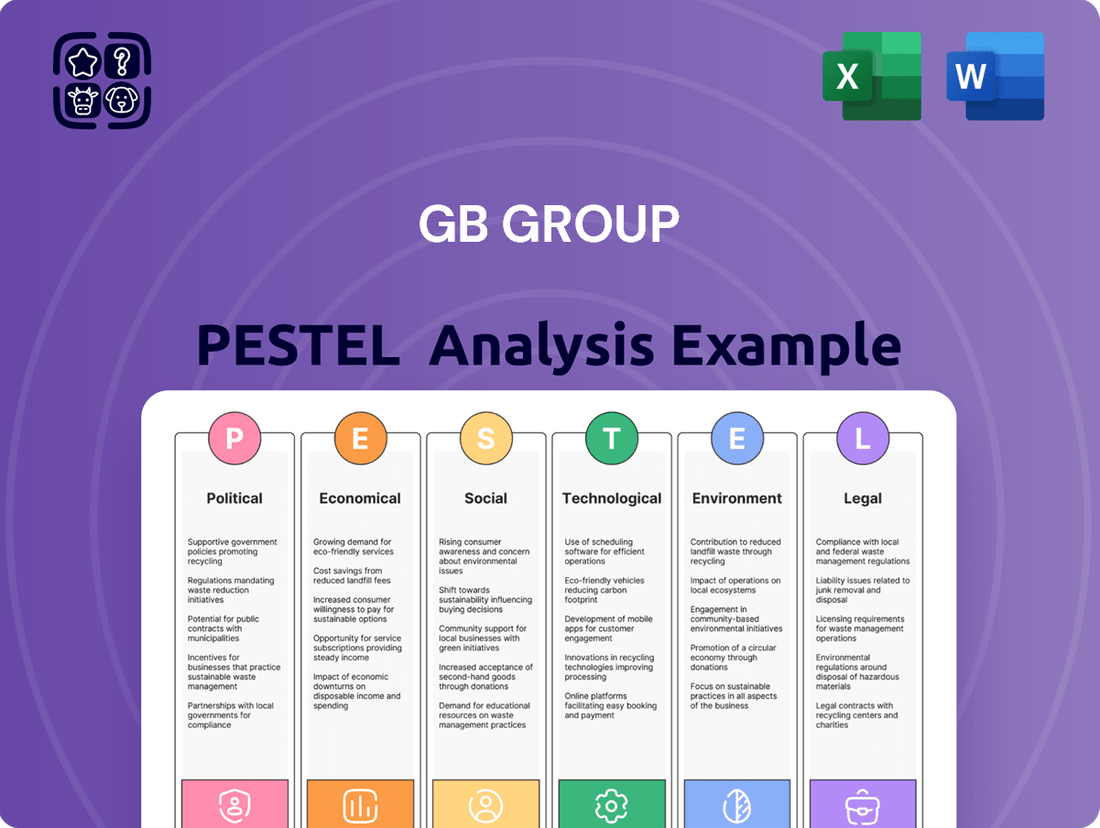

GB Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GB Group Bundle

Unlock critical insights into GB Group's operating environment with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping their future. Equip yourself with actionable intelligence to anticipate market shifts and refine your own strategic approach. Download the full analysis now for a competitive edge.

Political factors

GB Group's operations are significantly shaped by a dynamic regulatory landscape, particularly concerning data privacy and identity verification. For instance, the ongoing evolution of data protection laws, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), necessitates continuous adaptation of their compliance frameworks. Failure to adhere to these evolving standards, including emerging AI regulations expected to impact data handling in 2024 and 2025, poses a direct threat to their business continuity and brand reputation.

GB Group, as a global entity, is significantly influenced by shifts in global political stability and evolving international trade policies. For instance, the ongoing geopolitical tensions in Eastern Europe and the Middle East, which have persisted through 2024 and are projected to continue into 2025, can disrupt supply chains and create market uncertainty. These events directly impact GB Group's operational efficiency and market access in affected regions.

Changes in trade agreements and tariffs, such as potential adjustments to existing trade blocs or the introduction of new protectionist measures by major economies in 2024-2025, could affect the cost of doing business and data flow for GB Group. For example, if a key market implements higher tariffs on digital services, it could increase operational expenses and limit the company's ability to serve clients cost-effectively.

Governments worldwide are significantly increasing their investment in advanced identity verification and fraud prevention technologies to bolster national security and combat terrorism. For instance, the United States' Department of Homeland Security allocated approximately $2.4 billion to cybersecurity initiatives in fiscal year 2024, a portion of which directly supports identity management and border security solutions. This trend presents a substantial opportunity for GB Group, as its expertise in identity verification aligns directly with these critical public safety needs.

GB Group can leverage this evolving landscape by forging strategic partnerships with government agencies, offering its robust identity solutions to enhance public safety and counter threats. The global market for identity and access management is projected to reach $117.2 billion by 2027, according to Statista, indicating a strong demand for the services GB Group provides in this crucial sector.

Government Investment in Digital Infrastructure

Governments worldwide are significantly increasing their investments in digital infrastructure, recognizing its critical role in economic growth and citizen services. For instance, the United States' Bipartisan Infrastructure Law, enacted in 2021, allocated $65 billion for broadband expansion, aiming to connect millions of households and businesses. This push creates fertile ground for companies like GB Group, which can leverage these developments.

Digital identity initiatives, such as the proposed national digital ID system in the UK, represent a substantial opportunity. These systems require robust identity verification and management solutions, areas where GB Group's expertise is directly applicable. Such government-led projects often involve substantial funding, with many countries earmarking billions for digital transformation projects through 2025 and beyond.

- New Market Creation: Government investment in digital public services and national digital identity frameworks opens up new revenue streams and partnership opportunities for GB Group.

- Enhanced Digital Ecosystems: Improvements in national digital infrastructure, including broadband and secure online platforms, directly benefit businesses operating within the digital realm, such as GB Group.

- Regulatory Alignment: Government focus on digital identity and data security can lead to clearer regulatory landscapes, simplifying compliance and fostering trust for GB Group's services.

Regulatory Scrutiny of AI and Data Use

GB Group faces increasing regulatory scrutiny regarding the ethical use of AI and vast datasets, especially concerning sensitive information like identity verification. This trend, evident across global markets, requires companies to be exceptionally transparent and responsible in their data practices to avoid significant penalties and maintain customer trust. For instance, the European Union's AI Act, expected to fully come into effect in 2025, categorizes AI systems based on risk, with high-risk applications facing stringent compliance requirements, potentially impacting GB Group's AI-driven solutions.

Navigating this complex regulatory landscape presents both hurdles and avenues for growth. GB Group must proactively showcase its commitment to responsible AI deployment and robust data governance to build and sustain confidence among its clients and end-users. Failure to comply could lead to substantial fines, as seen with GDPR violations, which can reach up to 4% of global annual turnover.

- Increased Compliance Costs: Adapting AI and data handling processes to meet evolving regulations, such as those stemming from the EU AI Act and similar initiatives in the UK and US, will necessitate investment in compliance infrastructure and expertise.

- Reputational Risk: Non-compliance or perceived unethical data usage can severely damage GB Group's reputation, impacting customer acquisition and retention.

- Opportunity for Differentiation: Demonstrating superior data ethics and responsible AI practices can serve as a key competitive differentiator, attracting clients who prioritize trust and compliance.

Government initiatives to bolster national security and combat fraud are driving demand for advanced identity verification solutions. For example, the US Department of Homeland Security's 2024 cybersecurity budget included significant funding for identity management. This trend directly benefits GB Group, positioning its expertise in identity verification as crucial for public safety and critical infrastructure protection.

The global push for digital transformation, including national digital identity frameworks, creates substantial opportunities for GB Group. Countries are investing billions through 2025 in digital infrastructure and identity systems, requiring robust verification services. GB Group's alignment with these government priorities, such as the UK's proposed national digital ID, offers significant growth potential and new revenue streams.

| Government Focus Area | Impact on GB Group | Example/Data Point |

|---|---|---|

| National Security & Fraud Prevention | Increased demand for identity verification | US DHS cybersecurity budget 2024 |

| Digital Infrastructure Investment | New market creation and partnerships | Global digital transformation projects through 2025 |

| Digital Identity Initiatives | Leveraging expertise in identity management | UK's proposed national digital ID system |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing GB Group, providing a comprehensive understanding of the external forces shaping its operational landscape and strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

GB Group is well-positioned to capitalize on the accelerating global digitalization trend. This surge in online activity directly fuels the demand for their core services in identity verification and secure transactions. For instance, the global digital identity solutions market was valued at approximately $27.4 billion in 2023 and is projected to reach $85.7 billion by 2030, exhibiting a compound annual growth rate of 17.7% during this period.

Economic expansion, especially within burgeoning digital-first industries, translates into increased revenue streams for GB Group. As more businesses and consumers engage in online commerce and digital services, the need for robust identity and fraud prevention solutions becomes paramount. The World Bank forecasts global GDP growth to be 2.4% in 2024 and 2.7% in 2025, indicating a generally supportive economic environment for technology-driven businesses like GB Group.

The global economic impact of fraud and cybercrime is substantial, creating a strong market driver for GB Group's offerings. In 2023, the estimated cost of cybercrime worldwide reached a staggering $10.5 trillion annually, a figure projected to climb to $13.82 trillion by 2028. This escalating financial threat underscores the critical need for businesses and governments to invest in advanced fraud detection and prevention technologies, directly benefiting companies like GB Group.

Rising inflation in 2024 and 2025 directly affects GB Group's operational expenses. Increased costs for cloud services, software licenses, and hardware upgrades, driven by global supply chain issues and higher energy prices, can significantly impact the technology infrastructure budget. For instance, the average cost of cloud computing services saw an estimated increase of 5-10% in late 2024 due to these pressures.

Talent acquisition and retention also become more expensive amidst inflationary periods. As the cost of living rises, employees expect higher salaries and better benefits, putting upward pressure on GB Group's human resources expenditure. Reports from early 2025 indicate that salary inflation in the tech sector averaged around 6-8% year-over-year, making it a key challenge for companies like GB Group to manage.

Balancing these escalating operational costs with the need to maintain competitive pricing for GB Group's software and data services is a critical strategic imperative. Failure to manage this delicate act could erode profit margins, especially if competitors are more adept at absorbing or passing on these increased expenses to their customer base.

Currency Fluctuations

As a global entity, GB Group's financial performance is inherently sensitive to currency fluctuations. Changes in exchange rates can significantly impact the reported value of its international revenues and profits when converted back to its reporting currency. For instance, a strengthening pound sterling against currencies where GB Group generates substantial revenue could lead to lower reported earnings, even if underlying operational performance remains robust.

Strategic financial management is crucial for GB Group to navigate these currency risks. This often involves hedging strategies, such as forward contracts or options, to lock in exchange rates for future transactions. Effective management can cushion the impact of adverse currency movements and provide greater stability in financial reporting.

Recent data highlights the volatility in major currency pairs relevant to global businesses. For example, throughout 2024 and into early 2025, the GBP/USD exchange rate experienced notable swings, influenced by economic indicators from both the UK and the US, as well as global geopolitical events. Similarly, fluctuations against the Euro and other key trading currencies can present ongoing challenges and opportunities for companies like GB Group.

- Impact on Revenue: A stronger GBP can decrease the value of foreign earnings when translated back, potentially lowering reported revenue figures for GB Group.

- Profitability Concerns: Currency mismatches between costs and revenues in different regions can directly affect GB Group's net profit margins.

- Hedging Strategies: GB Group likely employs financial instruments to mitigate currency risk, aiming to stabilize its financial outcomes against exchange rate volatility.

- 2024/2025 Volatility: Exchange rate movements in 2024 and early 2025, particularly involving GBP, USD, and EUR, have presented significant challenges and required proactive financial management for multinational corporations.

Investment in Digital Transformation by Businesses

Businesses are significantly ramping up their digital transformation efforts, with a strong focus on improving customer onboarding, bolstering risk management, and ensuring robust regulatory compliance. This trend directly fuels the demand for specialized identity verification and fraud prevention solutions, areas where GB Group excels.

For instance, in 2024, global spending on digital transformation was projected to reach $2.3 trillion, a substantial increase from previous years, indicating a clear market appetite for the services GB Group provides. This investment surge is driven by the need to create seamless digital experiences while mitigating evolving fraud threats.

- Increased Digital Adoption: Companies are prioritizing digital channels for customer interaction, necessitating advanced identity solutions.

- Enhanced Compliance Needs: Stricter regulations worldwide require sophisticated tools for Know Your Customer (KYC) and Anti-Money Laundering (AML) processes.

- Fraud Prevention Focus: The rise in sophisticated online fraud schemes compels businesses to invest heavily in protective technologies.

- Market Growth: The identity verification market alone is expected to grow significantly, with some projections suggesting it could reach over $30 billion by 2027.

Economic factors present a dual-edged sword for GB Group. While global digitalization and economic growth in digital-first industries create significant demand for their identity verification and fraud prevention services, rising inflation impacts operational costs and talent acquisition expenses. Furthermore, currency fluctuations introduce volatility into reported earnings, necessitating strategic financial management.

| Economic Factor | Impact on GB Group | Supporting Data (2023-2025) |

|---|---|---|

| Digitalization Growth | Increased demand for identity and fraud prevention solutions. | Global digital identity solutions market valued at $27.4B in 2023, projected to reach $85.7B by 2030 (17.7% CAGR). |

| Global Economic Growth | Supportive environment for technology-driven businesses. | Global GDP growth forecast at 2.4% for 2024 and 2.7% for 2025 (World Bank). |

| Fraud & Cybercrime Costs | Strong market driver for GB Group's offerings. | Estimated global cost of cybercrime at $10.5 trillion annually in 2023, projected to reach $13.82 trillion by 2028. |

| Inflation | Increased operational expenses (cloud, software, hardware) and talent acquisition costs. | Estimated 5-10% increase in cloud computing services costs (late 2024); 6-8% average salary inflation in tech sector (early 2025). |

| Currency Fluctuations | Impact on reported value of international revenues and profits. | Notable swings in GBP/USD exchange rate throughout 2024 and into early 2025. |

Preview Before You Purchase

GB Group PESTLE Analysis

The preview you see here is the exact GB Group PESTLE analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, showcasing the comprehensive PESTLE analysis for GB Group, delivered exactly as shown, no surprises.

The content and structure shown in this preview is the same GB Group PESTLE analysis document you’ll download after payment, providing actionable insights.

Sociological factors

Consumers are increasingly comfortable using digital channels for essential services like banking, shopping, and interacting with government agencies. This growing reliance on online platforms fuels the demand for robust digital identity verification solutions, directly expanding the market opportunities for companies like GB Group.

For instance, in 2024, a significant portion of global retail sales, estimated to be over $6.3 trillion, occurred online, highlighting the pervasive nature of digital transactions. This trend necessitates secure methods to confirm user identities, benefiting GB Group's identity verification services.

Public concerns regarding data breaches and privacy violations are paramount. For companies like GB Group, this means investing heavily in robust security measures and being transparent about how customer data is handled to maintain consumer trust. For instance, a 2023 report indicated that 76% of consumers are concerned about how companies use their personal data, a figure that continues to influence corporate strategy.

Heightened public awareness regarding online fraud and identity theft is a significant sociological trend. This growing concern directly fuels demand for robust security measures, benefiting companies like GB Group that offer sophisticated fraud prevention solutions. For instance, a 2024 report indicated a 15% year-over-year increase in reported identity theft incidents, underscoring the urgency for better protection.

Demand for Seamless User Experience

Consumers today demand incredibly smooth and fast online interactions. Even when robust security is a must, people expect it to be almost invisible. This means GB Group has a significant challenge: making identity verification, which is crucial for their services, feel effortless rather than like a roadblock.

Failing to meet this expectation can directly impact GB Group's market position. For instance, in 2024, reports indicated that over 60% of consumers would abandon a transaction if the checkout process was too complicated. This highlights the direct link between user experience and conversion rates in the digital realm.

- Frictionless Identity Verification: Consumers expect quick and seamless online experiences, even with security measures.

- Balancing Security and Usability: GB Group must integrate stringent identity checks without compromising the user journey.

- Impact on Conversion Rates: A poor user experience can lead to significant customer drop-off, as seen in 2024 consumer behavior data.

- Competitive Advantage: Offering an intuitive and secure process is key to staying ahead in the digital identity market.

Demographic Shifts and Digital Inclusion

Demographic shifts, like the growing aging population in many developed nations, create a demand for accessible and user-friendly digital solutions. GB Group can leverage this by developing platforms and services that cater to the specific needs of older adults, enhancing their digital inclusion. For instance, by 2024, over 20% of the population in the EU is projected to be over 65, a significant market segment.

Simultaneously, increasing digital inclusion in emerging markets presents substantial growth opportunities. As more individuals gain internet access and smartphone penetration rises globally, GB Group can expand its reach. By the end of 2024, it's estimated that over 5 billion people worldwide will be active internet users, a number expected to climb further.

- Aging Population: Growing demand for user-friendly digital services, particularly in developed economies.

- Digital Inclusion Growth: Expanding internet and smartphone access in emerging markets opens new customer bases.

- Tailored Solutions: Opportunity for GB Group to adapt offerings to diverse demographic needs and preferences.

Sociological factors significantly shape the demand for GB Group's services. Consumers' increasing comfort with digital interactions, evidenced by over $6.3 trillion in global online retail sales in 2024, drives the need for secure identity verification. Public apprehension about data privacy, with 76% of consumers concerned about data usage in 2023, necessitates robust security and transparency from companies like GB Group.

The rising awareness of online fraud and identity theft, highlighted by a 15% year-over-year increase in reported incidents in 2024, directly boosts the market for fraud prevention solutions. Furthermore, the expectation of seamless digital experiences means GB Group must balance stringent security with user-friendliness to avoid transaction abandonment, a concern for over 60% of consumers in 2024.

Demographic shifts, such as the growing aging population in developed nations (over 20% of the EU population by 2024) and increasing digital inclusion in emerging markets (over 5 billion global internet users by 2024), present both challenges and opportunities for GB Group to tailor its offerings.

| Sociological Trend | Impact on GB Group | Supporting Data (2023-2024) |

|---|---|---|

| Digital Adoption | Increased demand for digital identity verification | $6.3T+ global online retail sales (2024) |

| Privacy Concerns | Need for robust security and data transparency | 76% of consumers concerned about data usage (2023) |

| Fraud Awareness | Growth in demand for fraud prevention solutions | 15% YoY increase in identity theft reports (2024) |

| User Experience Expectations | Requirement for frictionless, secure processes | 60%+ consumers abandon complex transactions (2024) |

| Demographic Shifts | Opportunities for tailored, accessible digital solutions | 20%+ EU population over 65 (2024); 5B+ global internet users (2024) |

Technological factors

GB Group's reliance on AI and machine learning is significant, as these technologies underpin its identity verification and fraud detection services. The company is actively developing solutions to counter emerging threats like AI-generated deepfakes and synthetic identities, areas where advancements are rapid. For instance, in 2024, the global AI market was projected to reach over $200 billion, highlighting the scale of investment and innovation in this field, directly impacting GB Group's operational capabilities and competitive edge.

GB Group is well-positioned to leverage the growing trend of biometric technology integration. The increasing adoption of facial recognition and fingerprint scanning for identity verification offers a significant opportunity to embed these advanced security features into GB Group's identity verification and fraud prevention solutions. This integration can dramatically enhance user experience by streamlining access and onboarding processes, making them faster and more intuitive.

The global biometric market is projected for substantial growth, with estimates suggesting it could reach over $100 billion by 2027, highlighting the immense potential for companies like GB Group. For instance, by 2024, it's anticipated that over 2.5 billion people will be using biometric authentication on their mobile devices, demonstrating widespread consumer acceptance and familiarity with these technologies.

The rise of blockchain and decentralized identity, often called Self-Sovereign Identity (SSI), presents a significant technological shift. These models allow individuals to have greater control over their digital personas, moving away from centralized data silos. This can foster enhanced privacy and security in how personal information is managed and shared.

For GB Group, exploring the integration of blockchain and SSI technologies could be a strategic move. By leveraging these advancements, GB Group might be able to offer more robust identity verification solutions that build greater user trust. Imagine a future where users can securely share verified credentials without compromising their personal data, a key differentiator in the evolving digital landscape.

The global decentralized identity market is projected for substantial growth, with some analysts predicting it could reach billions of dollars in the coming years. For instance, reports in late 2024 and early 2025 highlighted increasing investment in SSI solutions, indicating a strong market appetite for user-centric identity management. This trend suggests a ripe opportunity for companies like GB Group to innovate and capture market share.

Cloud Computing and Scalability

GB Group's adoption of cloud computing is a significant technological enabler, allowing them to deliver identity verification and fraud prevention services with remarkable scalability. This means they can effortlessly adjust their capacity to meet fluctuating client demands, whether it's a surge in user registrations or a peak in transaction volumes. For instance, in the fiscal year ending March 31, 2024, GB Group reported a 10% increase in revenue, partly driven by the ability to onboard and serve a growing international customer base efficiently, a feat heavily reliant on their cloud infrastructure.

This cloud-native approach ensures high availability and robust performance for their global clients. Businesses relying on GB Group's solutions can therefore expect consistent service delivery, minimizing downtime and maintaining operational continuity. The flexibility inherent in cloud platforms also allows for rapid deployment of new features and updates, keeping GB Group at the forefront of technological innovation in the identity and fraud prevention space.

Key benefits realized through cloud adoption include:

- Enhanced Scalability: Ability to handle millions of identity checks daily without performance degradation.

- Global Reach: Seamless service delivery across diverse geographical regions.

- Cost Efficiency: Optimized resource utilization and reduced infrastructure overhead.

- Agility and Innovation: Faster time-to-market for new product offerings and service enhancements.

Cybersecurity Threats and Counter-Technologies

The escalating sophistication of cyber threats, particularly those leveraging AI for fraud, demands constant technological advancement from GB Group. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, highlighting the immense financial stakes involved. GB Group must therefore invest in and deploy cutting-edge counter-technologies to safeguard its own operations and, crucially, the sensitive data entrusted to it by its customers.

This ongoing arms race requires a proactive approach to cybersecurity. For instance, advancements in machine learning for anomaly detection and behavioral analysis are becoming critical. The increasing prevalence of ransomware attacks, which saw a 72% increase in reported incidents in 2023 according to some industry reports, underscores the need for robust data backup and recovery solutions.

- AI-Powered Fraud: Sophisticated AI can generate highly convincing phishing attempts and deepfake scams, requiring equally advanced AI-driven defense mechanisms.

- Ransomware Evolution: Attacks are becoming more targeted and disruptive, necessitating advanced endpoint detection and response (EDR) solutions.

- Data Breach Costs: The average cost of a data breach in 2024 is estimated to be over $4.7 million, emphasizing the financial imperative for strong security.

- Zero Trust Architecture: Implementing a zero trust model, which verifies every access request, is crucial for mitigating internal and external threats.

GB Group's technological strategy heavily relies on AI and machine learning for its core identity verification and fraud detection services. The company is actively developing defenses against AI-generated threats like deepfakes, a critical area given the projected over $200 billion global AI market in 2024.

The integration of biometric technologies, such as facial recognition, presents a significant growth opportunity for GB Group, aligning with the projected over $100 billion global biometric market by 2027. By 2024, over 2.5 billion individuals were expected to use mobile biometric authentication, indicating strong consumer adoption.

Emerging technologies like blockchain and Self-Sovereign Identity (SSI) offer GB Group a path towards enhanced privacy and user control in digital identity management. The increasing investment in SSI solutions in late 2024 and early 2025 signals a growing market demand for these user-centric approaches.

GB Group's cloud computing infrastructure is vital for its scalable service delivery, supporting its reported 10% revenue increase in the fiscal year ending March 31, 2024. This cloud-native approach ensures global reach, cost efficiency, and agility, crucial for staying ahead in the competitive identity solutions market.

Legal factors

GB Group navigates a stringent global landscape of data protection laws, including the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Failure to comply can result in substantial fines, with GDPR penalties reaching up to 4% of global annual turnover or €20 million, whichever is greater. The impending EU AI Act further complicates this, introducing new requirements for AI systems that process personal data, impacting GB Group's technology development and data handling practices.

Financial institutions and other regulated sectors face rigorous Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. This regulatory landscape directly fuels the demand for GB Group's identity verification and fraud prevention services, as businesses strive to maintain compliance and avoid hefty penalties.

In 2024, the global financial crime compliance market, which includes AML and KYC solutions, was valued at approximately $35 billion, with projections indicating continued growth. GB Group's expertise in this area positions them to capitalize on this expanding market, offering essential tools for customer onboarding and ongoing monitoring.

The increasing complexity of financial crime and evolving regulatory frameworks, such as those updated in late 2024 by the Financial Action Task Force (FATF), necessitate sophisticated solutions. GB Group's ability to adapt and provide cutting-edge identity verification technology is crucial for clients navigating these challenges.

Increasing regulations around age verification for online services, especially in sectors like gaming and e-commerce, are creating a significant growth opportunity for GB Group's identity verification solutions. For instance, the UK's Gambling Act 2005 (and subsequent amendments) and similar legislation globally mandate robust age checks. This trend is expected to accelerate as governments worldwide prioritize online safety for minors.

Consumer Rights and Data Portability

Consumer rights are increasingly robust, demanding that companies like GB Group actively enable individuals to access, modify, and transfer their personal data. This necessitates developing technologies that not only comply with these evolving regulations but also ensure data security and privacy throughout the process. For instance, the General Data Protection Regulation (GDPR) in Europe, implemented in 2018, has set a precedent for data portability, impacting how businesses manage customer information globally.

GB Group must therefore invest in solutions that streamline data access and portability, a critical aspect given the growing consumer awareness of data ownership. As of early 2024, reports indicate a significant rise in data subject access requests (DSARs), underscoring the need for efficient management systems. This trend is expected to continue, making compliance a competitive advantage.

- Growing Data Subject Access Requests: Expect a continued increase in consumer requests for data access and deletion, driven by privacy awareness.

- Data Portability Mandates: Regulations worldwide are reinforcing the right of consumers to move their data between service providers.

- Security and Compliance Focus: GB Group's solutions must prioritize secure data handling to meet stringent regulatory requirements.

- Reputational Impact: Effective management of consumer data rights directly influences brand trust and customer loyalty.

International Legal Frameworks for Digital Identity

GB Group's global expansion will be significantly influenced by evolving international legal frameworks for digital identity. As more countries adopt digital identity solutions, the need for harmonized standards becomes critical. This harmonization could simplify GB Group's cross-border data verification processes, potentially reducing compliance costs and accelerating market entry. For instance, the European Union's eIDAS regulation, which sets standards for electronic identification and trust services, provides a precedent for such harmonization. GB Group's ability to navigate and adapt to these developing international legal landscapes will be key to its sustained global growth.

The push for global interoperability in digital identity systems presents both opportunities and challenges for GB Group. While a unified approach could streamline operations and enhance user experience across different regions, it also necessitates a proactive stance on adapting to potentially diverse regulatory requirements. For example, the United Nations Centre for Trade Facilitation and Electronic Business (UN/CEFACT) is working on standards for digital trade documents, which often rely on verified digital identities. GB Group must remain agile to integrate with these emerging global standards, ensuring its solutions remain compliant and competitive in a connected digital economy. As of early 2024, discussions around the World Trade Organization's Trade Facilitation Agreement are increasingly incorporating digital identity elements, highlighting this trend.

Key international legal factors impacting GB Group's digital identity strategy include:

- Global Data Protection Standards: Adherence to frameworks like the GDPR, which has influenced similar legislation worldwide, impacting how GB Group handles personal data for identity verification.

- Cross-Border Data Flow Regulations: Navigating differing national laws on transferring and processing identity data internationally, a crucial aspect for GB Group's multinational clients.

- Emerging Digital Identity Frameworks: Monitoring and adapting to new international standards and best practices for secure and verifiable digital identities, such as those being developed by ISO.

- Cybersecurity and Privacy Treaties: Understanding and complying with international agreements related to cybersecurity and the protection of digital personal information.

GB Group operates within a complex web of global data protection laws, with the GDPR and CCPA being prime examples, carrying penalties up to 4% of global annual turnover or €20 million for non-compliance. The upcoming EU AI Act will introduce new mandates for AI systems processing personal data, directly affecting GB Group's technological development and data handling. The increasing demand for robust Anti-Money Laundering (AML) and Know Your Customer (KYC) solutions, driven by stringent financial regulations, creates significant opportunities for GB Group's identity verification services. The global financial crime compliance market was valued at approximately $35 billion in 2024, with continued growth projected, positioning GB Group to capitalize on this expansion.

Environmental factors

GB Group, as a technology firm, faces substantial energy demands from its data centers, a critical component of its operations. In 2024, the global IT sector's energy consumption is projected to account for a significant portion of worldwide electricity usage, highlighting the scale of this challenge.

Addressing this environmental impact is paramount for GB Group's Environmental, Social, and Governance (ESG) targets. Initiatives like investing in energy-efficient hardware and exploring renewable energy procurement are key strategies for reducing their carbon footprint, with many tech companies aiming for 100% renewable energy by 2030.

GB Group is increasingly focused on ensuring its supply chain partners uphold environmental responsibility, particularly concerning hardware sourcing and energy consumption. This commitment is becoming a significant factor in supplier selection and ongoing partnerships.

By 2024, over 60% of major technology companies had publicly committed to reducing their supply chain's carbon footprint, a trend GB Group is aligning with to foster a more sustainable ecosystem.

This focus on sustainable supply chain management not only addresses environmental concerns but also mitigates risks associated with regulatory changes and enhances GB Group's brand reputation among environmentally conscious stakeholders.

Clients, especially those prioritizing Environmental, Social, and Governance (ESG) principles, are increasingly seeking identity and fraud prevention solutions from vendors with demonstrable environmental commitments. This trend is becoming a significant competitive advantage in the market.

For instance, a 2024 survey by Accenture found that 60% of consumers are more likely to buy from companies with strong sustainability practices. This translates directly to the B2B sector, where corporate clients are integrating ESG into their procurement decisions, potentially favoring GB Group if it showcases robust green initiatives.

Reporting and Transparency Requirements for ESG

GB Group faces increasing demands for detailed Environmental, Social, and Governance (ESG) reporting. Stakeholders, including investors and regulators, expect clear disclosure of environmental performance, such as carbon footprint and resource management. This trend is intensifying, with new regulations coming into effect globally.

For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD) requires many companies, including those operating within the EU, to report on sustainability matters starting from the 2024 financial year. This means GB Group needs robust systems to track and report metrics like Scope 1, 2, and 3 greenhouse gas emissions. The pressure extends to supply chain transparency, pushing companies to disclose environmental impacts beyond their direct operations.

- Increased Regulatory Scrutiny: Global regulations, like the CSRD, mandate detailed ESG disclosures, impacting companies like GB Group.

- Stakeholder Expectations: Investors and customers are increasingly prioritizing companies with transparent and strong ESG performance.

- Data Accuracy is Crucial: GB Group must accurately measure and report environmental data, such as carbon emissions, to meet these requirements.

- Resource Consumption Disclosure: Transparency regarding water usage, waste generation, and energy consumption is becoming a standard expectation.

Adaptation to Climate Change Risks

GB Group, like many businesses, faces indirect environmental impacts from climate change. Extreme weather events, such as severe storms or heatwaves, could disrupt operations, particularly for data centers which require stable environments. This necessitates robust infrastructure planning to ensure business continuity.

The increasing frequency of such events globally underscores the need for proactive adaptation strategies. For instance, the World Meteorological Organization reported in early 2024 that 2023 was the warmest year on record, with numerous extreme weather incidents contributing to significant economic losses. GB Group's resilience planning should account for potential disruptions to supply chains or physical assets.

- Infrastructure Resilience: Investing in climate-resilient data center designs and backup power solutions.

- Supply Chain Diversification: Assessing and mitigating risks associated with climate-vulnerable suppliers.

- Business Continuity Planning: Developing comprehensive plans to address potential disruptions from extreme weather.

- Insurance Coverage: Ensuring adequate insurance to cover potential damages and business interruption losses.

GB Group's operations, particularly its data centers, have significant energy demands, with the IT sector's global energy consumption a growing concern in 2024. To meet ESG targets, the company is investing in energy-efficient hardware and renewable energy sources, aligning with industry trends where many tech firms aim for 100% renewable energy by 2030.

The company is also scrutinizing its supply chain for environmental responsibility, a key factor in supplier selection as over 60% of major tech firms committed to reducing their supply chain carbon footprint by 2024. This focus enhances brand reputation and mitigates regulatory risks.

Increased stakeholder demand for ESG reporting, driven by regulations like the EU's CSRD effective from the 2024 financial year, requires GB Group to accurately track and disclose environmental data, including greenhouse gas emissions.

GB Group must also prepare for climate change impacts, such as extreme weather events disrupting operations, necessitating investments in resilient infrastructure and robust business continuity plans, especially considering 2023 was the warmest year on record according to the WMO.

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a comprehensive blend of public and proprietary data, drawing from official government statistics, reputable market research firms, and leading economic indicators. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in current, verifiable information relevant to your industry.