GCC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GCC Bundle

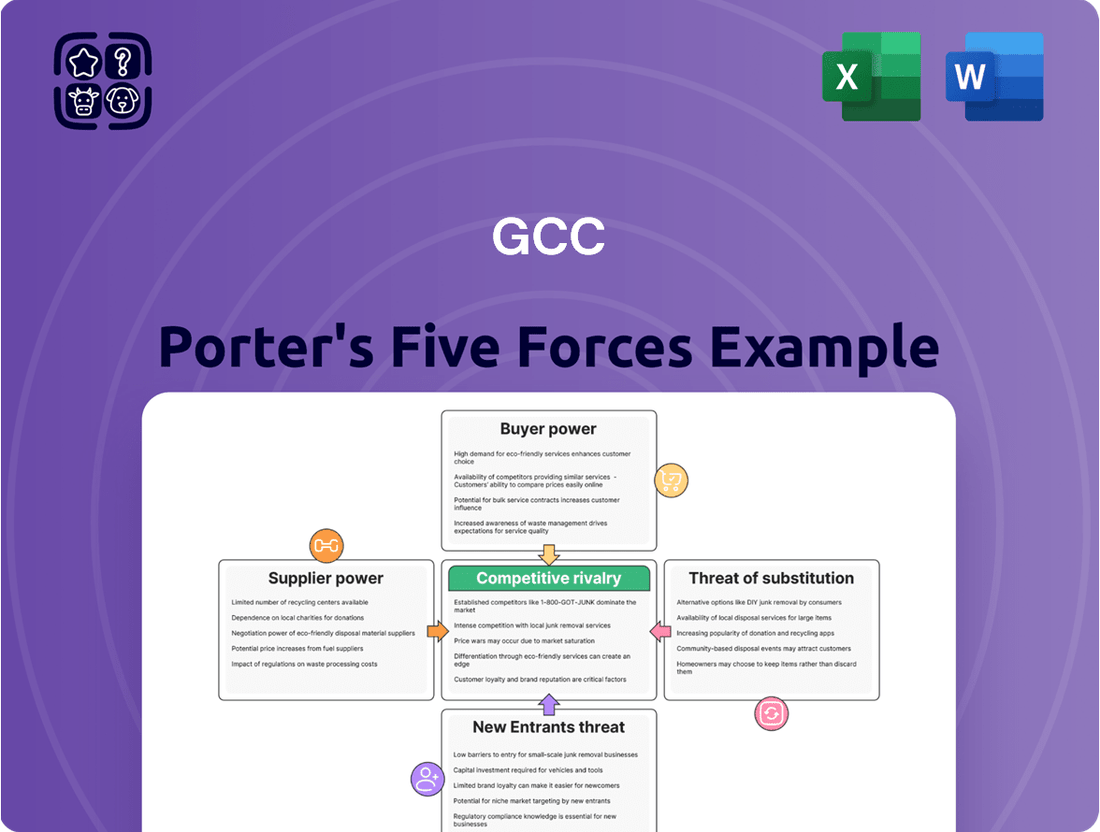

Understanding the competitive landscape of the GCC is crucial for success. Our Porter's Five Forces analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the region.

This initial glimpse only highlights the surface of GCC's industry dynamics. Unlock the full Porter's Five Forces Analysis to explore GCC’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

GCC's bargaining power with suppliers for key raw materials is notably limited due to its vertical integration. The primary inputs for cement production, including limestone, clay, and gypsum, are often sourced from quarries that GCC owns or leases. This direct control over essential resources significantly diminishes the leverage of external raw material suppliers.

This strategic advantage allows GCC to mitigate price pressures from third-party geological material providers. For instance, in 2024, GCC's operational efficiency was bolstered by its access to proprietary quarries, ensuring a stable and cost-effective supply chain for its core manufacturing processes.

Energy, a critical input for cement and concrete manufacturing in the GCC, presents a moderate level of supplier power. Costs associated with electricity and fuels like coal, natural gas, and petroleum coke are significant operational expenses.

While GCC producers might utilize long-term agreements or hedging to mitigate volatility, global energy market swings inevitably influence their expenses. For instance, Brent crude oil prices, a key benchmark, saw significant fluctuations throughout 2024, impacting natural gas and other fuel costs.

However, the availability of diverse global and regional energy sources, coupled with the substantial purchasing power of large industrial consumers in the GCC, generally prevents any single energy supplier from exerting undue influence.

Specialized machinery and spare parts for the GCC's construction sector, including cement kilns, crushers, and concrete mixers, are sourced from a limited number of global manufacturers. These suppliers hold an advantage due to their technical expertise and unique product designs, which are crucial for efficient operations.

However, the long operational life of this heavy equipment and the availability of multiple service providers for maintenance help to dilute the suppliers' bargaining power. For instance, in 2024, the average lifespan of a new industrial crusher can exceed 15 years, providing ample opportunity for competitive sourcing of spare parts and maintenance contracts.

Furthermore, the significant purchasing volume of major GCC construction firms enables them to negotiate more favorable terms on both initial equipment acquisitions and ongoing spare parts and service agreements, thereby capping supplier leverage.

Low Supplier Power for Transportation Services

The transportation of raw materials to plants and finished goods to customers is a vital component of operations for many companies, including those in the GCC region. In 2024, the logistics sector, encompassing trucking, rail, and maritime services, remained largely fragmented. This fragmentation means there are many transportation providers competing for business.

The high degree of competition within the transportation industry significantly limits the bargaining power of suppliers. Companies can leverage this competitive landscape to negotiate more favorable rates and terms. For instance, in 2023, global freight rates saw fluctuations, but the sheer number of carriers available often allowed shippers to secure competitive pricing, a trend expected to continue into 2024.

- Fragmented Market: The transportation sector, including trucking and shipping, is characterized by a large number of independent providers, reducing the leverage of any single supplier.

- Competitive Pricing: In 2024, the availability of multiple carriers allows businesses to compare quotes and negotiate lower costs for transporting raw materials and finished products.

- Operational Flexibility: A diverse supplier base provides businesses with the flexibility to switch providers if service levels or pricing become unfavorable.

Low Supplier Power for Labor

The labor force for cement and aggregates production in the GCC, while requiring specific skills for machinery operation and maintenance, is generally readily available across the region's operating areas. This broad availability limits the bargaining power of individual workers.

Although specialized technical positions may command higher compensation, the overall labor market for manufacturing and logistics roles typically does not empower individual workers or unions with significant leverage, particularly when dealing with a large employer like GCC. For instance, in 2024, the unemployment rate in the GCC region remained relatively stable, indicating a sufficient supply of available labor for industrial sectors.

- Labor Availability: A broad pool of workers with necessary operational and maintenance skills exists.

- Skill Specialization: While niche technical roles may see higher demand, general labor is plentiful.

- Union Influence: Limited union power in manufacturing and logistics sectors reduces wage negotiation leverage.

- Market Dynamics: The overall labor supply in the GCC in 2024 suggests a balanced employer-employee dynamic, favoring employers for non-specialized roles.

GCC's bargaining power with suppliers for key raw materials is notably limited due to its vertical integration, as it often owns or leases quarries for essential inputs like limestone and gypsum. This direct control significantly reduces the leverage of external raw material suppliers, ensuring a stable and cost-effective supply chain. For example, in 2024, GCC's operational efficiency benefited from its proprietary quarries, mitigating price pressures from third-party providers.

Energy costs, while significant, are managed by GCC through diverse sourcing and substantial purchasing power, preventing undue supplier influence despite global market volatility, as seen with Brent crude price fluctuations in 2024. Specialized machinery suppliers hold some power due to unique designs, but long equipment lifespans and competitive maintenance options dilute this leverage, with industrial crushers in 2024 having lifespans exceeding 15 years.

The transportation sector, characterized by fragmentation and intense competition in 2024, offers GCC companies significant negotiating power for logistics services. Similarly, the readily available labor pool in the GCC region in 2024, with a stable unemployment rate, limits the bargaining power of individual workers, especially for non-specialized roles.

| Supplier Type | GCC Bargaining Power | Key Factors (2024 Data/Trends) |

| Raw Materials (Quarries) | High (Limited Supplier Power) | Vertical integration, ownership of quarries |

| Energy (Fuel, Electricity) | Moderate | Global price volatility (e.g., Brent crude), diverse sourcing, large consumer volume |

| Machinery & Spare Parts | Moderate | Technical expertise, long equipment life (e.g., 15+ years for crushers), competitive maintenance market |

| Transportation | High (Limited Supplier Power) | Fragmented market, numerous carriers, competitive pricing |

| Labor | Moderate to High (Limited Supplier Power) | Broad availability, stable unemployment (GCC region 2024), limited union influence in manufacturing |

What is included in the product

Analyzes the competitive intensity and attractiveness of the GCC market by examining the threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and rivalry among existing competitors.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for proactive strategy adjustments.

Customers Bargaining Power

GCC's primary customers are substantial construction firms undertaking large-scale residential, commercial, and infrastructure projects. These major buyers wield significant influence due to their bulk purchasing power and their capacity to shift to alternative suppliers, particularly for commoditized items like cement and aggregates.

The sheer volume of these purchases means that customer demand directly impacts GCC's sales figures and its approach to pricing, especially in markets where competition is robust. For instance, in 2024, major infrastructure spending in the GCC region, such as the ongoing development of new cities and transportation networks, means these large construction firms are key players whose purchasing decisions carry substantial weight.

Smaller construction firms and individual contractors generally buy in smaller quantities, which naturally reduces their individual bargaining power. This means they have less sway when negotiating prices or terms with larger suppliers like GCC.

These smaller players often depend on local distributors or direct sales from manufacturers such as GCC for the convenience and immediate availability of materials. Their reliance on these channels further limits their ability to dictate terms.

While price sensitivity is a factor for these businesses, their smaller order sizes mean they don't hold as much leverage over GCC's pricing strategies as larger, bulk-purchasing clients do. For instance, a small contractor ordering a few tons of steel has less impact than a major developer ordering hundreds of tons.

Government entities are major customers for large infrastructure projects like roads and bridges within the GCC. These projects typically involve competitive bidding where price, quality, and timely delivery are paramount. For instance, Saudi Arabia's Vision 2030 includes massive infrastructure investments, with significant portions allocated to new cities and transportation networks, creating substantial demand.

While governments represent large purchasing volumes, their procurement processes are often structured and long-term. This structure can grant them some bargaining power, yet they also rely on suppliers for consistent quality and adherence to strict project specifications. The sheer scale of these government-led initiatives means that while they can negotiate, they also need reliable partners to ensure project success.

Price Sensitivity Due to Commoditized Nature

The commoditized nature of cement, aggregates, and standard concrete significantly heightens customer price sensitivity. With minimal product differentiation among suppliers, buyers can readily switch based on the lowest price. For instance, in 2024, the global cement market saw intense price competition, with regional price differences often driven by logistics and local supply-demand rather than product quality.

This lack of distinctiveness means that purchasers, particularly large construction firms and government projects, have considerable power to negotiate lower prices. They can easily solicit bids from multiple suppliers and leverage competitive offers. This dynamic forces companies like GCC to operate on thinner margins, constantly evaluating their cost efficiencies and service value propositions to stay competitive.

- Commoditization: Cement, aggregates, and standard concrete are largely undifferentiated products.

- Price Sensitivity: Customers can easily compare prices and switch suppliers, leading to increased sensitivity.

- Competitive Pressure: GCC must balance pricing with its cost structure and service offerings to maintain market share.

- Negotiating Power: Buyers, especially large-scale entities, possess significant leverage to demand lower prices.

Influence of Economic Cycles on Customer Demand

The construction sector's inherent cyclicality significantly shapes customer demand for GCC's offerings. During economic slowdowns, when construction projects become scarcer, customers gain leverage. This increased bargaining power stems from suppliers vying for limited opportunities, often leading to price concessions.

Conversely, when the economy is robust and construction activity surges, the dynamic shifts. High demand for materials and services diminishes customer influence. With more projects seeking resources, GCC can often command stronger pricing as demand outpaces available supply.

- 2024 Construction Spending: Global construction spending is projected to reach approximately $14.7 trillion in 2024, indicating a sector sensitive to economic fluctuations.

- GCC's Exposure: GCC's revenue is directly tied to this cyclical demand, meaning periods of low construction activity can reduce its pricing power.

- Customer Leverage in Downturns: In 2023, as interest rates rose and project financing tightened, many construction firms reported increased negotiation pressure from clients.

GCC's customers, primarily large construction firms and government entities, possess considerable bargaining power. This stems from their substantial order volumes, the commoditized nature of products like cement and aggregates, and their ability to switch suppliers easily. For instance, in 2024, major infrastructure projects in the GCC region, such as those driven by Saudi Arabia's Vision 2030, involve massive material procurement, giving these buyers significant leverage in price negotiations.

| Customer Type | Bargaining Power Factors | Impact on GCC |

| Large Construction Firms | Bulk purchasing, supplier switching capability, price sensitivity due to commoditization | Significant price negotiation leverage, potential for thinner margins |

| Government Entities | Large project volumes, competitive bidding processes, reliance on quality and specifications | Ability to negotiate on price and terms, but also require reliable, quality suppliers |

| Small Contractors | Lower individual order volumes, reliance on distributors/direct sales | Limited individual bargaining power, less impact on GCC's pricing strategies |

Preview Before You Purchase

GCC Porter's Five Forces Analysis

This preview displays the comprehensive GCC Porter's Five Forces Analysis you will receive upon purchase, offering an in-depth examination of competitive and market forces within the region. The detailed breakdown of each force—threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors—is presented in its entirety. You're looking at the actual document, so what you see is precisely what you'll get, ready for immediate download and application.

Rivalry Among Competitors

The construction materials sector, particularly for aggregates and concrete, is often characterized by a fragmented market structure. This means there are many companies, from small local suppliers to large national and international corporations, all competing for business. GCC's operations across the US, Mexico, and Canada reflect this reality, with each region presenting its own unique set of competitors vying for market share.

This intense competition means that companies like GCC must constantly innovate and maintain efficiency to stay ahead. For instance, in 2024, the US construction materials market saw continued activity, with regional players often holding significant sway in local markets. The sheer volume of competitors directly fuels a high degree of rivalry, impacting pricing strategies and the need for strong customer relationships.

GCC, like other cement producers, faces intense rivalry stemming from high fixed costs. Building and maintaining cement plants, along with quarrying operations, demands substantial capital investment. These significant upfront expenses create a strong incentive to maximize production volume.

The need to operate at high capacity utilization to spread these fixed costs and achieve profitability puts immense pressure on GCC. When demand falters or the market experiences overcapacity, this pressure can translate into aggressive pricing strategies among competitors, intensifying the competitive landscape.

For instance, in 2024, the global cement industry has seen fluctuating demand patterns. In regions with excess production capacity, such as parts of Asia and the Middle East, this dynamic can lead to price wars as companies strive to keep their plants running efficiently, directly impacting GCC's competitive positioning.

For fundamental construction materials like cement, aggregates, and standard ready-mix concrete, the ability to make products stand out is limited. This means that price often becomes the main battleground for competitors. GCC does highlight its commitment to quality and tailored customer solutions, but the basic nature of these core offerings makes them easily swapped out by customers, which fuels tougher competition based on price.

High Exit Barriers Due to Specialized Assets

The cement and construction materials sector is characterized by significant capital outlays for specialized production facilities. These substantial investments, often running into hundreds of millions of dollars for a single plant, create formidable exit barriers. For instance, a typical GCC cement plant represents a multi-year construction project with advanced machinery, making it difficult and costly to repurpose or sell off. This high sunk cost means that even companies struggling with profitability are often compelled to remain operational, contributing to persistent competitive intensity.

These high exit barriers directly influence competitive rivalry. When exiting the market is financially prohibitive, underperforming firms tend to stay in the game, leading to sustained competition. This can result in prolonged periods of oversupply, as these reluctant participants continue to produce, even at reduced capacity, to recoup some of their fixed costs. GCC, as a major player, navigates this landscape where the inability of weaker competitors to exit the market keeps pressure on pricing and market share.

- High Capital Investment: Cement and construction material production requires massive upfront investment in specialized, often custom-built, machinery and infrastructure.

- Specialized Assets: The assets are highly specific to cement production, lacking broad alternative uses, which increases the cost and difficulty of exiting the industry.

- Reluctance to Exit: Companies often continue operating even at low profitability to avoid realizing substantial losses on their fixed assets, prolonging competitive pressure.

- Oversupply Risk: The presence of firms unable to exit can lead to persistent overcapacity in the market, impacting pricing power for all industry participants, including GCC.

Regional Concentration and Logistics as a Competitive Factor

The cement industry, including players like GCC, faces intense rivalry driven by regional concentration and the critical role of logistics. Because cement, aggregates, and concrete have a high weight-to-value ratio, transportation costs significantly impact competitiveness. Companies with strategically positioned production facilities and robust distribution networks, such as GCC, can leverage lower logistics expenses to gain an edge. This often leads to fierce competition within specific geographic markets, where a limited number of key players vie for local construction contracts.

For instance, in 2023, the average cost of transporting cement in the GCC region could represent 15-25% of the total delivered price, depending on the distance. This highlights how crucial efficient logistics are for maintaining profitability and market share. Companies that invest in optimizing their supply chains, potentially through rail or sea transport where feasible, can significantly undercut competitors relying solely on road transport.

- Logistics Costs: Transportation can account for 15-25% of delivered cement prices in the GCC, making efficient logistics a major competitive differentiator.

- Strategic Location: GCC's network of strategically located plants and distribution centers provides a cost advantage over rivals with less optimized footprints.

- Regional Focus: Intense rivalry is often confined to specific local markets where a few dominant players compete for project bids.

Competitive rivalry within the construction materials sector, particularly for GCC, is high due to market fragmentation and the commodity nature of its core products. The need to operate large, capital-intensive facilities at high utilization rates drives aggressive pricing. This intensity is amplified by significant exit barriers, meaning even struggling companies remain operational, contributing to oversupply and sustained competitive pressure.

| Factor | Impact on Rivalry | GCC Relevance |

|---|---|---|

| Market Fragmentation | Numerous players lead to intense competition for market share. | GCC operates in a fragmented US, Mexico, and Canada market. |

| High Fixed Costs | Incentivizes high production volume and aggressive pricing to cover costs. | Cement plant operations require substantial capital, driving capacity utilization. |

| Commodity Products | Limited product differentiation makes price the primary competitive tool. | Cement, aggregates, and standard concrete are easily substituted, fueling price wars. |

| Exit Barriers | High sunk costs and specialized assets keep firms in the market, sustaining rivalry. | GCC's plants are costly to exit, prolonging competitive pressure from weaker players. |

| Logistics Sensitivity | Transportation costs create regional competitive advantages and local rivalries. | GCC leverages strategically located facilities to manage logistics costs, a key differentiator. |

SSubstitutes Threaten

While alternative building materials exist, concrete's dominance in construction, particularly for foundational elements and heavy infrastructure, remains largely unchallenged. Its unparalleled strength, durability, and cost-effectiveness for these core applications create a low threat from direct material substitutes.

Globally, concrete is the most utilized construction material, with the global concrete market valued at approximately $340 billion in 2023 and projected to reach over $450 billion by 2028. This widespread adoption underscores the difficulty for substitutes to match concrete's performance across its primary uses.

Emerging materials like mass timber show promise in specific applications, but they are not yet a scalable or cost-effective replacement for concrete's extensive role in large-scale projects. The sheer volume and versatility of concrete applications mean substitutes face significant hurdles in replicating its comprehensive utility.

The threat of substitutes for traditional concrete construction is currently moderate, but evolving. Advancements in modular construction, prefabrication, and 3D printing are gaining traction, potentially impacting the demand for on-site cast-in-place concrete. For instance, the global modular construction market was valued at approximately $100 billion in 2023 and is projected to grow significantly, indicating a shift in building methodologies.

While these alternative methods often still incorporate concrete elements, they can alter the volume and type of concrete consumed, potentially reducing the need for traditional, labor-intensive pouring. GCC must stay abreast of these technological shifts to understand how they might reshape market demand for its products and services.

The threat of substitutes for aggregates in their primary applications, such as concrete, asphalt, and road bases, remains low because there are few readily available alternatives that can match their performance and cost-effectiveness at scale. GCC's core products are essential building blocks for infrastructure, making direct replacement challenging.

While recycled materials like reclaimed asphalt pavement (RAP) and recycled concrete aggregate (RCA) are gaining traction, they typically serve as supplementary materials rather than complete replacements for virgin aggregates. Furthermore, GCC's potential involvement in producing or distributing these recycled products could mitigate this threat by allowing them to capture value from these emerging alternatives.

Emerging Threat from Sustainable or 'Green' Alternatives

Growing environmental awareness and stricter regulations are pushing demand towards sustainable building materials. While direct replacements for traditional cement are scarce, innovative options like geopolymer cements and alternative binders are emerging as potential long-term substitutes.

GCC is actively monitoring these advancements, likely investing in research and development to ensure its product offerings remain competitive and compliant with evolving environmental standards. For instance, by 2024, the global market for green building materials was projected to reach hundreds of billions of dollars, highlighting the significant shift underway.

- Growing demand for eco-friendly construction: Environmental concerns are a key driver for alternative materials.

- Emerging technologies: Geopolymer cements and alternative binders represent potential long-term threats.

- GCC's strategic response: Monitoring and investing in R&D to maintain competitiveness and compliance.

- Market trends: The green building materials market is experiencing substantial growth, indicating a significant shift in consumer and regulatory preferences.

Indirect Substitution from Material Efficiency and Design

Improved structural design and material optimization present an indirect threat by potentially reducing the overall volume of concrete and aggregates needed for construction projects. For instance, advancements in building techniques, such as prefabrication and advanced formwork, can lead to more efficient material usage. This means that even if the price of concrete remains stable, the total quantity demanded might decrease if structures can be built using less material while still meeting performance standards.

This trend is particularly relevant as the construction industry increasingly focuses on sustainability and cost-efficiency. For example, a 2024 report highlighted that innovative design approaches in high-rise buildings have shown the potential to reduce concrete usage by up to 15% through optimized structural systems. This shift towards material efficiency directly impacts the volume of sales for cement and aggregate producers.

GCC's strategy to mitigate this threat lies in its focus on providing specialized concrete mixes and integrated solutions. By offering higher-value products that enhance performance, durability, or ease of construction, GCC can command better pricing and maintain demand even with reduced material volumes. This approach shifts the competitive landscape from a pure volume game to one of specialized product offerings and technical expertise.

- Indirect Substitution Threat: Reduced material volume due to design and efficiency improvements.

- Impact on Demand: Potential decrease in overall concrete and aggregate quantities required for projects.

- Industry Trend: Growing emphasis on sustainability and cost-efficiency driving material optimization.

- GCC's Mitigation Strategy: Focus on specialized mixes and integrated solutions to offer higher value.

The threat of substitutes for concrete and aggregates is currently moderate but evolving, particularly concerning alternative building methodologies and materials. While direct replacements for concrete's core strengths in foundational and heavy infrastructure are limited, shifts in construction practices and a growing demand for sustainable options present indirect challenges.

Emerging trends like modular construction and prefabrication, while often still incorporating concrete, can alter the volume and type of concrete consumed. The global modular construction market's projected growth, reaching an estimated $130 billion by 2025, signifies a move towards different building processes. Furthermore, advancements in structural design and material optimization are leading to reduced overall material usage in projects, impacting demand for traditional concrete and aggregates.

The rise of green building materials, with the market projected to exceed $200 billion by 2024, also signals a growing preference for sustainable alternatives. While geopolymer cements and alternative binders are still developing, they represent potential long-term substitutes that GCC must monitor. GCC's strategy to counter these threats involves focusing on specialized concrete mixes and integrated solutions that offer higher value and performance, shifting the focus from sheer volume to product differentiation and technical expertise.

| Threat Category | Nature of Threat | Key Drivers | GCC's Strategic Response | Relevant Data (2024 Projections/Estimates) |

|---|---|---|---|---|

| Direct Material Substitutes | Low for core infrastructure applications | Concrete's strength, durability, cost-effectiveness | Focus on core strengths, R&D for performance enhancement | Global concrete market projected to exceed $400 billion |

| Alternative Construction Methods | Moderate, impacting volume and type of concrete used | Modular construction, prefabrication, 3D printing | Adaptation to new methodologies, offering specialized concrete for these applications | Global modular construction market projected to reach $130 billion |

| Sustainable/Green Materials | Emerging, potential long-term threat | Environmental concerns, regulatory push | R&D in geopolymer cements, alternative binders, recycled materials | Global green building materials market projected to exceed $200 billion |

| Material Efficiency/Optimization | Indirect, reducing overall volume demand | Improved structural design, advanced building techniques | Offering specialized, high-performance mixes; integrated solutions | Potential for up to 15% reduction in concrete usage in optimized designs |

Entrants Threaten

The cement industry, including major players like GCC, is characterized by exceptionally high capital requirements. Establishing a new cement plant necessitates enormous upfront investment in land, quarries, kilns, grinding mills, and extensive distribution infrastructure. For instance, building a modern cement plant can easily cost hundreds of millions of dollars, making it a significant hurdle.

This substantial financial barrier deters many potential new entrants. Aspiring competitors must secure vast amounts of capital, often facing lengthy payback periods and considerable financial risk. In 2024, the global average cost to construct a new cement plant with a capacity of 1 million tons per year was estimated to be between $200 million and $300 million, a figure that underscores the intensity of this barrier.

The construction materials sector, especially cement and aggregates, faces significant regulatory challenges. Stringent environmental standards, complex zoning laws, and arduous permitting processes are common. For instance, in 2024, the average time to secure environmental permits for new industrial facilities in many GCC countries can extend beyond 18 months, often involving multiple agency approvals.

These extensive requirements act as a substantial barrier to entry. New companies must navigate a labyrinth of regulations, invest heavily in compliance, and endure lengthy waiting periods. This complexity deters many potential entrants, as the upfront investment and time commitment can be prohibitive, thereby protecting established players.

GCC's existing players leverage substantial economies of scale in production and procurement, making it difficult for new entrants to match their cost efficiencies. For instance, major construction material suppliers in the GCC region often operate at volumes that allow for significant discounts on raw materials, a benefit new, smaller competitors cannot easily access.

Furthermore, established distribution networks and deep-rooted relationships with contractors and developers present a formidable barrier. Replicating these extensive logistical channels and trusted partnerships, which are crucial for project bidding and material supply, requires considerable time and investment for any new company entering the GCC market.

Access to Raw Materials and Strategic Locations

Securing essential raw materials like limestone and aggregates presents a significant hurdle for new entrants in the GCC cement and construction materials market. Established players, including GCC, already hold significant control over prime quarry locations. This existing control makes it difficult for newcomers to access the necessary high-quality reserves, directly impacting their ability to produce competitively.

Furthermore, the strategic advantage of proximity to key markets is largely captured by incumbent firms. For new entrants, the cost of transportation can become prohibitive if they cannot secure quarry sites near major demand centers. This logistical challenge, coupled with the difficulty in acquiring raw material access, significantly raises the barrier to entry.

- Limited Access to Prime Quarry Locations: Established companies, such as GCC, have secured access to the most advantageous limestone and aggregate reserves, making it difficult for new players to obtain sufficient high-quality raw materials.

- High Transportation Costs for New Entrants: Without access to strategically located quarry sites near major construction hubs, new entrants face significantly higher transportation expenses, impacting their price competitiveness.

- Control of Essential Resources by Incumbents: The concentration of control over critical raw material deposits in the hands of existing market participants creates a substantial barrier, limiting the operational capacity and market penetration potential for new companies.

Brand Loyalty and Customer Relationships

Brand loyalty is a significant barrier for new entrants in the GCC market. Established players have cultivated strong relationships with major contractors and project managers, built on years of reliability and consistent quality. For instance, in 2024, major construction projects in the UAE, valued in the billions, often rely on pre-qualified suppliers with proven track records, making it difficult for newcomers to break in.

New companies must offer compelling value propositions, such as aggressive pricing or enhanced service offerings, to challenge this entrenched trust. However, the mature nature of the GCC market, characterized by experienced and well-capitalized incumbents, makes this an uphill battle. The cost and effort required to build comparable reputation and client confidence can be substantial.

- Established Trust: Long-standing GCC companies benefit from deep-rooted relationships with key industry players.

- Reputation for Reliability: Consistent delivery and quality over time have fostered significant customer loyalty.

- Barriers to Entry: New entrants must overcome this established goodwill, often requiring aggressive strategies or superior service.

- Market Maturity: The GCC market's experience and dominance by established firms present a challenging environment for new competition.

The threat of new entrants in the GCC cement market is generally low, primarily due to the substantial capital requirements for establishing new production facilities. Building a modern cement plant in 2024 could cost between $200 million and $300 million, a significant financial hurdle. Regulatory complexities, including lengthy environmental permitting processes that can take over 18 months in some GCC countries in 2024, further deter potential newcomers. Established players also benefit from economies of scale, strong distribution networks, and secured access to prime quarry locations, all of which create formidable barriers for any new company attempting to enter the market.

| Barrier Type | Description | Impact on New Entrants (GCC Cement Market, 2024) |

|---|---|---|

| Capital Requirements | High upfront investment for plant construction. | Significant deterrent; estimated $200-$300 million for a 1 million ton/year plant. |

| Regulatory Hurdles | Complex environmental standards and permitting processes. | Lengthy waiting periods (e.g., >18 months for permits in some GCC nations), increasing time-to-market and costs. |

| Economies of Scale | Established players operate at higher volumes, reducing per-unit costs. | New entrants struggle to match cost efficiencies, impacting price competitiveness. |

| Distribution Networks | Extensive logistical channels and established relationships. | Difficult and costly for new firms to replicate, hindering market reach. |

| Raw Material Access | Incumbents control prime quarry locations. | Limited access to high-quality limestone and aggregates for new players. |

Porter's Five Forces Analysis Data Sources

Our GCC Porter's Five Forces analysis is built upon a robust foundation of data, drawing from official government statistics, regional economic reports, and industry-specific market research from reputable firms. This ensures a comprehensive understanding of the competitive landscape within the Gulf Cooperation Council.