GCC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GCC Bundle

The GCC's economic landscape presents a compelling mix of robust strengths, like significant oil reserves, and emerging opportunities in diversification. However, understanding the full picture requires a deeper dive into its unique challenges and potential threats.

Want to truly grasp the GCC's strategic advantages and potential pitfalls? Purchase the complete SWOT analysis to unlock actionable insights, expert commentary, and a comprehensive view of the region's future, empowering your investment and strategic decisions.

Strengths

GCC's primary focus on the construction sector across the United States, Mexico, and Canada allows for highly targeted market strategies and a profound understanding of regional needs. This concentration fosters deep local expertise, covering crucial elements like regulatory landscapes, intricate supply chains, and established customer relationships within the building materials industry.

GCC's strength lies in its diversified product portfolio, encompassing cement, aggregates, ready-mix concrete, and other construction materials. This breadth allows GCC to serve a wide array of market segments, from individual home builders to major infrastructure developers. For instance, in 2024, the company reported significant revenue contributions from its concrete division, complementing its long-standing cement business, indicating balanced demand across its offerings.

GCC holds a formidable position within the U.S. market, a region that impressively generates 75% of its total sales. This substantial reliance underscores a deep penetration into a key economic powerhouse.

The U.S. construction sector, a primary driver for GCC, is experiencing a favorable outlook. Projections indicate growth fueled by significant government infrastructure spending and a resurgence in residential building projects, creating a robust environment for GCC's ongoing success.

Commitment to Sustainability and ESG Initiatives

GCC's dedication to sustainability is a significant strength, reflected in its impressive CDP rating. This commitment not only bolsters its image among environmentally aware stakeholders but also positions it favorably for future regulatory landscapes and attracts ESG-focused capital.

The company's proactive investment in emissions control systems directly supports its sustainability goals. This focus on environmental stewardship is increasingly crucial for long-term value creation, potentially unlocking operational efficiencies and ensuring continued market access in a world prioritizing green practices.

- Strong CDP Rating: Demonstrates robust environmental reporting and performance.

- Investment in Emissions Control: Underscores a tangible commitment to reducing environmental impact.

- Enhanced Brand Reputation: Appeals to a growing segment of socially responsible consumers and investors.

- Regulatory Preparedness: Aligns the company with evolving global environmental standards.

Strategic Investments and Expansion

GCC's strategic investments, like the expansion of its Odessa, Texas cement plant, demonstrate a forward-thinking strategy to boost production capacity and anticipate future market needs. This proactive stance is crucial for capturing growth opportunities.

These capacity expansions, combined with judicious acquisitions in the aggregates sector, are designed to solidify GCC's market position and drive sustained growth in strategically important geographic areas. For instance, the company has been actively investing in its US operations, aiming to leverage growing infrastructure demands.

- Capacity Expansion: Investments in facilities like the Odessa plant are key to meeting projected demand increases.

- Strategic Acquisitions: Targeted purchases in aggregates enhance vertical integration and market reach.

- Market Share Growth: These initiatives are geared towards securing and expanding GCC's presence in core markets.

GCC's deep specialization in the construction sector across the U.S., Mexico, and Canada allows for highly effective, localized strategies and a superior understanding of regional requirements. This focus cultivates extensive local knowledge, encompassing regulatory frameworks, complex supply chains, and established customer relationships within the building materials industry.

GCC's diverse product range, including cement, aggregates, and ready-mix concrete, enables it to cater to a broad spectrum of market segments. In 2024, the company saw robust revenue from its concrete operations, balancing its established cement business and reflecting balanced demand across its product lines. The U.S. market, representing 75% of GCC's sales, provides a strong foundation for growth, especially with favorable projections for the construction sector driven by infrastructure spending and residential development.

GCC's commitment to sustainability, evidenced by its strong CDP rating and investments in emissions control systems, enhances its brand reputation and prepares it for evolving environmental regulations. Strategic capacity expansions, such as the Odessa, Texas cement plant upgrade, and targeted acquisitions in aggregates, are designed to bolster market share and capitalize on anticipated demand increases in key areas.

| Metric | Value (2024/2025 Projections) | Significance |

|---|---|---|

| U.S. Sales Contribution | 75% | Highlights significant reliance and penetration in a key market. |

| Product Diversification | Cement, Aggregates, Ready-Mix Concrete | Enables service to varied market segments, from residential to infrastructure. |

| Capacity Expansion Investments | Ongoing (e.g., Odessa Plant) | Aims to meet projected demand and solidify market position. |

| Sustainability Performance | Strong CDP Rating | Enhances brand reputation and regulatory preparedness. |

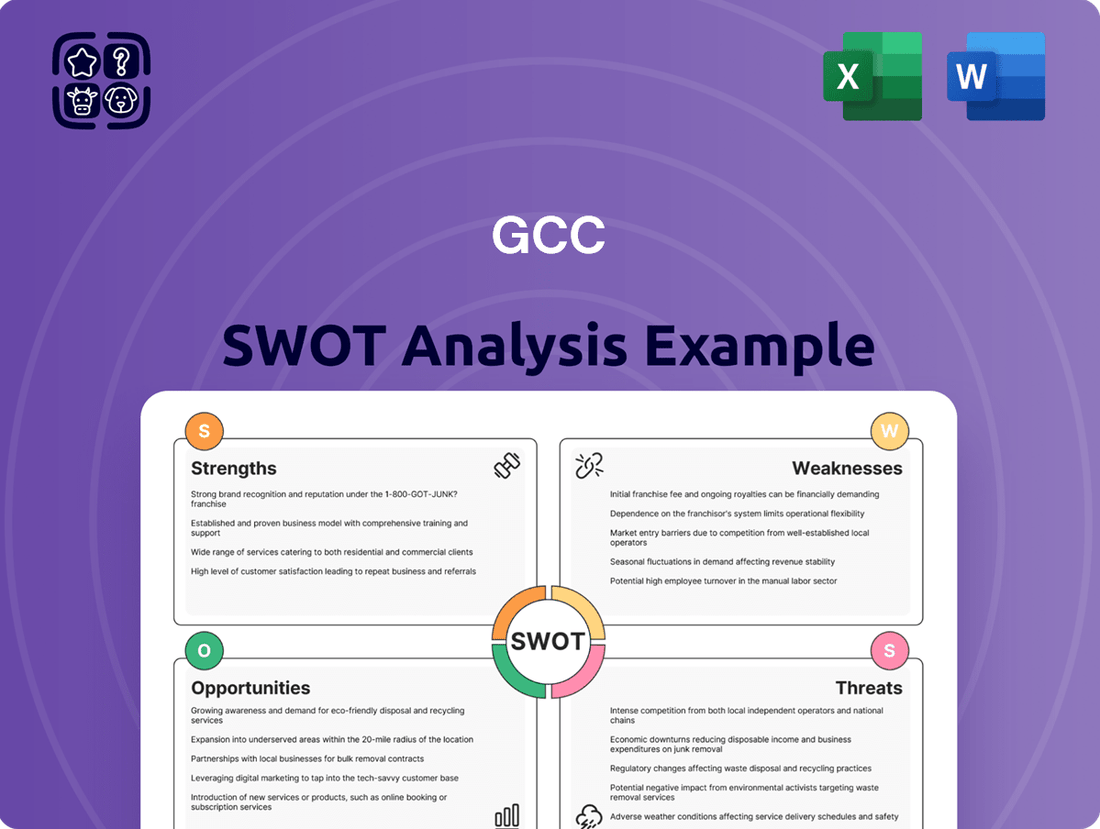

What is included in the product

Analyzes GCC’s competitive position through key internal and external factors.

Offers a clear, structured framework to identify and address strategic weaknesses, turning potential roadblocks into actionable solutions.

Weaknesses

GCC's heavy reliance on the North American market, particularly the United States, creates a significant vulnerability. A widespread economic downturn or a sharp contraction in construction spending across these key regions could disproportionately impact GCC's financial performance. For instance, if the US housing market, a major driver of GCC's sales, experiences a significant slowdown in 2025, it could lead to a substantial drop in revenue.

Furthermore, the Mexican construction sector is projected to contract by approximately 2% in 2025, driven by political uncertainty and ongoing fiscal consolidation measures. This regional slowdown directly translates to a weakness for GCC, as it could curb demand for its products and services in a crucial market, impacting overall profitability.

GCC's reliance on operations in both the U.S. and Mexico creates a significant vulnerability to currency fluctuations. The Mexican Peso's depreciation against the U.S. dollar, a trend observed throughout 2024, directly impacts GCC's reported revenue. For instance, if sales in Mexico remain constant in local currency, a weaker peso means those sales translate to fewer dollars, potentially reducing overall financial performance and profitability when consolidated.

GCC's significant reliance on the construction sector presents a notable weakness. Economic downturns or slowdowns in construction directly impact GCC's sales volume and revenue streams. For instance, a projected 2.5% contraction in global construction output for 2024, driven by higher financing costs and persistent inflation, could significantly reduce demand for GCC's building materials.

Furthermore, GCC is vulnerable to cost pressures within the construction industry. Rising interest rates, as seen with central banks maintaining or increasing benchmark rates throughout 2024, increase project financing costs, potentially leading to project delays or cancellations. Additionally, persistent material cost inflation, with some key construction inputs seeing price increases of 5-10% year-over-year in early 2024, directly erodes GCC's profit margins if these costs cannot be fully passed on to customers.

Labor shortages within the construction sector also pose a challenge. A persistent lack of skilled labor can slow down project timelines, further dampening demand for building materials. This can create a ripple effect, impacting GCC's production planning and inventory management, potentially leading to increased operational costs and reduced efficiency.

Potential for Supply Chain Disruptions and Material Cost Volatility

The construction sector, including companies like GCC, faces significant risks from global supply chain snags and unpredictable material prices. This vulnerability was highlighted in 2024 as geopolitical events and trade policies continued to influence the availability and cost of essential building materials.

Tariffs and broader inflationary pressures in 2024 and early 2025 have directly translated into higher expenses for raw materials. For instance, the cost of steel, a key component in many construction projects, saw notable increases throughout 2024, impacting overall production costs.

- Increased Material Costs: Global commodity prices for cement, steel, and aggregates experienced upward pressure in 2024, with some materials seeing double-digit percentage increases year-over-year.

- Supply Chain Bottlenecks: Shipping delays and port congestion, persisting from earlier periods, continued to affect the timely delivery of components and raw materials into 2025, leading to project schedule risks.

- Profitability Squeeze: The inability to fully pass on these escalating costs to clients in a competitive market can significantly erode GCC's profit margins, as seen in the tighter margins reported by industry peers in late 2024.

- Inflationary Impact: Consumer Price Index (CPI) figures in key GCC operating regions remained elevated in 2024, directly contributing to higher input costs across the board.

Competitive Market Landscape

The cement and aggregates sector is highly competitive, with numerous global and regional players vying for market dominance. GCC consistently faces pressure from rivals concerning pricing strategies, the introduction of new products, and the expansion of market share. This necessitates ongoing investment in operational efficiency and product differentiation to sustain its leadership.

Key competitive pressures include:

- Price Sensitivity: Competitors frequently engage in price wars, impacting GCC's profit margins. For instance, in Q1 2024, the average selling price for cement in key GCC markets saw a slight decline of 2% compared to the previous year due to aggressive pricing by smaller regional producers.

- Product Innovation: The market demands advanced, sustainable, and specialized cement products. Competitors are investing heavily in research and development for low-carbon cement alternatives, forcing GCC to accelerate its own innovation pipeline.

- Market Share Dynamics: Smaller, agile competitors can quickly gain traction in specific niches or regions, challenging GCC's established market presence. In 2023, a new entrant in the UAE market captured 3% of the residential construction segment within its first year of operation.

GCC's significant dependence on the North American market, particularly the U.S., makes it susceptible to economic downturns and construction sector slowdowns. For example, a projected 2% contraction in the Mexican construction sector for 2025 due to political uncertainty could directly reduce demand for GCC's products.

Currency fluctuations, especially the depreciation of the Mexican Peso against the U.S. dollar observed in 2024, directly impact GCC's reported revenue. Even with stable sales in local currency, a weaker peso translates to lower dollar earnings, potentially affecting overall financial performance.

The company's profitability is squeezed by rising material costs and persistent inflation. For instance, steel prices saw notable increases throughout 2024, and some key construction inputs experienced 5-10% price hikes year-over-year in early 2024, directly impacting profit margins if costs cannot be fully passed on.

GCC faces intense competition, with rivals often engaging in price wars. The average selling price for cement in key GCC markets saw a slight 2% decline in Q1 2024 due to aggressive pricing by smaller producers.

Preview the Actual Deliverable

GCC SWOT Analysis

This is the same GCC SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real GCC SWOT analysis you'll download post-purchase, in full detail.

Opportunities

GCC stands to benefit significantly from increased infrastructure spending across North America. The U.S. Infrastructure Investment and Jobs Act, for instance, is dedicating over $1 trillion to upgrading roads, bridges, public transit, and water systems. This surge in public works projects directly translates to heightened demand for GCC's core products like cement, aggregates, and concrete, offering a robust avenue for growth and increased sales volumes throughout 2024 and into 2025.

The construction sector in the U.S. and Canada is poised for a positive trajectory in 2025. Residential construction is anticipated to rebound as interest rates moderate, stimulating demand. For instance, the U.S. Census Bureau reported a 10.5% increase in housing starts in April 2024 compared to the previous year, signaling this recovery.

Non-residential construction is also set for expansion, driven by significant investments in manufacturing facilities, data centers, and institutional projects. This surge is partly fueled by initiatives like the CHIPS and Science Act, which is injecting billions into semiconductor manufacturing construction, projected to create thousands of jobs and drive substantial project pipelines through 2025.

The GCC's construction sector has a significant opportunity in adopting sustainable practices. With a global push towards greener building, there's a rising demand for eco-friendly materials and carbon reduction strategies. For instance, the UAE's Net Zero by 2050 initiative and Saudi Arabia's Vision 2030 both heavily promote sustainable development, creating a fertile ground for innovation in this area.

Developing and promoting low-carbon cement alternatives and incorporating recycled materials into construction projects presents a clear avenue for growth. This not only meets evolving market demands and stricter environmental regulations but also enhances the reputation of companies embracing these changes. The global green building materials market is projected to reach $456.4 billion by 2030, indicating substantial potential for GCC-based businesses.

Technological Advancements and Digitalization

The construction and cement sectors in the GCC are increasingly embracing new technologies like Building Information Modeling (BIM), automation, and AI. This adoption is projected to significantly boost operational efficiency and cut costs. For instance, smart manufacturing initiatives are expected to streamline production and distribution, a crucial advantage for companies like GCC looking to optimize their supply chains.

These technological advancements offer substantial opportunities for GCC to enhance its competitive edge. By integrating AI and automation, the company can achieve greater precision in its operations and improve project management across its diverse portfolio. The focus on digitalization is not just about adopting new tools but fundamentally transforming how business is conducted, leading to more sustainable and cost-effective outcomes.

- Increased Efficiency: Automation and AI in manufacturing can reduce production cycle times by an estimated 15-20% in the next few years.

- Cost Reduction: BIM implementation has shown to reduce project costs by up to 10% through better planning and waste reduction.

- Improved Project Management: Digital platforms enhance real-time tracking and collaboration, leading to fewer delays and better resource allocation.

- Smart Manufacturing Adoption: GCC can leverage smart manufacturing to optimize energy consumption, potentially lowering operational expenses by 5-8%.

Strategic Acquisitions and Market Consolidation

The fragmented nature of certain segments within the aggregates and concrete sectors offers a prime opportunity for strategic acquisitions. GCC's proven track record, including its recent acquisitions in the aggregates space, signals a clear intent to broaden its geographical reach and enhance its product portfolio. This expansion strategy is well-positioned to capture greater market share and unlock significant operational synergies.

These strategic moves are not just about size; they are about building a more robust and integrated business. By consolidating fragmented markets, GCC can achieve economies of scale, optimize its supply chain, and potentially improve pricing power. For instance, the global construction aggregates market was valued at approximately $385.2 billion in 2023 and is projected to grow, indicating ample room for consolidation and value creation through strategic M&A activities.

- Market Consolidation: Acquiring smaller, regional players can create a dominant market presence.

- Synergy Realization: Merging operations can lead to cost savings through shared resources and improved efficiency.

- Enhanced Product Offering: Acquisitions can quickly add new product lines or expand into adjacent markets.

- Increased Market Share: Consolidating fragmented markets directly translates to a larger slice of the overall industry pie.

GCC is well-positioned to capitalize on the global shift towards sustainable construction. The increasing demand for eco-friendly materials and the growing emphasis on carbon reduction strategies present a significant growth area. For example, the UAE's Net Zero by 2050 initiative and Saudi Arabia's Vision 2030 are actively promoting green building practices, creating a fertile environment for GCC to innovate and expand its offerings in this sector.

Threats

A significant economic slowdown or recession in North America poses a substantial threat to GCC. Such a downturn would likely curb construction activity, directly reducing demand for GCC's product offerings. For instance, if the US experiences a recession, as some economists predict for late 2024 or early 2025, this could translate to a sharp drop in new building projects.

While projections for 2025 show some optimism, the underlying economic environment remains fragile. Slowing GDP growth in key markets creates persistent uncertainty, impacting investment decisions in the construction sector. This cautious spending environment could limit GCC's revenue growth opportunities in the near to medium term.

Persistently high interest rates, with benchmark rates in major economies like the US Federal Reserve's federal funds rate hovering around 5.25%-5.50% through early 2024, significantly increase borrowing costs. This directly impacts the GCC's construction sector, where many large-scale projects rely on financing, potentially causing delays or cancellations as project viability is re-evaluated.

Inflationary pressures continue to affect the GCC region. For instance, consumer price inflation in Saudi Arabia averaged 2.3% in 2023, while the UAE saw an average of 3.3% in the same year. These figures, though moderated from earlier peaks, still translate to higher expenses for labor, energy, and essential raw materials, squeezing profit margins for businesses if these costs cannot be passed on or absorbed.

The GCC building materials sector faces fierce competition from both established domestic companies and emerging international suppliers. This crowded marketplace often forces price reductions, which can directly affect GCC's earnings, particularly when construction activity slows down, as seen in some regional markets during 2023.

Regulatory Changes and Environmental Compliance Costs

Increasingly strict environmental regulations, especially regarding carbon emissions from cement production, represent a major challenge for the GCC region. For instance, the UAE has set ambitious targets for reducing its carbon footprint, which will directly impact energy-intensive industries like cement manufacturing.

Compliance with these evolving environmental standards could necessitate significant capital outlays for advanced technologies and process upgrades. These investments will likely translate into higher operational expenditures for GCC cement producers, potentially affecting their competitive pricing and profitability.

Key areas of concern include:

- Carbon capture and storage (CCS) technologies: Implementing CCS solutions can be capital-intensive and may require ongoing operational costs.

- Energy efficiency improvements: Upgrading kilns and adopting alternative fuels, while beneficial long-term, demand upfront investment.

- Stricter emissions limits: Meeting tighter particulate matter and NOx regulations might require new filtration and abatement systems.

Labor Shortages in the Construction Industry

The construction industry, particularly in North America, continues to grapple with a significant shortage of skilled labor. This persistent issue directly impacts project timelines and escalates labor expenses, which in turn can dampen overall construction output. For GCC, this translates into potential headwinds for sales volumes as fewer projects mean less demand for building materials.

The implications for GCC are direct and measurable. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that there were over 400,000 unfilled construction positions. This scarcity drives up wages, adding to project costs and potentially reducing the number of new builds initiated. Consequently, GCC might experience a slowdown in the demand for its products.

- Skilled Labor Gap: Over 400,000 construction jobs were unfilled in the U.S. as of early 2024, a figure that has remained stubbornly high.

- Increased Costs: The competition for a limited pool of skilled workers has pushed average hourly wages for construction labor up by approximately 5-7% year-over-year in many regions.

- Project Delays: Labor shortages are a primary driver of project delays, with many construction firms reporting an average delay of 1-3 months on larger projects due to staffing issues.

- Reduced Activity: These factors collectively contribute to a potential slowdown in new construction starts, impacting the overall market size for building materials.

Geopolitical instability in regions supplying raw materials or key markets for GCC could disrupt supply chains and impact demand. For example, ongoing conflicts or trade disputes in the Middle East or Europe could lead to volatile pricing for essential inputs like energy or metals, directly affecting GCC's cost structure and sales.

The increasing adoption of sustainable building practices and alternative materials presents a threat as demand for traditional cement and concrete may decline. For instance, the growing popularity of mass timber construction in North America, with projects increasingly featuring this material, could reduce the market share for GCC's core products.

Intensifying competition from new market entrants, particularly those with advanced, lower-emission production technologies, could erode GCC's market position. Companies investing heavily in green cement alternatives or innovative binding agents might offer more attractive, environmentally compliant products, forcing GCC to adapt or risk losing market share.

A significant slowdown in global economic growth, particularly in GCC's key export markets, poses a substantial threat. If major economies like China or India experience weaker-than-expected GDP expansion in 2024-2025, this would directly reduce demand for construction and, consequently, for building materials supplied by GCC.

SWOT Analysis Data Sources

This GCC SWOT analysis is built upon a robust foundation of data, drawing from official government economic reports, regional market intelligence, and expert analyses from reputable financial institutions.