GameStop PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GameStop Bundle

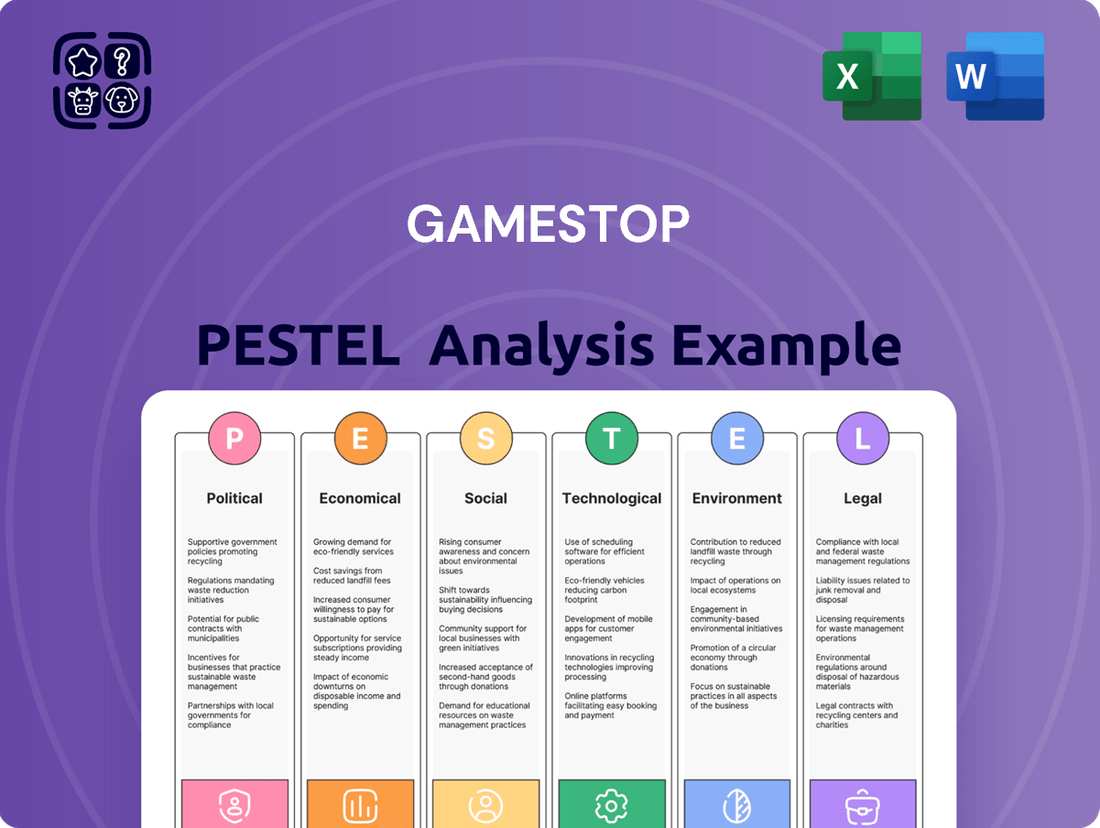

GameStop faces a dynamic external environment, from evolving consumer preferences to the rise of digital gaming. Understanding these political, economic, social, technological, legal, and environmental factors is crucial for navigating its future.

Our PESTLE analysis dives deep into these forces, revealing how they impact GameStop's strategy and market position. Gain clarity on the challenges and opportunities ahead.

Don't get left behind in a rapidly changing retail landscape. Equip yourself with actionable intelligence to make informed decisions.

Download the full GameStop PESTLE Analysis now and unlock the insights you need to stay ahead of the curve.

Political factors

Government regulations, like the ESRB's age-based ratings in the U.S., continue to directly shape GameStop's retail strategy, necessitating strict age verification for sales of mature game content.

Compliance with these evolving rules is paramount, especially as GameStop shores up its e-commerce footprint, to prevent legal issues and sustain customer confidence.

In 2024, the digital gaming market, a key area for GameStop, is projected to generate over $200 billion globally, underscoring the significant impact of online sales regulations.

E-commerce policies related to data privacy and consumer protection also influence GameStop's online sales channels, requiring robust security measures and transparent transaction practices.

International trade policies and tariffs, especially those affecting goods between the U.S. and China, directly impact GameStop's expenses. These policies influence the cost of importing essential gaming hardware and electronic components. For example, U.S. tariffs on certain electronics originating from China could potentially reach 25%, directly squeezing GameStop's profit margins and complicating its inventory management.

Government support for small and medium-sized retailers, including potential loan guarantees from agencies like the Small Business Administration (SBA), could offer GameStop a financial lifeline. For instance, programs aimed at fostering digital transformation and modernizing physical store footprints, which saw increased federal funding discussions in late 2024, might directly benefit GameStop's strategic initiatives. These initiatives could include investments in e-commerce capabilities and enhancing the in-store customer experience. The potential for tax credits related to retail sector innovation also presents an avenue for cost reduction and reinvestment.

Data Protection and Privacy Laws

GameStop must navigate an increasingly complex landscape of data protection and privacy laws. Regulations like the EU's General Data Protection Regulation (GDPR) and similar frameworks enacted globally, including in the US, mandate stringent handling of customer data. Failure to comply can result in significant fines and reputational damage. For instance, the California Consumer Privacy Act (CCPA) grants consumers more control over their personal information, impacting how companies like GameStop can collect and use data.

These evolving regulations directly affect GameStop's operational strategies, particularly in marketing and customer engagement. Stricter rules on data collection, consent, and usage can limit the effectiveness of personalized advertising campaigns and data-driven customer experience initiatives. GameStop needs to invest in robust data security measures and ensure ongoing compliance to maintain customer trust and avoid costly legal repercussions. The company's 2023 efforts to enhance its e-commerce platform likely included significant attention to these privacy requirements, aiming to build a more secure and compliant digital environment.

- GDPR Fines: Potential penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher.

- CCPA Impact: Consumer requests for data deletion or opt-outs can disrupt targeted marketing efforts.

- Customer Trust: Strong data privacy practices are becoming a key differentiator for customer loyalty.

- Operational Costs: Implementing and maintaining compliance requires ongoing investment in technology and training.

Potential Regulatory Challenges in Digital Content Resale and Crypto

GameStop faces significant regulatory hurdles in the digital content resale market. Laws governing the resale of digital goods are inconsistent globally, creating a complex legal landscape for the company as it operates in multiple countries. For instance, in the European Union, directives like the Digital Content Directive (2019/770) are shaping consumer rights for digital products, which could impact resale models.

The company's expansion into cryptocurrency and NFTs is particularly vulnerable to shifting regulations. The U.S. Securities and Exchange Commission (SEC) has been actively scrutinizing digital assets, with ongoing discussions around whether certain cryptocurrencies constitute securities. This uncertainty was a key factor in GameStop’s decision to shutter its NFT marketplace and crypto wallet in early 2024, demonstrating the direct impact of regulatory pressures on its digital asset strategy.

- Jurisdictional Variance: Digital content resale regulations differ significantly between the US, EU, and Asian markets, requiring GameStop to manage compliance across diverse legal frameworks.

- Evolving Crypto Landscape: The regulatory status of cryptocurrencies and NFTs remains fluid, with potential for new rules impacting custody, trading, and asset classification.

- Past Regulatory Impact: GameStop’s closure of its NFT marketplace and crypto wallet in 2024 highlights the immediate business consequences of regulatory uncertainty in the digital asset space.

- Consumer Protection Laws: Emerging consumer protection legislation for digital goods could impose new obligations on platforms facilitating their resale.

Government regulations directly influence GameStop's operations, from age verification for game sales to data privacy. The global digital gaming market, projected to exceed $200 billion in 2024, is heavily impacted by e-commerce policies, necessitating robust security and transparent practices for GameStop's online channels.

International trade policies, including potential tariffs on electronics from China, can significantly increase GameStop's import costs, affecting profit margins and inventory management. For example, U.S. tariffs on certain electronics can reach 25%, directly impacting the cost of goods sold.

GameStop must navigate a complex web of data protection laws like GDPR and CCPA, which mandate strict customer data handling and can impact marketing strategies. Failure to comply can lead to substantial fines, with GDPR penalties potentially reaching 4% of annual global turnover.

Regulatory uncertainty surrounding digital content resale and cryptocurrencies has already impacted GameStop, as seen with the closure of its NFT marketplace and crypto wallet in early 2024. This highlights the immediate business consequences of evolving digital asset regulations.

What is included in the product

This GameStop PESTLE analysis examines the impact of political, economic, social, technological, environmental, and legal factors on the company's operations and strategy.

It provides actionable insights and data-driven perspectives to help navigate the evolving retail and gaming landscape.

A PESTLE analysis for GameStop offers a structured framework to identify and address the external forces impacting its business, thereby relieving the pain point of navigating complex market dynamics.

This analysis provides a clear roadmap for understanding potential threats and opportunities, enabling GameStop to proactively mitigate risks and capitalize on emerging trends.

Economic factors

Consumer discretionary spending is a crucial driver for GameStop, as its product catalog primarily consists of non-essential items such as video games, consoles, and accessories. When consumers have more disposable income, they are more likely to purchase these types of goods, directly boosting GameStop's revenue. For instance, a healthy economy with rising wages often translates to increased spending on entertainment and gaming.

Inflationary pressures present a significant challenge. With U.S. inflation reported at 3.5% in March 2024, the cost of goods for GameStop, from new game inventory to store operational expenses, likely increased. Simultaneously, this inflation erodes consumers' purchasing power. As prices for necessities rise, consumers tend to cut back on discretionary purchases, meaning fewer video games and gaming hardware sales for GameStop.

The gaming industry's undeniable move to digital downloads significantly reshapes the market. By 2024, digital sales are expected to account for a substantial majority of all game purchases, with some estimates placing console game sales at over 80% digital. This seismic shift directly challenges GameStop's traditional reliance on physical media.

This ongoing digital transition necessitates a strategic pivot for GameStop, pushing the company to bolster its e-commerce capabilities and explore alternative revenue streams beyond physical game disc sales. The projected growth in digital game downloads, anticipated to reach hundreds of billions globally by 2025, underscores the urgency of this adaptation for long-term viability.

Economic cycles significantly impact GameStop, particularly during economic downturns. When consumers face financial strain, discretionary spending on items like video games often decreases, directly affecting GameStop's revenue streams.

Current projections suggest a challenging year for the U.S. video game market, with an anticipated decline in 2024. This contraction is a key consideration for GameStop's short-term financial outlook.

However, the market is expected to rebound in 2025. This projected recovery is anticipated to be fueled by the launch of new gaming consoles and a slate of highly anticipated game releases, offering a potential upside for GameStop.

Fluctuating Supply Chain Costs

Global supply chain disruptions, including the lingering effects of semiconductor shortages, significantly impact GameStop by inflating the costs of essential hardware components. This directly affects the company's ability to maintain competitive pricing and can compress profit margins. For instance, GameStop's gross margin saw a dip to 25.7% in fiscal year 2022, down from 28.1% in fiscal year 2021, with supply chain pressures being a contributing factor.

These fluctuating costs create uncertainty in inventory management and product availability. GameStop's reliance on new console releases and gaming hardware makes it particularly vulnerable to these upstream price increases and potential component scarcity. The company must navigate these challenges to ensure consistent stock and manage the financial implications of higher procurement expenses.

- Increased Hardware Component Costs: Global shortages of semiconductors and other critical components directly raise the cost of goods sold for new gaming consoles and accessories.

- Impact on Profit Margins: GameStop's gross margin decreased from 28.1% in FY2021 to 25.7% in FY2022, partly attributed to these supply chain cost pressures.

- Inventory Management Challenges: Fluctuating costs and availability create difficulties in forecasting demand and maintaining optimal inventory levels, potentially leading to stockouts or excess inventory.

- Pricing Strategy Adjustments: To maintain profitability, GameStop may need to adjust its product pricing, potentially impacting consumer demand and sales volume.

Interest Rates and Company Financing

Interest rates directly influence GameStop's cost of capital and its ability to finance growth initiatives. Higher rates mean increased borrowing expenses, potentially impacting profitability. Conversely, lower rates could reduce the cost of future debt issuance.

GameStop's financial strategy in early 2025, specifically the March offering of $1.3 billion in convertible notes, highlights the importance of financing costs. This capital infusion is intended for strategic moves, including investments like its foray into Bitcoin, which are sensitive to the prevailing interest rate environment.

The company's substantial cash reserves, bolstered by such offerings, also mean that interest rates affect the income generated from these holdings. A higher interest rate environment would likely increase earnings from its cash and equivalents.

- March 2025 Convertible Notes Offering: $1.3 billion raised to fund strategic initiatives.

- Impact on Borrowing Costs: Higher interest rates increase the expense of any future debt financing.

- Returns on Cash Reserves: Interest rates determine the yield GameStop earns on its significant cash holdings.

- Strategic Investment Sensitivity: Investments, such as in Bitcoin, are indirectly affected by the cost of capital.

Rising interest rates directly impact GameStop's borrowing costs and the returns on its cash reserves. For instance, the company's March 2025 offering of $1.3 billion in convertible notes is sensitive to the prevailing interest rate environment, affecting the cost of this capital. Higher rates would also boost earnings from GameStop's substantial cash holdings.

The U.S. video game market is projected to contract in 2024, a trend that presents near-term challenges for GameStop's revenue. However, a recovery is anticipated for 2025, driven by new console launches and expected game releases, offering a potential upside. This cyclical nature means GameStop's performance is closely tied to broader economic trends and industry product cycles.

Global economic factors such as inflation and supply chain disruptions continue to affect GameStop. Persistent inflation, with U.S. inflation at 3.5% in March 2024, erodes consumer purchasing power, potentially reducing discretionary spending on gaming products. Simultaneously, supply chain issues, including semiconductor shortages, inflate hardware costs, impacting GameStop's gross margin, which fell to 25.7% in fiscal year 2022.

Same Document Delivered

GameStop PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive PESTLE analysis of GameStop covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping GameStop's strategy and future. This preview offers a clear look at the valuable insights contained within the full report.

Sociological factors

A major sociological shift is the increasing demand for digital game content, including downloads, cloud gaming, and subscription models, which is rapidly eclipsing the market for physical media. This trend means GameStop must actively re-evaluate its inventory and operational strategy to keep pace with consumer expectations for immediate access and extensive digital libraries.

The gaming landscape continues to see a robust demand for physical collectibles and retro-inspired items, even as digital gaming grows. This trend taps into a powerful sense of nostalgia, which consumers are increasingly willing to spend on. GameStop is capitalizing on this by focusing on high-margin collectibles.

In the first quarter of 2025, collectibles represented a significant 28.9% of GameStop's total sales. This is a notable increase from 2021, highlighting the company's successful strategic shift into this lucrative segment of the market.

GameStop's stock trajectory in recent years, particularly through 2024 and into early 2025, has been profoundly shaped by social media. Online forums, most notably Reddit's r/WallStreetBets, have mobilized retail investors, creating substantial demand and driving unprecedented price swings. This digital community's collective action has turned GameStop into a poster child for the 'meme stock' phenomenon, demonstrating the potent influence of coordinated online sentiment on traditional markets.

The company itself has begun to acknowledge and even capitalize on this social media-driven engagement. For instance, GameStop has strategically incorporated 'meme culture' into its business operations. A notable example is their charity auction of a damaged PlayStation 5 console in early 2024, which garnered significant attention and participation precisely because of its viral potential and connection to the online communities that propelled the stock. This indicates a move towards a community-centric commerce model, leveraging social buzz for both brand visibility and potential revenue generation.

Changing Demographics and Gaming Culture

The gaming audience is rapidly expanding, moving beyond the stereotypical young male demographic. Globally, gaming is becoming more mainstream, with a significant portion of players integrating gaming into their daily digital lives through social media platforms. This trend is evident in the increasing numbers of older adults and women engaging with games, creating a more diverse player base.

GameStop can leverage this shift by diversifying its product offerings and in-store experiences to appeal to this wider audience. For instance, in 2024, the average age of gamers in the US continued to rise, with reports indicating over 40% of gamers are now women. This demographic evolution presents a clear opportunity for GameStop to adapt its strategy.

- Expanding Audience: Gaming is no longer niche; it's a broad cultural phenomenon.

- Social Integration: Gaming is intertwined with social media and online communities.

- Diversification Opportunity: GameStop can attract new customer segments by broadening its appeal.

- Demographic Shifts: Increased participation from women and older age groups in gaming is a key trend.

Importance of In-Store Experience and Community Hubs

Even with the shift to digital, GameStop's physical stores hold potential as community anchors. These locations can offer unique, in-person experiences that online platforms can't match, fostering customer loyalty and engagement. For instance, hosting events like trading card tournaments provides a tangible draw and creates a sense of belonging for enthusiasts. This experiential retail strategy aims to leverage GameStop's brick-and-mortar presence beyond simple transactions.

GameStop's approach in 2024 and 2025 focuses on revitalizing these physical spaces. The company has been actively promoting in-store events, particularly for collectible card games like Pokémon and Magic: The Gathering. These events not only drive foot traffic but also position GameStop as a central hub for hobbyists. This strategy acknowledges that while digital sales are crucial, the physical store can serve a vital role in community building and experiential commerce.

The success of these community-focused initiatives is crucial for GameStop's evolving retail model. By transforming stores into event venues, GameStop can create differentiated value.

- Experiential Retail: Physical stores offer tangible interactions, unlike online shopping.

- Community Hubs: Stores can host events, fostering a sense of belonging among customers.

- Collectible Card Gaming: Events for games like Pokémon and Magic: The Gathering are key drivers of in-store traffic.

- Foot Traffic Generation: These events aim to increase customer visits and engagement with the brand.

The increasing influence of social media on consumer behavior and investment trends has significantly impacted GameStop. Online communities, particularly on platforms like Reddit, have demonstrated an ability to mobilize retail investors, driving substantial stock volatility. This phenomenon, evident throughout 2024 and into early 2025, highlights the power of coordinated online sentiment in shaping corporate valuations.

GameStop is adapting by leveraging this social engagement, even incorporating 'meme culture' into its strategy, as seen with its charity auction of a damaged PlayStation 5 in early 2024. This indicates a move towards a community-centric commerce model, utilizing social buzz for brand visibility and potential revenue.

The gaming demographic is broadening, with more women and older adults participating. By 2024, women constituted over 40% of US gamers, and the average age of gamers continued to rise. GameStop can capitalize on this by diversifying its product offerings and in-store experiences to appeal to this wider audience.

Physical stores are being repositioned as community hubs offering unique, in-person experiences. Hosting events for popular collectible card games, such as Pokémon and Magic: The Gathering, has been a key strategy in 2024 and 2025 to drive foot traffic and foster customer loyalty beyond simple transactions.

| Sociological Factor | Impact on GameStop | 2024/2025 Data/Trend |

|---|---|---|

| Social Media Influence | Mobilized retail investors, stock volatility | Significant price swings driven by online communities like r/WallStreetBets |

| Changing Gaming Demographics | Need for broader product appeal | Over 40% of US gamers are women; average gamer age increasing |

| Experiential Retail Demand | Stores as community hubs | Increased in-store events for collectible card games (e.g., Pokémon, Magic: The Gathering) |

| Digital vs. Physical Demand | Shift in product mix | Collectibles represented 28.9% of sales in Q1 2025, up from prior years |

Technological factors

The industry's overwhelming shift towards digital distribution platforms like Steam, PlayStation Store, and Xbox Games Store significantly diminishes the importance of physical game sales for publishers. This technological evolution means that game access is increasingly tied to online storefronts rather than tangible media. By the end of 2024, projections indicate that digital sales will account for over 85% of console game revenue, a stark increase from previous years.

The surge in cloud gaming and subscription services, like Xbox Game Pass and PlayStation Plus, fundamentally alters how consumers access games. These platforms offer vast libraries for a recurring fee, diminishing the necessity for purchasing individual physical or digital titles, directly impacting GameStop's core business of selling new and pre-owned games.

This technological shift necessitates GameStop’s adaptation. For instance, Microsoft’s Xbox Cloud Gaming, available on PC and mobile devices, allows play without high-end console hardware, a model that bypasses traditional retail channels. By late 2024, Xbox Game Pass boasted over 30 million subscribers, demonstrating the significant market penetration of this subscription-based model.

Technological advancements are rapidly changing how people play video games. We're seeing big leaps in virtual reality (VR) and augmented reality (AR) headsets, offering more immersive experiences. For instance, Meta's Quest 3, released in late 2023, continues to drive VR adoption with its mixed-reality capabilities. Portable PC gaming devices, like Valve's Steam Deck, which saw strong sales throughout 2023 and into 2024, are also gaining significant traction, allowing players to enjoy PC titles on the go.

GameStop must actively adapt its product offerings and promotional strategies to align with these evolving hardware trends. This includes stocking a diverse range of VR/AR headsets, powerful gaming laptops, and accessories like controllers, charging docks, and specialized headsets. The company also needs to consider how to market and sell these newer, often higher-priced, hardware categories effectively to its customer base, potentially through bundles or trade-in programs for older consoles.

E-commerce Platform Development and Omnichannel Retail

GameStop is heavily investing in its e-commerce platform, aiming to create a seamless omnichannel experience. This strategic push is crucial for competing with established digital retailers in the gaming and entertainment sectors. By enhancing its online presence, GameStop seeks to attract and retain customers across both its physical stores and digital channels.

The company's focus on omnichannel excellence is reflected in its efforts to integrate online and in-store operations for a unified customer journey. This includes improving website functionality, mobile app capabilities, and fulfillment options to meet evolving consumer expectations. As of early 2024, GameStop continued to refine its digital infrastructure to support this strategy.

- Omnichannel Investment: GameStop is prioritizing the scaling of its e-commerce capabilities to serve as a primary destination for gaming and entertainment products.

- Digital Competition: The company's strategy is designed to directly address competition from major online retailers by enhancing its digital customer experience.

- Platform Enhancement: Significant resources are being allocated to improve the online platform, including website performance and mobile accessibility.

Blockchain and Cryptocurrency Integration

GameStop's engagement with blockchain and cryptocurrency remains a key technological factor. In May 2025, the company made a notable Bitcoin investment, reportedly around $100 million, explicitly citing it as a hedge against inflation. This move signals a strategic pivot towards digital assets as a store of value within their financial planning.

Furthermore, GameStop is actively investigating the integration of cryptocurrency payments for its collectible merchandise. This exploration aims to tap into the growing digital economy and offer alternative transaction methods to its customer base, potentially enhancing sales and customer engagement.

While earlier ventures, such as its NFT marketplace and crypto wallet, were discontinued primarily due to evolving regulatory landscapes, the company's continued assessment of blockchain's strategic applications indicates an ongoing interest. This includes evaluating how decentralized technologies could bolster their business model, despite past setbacks.

- Bitcoin Investment: GameStop invested approximately $100 million in Bitcoin in May 2025 as an inflation hedge.

- Payment Exploration: The company is exploring the use of cryptocurrency for transactions involving collectibles.

- Past Ventures: Previous NFT marketplace and crypto wallet initiatives were halted due to regulatory uncertainty.

- Strategic Reassessment: GameStop continues to evaluate the strategic benefits of blockchain and cryptocurrency technologies.

The increasing prevalence of digital distribution and subscription services, like Xbox Game Pass which surpassed 30 million subscribers by late 2024, fundamentally challenges GameStop's traditional retail model. Advancements in cloud gaming and VR/AR technology, exemplified by Meta's Quest 3, are also shifting consumer preferences away from physical media and towards more accessible, immersive digital experiences.

GameStop's strategic response involves significant investment in its e-commerce platform to create a seamless omnichannel experience and compete directly with online retailers. This includes enhancing website functionality and mobile app capabilities to meet evolving consumer expectations.

The company's exploration of blockchain technology, including a reported $100 million Bitcoin investment in May 2025 as an inflation hedge, indicates a forward-looking approach to digital assets and potential new revenue streams, such as cryptocurrency payments for collectibles.

| Technology Trend | Impact on GameStop | 2024/2025 Data/Projections |

|---|---|---|

| Digital Distribution & Subscriptions | Decreased demand for physical games; reliance on online storefronts | Digital sales projected to exceed 85% of console game revenue by end of 2024; Xbox Game Pass >30 million subscribers (late 2024) |

| Cloud Gaming & VR/AR | Shift towards service-based access and immersive experiences, bypassing traditional retail | Meta Quest 3 driving VR adoption (released late 2023); Steam Deck sales strong (2023-2024) |

| E-commerce & Omnichannel | Necessity to compete with online retailers; integration of online and in-store experiences | Ongoing platform enhancement and digital infrastructure refinement (early 2024) |

| Blockchain & Cryptocurrency | Potential for new payment methods and asset-based hedging strategies | $100 million Bitcoin investment (May 2025); exploration of crypto payments for collectibles |

Legal factors

Intellectual property laws are foundational to GameStop's operations, as the company's core business involves the sale of copyrighted video games and merchandise. Strict adherence to licensing agreements with publishers and developers is essential to prevent costly litigation. For instance, in 2023, the video game industry generated over $185 billion globally, highlighting the significant value of these intellectual properties.

The legal framework governing digital content rights and the burgeoning secondary market for these assets presents an evolving challenge. Potential regulations around digital content resale could directly impact GameStop's strategies for new and used digital game sales, a segment that saw significant growth in recent years.

GameStop operates under a stringent framework of consumer protection laws that dictate product safety standards, warranty provisions, and fair return policies for both new and previously owned merchandise. These regulations are crucial for safeguarding customers and ensuring fair market practices. For instance, the Magnuson-Moss Warranty Act in the US sets minimum standards for warranties, impacting how GameStop must handle product defects and repairs.

Adherence to these consumer protection mandates is paramount for maintaining customer confidence, particularly given GameStop's significant involvement in the pre-owned games market. In 2023, the pre-owned segment remained a key part of their business, though specific revenue figures fluctuate. Violations can lead to substantial fines and damage to brand reputation, making compliance a critical operational focus.

GameStop, as a major retailer, navigates a complex web of labor laws and employment regulations. These govern everything from minimum wage requirements, like the federal minimum wage of $7.25 per hour, to overtime pay, employee benefits, and workplace safety standards. Changes in these regulations, such as potential increases to the minimum wage or new paid leave mandates, can directly affect GameStop's operational costs and staffing strategies.

The ongoing evolution of labor laws, including debates around worker classification and the enforceability of arbitration agreements, presents a dynamic challenge. For instance, stricter regulations on independent contractor status could force GameStop to reclassify some roles, leading to increased payroll taxes and benefit expenses. Similarly, limitations on arbitration could expose the company to a higher volume of individual employment lawsuits, impacting its financial exposure and legal defense budgets.

In 2024, many states and cities continued to raise their minimum wages, with some reaching $15 or more per hour. This trend puts pressure on companies like GameStop to adjust their compensation structures across the board, potentially increasing overall wage expenses significantly, especially for entry-level retail positions.

Securities Regulations and Market Manipulation Scrutiny

GameStop's unique position as a "meme stock" means it's constantly under the watchful eye of securities regulators. This heightened scrutiny is due to the significant involvement of retail investors and concerns about potential market manipulation and the need for greater transparency. For instance, the Securities and Exchange Commission (SEC) has been actively investigating trading activity surrounding meme stocks, including GameStop, to understand the dynamics of social media-driven market movements.

Regulators are actively working to adapt existing securities laws to the evolving market landscape, which is increasingly influenced by social media platforms and new trading technologies. This includes examining how platforms like Reddit and new trading apps impact price discovery and whether current rules adequately address the risks associated with these phenomena. The SEC's proposed rule changes in 2024 aimed at increasing transparency in equity markets reflect this ongoing effort to address the challenges presented by meme stock events.

- Regulatory Scrutiny: GameStop faces ongoing investigations by the SEC and other bodies concerning trading practices and market manipulation, particularly in light of its meme stock status.

- Evolving Legislation: Securities regulators are adapting existing laws and considering new rules to address the impact of social media and retail investor sentiment on stock prices.

- Transparency Demands: There's a continued push for greater transparency in trading activities, especially concerning the communication and coordination among retail investors on online platforms.

- Enforcement Actions: Past events have led to increased vigilance and potential enforcement actions against individuals or entities found to be engaging in manipulative practices.

International Trade and Business Divestiture Regulations

GameStop's strategic move to divest international operations, including markets like France, Germany, and Canada, necessitates strict adherence to a web of international trade and business exit regulations. Navigating these legal landscapes is crucial for a smooth transition and to mitigate potential penalties. These regulatory hurdles can significantly impact the financial reporting, often resulting in one-time charges as the company unwinds its presence in these regions.

These divestitures are not merely operational shifts; they are legally complex undertakings. For instance, exiting a market like Germany involves complying with German labor laws regarding employee severance and notification periods, as well as specific corporate dissolution procedures. Similarly, in Canada, GameStop must navigate provincial and federal regulations concerning asset sales and the termination of business licenses. The financial implications of these legal requirements are substantial, often reflected in the company's quarterly earnings reports as restructuring costs or impairment charges.

The regulatory environment for international trade and business divestiture is dynamic. Changes in trade agreements, sanctions, or local business laws can introduce unforeseen complications and costs. GameStop's financial statements for the fiscal year ending February 2, 2025, will likely detail these charges, providing insight into the financial impact of these legal obligations. For example, in fiscal year 2023, GameStop reported approximately $12 million in asset impairment and restructuring charges, partly related to its ongoing strategic repositioning.

- Regulatory Compliance: GameStop must comply with diverse international trade laws, including import/export controls and tariffs, when divesting assets or ceasing operations in foreign markets.

- Business Exit Procedures: Specific legal requirements for winding down operations, such as notifying authorities, settling debts, and handling employee contracts, vary by country. For example, exiting Canada involves adhering to provincial business dissolution laws.

- Financial Reporting Impact: Divestitures often trigger one-time charges related to severance packages, lease terminations, and asset write-downs, as seen in GameStop's reported restructuring costs.

- Contractual Obligations: Existing contracts with suppliers, distributors, and service providers in divested regions must be legally terminated or transferred, often incurring penalties or settlement fees.

GameStop's operations are significantly influenced by intellectual property laws, requiring careful management of licenses for video games and merchandise. The global video game market's substantial value, exceeding $185 billion in 2023, underscores the importance of these legal protections.

Consumer protection laws are critical for GameStop, dictating product safety, warranty, and return policies for both new and pre-owned goods. Adherence to regulations like the Magnuson-Moss Warranty Act is vital for maintaining customer trust, especially given the significant role of the pre-owned market in their business model.

Labor laws, including minimum wage, overtime, and workplace safety, directly impact GameStop's operational costs and staffing. With many regions increasing minimum wages in 2024, companies like GameStop face pressure to adjust compensation, potentially raising overall wage expenses.

As a prominent "meme stock," GameStop operates under intense scrutiny from securities regulators like the SEC. The agency is actively adapting rules to address the impact of social media on trading, aiming to enhance transparency and prevent manipulation, as evidenced by proposed rule changes in 2024.

Environmental factors

GameStop's environmental footprint is under increasing scrutiny due to the significant e-waste generated from the sale and trade-in of consumer electronics like gaming consoles and accessories. As of early 2024, the global e-waste problem continues to grow, with projections indicating a steady rise in discarded electronics.

To address this, GameStop must actively implement and promote comprehensive e-waste recycling programs. This not only helps mitigate environmental impact but also significantly enhances the company's brand image and aligns it with the growing consumer demand for sustainable business practices.

For instance, in 2023, a significant portion of returned consoles and controllers still required proper disposal, highlighting the ongoing challenge. By partnering with certified e-waste recyclers, GameStop can ensure responsible handling and recovery of valuable materials, potentially offsetting some disposal costs.

The company's commitment to robust recycling initiatives can translate into tangible benefits, such as improved customer loyalty and a stronger position in a market increasingly prioritizing environmental, social, and governance (ESG) factors.

Consumers are increasingly prioritizing companies that show commitment to sustainable sourcing. GameStop's extensive product lines, especially in collectibles and electronics, mean its supply chain will be under a microscope for its environmental footprint. This trend saw the global sustainable products market reach an estimated $150 billion in 2024, highlighting the financial imperative for companies like GameStop to adapt.

GameStop's vast network of physical retail locations inherently contributes to its energy consumption and carbon footprint. Each store requires electricity for lighting, heating, cooling, and powering electronic displays and point-of-sale systems.

The company's sustainability program aims to mitigate this impact through focused energy management. Key initiatives include the rollout of energy-efficient LED lighting across its stores, a move that can significantly reduce electricity usage compared to traditional incandescent or fluorescent bulbs.

Furthermore, GameStop is exploring options like solar energy integration to further lessen its reliance on conventional power sources and decrease its operational carbon emissions. These efforts are designed to reduce both behavioral usage and the overall environmental impact of its retail operations.

Packaging Waste Reduction

Physical game boxes and the packaging for electronics, a core part of GameStop's business, contribute significantly to landfill waste, raising environmental concerns among consumers and regulators. This waste stream is a tangible environmental impact that GameStop must address to align with growing sustainability expectations.

GameStop is increasingly compelled to explore and implement sustainable packaging solutions. This involves looking at options like recycled materials, reduced plastic usage, and more compact designs to lessen its overall environmental footprint.

Consumer demand for eco-friendly practices continues to rise, putting pressure on retailers like GameStop to demonstrate commitment to sustainability. Failing to adapt could impact brand perception and customer loyalty.

While specific recent figures for GameStop's packaging waste are not publicly detailed, the broader retail industry faces scrutiny. For instance, in 2023, the Ellen MacArthur Foundation reported that packaging accounts for a significant portion of the plastic waste generated globally, highlighting the scale of the challenge for companies handling physical goods.

- Material Innovation: GameStop could investigate biodegradable or compostable packaging alternatives for its physical products.

- Reduced Packaging: Optimizing the size and amount of packaging used for shipments can directly cut down on waste.

- Recycled Content: Sourcing packaging made from post-consumer recycled materials is a key strategy for reducing virgin resource consumption.

- Consumer Education: Informing customers about recycling options for existing packaging can also play a role in waste reduction efforts.

Corporate Social Responsibility and Brand Image

GameStop's brand image is increasingly tied to its environmental, social, and governance (ESG) performance. Consumers are more aware of sustainability, and companies demonstrating genuine commitment often see improved loyalty. For instance, in 2023, a significant percentage of consumers reported that they would switch brands if a competitor offered a better sustainability record. By integrating eco-friendly practices, such as reducing packaging waste or promoting e-waste recycling programs, GameStop can resonate with this growing consumer segment.

Collaborations with environmental groups and involvement in local green initiatives can further solidify GameStop's reputation. These efforts not only contribute to positive public perception but can also create tangible benefits. For example, community sustainability projects can foster goodwill and attract customers who value corporate citizenship. This strategic approach can translate into enhanced long-term profitability by aligning business operations with societal expectations.

- Consumer Demand for Sustainability: A growing number of consumers, estimated to be over 60% in recent surveys (2023-2024), consider a company's environmental practices when making purchasing decisions.

- Brand Image Enhancement: Proactive engagement in sustainability can differentiate GameStop from competitors and improve its overall brand perception.

- Partnership Opportunities: Collaborating with organizations like the EPA's Safer Choice program or local environmental charities can amplify reach and impact.

- Long-Term Profitability: Investments in sustainable practices are increasingly linked to reduced operational costs and increased market share, contributing to sustained financial health.

GameStop's environmental impact is primarily shaped by e-waste from electronics and packaging materials. The growing global concern over e-waste, with projections showing a steady increase, necessitates robust recycling programs. In 2023, a significant volume of returned consoles and accessories required proper disposal, underscoring this challenge.

The company's retail operations contribute to its carbon footprint through energy consumption. Initiatives like LED lighting upgrades are being implemented to reduce electricity usage. Exploring solar energy integration is also part of their strategy to lower emissions.

Physical game boxes and electronics packaging are a notable source of landfill waste. GameStop is thus exploring sustainable packaging options, including recycled materials and reduced plastic usage, to align with consumer and regulatory expectations for eco-friendly practices.

PESTLE Analysis Data Sources

Our PESTLE analysis for GameStop is informed by a comprehensive review of financial news outlets, industry-specific publications, and government regulatory filings. We also incorporate data from market research firms and consumer behavior surveys to capture relevant economic and social trends.