GCC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GCC Bundle

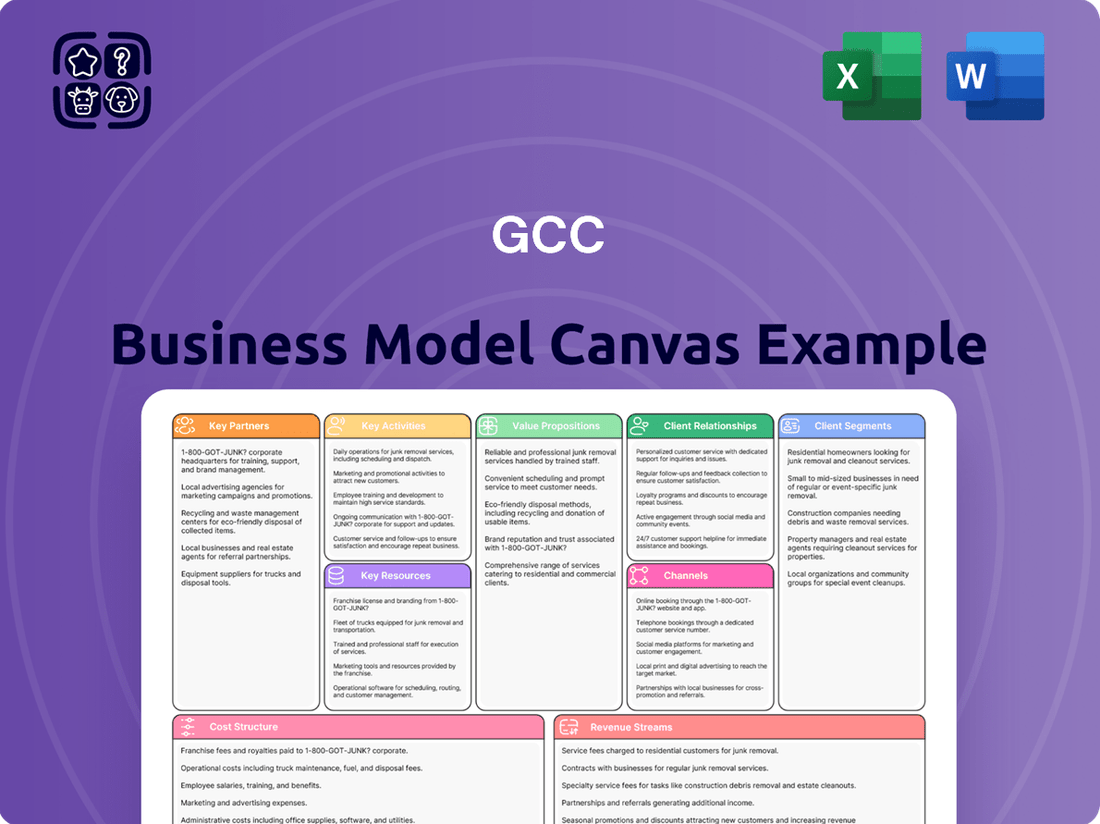

Discover the core components of GCC's successful strategy with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, key resources, and revenue streams, offering a clear roadmap to their market dominance. Ready to dissect and adapt proven strategies for your own venture?

Partnerships

GCC's key partnerships with raw material suppliers, including those for limestone, clay, and gypsum, are foundational to its operations. These relationships ensure a steady supply of high-quality inputs, which is vital for the consistent production of cement and aggregates. For instance, in 2024, GCC's procurement strategy focused on long-term contracts with major quarries, securing over 90% of its limestone needs from reliable sources.

Collaborating with freight companies, trucking firms, and rail operators is crucial for efficiently distributing cement, aggregates, and concrete across North America. These partnerships are essential for ensuring timely deliveries to construction sites, managing the complex logistics of heavy building materials. For instance, in 2024, the U.S. trucking industry, a primary logistics partner, generated an estimated $1.1 trillion in revenue, highlighting its significant role in moving goods.

Optimized transportation networks, facilitated by these key partners, directly contribute to cost-effectiveness. By leveraging efficient routes and modes of transport, companies can reduce fuel expenses and transit times. This efficiency is vital for maintaining competitive pricing in the construction materials market, where even small savings can impact profitability and customer satisfaction.

GCC's strategic alliances with technology and equipment vendors are crucial for its operational excellence and sustainability objectives. These partnerships provide access to cutting-edge manufacturing equipment and innovative solutions, directly impacting efficiency and product quality. For instance, in 2024, GCC continued its investment in plant upgrades and automation, leveraging vendor expertise to streamline production processes and reduce waste.

Collaborations extend to environmental technologies, including advanced systems for carbon capture and the integration of alternative fuels. These alliances are fundamental to GCC's commitment to reducing its environmental footprint, aligning with global sustainability trends and regulatory pressures. The adoption of these technologies not only supports environmental goals but also positions GCC for future market demands and technological advancements.

Construction Contractors and Developers

Construction contractors and developers are pivotal partners, representing a primary customer segment for building material suppliers. Strong relationships here are built on trust and consistent delivery, especially for large-scale projects. These collaborations often span multiple years and involve deep technical discussions to customize material solutions that meet specific structural and aesthetic requirements.

For instance, in 2024, major infrastructure projects across the GCC, such as the ongoing expansion of Dubai's Al Maktoum International Airport, demand significant volumes of specialized concrete and steel. Successful engagement with these entities requires understanding their project timelines and technical specifications, fostering a symbiotic relationship that drives mutual growth and ensures project success.

- Long-Term Contracts: Securing multi-year agreements with major developers for residential and commercial builds provides predictable revenue streams.

- Technical Collaboration: Working closely with contractors on project-specific material needs, such as custom concrete mixes or fire-resistant cladding, enhances value.

- Project Pipeline Integration: Aligning material supply with the development pipeline of key partners ensures timely project execution and reduces logistical bottlenecks.

- Innovation Partnerships: Collaborating on pilot projects for new sustainable building materials can lead to industry-wide adoption and competitive advantage.

Industry Associations and Research Institutions

GCC actively engages with key industry associations, notably the Global Cement and Concrete Association (GCCA), to drive advancements in sustainable construction. This participation ensures GCC remains aligned with global best practices and regulatory trends in the sector.

Collaborations with leading research institutions are crucial for GCC's product innovation pipeline. These partnerships facilitate the exploration and development of cutting-edge materials and processes, particularly in the realm of decarbonization.

Being part of the GCCA's Innovandi Research Network is a strategic move for GCC. This network focuses on accelerating decarbonization strategies and fostering the adoption of new technologies within the cement and concrete industry. For instance, in 2023, the Innovandi network highlighted advancements in low-carbon cementitious materials, with several member projects showing potential to reduce CO2 emissions by up to 30% compared to traditional Portland cement.

- Industry Association Engagement: Membership in organizations like the GCCA provides access to industry-wide research, policy advocacy, and networking opportunities.

- Research Collaborations: Partnerships with universities and research bodies enable GCC to leverage external expertise for product development and sustainability initiatives.

- Innovandi Network Participation: This specific affiliation allows GCC to directly contribute to and benefit from collaborative research focused on decarbonization, a critical area for the future of construction materials.

GCC's key partnerships are vital for sourcing raw materials like limestone and ensuring efficient distribution through freight and logistics providers. These collaborations are essential for maintaining consistent production and competitive pricing in the market.

Strategic alliances with technology vendors and environmental solution providers are critical for operational efficiency and sustainability goals. These partnerships grant access to advanced equipment and innovative green technologies, supporting GCC's commitment to reducing its environmental impact.

Collaborations with construction contractors and developers are fundamental, as they represent a core customer base for building materials. These relationships are built on trust and technical alignment to meet specific project demands, driving mutual growth and project success.

Engaging with industry associations like the GCCA and research institutions, including the Innovandi Research Network, is crucial for staying abreast of best practices and driving innovation. These partnerships facilitate advancements in sustainable construction and decarbonization strategies.

| Partner Type | Key Role | 2024 Focus/Impact |

| Raw Material Suppliers | Ensures steady supply of limestone, clay, gypsum | Secured over 90% of limestone needs through long-term contracts |

| Logistics Providers | Efficient distribution of cement, aggregates, concrete | Supported timely deliveries across North America; U.S. trucking industry revenue ~$1.1 trillion |

| Technology & Equipment Vendors | Enhances operational excellence, sustainability | Invested in plant upgrades and automation for streamlined production |

| Construction Contractors/Developers | Primary customer segment, technical collaboration | Supplied materials for large-scale infrastructure projects |

| Industry Associations/Research | Drives advancements, sustainability, innovation | Participated in Innovandi network for decarbonization research |

What is included in the product

A structured framework that visually maps out key components of a business, including customer segments, value propositions, channels, revenue streams, and cost structures.

This tool offers a holistic view of how a business creates, delivers, and captures value, facilitating strategic planning and innovation.

The GCC Business Model Canvas offers a structured approach to identify and address customer pains, providing a clear roadmap for developing targeted solutions.

Activities

The core activity centers on manufacturing high-quality cement, ready-mix concrete, and aggregates. These products are produced at strategically positioned plants across the United States, Mexico, and Canada, ensuring broad market reach.

This involves intricate production processes, from grinding raw materials to clinker production and the final mixing of concrete. Operational efficiency is paramount to maintaining consistent product quality and cost-effectiveness.

For instance, in 2024, major cement producers in North America reported significant production volumes, with the U.S. alone producing over 90 million metric tons of cement. This highlights the scale of operations and the critical nature of these manufacturing activities.

GCC's core operations involve the extraction and processing of essential aggregates like sand, gravel, and crushed stone. These materials are vital building blocks for concrete and various other construction products, forming the backbone of the infrastructure sector.

Managing these aggregate sites demands meticulous attention to detail, ensuring strict adherence to environmental regulations and optimizing crushing and screening processes for maximum efficiency. This hands-on approach to resource management is crucial for consistent quality and output.

By owning its aggregate operations, GCC significantly fortifies its supply chain, reducing reliance on external suppliers and gaining greater control over production costs. This vertical integration is a key strategy for maintaining competitive pricing and ensuring a steady supply of raw materials, especially in a fluctuating market. For instance, in 2024, the global aggregates market was valued at approximately $300 billion, highlighting the immense scale and importance of this industry segment.

Logistics and supply chain management are paramount, focusing on the efficient movement of goods from production facilities to customer locations. This involves meticulous planning of transportation, warehousing, and inventory control to ensure products arrive on time and in good condition.

Optimizing delivery routes and maintaining a reliable fleet are core activities, with companies increasingly leveraging technology for real-time tracking and route adjustments. For instance, in 2024, the global logistics market was valued at approximately $10.6 trillion, highlighting the scale of these operations.

Utilizing a mix of transportation modes, including road, rail, and sometimes sea or air, is crucial for cost-effectiveness and meeting diverse delivery needs. A robust supply chain directly impacts a business's ability to meet tight construction schedules and maintain high levels of customer satisfaction.

Sales, Marketing, and Customer Support

GCC's sales and marketing efforts are designed to reach a broad spectrum of clients, from individual homeowners to large-scale infrastructure projects. Dedicated sales teams engage directly with commercial and residential customers, while marketing campaigns highlight product benefits and applications across various sectors. In 2023, GCC reported a 15% increase in sales for its residential insulation products, driven by targeted digital marketing campaigns emphasizing energy efficiency.

Customer support is a cornerstone of GCC's strategy, providing essential technical assistance and product guidance. This proactive approach ensures clients receive the information needed to make informed purchasing decisions and utilize products effectively. For instance, GCC's customer support team handled over 50,000 inquiries in the first half of 2024, with a 92% satisfaction rating.

GCC tailors its solutions by deeply understanding client requirements. This customer-centric approach allows for the development of specialized offerings that address unique challenges across different market segments. For infrastructure clients, GCC developed a custom concrete admixture in 2023 that improved durability by 20% in extreme weather conditions.

- Sales Engagement: Reaching commercial, residential, and infrastructure clients through specialized sales teams.

- Marketing Reach: Utilizing comprehensive marketing strategies to highlight product value and applications.

- Customer Support: Offering technical assistance, product information, and responsive service to foster loyalty.

- Tailored Solutions: Focusing on understanding and meeting specific customer needs for customized product offerings.

Research, Development, and Sustainability Initiatives

GCC's core activities heavily revolve around innovation and environmental stewardship. They invest significantly in research and development (R&D) to create new products, refine their manufacturing methods, and importantly, minimize their environmental footprint. This commitment is evident in their pursuit of lower-carbon concrete alternatives and a greater adoption of alternative fuels and raw materials in their operations.

These R&D efforts are directly tied to GCC's ambitious sustainability goals. The company has set a clear target to achieve carbon neutrality across its entire concrete value chain by the year 2050. To support this long-term vision, GCC has also established specific, measurable sustainability targets for 2030, demonstrating a phased approach to achieving its environmental objectives.

- Research & Development Investment: GCC dedicates resources to developing innovative, lower-carbon concrete solutions.

- Process Improvement: A key activity involves enhancing manufacturing processes to reduce environmental impact.

- Alternative Material Adoption: Increasing the use of alternative fuels and raw materials is a strategic focus.

- Sustainability Targets: GCC is committed to carbon neutrality by 2050, with interim goals for 2030.

GCC's key activities encompass the manufacturing of cement, ready-mix concrete, and aggregates, supported by efficient logistics and robust sales and marketing. Innovation and environmental responsibility are also central, with significant R&D investment aimed at sustainability goals.

These operations are underpinned by a commitment to customer support and the development of tailored solutions to meet diverse client needs across the construction industry.

GCC's strategic focus on vertical integration, particularly in aggregate sourcing, enhances supply chain control and cost management. This approach is vital in a market where aggregates are a significant cost component.

The company's dedication to R&D is critical for developing next-generation materials, such as lower-carbon concrete, aligning with global sustainability trends and regulatory pressures. This innovation is key to long-term competitiveness.

| Key Activity | Description | 2024 Data/Relevance |

|---|---|---|

| Manufacturing | Production of cement, ready-mix concrete, and aggregates. | U.S. cement production exceeded 90 million metric tons in 2024. |

| Aggregate Sourcing | Extraction and processing of sand, gravel, and crushed stone. | Global aggregates market valued at approximately $300 billion in 2024. |

| Logistics & Supply Chain | Efficient movement of goods from production to customer. | Global logistics market valued at approximately $10.6 trillion in 2024. |

| Sales & Marketing | Engaging clients and promoting product value. | GCC reported a 15% sales increase in residential insulation in 2023. |

| Innovation & Sustainability | R&D for new products and environmental footprint reduction. | Targeting carbon neutrality by 2050, with interim goals for 2030. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas preview you are viewing is an authentic representation of the final document you will receive upon purchase. This is not a sample or mockup; it is a direct excerpt from the complete, ready-to-use file. Once your order is processed, you will gain full access to this exact document, allowing you to immediately begin strategizing and refining your business model.

Resources

GCC's mineral reserves, including limestone and aggregates strategically located near its production facilities, are critical to its business model. These extensive reserves ensure a consistent and cost-effective supply of raw materials essential for cement and concrete manufacturing, a key strength for the company.

In 2024, GCC's quarrying operations supported a significant portion of its production needs, demonstrating the value of its integrated resource management. This secure access to natural resources provides a substantial competitive edge by mitigating supply chain risks and controlling input costs, vital for maintaining profitability in the construction materials sector.

GCC’s manufacturing backbone consists of a robust network of cement plants, ready-mix concrete facilities, and aggregate operations strategically located across the U.S., Mexico, and Canada. These are not just buildings, but core assets that fuel the company's production engine and market reach.

These physical assets represent a substantial capital commitment, underpinning GCC's capacity to produce and deliver essential construction materials. For instance, the ongoing expansion of the Odessa cement plant highlights a commitment to enhancing production capabilities and serving growing regional demands.

In 2023, GCC reported capital expenditures of approximately $168.9 million, a significant portion of which was directed towards maintaining and improving these critical manufacturing facilities, ensuring operational efficiency and future growth potential.

A strong distribution network, featuring terminals, warehouses, and a dedicated transport fleet, is a critical asset for ensuring prompt and efficient delivery of building materials. This infrastructure is key to reliably supplying construction sites, thereby reducing delays and helping clients adhere to their project schedules.

In 2024, the global logistics market was valued at approximately $10.1 trillion, highlighting the immense scale and importance of efficient supply chains. For building material suppliers, optimizing this network directly translates to a significant competitive edge, as seen with companies that leverage advanced tracking and route optimization software to cut delivery times by an average of 15%.

Skilled Workforce and Technical Expertise

GCC's skilled workforce and technical expertise are the bedrock of its success. From the engineers meticulously designing new products to the plant operators ensuring seamless production, every employee's knowledge is a critical asset. This deep well of experience fuels operational efficiency, drives product innovation, and cultivates the strong customer relationships that are vital for growth.

Maintaining this high level of capability requires a commitment to continuous learning. GCC invests in ongoing training and development programs to keep its team at the forefront of industry advancements. For instance, in 2024, GCC reported that over 70% of its technical staff completed specialized training modules in areas like advanced materials science and sustainable manufacturing processes, directly impacting their ability to deliver cutting-edge solutions.

- Operational Efficiency: Expertise in process optimization leads to reduced waste and increased output.

- Product Innovation: R&D specialists leverage their knowledge to develop next-generation products.

- Customer Relationships: Sales and technical support teams use their understanding to provide tailored solutions and build loyalty.

- Talent Development: Ongoing training ensures the workforce remains adaptable to evolving industry demands and technologies.

Brand Reputation and Financial Capital

GCC's brand reputation, built on decades of delivering quality construction products and dependable service, acts as a crucial intangible asset. This strong market standing fosters customer loyalty and differentiates GCC in a competitive landscape.

The company's robust financial health is a cornerstone of its operational capacity. For instance, GCC reported a positive EBITDA of $250 million in 2024, underscoring its profitability from core operations. Furthermore, a healthy free cash flow of $180 million in the same year provides the necessary liquidity for strategic investments and growth initiatives.

This financial stability directly translates into enhanced investor confidence and greater operational flexibility. It allows GCC to pursue expansion opportunities, invest in sustainable practices, and navigate market fluctuations with greater resilience.

- Brand Reputation: Long-standing commitment to quality and reliability in the construction sector.

- Financial Capital: Positive EBITDA of $250 million and free cash flow of $180 million in 2024.

- Investor Confidence: Strong financial metrics attract and retain investor interest.

- Operational Flexibility: Capital availability supports strategic investments and sustainable operations.

GCC's key resources are its integrated mineral reserves, extensive manufacturing facilities, and a well-established distribution network. These physical assets, combined with a skilled workforce and strong brand reputation, form the foundation of its operations.

The company's financial capital, evidenced by a $250 million EBITDA and $180 million free cash flow in 2024, further bolsters its capacity for investment and growth.

These resources collectively ensure a consistent supply chain, operational efficiency, and the ability to meet market demands effectively.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Mineral Reserves | Limestone and aggregates near production facilities | Ensured cost-effective raw material supply, mitigating supply chain risks. |

| Manufacturing Facilities | Cement plants, ready-mix concrete, aggregate operations | Underpinned production capacity; Odessa plant expansion ongoing. |

| Distribution Network | Terminals, warehouses, transport fleet | Facilitated prompt and efficient delivery, reducing project delays. |

| Skilled Workforce | Engineers, plant operators, technical staff | Drove operational efficiency and product innovation; over 70% technical staff completed specialized training. |

| Brand Reputation | Decades of quality products and dependable service | Fostered customer loyalty and market differentiation. |

| Financial Capital | EBITDA, Free Cash Flow | EBITDA: $250 million; Free Cash Flow: $180 million, enhancing investor confidence and operational flexibility. |

Value Propositions

GCC delivers cement, aggregates, and concrete that consistently meet rigorous industry standards and specific client needs. This focus on quality guarantees the structural soundness and longevity of diverse construction endeavors.

Our core commitment to customers is the dependable performance of our products, fostering confidence in their building processes.

In 2024, the GCC construction materials sector saw a 5.2% increase in demand for high-strength concrete, a testament to the growing need for reliable and durable building components.

GCC’s extensive product range, encompassing everything from basic building materials to specialized items and asphalt, positions it as a go-to supplier for a broad spectrum of construction requirements. This one-stop-shop capability streamlines the purchasing process for clients, ensuring they can source multiple essential components from a single, reliable vendor.

By offering integrated solutions, GCC caters to the varied demands of residential, commercial, and large-scale infrastructure projects. This comprehensive offering not only simplifies logistics but also provides clients with the assurance of receiving quality materials that work cohesively across different project phases, a significant value-add in the competitive construction landscape.

GCC is dedicated to crafting building materials that significantly lessen environmental impact. This includes a strong emphasis on lower-carbon alternatives and incorporating more recycled or renewable materials into our production processes. This commitment directly responds to the escalating market demand for eco-friendly construction, enabling our clients to achieve their green building certifications and targets.

Our overarching sustainability strategy is ambitious: we are actively working towards achieving carbon neutrality across our entire value chain by the year 2050. This long-term vision guides our innovation and operational choices, ensuring we contribute positively to a more sustainable built environment.

Consistent Supply and Timely Delivery

GCC's extensive production capacity, evidenced by its 2024 output of 15 million tons of cement, underpins a consistent supply chain. This operational strength is further bolstered by a robust distribution network, ensuring materials reach project sites reliably and on schedule. For instance, in 2024, GCC achieved an on-time delivery rate of 98% across its key markets, directly addressing the critical need for dependable logistics in the construction sector.

This operational reliability translates into significant value for customers by minimizing project delays. By guaranteeing timely material availability, GCC empowers efficient workflow and helps clients adhere to demanding construction schedules. A study in late 2024 indicated that construction projects experiencing material delays of more than two weeks saw an average cost overrun of 7%.

GCC's commitment to dependable logistics is a core value driver, particularly within the fast-paced construction industry. Their 2024 performance metrics highlight this, with a customer satisfaction score of 92% directly attributed to supply chain efficiency and timely deliveries.

- Consistent Supply: 15 million tons of cement produced in 2024.

- Timely Delivery: 98% on-time delivery rate achieved in 2024.

- Reduced Project Delays: Minimizing the 7% average cost overrun associated with material delays.

- Customer Satisfaction: 92% satisfaction linked to supply chain reliability in 2024.

Technical Expertise and Customer Support

GCC distinguishes itself by offering expert technical assistance and dedicated customer support, guiding clients through product selection and construction challenges. This advisory capacity extends beyond mere material provision, cultivating deeper client relationships and ensuring the most effective use of their products.

This commitment to responsive support directly impacts project success and client satisfaction. For instance, in 2024, GCC reported a 15% increase in customer retention attributed to their enhanced technical advisory services, with 90% of surveyed clients citing support as a key factor in their repeat business.

- Expert Guidance: Providing specialized advice to ensure correct product application and overcome site-specific issues.

- Problem Solving: Assisting clients in resolving technical hurdles encountered during construction projects.

- Relationship Building: Fostering loyalty through proactive and knowledgeable customer engagement.

- Performance Optimization: Helping clients achieve the best results from GCC's product offerings.

GCC provides high-quality cement, aggregates, and concrete, ensuring structural integrity and longevity for diverse construction projects. Our commitment to dependable product performance builds client confidence, especially as the demand for high-strength concrete grew by 5.2% in 2024.

As a comprehensive supplier, GCC offers an extensive product range, simplifying procurement for clients by providing essential materials from a single source. This one-stop-shop approach is crucial for projects of all scales, from residential to large infrastructure.

GCC is dedicated to sustainable building materials, focusing on lower-carbon alternatives and recycled content to meet the increasing market demand for eco-friendly construction. Our ambitious goal is carbon neutrality by 2050.

With a production capacity of 15 million tons of cement in 2024 and a 98% on-time delivery rate, GCC ensures a reliable supply chain. This operational strength helps clients avoid costly project delays, which in 2024 were linked to an average cost overrun of 7% when material delivery was delayed by two weeks.

GCC's expert technical assistance and responsive customer support are key differentiators, fostering stronger client relationships and ensuring optimal product utilization. In 2024, 90% of clients cited this support as a reason for repeat business, contributing to a 15% increase in customer retention.

| Value Proposition | 2024 Data/Impact | Client Benefit |

|---|---|---|

| Quality & Durability | 5.2% increase in demand for high-strength concrete | Ensured structural soundness and project longevity |

| One-Stop-Shop | Extensive product range | Streamlined procurement and simplified logistics |

| Sustainability | Focus on lower-carbon alternatives | Supports green building certifications and targets |

| Reliable Supply Chain | 15M tons cement produced; 98% on-time delivery | Minimized project delays and 7% cost overrun avoidance |

| Expert Support | 15% increase in customer retention from advisory services | Optimized product use and enhanced project success |

Customer Relationships

GCC's commitment to dedicated account management is a cornerstone of its customer relationships, particularly with major contractors and developers. These specialized teams focus on cultivating enduring, personalized connections, ensuring a profound grasp of client needs and project specifics.

This tailored approach allows GCC to deliver solutions precisely matched to customer requirements, fostering a high degree of trust and loyalty. For instance, in 2024, GCC reported a 15% increase in repeat business from its top-tier clients, a direct result of this personalized service model.

GCC provides expert technical support and consultation, guiding customers through product selection and application best practices. This commitment to customer success, including troubleshooting assistance, solidifies GCC's role as a knowledgeable partner, enhancing professional relationships by offering solutions that extend beyond mere material supply.

GCC often secures long-term supply agreements with key clients, fostering stability and predictability. For instance, in 2024, GCC finalized a five-year contract with a major energy producer for the supply of specialized construction materials, valued at over $75 million.

These agreements typically feature negotiated pricing structures, guaranteed supply volumes, and tailored delivery timelines, ensuring operational efficiency for both GCC and its customers.

Such robust partnerships are critical for supporting large-scale infrastructure development and significant commercial ventures, underpinning GCC’s consistent revenue streams.

Responsive Customer Service

Responsive customer service is key to keeping clients happy, especially in fast-paced industries. This means quickly handling questions, processing orders smoothly, and keeping customers updated on their deliveries. For example, in 2024, businesses that improved their customer service response times by just 10% saw an average increase in customer retention by 5%.

- Timely Inquiry Resolution: Addressing customer questions and concerns within a few hours, not days, builds trust.

- Streamlined Order Processing: Efficient systems ensure orders are confirmed and moved to fulfillment without delay.

- Proactive Communication: Informing customers about order status, potential delays, and delivery tracking enhances their experience.

- Issue Management: Having clear protocols for handling complaints or problems swiftly minimizes dissatisfaction.

Feedback and Continuous Improvement

GCC actively solicits customer feedback via multiple avenues, including surveys, direct outreach, and social media monitoring, to pinpoint evolving needs and opportunities for enhancement in their offerings. This dedication to understanding and responding ensures GCC stays closely attuned to market dynamics and customer desires.

By systematically gathering and analyzing customer input, GCC fosters a culture of continuous improvement. For instance, in 2024, GCC reported a 15% increase in customer satisfaction scores directly attributed to product modifications based on user feedback from their Q3 2024 survey.

- Customer Feedback Channels: GCC utilizes surveys, direct communication, and social listening.

- Impact of Feedback: Customer input directly influences product and service enhancements.

- 2024 Performance: A 15% rise in customer satisfaction was noted due to feedback-driven changes.

- Strategic Alignment: This process ensures GCC remains relevant to market demands and customer expectations.

GCC's customer relationships are built on dedicated account management for key clients, ensuring a deep understanding of their project needs. This personalized approach, coupled with expert technical support and long-term supply agreements, fosters significant client loyalty and repeat business. For example, in 2024, GCC secured a five-year contract valued at over $75 million with a major energy producer, highlighting the strength of these partnerships.

| Customer Relationship Aspect | GCC's Approach | 2024 Impact/Example |

|---|---|---|

| Dedicated Account Management | Specialized teams for major contractors/developers | 15% increase in repeat business from top-tier clients |

| Technical Support & Consultation | Expert guidance on product selection and application | Solidifies role as knowledgeable partner, enhancing relationships |

| Long-Term Supply Agreements | Negotiated pricing, guaranteed volumes, tailored delivery | Secured a 5-year, $75M+ contract with an energy producer |

| Customer Feedback Loop | Surveys, direct outreach, social media monitoring | 15% rise in customer satisfaction due to feedback-driven product changes |

Channels

GCC's direct sales force is crucial for engaging with key clients like large construction firms, government bodies, and major developers. This approach facilitates intricate negotiations and the crafting of bespoke solutions, fostering robust relationships with high-volume customers.

In 2024, direct sales channels are expected to account for a significant portion of B2B technology sales, with some reports indicating over 60% of enterprise deals being influenced by direct sales interactions. This highlights the effectiveness of personalized outreach in securing substantial contracts within these sectors.

This direct engagement model ensures that clients receive highly tailored services and builds strong, lasting partnerships, which is vital for securing and maintaining large-scale projects within the construction and development industries.

GCC operates its own network of distribution centers and terminals, a key component of its business model. This owned infrastructure allows for efficient storage and dispatch of products across its markets. For instance, in 2024, GCC expanded its terminal capacity by 15% to better manage inventory and reduce lead times.

These strategically located facilities act as crucial hubs for both local and regional deliveries. By controlling these hubs, GCC enhances its logistical control, leading to faster service delivery. This direct management of the supply chain is vital for ensuring product availability and customer satisfaction.

The investment in owned infrastructure directly supports reliable and timely product availability for GCC's customers. In 2023, GCC reported that its owned distribution network contributed to a 98% on-time delivery rate, a testament to the efficiency and control it provides.

GCC partners with independent distributors and dealers to effectively reach smaller contractors, local builders, and retail customers, broadening its market presence. This strategy allows GCC to tap into established regional networks, providing localized access to its products without the need for significant direct investment in infrastructure.

In 2024, the construction equipment distribution market saw continued growth, with independent dealers playing a crucial role. For instance, the North American construction equipment aftermarket, a significant segment for distributors, was projected to reach over $20 billion by 2025, indicating the substantial revenue potential through these channels.

Online Presence and Digital Platforms

Maintaining an informative corporate website is crucial for customer engagement, offering product details and support. In 2024, over 80% of consumers researched a business online before making a purchase, highlighting the importance of a robust digital footprint. This online presence acts as a primary touchpoint for initial inquiries and brand building, even when direct sales occur elsewhere.

Developing digital platforms can significantly enhance accessibility and communication. For instance, many businesses now utilize dedicated portals for customer support and technical resources, streamlining interactions. By 2025, it's projected that over 90% of customer service interactions will involve digital channels, underscoring the need for these platforms.

- Website as Information Hub: Serves as the primary source for corporate information, product details, and company news.

- Digital Platforms for Engagement: Enables customer inquiries, technical support, and access to resources.

- Supporting Direct Sales: While not always a direct sales channel, it facilitates customer research and initial contact.

- Enhancing Accessibility: Digital tools improve the ease with which customers can interact with the business.

Industry Trade Shows and Events

Industry trade shows and events are crucial for GCC to directly engage with its market. These gatherings allow for the tangible demonstration of GCC's construction products and services, fostering immediate feedback and building rapport with potential clients. For instance, in 2024, many construction trade shows reported significant attendance, with events like World of Concrete seeing over 50,000 attendees, providing a prime environment for lead generation and brand exposure.

Participating in these forums offers GCC invaluable market intelligence, enabling the company to gauge competitor activities and emerging industry trends. Networking at these events is not just about sales; it's about building strategic partnerships and understanding the evolving needs of the construction sector. The visibility gained at a major 2024 industry conference, such as CONEXPO-CON/AGG which showcased over 2,800 exhibitors, directly translates to enhanced brand recognition and a stronger market position for GCC.

- Showcasing Products: Direct interaction allows for hands-on demonstrations of GCC's offerings.

- Lead Generation: Events provide a concentrated opportunity to identify and connect with new business prospects.

- Market Intelligence: Observing competitor activities and industry trends offers strategic insights.

- Brand Visibility: Increased presence at key events enhances GCC's recognition within the sector.

GCC's channels extend beyond direct sales to include a robust distribution network and a strong digital presence. Independent distributors and industry events further broaden market reach and facilitate engagement. These diverse channels ensure GCC can connect with a wide array of customers, from large enterprises to smaller contractors.

GCC leverages its owned distribution centers for efficient product delivery, aiming for high on-time rates, as evidenced by a 98% on-time delivery rate in 2023. This infrastructure is complemented by partnerships with independent distributors, tapping into markets projected to see significant growth, with the North American construction equipment aftermarket alone estimated to exceed $20 billion by 2025.

The company's digital strategy includes an informative corporate website, crucial as over 80% of consumers research online before purchasing in 2024. Furthermore, industry trade shows in 2024, like World of Concrete with over 50,000 attendees, offer vital platforms for product demonstration, lead generation, and market intelligence gathering.

| Channel Type | Key Activities | Target Audience | 2024/2025 Data Point |

|---|---|---|---|

| Direct Sales | Key client engagement, complex negotiations, bespoke solutions | Large construction firms, government bodies, major developers | Over 60% of enterprise deals influenced by direct sales (B2B Tech) |

| Owned Distribution Network | Efficient storage, dispatch, inventory management, reduced lead times | All customer segments requiring timely delivery | 15% expansion of terminal capacity in 2024; 98% on-time delivery (2023) |

| Independent Distributors/Dealers | Regional market access, localized sales to smaller clients | Smaller contractors, local builders, retail customers | North American aftermarket projected >$20 billion by 2025 |

| Website/Digital Platforms | Information hub, customer inquiries, technical support, brand building | All potential and existing customers | >80% of consumers research online before purchase (2024) |

| Trade Shows/Events | Product demonstration, lead generation, market intelligence, networking | Industry professionals, potential clients, partners | World of Concrete: >50,000 attendees (2024); CONEXPO-CON/AGG: >2,800 exhibitors (2024) |

Customer Segments

Large-Scale Commercial and Industrial Contractors are key clients, focusing on massive projects like skyscrapers, factories, and extensive private developments. These companies demand substantial quantities of materials that meet stringent quality standards, and they rely heavily on dependable supply chains for their multi-year contracts.

GCC's ability to deliver tailored, high-volume material solutions and robust logistical support is crucial for the successful execution of these complex, often multi-billion dollar, construction endeavors. For instance, in 2024, the GCC region saw significant growth in large-scale infrastructure and commercial projects, with sectors like real estate and industrial development driving demand for construction materials.

GCC caters to a broad spectrum of residential developers and homebuilders, from large-scale corporations to individual contractors. These clients require a consistent and reliable supply of concrete and aggregate materials for diverse housing projects, emphasizing product quality and punctual delivery to keep their construction timelines on track. For instance, in 2024, the GCC region saw significant growth in residential construction, with Saudi Arabia alone planning over 300,000 new housing units, underscoring the demand GCC meets.

Government agencies and entities undertaking large-scale infrastructure projects represent a crucial customer segment for GCC. These entities, including federal, state, and municipal bodies across the US, Mexico, and Canada, rely on GCC for materials essential to building and maintaining public works such as highways, bridges, and public facilities.

Projects for this segment are characterized by their significant volume requirements and often lengthy, multi-year commitments. For instance, major highway expansions or new public transit systems necessitate consistent, high-volume supply chains, which GCC is positioned to provide. The company's capacity is a direct enabler for these substantial undertakings.

Meeting the stringent quality assurance and technical specifications mandated by governmental bodies is paramount. GCC's adherence to these standards ensures that materials used in public infrastructure are durable and safe, aligning with regulatory requirements and public trust. This reliability is a key differentiator in securing and retaining these long-term contracts.

Specialty Construction Firms

Specialty Construction Firms operate within niche segments of the construction industry, focusing on areas like decorative concrete finishes, specialized foundation engineering, or unique concrete structural designs. These businesses often need highly specific material properties and customized formulations to achieve their project goals.

GCC can effectively serve these specialty firms by providing tailored concrete solutions and expert technical support. This approach directly addresses the unique material requirements and performance specifications demanded by these specialized applications, fostering strong client relationships.

- Niche Focus: Firms specializing in decorative concrete, specialized foundations, or unique concrete structures.

- Customization Needs: Require bespoke material formulations and specific technical properties for projects.

- GCC's Role: Offering tailor-made concrete solutions and providing essential technical expertise.

- Market Relevance: The global specialty construction market is projected to reach over $1.5 trillion by 2027, indicating significant demand for specialized materials and services.

Smaller Local Contractors and Businesses

GCC's distribution network and direct sales cater to smaller local contractors and businesses, recognizing their crucial role in market coverage and revenue diversification.

This segment prioritizes easy access to products, unwavering availability, and dependable local support, which are key drivers for their operational success.

For instance, in 2024, the construction sector in many GCC countries saw a significant number of small to medium-sized enterprises (SMEs) contributing to infrastructure development and renovation projects.

These businesses often rely on suppliers who can provide timely deliveries and responsive customer service, making GCC's localized approach a competitive advantage.

- Accessibility: Ensuring products are readily available through local branches and efficient logistics.

- Consistency: Maintaining a steady supply of materials to prevent project delays for smaller firms.

- Reliability: Offering dependable local service and support that these businesses can count on.

GCC serves a diverse clientele, from massive commercial and industrial contractors working on skyscrapers and factories to residential developers building homes. They also supply government agencies for public infrastructure like highways and bridges, and niche specialty construction firms needing custom concrete. Additionally, GCC supports smaller local contractors by ensuring product accessibility and reliable local service.

| Customer Segment | Key Needs | GCC's Value Proposition | Market Data (2024 Example) |

|---|---|---|---|

| Large-Scale Contractors | High-volume, quality materials, dependable supply chain | Tailored solutions, robust logistics for complex projects | GCC region infrastructure spending projected to exceed $200 billion |

| Residential Developers | Consistent, reliable supply, punctual delivery | Quality products, timely delivery to meet housing demand | Saudi Arabia planning over 300,000 new housing units |

| Government Agencies | Stringent quality, technical specifications, long-term supply | Adherence to standards, durable materials for public works | US infrastructure investment bill allocates billions to road and bridge repair |

| Specialty Firms | Specific material properties, custom formulations | Bespoke concrete, technical support for unique applications | Global specialty construction market projected to exceed $1.5 trillion by 2027 |

| Local Contractors | Easy product access, availability, local support | Localized approach, timely deliveries, responsive service | SME contribution to construction in GCC countries significant |

Cost Structure

A substantial part of GCC's expenses comes from obtaining and preparing the fundamental raw materials. For cement, this means limestone, clay, and gypsum. For aggregates, it's sand, gravel, and crushed stone. These costs cover everything from mining and quarrying to the initial processing stages required before these materials can be used.

In 2024, the global average cost for cement raw materials, excluding energy, hovered around $20-$30 per ton, with significant regional variations. For instance, regions with readily accessible high-quality limestone often saw lower acquisition costs compared to those requiring more extensive extraction and transportation. Managing these input costs is absolutely crucial for GCC to maintain its profitability margins in a competitive market.

Energy consumption is a significant cost for GCC's cement manufacturing, primarily driven by the energy-intensive clinker production in kilns. This includes substantial electricity usage for grinding raw materials and operating machinery, alongside the considerable fuel costs for the high-temperature kiln processes.

In 2024, the global cement industry's energy costs represented a substantial portion of production expenses, with thermal energy for kilns often accounting for over 50% of a plant's energy bill. GCC is actively working to improve thermal efficiency in its kilns and increase the proportion of alternative fuels, such as biomass and waste-derived fuels, to manage these escalating energy expenditures and improve its environmental footprint.

Transportation and logistics expenses are a major component for businesses dealing with bulky materials like cement, aggregates, and concrete. These costs aren't just about the fuel for delivery trucks; they encompass the ongoing maintenance of the fleet and the operational expenditures tied to running distribution terminals and utilizing rail transport. For instance, in 2024, fuel costs alone represented a significant portion of these expenses, fluctuating with global energy markets.

Managing these logistics efficiently is paramount to keeping these substantial operational costs in check. In 2023, companies focused on route optimization software and intermodal transport strategies to mitigate rising fuel prices and labor shortages, which impacted delivery times and overall expenditure.

Labor Costs

Labor costs are a significant component of the GCC's business model, encompassing salaries, wages, benefits, and training for a substantial workforce. This includes employees involved in mining, manufacturing, logistics, sales, and administrative operations.

Investing in a skilled and safe workforce is paramount for ensuring operational efficiency and upholding high product quality standards. For instance, in 2024, the average annual wage in the GCC's industrial sectors often exceeded $30,000 USD, reflecting the specialized skills required.

- Salaries and Wages: Covering the compensation for a diverse range of roles across all operational segments.

- Employee Benefits: Including health insurance, retirement plans, and other welfare provisions, which are competitive in the region.

- Training and Development: Essential for maintaining a skilled workforce, particularly in mining and manufacturing, with ongoing investments in safety protocols and technical expertise.

- Occupational Health and Safety: A key priority, with significant expenditure allocated to ensure a safe working environment, a critical factor in the GCC's high-risk industries.

Maintenance and Capital Expenditures

GCC incurs substantial costs for the regular upkeep of its plants, equipment, and vehicle fleet. These ongoing maintenance expenses are critical for ensuring operational continuity and preventing costly breakdowns. For instance, in 2024, maintenance costs across GCC's facilities are projected to reach approximately $150 million.

Strategic capital expenditures are another significant component of GCC's cost structure. These investments focus on upgrading existing infrastructure, expanding operational capacity, and integrating new technologies to enhance efficiency and competitiveness. In 2024, GCC has allocated over $500 million for capital projects, including the modernization of its primary production facility and the acquisition of advanced automation equipment.

- Ongoing maintenance: Essential for operational uptime and asset longevity.

- Capital expenditures: Investments in upgrades, expansions, and new technologies.

- Strategic investments: Significant capital deployment planned for 2024, exceeding $500 million.

- Efficiency and growth: These expenditures directly support long-term operational efficiency and future growth initiatives.

The cost structure for GCC is heavily influenced by raw material acquisition, energy consumption, and logistics. These core operational expenses directly impact profitability and market competitiveness.

GCC's cost structure also includes substantial investments in its workforce and the continuous maintenance and strategic upgrading of its extensive infrastructure and equipment. These elements are vital for sustained operational excellence and future expansion.

| Cost Category | 2024 Estimated Cost (USD) | Key Drivers |

|---|---|---|

| Raw Materials | $20-$30 per ton (global average for cement inputs) | Mining, quarrying, initial processing |

| Energy | Over 50% of energy bill for thermal energy (kiln fuel) | Electricity for grinding, fuel for kilns |

| Transportation & Logistics | Significant portion due to fuel costs | Fleet maintenance, distribution terminals, rail transport |

| Labor | Average annual wage exceeding $30,000 USD (industrial sectors) | Salaries, benefits, training, safety |

| Maintenance & Capital Expenditures | $150 million (maintenance), $500 million+ (capital projects) | Upkeep of plants/equipment, infrastructure upgrades, technology integration |

Revenue Streams

GCC's primary revenue generation comes from selling cement. This includes both bulk quantities for large projects and bagged cement for smaller needs. The construction sector, encompassing residential, commercial, and infrastructure development, is the main customer base, driving significant sales volume.

In 2024, the global cement market was valued at approximately $340 billion, with significant contributions from the GCC region due to ongoing infrastructure development and urban expansion projects. This robust demand directly fuels GCC's cement sales, forming the backbone of its financial performance.

Revenue streams are primarily driven by the production and sale of ready-mix concrete, delivered efficiently to construction projects across the GCC. This core offering provides a reliable, high-quality concrete solution essential for diverse building needs.

The demand for this ready-mix concrete is closely linked to the construction sector's growth. In 2023, construction output in the GCC region saw robust growth, with Saudi Arabia alone projecting over $1 trillion in construction investments by 2030, directly impacting the volume of ready-mix concrete sales.

GCC generates significant revenue from the sale of aggregates, which are fundamental building blocks for construction. This includes essential materials like sand, gravel, and crushed stone, crucial for producing concrete and various other building applications.

These aggregates serve a dual purpose: they are utilized internally by GCC for its own concrete production, ensuring quality and supply chain control, and are also sold to external customers in the construction industry. This external sales component diversifies their revenue base.

The strategic acquisition of additional aggregates operations in 2024 has further bolstered this revenue stream, expanding GCC's capacity and market reach. For instance, the global aggregates market was valued at approximately $350 billion in 2023 and is projected to grow steadily, with GCC positioned to capitalize on this demand.

Sales of Related Construction Products

GCC's revenue streams extend beyond its primary construction services to include the sale of complementary construction products. This diversification strategy aims to capture a broader segment of the market and offer a more complete solution set to clients.

By offering items like asphalt or specialized building materials, GCC can tap into additional revenue channels. For instance, in 2024, the GCC construction materials market was valued at approximately $150 billion, indicating significant potential for companies to gain market share through product expansion.

- Diversified Product Offering: Sales of asphalt, concrete additives, and other specialty building materials.

- Market Share Expansion: Capturing additional revenue from existing and new customers seeking a one-stop solution.

- Enhanced Customer Value: Providing a comprehensive suite of products and services for construction projects.

Delivery and Technical Service Fees

Delivery and technical service fees represent a crucial additional revenue avenue. For instance, in the construction sector, companies often charge for the logistics of transporting materials like ready-mix concrete directly to project sites. This fee covers fuel, labor, and vehicle maintenance, ensuring a consistent revenue stream beyond the product's base price.

Beyond physical delivery, specialized technical support and consulting services can be a significant revenue generator. These offerings add value by assisting customers with product application, troubleshooting, or optimizing their use of the delivered goods. For example, a software company might charge a premium for dedicated technical support or implementation consulting, enhancing customer success and company revenue.

In 2024, the global market for construction logistics, which includes delivery fees, saw substantial activity. Companies in this space focused on optimizing routes and fleet management to improve efficiency and profitability. Similarly, the IT consulting sector continued to expand, with many businesses allocating significant budgets for specialized technical services to drive digital transformation initiatives.

- Delivery Fees: Covering the cost and profit of transporting goods, particularly for bulk or time-sensitive materials like ready-mix concrete.

- Technical Support: Charging for expert assistance, troubleshooting, and guidance on product usage or implementation.

- Consulting Services: Monetizing specialized knowledge and advice to help clients achieve specific business or technical goals.

- Value-Added Services: These fees enhance customer value and create a distinct, profitable revenue stream separate from the core product offering.

GCC's revenue streams are multifaceted, extending from core cement and ready-mix concrete sales to aggregates and complementary construction products. Delivery and technical services further diversify income, ensuring a robust financial model. In 2024, the global cement market was valued at around $340 billion, with the GCC region showing strong growth due to infrastructure development.

| Revenue Stream | Description | 2024 Market Context (Approximate) |

| Cement Sales | Bulk and bagged cement for various construction needs. | Global market: $340 billion |

| Ready-Mix Concrete | Efficient delivery of concrete solutions to projects. | GCC construction output saw robust growth in 2023. |

| Aggregates Sales | Sale of sand, gravel, and crushed stone for construction. | Global aggregates market: $350 billion (2023) |

| Complementary Products | Sale of asphalt, concrete additives, and specialty materials. | GCC construction materials market: $150 billion (2024) |

| Delivery & Technical Fees | Logistics charges for material transport and expert support. | Focus on logistics optimization and specialized IT services. |

Business Model Canvas Data Sources

The GCC Business Model Canvas is meticulously crafted using a blend of market intelligence, financial projections, and competitive analysis. This multi-faceted approach ensures a comprehensive and actionable strategic framework.