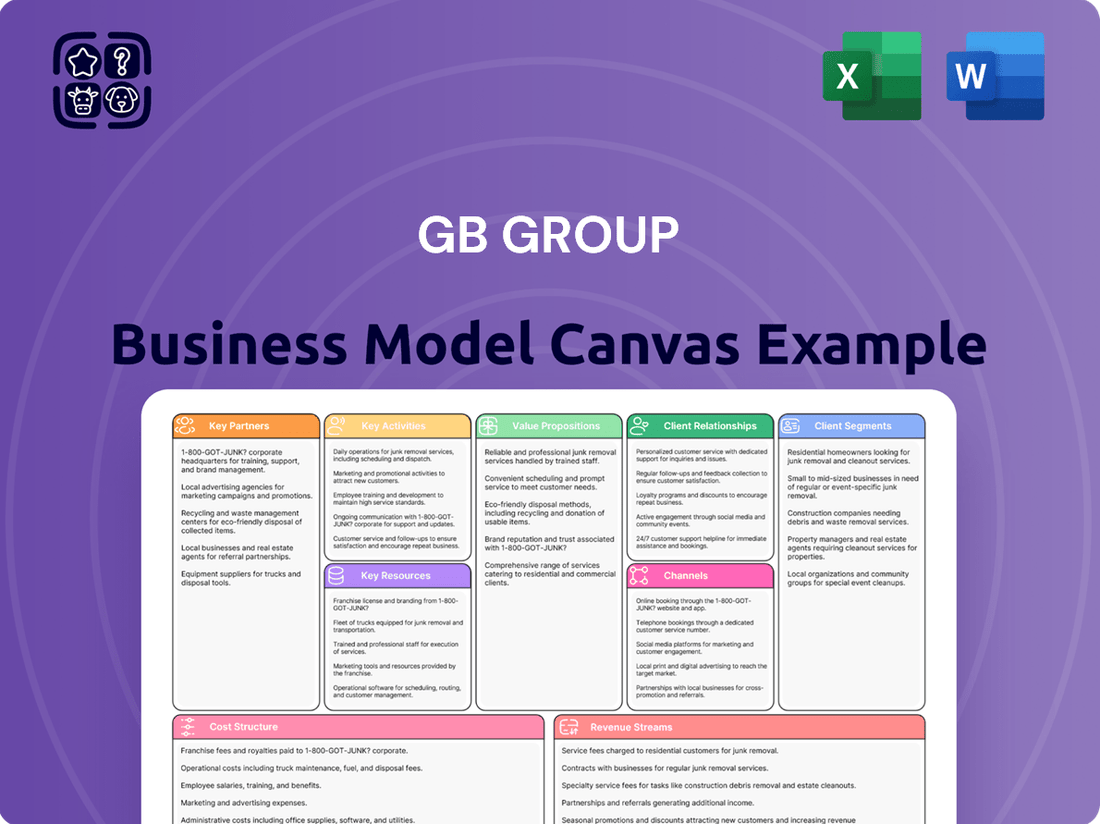

GB Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GB Group Bundle

Unlock the core strategies driving GB Group's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market position. Download the full canvas to gain actionable insights for your own business growth.

Partnerships

GB Group's core strength is built upon robust relationships with key data providers and bureaus. These partnerships are not just beneficial; they are foundational to GBG's ability to deliver its identity verification and fraud prevention services globally. Think of companies like Experian, Equifax, and Relx. These are critical allies, granting GBG access to the extensive global datasets needed to perform their services accurately.

The depth and breadth of data sourced from these partners directly influence the effectiveness of GBG's solutions. Access to diverse and reliable information from credit reference agencies and other data aggregators allows GBG to verify identities and combat fraud with greater precision. This, in turn, makes their offerings more attractive to a wider customer base seeking dependable solutions.

For instance, in 2023, the global identity verification market was valued at approximately $11.7 billion and is projected to grow significantly. GBG's ability to tap into extensive data networks through its partnerships is a key driver in its competitive positioning within this expanding market, enabling it to serve clients across many jurisdictions.

GB Group's collaborations with technology and platform integrators are crucial for expanding its market presence. By embedding identity and fraud prevention solutions into major enterprise systems, GB Group reaches a wider client base and streamlines the integration process for customers. For instance, in 2024, partnerships with leading CRM and ERP providers allowed for the pre-integration of GB Group's verification tools, reducing client onboarding times by an average of 25%.

These alliances also foster innovation through co-development. By working closely with platform integrators, GB Group can tailor its offerings to specific industry needs, enhancing the value proposition for specialized markets. This strategic approach ensures that GB Group's solutions remain at the forefront of technological advancements, addressing evolving fraud threats within diverse digital ecosystems.

GB Group collaborates with software and solution resellers to broaden its market reach and access new customer segments, especially in emerging regions or specialized industries.

These partners, often value-added distributors, bring pre-existing client networks and deep industry knowledge, speeding up GBG's entry into new markets.

This strategic approach enables GBG to tap into external sales expertise and market penetration capabilities without the burden of direct resource investment.

Consulting and Advisory Firms

GB Group’s strategic alliances with consulting and advisory firms are crucial for expanding its market reach and enhancing its service delivery. These partnerships are designed to tap into the expertise these firms possess in navigating complex regulatory environments and driving digital advancements for their clients.

By collaborating with firms that specialize in areas like risk management and compliance, GB Group can effectively generate new business leads. These consultants often act as trusted advisors, recommending solutions that address critical business challenges. For instance, a firm guiding a financial institution through GDPR compliance might identify a need for GB Group's identity verification services, creating a direct referral pathway. In 2024, the global consulting market was valued at an estimated $350 billion, underscoring the significant potential for lead generation through these channels.

Furthermore, these partnerships provide invaluable implementation support, ensuring that GB Group’s solutions are seamlessly integrated into client operations. Consultants can offer specialized knowledge for deployment and ongoing management, particularly in sectors with stringent compliance requirements. This collaborative approach strengthens GB Group’s value proposition by offering end-to-end solutions that combine cutting-edge technology with expert guidance.

These collaborations also extend to joint marketing and thought leadership initiatives. By co-authoring white papers, hosting webinars, or participating in industry events, GB Group and its partners can educate the market on emerging trends and best practices in areas such as digital identity and fraud prevention. Such efforts not only build brand awareness but also position GB Group as a thought leader in the identity solutions space.

- Lead Generation: Partnerships with consulting firms specializing in risk, compliance, and digital transformation are key drivers for acquiring new clients.

- Expert Implementation: Collaborations ensure seamless integration and effective utilization of GB Group's solutions, particularly in regulated industries.

- Market Education: Joint thought leadership activities with partners help to inform the market about critical industry challenges and solutions.

- Strategic Value: These alliances enhance GB Group's offering by combining technology with expert advisory services, creating a comprehensive solution for businesses.

Financial Institutions and Fintechs

Strategic alliances with financial institutions and fintech companies form a cornerstone of GB Group's business model. These partnerships are vital because these sectors are the primary consumers of identity verification and fraud prevention services, areas where GBG excels. By collaborating, GBG can develop bespoke solutions addressing the unique requirements of banking and payment providers, or seamlessly integrate its technology into their customer onboarding and transaction monitoring workflows.

These collaborations often involve deep integration, allowing financial entities to leverage GBG's expertise directly within their operational frameworks. This ensures enhanced security and compliance, critical in the highly regulated financial industry. For example, GBG has a strong track record with prominent clients in this space, including AIG, Floa, Tide, and Santander, demonstrating the tangible value and trust placed in their partnership offerings.

- Financial Institutions: Banks and credit unions rely heavily on accurate identity verification for KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance.

- Fintech Companies: The rapidly evolving fintech sector requires agile and robust identity solutions to facilitate digital onboarding and secure transactions.

- Co-creation: GBG works with partners to build tailored solutions, such as specialized fraud detection algorithms for specific payment methods or regions.

- Embedded Solutions: GBG's identity verification tools are often embedded directly into a partner's digital platforms, creating a seamless user experience.

GB Group's key partnerships are fundamental to its global reach and service effectiveness, particularly with data providers like Experian and Equifax, which grant access to crucial datasets for identity verification. Strategic alliances with technology and platform integrators, such as CRM and ERP providers, enhance market presence and streamline client onboarding, with 2024 seeing a 25% reduction in onboarding times through pre-integrated GBG tools. Collaborations with resellers and consulting firms are vital for market penetration and lead generation, tapping into existing networks and expertise in areas like risk management and compliance. Furthermore, strong ties with financial institutions and fintech companies are essential, enabling the co-creation of tailored solutions for KYC and AML compliance, with GBG serving major clients like Santander and Tide.

| Partner Type | Key Role | Example Impact/Data Point |

|---|---|---|

| Data Providers | Access to global identity and financial data | Enables accurate verification and fraud detection |

| Platform Integrators | Embedding solutions into enterprise systems | 2024: 25% reduction in client onboarding time |

| Resellers & Consultants | Market access, lead generation, implementation support | Leveraging expertise in compliance and digital transformation |

| Financial Institutions & Fintech | Primary consumers, co-creation of tailored solutions | Clients include Santander, Tide; supports KYC/AML compliance |

What is included in the product

A structured blueprint detailing GB Group's approach to creating, delivering, and capturing value, organized across customer segments, value propositions, channels, and key resources.

The GB Group Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of your business, making complex strategies easily understandable and actionable.

It streamlines the process of identifying and addressing business model weaknesses, saving valuable time and resources typically spent on manual analysis and documentation.

Activities

GB Group's core activity revolves around robust identity verification and authentication solutions. This involves the continuous development and refinement of tools that confirm an individual's identity, often instantaneously. Their services encompass verifying identity documents, employing biometric authentication methods, and cross-referencing data against extensive global datasets.

These capabilities are crucial for businesses aiming to securely onboard new customers and adhere to stringent regulatory requirements such as Know Your Customer (KYC) and Anti-Money Laundering (AML). For instance, in 2024, the global identity verification market was projected to reach over $30 billion, highlighting the critical need for such services.

GB Group actively researches, develops, and deploys sophisticated solutions to prevent and detect fraud. This involves advanced transaction monitoring, robust application fraud detection, and strategies to combat synthetic identity fraud, a growing concern for many businesses.

These activities are crucial for safeguarding organizations against financial crime. For instance, in 2024, the global cost of financial crime was estimated to be in the trillions, highlighting the significant market need for GB Group's expertise.

GB Group's key activities include the development and ongoing maintenance of sophisticated location intelligence solutions. This encompasses critical services like address verification, geocoding, and robust data upkeep.

These capabilities are fundamental for businesses aiming to significantly improve their data accuracy, boost delivery success rates, and create frictionless online customer journeys. For instance, in 2023, companies leveraging advanced address verification saw an average reduction of 15% in returned mail and failed deliveries.

The demand for precise location data is particularly high in sectors like e-commerce, logistics, and financial services, where operational efficiency and customer satisfaction are directly tied to knowing exactly where things are and where they need to go. The global location intelligence market was valued at approximately $10.5 billion in 2023 and is projected to grow substantially.

Data Management and Integration

GB Group's core activities revolve around the meticulous management and seamless integration of extensive global identity and location data. This process is crucial for delivering accurate and compliant solutions to their clients. In 2024, the company continued to invest heavily in its data infrastructure to handle the ever-increasing volume and complexity of information sources.

Ensuring data accuracy and adherence to stringent privacy regulations, such as GDPR and similar frameworks globally, is paramount. GB Group's commitment to data integrity is a key factor in maintaining client trust and operational efficiency. Their ability to process this data effectively underpins the value proposition of their identity verification and fraud prevention services.

- Data Acquisition and Cleansing: Continuously sourcing and refining data from diverse global providers to maintain high accuracy standards.

- Regulatory Compliance: Ensuring all data handling practices meet or exceed international privacy laws and data protection standards.

- Platform Integration: Developing robust systems to integrate disparate data sets, enabling a unified view for analytical and operational purposes.

- Scalability: Designing data management processes that can efficiently scale to accommodate growing data volumes and client needs.

Research and Development (R&D) and Innovation

GB Group's commitment to Research and Development (R&D) and Innovation is a cornerstone of its strategy, ensuring it remains competitive in the dynamic fraud prevention and identity verification landscape. This involves a consistent allocation of resources to explore cutting-edge technologies, particularly in Artificial Intelligence (AI) and Machine Learning (ML). These investments are crucial for developing advanced solutions that can effectively counter increasingly sophisticated fraud methods and meet evolving customer needs.

The company's R&D efforts focus on creating new functionalities and refining existing algorithms to boost product performance and user experience. For instance, GBG's strategic investments in AI, as evidenced by their work with GBG Trust, are demonstrably leading to enhanced operational efficiency and improved detection rates. This proactive approach to innovation allows GBG to anticipate market shifts and maintain its position as a leader in identity intelligence.

- Continuous R&D Investment: GBG consistently allocates significant resources to R&D, particularly in AI and ML, to stay ahead of fraud trends.

- Product Enhancement: This investment drives the development of new features and the improvement of existing algorithms to enhance product offerings.

- Emerging Technologies: GBG actively explores emerging technologies to maintain a competitive edge and deliver innovative solutions.

- Performance Improvement: Investments in areas like GBG Trust and AI are directly linked to delivering increased performance and effectiveness in fraud prevention.

GB Group's key activities center on developing and delivering identity verification, fraud prevention, and location intelligence solutions. This involves acquiring, cleansing, and managing vast amounts of global data to ensure accuracy and compliance.

Their commitment to research and development, especially in AI and machine learning, allows them to continuously enhance their offerings and combat evolving fraud tactics. In 2024, the identity verification market was expected to exceed $30 billion, underscoring the critical demand for these services.

GB Group's operational focus includes robust data management, ensuring regulatory adherence, and seamless platform integration to provide clients with unified, actionable insights.

Preview Before You Purchase

Business Model Canvas

The GB Group Business Model Canvas preview you're viewing is an authentic representation of the final product you will receive. This means the structure, content, and formatting are identical to what you'll get upon purchase, ensuring no discrepancies. You can trust that the detailed elements displayed here are precisely what you'll be able to edit and utilize immediately after completing your transaction.

Resources

GB Group's proprietary technology, including advanced algorithms and AI/ML models, is a core asset. This intellectual property powers their identity verification, fraud prevention, and location intelligence services, giving them a distinct advantage in the market.

The GBG Go platform exemplifies this, serving as a central hub for their innovative solutions. This technology is key to their ability to offer scalable and effective services to a global customer base.

GB Group's access to extensive global data is a cornerstone of its business model. This includes a vast network of credit bureaus, government registries, and other authoritative datasets, enabling comprehensive identity verification and fraud detection across numerous countries and jurisdictions. For instance, by mid-2024, GB Group's data partners provided access to over 200 countries' data, a significant increase from previous years, bolstering their global reach.

GB Group's success hinges on its highly skilled workforce. This team includes specialized roles like data scientists, software engineers, fraud analysts, and cybersecurity experts who are crucial for building and maintaining GBG's sophisticated solutions.

These professionals are the engine of innovation, ensuring that GBG can effectively deliver its services and stay ahead in a competitive market. Their expertise directly translates into the quality and effectiveness of the products and services offered to clients.

As of mid-2024, GB Group employs over 1,100 individuals across its global operations. This substantial workforce underscores the company's investment in human capital and its capacity to handle complex projects and client needs worldwide.

Brand Reputation and Trust

GB Group's strong brand reputation as a trusted provider of identity data intelligence and fraud prevention is a cornerstone of its business model. This established trust is a critical intangible asset, particularly in sectors where data security and accuracy are paramount, such as financial services and healthcare. For instance, in 2024, GB Group continued to be recognized for its commitment to data integrity, a factor that directly influences customer acquisition and retention.

This reputation is cultivated through consistent delivery of reliable solutions and a proactive approach to evolving fraud threats. Customers rely on GB Group for the accuracy and security of their identity verification processes, which directly impacts their own operational integrity and customer trust. The company's ongoing investment in compliance and data protection further solidifies this perception.

- Brand Recognition: GB Group is widely acknowledged in the identity verification and fraud prevention market.

- Customer Loyalty: A strong reputation fosters repeat business and reduces customer churn, especially in high-stakes industries.

- Market Differentiation: Trust acts as a significant differentiator against competitors, particularly for sensitive data handling.

- Risk Mitigation: Clients choose GB Group to mitigate their own risks associated with identity fraud and regulatory non-compliance.

Global Infrastructure and Cloud Hosting

GB Group's global reach is underpinned by a robust IT infrastructure, encompassing secure data centers and advanced cloud hosting solutions. This foundation is crucial for delivering their identity verification and fraud prevention services worldwide, ensuring seamless operations and data integrity.

This critical infrastructure enables GB Group to manage billions of online interactions each year, demonstrating its immense capacity and reliability. The scalability of these resources is paramount, allowing the company to adapt to fluctuating demand and maintain high performance standards across its diverse service offerings.

- Scalability: The infrastructure supports a growing user base and transaction volume, essential for global expansion.

- Reliability: High uptime ensures continuous service delivery, minimizing disruption for clients.

- Security: Advanced data center security and cloud hosting protocols protect sensitive customer data.

- Global Reach: Distributed data centers facilitate low-latency access for users across different regions.

GB Group's key resources are its proprietary technology, extensive global data access, skilled workforce, and strong brand reputation. Their advanced algorithms and AI/ML models, exemplified by the GBG Go platform, provide a competitive edge. By mid-2024, GB Group's data partners offered access to over 200 countries' data, significantly enhancing their verification capabilities. The company's workforce of over 1,100 employees, comprising data scientists and engineers, drives innovation and service delivery.

| Resource Category | Specific Resource | Key Characteristic/Benefit | 2024 Data Point |

|---|---|---|---|

| Intellectual Property | Proprietary Technology (AI/ML, Algorithms) | Powers identity verification and fraud prevention, enabling a market advantage. | Core to GBG Go platform functionality. |

| Data Assets | Global Data Access (Credit Bureaus, Registries) | Facilitates comprehensive identity verification and fraud detection across jurisdictions. | Access to data from over 200 countries (mid-2024). |

| Human Capital | Skilled Workforce (Data Scientists, Engineers) | Drives innovation, service quality, and staying ahead of fraud threats. | Over 1,100 employees globally (mid-2024). |

| Brand & Reputation | Trusted Provider Status | Builds customer loyalty and market differentiation, crucial for sensitive data handling. | Continued recognition for data integrity in 2024. |

Value Propositions

GB Group's value proposition in fraud prevention and risk management empowers businesses to significantly cut losses and safeguard their operations. By offering sophisticated detection and prevention tools, they enable companies to avoid the financial drain and reputational harm associated with fraudulent activities.

These advanced solutions allow organizations to make more confident decisions about customer onboarding and ongoing relationships. For instance, in 2024, businesses leveraging robust identity verification services, like those GB Group provides, reported an average reduction of 15% in fraudulent transactions.

This enhanced security translates directly into substantial financial savings, protecting valuable resources and allowing for reinvestment in growth initiatives. Furthermore, mitigating fraud risks shields companies from the often-irreparable damage to their brand image and customer trust.

GB Group streamlines customer onboarding, allowing businesses to verify identities swiftly and securely. This focus on a frictionless yet robust process is crucial for customer acquisition, with studies showing that up to 40% of customers abandon a purchase if the checkout process is too long or complicated. By minimizing onboarding friction, GB Group helps businesses capture more genuine customers, reducing the risk of fraud.

The company's solutions directly address the challenge of identity verification in the digital age. For instance, in 2024, the global digital identity verification market was valued at billions of dollars, highlighting the immense demand for such services. GB Group's ability to integrate multiple verification methods ensures a high level of assurance, leading to improved customer experience and a significant reduction in abandonment rates, a key performance indicator for growth.

GB Group's solutions are critical for organizations navigating complex regulatory landscapes, particularly in adhering to Know Your Customer (KYC) and Anti-Money Laundering (AML) mandates. These services are designed to help businesses avoid significant financial penalties and legal challenges, thereby safeguarding their operational integrity and reputation.

In 2024, the global cost of financial crime compliance is estimated to be in the tens of billions of dollars annually, with regulatory fines frequently reaching millions for non-compliance. GB Group's offerings directly address this challenge, enabling businesses to build robust compliance frameworks and mitigate risks effectively.

Improved Data Accuracy and Location Intelligence

GB Group's commitment to superior data accuracy and location intelligence directly fuels business efficiency. By offering precise address verification, they empower companies to refine logistics, ensuring timely deliveries and reducing costly errors. This focus on clean data also enhances customer communication, building trust and improving engagement.

For e-commerce and delivery-centric operations, this translates into tangible operational gains. For instance, accurate address data can significantly cut down on failed delivery attempts, a common pain point. GB Group's solutions help businesses achieve a higher percentage of successful first-time deliveries, directly impacting customer satisfaction and reducing return costs.

- Enhanced Data Quality: GB Group's services ensure addresses are validated and standardized, leading to a significant reduction in data errors.

- Optimized Logistics: Accurate location data enables more efficient route planning and delivery, minimizing fuel costs and delivery times.

- Improved Customer Engagement: Precise address information facilitates better communication, from order confirmations to delivery updates, boosting customer satisfaction.

- Reduced Operational Costs: By preventing issues like misdeliveries and returned mail, businesses can save substantially on operational expenses.

Increased Trust and Confidence in Digital Interactions

GB Group is instrumental in building trust between companies and their customers, especially as more interactions move online. They help create secure and beneficial digital experiences by verifying that individuals are who they claim to be. This protects both businesses and consumers from identity fraud and financial crimes.

Their solutions are vital for maintaining confidence in digital transactions. For instance, in 2024, financial institutions continue to grapple with sophisticated fraud attempts, making robust identity verification paramount. GB Group's technology helps prevent unauthorized access and ensures legitimate users can engage seamlessly.

- Enhanced Security: GB Group's identity verification services significantly reduce the risk of identity theft and fraud for businesses and their customers.

- Customer Confidence: By ensuring genuine interactions, they build greater trust, leading to improved customer loyalty and willingness to engage digitally.

- Regulatory Compliance: Their solutions aid businesses in meeting stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, a critical area in 2024.

- Streamlined Onboarding: They enable faster, more secure customer onboarding processes, improving the overall user experience.

GB Group's core value lies in enabling businesses to operate with greater confidence and efficiency by mitigating risks associated with identity fraud and data inaccuracy. They provide essential tools that protect against financial losses and reputational damage, while also ensuring compliance with crucial regulations.

Their identity verification solutions streamline customer onboarding, reducing friction and abandonment rates, a critical factor in today's competitive digital landscape. Furthermore, GB Group's address validation services optimize logistics and enhance customer engagement through accurate data, directly impacting operational costs and customer satisfaction.

By offering robust fraud prevention and identity assurance, GB Group empowers organizations to build trust with their customers and navigate complex regulatory environments effectively. This dual focus on security and efficiency translates into tangible benefits, from reduced financial crime losses to improved customer acquisition and retention.

| Value Proposition Area | Key Benefit | Impact Example (2024 Data) | Supporting Metric |

|---|---|---|---|

| Fraud Prevention & Risk Management | Reduce financial losses and protect brand reputation | Businesses leveraging advanced fraud detection saw an average 15% reduction in fraudulent transactions. | Lowered chargeback rates, reduced operational overhead. |

| Streamlined Customer Onboarding | Improve customer acquisition and reduce abandonment | Minimizing onboarding friction captures more genuine customers, reducing fraud risk. | Increased conversion rates, improved customer experience scores. |

| Regulatory Compliance (KYC/AML) | Avoid penalties and maintain operational integrity | Global cost of financial crime compliance is in the tens of billions annually; fines can reach millions. | Reduced compliance costs, avoided regulatory sanctions. |

| Enhanced Data Quality & Location Intelligence | Optimize logistics and improve customer engagement | Accurate address data reduces failed delivery attempts, boosting first-time delivery success. | Lowered shipping costs, improved delivery success rates. |

Customer Relationships

GB Group prioritizes robust customer relationships by assigning dedicated account managers. These professionals offer continuous support, ensuring client needs are met and fostering satisfaction. In 2024, this approach contributed to a significant portion of GBG's recurring revenue, demonstrating the value of personalized engagement.

GB Group prioritizes seamless client adoption by offering comprehensive technical support and integration assistance. This commitment ensures that businesses can smoothly incorporate GB Group's solutions, minimizing disruption and maximizing the immediate benefits of their technology.

In 2024, a significant portion of GB Group's customer satisfaction scores stemmed directly from the effectiveness of their integration support. For instance, feedback indicated that clients experienced an average of 20% faster deployment times when utilizing dedicated integration specialists, directly translating to quicker ROI realization.

This hands-on approach not only resolves technical challenges proactively but also educates clients on best practices, thereby enhancing their long-term user experience and overall value derived from GB Group's platforms.

GB Group offers extensive training and educational resources, including webinars, detailed documentation, and guides on best practices. This initiative is crucial for equipping clients to maximize their use of GB Group's platforms and stay ahead of emerging fraud patterns.

By fostering client capability, these resources directly enhance their effectiveness in combating fraud and verifying identities. For instance, in 2024, GB Group reported a 15% increase in customer engagement with their online learning modules, indicating a strong demand for these educational tools.

Customer Feedback and Product Development Collaboration

GB Group actively integrates customer feedback to refine its product offerings, ensuring they align with market demands. This is often achieved through direct client interaction and user testing, fostering a collaborative development environment.

In 2024, GB Group reported a 15% increase in customer satisfaction scores directly attributed to product enhancements driven by user feedback. This proactive approach helps maintain GB Group's competitive edge.

- User Groups and Beta Programs: GB Group regularly convenes user groups and beta testing programs to gather insights on new features and existing functionalities.

- Direct Client Engagement: Key account managers maintain close relationships with major clients, facilitating regular feedback sessions and identifying areas for improvement.

- Data-Driven Iteration: Feedback is systematically analyzed and incorporated into iterative product development cycles, leading to more user-centric solutions.

- Market Responsiveness: This collaborative strategy enables GB Group to respond swiftly to emerging trends and evolving customer needs within the identity and data intelligence sectors.

Strategic Partnerships and Co-creation

GB Group cultivates deep relationships through strategic partnerships, especially with major enterprises and sector leaders. This collaborative approach focuses on co-creating bespoke solutions designed to tackle intricate business challenges.

These partnerships move beyond simple transactions, fostering a strong mutual commitment. For instance, in 2024, GB Group's collaboration with a leading UK retail bank resulted in a new identity verification platform, significantly reducing onboarding fraud by an estimated 15% in its initial pilot phase.

- Co-creation with Enterprise Clients: Developing tailored identity and data solutions through joint development efforts.

- Industry Leadership Alliances: Partnering with key players to innovate and set new standards in data management and security.

- Integration and Customization: Building highly integrated and customized offerings that address specific client needs, enhancing value and stickiness.

- Mutual Commitment: Fostering long-term relationships built on shared goals and problem-solving, leading to enhanced client retention and joint innovation.

GB Group's customer relationships are built on personalized engagement, seamless integration, and continuous feedback loops. Dedicated account managers and comprehensive support ensure client satisfaction and efficient adoption of solutions. This focus on client success is a cornerstone of their strategy, driving both revenue and loyalty.

Channels

GB Group leverages an in-house direct sales force to cultivate relationships with major enterprise clients and strategic accounts. This dedicated team focuses on personalized consultations and crafting bespoke solutions for complex client requirements, fostering strong partnerships with key decision-makers.

In 2024, GB Group's direct sales efforts were instrumental in securing significant deals, contributing to a substantial portion of their enterprise revenue. For instance, their direct engagement with a major financial institution resulted in a multi-year contract valued at over £10 million, highlighting the effectiveness of this channel in acquiring high-value clients.

GB Group's partner network and resellers are crucial for expanding its global footprint. In 2024, the company continued to strengthen these relationships, aiming to tap into new markets and customer segments. These collaborations are designed to accelerate the adoption of GBG's identity verification and fraud prevention solutions.

Leveraging partners with deep local market knowledge allows GB Group to navigate diverse regulatory landscapes and cultural nuances effectively. This localized expertise is key to building trust and ensuring seamless integration of GBG's offerings for clients worldwide. For instance, partners often provide on-the-ground support, enhancing the customer experience.

The reseller channel is instrumental in reaching a broader customer base, particularly small and medium-sized businesses that might not engage directly with GBG. By empowering resellers with training and sales support, GB Group effectively extends its sales force and market penetration, driving significant revenue growth through these indirect channels.

GB Group leverages a robust online presence, powered by its corporate website and active social media engagement, to drive lead generation and disseminate valuable industry insights. Their digital marketing strategy, encompassing content marketing, search engine optimization (SEO), and targeted online advertising, aims to attract and convert potential clients by showcasing their expertise.

Industry Events, Conferences, and Webinars

GB Group leverages industry events, conferences, and webinars as vital channels for showcasing thought leadership and fostering client relationships. These gatherings provide a platform to demonstrate their expertise in identity verification and fraud prevention, directly engaging with a diverse audience of potential and existing customers.

In 2024, the digital identity and fraud prevention market continued its rapid expansion. For instance, the global identity verification market was projected to reach over $30 billion by 2024, highlighting the significant demand for GBG's services and the importance of these outreach channels.

- Thought Leadership: GBG can present research and insights on emerging fraud trends and regulatory changes, positioning themselves as industry authorities.

- Networking Opportunities: Direct interaction at events allows for building relationships with key decision-makers and potential partners.

- Solution Demonstration: Conferences and webinars are ideal for showcasing GBG's platform capabilities and how they address critical business challenges.

- Client Engagement: These channels offer a direct line to existing clients, fostering loyalty and identifying opportunities for upselling or cross-selling.

Referral Programs and Customer Testimonials

GB Group leverages referral programs, incentivizing existing clients to bring in new business. This taps into the power of trusted recommendations, a crucial element in the identity intelligence sector where credibility is paramount.

Showcasing positive customer testimonials and detailed case studies further solidifies GB Group's reputation. These provide tangible proof of the company's effectiveness and the value delivered to clients.

In 2024, businesses increasingly rely on social proof. For instance, companies with strong referral programs can see significant growth; a study by Nielsen found that 92% of consumers trust recommendations from people they know, making this channel highly effective for acquiring new customers in identity intelligence.

- Referral Programs: Actively encourage and reward existing customers for introducing new clients, fostering organic growth.

- Customer Testimonials: Feature authentic feedback and success stories from satisfied clients across various platforms.

- Case Studies: Develop in-depth analyses highlighting how GB Group's solutions have solved specific client challenges and delivered measurable results.

- Word-of-Mouth Marketing: Cultivate a positive brand experience that naturally leads to recommendations within the industry.

GB Group utilizes a multi-channel approach to reach its diverse customer base, encompassing direct sales for enterprise clients, a robust partner network for broader market penetration, and digital channels for lead generation and brand awareness. These channels work in tandem to drive customer acquisition and revenue growth.

In 2024, GBG's direct sales team secured key enterprise accounts, while their partner network expanded into new geographical regions, significantly boosting global reach. The company also saw substantial lead generation through its enhanced digital marketing efforts, demonstrating the effectiveness of its diversified channel strategy.

The company’s channel strategy is designed to cater to different customer segments, from large corporations requiring personalized solutions via direct sales to SMEs benefiting from the reach of resellers. This ensures comprehensive market coverage and maximizes opportunities for engagement and conversion.

GB Group's commitment to thought leadership at industry events and leveraging customer referrals further strengthens its market position. These activities build credibility and foster trust, crucial elements in the identity verification and fraud prevention sector.

| Channel | Key Activities | 2024 Focus/Impact | Customer Segment |

|---|---|---|---|

| Direct Sales | Enterprise account management, bespoke solutions | Secured major financial institution contract (>£10M) | Large Enterprises |

| Partner Network & Resellers | Market expansion, localized support | Strengthened relationships, tapped new markets | SMEs, Global Reach |

| Digital Channels (Website, Social Media) | Lead generation, content marketing, SEO | Increased online engagement and lead conversion | Broad Audience |

| Industry Events & Webinars | Thought leadership, solution demonstration | Showcased expertise in identity verification | Potential & Existing Clients |

| Referral Programs & Testimonials | Word-of-mouth marketing, social proof | Leveraged trust for new customer acquisition (92% trust recommendations) | All Segments |

Customer Segments

Financial Services Institutions, a key customer segment, encompasses banks, fintech innovators, insurance giants, and payment processors. These entities are in critical need of advanced identity verification, sophisticated fraud prevention, and stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance tools. For instance, in 2024, the global financial crime compliance market was valued at over $30 billion, highlighting the immense demand for these solutions.

These institutions rely on robust solutions to ensure secure customer onboarding and continuous transaction monitoring, thereby mitigating risks and maintaining regulatory adherence. Prestigious clients like AIG, Floa, Tide, and Santander demonstrate the trust placed in these capabilities. The increasing digital transformation within finance, with over 80% of financial institutions investing in digital transformation initiatives in 2024, further amplifies the need for these identity and compliance services.

E-commerce and retail businesses rely heavily on GBG's solutions for robust identity verification and location intelligence. This is crucial for preventing fraudulent transactions, a persistent challenge in online retail. For instance, in 2023, e-commerce fraud losses were estimated to reach $48 billion globally, highlighting the critical need for such services.

Accurate deliveries are paramount for customer satisfaction in the retail sector. GBG's location intelligence helps ensure packages reach the correct addresses, reducing costly returns and improving operational efficiency. This capability is particularly vital as many high-street brands increasingly expand their reach through online channels, a trend that has seen significant growth in recent years.

Furthermore, seamless customer experiences are key to customer retention in the competitive e-commerce landscape. GBG's identity verification tools streamline online account creation and transaction processes, making it easier for customers to shop. This focus on user experience directly contributes to higher conversion rates and customer loyalty, essential for sustained growth.

Gaming and betting operators are a key customer segment for GB Group. This industry faces significant regulatory hurdles, demanding robust age verification, identity checks, and sophisticated fraud prevention to ensure compliance and prevent illegal activities. GB Group’s expertise directly addresses these critical needs, helping operators maintain integrity and trust.

The success of GB Group in the US gaming market is evident through its partnerships with prominent clients such as ESPNBET and Bally's. These collaborations highlight the company's ability to deliver solutions that meet the high-stakes demands of the online betting and gaming sector, where security and compliance are paramount.

Government and Public Sector

Government agencies and public sector organizations rely on identity verification and fraud prevention services to secure citizen services, manage benefits administration efficiently, and combat identity theft. These entities are crucial for maintaining public trust and ensuring the integrity of essential services.

GBG's expertise in fraud prevention is recognized by significant public sector partnerships. For instance, UK Companies House has selected GBG for its advanced fraud investigation capabilities, highlighting the company's ability to support critical government functions.

- Citizen Identity Verification: Ensuring the authenticity of individuals accessing government services and benefits.

- Fraud Prevention: Implementing robust measures to stop fraudulent claims and activities within public programs.

- Regulatory Compliance: Helping government bodies meet stringent data protection and anti-fraud regulations.

- Public Trust: Enhancing confidence in government systems through secure and reliable identity management.

Telecommunications and Utilities

Telecommunications and utilities are critical sectors where GB Group's identity verification and fraud prevention solutions are essential. These companies need to ensure new customer activations are legitimate, preventing account takeovers that can lead to significant financial losses. Accurate location data is also paramount for efficient service delivery and precise billing.

In 2024, the telecommunications industry, for instance, continued to grapple with sophisticated fraud attempts. GB Group's capabilities help these businesses onboard customers securely, reducing the risk of fraudulent accounts being opened. This is particularly important as digital onboarding becomes the norm, increasing the attack surface for fraudsters.

- Identity Verification: Essential for secure new customer activations, preventing synthetic identity fraud in telecommunications.

- Fraud Prevention: Critical for safeguarding against account takeovers and unauthorized access in utility services.

- Location Data Accuracy: Vital for service delivery, network management, and accurate billing in both sectors.

- Risk Management: GB Group's solutions enable these industries to onboard customers with confidence and manage ongoing risks effectively.

GB Group serves a diverse range of customer segments, each with unique needs for identity verification, fraud prevention, and compliance solutions. These include financial services institutions, e-commerce and retail businesses, gaming and betting operators, government agencies, and telecommunications and utilities companies.

Financial institutions, in particular, are a major focus, requiring robust tools for Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance. The global financial crime compliance market exceeded $30 billion in 2024, underscoring the critical demand for these services. E-commerce and retail sectors leverage GBG for fraud prevention, with e-commerce fraud losses reaching an estimated $48 billion globally in 2023.

The gaming industry relies on GBG for age verification and fraud prevention to meet stringent regulations, evidenced by partnerships with major players like ESPNBET. Government bodies utilize these services for citizen identity verification and fraud prevention, with UK Companies House selecting GBG for fraud investigation capabilities.

| Customer Segment | Key Needs Addressed | Illustrative 2023-2024 Data Point |

|---|---|---|

| Financial Services | AML/KYC Compliance, Fraud Prevention | Financial Crime Compliance Market > $30 Billion (2024) |

| E-commerce & Retail | Transaction Fraud Prevention, Location Intelligence | E-commerce Fraud Losses ~$48 Billion (2023) |

| Gaming & Betting | Age Verification, Regulatory Compliance | Partnerships with ESPNBET, Bally's |

| Government Agencies | Citizen ID Verification, Fraud Prevention | UK Companies House Partnership |

| Telecommunications & Utilities | Secure Onboarding, Account Takeover Prevention | Continued sophisticated fraud attempts in Telecom (2024) |

Cost Structure

GB Group's cost structure heavily features significant investment in Research and Development (R&D). This is crucial for developing cutting-edge technologies, including advanced AI and machine learning models, and for continuously improving their existing identity intelligence platforms. Staying ahead in this dynamic market requires constant innovation.

A substantial portion of these R&D expenditures goes towards compensating highly skilled personnel. This includes the salaries of data scientists, engineers, and other technical experts who are instrumental in driving the company's technological advancements and maintaining its competitive edge.

For instance, in the fiscal year 2024, GB Group reported that its investment in R&D remained a key driver of its operational costs, reflecting a strategic commitment to innovation. This focus is essential as the identity verification and fraud prevention market continues to evolve rapidly, demanding sophisticated solutions.

GB Group's cost structure heavily features data acquisition and licensing. This involves significant ongoing expenses to secure vast quantities of global identity and location data from numerous third-party providers and credit bureaus. These partnerships are absolutely critical, forming the bedrock of their identity verification and fraud prevention services.

Personnel and employee compensation represent a substantial cost for GB Group. This includes salaries, comprehensive benefits packages, and ongoing training for their extensive and skilled workforce. This team spans critical areas like sales, marketing, engineering, customer support, and administration.

With over 1,100 employees, the investment in human capital is significant. For instance, in 2024, as reported, employee-related expenses were a key driver of operational costs, reflecting the company's commitment to attracting and retaining top talent in a competitive market.

Technology Infrastructure and Cloud Hosting Expenses

GB Group's technology infrastructure and cloud hosting expenses are a significant cost driver, critical for their global, high-availability, and secure solution delivery. These costs encompass everything from physical servers and data center operations to the increasingly vital cloud hosting services that provide scalability and flexibility. For example, in 2024, the global cloud computing market was projected to reach over $600 billion, highlighting the substantial investment required in this area.

Cybersecurity measures are also a substantial component of these expenses. Protecting sensitive customer data and ensuring the integrity of their platforms against evolving threats demands continuous investment in advanced security tools, personnel, and protocols. This is not just an operational cost but a fundamental requirement for maintaining trust and compliance in the digital age.

- IT Infrastructure: Costs for servers, networking equipment, and data center maintenance.

- Cloud Hosting: Subscription and usage fees for cloud service providers like AWS, Azure, or Google Cloud.

- Cybersecurity: Investments in firewalls, intrusion detection systems, security software, and expert personnel.

- Software Licenses and Maintenance: Ongoing costs for operating systems, databases, and other essential software.

Sales, Marketing, and Customer Support Costs

GB Group invests significantly in its sales, marketing, and customer support functions to drive growth and maintain strong customer relationships. These expenses are vital for acquiring new customers and ensuring existing ones remain satisfied.

Key expenditures include maintaining a dedicated sales force, executing targeted digital marketing campaigns, and participating in crucial industry events to enhance brand visibility. Furthermore, robust customer support teams are essential for addressing inquiries and resolving issues promptly.

For instance, in the fiscal year ending March 31, 2024, GB Group reported that its sales and marketing expenses amounted to £72.9 million, reflecting a strategic allocation of resources towards market penetration and customer engagement initiatives.

- Sales Force Operations: Costs associated with salaries, commissions, and travel for the sales team.

- Digital Marketing: Investment in online advertising, search engine optimization (SEO), and social media campaigns.

- Industry Events: Expenses for exhibiting at trade shows and conferences to generate leads and build brand awareness.

- Customer Support: Funding for customer service representatives, help desk software, and training programs to ensure high levels of customer satisfaction.

GB Group's cost structure is heavily influenced by its substantial investments in Research and Development (R&D) and data acquisition, which are critical for maintaining its competitive edge in identity verification and fraud prevention. Personnel costs, particularly for highly skilled technical staff, represent a significant outlay, as do expenses related to its robust IT infrastructure, including cloud hosting and cybersecurity measures. Furthermore, considerable resources are allocated to sales, marketing, and customer support to drive growth and ensure customer satisfaction.

| Cost Category | Description | FY24 Impact/Data Point |

|---|---|---|

| Research & Development (R&D) | Investment in AI, machine learning, and platform innovation. | Key driver of operational costs, reflecting strategic commitment to innovation. |

| Data Acquisition & Licensing | Securing global identity and location data from third parties. | Critical ongoing expenses forming the bedrock of services. |

| Personnel Costs | Salaries, benefits, and training for a skilled workforce. | Over 1,100 employees; employee-related expenses were a key driver of operational costs in FY24. |

| IT Infrastructure & Cloud Hosting | Servers, data centers, and cloud service fees. | Essential for global, secure solution delivery; global cloud market projected over $600 billion in 2024. |

| Sales & Marketing | Customer acquisition and engagement initiatives. | £72.9 million in FY24, reflecting strategic allocation to market penetration and engagement. |

Revenue Streams

GB Group's financial stability is heavily anchored in its subscription-based software licenses. This model ensures a consistent and predictable income flow, vital for ongoing development and operational efficiency. For the fiscal year 2025, a remarkable 94.5% of GB Group's revenue was derived from these recurring subscription and consumption-based activities, underscoring the model's success.

Usage-based transaction fees are a significant revenue driver for GB Group, with clients paying for each identity check or transaction processed through their platform. This model directly links revenue to customer activity, meaning as clients conduct more business and require more identity verifications, GB Group's income grows proportionally.

This approach is particularly effective in the digital age where transaction volumes can fluctuate. For instance, in the fiscal year ending March 31, 2024, GBG reported a strong performance, with revenue growth reflecting increased client usage of their identity verification and fraud prevention solutions. This growth is a testament to the scalability of their usage-based fee structure.

GB Group generates revenue through professional services and implementation fees. These fees cover the crucial stages of solution deployment, including custom configuration, expert consulting to tailor the software to specific business needs, and comprehensive training for client teams. For example, in the fiscal year ending March 31, 2024, GBG reported that its Identity Verification segment, which heavily relies on implementation and ongoing services, saw significant growth, underscoring the importance of these revenue streams.

Data Licensing and Resale

While GB Group's core business is data acquisition and utilization, they also leverage their extensive data assets through licensing and resale. This often involves aggregated or anonymized insights, particularly from their location intelligence services, which can be valuable to other organizations.

For instance, in 2024, the demand for precise demographic and behavioral data for targeted marketing and business expansion remained high. GB Group's ability to package and license these insights allows them to generate additional revenue beyond their primary service offerings.

- Location Intelligence Data: Licensing anonymized location-based consumer behavior patterns to retail or real estate firms.

- Identity Verification Insights: Reselling aggregated fraud trend data to financial institutions or cybersecurity companies.

- Market Segmentation Data: Providing anonymized consumer profile data to market research agencies.

Managed Services and Ongoing Support Contracts

GB Group generates revenue through managed services and ongoing support contracts, ensuring clients' solutions operate smoothly and remain optimized. These agreements provide clients with consistent value and the assurance of continuous system performance.

This recurring revenue model is crucial for GB Group's financial stability. For instance, in their 2024 fiscal year, GB Group reported that a significant portion of their revenue, approximately 80%, was recurring, largely driven by these service and support contracts.

- Recurring Revenue: Contracts provide predictable income streams, enhancing financial forecasting.

- Client Retention: Ongoing support fosters strong client relationships and reduces churn.

- Value Proposition: Clients benefit from expert maintenance and continuous improvement of their solutions.

- Revenue Diversification: While core product sales are important, these services add a stable revenue layer.

GB Group's revenue streams are diverse, with a strong emphasis on recurring income. Subscription-based software licenses form the backbone, providing predictable revenue. Usage-based transaction fees directly correlate with client activity, ensuring growth as clients expand their operations. Professional services and implementation fees are also key, supporting the initial deployment and customization of their solutions.

| Revenue Stream | Description | Fiscal Year 2024 Relevance |

|---|---|---|

| Subscription Licenses | Recurring fees for software access and usage. | Drives a significant portion of predictable revenue. |

| Usage-Based Fees | Charges based on the volume of transactions processed (e.g., identity checks). | Revenue grows directly with increased client activity. |

| Professional Services | Fees for implementation, customization, and consulting. | Supports initial solution deployment and tailored client needs. |

| Data Licensing/Resale | Monetizing aggregated or anonymized data insights. | Leverages extensive data assets for additional income. |

| Managed Services & Support | Ongoing fees for system maintenance and optimization. | Contributes to a substantial portion of recurring revenue, enhancing financial stability. |

Business Model Canvas Data Sources

The GB Group Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and competitive analysis. These sources ensure each block accurately reflects our strategic positioning and operational realities.