GCL Technology Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GCL Technology Holdings Bundle

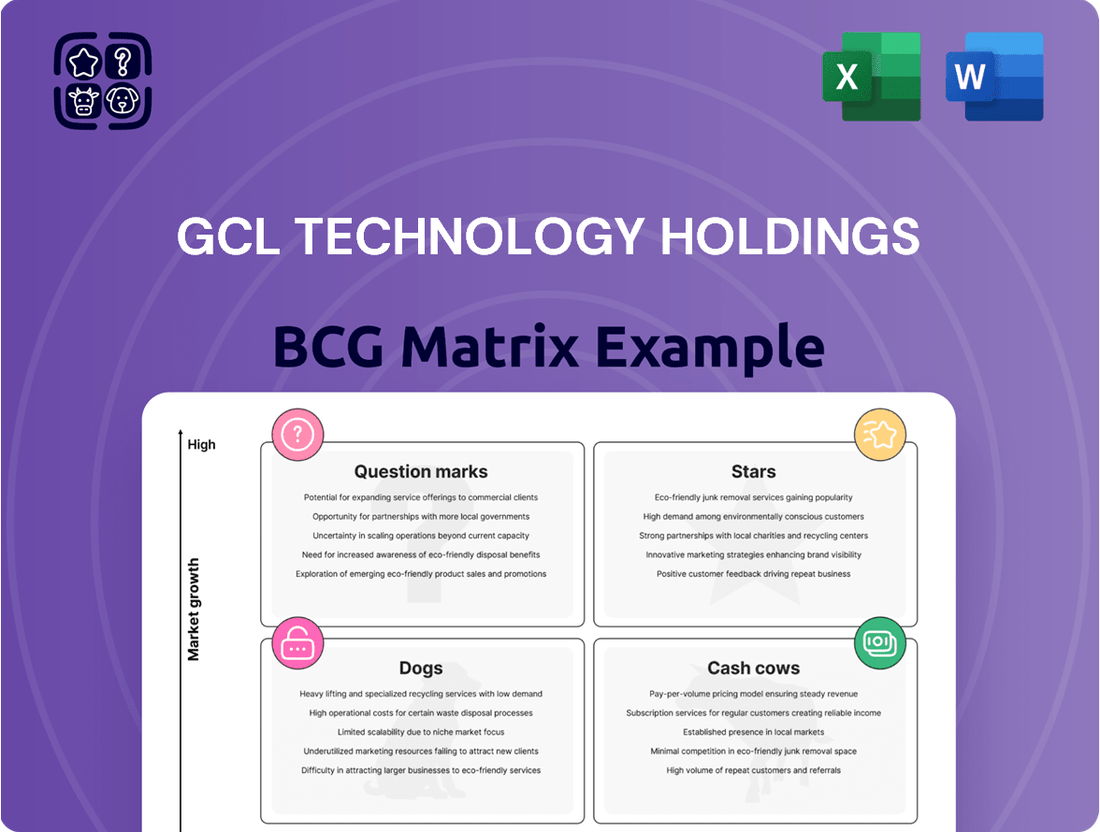

Curious about GCL Technology Holdings' product portfolio? Our BCG Matrix preview offers a glimpse into their market standing, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly understand their strategic direction and unlock actionable insights for your own investments, dive into the full report.

This isn't just a classification; it's a strategic roadmap. The complete GCL Technology Holdings BCG Matrix provides detailed quadrant analysis and data-driven recommendations, empowering you to make informed decisions about resource allocation and future product development. Secure your copy for a competitive edge.

Stars

GCL Technology's proprietary Fluidized Bed Reactor (FBR) granular silicon technology is a key differentiator, enabling lower production costs and higher quality polysilicon. This innovative approach achieved an ultra-low carbon footprint, setting a new global record at its Inner Mongolia Xinyuan facility in February 2024.

This technological advancement is vital for reducing carbon emissions across the photovoltaic sector. It solidifies GCL's position as a leader in polysilicon manufacturing, contributing to a more sustainable energy future.

GCL Technology Holdings stands as a titan in the polysilicon market, boasting substantial production capabilities. By January 2025, their silicon production capacity reached an impressive 460,000 tons, building upon a reported 480,000 MT capacity in 2024.

The company's strategic emphasis on fluidized bed reactor (FBR) granular silicon has been a key driver for increased output. This focus led to a significant 32.2% year-on-year rise in granular silicon production throughout 2024, underscoring their technological advancements and market position.

GCL Technology is doubling down on its FBR granular silicon production, a move that signals a significant shift in its operational strategy. By January 2025, the company plans to exit all investments tied to the Siemens process for polysilicon, a clear indication of its commitment to this more advanced and economical method. This strategic reallocation of capital is designed to sharpen its focus on the granular silicon technology, which is seen as the future of photovoltaic silicon material production.

This strategic pivot is not just about exiting one technology; it's about aggressively pursuing market leadership. GCL Technology has set an ambitious target to capture over 30% of the global demand for photovoltaic silicon materials in the coming years. This aggressive market share goal underscores the company's confidence in its FBR granular silicon technology and its potential to disrupt the existing market dynamics.

Global Expansion Initiatives

GCL Technology Holdings is strategically expanding its global footprint, aiming to leverage its advanced FBR granular silicon technology. The company is notably progressing with plans for its inaugural overseas granular silicon plant located in the United Arab Emirates. This move signifies a significant step in its internationalization strategy, targeting key growth markets.

Further underscoring this global ambition, GCL Technology is engaged in discussions for a substantial 120,000-ton-per-year silicon facility in Saudi Arabia. These international ventures are designed to meet the escalating global demand for solar materials, positioning GCL Technology as a key player in the worldwide renewable energy supply chain.

- International Expansion: GCL Technology is establishing its first overseas granular silicon plant in the United Arab Emirates.

- Strategic Partnerships: Discussions are underway for a 120,000-ton-per-year silicon facility in Saudi Arabia.

- Market Capitalization: As of early 2024, GCL Technology's market capitalization stood around $3.5 billion, reflecting investor confidence in its growth trajectory.

- Revenue Growth: The company reported a significant increase in revenue for the first half of 2023, driven by strong demand for its high-quality silicon products.

Innovation in Solar Materials

GCL Technology is pushing the boundaries of solar material science beyond traditional polysilicon. The company has been actively sampling wafers produced through its innovative Continuous Czochralski (CCz) process, which leverages Fluidized Bed Reactor (FBR) silicon as a key input. This development signifies a move towards more efficient and potentially cost-effective wafer manufacturing.

Further demonstrating their commitment to advanced materials, GCL Technology's full-sized perovskite modules have achieved a notable power conversion efficiency (PCE) of 19.04%. Looking ahead, the company has ambitious plans, aiming to produce 2.88 square meter silicon-based tandem modules with a target PCE of 27% by 2025. These advancements position GCL Technology at the forefront of next-generation solar technology development.

- CCz Process: Utilizes FBR silicon for wafer production.

- Perovskite Module Efficiency: Achieved 19.04% PCE in full-sized modules.

- Tandem Module Goal: Targeting 27% PCE for 2.88 m² silicon-based tandem modules by 2025.

GCL Technology's FBR granular silicon, with its ultra-low carbon footprint and cost advantages, positions it as a strong contender in the BCG matrix. The company's significant investment and production increases in this area, alongside its global expansion plans, suggest it is a "Star" product. This is further supported by its leadership in technological innovation and ambitious market share goals.

| Metric | Value | Year | Source |

|---|---|---|---|

| Granular Silicon Production Growth | 32.2% YoY | 2024 | GCL Technology |

| Total Silicon Production Capacity | 480,000 MT | 2024 | GCL Technology |

| Target Global Market Share | >30% | Future | GCL Technology |

What is included in the product

The GCL Technology Holdings BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

The GCL Technology Holdings BCG Matrix provides a clear, one-page overview of each business unit's market position, alleviating the pain of strategic ambiguity.

Cash Cows

GCL Technology's polysilicon segment is a clear cash cow. In 2024, the company achieved a notable 15.9% year-on-year increase in polysilicon production, reaching 281,915 metric tons. This robust output, coupled with a 24.7% surge in polysilicon sales, demonstrates significant market demand and operational efficiency.

The company also saw impressive growth in granular silicon production, up 32.2% year-on-year in 2024. Despite market price fluctuations, this high sales volume indicates GCL Technology's strong market position and its ability to generate substantial cash flow from its polysilicon operations.

GCL Technology Holdings has made impressive strides in lowering the costs associated with producing granular silicon. This efficiency is crucial for maintaining profitability in a dynamic market.

In 2024, the company's average cash manufacturing cost for granular silicon, which includes R&D, stood at RMB 33.52 ($4.62) per kilogram. This figure marked a 10% reduction from the fourth quarter of 2023. The trend of cost optimization continued into early 2025, with costs dropping further to RMB 27.14 ($3.74) per kilogram during January and February.

GCL Technology Holdings stands as a dominant force in the polysilicon market, a true cash cow within its BCG Matrix. The company is globally acknowledged as one of the largest polysilicon producers, playing a pivotal role in advancing technology within the photovoltaic materials industry. This established leadership translates to a substantial market share in a sector that, while mature, continues to experience robust growth.

Strategic Customer Relationships

GCL Technology Holdings' strategic customer relationships are a defining characteristic of its cash cow status. The company's reliance on a few major clients underscores the stability and predictability of its revenue streams.

In 2024, GCL Technology Holdings reported that its top 5 customers accounted for a significant 71.2% of its total granular silicon sales volume. This high concentration highlights the depth and strength of these relationships, which are crucial for maintaining a consistent and substantial cash flow. Such enduring partnerships are a hallmark of a mature business unit that generates more cash than it consumes, fitting the definition of a cash cow within the BCG matrix.

- Customer Concentration: Top 5 customers represented 71.2% of granular silicon sales in 2024.

- Revenue Stability: This concentration indicates strong, long-term relationships providing a predictable revenue base.

- Cash Flow Generation: The stable revenue supports consistent cash generation, a key trait of a cash cow.

Revenue Generation from Solar Materials Business

GCL Technology's solar materials division, despite facing a challenging 2024 marked by declining polysilicon prices, remains a significant revenue generator and a core cash cow for the company. In 2024, this segment brought in RMB 14.95 billion from external sales, demonstrating its enduring strength even amidst market volatility.

This substantial revenue, even with a downturn, highlights the business's capacity to produce consistent cash flow, a hallmark of a cash cow within the BCG Matrix framework. The sheer volume of sales underscores its importance to GCL Technology's overall financial health.

- 2024 External Revenue: RMB 14.95 billion from solar materials.

- Market Context: Revenue decline attributed to lower polysilicon prices.

- Business Classification: Positioned as a Cash Cow due to consistent cash generation despite headwinds.

- Strategic Importance: Core business contributing significantly to overall company revenue.

GCL Technology's polysilicon segment is a quintessential cash cow, consistently generating substantial revenue and cash flow. The company's significant market share and operational efficiency in this mature but growing sector solidify its position. Despite market price fluctuations in 2024, the sheer volume of sales and strategic customer relationships underscore its stability.

The company's ability to maintain strong sales, as evidenced by its top 5 customers accounting for 71.2% of granular silicon sales in 2024, highlights predictable revenue streams. Furthermore, the ongoing efforts to reduce manufacturing costs, with granular silicon costs dropping to RMB 27.14 per kilogram in early 2025, enhance profitability and cash generation. This segment is a vital contributor to GCL Technology's financial health.

| Metric | 2024 Data | Significance |

|---|---|---|

| Polysilicon Production | 281,915 metric tons (15.9% YoY increase) | Demonstrates high output and market demand. |

| Granular Silicon Sales Growth | 32.2% YoY increase | Indicates strong market position and cash flow generation. |

| Average Cash Mfg. Cost (Granular Silicon) | RMB 33.52/kg (Q4 2023: RMB 37.24/kg) | Shows cost optimization, boosting profitability. |

| Top 5 Customer Sales Concentration | 71.2% of granular silicon sales | Highlights stable, predictable revenue from key relationships. |

| Solar Materials External Revenue | RMB 14.95 billion | Significant revenue generation despite market headwinds. |

Delivered as Shown

GCL Technology Holdings BCG Matrix

The BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after purchase. This means the strategic insights and analysis presented here are exactly what you'll utilize for GCL Technology Holdings' business planning. No further edits or additions are necessary; this is the final, ready-to-deploy report.

Dogs

GCL Technology's silicon wafer segment is showing signs of weakness. In 2024, wafer production dropped to 32,243 MW, a substantial 36.9% decrease from 51,077 MW in 2023. This downturn was mirrored in sales, which also fell by 35.4% over the same period.

The challenging market conditions for silicon wafers in 2024 likely contributed to this decline. The significant drop in both production and sales suggests this business unit may be underperforming and potentially losing market share within the industry.

GCL Technology Holdings saw a significant 55.2% drop in overall revenue for 2024 compared to the previous year. This sharp decline is largely attributed to falling polysilicon prices, a key product for the company. Although polysilicon itself remains a robust offering, this substantial revenue decrease suggests broader market challenges or underperformance in other areas are negatively impacting the company's financial standing.

GCL Technology Holdings experienced a significant downturn in 2024, reporting a net loss of RMB 4.75 billion. This marks a stark contrast to the net profit achieved in the prior year.

This substantial financial setback is primarily due to a confluence of factors, including escalating operational costs, a decline in sales volume, and considerable impairment losses. These pressures collectively indicate business segments that are draining resources without generating sufficient returns, aligning them with the characteristics of a 'Dog' in the BCG matrix.

Impact of Polysilicon Price Slump

The polysilicon market has seen a dramatic downturn, with prices in China plummeting by 85% from their mid-2022 peak. This sharp decline is primarily attributed to a significant oversupply situation that has engulfed the industry.

While GCL Technology has made strides in cost reduction, the prevailing market conditions of intense competition and excess supply have undeniably squeezed profitability across the board. This environment makes it difficult for any product within the polysilicon sector to consistently achieve 'Star' or 'Cash Cow' status in a BCG matrix analysis.

- Market Oversupply: Chinese polysilicon prices fell by 85% from mid-2022 to mid-2024, driven by an oversupply.

- Profitability Squeeze: Fierce competition and excess inventory have severely impacted profit margins for polysilicon producers.

- Challenging Market Position: The current market dynamics make it difficult for GCL's polysilicon products to be classified as consistent Stars or Cash Cows.

Divestment from Siemens Process Polysilicon

GCL Technology Holdings has divested its involvement with Siemens process polysilicon production, a move that signals a strategic shift away from older technology. This exit from a segment with a 60,000-ton annual production capacity suggests the company viewed this particular operation as a cash trap, meaning it consumed significant capital without generating sufficient returns.

The decision to divest from the Siemens process polysilicon segment, which represented a substantial portion of its previous capacity, aligns with a BCG matrix approach where underperforming or low-growth assets are shed. By exiting this area, GCL Technology can reallocate resources and focus on its more promising and potentially higher-growth ventures, optimizing its overall portfolio for better future performance.

- Divestment Completed: GCL Technology has fully exited its direct and indirect investments in Siemens process polysilicon production.

- Capacity Exited: The divestment impacted a production capacity of 60,000 tons.

- Strategic Rationale: The move is interpreted as shedding a non-performing asset or 'cash trap' to focus on more strategic growth areas.

- BCG Matrix Alignment: This action reflects a strategy to move away from 'cash cows' that require significant investment for marginal returns, towards 'stars' or 'question marks' with higher growth potential.

GCL Technology's silicon wafer segment, with production down 36.9% in 2024 to 32,243 MW and sales down 35.4%, clearly fits the 'Dog' category. The company's overall revenue decline of 55.2% in 2024 and a net loss of RMB 4.75 billion further solidify this classification, indicating segments with low market share and low growth that consume resources without generating significant returns.

The divestment from its 60,000-ton Siemens process polysilicon production capacity underscores this. This move suggests GCL viewed this operation as a cash trap, a hallmark of 'Dogs' that require substantial capital investment for minimal returns, allowing the company to reallocate resources to more promising ventures.

The broader polysilicon market's struggles, with prices falling 85% from mid-2022 to mid-2024 due to oversupply, mean that even historically strong products are finding it difficult to maintain 'Star' or 'Cash Cow' status, reinforcing the 'Dog' classification for underperforming segments.

GCL Technology's 2024 performance, marked by a significant drop in wafer production and sales, alongside a substantial net loss, points to its silicon wafer and potentially other segments operating as 'Dogs' in the BCG matrix. These units exhibit low market share and low growth prospects, demanding significant capital while yielding minimal returns.

| Business Segment | 2023 Production (MW) | 2024 Production (MW) | Change (%) | BCG Classification |

| Silicon Wafers | 51,077 | 32,243 | -36.9% | Dog |

| Siemens Process Polysilicon | N/A (Divested) | N/A (Divested) | N/A | Dog (Divested) |

Question Marks

GCL Technology is investing heavily in perovskite and silicon-based tandem modules, signaling a strategic move towards next-generation solar technology. The company aims to produce 2.88 m² silicon-based tandem modules with a 27% power conversion efficiency (PCE) by 2025. This focus positions GCL within the 'Question Marks' quadrant of the BCG matrix due to their high growth potential but nascent market penetration and commercialization status.

GCL Technology Holdings is currently sampling wafers produced via its novel Continuous Czochralski (CCz) process, utilizing Fluidized Bed Reactor (FBR) silicon. This innovative approach is designed to enhance wafer manufacturing efficiency and cost-effectiveness.

However, the market's full embrace and the ultimate profitability of this CCz technology remain uncertain, positioning it squarely within the Question Mark quadrant of the BCG Matrix. While GCL reported significant advancements in FBR silicon production in 2023, the commercial viability of CCz wafers is still being assessed.

GCL Technology's electronic-grade polysilicon production, primarily through its associate XinHua Semiconductor, has seen significant expansion with the addition of 10,000 tons of capacity. This move has secured over 50% of the domestic market share, demonstrating GCL's strong position within China.

However, to accurately place this segment on the BCG Matrix, a deeper analysis of the global electronic-grade polysilicon market size and its growth rate is crucial. Comparing its trajectory to that of solar-grade polysilicon will help determine if it's a Star or a Question Mark on the international stage.

New Material Projects (Carbon Nanotubes, Silicon Carbide, Silicon Nitride)

GCL Technology Holdings is actively exploring and developing new material projects beyond its established solar business. These ventures include carbon nanotubes, graphite electrodes, silicon carbide, and silicon nitride. Many of these advanced materials have already undergone successful customer validation, indicating promising market reception.

These diversified projects operate in sectors with significant growth potential. However, given GCL Technology's current position, these new material initiatives likely represent low initial market shares within their respective industries. This strategic positioning, characterized by high growth potential but a nascent market presence, aligns them with the characteristics of a 'Question Mark' in the BCG Matrix.

- Carbon Nanotubes: While specific 2024 market share data for GCL in this segment is not yet widely published, the global carbon nanotube market was projected to reach approximately $5.3 billion by 2024, with significant growth driven by applications in electronics and composites.

- Silicon Carbide (SiC): The SiC market is experiencing robust expansion, with projections indicating it could exceed $6 billion in 2024, fueled by demand in electric vehicles and power electronics. GCL's entry into this space positions them to capture a share of this high-growth area.

- Silicon Nitride: This advanced ceramic material is finding increasing use in high-temperature applications and wear-resistant components. The market for silicon nitride, though smaller than SiC, is also on an upward trajectory, with growth expected to be driven by aerospace and industrial machinery sectors.

Overseas Granular Silicon Facilities in Emerging Markets

GCL Technology Holdings' strategic moves into overseas granular silicon facilities, particularly the planned plant in the UAE and ongoing discussions for a Saudi Arabian site, signal a significant push into emerging markets. These ventures are positioned as Stars within the BCG matrix, reflecting their high growth potential in the expanding global solar industry.

Establishing a foothold in these new regions demands substantial capital outlay and navigates a landscape with inherent market entry risks. For instance, the UAE's solar capacity is projected to reach 14.2 GW by 2030, presenting a substantial but competitive opportunity. GCL's investment in these facilities aims to capitalize on this growth, though market share acquisition will be a key challenge.

- UAE Facility: GCL's first overseas granular silicon plant is slated for the UAE, a region with ambitious renewable energy targets.

- Saudi Arabia Discussions: Talks are underway for a potential facility in Saudi Arabia, further expanding GCL's geographic footprint.

- Market Growth & Risk: These initiatives target the rapidly growing global solar market but involve significant investment and market penetration risks.

- Strategic Positioning: The ventures are categorized as Stars due to their high growth potential, contingent on successful market entry and competitive positioning.

GCL Technology's innovative CCz process for silicon wafer production and its ventures into advanced materials like carbon nanotubes and silicon carbide are currently in development phases. These initiatives exhibit high market growth potential but have yet to establish significant market share, characteristic of Question Marks. The company's strategic investments aim to capture future market demand in these burgeoning sectors.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including GCL Technology's financial reports, industry growth rates, and competitor analyses, to accurately position each business unit.