Groupe Bruxelles Lambert Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupe Bruxelles Lambert Bundle

Groupe Bruxelles Lambert navigates a complex landscape shaped by powerful buyer bargaining, intense rivalry, and the constant threat of substitutes. Understanding these forces is crucial for any strategic player in its diverse portfolio.

The complete report reveals the real forces shaping Groupe Bruxelles Lambert’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of capital providers, such as banks, bondholders, and equity investors, can range from moderate to high for Groupe Bruxelles Lambert (GBL). GBL accesses capital through its substantial net asset value and potentially through external financing avenues. Factors like macroeconomic trends and overall investor confidence directly impact the availability and cost of this crucial capital, granting these providers a degree of influence over GBL's investment activities and the conditions attached.

While GBL's robust financial standing and a conservative approach to leverage, evidenced by a 0% loan-to-value ratio as of March 2025, serve to temper the bargaining power of its capital providers, this influence remains a significant consideration in its strategic financial planning.

Specialized M&A advisory firms and top-tier legal counsels hold moderate bargaining power when advising entities like Groupe Bruxelles Lambert (GBL). Their expertise in navigating complex investment transactions, including due diligence, deal structuring, and regulatory compliance, is critical for GBL's active investment strategy. These firms can command premium fees due to their unique skill sets and established networks.

The market for highly skilled investment professionals, fund managers, and strategic advisors is a critical supplier group for Groupe Bruxelles Lambert (GBL). These individuals possess specialized knowledge, extensive experience, and valuable networks essential for identifying, evaluating, and managing complex, long-term investments. Their expertise directly influences GBL's ability to generate alpha and execute its strategic vision.

The bargaining power of these talent pools is considerable. The demand for top-tier investment talent often outstrips supply, particularly in specialized areas like private equity and alternative assets, which GBL is increasingly focusing on. For instance, in 2024, average compensation for senior private equity professionals in Europe saw significant increases, reflecting this competitive landscape.

GBL's success in attracting and retaining such talent is paramount, especially as it navigates portfolio rebalancing. A strong talent acquisition and retention strategy is not just about compensation but also about offering challenging opportunities, a compelling culture, and the chance to shape significant investment outcomes. This is vital for sustaining GBL's competitive edge and driving long-term value creation.

Information and Data Providers

Information and data providers wield moderate bargaining power over Groupe Bruxelles Lambert (GBL). GBL, a major investment holding company, depends critically on precise and prompt data for its strategic investment choices and ongoing portfolio oversight. The cost of specialized data, sophisticated analytical platforms, and in-depth research can be substantial, and shifting between information vendors often entails considerable integration challenges and potential disruptions.

For instance, Bloomberg Terminal, a dominant player in financial data services, typically charges significant annual subscription fees, often exceeding $25,000 per user, reflecting the high value and comprehensive nature of its offerings. Similarly, Refinitiv (now part of the London Stock Exchange Group) provides a suite of data and analytics tools that are essential for institutional investors, with pricing structures that reflect the depth and breadth of market coverage. GBL's reliance on such services means these providers have a degree of leverage, as the cost and complexity of switching can be prohibitive.

- Data Dependency: GBL's operational model necessitates access to high-quality, real-time financial data, market intelligence, and analytical tools to inform its investment decisions and manage its diverse portfolio.

- Switching Costs: The integration of new data systems and the training of personnel can represent significant upfront costs and operational hurdles for a firm like GBL, reinforcing the bargaining power of existing providers.

- Proprietary Value: Providers offering unique datasets, advanced proprietary analytics, or specialized research capabilities can command higher prices due to the difficulty in replicating such insights elsewhere.

- Market Concentration: The financial data industry is relatively concentrated, with a few major players dominating the market, which can lead to less competitive pricing and greater influence for these key suppliers.

Portfolio Company Management Teams

While not external vendors, the management teams within Groupe Bruxelles Lambert's (GBL) portfolio companies wield significant internal supplier power. Their operational execution and strategic alignment directly influence the success of GBL's investments, making their competence crucial for value creation.

GBL's active shareholder approach means these internal teams are key partners. For instance, in 2024, GBL's focus on driving operational improvements across its holdings, such as those in the energy and industrial sectors, hinges on the management teams' ability to implement these strategies effectively.

- Operational Execution: Portfolio company management teams are responsible for day-to-day operations, impacting efficiency and profitability.

- Strategic Implementation: Their ability to execute GBL's strategic vision is paramount to achieving investment objectives.

- Performance Impact: The performance of these teams directly affects the valuation and overall returns for GBL shareholders.

The bargaining power of suppliers for Groupe Bruxelles Lambert (GBL) is generally moderate. GBL's diverse portfolio and substantial financial resources allow it to negotiate favorable terms with many suppliers, particularly for common goods and services.

However, specialized suppliers, such as those providing niche technology solutions or highly skilled advisory services, can exert more influence. The cost of switching these specialized suppliers can be high, and their unique expertise is critical for GBL's investment strategy.

For example, the market for top-tier investment talent, a key supplier group, saw significant demand in 2024, driving up compensation and giving these professionals considerable leverage.

The bargaining power of suppliers for Groupe Bruxelles Lambert (GBL) is a key consideration, particularly concerning specialized services and talent. While GBL's scale offers some negotiation advantage, the unique expertise and high demand for certain suppliers, like top investment professionals, grant them moderate to significant bargaining power.

What is included in the product

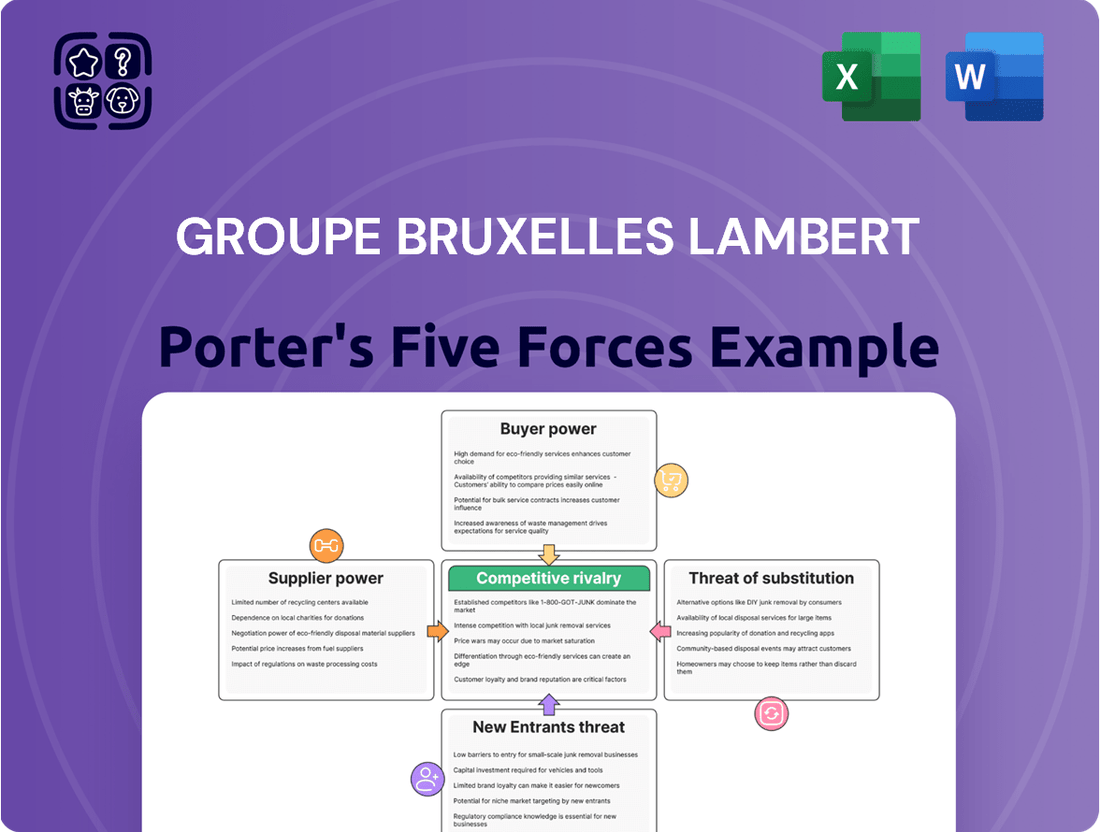

This analysis dissects the competitive landscape for Groupe Bruxelles Lambert, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its diverse portfolio of investments.

Visually map competitive intensity across all five forces to pinpoint and address GBL's most significant strategic threats.

Customers Bargaining Power

Shareholders, as GBL's primary stakeholders, wield considerable influence through their investment choices. They scrutinize GBL's performance by metrics like net asset value (NAV) growth and dividend distributions, aiming for a strong total shareholder return.

The widening of GBL's NAV discount to approximately 15% as of July 2025 signals a degree of shareholder doubt. This pressure can compel GBL to boost its performance or increase transparency to secure and maintain shareholder investment.

Large institutional investors, like pension funds and sovereign wealth funds, manage vast sums of capital. In 2024, these entities collectively hold trillions of dollars globally, giving them significant leverage. Their capacity to shift investments means they can exert considerable bargaining power over Groupe Bruxelles Lambert (GBL), expecting competitive returns and clear, reliable reporting.

These sophisticated investors also increasingly demand that companies align with their investment mandates, which frequently include Environmental, Social, and Governance (ESG) criteria. GBL's strategic focus on long-term value creation and sustainability is designed to resonate with these powerful stakeholders and maintain their favor.

While individual retail investors generally wield less direct bargaining power than large institutional investors, their collective actions can significantly impact Groupe Bruxelles Lambert's (GBL) market standing. The ease with which retail investors can access information and trade shares allows them to quickly reallocate their capital, thereby influencing GBL's share price and overall market capitalization.

GBL's strategy of consistently providing sustainable dividends and engaging in share buyback programs is a direct response to the need to maintain the confidence and attract the capital of this crucial customer segment. For instance, in 2024, GBL continued its commitment to shareholder returns, aiming to solidify its appeal to a broad base of investors.

Potential Co-investors

When Groupe Bruxelles Lambert (GBL) pursues co-investments, its partners, in essence, become customers for those specific investment opportunities. These co-investors wield significant bargaining power, influencing terms, governance structures, and the eventual exit strategies. They often bring their own stringent investment criteria and have numerous alternative investment avenues available, compelling GBL to present compelling deal structures and clearly articulate its potential for value creation.

GBL's strategy of building an indirect private assets portfolio, which notably includes funds and co-investments, means managing relationships with these powerful co-investors is crucial. For instance, in 2023, GBL reported its indirect private assets, including co-investments, represented a substantial portion of its overall portfolio, highlighting the importance of these partnerships. The ability to attract and retain these co-investors hinges on GBL's capacity to consistently identify attractive deals and demonstrate a clear path to profitable outcomes.

The bargaining power of these co-investors is amplified by several factors:

- Access to Capital: Co-investors often possess significant capital reserves, making them desirable partners for GBL.

- Deal Sourcing and Due Diligence: Their ability to source and rigorously vet deals independently means GBL must offer superior opportunities.

- Industry Expertise: Co-investors may bring specialized knowledge that influences deal terms and operational strategies.

- Exit Strategy Influence: Their desire for timely and profitable exits means GBL must align on realistic and attractive exit plans.

Companies Seeking Capital

For companies actively seeking capital, Groupe Bruxelles Lambert (GBL) represents a significant potential investor. These companies, especially those demonstrating strong growth trajectories, possess considerable bargaining power. They can indeed select from a diverse pool of potential investment partners, making GBL’s ability to attract and retain them crucial.

GBL’s strategy to be the preferred capital provider hinges on its unique value proposition. This includes a commitment to a long-term investment horizon, an active ownership model that goes beyond mere capital injection, and the provision of tangible strategic support. These elements are designed to appeal to ambitious companies looking for more than just funding.

- Customer Bargaining Power for Companies Seeking Capital: High-growth companies can choose from multiple capital providers, giving them leverage.

- GBL's Differentiation: GBL aims to stand out through its long-term view and active, strategic involvement.

- Competitive Landscape: The ability to attract investment means companies can negotiate terms favorable to their growth plans.

Companies seeking capital from Groupe Bruxelles Lambert (GBL) possess significant bargaining power, especially those with strong growth prospects. In 2024, the competitive landscape for investment capital remained robust, with numerous private equity firms and strategic investors vying for attractive opportunities. This allows these companies to negotiate favorable terms, influencing GBL's investment structure and expectations.

What You See Is What You Get

Groupe Bruxelles Lambert Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Groupe Bruxelles Lambert provides an in-depth examination of the competitive landscape, detailing the intensity of rivalry, the bargaining power of suppliers and buyers, the threat of new entrants, and the threat of substitute products. You'll gain a clear understanding of the strategic factors influencing GBL's profitability and market position.

Rivalry Among Competitors

Groupe Bruxelles Lambert (GBL) contends with formidable rivals in the investment holding company space, including European giants like Investor AB and EXOR NV, as well as the French firm Wendel SE. These entities often mirror GBL's approach, focusing on acquiring stakes in prominent, established businesses for long-term growth and value appreciation.

The competitive landscape is characterized by a scarcity of prime investment targets, compelling companies like GBL to continually prove their mettle in portfolio management and value generation. For instance, as of early 2024, Investor AB reported a portfolio value of approximately SEK 600 billion (around $57 billion USD), showcasing the scale of assets managed by these major players.

The landscape for Groupe Bruxelles Lambert (GBL) is increasingly shaped by the formidable presence of private equity funds. These entities, particularly those boasting substantial capital and specialized industry knowledge, are actively pursuing similar private company investments. For instance, by mid-2024, major private equity firms continued to deploy record levels of capital, with dry powder exceeding trillions globally, directly competing for attractive assets.

These private equity players often present a competitive challenge through their ability to offer aggressive valuations and provide hands-on operational improvements, making them formidable rivals. As GBL strategically shifts its focus and increases its allocation to private assets, its direct competition with these well-capitalized and operationally adept funds intensifies significantly.

Large sovereign wealth funds and pension funds, with their substantial capital and long-term investment horizons, are increasingly bypassing traditional intermediaries to engage in direct investments. This trend means more entities are competing for significant stakes in leading companies, intensifying rivalry.

For instance, the Norwegian Government Pension Fund Global, one of the world's largest, managed over $1.3 trillion as of early 2024, demonstrating the sheer scale of capital these players can deploy. Their patient capital and ability to take large, influential positions make them formidable rivals for any company seeking to attract or retain major investors.

Diversified Asset Managers

Diversified asset managers, offering everything from stocks to alternative investments, are significant competitors for investor capital. These firms, while employing varied strategies, target the same pool of institutional and retail funds. GBL needs to consistently highlight its distinct advantages against these broad-based competitors.

The competitive landscape is intense, with many firms vying for investor attention and capital. For instance, in 2024, the global asset management industry managed trillions of dollars, with major players like BlackRock and Vanguard overseeing vast sums across diverse product lines. GBL's challenge lies in differentiating its specialized approach within this crowded market.

- Broad Product Offerings: Competitors provide a wide array of investment vehicles, including equities, fixed income, real estate, and private equity, appealing to a broad investor base.

- Scale and Brand Recognition: Large, established asset managers benefit from significant economies of scale and strong brand loyalty, making it harder for specialized firms to gain market share.

- Fee Compression: The industry faces ongoing pressure on management fees, forcing all players, including GBL, to justify their value proposition through performance and unique strategies.

Market Fragmentation and Specialization

The investment landscape is indeed highly fragmented, with a vast array of players focusing on distinct sectors, geographical regions, or specific asset classes. This fragmentation means Groupe Bruxelles Lambert (GBL) faces competition not just from broadly diversified investment firms, but also from highly specialized entities that can offer deep expertise and tailored strategies within particular market segments.

For instance, in 2024, the private equity sector alone saw a significant number of specialized funds emerge, focusing on areas like renewable energy infrastructure or technology buyouts. While GBL maintains a diversified portfolio, this increasing specialization among competitors can intensify rivalry within GBL's chosen niches. This dynamic necessitates GBL to continuously cultivate and demonstrate strong sector-specific knowledge and maintain the agility to adapt its investment strategies swiftly.

- Market Fragmentation: The global investment market is characterized by a multitude of firms, each carving out its niche.

- Specialization Impact: Competitors focusing on specific sectors or asset classes can pose a more direct challenge within those areas.

- GBL's Response: Maintaining deep sector expertise and operational flexibility is crucial for GBL to navigate this competitive environment effectively.

Groupe Bruxelles Lambert (GBL) faces intense competition from other investment holding companies like Investor AB and EXOR NV, which often pursue similar strategies of acquiring stakes in established businesses. The market for prime investment targets is limited, forcing GBL to consistently demonstrate its value generation capabilities. For example, as of early 2024, Investor AB managed a portfolio valued at approximately SEK 600 billion (around $57 billion USD), indicating the significant scale of GBL's rivals.

Private equity funds, armed with substantial capital and specialized industry knowledge, are increasingly direct competitors, actively seeking the same private company investments that GBL targets. By mid-2024, major private equity firms continued to deploy vast amounts of capital globally, exceeding trillions in dry powder, directly challenging GBL for attractive assets.

Furthermore, large institutional investors such as sovereign wealth funds and pension funds are increasingly making direct investments, bypassing traditional routes and competing for significant stakes in leading companies. The Norwegian Government Pension Fund Global, for instance, managed over $1.3 trillion as of early 2024, underscoring the immense capital these entities can deploy, making them formidable rivals.

| Competitor Type | Key Characteristics | Example (as of early-mid 2024) |

|---|---|---|

| Investment Holding Companies | Acquire stakes in established businesses for long-term growth. | Investor AB (SEK 600 billion portfolio), EXOR NV, Wendel SE |

| Private Equity Funds | Deploy significant capital, offer aggressive valuations, and provide operational improvements. | Global dry powder exceeding trillions |

| Sovereign Wealth & Pension Funds | Possess substantial capital, long-term horizons, and engage in direct investments. | Norwegian Government Pension Fund Global (over $1.3 trillion managed) |

SSubstitutes Threaten

A significant substitute for investing in Groupe Bruxelles Lambert (GBL) is the direct investment in publicly traded companies. Investors can bypass GBL by directly buying shares of companies listed on stock exchanges, potentially offering higher liquidity and direct control over their portfolio.

The ease of access to global stock markets, especially with the proliferation of low-cost trading platforms, makes this a compelling alternative. For instance, in 2024, retail investors continued to show robust activity in direct stock purchases, with trading volumes remaining elevated across major exchanges, indicating a readily available substitute for indirect investment vehicles like GBL.

Exchange-Traded Funds (ETFs) and mutual funds present a significant threat to Groupe Bruxelles Lambert (GBL) by offering readily accessible, diversified investment portfolios. For instance, in 2024, the global ETF market continued its robust growth, with assets under management expected to surpass $15 trillion, providing investors with broad exposure to various sectors and geographies at a lower cost than traditional active management.

These investment vehicles act as direct substitutes for investors who might otherwise consider an investment holding company like GBL for diversification. The ease of trading, professional management, and inherent diversification within ETFs and mutual funds appeal to a wide range of investors, potentially diverting capital away from GBL's active ownership model.

The lower entry barriers and high liquidity of ETFs, in particular, make them an attractive alternative for individual and institutional investors alike. As of early 2024, the average expense ratio for ETFs remained significantly lower than actively managed mutual funds, further enhancing their appeal as a cost-effective way to gain diversified market exposure.

Investors seeking different risk-return profiles might choose alternative asset classes like real estate, commodities, or hedge funds. These options can provide diversification or specific market exposures not found in GBL's core strategy. For instance, by mid-2024, global real estate investment volumes were projected to reach trillions, offering a tangible asset alternative to publicly traded equities.

Venture Capital and Growth Equity

Venture capital (VC) and growth equity (GE) firms represent significant substitutes for Groupe Bruxelles Lambert's (GBL) direct private equity investments. These specialized firms often cater to companies at different stages of development, providing tailored capital and strategic support. For instance, in 2024, VC funding reached approximately $150 billion globally, while growth equity deals continued to be robust, indicating a substantial market of alternative capital providers.

These alternative capital sources can be particularly attractive to entrepreneurs and founders seeking not just funding, but also specific industry expertise and access to established networks. For example, a tech startup might find a VC firm with deep Silicon Valley connections a more suitable partner than a diversified holding company like GBL, especially if they are in an early growth phase.

The presence of numerous VC and GE players creates a competitive landscape for GBL, as companies have multiple avenues to secure financing. This can influence GBL's deal flow and the terms it can negotiate for its direct investments.

- Specialization: VC and GE firms often possess niche expertise, offering targeted support that GBL's broader investment strategy might not replicate.

- Stage Focus: Many VC/GE firms specialize in early-stage or high-growth companies, providing alternatives for businesses at specific points in their lifecycle.

- Competitive Landscape: The availability of VC and GE funding creates a competitive environment for direct private investment, impacting deal terms and access for companies.

- Global Deal Volume: In 2024, venture capital funding globally was around $150 billion, highlighting the significant scale of substitute capital available.

Debt Financing and Internal Capital Generation

For Groupe Bruxelles Lambert's (GBL) portfolio companies, the threat of substitutes for equity financing is significant. Traditional bank loans and corporate bonds offer alternative debt financing routes. In 2024, the corporate bond market remained robust, with European companies issuing over €1 trillion in new bonds, providing ample alternative capital.

Furthermore, internal capital generation presents a powerful substitute, particularly for highly profitable portfolio companies. Businesses with strong cash flows can reinvest earnings to fund growth, thereby reducing their need for external equity partners like GBL. This self-funding capability allows them to retain full ownership and control.

- Alternative Financing Options: Traditional bank loans and corporate bonds are readily available substitutes for GBL's equity.

- Debt Preference: Established companies may opt for debt to maintain 100% ownership of their businesses.

- Internal Capital Generation: Profitable companies can self-fund growth, diminishing reliance on equity investors.

- Market Conditions (2024): The European corporate bond market saw over €1 trillion in new issuances, highlighting the availability of debt capital.

The threat of substitutes for Groupe Bruxelles Lambert (GBL) arises from various investment vehicles and financing options that offer similar exposure or capital. Direct investment in publicly traded stocks, Exchange-Traded Funds (ETFs), and mutual funds provide readily accessible and often lower-cost diversification. Alternative asset classes like real estate and commodities, alongside specialized venture capital and growth equity firms, also present compelling alternatives for investors and companies seeking different risk-return profiles or targeted support.

Furthermore, traditional debt financing through bank loans and corporate bonds, as well as a company's own internal capital generation, serve as significant substitutes for equity investment. The robust European corporate bond market in 2024, with over €1 trillion in new issuances, exemplifies the availability of alternative debt capital. This array of substitutes means GBL must continually demonstrate its value proposition to both investors and the companies it seeks to partner with.

| Substitute Category | Examples | Key Advantage | 2024 Data Point |

|---|---|---|---|

| Direct Equity Investment | Publicly traded stocks | Liquidity, direct control | Elevated retail investor trading volumes |

| Diversified Funds | ETFs, Mutual Funds | Diversification, lower cost | Global ETF AUM projected > $15 trillion |

| Alternative Assets | Real Estate, Commodities | Tangible assets, different risk exposure | Global real estate investment volumes in trillions |

| Specialized Capital | Venture Capital, Growth Equity | Niche expertise, stage-specific funding | Global VC funding approx. $150 billion |

| Debt Financing | Bank Loans, Corporate Bonds | Maintain ownership, leverage | European corporate bond issuance > €1 trillion |

Entrants Threaten

The sheer scale of capital needed to operate as a major investment holding company like Groupe Bruxelles Lambert (GBL) presents a formidable barrier to entry. Establishing a diversified portfolio comprising significant stakes in leading international businesses demands vast financial resources that most aspiring competitors simply cannot muster.

For context, GBL's net asset value stood at €15.7 billion as of December 31, 2024. This figure underscores the immense financial muscle required to replicate GBL's strategic positioning and operational capacity, effectively deterring new players from entering the market.

Groupe Bruxelles Lambert's (GBL) seventy-year history on the stock exchange, coupled with a consistent track record of successful value creation, acts as a significant deterrent to new entrants. This established reputation fosters deep trust among investors and makes it easier for GBL to attract high-quality portfolio companies.

Newcomers struggle to replicate this level of credibility and performance history, which is crucial for securing both the necessary capital and the most attractive investment opportunities.

Groupe Bruxelles Lambert's (GBL) proprietary deal flow and extensive industry networks are significant barriers to entry. These deep relationships, cultivated over years, grant GBL privileged access to high-quality, often non-public, investment opportunities. For instance, by mid-2024, GBL's strategic investments in sectors like renewable energy and technology allowed it to identify and secure stakes in promising, early-stage companies before competitors could even learn of them.

New entrants would find it exceptionally difficult to replicate GBL's established presence and the trust it has built within the European investment ecosystem. Building comparable networks takes substantial time and consistent performance, resources that are not readily available to nascent firms. Without this established access, new players would be relegated to less attractive, publicly available deals, significantly hindering their ability to compete effectively.

Regulatory and Legal Complexities

The threat of new entrants for Groupe Bruxelles Lambert (GBL) is significantly shaped by the intricate web of regulatory and legal complexities inherent in operating as a diversified investment holding company across multiple jurisdictions. New players must invest heavily in understanding and complying with varying legal frameworks, robust compliance protocols, and distinct corporate governance mandates. This can be a substantial barrier, requiring considerable time and financial resources to overcome.

For instance, GBL's commitment to directives such as the Corporate Sustainability Reporting Directive (CSRD) exemplifies the depth of regulatory engagement required. Navigating these evolving standards demands specialized expertise and ongoing adaptation, making it challenging for newcomers to establish a foothold without significant prior experience and infrastructure.

- Navigating Diverse Legal Frameworks: New entrants must master the legal requirements in each jurisdiction where GBL operates, a task that is both time-consuming and resource-intensive.

- Compliance Costs: Adhering to varied regulatory standards, including evolving sustainability reporting like CSRD, incurs substantial upfront and ongoing compliance expenses.

- Corporate Governance Standards: Understanding and implementing the diverse corporate governance expectations across different legal systems presents a significant hurdle for potential competitors.

Active Ownership Expertise

Groupe Bruxelles Lambert's (GBL) active ownership model, which emphasizes deep engagement in corporate governance, strategic direction, and operational enhancements, presents a significant barrier to new entrants. This specialized expertise, crucial for effectively influencing portfolio companies, is not easily replicated. For instance, GBL's commitment to long-term value creation is evident in its strategic partnerships and board representation across its diverse holdings.

The difficulty for potential competitors lies in acquiring the necessary human capital. This includes not only financial resources but also seasoned professionals possessing extensive industry knowledge and a proven track record in driving strategic change. GBL's approach requires a nuanced understanding of complex business operations and the ability to foster collaborative relationships with management teams.

- Specialized Expertise: GBL's active ownership demands deep knowledge in corporate governance, strategy, and operations.

- Human Capital Requirement: Acquiring the right talent with industry insight and influence is a significant hurdle for new players.

- Difficult to Replicate: The combination of capital, knowledge, and proven influence is hard for new entrants to quickly build.

- Long-Term Value Focus: GBL's commitment to sustained growth through active management differentiates its model.

The threat of new entrants for Groupe Bruxelles Lambert (GBL) is significantly low due to the immense capital requirements, established reputation, proprietary networks, and regulatory complexities. Replicating GBL's scale, which saw its net asset value reach €15.7 billion by the end of 2024, demands financial resources far beyond the reach of most potential competitors. Furthermore, GBL's decades of proven performance and deep-seated industry relationships create formidable barriers.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | GBL's net asset value was €15.7 billion as of December 31, 2024. | Extremely high, requiring substantial financial backing. |

| Reputation & Track Record | Seventy years of stock exchange history and consistent value creation. | Difficult to match; erodes trust and access to capital/deals for newcomers. |

| Proprietary Networks | Extensive, long-cultivated industry relationships. | Limits access to quality, often non-public, investment opportunities for new players. |

| Regulatory & Legal Complexity | Navigating diverse multi-jurisdictional compliance and governance. | Requires significant investment in expertise and time to manage. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Groupe Bruxelles Lambert leverages data from its official annual reports, investor presentations, and filings with regulatory bodies like the FSMA. We also incorporate insights from reputable financial news outlets and industry-specific market research reports to provide a comprehensive view of the competitive landscape.