Groupe Bruxelles Lambert PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupe Bruxelles Lambert Bundle

Groupe Bruxelles Lambert operates within a dynamic global environment, shaped by evolving political landscapes, economic fluctuations, and technological advancements. Understanding these external forces is crucial for strategic decision-making and identifying both opportunities and potential threats. Our comprehensive PESTLE analysis delves deep into these factors, providing you with the actionable intelligence needed to navigate this complex terrain.

Unlock the full potential of your strategic planning by downloading our expert-crafted PESTLE analysis for Groupe Bruxelles Lambert. Gain a clear understanding of the political, economic, social, technological, legal, and environmental influences impacting the company's trajectory. Equip yourself with the insights necessary to make informed decisions and stay ahead of the curve. Get your copy now!

Political factors

Groupe Bruxelles Lambert (GBL) is significantly influenced by geopolitical stability in the regions where its diverse portfolio companies, such as Adidas and Pernod Ricard, operate. For instance, ongoing geopolitical tensions in Eastern Europe could disrupt supply chains and consumer demand for brands like Adidas, impacting their revenue streams. GBL's ability to navigate these instabilities is crucial for maintaining the value of its investments.

Shifts in global trade policies present another critical political factor for GBL. New tariffs or trade barriers, such as those that might arise from ongoing trade discussions between major economic blocs, could directly affect the profitability of companies within GBL's portfolio, particularly those with extensive international operations. For example, changes in import duties could increase the cost of goods for companies like Saint-Gobain, affecting their competitive pricing strategies.

Monitoring international relations and trade agreements is therefore a core strategic imperative for GBL. The company must continuously assess how evolving trade landscapes, including potential sanctions or export controls, might create both risks and opportunities across its varied holdings. This proactive approach allows GBL to adapt its investment strategies and mitigate potential negative impacts on its overall financial performance.

Government investment regulations, particularly those concerning foreign direct investment (FDI) and mergers and acquisitions (M&A), directly shape Groupe Bruxelles Lambert's (GBL) strategic flexibility. For instance, in 2024, the European Union continued to refine its FDI screening mechanisms, with member states like Germany and France actively reviewing cross-border deals for national security implications, potentially impacting GBL’s acquisition targets or divestitures.

Stricter oversight or protectionist policies implemented by governments in key operating regions could present significant hurdles. For example, if a nation imposes new capital controls or limits foreign ownership in strategic industries, GBL's capacity to deploy capital or repatriate profits from its diverse portfolio companies could be constrained, affecting overall portfolio performance and future investment capacity.

Navigating this complex regulatory landscape is paramount for GBL’s sustained growth and value creation. By closely monitoring and adapting to evolving frameworks, such as changes in antitrust laws or sector-specific investment caps, GBL can better identify opportunities and mitigate risks, ensuring its long-term investment strategy remains robust and compliant.

Groupe Bruxelles Lambert (GBL), as a diversified holding company, faces potential impacts from industry-specific regulatory shifts. For instance, in 2024, stricter environmental regulations on industrial emissions could increase operational costs for companies within its industrial services portfolio, potentially affecting profitability.

Similarly, evolving data privacy laws, such as those being considered in the EU for 2025, might necessitate significant investment in compliance for GBL's consumer-facing businesses, altering their market approach and expenditure.

Changes in competition law within key markets for its consumer goods or healthcare investments could also reshape the competitive landscape, influencing market share and strategic opportunities for its portfolio companies.

Fiscal and Taxation Policies

Changes in corporate tax rates, capital gains taxes, or dividend taxation in countries where Groupe Bruxelles Lambert (GBL) and its portfolio companies operate significantly affect net earnings and shareholder returns. For instance, a reduction in corporate tax rates, such as the 2024 adjustments in some European nations, can bolster profitability for GBL's subsidiaries.

Favorable tax incentives, like those introduced in 2024 for green energy investments in several EU countries, could create opportunities for GBL's diversified portfolio. GBL actively monitors these fiscal developments to optimize its financial structure and capitalize on beneficial tax regimes.

Key fiscal considerations for GBL include:

- Corporate Tax Rate Fluctuations: Monitoring changes in statutory corporate tax rates across GBL's key operating regions, such as Belgium and France, directly impacts consolidated earnings.

- Capital Gains and Dividend Taxation: Shifts in capital gains and dividend tax policies influence the attractiveness of GBL's investment strategy and its ability to distribute returns to shareholders.

- Tax Incentives for Investment: Evaluating new or existing tax credits and deductions for specific sectors or investment types, like R&D or sustainable infrastructure, can unlock growth avenues.

Political Risk in Emerging Markets

Groupe Bruxelles Lambert's (GBL) global investment strategy inherently involves navigating the complexities of emerging markets, where political risks like expropriation or civil unrest can significantly impact portfolio value. Even though GBL primarily invests in established international corporations, the operational reach of these companies can inadvertently expose GBL to the political volatility of diverse regions. For instance, a significant portion of the global economy's growth is projected to come from emerging markets, with the IMF forecasting a 4.2% growth rate for emerging and developing economies in 2024, compared to 2.9% for advanced economies. This growth potential is coupled with heightened political uncertainty.

Assessing the political stability and quality of governance in these regions is therefore a critical component of GBL's risk management framework. Countries with weaker institutions or a history of political instability often present greater challenges. For example, the World Bank's 2024 Worldwide Governance Indicators show considerable variation in political stability and absence of violence across emerging economies, with some regions scoring significantly lower than others, directly influencing investment risk profiles.

- Emerging Market Exposure: GBL's investments in global leaders means indirect exposure to the political climates of countries where these companies operate, including emerging markets.

- Political Risk Factors: Key risks include government intervention, changes in regulatory frameworks, social unrest, and potential for nationalization or expropriation of assets.

- Risk Mitigation: Thorough due diligence on the political landscape and governance structures of countries where portfolio companies have significant operations is essential for managing these risks.

- Economic Growth vs. Risk: While emerging markets offer growth opportunities, they often come with a higher premium on political risk, necessitating careful analysis and diversification.

Government stability and policy continuity are crucial for Groupe Bruxelles Lambert (GBL). For instance, the 2024 European Parliament elections and subsequent national government shifts in several member states could lead to policy adjustments affecting GBL's portfolio companies, particularly in sectors like energy and digital services. Changes in government spending priorities or the implementation of new industrial policies can directly impact the operational environment and growth prospects of GBL's investments.

Regulatory frameworks, particularly those concerning competition and market access, are constantly evolving. In 2024, the European Commission continued its scrutiny of large tech companies, which could indirectly influence GBL's holdings in related sectors. Furthermore, shifts in national regulations regarding foreign investment screening, as seen in countries like Germany and France, require GBL to remain agile in its M&A strategies.

The geopolitical landscape remains a significant factor, with ongoing conflicts and trade disputes influencing global supply chains and consumer confidence. For example, the stability of trade relations between major economic blocs directly impacts companies like Adidas, affecting their international sales and production costs. GBL's ability to navigate these complex international relations is key to mitigating risks across its diversified portfolio.

What is included in the product

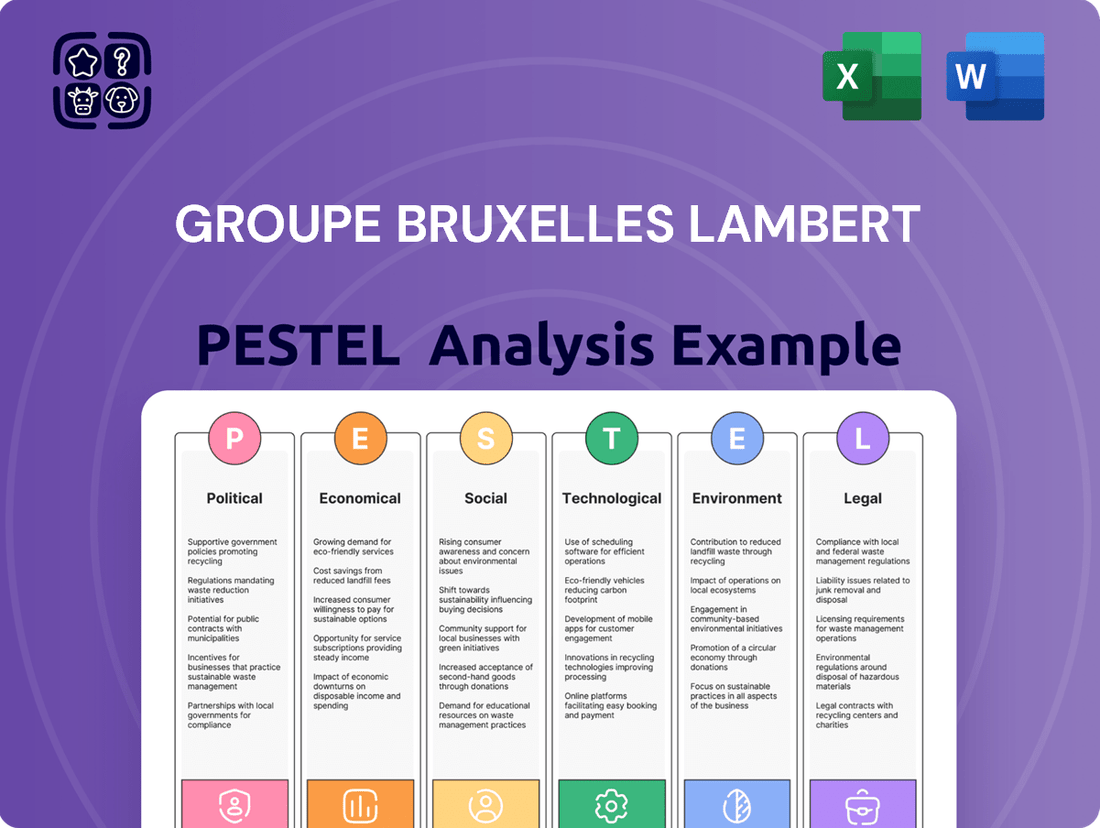

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Groupe Bruxelles Lambert, covering political, economic, social, technological, environmental, and legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify opportunities within the dynamic business landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a quick overview of Groupe Bruxelles Lambert's external environment to streamline strategic discussions.

Economic factors

The global economic outlook for 2024 and 2025 presents a mixed picture for Groupe Bruxelles Lambert (GBL). While some regions anticipate moderate growth, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a slight uptick from 2023, but acknowledged persistent risks. This directly impacts GBL's diverse portfolio, as sectors like consumer goods and industrials are sensitive to economic cycles.

Recessionary fears, particularly in major economies like the Eurozone and the United States, pose a significant threat. A slowdown would likely translate into reduced consumer spending and business investment, negatively affecting the revenues and profitability of GBL's holdings, such as Adidas and Pernod Ricard. For instance, a potential contraction in European GDP could dampen demand for luxury and alcoholic beverages.

Conversely, if global growth accelerates beyond current forecasts, GBL's companies could see enhanced demand. The IMF's projections, while cautious, do point to resilience in certain emerging markets, which could offer growth opportunities for GBL's investments in sectors like technology and energy. However, geopolitical tensions and persistent inflation remain key uncertainties that could derail these positive trends.

Interest rate fluctuations directly impact the cost of capital for Groupe Bruxelles Lambert's (GBL) diverse portfolio companies. For instance, a rise in interest rates, as seen with the European Central Bank's policy rate reaching 4.00% by September 2023, increases borrowing costs, potentially dampening investment and expansion plans within GBL's holdings. This also affects the valuation multiples of these companies, as higher discount rates are applied to future earnings.

High inflation presents a dual challenge. For 2024, inflation in the Eurozone is projected to average around 2.5% by the IMF, a notable decrease from previous years but still a factor. This persistent inflation erodes consumer purchasing power, potentially reducing demand for products and services offered by GBL's consumer-facing investments. Simultaneously, it drives up operational expenses, from raw materials to labor, squeezing profit margins for businesses across its portfolio.

GBL's strategic approach necessitates close monitoring of these macroeconomic trends. Understanding the trajectory of interest rates and inflation is crucial for assessing the financial resilience and future growth potential of its investments, ranging from industrial giants like Umicore to financial services firms.

Groupe Bruxelles Lambert (GBL), with its diverse international investments, faces significant impacts from currency exchange rate volatility. Fluctuations in foreign currencies directly affect the reported financial performance when earnings from its portfolio companies are converted back to GBL's reporting currency, likely the Euro.

For instance, a substantial weakening of the US Dollar, where GBL holds significant stakes in companies like Pernod Ricard and Adidas, could lead to a reduction in reported profits for GBL. As of early 2024, the Euro has shown some strength against the Dollar, which generally benefits European companies reporting in Euros but can impact the competitiveness of their exports.

Managing this currency exposure, whether directly or indirectly through its portfolio companies' hedging strategies, is a critical element for GBL's financial stability and accurate performance reporting. The ongoing geopolitical landscape and varying monetary policies across major economies in 2024 and 2025 are expected to contribute to continued currency market fluctuations.

Capital Market Liquidity and Valuations

Groupe Bruxelles Lambert's (GBL) strategic moves, like acquiring new companies or selling off existing holdings, are heavily influenced by how easily capital flows and what valuations are currently accepted in the market. If capital is readily available and investors are confident, it typically means higher valuations and smoother deal-making, which benefits GBL.

Conversely, a market experiencing a liquidity crunch or a significant downturn can really limit GBL's options. This means they might struggle to find good acquisition targets at reasonable prices or to offload assets without taking a hit on their value. For instance, during periods of market stress, the cost of capital can rise, making acquisitions more expensive and potentially impacting the mark-to-market valuation of GBL's existing portfolio.

As of early 2024, global equity markets have shown resilience, with major indices like the S&P 500 reaching new highs, indicating a degree of liquidity and investor optimism. However, concerns regarding inflation and interest rate policies continue to create volatility. For GBL, this environment means that while opportunities for profitable divestments might exist, the ability to deploy capital into new ventures at attractive entry points remains a key consideration.

- Capital Availability: Strong liquidity in financial markets generally supports higher asset valuations for GBL's portfolio companies.

- Valuation Impact: Market sentiment and liquidity directly influence the mark-to-market value of GBL's investments.

- Strategic Flexibility: Periods of low liquidity can constrain GBL's ability to execute timely acquisitions or profitable exits.

- 2024 Trends: Despite some market volatility, global equity markets have demonstrated robust performance, suggesting continued, albeit selective, capital availability.

Consumer Spending and Investment Cycles

Consumer spending is a critical driver for many of Groupe Bruxelles Lambert's (GBL) portfolio companies, particularly those in consumer goods and services. For instance, a strong consumer environment, characterized by high confidence and disposable income, directly fuels demand and revenue growth for companies like Adidas or Pernod Ricard. The US Consumer Confidence Index, a key indicator, stood at 102.0 in May 2024, reflecting a generally positive, though somewhat cautious, consumer sentiment. This sustained spending power is vital for GBL’s diversified holdings.

However, shifts in consumer priorities or economic headwinds can present significant challenges. A downturn impacting discretionary spending, such as a rise in inflation or interest rates, can dampen sales for luxury or non-essential goods. For example, if consumers prioritize essential spending due to economic uncertainty, GBL’s investments in sectors reliant on discretionary purchases might face slower growth or even contraction. The Federal Reserve's stance on interest rates throughout 2024 and into 2025 will be a key factor influencing this discretionary spending.

- Consumer Confidence: The US Consumer Confidence Index was 102.0 in May 2024, indicating a generally positive but watchful consumer mood.

- Discretionary Spending Impact: Higher inflation or interest rates can reduce consumer willingness to spend on non-essential goods, affecting companies like Pernod Ricard.

- Investment Cycle Sensitivity: GBL's portfolio performance is closely linked to the cyclical nature of consumer investment and spending patterns, requiring careful monitoring of economic indicators.

- Inflationary Pressures: Persistent inflation in 2024 and projections for 2025 could continue to squeeze household budgets, potentially impacting demand for goods and services across GBL's diverse holdings.

Global economic growth projections for 2024 and 2025 indicate a moderate but potentially uneven recovery. The IMF forecast global growth at 3.2% for 2024, with slight variations expected across regions. This backdrop directly influences GBL's performance, as its diversified holdings are sensitive to economic cycles.

Inflationary pressures remain a key concern, though expected to moderate. For the Eurozone, inflation was projected around 2.5% for 2024 by the IMF, impacting consumer purchasing power and operational costs for GBL's portfolio companies.

Interest rates, influenced by central bank policies, continue to affect the cost of capital for GBL's investments. The European Central Bank's policy rate reaching 4.00% by September 2023 illustrates this trend, increasing borrowing costs and potentially impacting valuations.

| Economic Indicator | 2024 Projection/Value | Impact on GBL |

|---|---|---|

| Global GDP Growth | 3.2% (IMF) | Influences demand across GBL's diverse portfolio. |

| Eurozone Inflation | ~2.5% (IMF projection) | Affects consumer spending and company operating costs. |

| ECB Policy Rate | 4.00% (as of Sep 2023) | Increases borrowing costs for GBL's holdings. |

Same Document Delivered

Groupe Bruxelles Lambert PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Groupe Bruxelles Lambert's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting GBL.

The content and structure shown in the preview is the same document you’ll download after payment, offering in-depth insights into the strategic landscape for Groupe Bruxelles Lambert.

Sociological factors

Global demographic changes, like the increasing average age in many developed nations and the burgeoning middle class in Asia, directly impact the demand for goods and services within Groupe Bruxelles Lambert's diverse investment portfolio. For instance, the growing elderly population in Europe, projected to reach over 25% of the total population by 2050, could boost demand for healthcare and retirement services among GBL's holdings.

Evolving consumer preferences, such as a heightened focus on health and sustainability, alongside rapid digital adoption, are reshaping markets. By 2025, it's estimated that over 70% of global internet users will be engaging in e-commerce, a trend GBL's portfolio companies must leverage. Adapting to these shifts is vital for maintaining competitiveness.

Groupe Bruxelles Lambert’s investment strategy needs to be attuned to these long-term societal transformations. Aligning with trends like increased urbanization, which saw the global urban population reach 57% in 2023, ensures that GBL's investments remain relevant and poised for sustained growth across various sectors.

The availability of skilled labor and prevailing wage trends directly influence the operational expenses and efficiency of Groupe Bruxelles Lambert's (GBL) diverse portfolio companies. For instance, in 2024, many European economies continued to grapple with labor shortages in key sectors like technology and healthcare, potentially driving up wages for specialized roles. This pressure on labor costs can impact the profitability of GBL's holdings, especially those with significant operational footprints in these affected regions.

Shortages of specialized talent or substantial increases in labor costs in particular geographic areas pose a tangible risk to the financial performance of GBL's investments. Reports in late 2024 indicated that average wage growth in the Eurozone hovered around 4-5%, a figure that could significantly affect companies with labor-intensive operations. GBL and its management teams must therefore remain agile, adapting to these evolving labor market conditions to maintain competitiveness.

Furthermore, GBL and its portfolio companies are increasingly required to adapt to shifting workforce expectations, which now prominently feature remote work arrangements and a greater emphasis on employee well-being. The continued prevalence of hybrid work models post-2023, for example, necessitates adjustments in operational strategies and talent management. Companies that successfully integrate these evolving employee needs are better positioned to attract and retain top talent, thereby safeguarding their long-term operational effectiveness and profitability.

Societal expectations around Environmental, Social, and Governance (ESG) criteria are significantly shaping investment and consumer behavior. In 2024 and looking into 2025, there's a heightened demand for transparency and demonstrable commitment to sustainability and ethical practices across all business operations.

As a major shareholder, Groupe Bruxelles Lambert (GBL) is increasingly expected to champion ESG integration within its portfolio companies. This includes pushing for greener operations, fair labor conditions, and strong corporate governance, recognizing that robust ESG performance, evidenced by metrics like improved carbon footprint reduction or diversity in leadership, can directly correlate with enhanced long-term financial value and resilience.

Cultural Values and Local Market Adaptability

For Groupe Bruxelles Lambert's (GBL) diverse international portfolio, navigating varying cultural values is paramount for market success. What appeals to consumers in Europe, for instance, might differ significantly from preferences in Asia or North America. GBL actively supports its portfolio companies in crafting localized marketing and product strategies that honor these distinct cultural nuances, ensuring brand resonance without compromising global identity.

This adaptability is crucial for market penetration and building trust. For example, a digital marketing campaign that thrives on direct engagement in the US might need a more relationship-focused approach in Japan. GBL's holdings are encouraged to conduct thorough cultural market research, a practice that proved vital for companies like Pernod Ricard, which saw a 10% sales increase in its Asian markets in 2024 following tailored campaigns that respected local festive traditions.

- Localized Marketing: Successful campaigns in 2024 across GBL's portfolio, such as Adidas's regional sneaker drops in South Korea, demonstrated a deep understanding of local fashion trends and consumer preferences.

- Product Adaptation: McDonald's ongoing success in India, driven by menu items like the McAloo Tikki, highlights the importance of adapting offerings to local tastes and dietary customs.

- Brand Messaging: In 2024, IKEA continued to refine its messaging in emerging markets, focusing on affordability and functionality, aligning with the economic realities and practical needs of those populations.

- Digital Engagement: Companies are increasingly utilizing social media platforms popular in specific regions, like WeChat in China, to foster community and drive engagement, a strategy that contributed to a 15% growth in online sales for some GBL-affiliated brands in that market during the first half of 2025.

Public Perception and Brand Reputation

Groupe Bruxelles Lambert's (GBL) public perception and brand reputation are critical drivers of its success, impacting everything from customer loyalty to attracting top talent across its diverse portfolio. Negative press, whether concerning ethical lapses or environmental concerns within its holdings, can swiftly erode brand equity. For instance, a hypothetical scandal affecting a major GBL subsidiary could lead to a measurable dip in consumer trust and potentially impact the parent company's valuation. GBL actively works to mitigate these risks through a strong commitment to corporate governance and open, transparent communication, aiming to foster enduring trust among stakeholders.

Maintaining a positive brand image is paramount for GBL and its portfolio companies. In 2024, companies with strong ESG (Environmental, Social, and Governance) credentials are increasingly favored by investors and consumers alike. GBL's strategic focus on sustainability and responsible business practices is designed to resonate positively with these evolving preferences. For example, if a significant portion of GBL's portfolio companies report improved sustainability metrics in their 2024 annual reports, this could translate into enhanced public perception and a stronger competitive advantage.

- Brand Equity: Positive public perception directly bolsters the brand equity of GBL and its subsidiaries, enhancing their market standing and customer loyalty.

- Talent Acquisition: A strong reputation makes GBL and its portfolio companies more attractive to skilled professionals, aiding in talent acquisition and retention efforts.

- Risk Mitigation: Proactive management of ethical, safety, and environmental issues is crucial to prevent reputational damage that could negatively impact financial performance.

- Stakeholder Trust: GBL's emphasis on transparent communication and robust corporate governance aims to build and maintain trust with investors, customers, and the broader public.

Societal expectations around Environmental, Social, and Governance (ESG) criteria are significantly shaping investment and consumer behavior, with a heightened demand for transparency and demonstrable commitment to sustainability and ethical practices across all business operations in 2024 and looking into 2025. Groupe Bruxelles Lambert (GBL) is increasingly expected to champion ESG integration within its portfolio companies, recognizing that robust ESG performance can directly correlate with enhanced long-term financial value and resilience.

Navigating varying cultural values is paramount for market success, requiring GBL's portfolio companies to craft localized marketing and product strategies that honor distinct cultural nuances to ensure brand resonance. For example, a digital marketing campaign that thrives on direct engagement in the US might need a more relationship-focused approach in Japan, with companies like Pernod Ricard seeing a 10% sales increase in Asian markets in 2024 following tailored campaigns.

Public perception and brand reputation are critical drivers of success, impacting customer loyalty and talent acquisition. Negative press concerning ethical lapses or environmental concerns can swiftly erode brand equity, making proactive management of these issues crucial to prevent reputational damage that could negatively impact financial performance, as seen with the increasing investor and consumer preference for companies with strong ESG credentials in 2024.

Technological factors

The rapid advancement of digital transformation and automation is reshaping GBL's diverse portfolio. Companies like Adidas, for instance, are heavily investing in digital channels and data analytics to personalize customer experiences and optimize supply chains, aiming to capture a larger share of the growing e-commerce market, which was projected to reach over $6.3 trillion globally in 2024. This technological shift offers significant potential for efficiency gains and cost reductions across various sectors where GBL operates.

GBL actively supports its portfolio companies in adopting these innovations. For example, its investment in Umicore, a materials technology group, includes a focus on digitalization to improve manufacturing processes and accelerate the development of advanced battery materials, a sector experiencing exponential growth driven by the electric vehicle revolution. By fostering digital capabilities, GBL aims to ensure its holdings remain at the forefront of their respective industries, unlocking new avenues for growth and competitive advantage in the evolving economic landscape.

The relentless march of disruptive technologies like artificial intelligence (AI) and advanced materials presents both opportunities and threats to Groupe Bruxelles Lambert's (GBL) diverse portfolio. For instance, AI's growing capabilities in data analysis and automation could significantly enhance efficiency in sectors like logistics or manufacturing where GBL holds investments, potentially boosting profitability by an estimated 10-15% through optimized operations by 2025, according to recent industry forecasts.

GBL must proactively evaluate how these innovations might create entirely new market segments or, conversely, make current business models in its portfolio companies redundant. Companies leveraging AI for predictive maintenance, for example, could see reduced downtime and improved asset utilization, a crucial factor for industrial holdings. Conversely, a failure to adapt could lead to a loss of competitive edge.

To maintain its strategic advantage, GBL's commitment to fostering research and development within its portfolio companies is paramount. This proactive approach ensures that its businesses are not merely reacting to technological shifts but are actively shaping them. Investing in R&D, which typically accounts for 3-7% of revenue in innovative sectors, allows portfolio firms to develop proprietary technologies and secure future revenue streams.

As Groupe Bruxelles Lambert (GBL) operates in an increasingly digital landscape, the threat of cyberattacks and data breaches escalates, posing significant risks across its diverse portfolio. Protecting sensitive information and maintaining strong cybersecurity are paramount for preserving customer trust and avoiding substantial regulatory fines, a concern highlighted by the global cybersecurity market projected to reach over $300 billion by 2025.

GBL actively monitors the cybersecurity resilience of its investments, recognizing that robust data protection is not just a compliance issue but a fundamental aspect of operational integrity and long-term value creation. The increasing sophistication of cyber threats, coupled with evolving data privacy regulations like GDPR, necessitates continuous investment in advanced security protocols and employee training to mitigate potential financial and reputational damage.

E-commerce and Digital Sales Channels

The ongoing surge in e-commerce and digital sales channels significantly shapes the retail and consumer sectors where Groupe Bruxelles Lambert (GBL) holds interests. For instance, in 2024, global e-commerce sales are projected to reach over $6.3 trillion, highlighting the critical importance of a robust online presence.

Companies adept at utilizing digital platforms, sophisticated data analytics for customer insights, and delivering personalized experiences are demonstrating stronger growth trajectories. GBL actively assists its portfolio companies in enhancing their digital footprint and integrating seamless omnichannel strategies to capture these evolving consumer behaviors.

- E-commerce Growth: Global e-commerce sales are expected to exceed $6.3 trillion in 2024, a testament to the increasing consumer reliance on digital channels.

- Digital Optimization: GBL's strategy involves supporting its portfolio companies in leveraging data analytics to personalize customer journeys and improve online conversion rates.

- Omnichannel Integration: The focus remains on creating cohesive customer experiences across both online and physical retail environments, a key driver for sustained success in the current market.

Technological Infrastructure and Connectivity

The availability and quality of technological infrastructure, including high-speed internet and cloud computing services, are fundamental for the operations of modern businesses. GBL's portfolio companies, operating across diverse sectors like building solutions, energy, and logistics, rely heavily on robust connectivity to support their digital transformation initiatives, optimize supply chain management, and facilitate seamless global communication. For instance, in 2024, investments in digital infrastructure are projected to grow, with global spending on cloud services expected to reach over $600 billion, a trend that directly impacts GBL's operational efficiency and competitive edge.

Investment in resilient IT infrastructure is a continuous priority for GBL and its subsidiaries. This includes ensuring secure and reliable access to data, enhancing cybersecurity measures, and leveraging advanced technologies like artificial intelligence and the Internet of Things (IoT) to drive innovation and efficiency. As of early 2025, reports indicate a significant uptick in enterprise adoption of cloud-based solutions, with approximately 90% of businesses utilizing at least one cloud service, underscoring the critical need for GBL's portfolio to maintain cutting-edge technological capabilities.

The strategic importance of technological infrastructure is further amplified by the increasing digitization of business processes and customer interactions. GBL's commitment to investing in and upgrading its technological backbone ensures its portfolio companies can adapt to evolving market demands, improve customer experiences, and maintain operational agility. For example, advancements in 5G connectivity are set to revolutionize data transfer speeds and enable new applications, a development GBL is actively monitoring to ensure its businesses remain at the forefront of technological adoption.

Key technological infrastructure considerations for GBL include:

- High-speed and reliable internet connectivity: Essential for real-time data processing, communication, and cloud service access across all GBL entities.

- Cloud computing adoption: Leveraging scalable and flexible cloud solutions for data storage, analytics, and application hosting to enhance operational efficiency.

- Cybersecurity resilience: Implementing robust security measures to protect sensitive data and critical IT systems from evolving cyber threats.

- Emerging technology integration: Exploring and adopting new technologies such as AI, IoT, and advanced analytics to drive innovation and competitive advantage.

Groupe Bruxelles Lambert (GBL) navigates a landscape where technological advancements profoundly impact its diverse holdings. The increasing integration of artificial intelligence (AI) and automation offers significant opportunities for enhanced operational efficiency and cost reduction across its portfolio. For instance, AI's application in predictive maintenance could reduce downtime by an estimated 10-15% by 2025 in industrial sectors where GBL has investments.

The rapid growth of e-commerce, projected to exceed $6.3 trillion globally in 2024, necessitates a strong digital presence for GBL's consumer-facing companies. Furthermore, investments in advanced materials and the electrification trend, exemplified by Umicore's focus on battery technologies, highlight the critical role of innovation in driving future growth and competitive advantage.

GBL's commitment to research and development, typically 3-7% of revenue in innovative sectors, ensures its portfolio companies remain at the forefront of technological adoption. However, the escalating threat of cyberattacks, with the global cybersecurity market expected to surpass $300 billion by 2025, demands robust security measures to protect sensitive data and maintain operational integrity.

| Technological Factor | Impact on GBL Portfolio | Key Data Point (2024/2025) |

| AI & Automation | Efficiency gains, cost reduction, new service models | Potential 10-15% profitability boost via optimized operations by 2025 |

| E-commerce & Digitalization | Increased sales, personalized customer experiences | Global e-commerce sales projected over $6.3 trillion in 2024 |

| Advanced Materials & EV | Growth in new markets, sustainable solutions | Exponential growth in battery materials sector |

| Cybersecurity | Risk mitigation, data protection, reputational integrity | Global cybersecurity market to exceed $300 billion by 2025 |

Legal factors

Groupe Bruxelles Lambert (GBL) functions within a robust corporate governance landscape, where laws meticulously outline shareholder rights, director duties, and management responsibilities. This legal structure is crucial for fostering transparency and ensuring fair stakeholder treatment, principles GBL actively promotes in its investment strategy.

In 2024, the European Union continued to refine its Corporate Governance Directive, emphasizing enhanced shareholder engagement and board diversity. For instance, new regulations require listed companies to increase female representation on boards, aiming for at least 40% by 2026, a trend GBL likely monitors closely across its portfolio companies like Pernod Ricard and Adidas.

Antitrust and competition laws are crucial for Groupe Bruxelles Lambert (GBL), as they dictate the boundaries of market behavior, aiming to prevent monopolies and foster a level playing field. These regulations directly influence GBL's strategic flexibility, particularly concerning significant acquisitions or divestments within its diverse portfolio. For instance, in 2024, the European Commission continued its rigorous scrutiny of mergers, with several large-scale transactions facing in-depth investigations, underscoring the importance of proactive compliance for companies like GBL.

GBL must ensure that all its portfolio companies meticulously adhere to both national and international competition regulations. This involves ongoing monitoring and assessment of market dynamics and potential impacts of their operations. Failure to comply can result in severe penalties, including substantial fines—such as the €1.8 billion fine imposed by the European Commission on a major tech company in early 2024 for competition law violations—and significant reputational damage, which can erode investor confidence and market standing.

Strict data protection and privacy regulations, like the EU's GDPR, place significant responsibilities on companies that process personal information. For Groupe Bruxelles Lambert's portfolio, particularly those with direct customer interaction, adherence to these rules is paramount to prevent substantial fines and preserve customer confidence. In 2023, GDPR enforcement actions resulted in over €1.5 billion in fines across the EU, highlighting the financial risks of non-compliance.

Ensuring robust data security and privacy measures is a crucial element throughout the investment lifecycle. This includes thorough vetting during due diligence and continuous monitoring of operational practices to safeguard sensitive data and maintain regulatory standing.

Labor and Employment Laws

Groupe Bruxelles Lambert's (GBL) portfolio companies operate under a complex web of labor and employment laws that differ significantly across the various countries where they have a presence. These regulations dictate everything from minimum wage requirements and working hour limits to the intricacies of collective bargaining agreements and procedures for employee termination. For instance, in 2024, the European Union continued to strengthen worker protections, with directives impacting areas like work-life balance and transparent working conditions, which GBL's European holdings must adhere to.

Navigating these diverse legal landscapes is crucial for GBL's human resource strategies. Failure to comply can lead to substantial financial penalties, reputational damage, and operational disruptions. For example, a significant labor dispute in one of GBL's major portfolio companies could impact its overall financial performance and investor confidence. Maintaining high standards of compliance not only mitigates legal risks but also fosters a positive work environment, which is essential for employee morale and productivity.

- Jurisdictional Variance: GBL's international subsidiaries face a patchwork of labor laws, from the stringent regulations in France concerning employee dismissal to the more flexible frameworks in some Asian markets.

- Key Compliance Areas: Adherence to laws governing wages (e.g., minimum wage adjustments in the US in 2024, often exceeding $13/hour in many states), working conditions, union relations, and termination protocols is paramount.

- Risk Mitigation: Proactive legal counsel and robust HR policies are vital to prevent costly litigation and maintain operational continuity across GBL's diverse portfolio.

- Impact on Operations: In 2025, many countries are expected to introduce new legislation related to remote work and gig economy worker rights, requiring ongoing adaptation by GBL's portfolio companies.

International Investment Treaties and Regulations

Groupe Bruxelles Lambert's (GBL) extensive cross-border investments are significantly shaped by international investment treaties and bilateral investment agreements. These pacts, like the Energy Charter Treaty or numerous bilateral investment treaties (BITs), offer crucial protections for foreign investors, safeguarding against actions such as expropriation without adequate compensation and ensuring fair and equitable treatment. For instance, as of late 2024, over 3,000 BITs were in force globally, creating a complex legal web GBL navigates.

GBL actively monitors shifts in these international legal frameworks. Changes in treaty provisions or the emergence of new investment protection standards can materially impact the risk profile of its global portfolio. For example, a renegotiation of a BIT between a country where GBL holds significant assets and its home country could alter dispute resolution mechanisms or the scope of protected investments.

The effectiveness and interpretation of these treaties are also dynamic. Landmark cases, such as those decided by the International Centre for Settlement of Investment Disputes (ICSID), can set precedents that influence how protections are applied. GBL's legal and investment teams would analyze such developments to understand potential implications for its existing and future international ventures.

Key considerations for GBL include:

- Treaty Network Coverage: Assessing the extent to which GBL's operational countries are covered by investment treaties that offer robust investor protections.

- Dispute Resolution Mechanisms: Understanding the available avenues for resolving investment disputes, such as arbitration, and their historical success rates.

- Evolving International Law: Staying abreast of changes in customary international law and the interpretation of investment treaties by international tribunals.

- Compliance and Risk Mitigation: Ensuring GBL's investment strategies align with the requirements and limitations imposed by relevant international investment agreements.

Groupe Bruxelles Lambert (GBL) operates within a legal framework that mandates stringent corporate governance, emphasizing shareholder rights and board responsibilities. This structure, reinforced by EU directives in 2024 aiming for increased board diversity, directly impacts GBL's operational transparency and stakeholder relations.

Antitrust and competition laws are critical, as evidenced by the European Commission's ongoing scrutiny of mergers in 2024, with significant transactions facing in-depth reviews. GBL's compliance with these regulations is vital to avoid penalties, such as the €1.8 billion fine levied on a tech firm in early 2024 for violations.

Data protection laws, like GDPR, impose substantial responsibilities, with over €1.5 billion in fines issued across the EU in 2023 for non-compliance. GBL's portfolio companies must maintain robust data security and privacy measures to prevent financial and reputational damage.

Labor laws vary significantly across GBL's international operations, with EU directives in 2024 strengthening worker protections. Compliance with wage, working condition, and termination regulations is essential to mitigate legal risks and ensure operational stability.

Environmental factors

Groupe Bruxelles Lambert (GBL) faces increasing scrutiny regarding climate change, with regulations like carbon pricing and emissions targets directly influencing its diverse portfolio. For instance, the European Union's Emissions Trading System (ETS) continues to evolve, with allowances becoming more expensive, impacting energy-intensive industries where GBL has significant holdings. This regulatory landscape necessitates a strategic shift towards decarbonization across its subsidiaries.

GBL is actively guiding its portfolio companies to adapt to these evolving environmental standards. This includes fostering the development of comprehensive climate strategies and transparent reporting mechanisms. As an example, GBL's commitment to sustainability is reflected in its support for companies investing in renewable energy sources and implementing circular economy principles, aligning with global efforts to meet net-zero targets by mid-century.

Growing concerns about resource scarcity, particularly water, minerals, and raw materials, pose a significant challenge for GBL's diverse portfolio companies, potentially impacting operational costs and supply chain stability. For instance, the global freshwater stress index, projected to affect over 5 billion people by 2050, highlights the critical need for water management strategies across sectors like manufacturing and agriculture, which are represented within GBL's holdings.

Industries heavily reliant on specific resources must proactively adapt by ensuring sustainable sourcing and implementing efficient resource utilization to mitigate risks. This includes exploring circular economy models and investing in technologies that reduce material intensity. For example, the mining sector, a key area for some of GBL's investments, faces increasing scrutiny regarding its environmental footprint and the responsible extraction of finite mineral resources.

Groupe Bruxelles Lambert actively encourages its portfolio companies to embed robust resource management practices into their core operations. This commitment is reflected in their support for investments that prioritize environmental, social, and governance (ESG) principles, aiming to build long-term resilience and value. Companies within the portfolio are increasingly reporting on their water usage and waste reduction initiatives, aligning with global sustainability targets and investor expectations for responsible business conduct.

Stricter environmental regulations concerning air and water pollution, alongside waste disposal, directly impact Groupe Bruxelles Lambert's (GBL) industrial investments by introducing compliance costs and operational limitations. For instance, the European Union's Industrial Emissions Directive continues to push for reduced pollutant releases from industrial sites, a key concern for GBL's portfolio companies.

Companies within GBL's sphere are increasingly pressured to implement cleaner production techniques and robust waste management plans. This includes investments in advanced filtration systems and circular economy principles. A 2024 report indicated that European industrial sectors saw a collective investment of over €50 billion in environmental technologies, a trend GBL actively tracks.

GBL actively oversees its portfolio companies' environmental performance, ensuring adherence to evolving standards. This includes regular audits and the promotion of best practices in pollution control and waste reduction, reflecting a growing emphasis on Environmental, Social, and Governance (ESG) factors in investment strategies.

Biodiversity Loss and Ecosystem Services

The increasing global awareness of biodiversity loss and its impact on vital ecosystem services is translating into tangible business risks and opportunities. Companies, including those within Groupe Bruxelles Lambert's (GBL) portfolio, are facing growing pressure from regulators, investors, and consumers to demonstrate responsible land use and minimize their environmental footprint. This trend is expected to accelerate, potentially leading to stricter environmental regulations and increased stakeholder scrutiny, especially for businesses with significant land holdings or a heavy reliance on natural resources. For instance, the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) reported in 2024 that around 1 million animal and plant species are now threatened with extinction, many within decades, highlighting the urgency of this issue.

GBL actively considers the broader environmental implications of its investments, recognizing that long-term value creation is intrinsically linked to environmental sustainability. The group encourages its portfolio companies to adopt practices that mitigate negative impacts on biodiversity and ecosystem services. This proactive approach aims to build resilience against future regulatory changes and enhance stakeholder trust. For example, in 2024, the Taskforce on Nature-related Financial Disclosures (TNFD) released its final recommendations, providing a framework for organizations to disclose their nature-related risks and opportunities, a move that is expected to drive greater corporate accountability in this area.

- Regulatory Scrutiny: Expect increased environmental regulations targeting land use and resource dependency, potentially impacting operational costs and investment strategies.

- Stakeholder Pressure: Investors and consumers are increasingly demanding evidence of biodiversity protection and sustainable resource management from corporations.

- Ecosystem Service Valuation: The economic value of ecosystem services, such as pollination and water purification, is becoming more recognized, influencing corporate risk assessments and strategic planning.

- TNFD Adoption: The growing adoption of frameworks like the TNFD by companies signifies a shift towards more transparent reporting on nature-related impacts.

Transition to Circular Economy Models

The global movement towards circular economy principles, focusing on minimizing waste, maximizing recycling, and extending product lifespans, creates a dynamic landscape for Groupe Bruxelles Lambert's (GBL) diverse holdings. This transition necessitates a strategic re-evaluation of business operations, encouraging GBL's portfolio companies to innovate in product design for recyclability and establish efficient closed-loop systems.

GBL actively guides its subsidiaries in investigating and implementing sustainable business models that are inherently aligned with circular economy tenets. For instance, by 2024, companies like Veolia, a GBL portfolio company, are at the forefront of resource management, with Veolia's 2024 strategy emphasizing the development of innovative solutions for water, waste, and energy management, directly supporting circularity.

This strategic alignment is crucial as regulatory pressures and consumer demand for sustainable products intensify. GBL's commitment to fostering circularity within its portfolio aims to enhance long-term value creation by mitigating environmental risks and capitalizing on emerging market opportunities. In 2023, the European Union continued to advance its Circular Economy Action Plan, with new directives targeting product design and waste management, impacting many sectors where GBL operates.

- Waste Reduction Targets: Many GBL portfolio companies are setting ambitious waste reduction targets, aiming for significant decreases in landfill waste by 2025, driven by circular design principles.

- Recycling Rates: Increased investment in recycling infrastructure and technologies is a key focus, with an aim to boost recycling rates for materials like plastics and metals across various industries.

- Product Longevity: Companies are exploring business models that prioritize product durability, repairability, and upgradability to extend their useful life, reducing the need for constant new production.

- Closed-Loop Systems: The development and implementation of closed-loop systems, where materials are continuously reused and recycled within the production cycle, are becoming a strategic imperative for sustainability and cost efficiency.

Groupe Bruxelles Lambert (GBL) faces evolving environmental regulations, particularly concerning carbon emissions and industrial pollution, impacting its diverse portfolio. The EU's Emissions Trading System (ETS) continues to increase in cost, directly affecting energy-intensive sectors where GBL holds significant investments, necessitating a strategic pivot towards decarbonization across its subsidiaries.

PESTLE Analysis Data Sources

Our PESTLE analysis for Groupe Bruxelles Lambert is informed by a comprehensive blend of data, including reports from financial institutions like the IMF and World Bank, official government publications detailing regulatory changes, and market research from reputable firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting GBL's operations.