GameStop Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GameStop Bundle

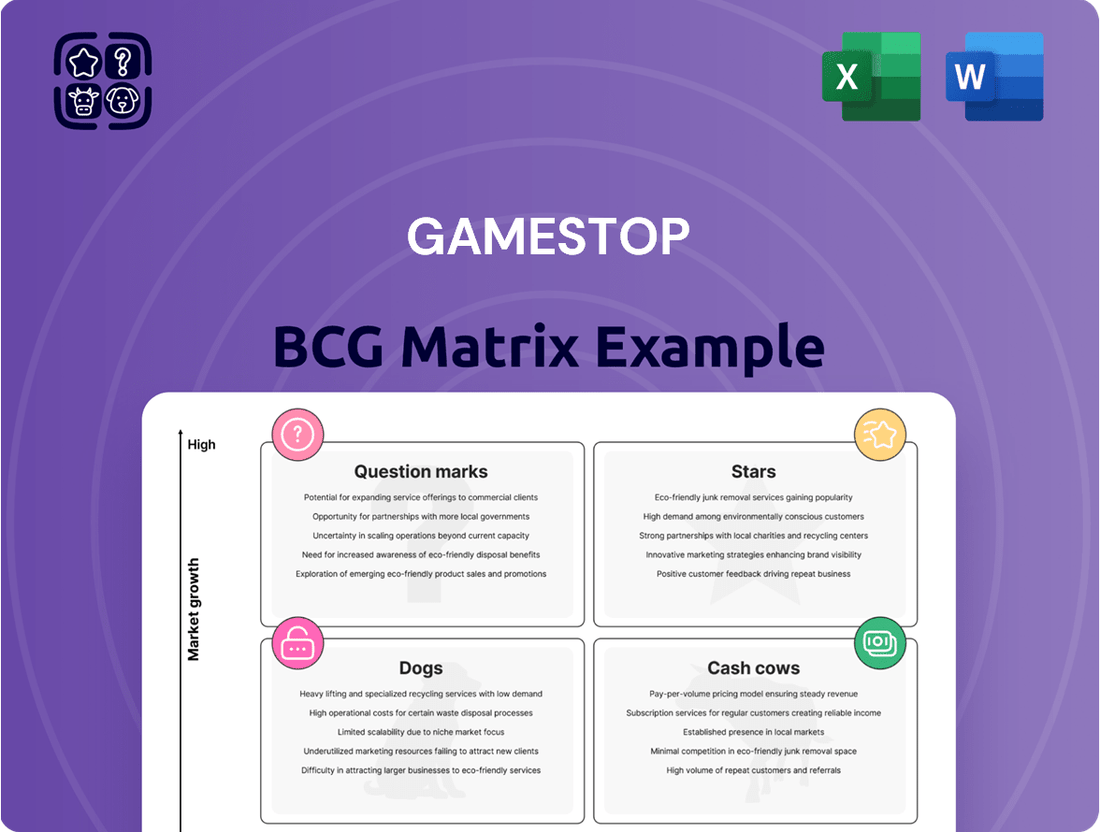

The GameStop BCG Matrix offers a fascinating glimpse into the company's product portfolio. Imagine a landscape where some ventures are booming, others are steady generators, and a few might be struggling for traction. Understanding these dynamics is crucial for any investor or business strategist looking to navigate the retail and gaming landscape.

This preview highlights the need for a deeper dive. Are GameStop's core offerings cash cows, or are there emerging stars poised for future growth? Without the full matrix, you're only seeing a fraction of the strategic picture.

Dive deeper into GameStop's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

GameStop's strategic push into the collectibles market, particularly with trading cards like Pokémon and Magic: The Gathering, has yielded impressive results. This expansion has been a major driver of growth for the company.

Sales in the collectibles category experienced a substantial surge of 55% over the past year. This strong performance now means that collectibles account for a significant 29% of GameStop's overall revenue, highlighting its increasing importance.

The company is successfully tapping into robust consumer demand within this segment. The high-margin potential inherent in collectibles further solidifies this category as a crucial area for GameStop's future growth and profitability.

GameStop is significantly investing in its e-commerce platform to bolster its online presence and compete more effectively. This strategic push aims to create a more engaging user experience and attract a wider digital customer base.

The company's digital transformation efforts are crucial for diversifying revenue beyond its traditional brick-and-mortar model, especially as the gaming industry continues its online shift. This focus is vital for long-term growth and relevance in a competitive market.

By enhancing its e-commerce infrastructure and exploring AI-driven personalization, GameStop seeks to capture a larger share of the expanding online retail sector. This could translate into increased sales and customer loyalty in the digital realm.

GameStop's strategy of offering exclusive and limited-edition products leverages its strong relationships with major console manufacturers like Sony and Microsoft. For instance, during the 2024 holiday season, GameStop was a key retailer for limited-edition console bundles and collector's editions of highly anticipated games, often selling out within hours of release. This exclusivity taps into a dedicated fan base eager for unique merchandise, creating significant buzz and driving substantial sales figures for these specific SKUs.

Strategic Partnerships in Emerging Gaming Tech

GameStop is actively pursuing strategic partnerships to penetrate emerging gaming technology sectors, such as cloud gaming hardware. While their current market presence in these innovative areas might be minimal, the substantial growth prospects are undeniable.

These collaborations are crucial for GameStop's strategy to become a leader in high-potential, nascent markets. For example, by securing early access to new cloud gaming hardware, they can build a foundation for future market share. The global cloud gaming market was projected to reach over $15 billion in 2024, indicating significant opportunity.

- Focus on High-Growth Potential: GameStop targets rapidly expanding segments within the gaming industry.

- Strategic Alliances: Partnerships are key to accessing and establishing a foothold in new technologies.

- Future Market Leadership: The strategy aims to position GameStop as a dominant player in emerging gaming tech.

- Cloud Gaming Expansion: Exploring early access to cloud gaming hardware is a primary objective.

Refurbished and Premium Pre-Owned Hardware

GameStop's refurbished and premium pre-owned hardware segment, while operating within a mature market, demonstrates a strategic advantage. By focusing on higher-value items like current-generation consoles and premium accessories, the company taps into a niche but consistently sought-after market. This allows them to secure a substantial share of this segment, leveraging their expertise in acquisition and refurbishment.

This strategy is particularly effective because it caters to a growing base of cost-conscious consumers who still desire quality technology. The margins on these refurbished items are typically robust, contributing positively to GameStop's overall profitability. For instance, in early 2024, the demand for pre-owned gaming hardware remained strong, with many consumers looking for more affordable entry points into current-generation gaming.

- Niche Market Dominance: GameStop excels in refurbishing and reselling high-value pre-owned hardware, including current-gen consoles and premium accessories.

- Strong Margin Potential: This segment offers attractive profit margins, benefiting from the company's refurbishment capabilities.

- Cost-Conscious Appeal: The focus on quality pre-owned items attracts consumers seeking value without compromising on performance.

- Market Resilience: Despite the maturity of the pre-owned market, this specific segment shows consistent demand.

GameStop's collectibles business, fueled by strong demand for trading cards, has become a significant growth engine. This segment now represents 29% of total revenue, with sales climbing 55% year-over-year, underscoring its high-margin potential and strategic importance.

The company's focus on exclusive and limited-edition products, particularly console bundles and collector's editions, leverages strong manufacturer relationships. This strategy proved successful during the 2024 holiday season, with items often selling out rapidly, demonstrating the value of unique merchandise.

Emerging technology sectors, such as cloud gaming hardware, represent a key area for future expansion. GameStop's strategic partnerships aim to establish a foothold in these high-potential, nascent markets, tapping into a global cloud gaming market projected to exceed $15 billion in 2024.

The refurbished and premium pre-owned hardware segment, especially current-generation consoles, showcases GameStop's ability to dominate a niche market. This segment appeals to value-conscious consumers and consistently delivers robust profit margins, as evidenced by strong demand in early 2024.

What is included in the product

This GameStop BCG Matrix analysis identifies its product portfolio's market share and growth, highlighting units for investment or divestment.

GameStop's BCG Matrix analysis offers a clear, one-page overview to pinpoint underperforming "Dogs" and strategize for "Stars," alleviating the pain of resource misallocation.

Cash Cows

GameStop's pre-owned physical game trade-in program continues to be a significant revenue generator, functioning as a classic cash cow within its business model. This initiative allows customers to exchange used games, consoles, and accessories for store credit or cash, fostering a loyal customer base and encouraging repeat business. Despite the broader decline in physical game sales, GameStop's efficient management of this circular economy sustains its profitability.

In 2023, GameStop reported that pre-owned and other categories, which heavily feature the trade-in program, contributed approximately $1.1 billion to its total net sales. This segment offers higher profit margins compared to new product sales, underscoring its importance as a cash cow. The program's continued success demonstrates GameStop's ability to leverage its physical store footprint for a sustainable, high-margin business.

Current-generation gaming accessories, such as controllers and headsets for consoles like the PlayStation 5 and Xbox Series X/S, represent a significant cash cow for GameStop. These essential items generate consistent revenue due to their high demand and typically offer robust profit margins, bolstering GameStop's overall profitability.

Unlike digital game downloads, physical accessories remain a stable revenue stream, less impacted by the ongoing shift towards digital distribution. This stability is crucial for maintaining predictable income.

In 2024, the gaming accessory market continued its strong performance, with sales of controllers and headsets remaining a cornerstone for retailers. GameStop likely benefited from this trend, leveraging its established presence to capture a substantial share of this consistent demand.

PowerUp Rewards Pro Subscriptions represent a significant cash cow for GameStop. The program leverages a substantial membership base, offering exclusive perks like discounts on pre-owned games and monthly reward credits, which directly contribute to its strong recurring revenue. This predictable cash flow, fueled by customer loyalty, encourages repeated engagement within GameStop's marketplace. As of early 2024, GameStop reported approximately 6.4 million PowerUp Rewards members, with a notable portion of these being Pro subscribers, underscoring the program's financial contribution.

Sales of Gift Cards

Sales of gift cards are a classic example of a Cash Cow for GameStop, generating consistent upfront cash. These cards, once purchased, essentially provide GameStop with interest-free capital. Customers redeeming these cards often spend more than the card's value, leading to incremental sales and customer loyalty.

The predictability of gift card sales offers a stable foundation for GameStop's financial planning. For instance, in the fiscal year 2023, GameStop reported total net sales of $5.93 billion. While specific gift card revenue isn't always broken out, their role in driving traffic and subsequent purchases is undeniable.

- Steady Cash Inflow: Gift card sales provide immediate cash without immediate product cost, improving working capital.

- Customer Retention: They encourage repeat visits and purchases as customers redeem their balances.

- Increased Basket Size: Often, customers spend beyond the gift card amount, boosting overall transaction value.

- Predictable Revenue: Their consistent performance makes them a reliable component of GameStop's revenue streams.

Established Physical Store Locations (Profitable)

Despite the broader trend of retail closures, GameStop's strategically positioned physical stores, especially those in high-traffic areas, remain robust revenue generators. These locations act as vital hubs for customer engagement, facilitating essential services like order pickups, returns, and trade-ins, which contribute significantly to consistent cash flow.

As of the first quarter of 2024, GameStop reported that its physical store base, while smaller than in previous years, still accounted for a substantial portion of its overall sales. For instance, in fiscal year 2023, a significant percentage of GameStop's revenue was still derived from its brick-and-mortar operations, underscoring their role as cash cows.

- Prime Locations: Stores situated in high-foot-traffic shopping centers and urban hubs continue to attract consistent customer visits.

- Customer Service Hubs: These locations are crucial for in-store order fulfillment, managing returns, and facilitating the popular trade-in program, all of which drive foot traffic and ancillary sales.

- Brand Visibility: Established physical presence reinforces brand recognition and provides a tangible touchpoint for customers, especially for new product launches and events.

- Profitability: While overall store count has decreased, the focus has shifted to optimizing the performance of these select profitable locations, ensuring they remain strong contributors to GameStop's financial stability.

GameStop's pre-owned sales, a cornerstone of its business, continue to function as a significant cash cow. This segment, driven by the trade-in program, offers higher profit margins than new product sales, providing a consistent and reliable revenue stream. In fiscal year 2023, GameStop's pre-owned and other categories generated approximately $1.1 billion in net sales, highlighting its enduring importance.

The company's PowerUp Rewards Pro subscription service is another key cash cow, boasting around 6.4 million members as of early 2024. This program generates predictable, recurring revenue through membership fees and encourages customer loyalty, leading to increased spending on other GameStop products and services.

Sales of gaming accessories, such as controllers and headsets for current-generation consoles, also represent a stable cash cow. These high-demand items maintain robust profit margins and are less susceptible to the shift towards digital game downloads, ensuring a steady income for the company.

Gift cards are a classic cash cow, providing GameStop with upfront, interest-free capital and often leading to incremental sales as customers spend more than the card's value. While specific figures aren't always itemized, their role in driving traffic and purchases is undeniable, contributing to GameStop's overall financial health, which saw total net sales of $5.93 billion in fiscal year 2023.

| Business Segment | Role in BCG Matrix | Key Contribution | Approximate FY23 Contribution (USD) |

| Pre-owned Sales & Trade-in | Cash Cow | High profit margins, consistent revenue | $1.1 billion (Pre-owned and other categories) |

| PowerUp Rewards Pro | Cash Cow | Recurring revenue, customer loyalty | Significant contribution from 6.4 million members (as of early 2024) |

| Gaming Accessories | Cash Cow | High demand, stable profit margins | Integral part of overall sales, supporting $5.93 billion total net sales (FY23) |

| Gift Cards | Cash Cow | Upfront capital, drives incremental sales | Contributes to overall sales, supporting $5.93 billion total net sales (FY23) |

Full Transparency, Always

GameStop BCG Matrix

The GameStop BCG Matrix preview you're viewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, detailing GameStop's product portfolio and market position, is fully formatted and ready for immediate strategic application. You can confidently expect the exact same professionally compiled report, enabling informed decision-making for your business planning or presentations.

Dogs

Physical PC game sales have significantly shrunk, a casualty of digital distribution's dominance. Platforms like Steam and Epic Games Store now command the market, making physical media a niche. GameStop's remaining stock in this area generates minimal revenue, barely contributing to overall sales figures and posing a challenge for efficient inventory management.

GameStop's brick-and-mortar stores are facing significant challenges, often categorized as 'Dogs' in the BCG Matrix due to their underperformance. The company has been strategically closing hundreds of these legacy locations across the United States, a move necessitated by high operating expenses and a consistent decline in customer visits.

These physical retail spaces are proving to be substantial drains on company resources, consuming capital without offering a clear path toward future growth or profitability. For instance, in fiscal year 2023, GameStop reported a significant reduction in its physical store footprint as part of its broader restructuring efforts.

Sales of last-generation physical game software at GameStop are increasingly becoming a challenge. As newer consoles like the PlayStation 5 and Xbox Series X/S dominate the market, and digital backward compatibility becomes standard, demand for older physical discs has understandably shrunk. This shift means these older titles often sit on shelves longer, generating slow turnover.

The financial implications are clear: inventory of these older physical games ties up valuable capital. Low margins on these declining sales further exacerbate the issue, making them less attractive from a profitability standpoint. For instance, by early 2024, the resale market for many older physical games saw continued price depreciation as the collector's interest waned in favor of readily available digital versions or newer hardware.

Legacy Digital Initiatives (e.g., failed NFT marketplace aspects)

GameStop's foray into the NFT marketplace, while an ambitious digital pivot, encountered significant headwinds. The broader NFT market experienced substantial volatility throughout 2023 and into 2024, with trading volumes plummeting from their 2021 peaks. This market downturn directly impacted the potential for GameStop's digital initiatives to gain traction and generate sustainable revenue.

These legacy digital ventures can be categorized as cash traps within the BCG framework. They represent areas where GameStop has invested capital and resources but has failed to secure a meaningful market share or achieve profitability. The initial excitement surrounding NFTs did not translate into consistent consumer engagement or a robust revenue stream for the company.

- Market Volatility: The NFT market saw a significant contraction in 2023, with many platforms experiencing sharp declines in trading volume and user activity.

- Low Adoption: Despite initial hype, broader consumer adoption of GameStop's NFT offerings did not materialize to the extent needed for sustained growth.

- Resource Consumption: Investments in these digital initiatives, while strategic, have consumed capital without delivering commensurate returns, impacting overall financial performance.

- Cash Trap Classification: Given the lack of market share and profitability, these initiatives are now viewed as cash traps, draining resources rather than generating cash.

Outdated Inventory Management Systems

GameStop's reliance on outdated inventory management systems prior to its modernization efforts created significant operational hurdles. These legacy systems were often disconnected, leading to inefficiencies in tracking stock levels. This disconnect resulted in situations like overstocking certain items while missing opportunities to sell popular products, directly impacting revenue.

The consequences of these outdated systems were tangible. They contributed to increased operational costs due to manual processes and the need for extensive manual reconciliation. Furthermore, reduced profitability stemmed from lost sales and the expenses associated with managing excess inventory. For instance, in the fiscal year ending February 2023, GameStop reported a net loss of $302.5 million, a portion of which can be attributed to inefficiencies in its supply chain and inventory control.

- Inefficient Stock Tracking: Disconnected systems made real-time inventory visibility difficult.

- Overstocking & Lost Sales: Poor data led to excess inventory of slow-moving items and shortages of popular ones.

- Increased Operational Costs: Manual processes and storage of excess stock raised expenses.

- Reduced Profitability: A combination of lost sales and higher costs negatively impacted the bottom line.

Physical retail stores, particularly those focused on older gaming hardware and software, represent GameStop's 'Dogs' in the BCG Matrix. These segments exhibit low market share and low growth potential, necessitating careful management to minimize losses. The company has actively reduced its physical footprint to mitigate these challenges.

GameStop has been closing underperforming stores, a strategy reflecting the declining relevance of physical retail for many gaming products. This includes locations selling older generation consoles and physical games, which face reduced demand due to digital downloads and the lifecycle of gaming hardware. For example, GameStop closed approximately 1,000 stores between 2019 and early 2024, indicating a significant shift away from this model.

The company's NFT marketplace initiative, while an attempt at digital diversification, also falls into the 'Dog' category. The broader NFT market experienced a significant downturn in 2023 and early 2024, with trading volumes plummeting. This lack of sustained market growth and adoption for GameStop's specific offerings means these digital ventures are currently low-growth, low-share businesses.

The financial performance of GameStop's physical store segment and its NFT marketplace clearly places them in the 'Dog' quadrant. These areas consume resources without generating significant returns, reflecting their low market share and stagnant growth prospects.

| Category | BCG Quadrant | Key Characteristics | Financial Implication |

|---|---|---|---|

| Physical Retail Stores (Older Hardware/Software) | Dogs | Low market share, low growth, declining demand | Inventory holding costs, store operating expenses, asset impairment |

| NFT Marketplace | Dogs | Low market share, low growth (post-hype), volatile market | Platform maintenance costs, investment in digital infrastructure without commensurate revenue |

Question Marks

GameStop's decision to allocate a significant portion of its treasury, around $513 million, to Bitcoin in 2024 represents a bold, high-stakes gamble. This move positions Bitcoin as a speculative reserve asset, offering the tantalizing prospect of substantial gains should the cryptocurrency's value surge. However, it simultaneously exposes the company to extreme price volatility, a departure from traditional treasury management.

This strategy is arguably a "question mark" within the context of GameStop's business model, as it's a venture far removed from their core operations in video game retail. The long-term implications of holding such a volatile digital asset on their brand identity and financial stability remain uncertain, making it a critical area for ongoing observation and analysis.

GameStop's 2024 move into buying and selling graded Pokémon TCG singles, alongside a partnership with PSA as an authorized dealer, signals a strategic pivot towards the burgeoning collectibles market. This initiative taps into a sector experiencing significant growth, with the global trading card market valued at billions of dollars and projected to continue expanding.

While GameStop's entry into the graded card space is promising, its current market share in professional grading services remains minimal. Establishing a dominant position will necessitate substantial investment in infrastructure, expertise, and marketing to compete with established players in this specialized niche.

GameStop's venture into new digital content partnerships, particularly with indie game developers, positions them in a high-growth but intensely competitive segment. This strategy aims to leverage the burgeoning indie gaming market, which saw global revenues exceed $20 billion in 2023, offering exclusive digital content on their platform.

However, GameStop's current digital market share remains minuscule compared to dominant players like Steam or the Epic Games Store. This makes the investment in securing and promoting exclusive indie titles a high-risk, potentially low-return endeavor, requiring significant capital outlay for uncertain gains in a crowded digital landscape.

Diversification into General Pop Culture Merchandise

GameStop's venture into general pop culture merchandise, including licensed items, toys, and apparel, represents a strategic move to tap into wider consumer interests beyond core gaming. This diversification aims to capture a larger share of the entertainment and collectibles market.

While the market for pop culture merchandise is expanding, GameStop faces formidable competition from established general retailers and niche specialty stores. This intense competitive landscape means GameStop's current market share in this segment, though growing, remains relatively modest.

- Market Growth: The global market for licensed merchandise is substantial and projected to continue its upward trajectory, driven by popular franchises and entertainment properties.

- Competitive Landscape: GameStop competes with giants like Amazon, Walmart, and specialized retailers such as Hot Topic and BoxLunch, which have long-standing relationships with licensors and established customer bases.

- Strategic Importance: This diversification is crucial for GameStop to reduce its reliance on the cyclical gaming market and build new revenue streams.

- Challenges: Key challenges include differentiating its offerings, managing inventory for a wider range of products, and effectively marketing to a broader audience.

Potential for Esports Lounges/In-store Events

GameStop is exploring the potential of esports lounges and in-store events to revitalize its retail footprint. Analysts see this as a move into a high-growth sector, aiming to transform stores into community hubs and unlock new revenue streams.

This initiative aligns with a strategy to tap into the burgeoning esports market, which saw global revenue reach an estimated $1.38 billion in 2023 and is projected to continue its upward trajectory. However, GameStop’s current presence in this space is very limited, necessitating significant investment and a well-defined strategic plan for successful market penetration.

- Community Hubs: Stores could become local gathering spots for gamers, fostering loyalty and engagement.

- New Revenue Streams: Charging for lounge access, hosting tournaments, and selling related merchandise present monetization opportunities.

- High-Growth Market: The esports industry continues to expand, offering substantial potential if effectively captured.

- Implementation Challenges: Significant capital expenditure and strategic execution are required to establish a competitive offering.

GameStop's significant investment in Bitcoin, amounting to $513 million in 2024, firmly places it in the question mark category of the BCG matrix. This move, outside its core retail business, carries substantial risk due to Bitcoin's volatility. While offering potential high returns, it also introduces significant financial uncertainty for the company.

BCG Matrix Data Sources

This GameStop BCG Matrix leverages comprehensive market data, including financial reports, industry analysis, and sales figures, to accurately position each business unit.