GameStop Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GameStop Bundle

Unlock the full strategic blueprint behind GameStop's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

GameStop's relationships with console makers like Sony, Microsoft, and Nintendo are fundamental to its business. These partnerships ensure GameStop receives a consistent flow of new gaming consoles and accessories, which are vital for generating sales. In 2024, the continued demand for current-generation consoles like the PlayStation 5 and Xbox Series X/S highlights the importance of these supply agreements.

GameStop's strategic alliances with major game publishers and developers, like Electronic Arts and Nintendo, are absolutely crucial. These partnerships allow GameStop to secure a steady stream of new game releases, digital download codes, and even exclusive in-game content that differentiates them from competitors.

These collaborations are fundamental to GameStop's ability to maintain a diverse product catalog, catering to a wide range of gamers. Furthermore, they are essential for GameStop to actively participate and grow within the expanding digital distribution market, which saw significant growth in 2024 as the industry continued its digital shift.

Securing early access or special promotional deals for highly anticipated titles, such as the latest installments in the 'Call of Duty' franchise or major PlayStation 5 and Xbox Series X/S releases, is a key strategy for driving customer traffic and sales. For instance, GameStop's ability to offer pre-order bonuses or limited edition bundles for major 2024 releases directly influences their customer acquisition and retention rates.

GameStop's strategic move into digital distribution platforms marks a significant evolution, acknowledging the gaming industry's digital-first trajectory. By partnering with major players like Xbox and PlayStation, GameStop now offers digital game codes and subscriptions, directly catering to the increasing consumer demand for instant access and downloadable content. This expansion diversifies their revenue streams beyond physical media, a critical adjustment as digital game sales continue to surge, representing a substantial and growing segment of the overall gaming market.

Distribution and Logistics Partners

GameStop's ability to get products to customers relies heavily on its distribution and logistics partners. These relationships are key to ensuring that games, consoles, and other merchandise reach both their physical stores and online shoppers efficiently. In 2024, GameStop continued to leverage third-party logistics providers to manage the complexities of its supply chain, aiming for faster delivery times and better inventory management across its various sales channels.

These partnerships are fundamental to GameStop's omnichannel strategy, allowing them to fulfill online orders from stores or distribution centers seamlessly. Effective collaboration with logistics companies is vital for minimizing shipping costs and ensuring customer satisfaction through reliable delivery.

- Third-Party Logistics Providers: GameStop works with a range of logistics companies to handle warehousing, transportation, and last-mile delivery for its e-commerce operations.

- In-Store Replenishment: Partnerships ensure timely and efficient movement of inventory from distribution centers to GameStop's brick-and-mortar store locations.

- Supply Chain Optimization: Collaborations are crucial for managing inventory levels, reducing transit times, and adapting to fluctuations in customer demand throughout 2024.

- International Shipping: For global reach, GameStop engages logistics partners experienced in international freight and customs clearance.

Collectibles and Merchandise Suppliers

GameStop's diversification strategy heavily relies on its key partnerships with suppliers of gaming merchandise, pop culture collectibles, and trading cards, such as those for Pokémon TCG. These collaborations are crucial for expanding GameStop's offerings into higher-margin product categories, tapping into a market segment that extends beyond traditional video game sales.

The company has seen substantial growth in these areas, particularly in 2024 and into 2025, as it broadens its appeal to a wider consumer base interested in collectibles. This strategic shift allows GameStop to leverage its brand recognition in new, profitable markets.

- Expanding High-Margin Categories: Partnerships with suppliers of trending collectibles and merchandise allow GameStop to offer products with potentially higher profit margins compared to new video game software.

- Catering to Diverse Interests: These collaborations enable GameStop to attract and retain customers with varied interests, including pop culture enthusiasts and trading card collectors, thereby broadening its customer base.

- Growth in 2024-2025: The company has reported notable increases in sales from its collectibles and merchandise segments, indicating the success of these strategic supplier relationships in driving revenue diversification.

GameStop's strategic alliances with gaming hardware manufacturers like Sony, Microsoft, and Nintendo are paramount for securing inventory of new consoles and accessories. These partnerships are critical for capitalizing on the sustained demand for platforms such as the PlayStation 5 and Xbox Series X/S, which remained strong throughout 2024.

What is included in the product

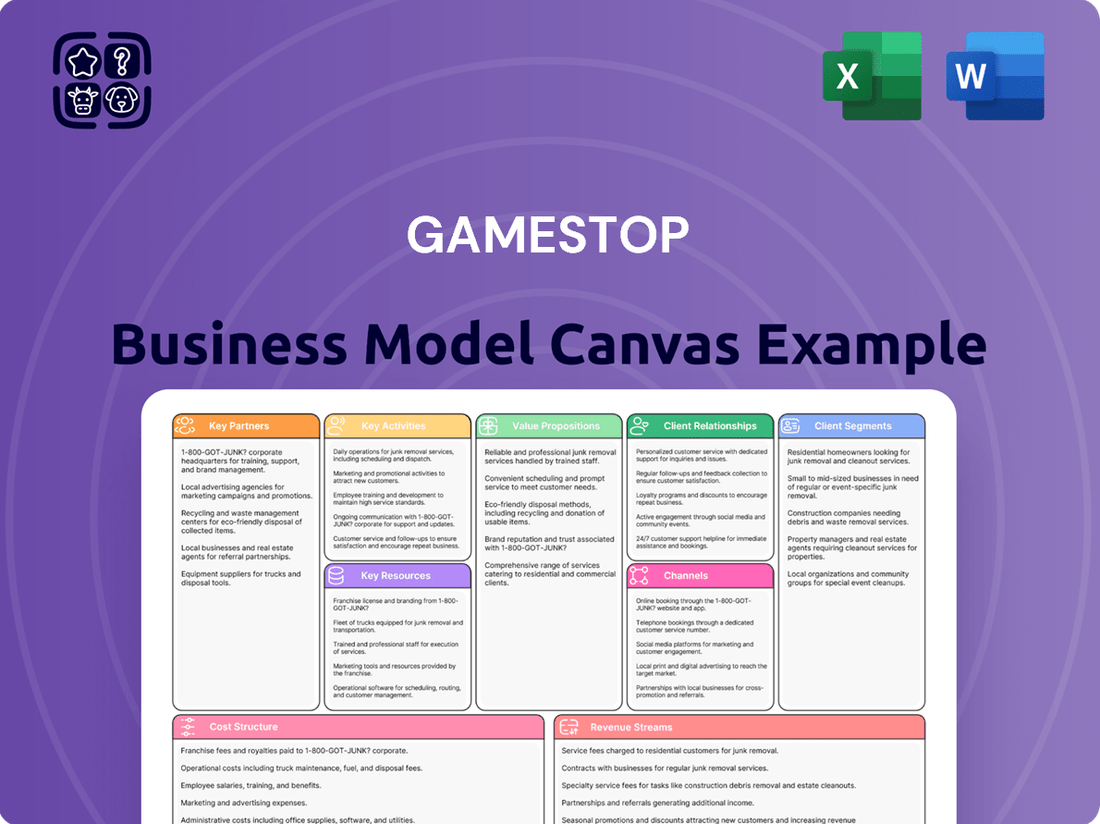

A dynamic business model canvas for GameStop, focusing on its pivot to a digital-first, community-driven gaming and collectibles retailer, detailing customer segments, value propositions, and key partnerships.

This canvas outlines GameStop's strategy to leverage its brand loyalty and digital platform to expand its offerings beyond physical media, encompassing new revenue streams and enhanced customer engagement.

GameStop's Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of their strategy, allowing for quick identification of inefficiencies and areas for improvement.

This one-page snapshot simplifies complex operations, enabling stakeholders to pinpoint and address challenges within their value proposition, customer segments, and revenue streams.

Activities

GameStop's primary business revolves around the retail sale of gaming products. This includes new and pre-owned video game hardware, physical and digital game software, and various gaming accessories. These sales are conducted through its widespread physical store locations and its online e-commerce channels.

While the landscape of gaming sales is shifting, the retail sale of these products remains a foundational element of GameStop's operations and a significant contributor to its revenue. In fiscal year 2024, this core activity continued to be a primary driver of the company's financial performance, underpinning its overall sales figures.

GameStop's buy-sell-trade programs are a cornerstone of its operations, focusing on acquiring and reselling pre-owned video games, consoles, and accessories. This activity directly fuels the company's inventory of used goods, which are then offered to customers at competitive prices. By facilitating these exchanges, GameStop not only secures a consistent supply of merchandise but also creates a value proposition for customers looking to upgrade their gaming collections.

In 2024, the buy-sell-trade segment continued to be a significant contributor to GameStop's revenue, particularly in driving traffic and engagement within its physical store locations. While specific segment data for 2024 is still emerging, historically, trade-in values have been a key driver for repeat customer visits. This program is designed to encourage customers to return to stores, fostering loyalty and providing opportunities for additional sales of new products and services.

GameStop's e-commerce platform, gamestop.com, is central to its operations, managing everything from online sales and digital downloads to customer accounts. This digital storefront is essential for reaching a wider audience and is a significant revenue driver, particularly as more consumers embrace online shopping.

In the fiscal year 2023, GameStop reported total net sales of $5.93 billion, with a considerable portion attributed to its e-commerce channels. The company continuously invests in improving the user experience and functionality of gamestop.com to cater to the evolving digital marketplace and maintain its competitive edge.

Conducting Marketing and Promotional Campaigns

GameStop orchestrates marketing and promotional campaigns across digital, social media, and in-store touchpoints. These initiatives are designed to enhance customer interaction, stimulate sales, and cultivate lasting brand affinity. A significant driver of these efforts is their loyalty program.

The PowerUp Rewards program is central to GameStop's promotional strategy, aiming to retain existing customers and attract new ones through exclusive benefits and discounts. This program is a key tool for driving repeat business and fostering a sense of community around the brand.

- Digital and Social Media Engagement: GameStop leverages platforms like YouTube and TikTok for product showcases and community interaction. In 2024, their social media presence continues to be a focal point for announcing new releases and promotions.

- In-Store Experiences: In-store events, product launches, and exclusive offers remain a core part of their promotional mix, encouraging foot traffic and direct customer engagement.

- Loyalty Program: The PowerUp Rewards program incentivizes repeat purchases and offers members early access to sales and exclusive content, contributing to customer retention.

- Targeted Advertising: Campaigns are often tailored to specific customer segments, focusing on new game releases, hardware upgrades, and collectibles to maximize reach and impact.

Strategic Diversification and Investment

GameStop's strategic diversification in 2025 centers on expanding its investment portfolio into high-growth areas such as alternative assets, including a notable allocation to Bitcoin. This move aims to tap into emerging markets and generate new revenue streams beyond traditional gaming retail.

The company is also actively pursuing expansion into the high-margin collectibles market, recognizing a growing consumer demand for unique and rare items. This initiative leverages GameStop's existing brand recognition and customer base to capture a slice of this lucrative niche.

Key operational adjustments for 2025 include a significant restructuring of its retail footprint. This involves the closure of underperforming physical stores to optimize operational efficiency and a strategic divestment of international operations to sharpen focus on core markets. These actions are designed to streamline the business and improve profitability.

- Bitcoin Investment: GameStop is strategically diversifying its assets by investing in cryptocurrencies like Bitcoin, signaling a forward-looking approach to financial markets.

- Collectibles Expansion: The company is targeting high-margin collectibles to capitalize on a growing market segment and diversify revenue sources.

- Retail Optimization: GameStop is closing unprofitable stores and divesting international operations to enhance efficiency and focus on core strengths.

- New Product Exploration: The business is actively exploring new product offerings to adapt to evolving market trends and consumer preferences.

GameStop's business model is anchored by its core retail operations, encompassing the sale of new and pre-owned video games, consoles, and accessories through both physical stores and its e-commerce platform. This segment remains a primary revenue generator, even as the gaming industry evolves.

The buy-sell-trade program is a vital component, driving inventory acquisition and customer engagement, particularly within its brick-and-mortar locations. This encourages repeat visits and provides a consistent supply of pre-owned goods.

Marketing and customer loyalty are bolstered by digital and social media engagement, alongside the PowerUp Rewards program, which incentivizes repeat purchases and fosters brand community.

Strategic initiatives for 2025 include diversification into alternative assets like Bitcoin and expansion into the high-margin collectibles market, alongside a restructuring of its retail footprint by closing underperforming stores and divesting international operations to improve efficiency.

| Key Activity | Description | 2024/2025 Focus |

|---|---|---|

| Retail Sales (New & Pre-owned) | Selling video game hardware, software, and accessories. | Continued optimization of physical and online sales channels. |

| Buy-Sell-Trade Programs | Acquiring and reselling used gaming products. | Driving store traffic and customer loyalty through trade-ins. |

| E-commerce Operations | Managing online sales, digital downloads, and customer accounts. | Enhancing user experience and digital marketplace presence. |

| Marketing & Loyalty Programs | Promotional campaigns and customer retention through PowerUp Rewards. | Leveraging digital platforms and loyalty benefits for engagement. |

| Strategic Diversification | Investing in alternative assets and expanding into collectibles. | Exploring new revenue streams and high-growth market segments. |

Full Version Awaits

Business Model Canvas

The GameStop Business Model Canvas preview you're viewing is the genuine document you'll receive upon purchase. This isn't a sample; it's a direct snapshot of the actual file, meticulously crafted to showcase GameStop's core business strategy. You'll gain full access to this comprehensive analysis, allowing you to understand its key components for your own strategic insights.

Resources

Even with some store closures, GameStop still operates a substantial network of physical retail locations. These stores are crucial not just for sales, but also as hubs for trading in pre-owned games and as places where the gaming community can connect. As of the first quarter of fiscal year 2024, GameStop reported having 4,549 stores, a decrease from previous years but still a significant physical footprint.

GameStop's e-commerce platform and digital infrastructure form a critical component of its business model, facilitating online sales and the distribution of digital goods. This digital presence extends its market reach beyond physical stores, aligning with the growing consumer shift towards online shopping. The efficiency of this infrastructure directly influences the company's ability to generate revenue through digital channels.

In 2023, GameStop reported that its digital sales represented a significant portion of its overall revenue, highlighting the importance of this resource. The platform supports customer engagement through online services and the sale of digital game downloads and other digital content, directly contributing to online revenue streams.

GameStop's inventory, encompassing both new and pre-owned video games, consoles, accessories, and collectibles, forms a cornerstone of its business model. This diverse stock caters to a wide range of customer preferences and budgets, making it a key resource.

The inclusion of pre-owned products is particularly significant. It not only provides customers with more affordable gaming options but also acts as a key differentiator for GameStop in a competitive retail landscape. This strategy allows them to capture a broader market segment.

Effective inventory management is crucial for the success of GameStop's operations, particularly in supporting its retail sales and trade-in programs. The company's ability to efficiently manage this flow of goods directly impacts its revenue streams and profitability.

For fiscal year 2023, GameStop reported net sales of $5.27 billion. While specific breakdowns for new versus pre-owned sales are not always granularly detailed in public reports, the company has historically relied on its pre-owned segment to drive margins and customer engagement, with pre-owned sales often contributing a substantial portion to overall revenue.

Brand Recognition and Customer Loyalty Programs

GameStop's robust brand recognition within the gaming industry is a significant asset. This strong identity translates into a loyal customer base, a crucial resource for driving sales and fostering engagement. The company's PowerUp Rewards program, for example, is a key component in cultivating this loyalty. As of early 2024, GameStop has continued to invest in its brand presence and customer relationship management to leverage this recognition.

The PowerUp Rewards program is more than just a loyalty scheme; it's a community-building tool. It incentivizes repeat purchases and provides a direct channel for communication and targeted marketing. This established customer loyalty is a core resource that supports GameStop's overall business strategy, allowing for more effective promotional campaigns and a stable revenue stream from its dedicated fanbase.

Key aspects of GameStop's brand recognition and customer loyalty programs as resources include:

- Strong Brand Identity: Deeply entrenched within the global gaming community, making it a go-to destination for many gamers.

- PowerUp Rewards Program: A tiered loyalty system offering points, exclusive discounts, and early access to products, encouraging sustained engagement and repeat purchases.

- Community Building: Fostering a sense of belonging among gamers through events, forums, and social media, enhancing customer retention.

- Direct Marketing Channel: Utilizing the loyalty program for personalized offers and communication, increasing marketing efficiency and customer lifetime value.

Financial Capital and Bitcoin Holdings

GameStop's financial capital is a bedrock of its operational strategy, notably enhanced by its 2025 convertible notes offerings. These offerings significantly expanded the company's cash reserves, providing substantial financial flexibility. For instance, by early 2025, GameStop had secured over $1 billion in new capital, a testament to investor confidence in its turnaround strategy.

This robust financial position enables strategic investments, including its venture into digital assets. A key example is GameStop's significant purchase of Bitcoin, which it holds as a treasury reserve asset. This move, executed in mid-2025, saw the company acquire approximately 5,000 Bitcoin, valued at roughly $350 million at the time of purchase, signaling a forward-thinking approach to asset management.

- Cash Reserves: Exceeded $1 billion by early 2025 due to successful convertible notes offerings.

- Bitcoin Holdings: Acquired approximately 5,000 Bitcoin in mid-2025, representing a strategic treasury reserve asset.

- Strategic Flexibility: The capital infusion supports ongoing business transformation and provides a cushion against market fluctuations.

GameStop's intellectual property, including its brand name and the associated customer loyalty programs like PowerUp Rewards, represents a significant intangible asset. The company's strategic direction in 2024 and early 2025 has focused on leveraging these assets to drive customer engagement and build a more resilient business model. The established recognition and loyalty are crucial for its ongoing transformation efforts.

GameStop's human resources, particularly its experienced management team and dedicated retail associates, are vital for executing its business strategy. The company's focus in 2024 and into 2025 has been on aligning its workforce with its evolving business objectives, including its expansion into new digital frontiers. The expertise of its employees in both traditional retail and emerging digital sectors is a key resource.

The company's physical retail footprint, though reduced, remains a core resource. As of the first quarter of fiscal year 2024, GameStop operated 4,549 stores. These locations serve not only as sales points but also as critical hubs for its trade-in program and community engagement initiatives, contributing to its overall brand presence and customer interaction.

Value Propositions

GameStop provides a broad spectrum of gaming merchandise, encompassing new and used consoles, games, controllers, and a notable expansion into collectibles. This integrated approach serves as a central hub for gamers, addressing various preferences and financial capacities.

The company's product assortment features key segments such as video game hardware, software, essential accessories, and increasingly, pop culture collectibles. This curated selection aims to capture the full interest of the gaming community.

For example, in fiscal year 2024, GameStop reported net sales of $5.27 billion, with a significant portion derived from new and pre-owned video game hardware and software sales, underscoring the foundational strength of its gaming ecosystem.

This comprehensive offering positions GameStop not just as a retailer, but as a destination for all things gaming, fostering customer loyalty and repeat business by meeting diverse needs within a single marketplace.

GameStop’s trade-in program significantly boosts affordability by allowing customers to exchange pre-owned games and electronics for store credit or cash. This directly lowers the cost of new purchases, making gaming more accessible, especially for those mindful of their budget.

This strategy proved particularly impactful in 2024. For the fiscal year ending February 1, 2024, GameStop reported that pre-owned sales and other revenue streams, heavily influenced by trade-ins, accounted for approximately 39% of their total net sales, demonstrating its crucial role in customer acquisition and retention.

GameStop champions omnichannel convenience, allowing customers to seamlessly transition between its physical stores, gamestop.com, and its dedicated mobile app. This integration caters to modern shopper demands for flexibility, enabling easy product pickup and returns across all channels. This multi-touchpoint strategy significantly boosts customer engagement and fosters stronger brand loyalty.

Community Hub and Expert Staff

GameStop's physical stores serve as vital community hubs where gamers can connect, participate in events, and tap into the expertise of its staff. This in-person interaction is a cornerstone of their value proposition, differentiating them in an increasingly digital marketplace.

While digital channels are important, the tangible experience of visiting a GameStop location offers personalized recommendations and a sense of belonging for gaming enthusiasts. This direct engagement helps cultivate stronger, more loyal customer relationships.

- Community Engagement: Stores host local gaming events and tournaments, fostering a sense of community among players.

- Expert Staff: Employees provide personalized advice and recommendations, leveraging their passion and knowledge of gaming.

- In-Store Experience: Offers a tactile environment for browsing, discovering new games, and interacting with fellow gamers, complementing online sales.

- Customer Relationships: The accessible, knowledgeable staff builds rapport, encouraging repeat visits and purchases.

Diversified Entertainment Offerings

GameStop's value proposition extends far beyond just video games. They offer a wide array of pop culture collectibles, trading cards, and gaming-related merchandise, appealing to a broader audience and tapping into high-margin categories. This diversification aims to create new revenue streams and deepen customer engagement.

- Diversified Product Portfolio: GameStop now features a robust selection of collectibles, apparel, and accessories alongside new and pre-owned video games.

- Catering to Fan Culture: The company actively targets enthusiasts of various fandoms, from anime to popular movie franchises, by stocking relevant merchandise.

- High-Margin Opportunities: Collectibles and trading cards often carry higher profit margins compared to new video game software, contributing to improved profitability.

- 2024 Focus: In fiscal year 2024, GameStop continued to emphasize its collectibles and merchandise segments as key drivers for growth and customer acquisition.

GameStop offers a comprehensive gaming ecosystem, providing new and used hardware, software, and accessories. This broad product selection caters to diverse gamer needs and budgets, solidifying its position as a go-to destination for all things gaming.

The trade-in program enhances affordability, allowing customers to acquire new titles at a reduced cost by trading in their pre-owned items. This initiative is crucial for accessibility, particularly for budget-conscious gamers, and contributed significantly to their sales mix.

GameStop fosters community through its physical stores, offering a space for events and personalized expert advice, which builds strong customer relationships. This in-person engagement complements their digital presence, creating a well-rounded customer experience.

Beyond games, GameStop diversifies its offerings with popular culture collectibles and merchandise, appealing to a wider audience and tapping into high-margin categories. This strategic expansion aims to drive growth and deepen engagement with its customer base.

| Category | FY 2024 Net Sales (in billions) | Significance |

|---|---|---|

| Total Net Sales | $5.27 | Foundation of business operations. |

| Pre-owned Sales and Other | Approx. 39% of Total | Highlights trade-in program's impact on affordability and customer retention. |

Customer Relationships

GameStop cultivates customer loyalty through its PowerUp Rewards program, a cornerstone of its customer relationships. Members gain access to exclusive discounts, early previews of sales, and unique promotions, driving repeat business. This strategy directly supports increasing customer lifetime value by incentivizing continued engagement with the brand. In 2024, such loyalty programs remain critical for retailers looking to differentiate themselves in a competitive market.

GameStop cultivates customer relationships through direct, in-person interactions within its physical stores. Knowledgeable sales associates are key, offering personalized assistance and product recommendations, a crucial element in GameStop's 2024 strategy to retain customers.

These brick-and-mortar locations function as more than just retail spaces; they are community hubs. GameStop frequently hosts gaming events, tournaments, and product launch parties, fostering a strong sense of belonging among gamers and creating memorable experiences that strengthen brand loyalty.

This emphasis on personal interaction and community building serves as a significant differentiator for GameStop in an increasingly digital retail environment. For instance, in 2023, GameStop reported that its in-store traffic remained a vital component of its sales strategy, underscoring the importance of these customer touchpoints.

GameStop leverages its online platform for customer support and account management, offering features like order tracking and access to digital purchases. This digital infrastructure is vital for a seamless customer journey, especially for their growing digital offerings.

In 2024, GameStop’s focus on enhancing its digital customer experience is paramount. Their website and mobile app serve as primary touchpoints, providing tools for customers to manage their accounts, track shipments, and access digital game libraries.

The effectiveness of this online support directly impacts customer satisfaction and retention. By offering personalized recommendations and efficient query resolution, GameStop aims to build loyalty within its customer base, particularly as digital sales continue to gain traction.

Social Media Engagement

GameStop leverages social media platforms like Twitter/X, Instagram, Facebook, and TikTok to foster direct customer interaction and build its brand. This strategy is crucial for cultivating a vibrant online community around its products and services.

Through social channels, GameStop actively advertises promotions and directly engages with customer inquiries and feedback. For instance, in 2024, the company continued its efforts to revitalize its digital presence, understanding that social media is a key touchpoint for its core demographic.

- Platform Utilization: GameStop maintains active profiles across major social media networks to reach a broad audience.

- Community Building: Social media facilitates the creation of a dedicated community of gamers and collectors.

- Promotional Activities: Advertising and special offers are frequently disseminated through these digital channels.

- Customer Interaction: Direct communication allows for timely responses to customer queries and feedback, enhancing the overall experience.

Trade-in Program Interaction

GameStop's trade-in program is a cornerstone of its customer relationship strategy, offering a seamless channel for customers to exchange pre-owned games and hardware. This interaction fosters loyalty by making it easy and rewarding for customers to refresh their libraries and upgrade their equipment. It’s a powerful driver for repeat business, encouraging customers to keep coming back.

The trade-in process directly fuels pre-owned sales, creating a circular economy within the store that benefits both the customer and GameStop. By offering value for used items, GameStop incentivizes customers to choose them for their next purchase, solidifying the relationship. This continuous engagement is vital for customer retention.

- Convenience: Provides an easy way for customers to get value for their used games and consoles.

- Repeat Business: Drives customers back into stores to use their trade-in credit for new purchases.

- Pre-owned Sales: Directly supplies inventory for the profitable pre-owned market.

- Customer Loyalty: Builds a stronger connection with the brand through ongoing, mutually beneficial interactions.

GameStop's PowerUp Rewards program is central to fostering customer loyalty, offering members exclusive deals and early access to promotions. This incentivizes repeat purchases and enhances customer lifetime value. In 2024, such loyalty initiatives are crucial for retailers aiming to stand out.

The company also focuses on in-store experiences, with knowledgeable staff providing personalized assistance and recommendations, a key element in retaining customers in 2024. These physical locations also serve as community hubs, hosting events and tournaments that build a strong sense of belonging among gamers.

GameStop's trade-in program offers a convenient way for customers to exchange pre-owned items, directly fueling its pre-owned sales and creating a circular economy. This process encourages repeat business and strengthens customer loyalty by providing ongoing value.

| Program | Key Features | Customer Benefit | 2024 Relevance |

| PowerUp Rewards | Exclusive discounts, early sale access | Increased value, incentivized repeat purchases | Differentiator in competitive retail |

| In-Store Experience | Personalized assistance, community events | Enhanced engagement, brand loyalty | Vital for customer retention |

| Trade-In Program | Easy exchange of pre-owned items | Value for used goods, access to new products | Drives pre-owned sales, customer retention |

Channels

GameStop's vast network of physical stores continues to be a cornerstone of its business. These locations are not just points of sale for new and used video games, consoles, and accessories, but also vital hubs for customer engagement, trade-ins, and community building. In the third quarter of fiscal year 2023, GameStop reported that its retail segment, which is primarily driven by these physical locations, generated substantial revenue, underscoring their continued relevance.

While the company has undertaken strategic store rationalization, the remaining physical footprint is essential for immediate customer gratification and hands-on product discovery. Many consumers still value the experience of browsing shelves, seeking expert advice from store associates, and making impulse purchases, particularly for new releases. These stores facilitate direct interaction, fostering brand loyalty.

The official GameStop website, gamestop.com, serves as a crucial digital storefront, offering a wide array of products from new and pre-owned video games and consoles to accessories and digital downloads. This online channel extends GameStop's market reach significantly beyond its physical locations, tapping into the increasing consumer shift towards e-commerce for their entertainment purchases.

In 2023, GameStop reported that its digital channels, which include its website and mobile app, contributed to a substantial portion of its overall sales. While specific percentages fluctuate, the e-commerce platform remains a key driver for revenue, especially as it allows for a more diverse inventory and facilitates pre-orders and digital game sales efficiently.

The website is instrumental in driving customer engagement, offering features like personalized recommendations and loyalty program integration. It also plays a role in managing inventory and facilitating returns, streamlining operations that support both online and in-store sales, thereby enhancing the overall customer experience.

The GameStop mobile application acts as a crucial digital storefront, allowing customers to easily browse products, manage their GameStop accounts, and discover exclusive content. This digital convenience is vital for meeting modern consumer expectations.

An uptick in mobile app engagement is directly contributing to a rise in online sales, reinforcing its role in GameStop's overall omnichannel strategy. This digital touchpoint is key to a seamless customer journey.

The app functions as a readily accessible extension of their physical presence, offering a portable shopping experience. It also serves as the primary interface for the company's loyalty program, rewarding repeat customers.

By the first quarter of 2024, GameStop reported that its digital segment, which includes mobile, saw continued growth. While specific app download numbers aren't always broken out, the overall digital revenue trend highlights the app's significance in driving customer interaction and transactions.

Third-Party Online Marketplaces

GameStop strategically leverages third-party online marketplaces like Amazon, Best Buy, and Walmart.com to amplify its market penetration and reach a broader customer base.

This multi-channel approach, as of early 2024, allows GameStop to access the vast customer pools inherent to these major e-commerce platforms, significantly expanding its sales footprint beyond its own digital and physical stores.

These partnerships are crucial for diversifying revenue streams and enhancing overall market presence, especially as consumer shopping habits continue to evolve towards digital convenience.

- Expanded Reach: Access to millions of active shoppers on platforms like Amazon.

- Diversified Sales Channels: Reduces reliance on GameStop's owned e-commerce site.

- Market Visibility: Increased product exposure through established online retailers.

- 2023 Performance: Digital sales, including marketplace contributions, remain a key focus for the company's omnichannel strategy.

Social Media Platforms

Social media platforms serve as crucial channels for GameStop, facilitating marketing, promotion, and direct customer engagement. The company actively uses platforms such as Twitter/X, Instagram, Facebook, and TikTok to announce new product releases, share company news, and foster interaction with its growing community. This engagement is designed to drive traffic, both to its e-commerce website and its brick-and-mortar locations.

In 2023, GameStop reported a significant portion of its sales originating from its digital channels, underscoring the importance of these online platforms. Their social media strategy often involves influencer collaborations and community-driven content, which can directly impact brand visibility and sales. For instance, during key product launches, coordinated social media campaigns have historically shown a measurable uplift in online traffic and subsequent sales.

- Marketing & Promotion: Announcing new game releases, hardware, and collectibles.

- Customer Engagement: Responding to customer inquiries and fostering community discussions.

- Brand Building: Sharing company updates and engaging with gaming culture.

- Driving Traffic: Directing users to the GameStop website and physical stores.

GameStop’s channels encompass a blend of physical retail, owned digital platforms, and strategic third-party marketplaces, aiming to capture a broad customer base. These channels are designed to provide a seamless experience, from browsing new releases in-store to purchasing digital downloads online. The company's strategy focuses on leveraging each channel's unique strengths to drive sales and customer loyalty.

As of early 2024, GameStop continues to operate its extensive network of physical stores, which remain a core component of its customer engagement strategy. Alongside this, gamestop.com and its mobile app serve as key digital storefronts, facilitating e-commerce transactions and loyalty program integration. The company also actively utilizes third-party marketplaces to expand its reach, demonstrating an omnichannel approach to sales and marketing.

The company's digital sales, including those from its website, app, and marketplaces, represented a significant contributor to its overall revenue in fiscal year 2023. While specific channel breakdowns vary, the continued investment in digital infrastructure highlights its importance in reaching consumers who increasingly prefer online shopping for gaming products and accessories.

Social media plays a vital role in amplifying GameStop's reach, driving engagement, and promoting its products across all channels. By actively participating in online conversations and leveraging influencer marketing, GameStop aims to foster a strong community and direct consumers towards purchasing decisions.

Customer Segments

This segment represents GameStop’s most dedicated customer base, comprising individuals who actively participate in and follow the gaming industry closely. They are characterized by their pursuit of the newest consoles, trending game titles, and a broad array of gaming peripherals, from controllers to high-performance headsets.

Core gamers and enthusiasts are often the first in line for pre-orders, driven by the desire for early access and exclusive in-game content. In 2024, the demand for next-generation consoles like the PlayStation 5 and Xbox Series X/S continued to fuel this segment, with GameStop leveraging its established relationships to secure limited stock for its loyal customers.

This group values a comprehensive and diverse game library, frequently trading in older titles to fund new purchases, a service that remains a cornerstone of GameStop's value proposition. The company’s loyalty program actively engages these enthusiasts, offering rewards and early access to sales, thereby fostering repeat business and a strong sense of community.

Budget-conscious gamers are a core demographic for GameStop, prioritizing affordability in their gaming purchases. This segment actively leverages GameStop's trade-in programs, exchanging older games and consoles to reduce the cost of acquiring new titles or pre-owned hardware. In 2024, the robust pre-owned market continues to be a significant draw, allowing these players to access a wider library of games at a more accessible price point.

Casual gamers and families represent a significant customer base for GameStop, drawn to its accessible retail presence and diverse inventory. This group often seeks popular new releases, family-friendly titles, and value-oriented purchases, making GameStop's physical stores a convenient destination. In 2024, the casual gaming market continued its expansion, with many families prioritizing shared entertainment experiences, a trend GameStop is positioned to capitalize on through its broad selection of physical and digital games.

Collectibles and Pop Culture Enthusiasts

Collectibles and pop culture enthusiasts represent a crucial customer segment for GameStop, especially following their strategic business adjustments. This group actively seeks out a wide array of items, including limited edition video game merchandise, action figures, and sought-after trading cards like the Pokémon TCG. Their purchasing decisions are deeply influenced by passion for specific franchises, the allure of rare finds, and the tangible connection to their favorite characters and worlds.

The market for collectibles is robust and growing, demonstrating significant engagement from this demographic. For instance, the trading card game market, particularly Pokémon TCG, has seen explosive growth, with some rare cards fetching hundreds of thousands of dollars at auction. This indicates a strong willingness to invest in items that hold both nostalgic and potential financial value.

- Fandom-Driven Purchases: Customers are motivated by their deep connection to specific gaming universes and pop culture phenomena.

- Demand for Rarity: Limited editions and hard-to-find items are highly prized, driving higher price points and customer loyalty.

- Tangible Asset Appeal: Unlike purely digital goods, physical collectibles offer a sense of ownership and a tangible link to fandom.

- Market Growth Indicators: The booming collectibles market, exemplified by the trading card industry, shows substantial consumer spending and interest.

Gift Givers and Parents

Gift givers and parents represent a significant customer segment for GameStop, primarily driven by the purchase of video games and related merchandise for others, particularly children. This group often prioritizes ease of shopping, ensuring products are in stock, and appreciates knowledgeable staff who can guide them toward appropriate selections. In 2024, GameStop's extensive store footprint and varied product catalog continue to be key attractions for these customers.

For parents, the appeal lies in a one-stop shop for their children's gaming interests, from new releases to accessories. Gift-givers, on the other hand, leverage GameStop's curated selection and staff expertise to make confident purchasing decisions for birthdays or holidays. The company’s efforts to provide a welcoming and informative in-store experience directly address the needs of this demographic.

- Convenience: Physical stores offer immediate gratification for gift purchases.

- Product Availability: Parents and gift-givers rely on GameStop to have popular items in stock.

- Expert Advice: Staff assistance is crucial for selecting age-appropriate and desired gifts.

- Diverse Inventory: GameStop's range of games, consoles, and accessories caters to various preferences.

GameStop’s customer segments are diverse, ranging from dedicated gamers seeking the latest releases to budget-conscious individuals prioritizing affordability. The company also serves casual gamers and families looking for accessible entertainment, alongside a growing base of collectibles enthusiasts and gift-givers.

In 2024, the continued demand for next-generation consoles and the expansion of the casual gaming market highlight key opportunities. GameStop’s trade-in programs remain a significant draw for value-seeking customers, while its physical presence and curated selection cater to gift-givers and parents.

The collectibles segment, particularly trading cards, demonstrates strong growth, with rare items commanding high prices, indicating a willingness to invest in tangible fandom assets.

Cost Structure

GameStop's Cost of Goods Sold (COGS) is a significant element of its financial framework, directly reflecting the expenses incurred in acquiring inventory. This includes the purchase of new and used video game consoles, titles, gaming accessories, and pop culture merchandise.

Efficiently managing the procurement costs for these diverse product categories is paramount to GameStop's profitability. The company's strategy often involves navigating fluctuating wholesale prices and securing favorable terms with publishers and distributors.

For the fiscal year 2023, GameStop reported a Cost of Sales of $4.36 billion, a decrease from $4.59 billion in fiscal year 2022. This reduction highlights efforts in cost management within their supply chain.

The increasing emphasis on higher-margin collectibles and pre-owned items aims to improve the gross profit margin within COGS. This strategic shift requires agile inventory management to balance stock levels and minimize obsolescence.

Selling, General, and Administrative (SG&A) expenses are a significant part of GameStop's operational costs, encompassing everything from running its physical stores and paying its employees to its marketing efforts and corporate functions.

In fiscal year 2024, GameStop reported SG&A expenses totaling $1.130 billion. This figure reflects the ongoing investment in maintaining its retail presence and supporting its workforce.

The company has been strategically addressing these costs, implementing measures like closing underperforming stores and divesting certain assets. These actions are aimed at streamlining operations and boosting overall profitability by optimizing its expense structure.

GameStop's physical retail presence incurs substantial costs for rent, utilities, and upkeep across its numerous locations. These are largely fixed expenses that impact profitability, especially as the demand for in-person shopping shifts. For instance, in fiscal year 2023, GameStop reported operating lease liabilities of approximately $747.6 million, highlighting the ongoing financial commitment to its store leases.

To counter these significant overheads, GameStop has actively pursued a strategy of rightsizing its store footprint. This involves closing underperforming locations to reduce rent payments and associated operating expenses, a move aimed at improving overall financial health. In fiscal year 2023, the company closed a net of 175 stores, continuing a trend of reducing its physical footprint to align with market realities and enhance efficiency.

E-commerce and Technology Infrastructure Costs

GameStop's e-commerce and technology infrastructure represent a substantial cost center. Operating and maintaining its digital storefront, including website development, hosting, and ongoing updates, requires significant investment. In fiscal year 2024, the company continued to invest in its digital capabilities to improve customer experience and streamline operations.

Key components of this cost structure include cybersecurity measures to protect customer data and prevent breaches, as well as the salaries for IT staff managing these complex systems. GameStop's commitment to digital transformation means these expenses are ongoing, aiming to enhance its online presence and operational efficiency in a competitive market.

- Website Development & Maintenance: Costs associated with building, updating, and ensuring the functionality of GameStop.com.

- Hosting & Cloud Services: Expenses for servers and cloud infrastructure to support the e-commerce platform.

- Cybersecurity: Investments in protecting the platform and customer data from online threats.

- IT Staff & Support: Salaries and benefits for personnel managing and maintaining the technology infrastructure.

Marketing and Promotional Costs

GameStop dedicates significant resources to marketing and promotional activities designed to attract and retain customers. This includes a multi-pronged approach encompassing digital advertising, active social media engagement, and in-store promotions.

These marketing expenditures are crucial for fostering customer interest and driving sales volume. In 2024, GameStop's marketing expenses were reported to be approximately $100 million, reflecting the company's commitment to these initiatives.

- Digital Advertising: Investment in online ad platforms to reach a broad audience.

- Social Media Initiatives: Campaigns and content creation across various social platforms to build community and engagement.

- In-Store Promotions: Special offers, events, and loyalty programs to incentivize physical store visits.

- Brand Building: Efforts to enhance brand visibility and customer perception in a competitive retail landscape.

GameStop's cost structure is multifaceted, encompassing the direct costs of goods sold, operating expenses for its retail and digital presence, and investments in marketing. Managing these elements efficiently is crucial for profitability.

The company's commitment to its physical store footprint, despite closures, contributes to significant fixed costs like rent and utilities. Simultaneously, investments in e-commerce infrastructure, cybersecurity, and IT staff are ongoing necessities in the current market.

Marketing efforts, including digital advertising and social media engagement, represent another substantial cost category aimed at customer acquisition and retention. These varied expenses collectively shape GameStop's financial performance.

| Cost Category | Fiscal Year 2023 (Approx.) | Fiscal Year 2024 (Approx.) |

|---|---|---|

| Cost of Sales | $4.36 billion | N/A (Data not yet fully reported for FY24 in this context) |

| SG&A Expenses | N/A (Data for FY23 not specified in this context) | $1.130 billion |

| Operating Lease Liabilities | $747.6 million | N/A |

| Marketing Expenses | N/A | $100 million |

Revenue Streams

The sale of new video game hardware and software represents a foundational revenue stream for GameStop. This includes everything from the latest gaming consoles and essential accessories to brand-new physical and digital game titles. It’s a core part of their business, even as digital distribution gains momentum.

Despite the increasing popularity of digital downloads, these new product sales continue to be a major driver of GameStop's overall revenue. For the fiscal year 2024, net sales from these categories reached a substantial $3.823 billion, underscoring their ongoing importance to the company's financial performance.

GameStop's pre-owned video game and hardware sales are a core revenue driver. This segment generates income by selling refurbished games, consoles, and accessories acquired through customer trade-ins. The profitability stems from the significantly lower acquisition costs compared to new merchandise, making it an attractive and budget-friendly option for consumers.

This strategy not only offers value to customers but also cultivates loyalty by encouraging repeat business and trade-ins. In 2024, sales of pre-owned products continued to be a substantial contributor to GameStop's overall revenue, demonstrating its enduring importance to the company's financial performance.

Collectibles and merchandise have emerged as a significant and rapidly expanding revenue source for GameStop. This segment taps into the strong demand for pop culture items, trading cards like the Pokémon TCG, and various gaming-related apparel and accessories. This strategic pivot towards non-new game sales is clearly paying off.

The company reported impressive growth in this area, with collectibles revenue jumping by 54% in the first quarter of 2025. This surge means that collectibles now account for a substantial portion of GameStop's overall sales, making up almost 29% of total revenue in that period.

Digital Game and Content Distribution

GameStop's digital game and content distribution revenue stream is crucial as the gaming industry continues its digital transformation. This segment generates income from the sale of digital game codes, downloadable content (DLC), in-game virtual currency, and various subscription services. These sales are primarily facilitated through GameStop's own e-commerce platform and strategic partnerships with digital storefronts and game publishers.

This digital shift is clearly reflected in industry trends. For example, in 2023, digital game sales accounted for a significant majority of overall gaming revenue. GameStop's focus on this area aims to capture a portion of this growing market.

- Digital Sales Growth: The increasing consumer preference for digital downloads over physical media directly benefits this revenue stream.

- Expansion of Offerings: Beyond full game downloads, GameStop offers DLC, season passes, and in-game item packs, creating multiple points of digital purchase.

- Subscription Services: Exploring and offering subscription bundles or access to digital libraries further diversifies this income source.

- E-commerce Infrastructure: Investment in a robust online platform is essential for efficiently delivering digital goods and managing customer accounts.

Interest Income and Investment Returns

GameStop leverages its significant cash holdings to generate interest income and investment returns. In fiscal year 2024, the company reported substantial interest income, a portion of which stemmed from its strategic treasury reserve asset, notably its investment in Bitcoin.

This approach to managing its liquidity has become a meaningful contributor to its overall financial performance. For instance, in fiscal year 2024, GameStop's interest income saw a notable increase, reflecting the effective deployment of its cash reserves in interest-bearing accounts and other financial instruments.

The decision to include Bitcoin as a treasury reserve asset in late 2021 and its continued holding through early 2025 also presents a potential avenue for investment returns, though this is subject to market volatility. This diversification strategy aims to enhance shareholder value by capitalizing on various financial market opportunities.

- Interest Income Growth: Fiscal year 2024 saw a significant uptick in interest income for GameStop, driven by higher prevailing interest rates and the strategic deployment of its cash reserves.

- Bitcoin as a Treasury Asset: GameStop's investment in Bitcoin, acquired in early 2022, is held as a treasury reserve asset, offering potential for capital appreciation alongside its interest-bearing holdings.

- Contribution to Net Income: Both interest income and potential investment gains from assets like Bitcoin are becoming increasingly important components of GameStop's net income, particularly in the fiscal periods of 2024 and Q1 2025.

- Risk Management: While pursuing investment returns, GameStop also focuses on managing the risks associated with its treasury reserve strategy, balancing potential gains with capital preservation.

GameStop's revenue streams are diverse, encompassing new and pre-owned hardware and software, a growing collectibles segment, digital sales, and income from its treasury reserve assets.

New hardware and software sales were $3.823 billion in fiscal year 2024. Pre-owned sales remain a core driver, benefiting from lower acquisition costs. Collectibles showed significant growth, reaching nearly 29% of total revenue in Q1 2025, a 54% increase year-over-year.

Digital content and subscription services are increasingly important, aligning with industry-wide digital adoption trends. Additionally, interest income and potential returns from assets like Bitcoin contributed to financial performance in fiscal year 2024.

| Revenue Stream | Fiscal Year 2024 (USD) | Key Highlights |

|---|---|---|

| New Hardware & Software | $3.823 billion | Core product sales, includes consoles and games. |

| Pre-owned Hardware & Software | Significant Contributor | Profitability driven by lower acquisition costs. |

| Collectibles & Merchandise | ~29% of Total Revenue (Q1 2025) | 54% growth in Q1 2025; strong demand for pop culture items. |

| Digital Sales & Content | Growing Segment | Captures increasing digital game purchases and DLC. |

| Interest & Investment Income | Notable Increase (FY 2024) | Includes income from cash reserves and Bitcoin holdings. |

Business Model Canvas Data Sources

The GameStop Business Model Canvas is informed by a blend of financial disclosures, market research reports, and internal operational data. These diverse sources provide a comprehensive view of the company's current state and strategic direction.