GCL Technology Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GCL Technology Holdings Bundle

Unlock the strategic blueprint behind GCL Technology Holdings's innovative business model. This comprehensive Business Model Canvas reveals their core activities, key partnerships, and unique value propositions. Discover how they effectively reach their customer segments and generate revenue in the competitive tech landscape.

Partnerships

GCL Technology Holdings cultivates strategic alliances with major downstream solar manufacturers, securing a predictable demand for its polysilicon and silicon wafer products. These collaborations are vital for obtaining substantial volume agreements and embedding GCL's materials into the global solar energy ecosystem, promoting shared expansion and market resilience.

The company's reliance on key clients is underscored by its 2024 performance, where sales to its top five customers constituted 71.2% of its total granular silicon sales volume, emphasizing the critical nature of these partnerships for sustained business operations and market presence.

GCL Technology Holdings actively pursues technology and research collaborations to drive innovation in its core solar material advancements. These partnerships are crucial for enhancing the efficiency and cost-effectiveness of technologies like FBR granular silicon and perovskite, while also uncovering novel applications for these materials.

A prime example of this commitment is GCL Group's participation in GTC 2025, where it partnered with Peking University and NVIDIA. This collaboration resulted in the release of a large model for photovoltaic power prediction, underscoring GCL's dedication to leveraging cutting-edge research and development to improve solar energy solutions.

GCL Technology Holdings relies heavily on logistics and supply chain partners to ensure the smooth flow of materials. These partnerships are crucial for transporting raw silicon materials to their production sites and then delivering finished polysilicon and wafers to customers worldwide, keeping costs down and operations efficient.

In 2024, GCL Technology continued to emphasize sustainable procurement, working with partners who adhere to strict environmental and social guidelines. Their robust procurement management system aims to secure a stable supply of high-quality raw materials while minimizing risks and ensuring ethical sourcing.

Financial Institutions and Investors

GCL Technology Holdings relies heavily on its relationships with financial institutions and investors to fuel its ambitious growth plans. These partnerships are essential for securing the substantial capital needed for large-scale expansion projects, ongoing research and development, and maintaining efficient working capital. For instance, in 2023, GCL secured significant financing facilities, demonstrating the critical role these relationships play in their operational and strategic execution.

These financial alliances are not just about day-to-day operations; they are foundational to GCL's long-term strategic objectives. This includes enabling potential overseas plant developments, which require considerable upfront investment and robust financial backing. The company's ability to attract and maintain these partnerships underscores its perceived stability and future potential within the renewable energy sector.

- Bank Loans and Credit Facilities: Access to diverse credit lines from major financial institutions provides the liquidity necessary for operational needs and short-term investments.

- Investment Firms and Equity Partners: Collaborations with investment firms are vital for raising equity capital, supporting major capital expenditures, and facilitating strategic acquisitions or joint ventures.

- Bond Issuances: Issuing corporate bonds allows GCL to tap into broader capital markets, diversifying its funding sources and potentially securing longer-term, fixed-rate financing for expansion.

Government and Regulatory Bodies

GCL Technology Holdings actively engages with government and regulatory bodies to ensure compliance and foster favorable operational conditions. This partnership is crucial for navigating evolving industry policies, securing essential permits for manufacturing and project development, and participating in government-backed initiatives aimed at advancing renewable energy and sustainable practices. For instance, in 2024, GCL Technology's participation in China's renewable energy policies, such as those supporting distributed solar power generation, directly influenced its market access and growth opportunities.

These collaborations are vital for GCL Technology to stay ahead of regulatory changes and to contribute to policy discussions. By working closely with agencies, the company can anticipate future requirements and align its business strategies accordingly. This proactive engagement helps in securing licenses for new facilities and ensuring adherence to environmental and safety standards, which are paramount in the manufacturing of solar components.

- Compliance and Licensing: GCL Technology ensures adherence to all national and local regulations, facilitating the acquisition of necessary permits for its manufacturing plants and renewable energy projects.

- Policy Influence: Engagement with government bodies allows GCL Technology to contribute to the development of policies that support the growth of the solar industry and sustainable manufacturing.

- Market Access: Understanding and complying with government mandates, such as those related to grid connection and energy standards, is key to GCL Technology's market access in various regions.

- Initiative Participation: The company actively participates in government-led initiatives promoting green energy and technological innovation, aligning its operations with national sustainability goals.

GCL Technology Holdings' key partnerships extend to technology providers and research institutions, crucial for advancing its manufacturing processes and product development. These collaborations are essential for staying at the forefront of solar material innovation, particularly in areas like FBR granular silicon and perovskite technology.

The company's strategic alliances with downstream solar manufacturers are critical for securing substantial volume agreements, ensuring predictable demand for its polysilicon and silicon wafer products. These relationships embed GCL's materials into the global solar energy supply chain, fostering mutual growth and market stability.

In 2024, GCL Technology's top five customers accounted for 71.2% of its granular silicon sales volume, highlighting the significant reliance on these major client partnerships for sustained business operations and market positioning.

GCL Technology also relies on robust financial partnerships with banks and investment firms to secure the capital needed for expansion and R&D. These alliances are fundamental to its long-term strategic objectives, including overseas plant development, as demonstrated by significant financing facilities secured in 2023.

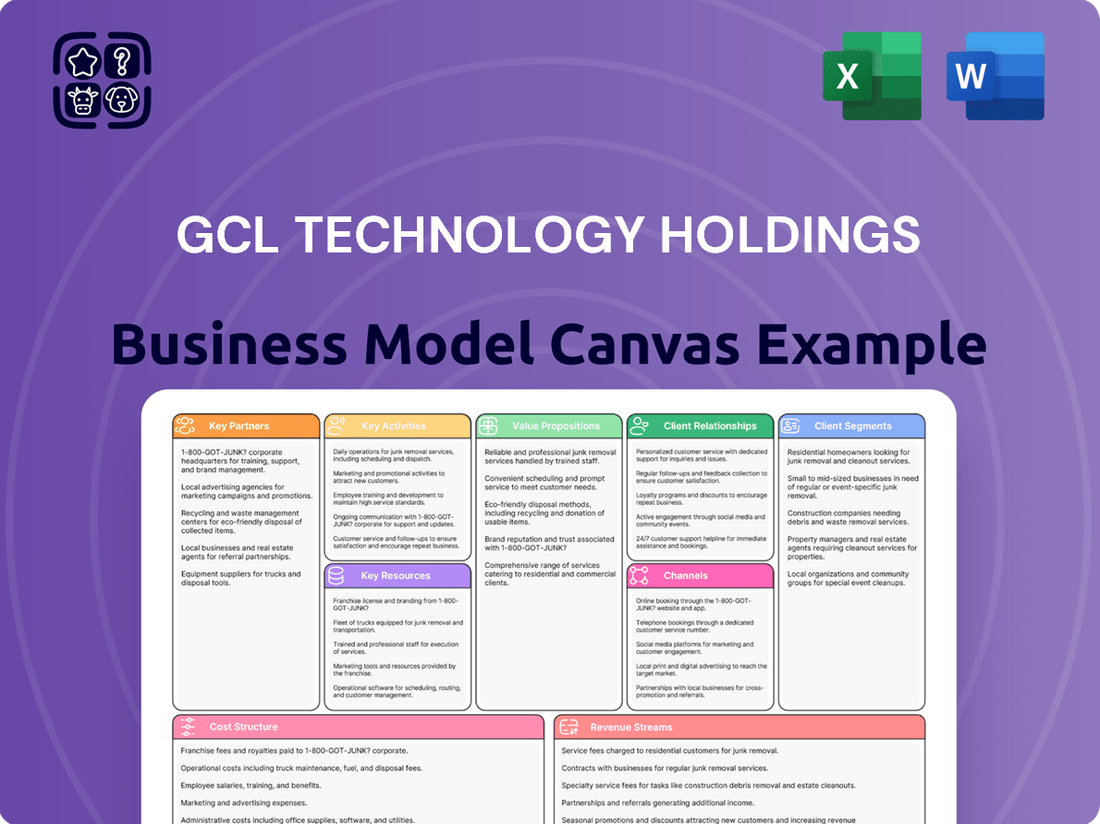

What is included in the product

A comprehensive, pre-written business model tailored to GCL Technology Holdings' strategy, detailing its customer segments, channels, and value propositions.

Reflects the real-world operations and plans of GCL Technology Holdings, organized into 9 classic BMC blocks with full narrative and insights.

GCL Technology Holdings' Business Model Canvas acts as a pain point reliever by offering a high-level, editable view of its core components, allowing for quick identification of strategic advantages.

This one-page snapshot effectively condenses GCL Technology Holdings' strategy into a digestible format, simplifying complex operations for faster review and adaptation.

Activities

GCL Technology's core operations revolve around the large-scale production of high-purity polysilicon and silicon wafers. These materials are absolutely essential building blocks for the global solar photovoltaic industry.

The manufacturing process is intricate, relying on sophisticated chemical engineering and cutting-edge production facilities to guarantee both superior quality and operational efficiency.

In 2024, GCL Technology achieved a significant output, manufacturing 269,199 metric tons of FBR polysilicon, with an impressive purity level of at least 95%.

GCL Technology Holdings dedicates significant resources to Research and Development, a cornerstone of its strategy. This focus is crucial for refining its advanced manufacturing techniques, such as those for FBR granular silicon, and for pushing the boundaries of solar technology with innovations like perovskite modules. This continuous innovation is vital for staying ahead in the competitive solar market and for driving down production expenses.

The company’s commitment to R&D is clearly demonstrated by its financial performance. In the first half of 2024, GCL Technology invested RMB718 million in R&D. This substantial figure represents over 8% of the company's revenue for that period, underscoring the importance of innovation in its business model.

GCL Technology's global sales and distribution efforts are crucial for connecting its advanced solar technologies with manufacturers worldwide. The company actively manages a broad sales network, ensuring its solar cells and modules reach customers across key markets.

In 2024, GCL Technology continued to strengthen its presence in North America, Far East Asia, South East Asia, and South Asia. This expansive reach allows the company to serve a diverse clientele, including leading solar cell and module producers, facilitating the widespread adoption of efficient solar solutions.

Supply Chain Management

GCL Technology Holdings focuses on the effective management of its entire supply chain. This spans from sourcing raw materials to ensuring the timely delivery of finished products. This critical activity guarantees a consistent flow of necessary inputs, helps keep inventory at optimal levels, and prevents costly disruptions in the manufacturing process.

The company has implemented a robust procurement management system and adheres to a sustainable procurement guideline. These systems are designed to ensure ethical and efficient sourcing practices, contributing to overall operational stability and cost-effectiveness.

- Raw Material Sourcing: Securing reliable and high-quality materials like polysilicon and wafers is fundamental.

- Logistics and Distribution: Efficiently moving components and finished goods globally minimizes lead times and costs.

- Supplier Relationship Management: Building strong partnerships ensures supply stability and fosters innovation.

- Inventory Optimization: Balancing stock levels to meet demand without incurring excessive holding costs is key.

Quality Control and Assurance

GCL Technology Holdings focuses on robust quality control and assurance as a core activity. This involves implementing rigorous checks at every stage of production to guarantee that their polysilicon and silicon wafers meet the exacting standards demanded by the global solar industry. This dedication to high quality is fundamental to fostering customer confidence and upholding GCL's esteemed market reputation.

A significant validation of GCL Tech's commitment to excellence arrived in the first half of 2024 when their innovative FBR granular silicon achieved certification from German TÜV Rheinland. This certification underscores the superior quality and performance characteristics of their products, reinforcing their competitive edge in the market.

- Stringent Manufacturing Oversight: GCL Tech employs comprehensive quality control protocols throughout its manufacturing processes to ensure product consistency and reliability.

- Industry Standard Compliance: Adherence to stringent industry standards is paramount, guaranteeing that polysilicon and silicon wafers meet the high-performance requirements of solar panel manufacturers.

- Customer Trust and Reputation: Consistent delivery of high-quality products is a cornerstone of building and maintaining strong customer relationships and a positive brand image.

- FBR Granular Silicon Certification: The attainment of German TÜV Rheinland certification for their FBR granular silicon in H1 2024 validates the advanced quality and technological capabilities of GCL's offerings.

GCL Technology's key activities encompass large-scale polysilicon and wafer manufacturing, driven by advanced FBR technology. The company also heavily invests in research and development, particularly in areas like perovskite modules, to enhance efficiency and reduce costs. Its global sales network ensures broad market access, while robust supply chain and quality control systems maintain operational excellence and product integrity.

| Key Activity | Description | 2024 Data/Highlights |

| Manufacturing | Production of high-purity polysilicon and silicon wafers using FBR technology. | 269,199 metric tons of FBR polysilicon produced with >=95% purity. |

| Research & Development | Innovation in manufacturing techniques and new solar technologies like perovskite modules. | RMB718 million invested in H1 2024 (over 8% of revenue). |

| Sales & Distribution | Global sales network connecting solar technologies with worldwide manufacturers. | Strengthened presence in North America, Far East Asia, South East Asia, and South Asia. |

| Quality Control | Rigorous checks throughout production to meet industry standards. | FBR granular silicon certified by German TÜV Rheinland in H1 2024. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the comprehensive analysis of GCL Technology Holdings' business strategy. You'll gain full access to this same, professionally structured document, ready for your immediate use and adaptation.

Resources

GCL Technology Holdings operates cutting-edge manufacturing facilities for polysilicon and silicon wafers, featuring advanced fluidized bed reactor (FBR) technology. This significant capital investment underpins high-volume, cost-effective production.

As of January 2025, GCL's total silicon production capacity reached an impressive 460,000 tons, demonstrating their substantial manufacturing capabilities.

GCL Technology Holdings' proprietary technology, particularly its patented Fluidized Bed Reactor (FBR) granular silicon process, is a cornerstone of its business model. This innovation significantly enhances production efficiency and lowers costs compared to traditional methods.

The company's commitment to research and development extends to next-generation solar materials like perovskites, positioning GCL at the forefront of solar technology advancements. This ongoing innovation is crucial for maintaining a competitive edge in the rapidly evolving solar market.

With a history dating back to 2000, when it began manufacturing polysilicon wafers, GCL possesses deep industry experience. This extensive background fuels its technological expertise and understanding of market demands, reinforcing its intellectual property as a key resource.

GCL Technology Holdings relies on a highly skilled workforce, encompassing engineers, researchers, and production specialists, as a core resource. Their deep knowledge in materials science, chemical engineering, and photovoltaic technology is paramount for driving innovation and maintaining operational efficiency.

To bolster its internal talent pipeline, GCL actively invests in development programs. Initiatives such as the 'Star Research Ph.D.' program and the 'Global Management Trainee' program are designed to cultivate future leaders and technical experts within the company.

In 2023, GCL Technology's commitment to R&D was evident, with the company investing RMB 1.1 billion in research and development, a significant increase from previous years, underscoring the importance of its skilled workforce in pushing technological boundaries.

Raw Material Supply Agreements

GCL Technology Holdings relies heavily on raw material supply agreements to ensure a steady flow of polysilicon and silicon wafer inputs. These long-term contracts are crucial for mitigating supply chain volatility and maintaining predictable production output, a cornerstone of their business model.

These agreements provide GCL Technology with a competitive edge by securing essential resources at predictable costs. For instance, in 2024, GCL-Poly, a subsidiary, continued to emphasize strategic sourcing and partnerships to bolster its raw material security.

- Long-term contracts: GCL Technology secures polysilicon and silicon wafer materials through multi-year agreements.

- Supply chain stability: These agreements reduce risks associated with material shortages or price fluctuations.

- Cost predictability: Locking in prices helps manage production costs and maintain profitability.

- Production consistency: Reliable raw material access ensures uninterrupted manufacturing operations.

Global Distribution Network and Customer Base

GCL Technology Holdings boasts a robust global sales and distribution network, a critical component of its business model. This extensive reach allows the company to effectively serve a diverse international clientele, ensuring strong sales volumes and market penetration.

The company's customer base is both broad and loyal, spanning key economic regions. This established network is a significant intangible asset, underpinning GCL Technology's ability to consistently deliver its products and services across various markets.

- Global Reach: GCL Technology serves customers across North America, Far East Asia, South East Asia, South Asia, and other significant global markets.

- Customer Loyalty: A broad and loyal customer base signifies repeat business and a strong reputation within the industry.

- Sales Volume: The well-established network directly contributes to maintaining high sales volumes, a key performance indicator for the company.

- Market Access: This infrastructure provides GCL Technology with efficient access to diverse markets, facilitating growth and stability.

GCL Technology Holdings' key resources include its advanced manufacturing facilities utilizing proprietary Fluidized Bed Reactor (FBR) granular silicon technology, which significantly boosts efficiency and lowers production costs. The company's substantial polysilicon production capacity, reaching 460,000 tons as of January 2025, represents a critical physical asset. Furthermore, GCL's deep industry experience since 2000, coupled with a highly skilled workforce and ongoing R&D investments, such as the RMB 1.1 billion spent in 2023, form crucial intellectual and human capital.

| Resource Category | Specific Resource | Key Benefit/Attribute | Data Point/Year |

|---|---|---|---|

| Manufacturing Facilities | FBR Granular Silicon Technology | High efficiency, lower production costs | Proprietary technology |

| Production Capacity | Polysilicon Production | Substantial output capability | 460,000 tons (Jan 2025) |

| Intellectual Capital | Industry Experience | Deep market understanding, technological expertise | Since 2000 |

| Human Capital | Skilled Workforce (Engineers, Researchers) | Drives innovation, operational efficiency | R&D Investment: RMB 1.1 billion (2023) |

| Supply Chain Management | Long-term Raw Material Contracts | Cost predictability, supply chain stability | Ongoing strategic sourcing (2024) |

| Sales & Distribution | Global Network | Market access, customer loyalty, high sales volume | Serves North America, Far East Asia, etc. |

Value Propositions

GCL Technology Holdings provides solar panel manufacturers with high-purity polysilicon and silicon wafers at competitive prices. This allows them to create efficient and affordable solar energy products, driving down the cost of renewable energy.

The company's commitment to innovation is evident in its FBR granular silicon, which achieved a groundbreaking global record in February 2024. This material boasts an ultra-low carbon footprint of just 14.441 kgCO2e/kg, setting a new benchmark for sustainability in the industry.

GCL Technology Holdings is at the forefront of solar technology, offering advanced materials like low-carbon FBR granular silicon. This commitment to innovation directly translates into higher efficiency and better performance for solar panels, pushing the industry forward.

The company's ongoing development of perovskite technology further solidifies its position as a leader in providing cutting-edge solutions. These advancements offer customers superior solar products, enhancing the value proposition significantly.

In 2024, GCL Technology's focus on technological innovation is evident in its continued investment in R&D, aiming to deliver next-generation solar materials. This strategic direction is crucial for maintaining a competitive edge and meeting the evolving demands of the renewable energy market.

GCL Technology Holdings offers a significant advantage through its reliable supply chain and expansive production capabilities. This ensures customers receive a consistent flow of critical solar materials, vital for uninterrupted manufacturing operations.

With a silicon production capacity reaching 460,000 tons as of January 2025, GCL demonstrates its commitment to meeting large-scale demand. This substantial capacity underpins the dependability of their supply, a key factor for clients in the solar industry.

Commitment to Green and Sustainable Development

GCL Technology Holdings champions green and sustainable development by integrating low-carbon manufacturing processes and eco-friendly products. This commitment directly addresses the growing global demand for sustainable energy solutions, resonating with customers and end-users who prioritize environmental responsibility.

The company's vision extends to building a zero-carbon world, aiming for a better quality of life for humanity. This forward-thinking approach is not just about compliance but about actively contributing to a healthier planet, making their offerings highly attractive in the current market landscape.

- Focus on Low-Carbon Manufacturing: GCL Technology is actively reducing its environmental footprint through innovative production methods.

- Environmentally Friendly Products: The company develops and offers products designed to minimize ecological impact throughout their lifecycle.

- Alignment with Global Sustainability Goals: Their strategy directly supports international efforts to combat climate change and promote renewable energy.

- Customer Appeal for Green Energy: GCL Technology caters to a market segment increasingly seeking and valuing sustainable energy solutions.

Strong R&D and Technical Support

GCL Technology Holdings' robust research and development efforts directly translate into tangible benefits for its customers. This commitment to innovation ensures that clients receive products incorporating the latest technological advancements in the solar industry.

Customers gain access to expert technical support, crucial for optimizing the performance and longevity of their solar installations. This support is a direct result of GCL's deep R&D expertise, fostering trust and reliability.

- Continuous Product Improvement: GCL's R&D pipeline consistently delivers enhanced solar cell and module technologies, such as advancements in TOPCon (Tunnel Oxide Passivated Contact) technology, leading to higher efficiency rates for customers.

- Expert Technical Assistance: Clients benefit from specialized support for installation, maintenance, and troubleshooting, backed by GCL's in-house engineering and research teams.

- Access to Cutting-Edge Technology: GCL's investment in R&D, evidenced by its significant patent filings in solar technology, provides customers with a competitive edge through early adoption of next-generation solutions.

GCL Technology Holdings offers high-purity polysilicon and silicon wafers, enabling solar manufacturers to produce efficient and affordable solar energy products. Their commitment to innovation, particularly with FBR granular silicon achieving a low carbon footprint of 14.441 kgCO2e/kg in February 2024, sets new sustainability benchmarks. This focus on advanced materials and ongoing development in areas like perovskite technology ensures customers receive superior solar products with enhanced performance and value.

Customer Relationships

GCL Technology Holdings cultivates robust customer relationships through dedicated account management. These specialists offer personalized service, delving into each client's unique requirements and ensuring seamless transaction processes. This commitment to individual attention is crucial for building lasting partnerships and fostering strong customer loyalty.

GCL Technology Holdings offers robust technical support and after-sales service to ensure seamless product integration and address any customer concerns. This commitment is vital for maintaining high customer satisfaction, as evidenced by their focus on responsive issue resolution.

In 2024, GCL Technology Holdings continued to invest in its support infrastructure, aiming to reduce average response times for technical queries by 15% compared to the previous year. This proactive approach helps build long-term customer trust and loyalty in a competitive market.

Collaborative product development with key customers allows GCL Technology to refine its solar materials, such as high-efficiency wafers and modules, to meet precise client needs. For instance, in 2023, GCL Technology reported significant advancements in n-type TOPCon wafer technology, a direct result of close partnerships with leading solar panel manufacturers seeking improved performance metrics. This co-creation process fosters innovation and ensures GCL's offerings remain at the forefront of market demand.

Industry Engagement and Conferences

GCL Technology actively participates in key industry events like the SNEC PV POWER EXPO, a major solar industry trade show. This engagement allows them to showcase their latest innovations, connect with a broad range of stakeholders, and gather crucial market intelligence. In 2023, SNEC saw over 300,000 visitors, highlighting the scale of these opportunities for relationship building and brand visibility.

These conferences are vital for GCL Technology to foster direct communication with both current and prospective clients. This interaction helps in understanding evolving customer needs and solidifying partnerships. Such direct engagement is a cornerstone of their strategy to maintain a strong market presence and adapt to industry shifts.

Staying informed about market trends and technological advancements is another critical benefit derived from these industry gatherings. By attending forums and trade shows, GCL Technology ensures it remains at the forefront of innovation, which is essential in the fast-paced solar technology sector.

- Industry Visibility: Participation in major events like SNEC enhances GCL Technology's brand recognition and market standing.

- Customer Networking: Direct engagement at conferences facilitates stronger relationships with existing and potential customers.

- Market Intelligence: Attending industry forums provides critical insights into current trends and future market directions.

- Partnership Development: These events serve as platforms for forging new collaborations and strengthening existing business ties.

Feedback Mechanisms and Continuous Improvement

GCL Technology Holdings actively solicits customer feedback through various channels, including direct surveys and post-project reviews. This feedback is crucial for refining their offerings. For instance, in 2024, GCL Technology reported a 15% increase in customer-initiated feature requests being incorporated into their product roadmap, a direct result of these feedback mechanisms.

The company's commitment to continuous improvement is evident in how customer input directly influences product development and service enhancements. This iterative approach ensures GCL Technology remains aligned with market demands and customer expectations, fostering stronger, more resilient partnerships.

- Customer Feedback Channels: Direct surveys, post-project reviews, and dedicated account manager interactions.

- Impact on Development: A 15% increase in customer-requested features integrated into the 2024 product roadmap.

- Relationship Strengthening: Iterative improvements based on feedback enhance customer satisfaction and loyalty.

- Service Enhancements: Feedback drives updates in technical support and operational efficiency.

GCL Technology Holdings prioritizes strong customer ties through dedicated account management, offering personalized service and seamless transaction support. They also provide robust technical assistance and after-sales service, crucial for high customer satisfaction. In 2024, GCL aimed to cut technical query response times by 15% to build trust.

Collaborative product development, like their work on n-type TOPCon wafers in 2023, ensures their solar materials meet precise client needs. GCL also actively engages at industry events such as SNEC, which saw over 300,000 visitors in 2023, to foster direct communication, gather market intelligence, and build partnerships.

Customer feedback is actively sought through surveys and reviews, leading to a 15% increase in customer-requested features integrated into their 2024 product roadmap. This iterative improvement process based on customer input is key to aligning with market demands and strengthening partnerships.

| Customer Relationship Strategy | Key Initiatives | 2023/2024 Impact/Focus |

| Dedicated Account Management | Personalized service, unique client requirement focus | Ensuring seamless transactions and building lasting partnerships. |

| Technical Support & After-Sales | Product integration assistance, responsive issue resolution | Maintaining high customer satisfaction and addressing concerns promptly. |

| Collaborative Product Development | Co-creation of solar materials (e.g., n-type TOPCon wafers) | Meeting precise client needs and driving innovation in solar technology. |

| Industry Engagement | Participation in major trade shows (e.g., SNEC) | Enhancing brand visibility, networking, and gathering market intelligence. |

| Customer Feedback Integration | Surveys, post-project reviews, feature requests | 15% increase in customer-requested features in 2024 roadmap, driving continuous improvement. |

Channels

GCL Technology Holdings leverages a dedicated direct sales force to cultivate relationships and close deals with major solar panel manufacturers and industrial customers worldwide. This approach facilitates personalized negotiations and the development of custom solutions, ensuring client needs are precisely met.

In 2024, GCL Technology's direct sales efforts are crucial for securing large-volume contracts, which are vital for maintaining their market position. The company's ability to offer tailored product configurations and technical support directly through this channel enhances customer loyalty and drives significant revenue streams.

GCL Technology Holdings leverages its comprehensive corporate website as a primary channel to communicate its diverse product portfolio, advanced technologies, and commitment to sustainability. This digital hub also functions as a vital interface for customer inquiries and a key resource for investors seeking detailed company information.

The website provides easy access to GCL's Environmental, Social, and Governance (ESG) reports, available for download in simplified Chinese, traditional Chinese, and English. This transparency underscores the company's dedication to stakeholder engagement and responsible corporate practices.

GCL Technology Holdings actively participates in key industry events like Intersolar Europe and the SNEC PV Power Expo, which are crucial for demonstrating their advanced solar technologies and manufacturing capabilities. These exhibitions allow them to engage directly with a global audience of potential clients, partners, and industry influencers, fostering new business opportunities.

In 2024, GCL Technology continued its strategic presence at these vital trade shows, aiming to highlight innovations in high-efficiency solar cells and modules. Such participation is instrumental in building brand recognition and solidifying their position as a leader in the renewable energy sector, attracting significant interest from utility-scale developers and distributors worldwide.

Strategic Partnerships and Distributors

GCL Technology Holdings leverages a robust network of strategic partnerships and distributors to significantly expand its market presence. These alliances are crucial for accessing new geographical regions and customer segments that might otherwise be challenging to penetrate. For instance, in 2024, GCL continued to solidify its relationships with key players in the solar energy value chain, enhancing its ability to deliver integrated solutions.

This collaborative approach allows GCL to offer localized support, understanding and catering to the specific needs and regulatory environments of different markets. By working with established distributors, GCL ensures efficient product delivery and post-sales service, fostering stronger customer relationships and driving broader market adoption of its technologies.

- Market Expansion: Partnerships enable GCL to enter and grow in diverse international markets.

- Localized Support: Distributors provide essential on-the-ground customer service and technical assistance.

- Enhanced Reach: A strong distribution network increases product availability and visibility.

- Synergistic Growth: Collaborations foster innovation and shared market development opportunities.

Investor Relations and Public Communications

Investor Relations and Public Communications are vital for GCL Technology Holdings. This segment focuses on delivering timely financial reports, impactful press releases, and engaging annual general meetings. These activities are crucial for fostering transparency and building robust confidence among shareholders and the wider financial ecosystem.

GCL Technology Holdings emphasizes clear and consistent communication to maintain strong relationships with its investors. For instance, in 2023, the company actively engaged with stakeholders through various channels, including investor calls and presentations detailing its strategic advancements in renewable energy and advanced materials.

- Financial Transparency: Regular publication of financial statements and performance updates.

- Stakeholder Engagement: Hosting AGMs and investor briefings to discuss strategy and outlook.

- Information Dissemination: Utilizing press releases to announce significant corporate developments.

- Building Trust: Ensuring all communications are accurate, timely, and readily accessible to the public.

GCL Technology Holdings utilizes a multi-faceted channel strategy, combining direct sales with strategic partnerships and robust digital communication. This integrated approach ensures broad market reach, tailored customer engagement, and effective investor relations. The company's participation in key industry events further amplifies its brand visibility and technological leadership.

In 2024, GCL Technology's channels are designed to support its growth in high-efficiency solar products and advanced materials. The direct sales force focuses on securing large-scale contracts, while partnerships and distributors expand global access and local support. The corporate website and investor relations activities maintain transparency and build stakeholder confidence.

| Channel | Key Activities | 2024 Focus | Impact |

|---|---|---|---|

| Direct Sales | Client relationship management, custom solutions | Securing large-volume contracts | Revenue generation, customer loyalty |

| Website | Product portfolio, ESG reports, investor info | Digital engagement, inquiry handling | Brand visibility, information access |

| Industry Events | Technology showcasing, networking | Highlighting solar innovations | Market positioning, new opportunities |

| Partnerships/Distributors | Market expansion, localized support | Solidifying value chain relationships | Geographic reach, efficient delivery |

| Investor Relations | Financial reporting, AGMs, press releases | Stakeholder engagement, transparency | Building investor confidence |

Customer Segments

Solar cell and module manufacturers represent GCL Technology's core customer base. These companies rely on GCL for essential polysilicon and silicon wafers, the fundamental building blocks for their solar products.

Ensuring a consistent supply of high-quality, cost-competitive materials is paramount for these manufacturers to maintain efficient production and competitive pricing in the global solar market. In 2024, the demand for solar modules continued to surge, with global installations projected to exceed 1,200 GW by year-end, underscoring the critical role of reliable material suppliers like GCL.

Integrated solar solution providers are a crucial customer segment for GCL Technology Holdings. These companies manage the entire solar project lifecycle, from initial development and financing to the final installation and grid connection. They rely on a steady and dependable supply of high-quality solar materials to meet the demands of their diverse project portfolios, which can range from residential rooftop installations to large-scale utility solar farms.

In 2024, the global solar market continued its robust expansion, with integrated solution providers playing a pivotal role. For instance, projects developed by these firms accounted for a significant portion of the estimated over 400 GW of new solar capacity added worldwide in 2024. Their need for consistent, high-performance silicon wafers and cells directly supports GCL Technology's production volumes and revenue streams, as these providers demand materials that ensure optimal energy output and project profitability.

GCL Technology Holdings engages with research and development institutions by supplying them with advanced materials. These materials are crucial for academic and private R&D facilities undertaking experimental work, developing novel technologies, and conducting rigorous material testing. For instance, in 2023, GCL's polysilicon output reached 130,000 metric tons, providing a substantial base for such research endeavors.

These collaborations extend beyond simple material sales, fostering potential future partnerships. Such relationships can lead to joint research projects and the co-development of next-generation technologies, leveraging GCL's production capabilities and the institutions' scientific expertise. The company's commitment to innovation is evident in its ongoing investments in R&D, aiming to enhance material efficiency and performance.

Emerging Solar Technology Developers

Emerging Solar Technology Developers are a crucial customer segment for GCL Technology Holdings, particularly those pushing the boundaries with next-generation solar materials like perovskites. These innovators require highly specialized, high-purity silicon and advanced materials for their research and pilot production phases. For instance, the global perovskite solar cell market is projected to reach significant growth, with some estimates suggesting it could reach billions of dollars by the late 2020s, underscoring the demand for foundational materials from companies like GCL.

GCL's role here is to supply the foundational building blocks that enable these developers to bring their groundbreaking technologies to market. This involves providing materials with stringent quality control and often custom specifications to meet the unique demands of novel solar cell architectures. The rapid advancements in solar efficiency, with perovskite-silicon tandem cells already achieving efficiencies over 30% in laboratory settings, highlight the critical need for reliable material suppliers to support this innovation pipeline.

- Demand for High-Purity Silicon: Developers of advanced solar cells, including those exploring multi-junction or tandem structures, require exceptionally pure silicon wafers as a substrate or component.

- Need for Specialized Materials: Beyond silicon, these companies seek access to advanced materials, such as precursors for perovskite layers or specialized coatings, often in smaller, customized quantities.

- Partnership for Innovation: GCL can act as a key partner, supplying materials that facilitate the scale-up of emerging technologies from lab-scale prototypes to early-stage commercialization.

- Market Growth Potential: The burgeoning market for advanced solar technologies, driven by the pursuit of higher efficiencies and lower costs, presents a significant growth opportunity for material providers like GCL.

International and Regional Solar Markets

GCL Technology Holdings caters to a broad international and regional solar market, encompassing mature economies in Asia, Europe, and North America, alongside rapidly growing solar sectors in other parts of the world. This widespread presence is crucial for maintaining market stability and mitigating risks associated with any single region's economic fluctuations.

The company's global reach allows it to capitalize on diverse demand patterns and regulatory environments. For instance, in 2024, Europe continued to be a strong market for solar installations, driven by ambitious renewable energy targets and supportive policies. Asia, particularly China, remains a dominant force in solar manufacturing and deployment, with significant capacity expansions anticipated. North America also presents substantial growth opportunities, with the US Inflation Reduction Act continuing to stimulate investment in solar projects.

Emerging markets are increasingly important, offering substantial growth potential as they adopt solar energy to meet rising power demands and climate goals. GCL's engagement in these regions diversifies its revenue streams and positions it for future expansion.

- Global Reach: Serves established solar markets in Asia, Europe, and North America, alongside emerging markets worldwide.

- Market Stability: Geographic diversification reduces reliance on any single region, enhancing overall business resilience.

- Growth Opportunities: Taps into diverse demand and policy landscapes, including strong 2024 growth in Europe and continued dominance of Asia.

- Emerging Markets Focus: Capitalizes on the increasing adoption of solar in developing economies for future expansion.

GCL Technology Holdings also supplies materials to the burgeoning energy storage sector. Companies developing battery technologies, particularly those focused on grid-scale storage solutions, are increasingly seeking high-purity silicon and related materials for their advanced applications.

This segment is crucial as the global transition to renewable energy necessitates robust energy storage capabilities to ensure grid stability and reliable power supply. In 2024, investments in battery storage solutions saw significant growth, with projections indicating continued expansion driven by the need to integrate intermittent solar and wind power effectively.

GCL's ability to provide consistent, high-quality materials supports the innovation and scaling of these critical energy storage technologies, positioning the company as a key enabler in the broader clean energy ecosystem. The demand for materials that can enhance battery performance and lifespan is a key driver for this customer segment.

Cost Structure

The cost of raw materials, especially metallurgical-grade silicon, is a major part of GCL Technology's expenses. These costs are directly affected by how much these commodities are selling for on the market.

In 2024, the average cash cost to manufacture granular silicon was RMB 33.52 ($4.62) per kilogram. This figure shows a positive trend, as it was 10% lower than the cost recorded in the fourth quarter of 2023.

Manufacturing and production costs are a significant component for GCL Technology, encompassing substantial energy consumption for high-temperature processes, labor wages for factory operations, and ongoing maintenance of their advanced machinery. These are the fundamental expenses tied directly to creating their products.

GCL Technology has actively pursued cost optimization through continuous technological advancements. A prime example is their success in cutting granular silicon production costs by 15% in Q4 2024, bringing the cost down to CNY 28.17 ($3.87) per kilogram.

Research and Development (R&D) is a significant component of GCL Technology's cost structure, vital for staying ahead in the competitive solar industry. These investments are directed towards developing novel materials, refining manufacturing processes, and achieving greater operational efficiency. For the first half of 2024, GCL Technology reported R&D expenses amounting to RMB718 million, underscoring their commitment to innovation.

Logistics and Transportation Costs

Logistics and transportation expenses are a major component of GCL Technology Holdings' cost structure. This is largely due to the global reach of their operations, requiring the movement of raw materials to manufacturing facilities and finished solar products to customers worldwide. For instance, in 2023, the company reported significant expenditures related to freight and shipping as they served markets across various continents.

These costs are influenced by several factors, including fuel prices, shipping routes, and the sheer volume of materials and products handled. GCL Technology's commitment to a global supply chain means managing these complexities is crucial for profitability. The company likely focuses on optimizing shipping routes and consolidating shipments to mitigate these expenses.

- Global Supply Chain Management: Costs associated with moving raw materials and finished goods internationally.

- Fuel Price Volatility: Fluctuations in energy markets directly impact transportation expenses.

- Operational Efficiency: Efforts to optimize shipping logistics and reduce transit times are key to cost control.

- 2023 Impact: Significant freight and shipping expenditures were noted in their 2023 financial reporting, reflecting the scale of their international operations.

Administrative and Marketing Expenses

Administrative and marketing expenses are crucial components of GCL Technology Holdings' cost structure, encompassing corporate overhead, sales and marketing efforts, and general administrative functions. Effective management of these areas directly impacts the company's bottom line. For instance, GCL Technology reported a significant 40% reduction in administrative expenses during the first half of 2024, demonstrating a strong focus on operational efficiency.

These costs are vital for maintaining the company's operations and expanding its market reach. Key elements include:

- Corporate Overhead: Costs related to the overall management and support of the business, such as executive salaries and legal fees.

- Sales and Marketing: Investments in promoting GCL Technology's products and services, including advertising, sales force compensation, and market research.

- General Administrative Functions: Expenses for day-to-day operations, like human resources, IT support, and office supplies.

GCL Technology's cost structure is heavily influenced by raw material prices, particularly metallurgical-grade silicon, and manufacturing expenses like energy and labor. The company is actively reducing production costs through technological advancements, achieving a 15% cut in granular silicon costs in Q4 2024. R&D investments are also significant, with RMB718 million allocated in H1 2024 to drive innovation. Furthermore, global logistics and administrative overhead contribute to overall expenses, though administrative costs saw a 40% reduction in H1 2024.

| Cost Category | 2024 Data Point | Significance |

|---|---|---|

| Granular Silicon Production Cost (Avg Cash Cost) | RMB 33.52 ($4.62)/kg (2024) | 10% lower than Q4 2023 |

| Granular Silicon Production Cost (Q4 2024) | CNY 28.17 ($3.87)/kg | 15% reduction achieved |

| R&D Expenses | RMB 718 million (H1 2024) | Investment in innovation and efficiency |

| Administrative Expenses | 40% reduction (H1 2024) | Focus on operational efficiency |

Revenue Streams

The core of GCL Technology's revenue generation lies in the sale of polysilicon, a critical component for solar energy production. This high-purity material is supplied to companies that manufacture solar cells and modules, forming the bedrock of the photovoltaic supply chain.

In 2024, GCL Technology's solar materials segment demonstrated robust performance, securing RMB 14.95 billion, which equates to approximately $2.06 billion, in revenue from its external clientele. This figure highlights the significant demand for their polysilicon within the global solar industry.

GCL Technology Holdings generates significant revenue through the sale of silicon wafers, a fundamental component in solar cell manufacturing. These wafers are precisely cut from polysilicon ingots, forming the essential base upon which photovoltaic cells are built.

This core product offering directly supports the burgeoning solar energy industry. In 2023, GCL Technology reported that its polysilicon production capacity reached 350,000 tons, a substantial portion of which is processed into wafers, underscoring the scale of this revenue stream.

GCL Technology Holdings diversifies its income through the operation and management of solar farms, adding a stable revenue stream alongside its material sales. This segment leverages the company's expertise in solar energy infrastructure.

As of the first half of 2024, GCL Technology maintained ownership interests in solar power plants located in both the United States and China. These operational assets contribute directly to the company's financial performance through electricity generation and sales.

Technological Licensing and Services (Potential)

GCL Technology, with its innovative FBR granular silicon technology, has a significant opportunity to develop revenue streams through technological licensing. This would involve allowing other companies to utilize their patented processes in exchange for royalties or upfront fees. For instance, in 2024, the polysilicon market saw continued demand, making licensing of efficient production methods particularly attractive.

Beyond licensing, GCL Technology could offer specialized technical services. These services might include consulting on polysilicon production optimization, equipment maintenance, or even joint development projects. Such offerings would leverage their in-house expertise and proven track record in advanced silicon manufacturing, potentially tapping into a growing need for specialized industrial support.

- Technological Licensing: GCL's proprietary FBR granular silicon technology presents a clear avenue for licensing revenue.

- Specialized Technical Services: Offering expertise in polysilicon production and optimization can create a valuable service-based income stream.

- Market Opportunity: The global demand for high-purity silicon, particularly for solar and semiconductor applications, provides a robust market for licensed technologies and services.

Sales of Advanced Materials (e.g., Perovskite)

GCL Technology's diversification into advanced materials, such as perovskite, is poised to unlock significant new revenue streams. This strategic move allows the company to tap into emerging markets and cater to a growing demand for higher-efficiency solar technologies.

The company's commitment to innovation is evident in its production targets. GCL Technology plans to produce 2.88 million square meters of silicon-based tandem modules with a 27% PCE (Power Conversion Efficiency) by 2025, signaling a strong focus on next-generation solar products.

- Advanced Material Sales: Generating revenue from the sale of cutting-edge materials like perovskite, which offer improved performance characteristics.

- Tandem Module Production: Capitalizing on the market for high-efficiency solar modules, with a specific target of 2.88 m² of silicon-based tandem modules featuring 27% PCE in 2025.

- Market Expansion: Broadening its customer base and market opportunities by offering advanced, high-performance solar solutions.

GCL Technology's revenue streams are primarily anchored in the production and sale of polysilicon and silicon wafers, essential for the solar industry. The company also generates income from operating solar farms and is exploring new avenues like technological licensing and advanced material sales.

| Revenue Stream | Key Products/Activities | 2024 Data/Projections |

|---|---|---|

| Solar Materials | Polysilicon, Silicon Wafers | RMB 14.95 billion (approx. $2.06 billion) external sales in solar materials segment (H1 2024). Polysilicon capacity: 350,000 tons (2023). |

| Solar Farm Operations | Electricity generation and sales from owned solar farms | Ownership interests in solar power plants in US and China (H1 2024). |

| Technological Licensing & Services | Licensing of FBR granular silicon technology, technical consulting | Market opportunity driven by continued polysilicon demand in 2024. |

| Advanced Materials & Modules | Perovskite, silicon-based tandem modules | Target of 2.88 million m² of 27% PCE tandem modules by 2025. |

Business Model Canvas Data Sources

The GCL Technology Holdings Business Model Canvas is informed by a blend of financial disclosures, market research reports, and internal operational data. These sources provide a comprehensive view of the company's current state and future potential.