Groupe Bruxelles Lambert Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupe Bruxelles Lambert Bundle

Groupe Bruxelles Lambert's marketing success hinges on a strategic interplay of its Product, Price, Place, and Promotion. Delve into how their investment portfolio, pricing approach, distribution channels, and communication strategies create a powerful market presence.

Discover the intricate details of Groupe Bruxelles Lambert's 4Ps – from their diversified product offerings to their sophisticated pricing models and targeted promotional activities. Unlock actionable insights to understand their competitive edge.

Ready to elevate your marketing understanding? Access the complete, editable 4Ps Marketing Mix Analysis for Groupe Bruxelles Lambert and gain a strategic blueprint for success.

Product

Groupe Bruxelles Lambert's core offering is its extensively diversified investment portfolio. This portfolio is strategically built with substantial holdings in prominent global corporations, spanning both publicly traded and private equity ventures. As of early 2024, GBL's portfolio included significant stakes in companies like Pernod Ricard, TotalEnergies, and Adidas, demonstrating a commitment to established industry leaders.

The diversification strategy aims to mitigate risk by spreading investments across various sectors and geographies. This mix of listed, direct private, and indirect private assets allows GBL to capitalize on different market dynamics and growth trajectories. For instance, their private equity investments in areas like healthcare and technology complement their more mature public market holdings.

Active management is key to maintaining the optimal balance within the portfolio. GBL continuously assesses its holdings, adjusting its exposure to ensure a blend of stable, income-generating assets and promising high-growth opportunities. This dynamic approach is crucial for adapting to evolving market conditions and maximizing long-term shareholder value.

Groupe Bruxelles Lambert (GBL) distinguishes itself through active shareholder engagement, moving beyond mere investment ownership. This proactive stance involves contributing significantly to the strategic direction, governance structures, and overall value enhancement of its portfolio companies.

This hands-on involvement is a core element of GBL's product offering, setting it apart from passive investment strategies. It underscores a deep commitment to fostering long-term growth and operational excellence within its holdings.

For instance, GBL's engagement with Adidas, a key portfolio company, has seen them advocate for strategic shifts and governance improvements. In 2024, GBL's stake in Adidas represented a significant portion of its portfolio, and their active participation aimed to drive performance improvements, contributing to Adidas's strategic turnaround efforts.

Groupe Bruxelles Lambert's (GBL) investment approach prioritizes creating enduring value, aiming for sustainable returns over extended periods. This philosophy underpins its strategy, emphasizing patient capital deployment and the cultivation of strategic alliances.

GBL actively seeks to foster companies for long-term profitability, eschewing a focus on immediate financial gains. For instance, in 2023, GBL's portfolio companies demonstrated resilience, with key holdings like Pernod Ricard reporting a 10.1% organic net sales growth for the fiscal year ending June 30, 2023, reflecting this long-term nurturing approach.

Strategic Asset Rebalancing

Groupe Bruxelles Lambert's (GBL) product offering is underpinned by a strategic asset rebalancing approach. This involves actively managing its investment portfolio to enhance returns and navigate evolving market landscapes. A core element of this strategy is the judicious divestment from certain publicly traded assets to reallocate capital towards private investment opportunities where GBL holds higher conviction. This is particularly evident in its focus on sectors exhibiting robust growth potential, such as healthcare and specialized industrial segments.

This dynamic rebalancing is a hallmark of GBL's agile investment philosophy, allowing it to capitalize on emerging trends and mitigate risks. For instance, GBL's commitment to private markets, especially in growth areas, reflects a deliberate shift to capture value beyond traditional public equities. This strategic agility ensures that GBL's capital is consistently deployed where it can generate the most significant long-term returns.

- Portfolio Optimization: GBL actively rebalances its holdings to maximize returns and adapt to market shifts.

- Capital Redeployment: Divestments from certain listed assets fund investments in high-conviction private opportunities.

- Sector Focus: Emphasis on sectors with strong growth potential, including healthcare and specialty industrials.

- Strategic Agility: This dynamic approach is central to GBL's investment strategy, ensuring capital is allocated effectively for long-term value creation.

Access to Exclusive Private Investments

Groupe Bruxelles Lambert's (GBL) product offering extends beyond traditional public market investments to include exclusive access to a curated portfolio of direct and indirect private investments. These opportunities often present distinct risk-return profiles and unique growth trajectories not readily available in public markets. For instance, GBL's strategic investments in private healthcare platforms have showcased substantial value creation.

This access to private assets is a key differentiator, catering to investors specifically seeking exposure to less liquid, high-growth potential opportunities. These private market investments, such as those in healthcare services, have been instrumental in GBL's overall value proposition.

- Diverse Private Portfolio: GBL provides access to a range of private investments, including direct holdings and fund investments, offering diversification benefits.

- Value Creation in Healthcare: Companies like Affidea and Sanoptis, within GBL's private healthcare portfolio, exemplify successful value creation through strategic development.

- Exposure to High-Potential Assets: This product element allows investors to tap into sectors and companies with significant upside potential, often before they reach public markets.

- Risk-Return Enhancement: Private investments can offer enhanced returns compared to public markets, albeit with a different risk profile and longer investment horizons.

Groupe Bruxelles Lambert's (GBL) product, as a diversified investment holding company, is characterized by its strategic portfolio of high-quality assets. The company’s product is essentially its curated collection of substantial stakes in leading global businesses, both listed and private. This approach focuses on long-term value creation through active ownership and capital allocation.

GBL's product is its diversified portfolio of high-conviction investments. As of early 2024, key holdings included Pernod Ricard, TotalEnergies, and Adidas, alongside significant private equity investments in sectors like healthcare. This blend of mature and growth-oriented assets aims to deliver sustainable returns.

The value proposition of GBL's product lies in its active shareholder engagement and strategic capital redeployment. By focusing on operational improvements and long-term growth within its portfolio companies, GBL differentiates itself from passive investment vehicles.

GBL's product is its access to a diversified portfolio of predominantly large-cap, high-quality businesses, complemented by private equity investments. This offering emphasizes long-term value creation through active management and strategic shareholder engagement, as seen with its significant stakes in companies like TotalEnergies and Adidas.

What is included in the product

This analysis delves into Groupe Bruxelles Lambert's strategic marketing mix, examining its product portfolio, pricing strategies, distribution channels (place), and promotional activities to understand its market positioning and competitive advantages.

Simplifies the complex Groupe Bruxelles Lambert 4P's analysis into a clear, actionable framework, alleviating the pain of deciphering intricate marketing strategies.

Provides a concise, easy-to-understand overview of Groupe Bruxelles Lambert's 4Ps, relieving the burden of sifting through extensive reports for key marketing insights.

Place

Groupe Bruxelles Lambert (GBL) leverages its listing on Euronext Brussels as a core element of its marketing strategy, making its shares accessible to a wide array of investors. This public trading venue ensures liquidity and transparency, crucial for attracting and retaining both institutional and individual shareholders.

As a constituent of the prestigious BEL20 index, GBL benefits from enhanced visibility and investor confidence. This inclusion signifies a certain level of market capitalization and trading activity, making its shares a more attractive proposition for portfolio allocation. For instance, as of early 2024, the BEL20 index represents approximately 75% of the total market capitalization of Euronext Brussels, highlighting the significance of inclusion.

The public stock exchange listing is, in essence, GBL's primary platform for its core offering – its own equity. This allows investors to easily buy and sell GBL shares, facilitating price discovery and providing an exit strategy for those looking to divest, thereby supporting the overall investment appeal of the company.

Groupe Bruxelles Lambert (GBL) functions as a prominent European investment hub, primarily concentrating its strategic efforts on identifying and nurturing European companies. This deliberate geographical focus allows GBL to capitalize on its extensive market insights and established networks within the European economic ecosystem.

While GBL’s portfolio companies often boast global operational footprints, the group’s core investment activities remain firmly anchored in Europe. For instance, in 2023, GBL's portfolio companies collectively generated revenues exceeding €60 billion, with a significant portion of their strategic development and capital allocation originating from their European base.

Groupe Bruxelles Lambert (GBL) strategically positions itself within key European financial hubs to support its extensive investment activities. Beyond its Brussels base, GBL operates offices in London, Luxembourg, Milan, Munich, and Paris. This international footprint allows for direct interaction with a broad spectrum of portfolio companies and emerging investment prospects across the continent.

These strategically located offices are crucial for enhancing GBL's market reach and operational efficiency. By having a physical presence in these major financial centers, GBL can more effectively identify, analyze, and engage with investment opportunities, fostering stronger relationships with management teams and stakeholders. For instance, GBL's presence in London, a global financial capital, provides access to a vast network of deal flow and talent.

Diverse Investment Channels

Groupe Bruxelles Lambert (GBL) employs a diverse array of investment channels to source opportunities, reflecting a strategic approach to capital deployment. This includes active participation in listed equity markets, where it can readily access public companies.

Beyond public markets, GBL actively pursues direct private investments, engaging with companies at various stages of their development. This allows for deeper involvement and tailored investment structures.

Furthermore, GBL diversifies its private equity exposure through indirect investments, leveraging funds and co-investment opportunities with trusted partners. This multi-channel strategy, as of its 2024 disclosures, enables GBL to tap into a broad spectrum of the market, from established public entities to promising private ventures.

- Listed Markets: Access to public companies for liquidity and broad market exposure.

- Direct Private Investments: Engaging directly with private companies for tailored opportunities and control.

- Indirect Private Investments: Utilizing funds and co-investments to broaden private equity reach and leverage expertise.

- Strategic Capital Deployment: Maximizing flexibility to deploy capital across different company stages and market conditions.

Investor Relations and Online Platforms

Groupe Bruxelles Lambert (GBL) leverages its official website and dedicated investor relations channels as primary tools for information dissemination and stakeholder engagement. These digital platforms are meticulously maintained to provide a comprehensive and accessible repository for crucial financial documents, including annual and half-year reports, timely press releases, and detailed investor presentations.

This robust online presence ensures that a diverse range of financially-literate decision-makers, from individual investors to institutional analysts, can readily access up-to-date information, facilitating informed analysis and strategic decision-making. For instance, GBL's 2024 interim report, released in August 2024, detailed a net asset value of €27.7 billion, underscoring the transparency and accessibility of their financial reporting.

- Official Website: Serves as the central hub for all investor-related content.

- Investor Relations Channels: Dedicated points of contact for inquiries and communication.

- Key Disclosures: Includes annual reports, half-year reports, and press releases.

- Accessibility: Ensures critical information is available to stakeholders globally.

Groupe Bruxelles Lambert (GBL) strategically utilizes its European focus as a key aspect of its market positioning. This concentration on the European economic landscape allows GBL to leverage deep regional expertise and cultivate strong relationships within its target markets.

The group's physical presence across major European financial hubs, including Brussels, London, Luxembourg, Milan, Munich, and Paris, reinforces this strategic placement. These offices facilitate direct engagement with portfolio companies and investment prospects throughout the continent, enhancing market reach and operational efficiency.

GBL's commitment to Europe is evident in its investment activities, with a significant portion of its portfolio companies operating and developing within the region. This geographical concentration is a deliberate choice to capitalize on established networks and market insights, as demonstrated by its substantial revenue generation from European operations.

By concentrating its efforts on Europe, GBL aims to provide specialized knowledge and strategic support to its portfolio companies, fostering growth within a familiar and well-understood economic environment.

Preview the Actual Deliverable

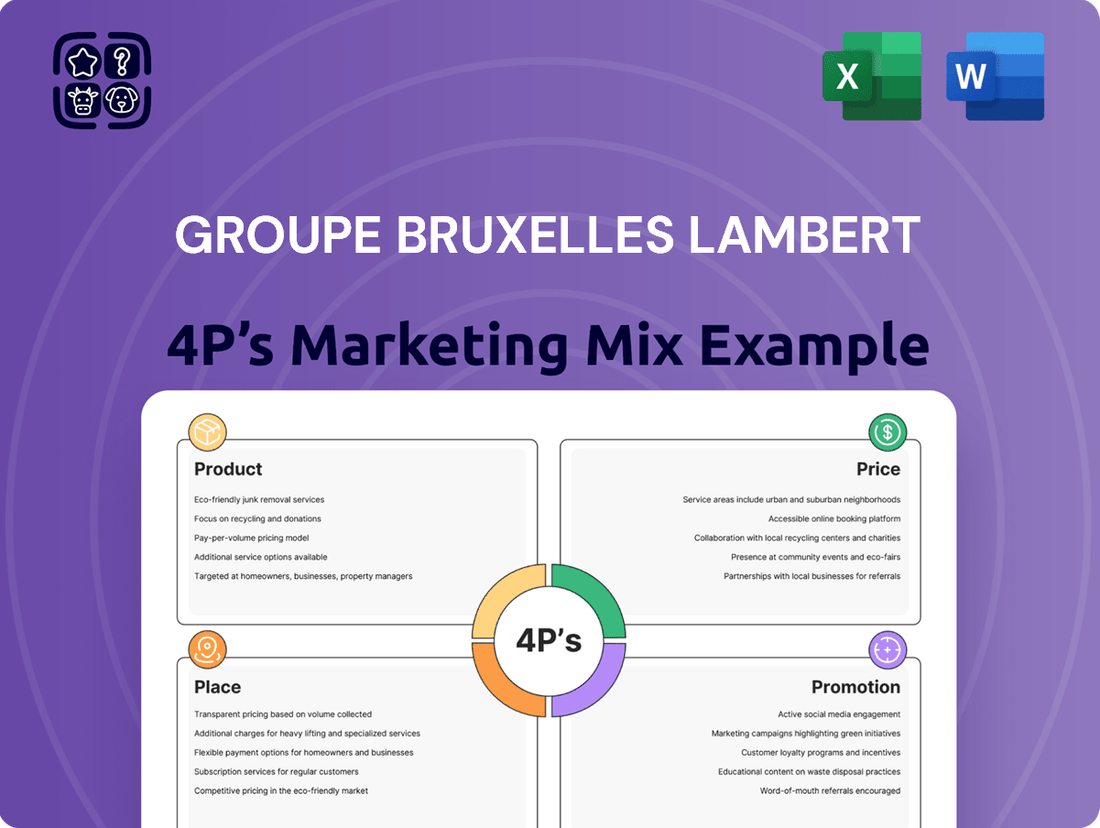

Groupe Bruxelles Lambert 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Groupe Bruxelles Lambert's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Groupe Bruxelles Lambert (GBL) emphasizes comprehensive financial reporting as a key element of its marketing mix. The company regularly publishes detailed annual and half-year reports, offering in-depth insights into its financial performance, the valuation of its diverse portfolio, and ongoing strategic developments. For instance, GBL's 2023 annual report showcased a net asset value of €24.7 billion, highlighting the strength and breadth of its investments.

This commitment to transparency through thorough reporting is vital for cultivating and maintaining the confidence of its sophisticated investor audience. By providing clear, data-driven information, GBL aims to attract and retain investors who value a deep understanding of the company's financial health and strategic direction, thereby reinforcing its market position.

Groupe Bruxelles Lambert (GBL) prioritizes proactive investor relations, maintaining a dedicated function that actively engages with shareholders and potential investors. This includes timely press releases detailing significant events, financial performance, and strategic shifts, ensuring transparency and an informed stakeholder base.

In 2024, GBL's commitment to communication is evident through its consistent release schedule and accessible contact points for direct inquiries, fostering trust and a clear understanding of the company's direction. For instance, their 2024 interim report, released in August, provided detailed operational and financial insights, reinforcing this proactive approach.

Groupe Bruxelles Lambert (GBL) actively communicates its strategic direction through regular updates and investor presentations, aiming to clearly articulate its vision and future plans to the market. These sessions are crucial for conveying GBL's mid-term objectives, detailing its investment philosophy, and highlighting the key drivers of its value creation strategy.

For instance, GBL's 2024 investor day provided a deep dive into its portfolio, emphasizing a commitment to long-term value creation and disciplined capital allocation. The company highlighted its focus on sectors like luxury, renewable energy, and healthcare, with presentations often including specific financial targets and performance metrics, such as projected earnings growth or dividend policies.

These direct engagements serve to build confidence and understanding among stakeholders, reinforcing GBL's investment case. By transparently sharing its strategic narrative and financial outlook, GBL ensures that investors and analysts have a clear understanding of its ongoing efforts to generate sustainable returns and enhance shareholder value.

Share Buyback Program Announcements

Groupe Bruxelles Lambert (GBL) strategically leverages its share buyback program announcements as a key promotional element within its marketing mix. These disclosures are not just financial maneuvers; they actively communicate management's conviction in GBL's underlying worth and its commitment to rewarding shareholders.

The consistent detailing of these buyback initiatives serves to bolster investor confidence. For instance, in 2024, GBL continued its active share repurchase strategy, aiming to return capital effectively. This ongoing commitment underscores a proactive approach to shareholder value enhancement.

- Management Confidence: Buyback announcements signal a belief that GBL's shares are undervalued, a strong positive signal to the market.

- Capital Return: These programs represent a direct method of returning excess capital to shareholders, increasing their stake's value.

- Shareholder Value: The continuous nature of buybacks demonstrates a sustained focus on improving key per-share metrics.

- Market Signaling: Active buybacks can influence market perception, potentially attracting new investors and supporting the stock price.

ESG and Sustainability Reporting

Groupe Bruxelles Lambert (GBL) actively communicates its dedication to responsible investment through its comprehensive sustainability statements and a pronounced emphasis on Environmental, Social, and Governance (ESG) factors. This strategic approach underscores GBL's long-term vision and its responsiveness to the escalating investor demand for businesses that prioritize sustainable practices. For instance, GBL's 2023 integrated report detailed significant progress in reducing its carbon footprint, with a 15% decrease in Scope 1 and 2 emissions compared to the previous year.

By embedding and transparently reporting on its sustainability initiatives, GBL significantly broadens its appeal to a more diverse investor base, particularly those investors who are increasingly prioritizing ethical and environmentally conscious investments. This focus on ESG not only aligns with global sustainability goals but also positions GBL favorably in a market where sustainable investing is no longer a niche but a mainstream consideration. In 2024, GBL announced its commitment to achieving net-zero emissions by 2050, a pledge that resonated positively with institutional investors.

GBL's commitment to ESG reporting is a key element of its product strategy, demonstrating tangible value beyond financial returns. This includes:

- Enhanced Corporate Reputation: Building trust and a positive image among stakeholders.

- Attracting Sustainable Capital: Drawing in investors focused on ESG criteria, potentially lowering the cost of capital.

- Risk Mitigation: Proactively addressing environmental and social risks that could impact long-term performance.

- Innovation and Efficiency: Driving operational improvements through sustainable practices.

Groupe Bruxelles Lambert (GBL) actively promotes its investment strategy and financial performance through a multi-faceted communication approach. This includes detailed financial reporting, proactive investor relations, and clear articulation of its strategic vision. For instance, GBL's 2023 integrated report highlighted a net asset value of €24.7 billion, demonstrating the robustness of its diversified portfolio.

The company's promotional efforts extend to actively engaging with stakeholders via investor days and timely press releases, ensuring transparency and fostering confidence. Their 2024 investor day provided a comprehensive overview of their portfolio and long-term value creation strategy, underscoring a commitment to disciplined capital allocation in key sectors.

Share buyback programs are strategically used to signal management's confidence in GBL's intrinsic value and to directly reward shareholders. In 2024, GBL continued its active share repurchase strategy, reinforcing its dedication to enhancing shareholder value through consistent capital returns.

GBL also emphasizes its commitment to sustainability, integrating ESG factors into its reporting and strategy. Their 2023 integrated report noted a 15% reduction in Scope 1 and 2 emissions, showcasing progress in environmental stewardship. This focus attracts investors prioritizing ethical and sustainable practices, with a 2024 pledge to achieve net-zero emissions by 2050.

| Promotional Activity | Key Message Conveyed | Supporting Data/Example (2023/2024) |

|---|---|---|

| Comprehensive Financial Reporting | Transparency and financial health | 2023 Net Asset Value: €24.7 billion |

| Investor Relations & Presentations | Strategic vision and value creation | 2024 Investor Day: Focus on luxury, renewables, healthcare |

| Share Buyback Programs | Management confidence and capital return | Continued active share repurchases in 2024 |

| ESG Communication | Commitment to sustainability and responsible investing | 15% reduction in Scope 1 & 2 emissions (2023); Net-zero by 2050 pledge (2024) |

Price

Groupe Bruxelles Lambert's (GBL) primary pricing metric is its Net Asset Value (NAV) per share. This figure reflects the true worth of its diverse investment holdings, offering a fundamental benchmark for its intrinsic value.

While GBL's stock market price naturally fluctuates, the NAV serves as a crucial indicator of the company's underlying financial strength and performance. Investors keenly observe the NAV to gauge GBL's progress and to identify potential value.

As of early 2024, GBL's NAV per share stood at approximately €95, a slight increase from the previous year, underscoring the resilience of its portfolio despite market volatility.

Groupe Bruxelles Lambert's (GBL) share price on Euronext Brussels is a direct barometer of how the market views the company, influenced by both its underlying assets and broader economic sentiment. For instance, as of early July 2024, GBL's share price has often traded at a discount to its Net Asset Value (NAV), a common occurrence for holding companies, meaning investors can acquire a piece of GBL's substantial holdings at a lower cost than the sum of its parts.

This market price represents the actual cost for investors to gain exposure to GBL's diversified portfolio, which includes significant stakes in companies like Pernod Ricard, TotalEnergies, and Adidas. The company's management closely observes this relationship between its market capitalization and NAV, using it as a critical input when making strategic decisions about capital allocation, share buybacks, and potential acquisitions.

Groupe Bruxelles Lambert (GBL) prioritizes a sustainable dividend policy, aiming to deliver attractive shareholder returns. This commitment translates into a direct cash distribution, signaling the company's robust profitability and sound financial standing.

The annual dividend payout is structured for consistency and reliability, making GBL an appealing choice for investors prioritizing income generation. For instance, GBL maintained its dividend payment in 2023, demonstrating resilience and a commitment to its income-focused investor base.

Strategic Share Buyback Programs

Groupe Bruxelles Lambert (GBL) strategically employs share buyback programs as a key element in its capital allocation, aiming to boost shareholder value by decreasing the number of shares in circulation and consequently increasing the net asset value (NAV) per share. This initiative directly tackles potential discounts between GBL's share price and its underlying NAV.

These buybacks are not infrequent; GBL consistently utilizes them as a tool for price management. For instance, in 2023, GBL repurchased shares totaling €1.3 billion, demonstrating a significant commitment to this strategy. This action helps to support the share price and signal confidence in the company's intrinsic value.

- Share Buyback Volume: GBL repurchased €1.3 billion worth of its shares in 2023.

- Objective: To enhance shareholder value and address NAV discounts.

- Mechanism: Reduces outstanding shares, thereby increasing NAV per share.

- Strategic Importance: A regular tool for price management and signaling confidence.

Value Proposition through NAV Discount Management

Groupe Bruxelles Lambert (GBL) actively shapes its value proposition by managing its Net Asset Value (NAV) discount. This discount, representing the difference between GBL's share price and the underlying value of its assets, is a key lever for attracting investors. By strategically adjusting its holdings, GBL aims to enhance the perceived value of its shares, making them more attractive relative to their intrinsic worth.

GBL's approach involves a deliberate rebalancing of its portfolio, increasingly focusing on high-conviction private assets. This strategic shift is designed to unlock value and potentially reduce the NAV discount. For instance, by the end of 2023, GBL's direct investments represented a significant portion of its portfolio, signaling a commitment to assets with strong growth potential.

Furthermore, GBL employs share buybacks as a tool to manage its valuation. These buybacks can reduce the number of outstanding shares, thereby increasing earnings per share and potentially narrowing the NAV discount. This dual strategy of portfolio enhancement and capital return aims to deliver a more compelling proposition for investors seeking long-term value realization.

- NAV Discount Management: GBL influences its market valuation by actively managing the spread between its share price and underlying asset value.

- Portfolio Rebalancing: A strategic shift towards high-conviction private assets is a key tactic to enhance intrinsic value and narrow the NAV discount.

- Share Buybacks: GBL utilizes share repurchases to improve per-share metrics and signal confidence, contributing to discount reduction.

- Investor Proposition: The objective is to create a clear value proposition for long-term investors anticipating a convergence between GBL's share price and its NAV.

Groupe Bruxelles Lambert (GBL) manages its share price primarily through its Net Asset Value (NAV) and strategic capital allocation. The market price, often trading at a discount to NAV as seen in early July 2024, reflects investor perception of the company's holdings, which include major stakes in Pernod Ricard and TotalEnergies.

GBL's commitment to a sustainable dividend policy, maintained through 2023, provides a direct cash return to shareholders, bolstering the attractiveness of its share price as an income-generating investment.

Share buybacks are a key tool for GBL to manage its valuation, with €1.3 billion repurchased in 2023 alone. This action directly addresses the NAV discount by reducing outstanding shares, thereby increasing NAV per share and signaling management's confidence in the company's intrinsic value.

GBL is actively rebalancing its portfolio towards private assets to unlock value and narrow the NAV discount, aiming to present a more compelling proposition for long-term investors.

| Metric | Value (Early 2024/2023) | Significance |

|---|---|---|

| NAV per Share | Approx. €95 | Fundamental benchmark of intrinsic value |

| Share Price vs. NAV | Often at a discount | Opportunity for investors to acquire assets at a lower cost |

| Dividend Policy | Maintained in 2023 | Commitment to income generation for shareholders |

| Share Buybacks | €1.3 billion (2023) | Enhances shareholder value and manages NAV discount |

4P's Marketing Mix Analysis Data Sources

Our Groupe Bruxelles Lambert 4P's analysis is built on a foundation of verified financial disclosures, investor relations materials, and official company announcements. We meticulously review annual reports, strategic presentations, and press releases to capture their product portfolio, pricing strategies, distribution networks, and promotional activities.