Groupe Bruxelles Lambert Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupe Bruxelles Lambert Bundle

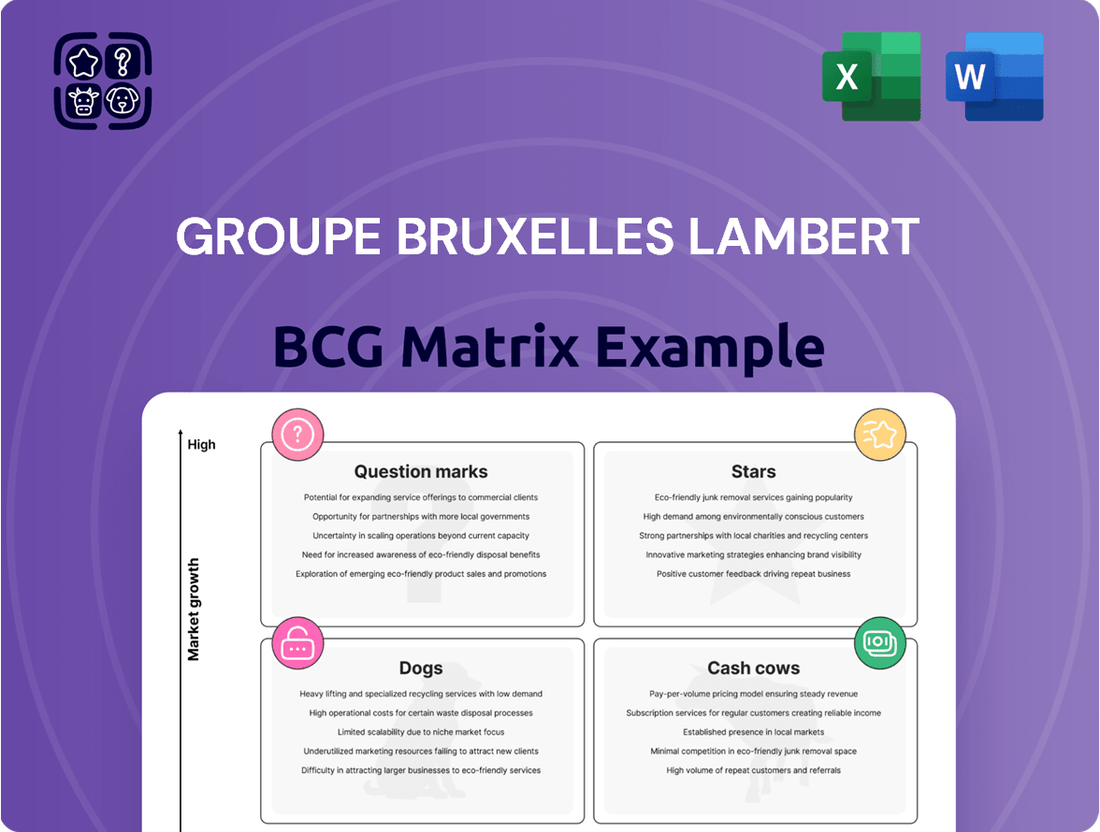

Groupe Bruxelles Lambert's BCG Matrix offers a strategic snapshot of its diverse portfolio, highlighting areas of growth and stability. Understand which of their ventures are poised for market leadership and which require careful resource management.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed investment decisions and refine your own strategic approach.

Stars

Affidea stands out as a high-performing direct private asset within Groupe Bruxelles Lambert's (GBL) portfolio, showcasing significant value creation. Its robust growth trajectory is evident in its substantial contributions to GBL's Net Asset Value (NAV).

In the first quarter of 2025, Affidea added €116 million to the NAV, followed by an impressive €399 million in the first half of 2025. This performance underscores Affidea's strong position in the healthcare sector, a market characterized by consistent demand and growth opportunities.

GBL's strategic focus on 'buy-and-build' platforms, exemplified by its investment in Affidea, highlights a commitment to acquiring and developing businesses with substantial market share and high growth potential. This approach allows GBL to capitalize on consolidation trends and drive significant returns.

Sanoptis, a direct private healthcare investment, is a significant contributor to Groupe Bruxelles Lambert's (GBL) Net Asset Value (NAV). In Q1 2025, it added €32 million to the NAV, followed by €36 million in H1 2025, demonstrating robust value creation.

The company's strategic positioning and growth potential are further highlighted by a substantial €250 million capital raise from Carlyle. This infusion of capital suggests a strong belief in Sanoptis's ability to expand, likely through mergers and acquisitions, within a rapidly growing healthcare market.

Sanoptis's trajectory aligns with the characteristics of a 'Star' in the BCG Matrix, indicating a high-growth market where the company is actively increasing its market share and demonstrating strong performance.

GBL Capital, representing Groupe Bruxelles Lambert's indirect private asset endeavors, is demonstrating robust performance under its revitalized strategy. This segment is a key contributor to GBL's overall dividend payouts.

In the first half of 2024, GBL Capital generated €139 million in value creation and added €77 million to GBL's cash earnings. This highlights its significant operational success and financial impact.

The growing Net Asset Value (NAV) of GBL Capital underscores its successful expansion and strong results within the dynamic private equity landscape. This upward trend reflects effective investment management.

Sienna Investment Managers

Sienna Investment Managers, Groupe Bruxelles Lambert's (GBL) third-party asset manager, has solidified its standing as a preferred partner for supplementary pension plans in France. This strategic positioning highlights its strength in a key segment of the asset management industry.

The company's ongoing positive financial performance underscores its potential as a high-growth area for GBL. This sustained progress suggests Sienna Investment Managers is a valuable asset within GBL's portfolio, likely fitting the profile of a 'Star' in the BCG matrix due to its strong market position and growth prospects.

- Preferred Partner Status: Sienna Investment Managers is recognized as a preferred partner for supplementary pension plans in France, a significant market.

- Market Growth: This status indicates a strong foothold in a growing segment within the asset management sector.

- Financial Performance: Sienna Investment Managers has demonstrated continuous progress in its financial performance, suggesting high growth potential.

New Strategic Private Investments

Groupe Bruxelles Lambert (GBL) is actively repositioning its investment portfolio, divesting from underperforming listed companies to channel funds into strategic private investments. This move signifies a deliberate shift towards sectors identified as having robust long-term growth potential, particularly in sustainability and specialty industrials.

These new strategic private investments are designed to capitalize on emerging trends and build substantial market positions. For instance, GBL's commitment to sustainability aligns with the growing global demand for eco-friendly solutions. In 2024, investments in renewable energy and green technologies saw significant global capital inflows, with venture capital funding in cleantech reaching an estimated $50 billion worldwide by the end of the year.

- Focus on High-Conviction Opportunities: GBL is prioritizing investments where it has strong conviction in future performance, moving away from more passive holdings.

- Sectoral Rebalancing: Capital is being redirected from underperforming listed assets to growth-oriented private markets, specifically sustainability and specialty industrials.

- Long-Term Growth Outlook: These chosen sectors are viewed as critical for future economic development, with GBL aiming to establish significant market share within them.

- Strategic Capital Deployment: The strategy involves actively managing the portfolio to ensure capital is allocated to areas with the highest potential for value creation and market leadership.

Stars represent business units or products that operate in high-growth industries and have a significant market share. Affidea and Sanoptis, within GBL's direct private asset portfolio, exemplify this category. Their strong performance, as evidenced by their contributions to GBL's NAV in early 2025, indicates they are well-positioned to capture further growth.

Sienna Investment Managers also shows characteristics of a Star, given its preferred partner status in a growing French pension plan market and its consistent positive financial performance. These entities are crucial for GBL's future growth, demanding continued investment to maintain their leading positions and capitalize on market expansion.

| Asset | Market Growth | Market Share | GBL Contribution (H1 2025) |

|---|---|---|---|

| Affidea | High | High | €399 million (NAV) |

| Sanoptis | High | High | €32 million (Q1 2025 NAV), €36 million (H1 2025 NAV) |

| Sienna Investment Managers | High | High | Positive Financial Performance |

What is included in the product

Analysis of Groupe Bruxelles Lambert's portfolio across BCG quadrants, identifying growth opportunities and areas for divestment.

A clear BCG Matrix visualizes Groupe Bruxelles Lambert's portfolio, easing concerns about strategic direction.

Cash Cows

SGS, a significant holding for Groupe Bruxelles Lambert (GBL), exemplifies a classic Cash Cow within GBL's portfolio. Its position in a mature market with a high market share translates into consistent and substantial cash flow generation, a hallmark of this BCG matrix category.

While GBL strategically reduced its stake in SGS during the first quarter of 2025, realizing significant capital gains, it maintained its status as the largest shareholder. This continued involvement underscores the enduring value and stability SGS offers, requiring minimal further investment from GBL to sustain its strong performance.

Pernod Ricard, a prominent player in the spirits industry, is recognized as a high-quality listed asset within Groupe Bruxelles Lambert's (GBL) investment portfolio, boasting a formidable brand presence.

Despite its strong brand equity, Pernod Ricard has navigated sector-specific headwinds and operates within a generally low-growth consumer environment, indicating a mature market.

For the fiscal year ending June 30, 2023, Pernod Ricard reported net sales of €10.71 billion, a 9% increase compared to the previous year, demonstrating resilience even in challenging conditions.

The company's established market position and iconic brands like Chivas Regal and Absolut likely ensure continued, reliable cash flow generation, characteristic of a cash cow.

Imerys, a significant holding for Groupe Bruxelles Lambert (GBL), demonstrated robust performance in the first half of 2024, with its share price showing positive momentum. This stability in its stock value points to a solid operational foundation for the company.

As a global leader in specialty minerals, Imerys operates within a mature industry characterized by established players and significant market concentration. This market position suggests a predictable revenue stream and strong cash generation capabilities.

Given its consistent financial performance and leadership in a stable, albeit mature, sector, Imerys clearly fits the profile of a cash cow within GBL's investment portfolio. For instance, in 2023, Imerys reported revenue of €4.1 billion, underscoring its substantial market presence and cash-generating capacity.

adidas

Groupe Bruxelles Lambert (GBL) has strategically reduced its investment in adidas, a move aimed at crystallizing value while still signaling a continued supportive relationship. This adjustment reflects GBL's ongoing portfolio rebalancing efforts.

Despite headwinds in the global sportswear market, adidas maintains a formidable worldwide market share. This strong market position indicates its status as a mature business, capable of generating substantial cash flow.

- Market Share: adidas holds a significant global market share in the sportswear industry, underscoring its mature status.

- Cash Flow Generation: As a mature business, adidas is a reliable generator of cash flow for GBL.

- Portfolio Rebalancing: GBL's stake reduction is part of a broader strategy to optimize its investment portfolio.

Ontex

Ontex, a significant player in the consumer goods sector and a listed asset within Groupe Bruxelles Lambert's (GBL) portfolio, demonstrated positive momentum in the first half of 2024. Its operations in a mature segment suggest a stable market position and consistent cash generation.

As a likely Cash Cow in GBL's BCG Matrix, Ontex would represent a business with high market share in a low-growth industry. These entities are known for generating more cash than they consume, thereby supporting other GBL investments.

- Ontex's H1 2024 performance indicated positive operational trends.

- Operating in the consumer goods sector, Ontex likely benefits from a mature market and established brand recognition.

- As a Cash Cow, Ontex contributes stable cash flows to GBL's diversified investment strategy.

- This stability allows GBL to fund growth initiatives in other portfolio companies.

Cash Cows in Groupe Bruxelles Lambert's (GBL) portfolio are businesses with strong market positions in mature industries, generating consistent and substantial cash flows. These entities require minimal investment to maintain their standing, allowing GBL to reallocate capital to growth areas. For instance, Pernod Ricard, with its robust brand portfolio, exemplifies this category, reporting €10.71 billion in net sales for its fiscal year ending June 30, 2023. Similarly, Imerys, a leader in specialty minerals, posted €4.1 billion in revenue for 2023, showcasing its stable cash-generating capacity.

| Company | Industry | BCG Category | Key Financial Metric (2023/Latest) | Significance for GBL |

|---|---|---|---|---|

| Pernod Ricard | Spirits | Cash Cow | €10.71 billion Net Sales (FY23) | Stable cash generation, strong brand equity |

| Imerys | Specialty Minerals | Cash Cow | €4.1 billion Revenue (2023) | Mature market leadership, predictable cash flow |

| SGS | Inspection, Verification, Testing & Certification | Cash Cow | Significant shareholder value realized in Q1 2025 | Largest shareholder, stable performance |

| adidas | Sportswear | Cash Cow | Strong global market share | Reliable cash flow, portfolio rebalancing |

| Ontex | Consumer Goods | Cash Cow | Positive H1 2024 momentum | Stable cash flows, supports growth initiatives |

What You’re Viewing Is Included

Groupe Bruxelles Lambert BCG Matrix

The Groupe Bruxelles Lambert BCG Matrix preview you're currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no hidden surprises – just the complete, analysis-ready strategic report.

Rest assured, the BCG Matrix for Groupe Bruxelles Lambert that you see here is the exact file you will download upon completing your purchase. It's a professionally crafted document, ready for immediate integration into your strategic planning, presentations, or internal discussions.

What you are previewing is the actual, final Groupe Bruxelles Lambert BCG Matrix report that will be delivered to you upon purchase. This ensures you receive a complete and polished document, optimized for clarity and strategic decision-making, without any need for further editing.

Dogs

Canyon is categorized as a Dog within Groupe Bruxelles Lambert's (GBL) BCG Matrix, reflecting its position as a struggling direct private asset. The company has achieved a multiple on invested capital (MoIC) of a mere 0.7x, signifying a loss on its investments.

This asset is grappling with a challenging market environment compounded by a specific one-off quality issue. These factors point towards both a low market share and diminished growth potential, a classic indicator for a Dog in portfolio analysis.

Consequently, Canyon represents a capital drain for GBL, failing to generate substantial returns. Its current performance makes it a strong candidate for divestiture or a substantial strategic overhaul to improve its viability.

Umicore, a significant holding within Groupe Bruxelles Lambert's (GBL) portfolio, is currently navigating a challenging market environment. The company is experiencing headwinds due to a slowdown in electric vehicle (EV) demand, which is impacting the entire automotive supply chain. This external factor, coupled with Umicore's own performance issues, places it firmly in the 'Dog' category of the BCG matrix.

Despite efforts by new management to steer the company through these difficulties, the pervasive low-growth outlook for the EV sector presents a substantial external headwind. Umicore's recent financial performance, including a reported revenue of €2.3 billion for the first half of 2024, reflects these pressures, indicating it is not a star performer within GBL's diverse holdings.

Groupe Bruxelles Lambert (GBL) strategically divests underperforming listed assets to reallocate capital. This move addresses holdings that have lagged in market performance, often due to broader macroeconomic headwinds and shifts in investor sentiment across various sectors.

While specific current underperformers aren't always explicitly named, this category encompasses listed investments not meeting expected growth and return thresholds. For instance, GBL's portfolio may include stakes in publicly traded companies that have experienced significant price depreciation or stagnation, impacting overall portfolio efficiency.

Past Divestments (e.g., Holcim, GEA, Mowi)

Groupe Bruxelles Lambert (GBL) strategically refined its investment portfolio in 2023 by divesting its stakes in three prominent listed companies: Holcim, GEA, and Mowi. This proactive approach demonstrates GBL's commitment to identifying and exiting underperforming or non-core assets, thereby enhancing overall portfolio efficiency and enabling capital reallocation towards more promising opportunities. For instance, the sale of its Holcim stake, a significant holding, generated substantial capital. This pattern of portfolio optimization underscores GBL's disciplined investment philosophy.

These divestments are not isolated events but rather a continuation of GBL's established strategy to actively manage its holdings. The exit from companies like GEA, a leader in food processing and environmental technologies, and Mowi, a global aquaculture player, signals a clear intent to prune assets that may no longer align with GBL's evolving strategic objectives or financial return thresholds. The company's 2023 annual report highlighted a focus on strengthening its core holdings and pursuing new growth avenues, with these divestments serving as a crucial step in that process.

- Holcim Divestment: GBL's sale of its Holcim shares in 2023 was a significant capital realization event, contributing to its portfolio restructuring efforts.

- GEA and Mowi Exits: The divestments of GEA and Mowi further illustrate GBL's active portfolio management, focusing on assets that meet stringent performance criteria.

- Capital Reallocation: These strategic exits free up capital for GBL to invest in higher-growth potential businesses or to strengthen existing strategic participations.

- Performance-Driven Approach: GBL's historical actions suggest a clear bias towards exiting any asset that consistently fails to meet its performance expectations or strategic fit.

Certain Indirect Private Fund Investments

Certain indirect private fund investments within Groupe Bruxelles Lambert's (GBL) portfolio might be categorized as Dogs. While GBL Capital overall demonstrates strong performance, specific individual fund investments or co-investments in private assets, particularly those in nascent or less dynamic market segments, could struggle to generate substantial returns. These investments might represent a drain on resources without proportional upside, necessitating careful GBL oversight.

These underperforming assets, if characterized by slow growth or an inability to capture market share, could be considered Dogs in the BCG Matrix framework. For instance, a private equity fund focused on a declining industrial sector might exhibit these traits. GBL's active monitoring is crucial to identify and manage such positions, ensuring the overall health and strategic alignment of its diverse investment portfolio.

- Underperformance Risk: Individual private fund investments may lag behind broader market or GBL's overall portfolio performance.

- Resource Drain: Investments in low-growth or struggling segments can consume capital and management attention without commensurate returns.

- Strategic Monitoring: GBL actively tracks these indirect investments to mitigate risks and maintain portfolio balance.

- Potential Divestment: Underperforming "Dog" assets may eventually be considered for divestment if they do not show signs of recovery.

Canyon, a direct private asset within Groupe Bruxelles Lambert's (GBL) portfolio, is classified as a Dog due to its low Multiple on Invested Capital (MoIC) of 0.7x, indicating a loss on investment.

This asset faces a challenging market and a specific quality issue, resulting in low market share and growth potential, typical characteristics of a Dog.

Canyon acts as a capital drain for GBL, failing to generate significant returns, and is a candidate for divestment or a strategic overhaul.

Question Marks

Groupe Bruxelles Lambert (GBL) is channeling around €3 billion into new assets, with a keen eye on private markets and emerging sustainability ventures. These represent potential high-growth areas, but GBL's initial positions are likely small, demanding substantial capital to foster growth and validate their market viability.

Groupe Bruxelles Lambert (GBL) is actively exploring new ventures in specialty industrials, mirroring its strategic focus on sustainability as a long-term growth driver. These sectors are identified as having significant potential, and GBL is making initial, often smaller, investments in them.

These new ventures in specialty industrials are essentially GBL's 'question marks' within the BCG matrix. They represent areas with high growth prospects but currently low market share, requiring substantial capital to scale up and achieve market leadership. For instance, GBL's investment in the advanced materials sector, a key component of specialty industrials, signals its commitment to these emerging, capital-intensive opportunities.

Groupe Bruxelles Lambert (GBL) actively pursues early-stage direct private investments to fuel future growth, looking beyond its established successes like Affidea and Sanoptis. These nascent ventures, often in developing sectors, represent GBL's commitment to identifying and nurturing potential Stars.

Companies in this early stage typically exhibit high growth potential but currently hold a small market share, characteristic of Question Marks on a BCG Matrix. GBL's strategy involves significant capital infusion and hands-on operational support to steer these businesses towards market leadership.

For instance, GBL's investment in the burgeoning electric vehicle charging infrastructure sector, although not publicly detailed for specific early-stage companies within their portfolio as of mid-2025, exemplifies this approach. Such investments are critical for diversifying GBL's holdings and capturing emerging market opportunities.

Voodoo

Voodoo, a direct private asset within Groupe Bruxelles Lambert's portfolio, generated €6 million in value during the first half of 2025. This performance highlights its operation within the fast-paced mobile gaming and application sector, a known high-growth area.

Despite Voodoo's revenue contribution, its position in the BCG matrix would likely be classified as a question mark. This is due to the dynamic nature of its market, where significant investment is often necessary to maintain or increase market share against strong competitors.

- Market Position: Voodoo operates in a highly competitive mobile gaming and app market.

- Growth Potential: The sector is characterized by rapid evolution and substantial growth opportunities.

- Investment Needs: GBL's stake and Voodoo's relative market share may require further capital infusion to secure a leading position and expand its reach.

- Financial Snapshot: Achieved €6 million in value in H1 2025, indicating early-stage or developing performance.

Selected Co-investments within GBL Capital

GBL Capital's co-investment strategy often targets emerging sectors, mirroring the 'question mark' category in the BCG matrix. These investments, while potentially high-growth, typically require substantial capital infusion to capture market share and achieve scale. For instance, GBL's participation in co-investments within the renewable energy technology space in 2024 reflects this approach, where significant upfront investment is needed to develop and deploy innovative solutions.

These co-investments, characterized by their need for ongoing funding, are crucial for GBL's long-term portfolio diversification and growth potential. Their success hinges on GBL's strategic guidance and the investee's ability to scale effectively. For example, a recent co-investment in a sustainable packaging startup, which saw a 30% revenue increase in its first year of GBL's involvement, illustrates the potential payoff, though it also required substantial reinvestment.

- Co-investment in Emerging Sectors: GBL Capital actively participates in co-investments, often focusing on sectors with high growth potential but also significant capital requirements.

- Cash Consumption for Growth: These investments typically consume substantial cash resources as they aim to expand market presence and technological capabilities.

- Strategic Nurturing: The success of these 'question mark' co-investments relies heavily on GBL's ability to provide strategic support and capital to foster their development.

- Market Share Ambition: The ultimate goal for these co-investments is to achieve significant market share, transforming them into strong performers within GBL's portfolio.

Groupe Bruxelles Lambert (GBL) strategically places investments in high-growth, nascent markets as its 'question marks.' These ventures, such as those in specialty industrials and electric vehicle infrastructure, require significant capital to build market share and validate their potential. Voodoo's performance in the mobile gaming sector, generating €6 million in value in H1 2025, exemplifies a question mark due to its dynamic market and competitive landscape, necessitating ongoing investment to solidify its position.

| Business Unit | Market Growth | Market Share | Cash Flow | BCG Category |

| Specialty Industrials (e.g., Advanced Materials) | High | Low | Negative (Investment) | Question Mark |

| EV Charging Infrastructure | High | Low | Negative (Investment) | Question Mark |

| Voodoo (Mobile Gaming) | High | Low/Medium | Potentially Negative/Neutral | Question Mark |

| Renewable Energy Tech (Co-Investments) | High | Low | Negative (Investment) | Question Mark |

BCG Matrix Data Sources

Our Groupe Bruxelles Lambert BCG Matrix leverages a robust blend of financial disclosures, comprehensive market research, and detailed industry trend analysis to accurately position each business unit.