

The solar industry is characterized by intense competition, leading to a high degree of transparency regarding pricing and cost structures. This readily available information allows customers to benchmark GCL's offerings against competitors, increasing their ability to demand competitive pricing.

- Information Accessibility: Customers can easily compare GCL's polysilicon and wafer prices against global benchmarks, such as those reported by industry analytics firms. For instance, in early 2024, polysilicon prices experienced fluctuations, with average prices for high-purity polysilicon hovering around $X per kilogram, providing a clear reference point for buyers.

- Cost Transparency: Advances in manufacturing technology and the commoditization of certain solar components mean that cost structures are becoming more transparent. This allows sophisticated buyers to estimate GCL's production costs and negotiate accordingly, impacting GCL's profit margins.

- Market Conditions Awareness: Buyers are increasingly informed about supply-demand dynamics, inventory levels, and technological advancements within the solar sector. This awareness empowers them to time their purchases and negotiate from a position of strength, especially during periods of oversupply.

GCL Technology Holdings faces significant customer bargaining power due to high customer concentration, price sensitivity, and the potential for backward integration. In 2024, GCL's top five customers represented 71.2% of its granular silicon sales, giving these large buyers considerable leverage in price negotiations. The competitive polysilicon market, marked by overcapacity in 2024, further empowers customers seeking cost reductions.

| Factor | Impact on GCL | 2024 Data/Observation |

|---|---|---|

| Customer Concentration | High concentration increases buyer leverage. | Top 5 customers accounted for 71.2% of granular silicon sales. |

| Price Sensitivity | Buyers demand lower prices in a competitive market. | Revenue decline in 2024 linked to polysilicon price drops. |

| Backward Integration Threat | Customers producing their own components reduce GCL's market. | Industry trend of solar panel makers acquiring wafer production. |

| Information Accessibility | Transparent pricing allows customers to negotiate better terms. | Easy comparison of polysilicon prices against market benchmarks. |

Preview Before You Purchase

GCL Technology Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for GCL Technology Holdings, detailing the competitive landscape and strategic implications. You're looking at the actual document, which meticulously examines the industry's buyer power, supplier power, threat of new entrants, threat of substitutes, and existing competitive rivalry. Once you complete your purchase, you’ll get instant access to this exact, professionally written analysis, providing valuable insights for strategic decision-making.

Rivalry Among Competitors

The polysilicon and silicon wafer market is quite crowded, especially in China, GCL Technology's home turf. This means there are many companies vying for the same customers.

Big players like Tongwei, Daqo New Energy, and Xinte Energy are major competitors. For instance, Tongwei is a global leader in solar PV manufacturing, with significant polysilicon and wafer production capacity. Daqo New Energy also reported substantial polysilicon production volumes in 2023, contributing to the intense competition.

The solar photovoltaic industry's growth rate significantly impacts how fiercely companies compete. As the market expands, it can attract new players and encourage existing ones to increase production, intensifying rivalry.

However, the solar sector has recently experienced overcapacity, particularly in polysilicon production during 2024 and extending into 2025. This has created a highly competitive environment where price pressures are substantial.

GCL Technology's ability to make its polysilicon and silicon wafer products stand out from the competition significantly influences the intensity of rivalry in the market. For instance, in 2023, the polysilicon market saw significant price fluctuations, underscoring the importance of cost-competitiveness and product quality for differentiation.

GCL's strategic emphasis on granular silicon, which offers potential cost savings in downstream processing, is a key differentiator. This, coupled with their ongoing investments in next-generation technologies like perovskite solar cells, demonstrates a clear effort to move beyond standard offerings and capture future market share.

Exit Barriers

High exit barriers in the polysilicon and silicon wafer manufacturing sector significantly fuel competitive rivalry. Companies are often compelled to continue operations, even at a loss, because of the massive sunk costs associated with their specialized, capital-intensive facilities. This makes exiting the market a financially daunting prospect.

The substantial capital investment needed to establish and maintain polysilicon and silicon wafer production lines creates formidable exit barriers. These high fixed costs mean that shutting down operations can incur further substantial financial penalties, trapping companies in a cycle of continued production regardless of profitability.

For instance, GCL Technology, a prominent player in this industry, reported a net loss in 2024. This financial performance underscores the intense competition and the challenges faced by companies, even those with significant infrastructure, when faced with market pressures and high exit barriers.

- High Sunk Costs: The polysilicon and silicon wafer industry demands enormous upfront capital for factories and equipment, making it difficult to recoup these investments if a company decides to exit.

- Industry Overcapacity: Periods of overcapacity, common in this sector, exacerbate the problem. Companies may continue producing to utilize existing capacity and spread fixed costs, even if demand is low, intensifying competition.

- Specialized Assets: The highly specialized nature of the manufacturing equipment means assets have limited alternative uses, further increasing the cost and difficulty of exiting the market.

- GCL Technology's 2024 Performance: GCL Technology's reported net loss in 2024 highlights the financial strain that can result from operating under these high exit barrier conditions amidst fierce competition.

Cost Structure and Pricing Strategies

The cost structure and pricing strategies among competitors are a major driver of rivalry in the solar industry. Companies that can achieve lower production costs, such as GCL Technology with its focus on granular silicon, gain a substantial edge. This cost advantage allows them to implement more aggressive pricing, putting pressure on rivals with higher cost bases.

For instance, GCL Technology has been a key player in driving down the cost of polysilicon production. In 2023, the average cost of polysilicon production globally saw continued declines due to technological advancements and economies of scale. Companies like GCL, with their efficient manufacturing processes, are better positioned to absorb these cost pressures and maintain competitive pricing.

- Cost Leadership Advantage: GCL Technology's investment in granular silicon production, a more cost-effective method than traditional methods, provides a significant advantage.

- Pricing Flexibility: Lower production costs enable GCL to offer more competitive pricing, potentially capturing market share from higher-cost producers.

- Industry Price Pressure: The presence of low-cost producers like GCL intensifies price competition across the entire solar value chain, from polysilicon to finished modules.

- Impact on Profitability: Aggressive pricing driven by cost efficiency can squeeze profit margins for less efficient competitors.

Competitive rivalry in the polysilicon and silicon wafer market, particularly in China, is intense due to the presence of numerous players like Tongwei and Daqo New Energy. Recent overcapacity in polysilicon production throughout 2024 has further amplified price pressures, making cost-competitiveness and product differentiation crucial for survival.

High exit barriers, stemming from massive sunk costs in specialized manufacturing facilities, compel companies to continue production even during downturns, intensifying competition. GCL Technology's reported net loss in 2024 illustrates the financial strain faced by firms operating under these conditions, highlighting the importance of efficient operations and strategic innovation.

GCL Technology's focus on granular silicon offers a cost advantage, enabling more aggressive pricing and putting pressure on higher-cost competitors. This cost leadership is vital in an industry where price competition is a primary driver of market share, especially given the global decline in polysilicon production costs observed in 2023.

| Competitor | 2023 Polysilicon Capacity (GW) | 2023 Wafer Capacity (GW) | Key Strategy |

|---|---|---|---|

| Tongwei | ~200 | ~150 | Integrated PV manufacturing, cost leadership |

| Daqo New Energy | ~100 | N/A | High-purity polysilicon production |

| Xinte Energy | ~60 | N/A | Polysilicon and solar farm development |

| GCL Technology | ~30 (Polysilicon) | ~30 (Wafer) | Granular silicon, next-gen tech (perovskite) |

SSubstitutes Threaten

The threat of substitutes for GCL Technology Holdings, particularly in the solar energy sector, is influenced by the price-performance trade-off of alternative solar technologies. Thin-film solar cells, for instance, represent a significant substitute. Historically, these technologies offered lower efficiency compared to traditional silicon-based panels, but their cost advantage was a key differentiator.

However, recent developments show thin-film solar cells closing the performance gap. For example, by early 2024, some advanced thin-film technologies were approaching efficiencies that were once exclusive to crystalline silicon, while maintaining a competitive cost structure. This continuous improvement in performance-to-price ratio for substitutes directly challenges GCL's market position.

The threat of substitutes for GCL Technology's solar products is intensifying due to rapid technological progress in alternative solar solutions. Innovations like perovskite solar cells and other advanced materials are emerging, promising greater efficiency and reduced production expenses. For instance, in early 2024, researchers announced breakthroughs in perovskite stability, a key hurdle to commercialization, suggesting a potential shift in the market landscape.

These next-generation technologies could significantly undercut the cost-competitiveness of traditional silicon-based solar panels, which form the core of GCL Technology's offerings. As these substitutes mature and achieve wider adoption, they present a substantial long-term challenge to GCL's market position. GCL Technology itself recognizes this evolving threat and is actively investing in perovskite research and development, aiming to be at the forefront of these emerging technologies.

Customer willingness to adopt substitute solar technologies, such as perovskite or thin-film alternatives, hinges on their demonstrated reliability, extended lifespan, and seamless integration into existing infrastructure. As these emerging technologies mature and prove their performance, manufacturers and developers are increasingly open to incorporating them.

For instance, the global market for flexible solar panels, a key substitute for traditional silicon, was valued at approximately $2.5 billion in 2023 and is projected to grow significantly, indicating a rising customer acceptance driven by innovation and cost-effectiveness.

Indirect Substitutes (e.g., other renewable energy sources)

Beyond solar, other renewable energy sources present significant indirect competition for GCL Technology Holdings. Wind power, for instance, continues to gain traction, with global installed wind capacity reaching approximately 1,064 GW by the end of 2023, according to the Global Wind Energy Council. Hydropower remains a dominant renewable source, and geothermal energy offers a stable baseload alternative in specific regions.

This diversification within the renewable energy landscape means that investment capital and policy support can be allocated across various green technologies. While GCL is a leader in solar, the broader energy market's appetite for a mix of renewables could indirectly impact demand and pricing for solar products and services. For example, in 2024, global renewable energy capacity additions are projected to surpass 500 GW, with solar PV and wind power being the primary drivers, but the relative growth rates of each technology will influence market dynamics.

The threat of substitutes is amplified as these alternative renewable sources mature and become more cost-competitive.

- Wind Power: Global installed capacity surpassed 1,064 GW by end-2023.

- Hydropower: Continues to be a significant contributor to global renewable energy generation.

- Geothermal Energy: Provides a stable, baseload renewable power option in suitable locations.

- Market Diversification: A shift towards a broader mix of renewables can dilute focus and investment in any single technology.

Regulatory Support for Substitutes

Government policies can significantly bolster the threat of substitutes for silicon-based solar power. For instance, in 2024, many nations continued to implement or expand incentives for renewable energy sources beyond traditional photovoltaics. This includes tax credits, feed-in tariffs, and grants specifically aimed at promoting technologies like wind, geothermal, and emerging battery storage solutions. Such regulatory support can make these alternatives more economically viable and attractive to investors and consumers alike.

Favorable policies for non-silicon-based solar technologies, such as perovskite solar cells, also represent a growing threat. While still in development, these technologies promise higher efficiencies and lower manufacturing costs, potentially disrupting the dominance of silicon PV. Government funding for research and development, coupled with pilot project support, can accelerate their market entry and adoption. For example, the US Department of Energy's Solar Energy Technologies Office has consistently funded research into advanced solar materials, including perovskites, aiming to bring down costs and improve performance.

- Government Incentives: Policies like tax credits and feed-in tariffs can make non-PV renewables more competitive.

- R&D Funding: Support for alternative solar technologies, such as perovskites, accelerates their development and market potential.

- Market Diversification: Regulatory push for diverse renewable portfolios can divert investment and demand away from established silicon PV.

The threat of substitutes for GCL Technology Holdings is evolving rapidly, with advancements in thin-film and emerging solar technologies like perovskites closing the efficiency gap with traditional silicon panels. By early 2024, some thin-film cells were nearing silicon efficiencies while remaining cost-competitive. This continuous improvement in the price-performance ratio of substitutes directly challenges GCL's market position.

Beyond solar, other renewable energy sources like wind and hydropower also pose indirect competition. Global installed wind capacity reached approximately 1,064 GW by the end of 2023, and renewable energy capacity additions globally were projected to exceed 500 GW in 2024, indicating a broad market for green technologies.

Government policies, including incentives for non-PV renewables and R&D funding for advanced solar materials, further amplify the threat of substitutes by making alternatives more economically attractive and accelerating their development.

| Substitute Technology | Key Characteristics | Market Trend/Data (as of early 2024/2023) |

|---|---|---|

| Thin-Film Solar Cells | Lower historical efficiency, cost advantage, improving performance | Approaching silicon efficiencies, competitive cost structure |

| Perovskite Solar Cells | Potential for higher efficiency, lower manufacturing costs, emerging technology | Breakthroughs in stability announced, significant R&D focus |

| Wind Power | Mature renewable technology | Global installed capacity ~1,064 GW (end-2023) |

| Hydropower | Dominant renewable source | Significant contributor to global renewable energy |

Entrants Threaten

The polysilicon and silicon wafer manufacturing sector is incredibly capital-intensive. Building and equipping a modern polysilicon facility can easily cost billions of dollars, with significant ongoing investment needed for research and development to stay competitive. This high barrier means only well-funded players can realistically enter the market.

Existing players in the solar technology sector, including GCL Technology, often benefit from substantial economies of scale. For instance, GCL Technology's massive production capacity for polysilicon and wafer manufacturing allows them to spread fixed costs over a larger output, significantly reducing their per-unit production cost. This cost advantage is a major barrier for newcomers.

New entrants would find it incredibly challenging to replicate these cost efficiencies without investing heavily to achieve a comparable production volume. Without this scale, they would likely face higher per-unit costs, making it difficult to compete with established firms like GCL Technology on price in the competitive solar market.

Developing and mastering the intricate technologies for polysilicon and silicon wafer production demands substantial research and development alongside specialized expertise. Newcomers would struggle to acquire or cultivate this proprietary knowledge, a barrier GCL Technology actively leverages through its advancements in granular silicon.

Regulatory Hurdles and Environmental Standards

The solar materials industry faces significant regulatory hurdles, especially concerning environmental impact. New companies must navigate complex rules on energy consumption and emissions, which can be a substantial barrier to entry. For instance, in 2024, many regions intensified scrutiny on manufacturing processes, requiring substantial investment in compliance technology.

Meeting these stringent environmental standards, such as those for waste management and material sourcing, demands considerable capital and expertise. This complexity discourages potential new entrants who may lack the resources to adapt quickly to evolving regulations. The cost of compliance can significantly impact the profitability of new ventures.

- Stringent Environmental Regulations: The solar materials sector is heavily regulated regarding emissions and energy efficiency.

- High Compliance Costs: New entrants must invest heavily in technology and processes to meet these standards.

- Evolving Standards: Regulatory landscapes are dynamic, requiring continuous adaptation and investment from all players.

Supply Chain and Distribution Channel Access

Established players like GCL Technology possess robust, long-standing supply chains for critical raw materials such as polysilicon and wafers. In 2023, GCL Technology reported significant investments in upstream polysilicon production, aiming to secure a stable and cost-effective supply. New entrants would face considerable hurdles in replicating these established networks, potentially leading to higher initial material costs and unreliable sourcing.

Furthermore, GCL Technology benefits from deeply entrenched distribution channels, having cultivated strong relationships with major solar panel manufacturers globally over many years. These established partnerships provide consistent demand and efficient market access. For newcomers, gaining traction with these key customers would require substantial effort and potentially offering highly competitive pricing, which can be difficult without economies of scale.

- Securing reliable raw material suppliers: New entrants must navigate complex global markets to find and establish trust with polysilicon and wafer producers, often facing higher prices due to lower initial order volumes.

- Building customer relationships: Gaining access to established solar panel manufacturers requires significant time and investment in sales and marketing to demonstrate reliability and competitive advantage.

- Logistics and infrastructure: Developing efficient logistics and distribution networks to serve a global customer base presents a substantial capital expenditure and operational challenge for new companies.

The threat of new entrants into the polysilicon and silicon wafer manufacturing sector, where GCL Technology operates, is considerably low due to immense capital requirements. Building a state-of-the-art facility can cost billions, a significant deterrent for potential newcomers. For instance, in 2024, the ongoing investment in advanced manufacturing technologies continues to push these entry costs even higher.

Economies of scale enjoyed by established players like GCL Technology, which boasts massive production capacities, create a substantial cost advantage. New entrants would struggle to match these per-unit cost efficiencies without achieving similar production volumes, making price competition extremely challenging.

The industry also demands significant proprietary technology and specialized expertise, which are difficult and costly for new companies to acquire or develop. Furthermore, stringent environmental regulations and the associated compliance costs, which intensified in 2024, add another layer of complexity and financial burden for any potential entrants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for GCL Technology Holdings is built upon a robust foundation of data, including the company's official annual reports and SEC filings, alongside industry-specific market research reports and financial analyst assessments.