GB Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GB Group Bundle

GB Group's current SWOT analysis reveals a strong market presence and innovative product development, but also highlights potential challenges in adapting to rapid technological shifts. Understanding these dynamics is crucial for navigating the competitive landscape.

Want the full story behind GB Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

GB Group plc is a recognized global leader in identity technology, offering specialized solutions in identity verification, fraud prevention, and location intelligence. This strong market position is built on deep expertise that serves over 20,000 organizations worldwide, demonstrating their significant reach and influence in critical digital trust services.

Their leadership is underscored by a proven track record of innovation and a comprehensive understanding of the evolving needs in identity management. This allows GB Group to deliver essential insights and robust solutions, empowering businesses to operate securely and efficiently in an increasingly complex digital environment.

GB Group's strength lies in its extensive array of solutions, covering critical areas like document and data verification, identity investigation, and fraud monitoring. This broad offering includes essential anti-money laundering (AML) checks, making it a one-stop shop for businesses.

This comprehensive portfolio serves a wide range of sectors, including financial services, e-commerce, and government agencies. By providing tools for secure customer onboarding and robust risk management, GB Group addresses diverse industry needs effectively.

For instance, in the fiscal year ending March 31, 2024, GB Group reported a 10% increase in revenue, driven by strong demand for its identity verification and fraud prevention services. This growth highlights the market's reliance on their complete solution suite.

GB Group has showcased impressive financial strength, with revenues reaching £282.7 million for the fiscal year ending March 31, 2025. This represents a healthy 3.0% growth when measured on a constant currency basis, indicating solid underlying business expansion.

The company's operational efficiency is further underscored by its exceptional cash conversion, exceeding 90% in FY25. This strong cash generation, coupled with a significant reduction in net debt, points to a well-managed and financially robust business model.

Global Reach and Diverse Customer Base

GB Group's global presence is a significant strength, with operations spanning over 70 countries. This extensive reach allows them to tap into diverse markets and customer segments. By serving more than 20,000 customers worldwide, GB Group has built a robust and geographically diversified revenue stream.

This broad customer base, which includes major financial institutions and leading e-commerce players, insulates the company from downturns in any single region or industry. The diversification also means GB Group is less dependent on any one market, providing a stable foundation for growth.

- Global Footprint: Operations in over 70 countries.

- Customer Diversification: Serving more than 20,000 clients globally.

- Sector Penetration: Strong relationships with key players in banking and e-commerce.

- Revenue Stability: Reduced reliance on single markets due to broad reach.

Innovation and AI Integration

GB Group's commitment to innovation is a significant strength, particularly evident in its ongoing investment in advanced AI capabilities. The recent launch of GBG Go, a new global identity platform, showcases this forward-thinking approach. This strategic focus on technology is vital for maintaining a competitive edge in the rapidly evolving digital trust and security market, especially as AI-driven fraud becomes more sophisticated.

The company's integration of AI into its solutions directly addresses the growing threat of AI-powered fraud. For instance, GB Group's identity verification solutions leverage machine learning to detect and prevent fraudulent activities more effectively. This proactive stance on technological advancement ensures their offerings remain relevant and powerful in safeguarding businesses and consumers.

- AI-Driven Fraud Prevention: GB Group is enhancing its platforms with AI to combat increasingly complex, AI-generated fraud schemes.

- GBG Go Platform: The introduction of this new global identity platform signifies a major step in their innovation pipeline, aiming to streamline identity verification worldwide.

- Investment in R&D: Continued investment in research and development, particularly in AI and machine learning, bolsters their ability to offer cutting-edge digital trust solutions.

GB Group's robust financial performance, including revenues of £282.7 million for the fiscal year ending March 31, 2025, demonstrates significant market traction. Their operational efficiency is highlighted by a cash conversion exceeding 90% in FY25, alongside a notable reduction in net debt, signaling a well-managed and financially sound business. This financial strength underpins their capacity for continued investment and growth.

| Financial Metric | FY25 (ending March 31, 2025) | Change vs. Previous Year |

|---|---|---|

| Revenue | £282.7 million | 3.0% (constant currency) |

| Cash Conversion | >90% | Strong operational efficiency |

| Net Debt | Reduced | Improved financial leverage |

What is included in the product

Delivers a strategic overview of GB Group’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

GB Group's Americas Identity segment has been a significant area of focus, with the company acknowledging operational challenges that have impacted its performance. While efforts are underway to revitalize this business, its turnaround remains a critical factor for GB Group's overall growth trajectory.

The company has been implementing strategic initiatives, including leadership adjustments, to address the underperformance in its Americas Identity operations. The success of these measures is crucial for unlocking the full potential of this segment and contributing positively to GB Group's financial results in the coming periods.

GB Group's fraud segment faced a notable slowdown, with a decline of around 4% in fiscal year 2025. This dip was largely attributed to a concentration of customer license renewals shifting to the latter half of the fiscal year, impacting the first half's performance.

While the second half of FY25 showed some recovery, the segment's overall growth was constrained by a slower pace in acquiring new clients and a reduced volume of related professional services engagements.

Despite a solid corporate performance and strong financial results, GB Group's stock faces potential headwinds due to bearish technical indicators and a valuation that some analysts deem high. This elevated valuation could deter certain investors, potentially dampening market sentiment and impacting the stock's future price trajectory.

Exposure to Macroeconomic Uncertainty

GB Group faces significant headwinds from macroeconomic uncertainty, which could temper its growth trajectory. Events like escalating trade tariffs and geopolitical tensions, such as ongoing conflicts, introduce considerable volatility into the global economic landscape. This instability can directly affect consumer spending and business investment, impacting GB Group's revenue streams and operational planning.

The company's reliance on global markets means it's particularly susceptible to these external shocks. For instance, a slowdown in key markets due to inflation or recessionary fears, as observed in various economic forecasts for 2024 and early 2025, could dampen demand for its products and services. This exposure necessitates a robust risk management strategy to navigate potential downturns.

- Tariff Uncertainty: Increased tariffs on imported components or finished goods could raise operational costs and potentially reduce profit margins.

- Geopolitical Risks: Conflicts in key regions can disrupt supply chains, impact international sales, and create a more challenging operating environment.

- Economic Slowdowns: Recessions or significant economic downturns in major markets can lead to reduced consumer and business spending, directly affecting GB Group's revenue.

Competitive Landscape

GB Group faces a crowded marketplace in the identity verification and fraud prevention software sector. Companies like Trustpilot Group, Experian, Equifax, TransUnion, and Onfido are significant rivals, potentially impacting GBG's pricing power and ability to capture market share.

The intense competition can lead to pressure on GBG's profit margins as companies vie for customers. Furthermore, the need to constantly innovate and differentiate its offerings in a rapidly evolving technological landscape presents an ongoing challenge.

- Intense Competition: GBG operates in a crowded software application industry with many providers of similar identity verification and fraud prevention solutions.

- Key Competitors: Major rivals include Trustpilot Group, Experian, Equifax, TransUnion, and Onfido, all offering comparable services.

- Market Share Challenges: The presence of these strong competitors can create difficulties for GBG in maintaining and expanding its market share.

- Pricing Pressures: A highly competitive environment often results in downward pressure on pricing, potentially affecting GBG's revenue and profitability.

GB Group's Americas Identity segment has been a significant area of focus, with the company acknowledging operational challenges that have impacted its performance. While efforts are underway to revitalize this business, its turnaround remains a critical factor for GB Group's overall growth trajectory.

The company has been implementing strategic initiatives, including leadership adjustments, to address the underperformance in its Americas Identity operations. The success of these measures is crucial for unlocking the full potential of this segment and contributing positively to GB Group's financial results in the coming periods.

GB Group's fraud segment faced a notable slowdown, with a decline of around 4% in fiscal year 2025. This dip was largely attributed to a concentration of customer license renewals shifting to the latter half of the fiscal year, impacting the first half's performance.

While the second half of FY25 showed some recovery, the segment's overall growth was constrained by a slower pace in acquiring new clients and a reduced volume of related professional services engagements.

Despite a solid corporate performance and strong financial results, GB Group's stock faces potential headwinds due to bearish technical indicators and a valuation that some analysts deem high. This elevated valuation could deter certain investors, potentially dampening market sentiment and impacting the stock's future price trajectory.

GB Group faces significant headwinds from macroeconomic uncertainty, which could temper its growth trajectory. Events like escalating trade tariffs and geopolitical tensions, such as ongoing conflicts, introduce considerable volatility into the global economic landscape. This instability can directly affect consumer spending and business investment, impacting GB Group's revenue streams and operational planning.

The company's reliance on global markets means it's particularly susceptible to these external shocks. For instance, a slowdown in key markets due to inflation or recessionary fears, as observed in various economic forecasts for 2024 and early 2025, could dampen demand for its products and services. This exposure necessitates a robust risk management strategy to navigate potential downturns.

- Tariff Uncertainty: Increased tariffs on imported components or finished goods could raise operational costs and potentially reduce profit margins.

- Geopolitical Risks: Conflicts in key regions can disrupt supply chains, impact international sales, and create a more challenging operating environment.

- Economic Slowdowns: Recessions or significant economic downturns in major markets can lead to reduced consumer and business spending, directly affecting GB Group's revenue.

GB Group faces a crowded marketplace in the identity verification and fraud prevention software sector. Companies like Trustpilot Group, Experian, Equifax, TransUnion, and Onfido are significant rivals, potentially impacting GBG's pricing power and ability to capture market share.

The intense competition can lead to pressure on GBG's profit margins as companies vie for customers. Furthermore, the need to constantly innovate and differentiate its offerings in a rapidly evolving technological landscape presents an ongoing challenge.

- Intense Competition: GBG operates in a crowded software application industry with many providers of similar identity verification and fraud prevention solutions.

- Key Competitors: Major rivals include Trustpilot Group, Experian, Equifax, TransUnion, and Onfido, all offering comparable services.

- Market Share Challenges: The presence of these strong competitors can create difficulties for GBG in maintaining and expanding its market share.

- Pricing Pressures: A highly competitive environment often results in downward pressure on pricing, potentially affecting GBG's revenue and profitability.

The Americas Identity segment's underperformance presents a significant drag on overall company results, requiring substantial turnaround efforts. Additionally, the fraud segment experienced a 4% decline in FY25 due to a lopsided renewal schedule and slower new client acquisition. High stock valuation and bearish technical indicators could also limit investor enthusiasm and future price appreciation.

What You See Is What You Get

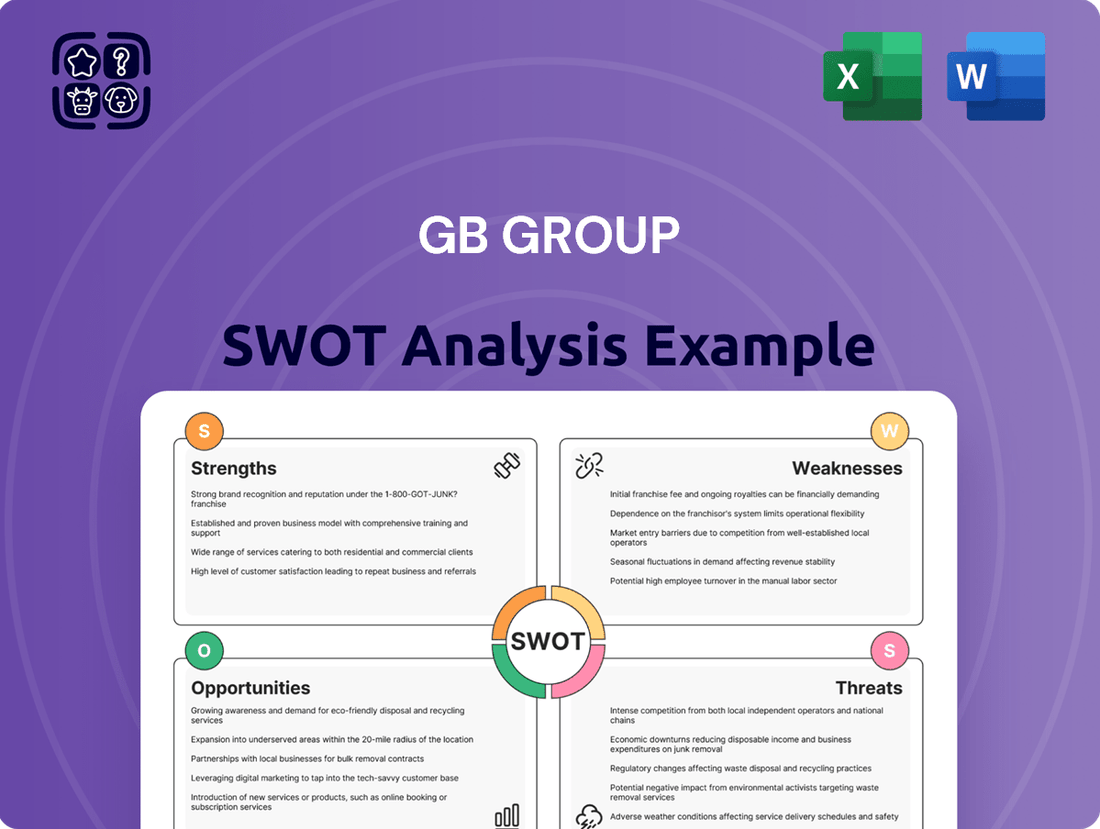

GB Group SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for the GB Group. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after checkout.

Opportunities

The global identity verification market is set for robust expansion, anticipated to reach $15.72 billion by 2025. This growth trajectory indicates a strong demand for secure and reliable identity solutions, a core area for GB Group.

Furthermore, the fraud detection and prevention market is poised for even more dramatic growth, projected to surge from $63.90 billion in 2025 to an impressive $246.16 billion by 2032. This significant market expansion offers substantial opportunities for GB Group to leverage its expertise and capture a larger share.

The increasing integration of artificial intelligence in identity verification (IDV) and fraud prevention presents a significant opportunity for GB Group. As AI-powered biometrics and advanced document verification become the norm, GB Group's commitment to developing these capabilities, exemplified by solutions like GBG Go, positions it favorably to meet the growing market demand.

This trend is driven by the need to counter increasingly sophisticated fraud methods, including deepfakes and synthetic identities. GB Group's continued investment in AI research and development ensures it can offer cutting-edge solutions to protect businesses and consumers.

The global landscape of financial regulations is becoming increasingly stringent. For instance, the Financial Action Task Force (FATF) continues to emphasize robust Anti-Money Laundering (AML) and Know Your Customer (KYC) frameworks. This trend directly fuels the demand for advanced identity verification and fraud prevention technologies, areas where GB Group possesses significant expertise.

GB Group is well-positioned to capitalize on this by helping businesses navigate complex compliance mandates. Their solutions are designed to meet these evolving requirements, offering a critical service to organizations worldwide. This creates a substantial opportunity for growth and market penetration.

Demand for Seamless Customer Experiences

The market is clearly leaning towards solutions that offer robust security without hindering the customer journey. GB Group's strategic push to consolidate its identity services onto the unified GBG Go platform directly addresses this growing need. This integration is designed to streamline customer onboarding and ongoing interactions by enabling instant identity verification and advanced fraud detection, creating the seamless experiences businesses are actively seeking.

This focus on frictionless customer journeys is a significant opportunity for GB Group. For instance, in 2024, businesses reported that improving customer experience was a top priority, with 75% stating it was crucial for customer retention. GBG Go's ability to simplify identity processes while maintaining high security standards positions the company to capture a larger share of this market.

Key aspects of this opportunity include:

- Meeting evolving customer expectations: Consumers increasingly expect quick and easy digital interactions, making identity verification a critical touchpoint.

- Reducing friction in onboarding: A streamlined identity process can significantly lower customer acquisition costs and improve conversion rates.

- Enhancing fraud prevention: By unifying identity data, GB Group can offer more sophisticated, real-time fraud detection capabilities.

- Platform consolidation benefits: Offering a single, integrated platform simplifies management for clients and provides a more cohesive solution.

Strategic Acquisitions and Partnerships

The identity and fraud prevention market remains quite fragmented, presenting a significant opportunity for GB Group to grow through strategic acquisitions. By acquiring companies with complementary technologies or extensive data sets, GBG can bolster its own offerings and extend its presence into new market segments.

For instance, in 2024, the global identity verification market was valued at approximately $15.6 billion and is projected to reach $39.7 billion by 2030, growing at a compound annual growth rate of 17.1%. This expansion highlights the potential for consolidation and the value of acquiring innovative solutions.

Furthermore, forging strategic partnerships, particularly with financial institutions like banks and other technology vendors, can create a more robust ecosystem. These collaborations allow GBG to integrate its solutions more deeply, offering clients more comprehensive and seamless identity verification and fraud prevention services.

- Market Fragmentation: The identity and fraud prevention sector's fragmented nature allows for strategic acquisitions to enhance technology, data, and market reach.

- Market Growth: The global identity verification market's projected growth from $15.6 billion in 2024 to $39.7 billion by 2030 at a 17.1% CAGR underscores acquisition opportunities.

- Ecosystem Enhancement: Partnerships with banks and vendors can expand GBG's ecosystem, leading to more comprehensive and integrated customer solutions.

GB Group is positioned to benefit from the expanding global identity verification market, which was valued at approximately $15.6 billion in 2024 and is projected to reach $39.7 billion by 2030, exhibiting a strong 17.1% CAGR. The company can leverage this growth through strategic acquisitions in the fragmented identity and fraud prevention sector, enhancing its technological capabilities and data assets. Furthermore, forming partnerships with financial institutions and technology vendors will allow GB Group to build a more comprehensive ecosystem, offering integrated solutions and expanding its market reach.

| Market Segment | 2024 Value (USD Billion) | 2030 Projection (USD Billion) | CAGR (%) |

|---|---|---|---|

| Global Identity Verification | 15.6 | 39.7 | 17.1 |

| Fraud Detection & Prevention | 63.90 (2025 Est.) | 246.16 (2032 Est.) | ~20.5 |

Threats

Fraudsters are leveraging advanced AI to craft convincing deepfakes and synthetic identities, escalating the frequency and sophistication of fraudulent activities. This trend poses a significant challenge, demanding ongoing, substantial investment in cutting-edge counter-fraud technology to maintain efficacy.

For instance, in 2023, the global cost of cybercrime, including fraud, reached an estimated $8.44 trillion, a stark indicator of the escalating threat landscape. GB Group must continually adapt its technological defenses to counter these rapidly evolving AI-driven fraud tactics.

GB Group operates in a fiercely competitive identity verification and fraud prevention landscape, facing numerous established companies and emerging disruptors. This crowded market can exert downward pressure on pricing, potentially impacting profit margins and making it harder to grow market share.

The market's saturation means that differentiation is key. For instance, in 2024, the global digital identity solutions market was valued at approximately $30 billion and is projected to grow significantly, indicating both opportunity and intense rivalry for companies like GB Group.

GB Group faces significant threats from the increasing complexity and divergence of regulations across its operating regions. Navigating these intricate compliance landscapes, which can differ substantially from country to country, demands considerable resources and expertise. Failure to adhere to these evolving rules, such as data privacy laws like GDPR or specific financial reporting standards, can result in substantial fines and damage to its brand reputation.

Data Privacy Concerns and Breaches

GB Group, as a custodian of sensitive identity information, is inherently exposed to substantial threats stemming from data privacy concerns and potential security breaches. A significant data breach could trigger severe financial penalties, erode customer confidence, and inflict lasting reputational damage, thereby disrupting core business functions.

The regulatory landscape surrounding data privacy is increasingly stringent. For instance, under GDPR, fines for non-compliance can reach up to 4% of global annual turnover or €20 million, whichever is higher. This underscores the financial gravity of any security lapse. In 2023, the identity verification market continued to see heightened scrutiny, with regulators worldwide imposing stricter data handling protocols. Companies like GB Group must invest heavily in robust cybersecurity measures and compliance frameworks to mitigate these risks.

- Regulatory Fines: Potential penalties under GDPR and similar global regulations can be substantial, impacting profitability.

- Customer Trust Erosion: A breach can severely damage the trust clients place in GB Group's ability to protect their data.

- Reputational Damage: Negative publicity from a security incident can deter new business and alienate existing customers.

- Operational Disruption: Responding to a breach diverts resources and can halt normal business operations.

Economic Downturns and Reduced Business Spending

Economic downturns and heightened uncertainty, such as those stemming from ongoing tariff disputes and geopolitical tensions, pose a significant threat to GB Group. During such periods, businesses often tighten their belts and reduce discretionary spending, which can directly impact demand for identity verification and fraud prevention solutions. This reduced business expenditure could dampen GB Group's revenue growth prospects.

For instance, a global economic slowdown in 2024 or 2025 could see companies delaying or scaling back investments in critical security infrastructure. This cautious approach by clients, driven by macroeconomic uncertainty, directly affects GB Group's financial outlook and the pace of its expansion.

- Reduced Client Budgets: Businesses facing economic headwinds may cut spending on non-essential services, including identity verification.

- Delayed Investment Cycles: Uncertainty can lead to postponed decisions on adopting new fraud prevention technologies.

- Increased Price Sensitivity: Clients may become more price-conscious, seeking lower-cost alternatives or negotiating harder on existing contracts.

- Impact on Growth Projections: A sustained downturn could force GB Group to revise its revenue and profit growth forecasts downwards.

GB Group faces a significant threat from increasingly sophisticated AI-driven fraud. Fraudsters are using advanced techniques like deepfakes and synthetic identities, making detection harder and requiring continuous investment in new technologies. The global cost of cybercrime, including fraud, was estimated at $8.44 trillion in 2023, highlighting the scale of this challenge.

The identity verification market is highly competitive, with many established players and emerging disruptors. This intense rivalry can lead to price pressures, potentially impacting GB Group's profitability and market share growth. The global digital identity solutions market, valued at around $30 billion in 2024, exemplifies this crowded and dynamic environment.

Navigating diverse and evolving global regulations presents a major hurdle. Differences in data privacy laws, like GDPR, and financial reporting standards across regions demand significant resources for compliance. Non-compliance can result in substantial fines, with GDPR penalties potentially reaching 4% of global annual turnover or €20 million.

Data privacy concerns and the risk of security breaches are inherent threats for GB Group. A major breach could lead to severe financial penalties, loss of customer trust, and lasting reputational damage. The heightened scrutiny in the identity verification market in 2023 underscores the need for robust cybersecurity and compliance.

| Threat Category | Specific Risk | Impact on GB Group | Supporting Data/Example |

|---|---|---|---|

| Technological Advancement in Fraud | AI-powered deepfakes and synthetic identities | Increased sophistication of fraud attempts, requiring constant tech upgrades | Global cybercrime cost $8.44 trillion in 2023 |

| Market Competition | Crowded digital identity solutions market | Price pressure, difficulty in gaining market share | Global digital identity market valued at ~$30 billion (2024) |

| Regulatory Complexity | Divergent global data privacy and financial regulations | High compliance costs, risk of substantial fines (e.g., GDPR up to 4% global turnover) | Increased regulatory scrutiny in 2023 |

| Data Security and Privacy | Potential data breaches and privacy violations | Erosion of customer trust, reputational damage, operational disruption | GDPR fines can be up to €20 million |

SWOT Analysis Data Sources

This GB Group SWOT analysis is built upon a foundation of robust data, including their official financial filings, comprehensive market research reports, and expert industry commentary to ensure a well-rounded and insightful assessment.