GameStop Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GameStop Bundle

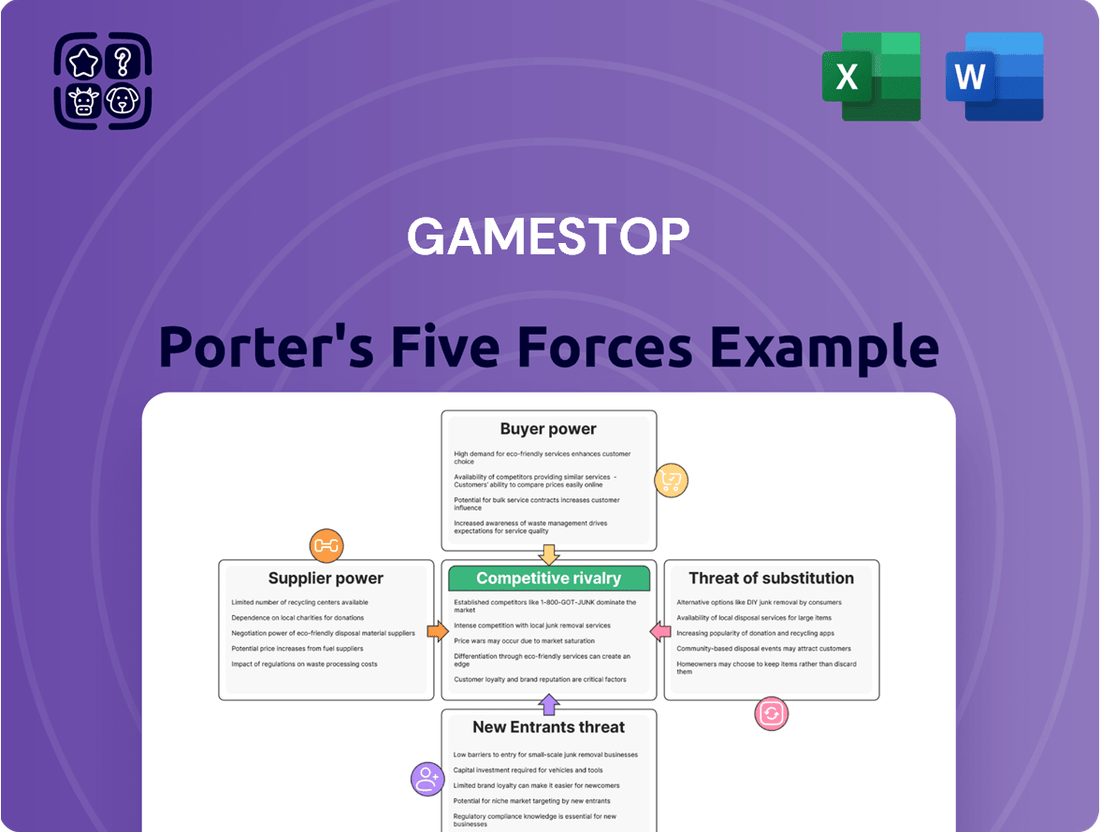

GameStop faces significant pressure from powerful buyers, often savvy gamers seeking the best deals, while the threat of new entrants is moderate due to established distribution channels and brand recognition. The intense rivalry among existing retailers, including digital storefronts, constantly squeezes profit margins. Suppliers, particularly game publishers and hardware manufacturers, hold considerable sway, impacting GameStop's product availability and pricing.

The threat of substitutes, primarily digital downloads and game-streaming services, looms large, directly challenging GameStop's traditional brick-and-mortar model. Understanding these dynamic forces is crucial for any stakeholder looking to navigate GameStop's complex retail landscape.

The complete report reveals the real forces shaping GameStop’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

GameStop's dependence on a limited number of major console manufacturers, such as Sony, Microsoft, and Nintendo, directly fuels their bargaining power. These companies are the gatekeepers of new hardware, essential for GameStop to maintain its customer base and sales volume.

The concentration of these manufacturers means GameStop has few alternative suppliers for the latest gaming consoles. This scarcity significantly strengthens the suppliers' position, allowing them to dictate terms regarding product allocation, pricing, and promotional support.

Furthermore, the direct control these manufacturers exert over their own digital storefronts for new game sales diminishes GameStop's traditional role and leverage. This shift limits GameStop's ability to influence the distribution and pricing of digital game purchases, a growing segment of the market.

Major game publishers like Electronic Arts and Activision Blizzard wield significant power due to their ownership of highly sought-after franchises. This dominance allows them to dictate terms, impacting GameStop's profitability.

The ongoing shift towards digital distribution by these publishers directly challenges GameStop's traditional retail model. In 2023, digital game sales continued to represent a large portion of the overall gaming market, further reducing GameStop's leverage in negotiating wholesale prices for physical games.

Game publishers and console manufacturers are increasingly pushing digital game sales directly to consumers through their own online platforms. This shift away from physical retail channels directly impacts GameStop’s leverage for new physical game titles.

By December 2024, digital format games accounted for over 95% of the total market value within the gaming industry. This substantial market share for digital distribution significantly amplifies the bargaining power of suppliers who control these direct-to-consumer channels.

Supplier Control over Pricing and Bundling

Suppliers, such as game developers and console manufacturers, hold significant sway over GameStop's ability to set prices. They dictate the wholesale costs for new games and consoles, directly impacting GameStop's profit margins. For instance, the wholesale cost of a new AAA game can significantly influence the retail price GameStop can realistically charge while remaining competitive.

Furthermore, suppliers can leverage their position by bundling digital content or offering exclusive digital versions of games. This practice limits GameStop's ability to offer comparable value propositions, as they are often unable to replicate these exclusive digital bundles or content. This control restricts GameStop's pricing flexibility and ability to differentiate its offerings in the market.

- Supplier Pricing Power: Game publishers and console makers set wholesale prices, directly affecting GameStop's cost of goods sold and potential profit margins on new releases.

- Bundling and Exclusivity: Suppliers can offer digital bundles or exclusive in-game content, a strategy GameStop often cannot match, diminishing its competitive edge on new product sales.

- Impact on Margins: This supplier control can compress GameStop's profit margins on new hardware and software, as they have limited ability to negotiate favorable terms or replicate value-added digital offerings.

Limited Differentiation for GameStop

GameStop's bargaining power with suppliers is somewhat constrained by the limited differentiation of its core product offerings. When selling new physical video games, GameStop offers the same identical products that are available from numerous other retailers. This lack of unique product value from a supplier's perspective means GameStop has less leverage to negotiate favorable terms or demand special considerations.

While GameStop has strategically expanded into collectibles and other merchandise, its primary revenue driver remains new video game sales. For these core gaming products, suppliers (game publishers and distributors) are not significantly influenced by GameStop's unique selling proposition for these identical new items. This creates a situation where suppliers have considerable power, as they can easily shift supply to other retail channels.

- Limited Differentiation: New physical games sold by GameStop are identical to those offered by competitors, weakening bargaining power.

- Supplier Power: Game publishers and distributors hold significant leverage due to the fungible nature of new game inventory.

- Diversification Impact: While collectibles offer some differentiation, the core gaming segment remains susceptible to supplier influence.

GameStop's bargaining power with suppliers, particularly console manufacturers and game publishers, is significantly challenged by the industry's shift towards digital distribution. By December 2024, digital format games represented over 95% of the total gaming market value, amplifying the leverage of suppliers controlling these direct-to-consumer channels.

Major console makers like Sony and Microsoft, along with dominant publishers such as Electronic Arts and Activision Blizzard, possess substantial power. They dictate wholesale pricing, product allocation, and increasingly offer exclusive digital content or bundles that GameStop often cannot match, directly impacting GameStop's profit margins and competitive standing.

The fungible nature of new physical games, identical across all retailers, further weakens GameStop's negotiating position. This lack of product differentiation means suppliers can easily prioritize other sales channels, reinforcing their control over terms.

| Supplier | Key Leverage Point | Impact on GameStop |

|---|---|---|

| Console Manufacturers (Sony, Microsoft, Nintendo) | Exclusive hardware, control over new console allocation | Limits GameStop's access to essential inventory, dictates terms for new hardware sales. |

| Major Game Publishers (EA, Activision Blizzard) | Ownership of popular franchises, digital distribution channels | Dictates wholesale prices for physical games, ability to offer exclusive digital content that bypasses retail. |

| Digital Distribution Platforms | Dominance in digital game sales (over 95% market share by Dec 2024) | Reduces GameStop's relevance for digital game purchases, shifting revenue away from physical retail. |

What is included in the product

This analysis uncovers the intensity of competition, buyer and supplier power, the threat of new entrants and substitutes, all specifically within GameStop's unique market context.

Effortlessly assess GameStop's competitive landscape by visualizing the impact of each force on a single, intuitive dashboard.

Customers Bargaining Power

The sheer number of places customers can buy video games and related items gives them a lot of leverage. Think about it: they can go to massive online stores like Amazon, big box retailers such as Walmart and Best Buy, or even buy directly from the companies that make the game consoles or the games themselves.

This wide array of choices means GameStop faces strong customer bargaining power. In 2024, the digital game download market continued its strong growth, with global spending projected to reach over $180 billion, directly competing with physical retail.

Customers aren't tied to GameStop; they can easily find better prices or more convenient options elsewhere. This forces GameStop to be more competitive, often through sales and loyalty programs, to keep shoppers coming back.

The gaming industry's significant pivot to digital downloads and streaming has dramatically amplified customer bargaining power. Platforms like Steam, PlayStation Store, and Xbox Live now provide instant game access, frequently at prices that undercut physical retail. This trend is undeniable; by 2024, digital game sales constituted over 95% of the market, directly eroding the demand for GameStop's primary physical inventory.

Gamers are notoriously price-sensitive, constantly scanning for the best deals across digital storefronts and physical retailers. This means GameStop faces significant pressure to match or beat prices, directly impacting its ability to maintain healthy profit margins.

The rise of digital game distribution, with platforms like Steam and the PlayStation Store, offers consumers a convenient and often cheaper way to acquire games, bypassing the overheads associated with physical retail. This competitive landscape intensifies the price sensitivity factor for GameStop.

For instance, during the 2024 holiday season, many new AAA game releases were available digitally at a discount shortly after launch, a trend that directly pressures GameStop's pricing strategy for new physical copies.

Low Switching Costs for Consumers

Consumers face very low switching costs when deciding where to purchase video games and related products. It’s effortless for customers to shift their allegiances between physical retailers like GameStop and digital storefronts, or even between different online platforms. For instance, buying a digital game from PlayStation Store or Xbox Games Store instead of a physical copy from GameStop involves no significant financial penalty or added inconvenience. This ease of transition directly empowers customers, giving them considerable leverage.

The digital gaming market, which is increasingly dominant, exemplifies this low switching cost. In 2024, digital game sales continued to outpace physical sales, with industry reports indicating that digital downloads accounted for over 70% of game sales in major markets. This means a vast majority of consumers are already accustomed to purchasing games digitally, where switching between platforms or retailers is as simple as clicking a different link. This trend significantly weakens GameStop's ability to retain customers based on loyalty alone, as price and convenience often dictate their choices.

- Low Barriers to Entry for Competitors: Retailers face minimal hurdles in offering similar product lines, especially with the rise of digital distribution.

- Price Sensitivity: Consumers can easily compare prices across various physical and digital channels, forcing retailers to compete on cost.

- Ubiquity of Digital Options: The widespread availability of digital game downloads means consumers aren't tied to a specific physical location or store.

- Minimal Investment for Consumers to Switch: There are virtually no costs incurred by a customer when moving from one gaming platform or retailer to another.

Diminishing Value of Trade-in Programs

The bargaining power of customers is amplified by the diminishing value of trade-in programs. GameStop's once-lucrative trade-in for pre-owned games and hardware is losing its luster. This decline is directly linked to the industry's pivot towards digital-only gaming platforms and a shrinking physical media market. Consequently, the incentive for customers to trade in older titles or consoles has significantly decreased, weakening a key customer loyalty driver.

This shift means fewer customers are engaging with trade-in services, impacting GameStop's ability to leverage them for customer retention. For instance, in 2023, physical game sales continued their downward trend, making the trade-in of such items less appealing. The increasing adoption of digital downloads means customers often have no physical discs to trade in, further eroding the program's utility.

- Declining Physical Media: The ongoing shift to digital-only consoles reduces the pool of physical games available for trade-in.

- Reduced Trade-in Value: As physical games become less sought after, their trade-in values naturally decrease.

- Digital Alternatives: Customers can often sell used games online directly or through other platforms, bypassing GameStop's trade-in program.

- Weakened Retention Tool: The diminished appeal of trade-ins weakens GameStop's ability to use this program as a strong customer retention strategy.

Customers possess significant bargaining power due to the abundance of purchasing options, including digital storefronts and competing retailers. This accessibility, coupled with their price sensitivity, forces GameStop to remain competitive. For example, in 2024, the digital gaming market continued its robust expansion, with global spending projected to exceed $180 billion, directly challenging GameStop's physical retail model.

The ease with which customers can switch between platforms and retailers, largely driven by the dominance of digital downloads, further enhances their leverage. By 2024, digital game sales represented over 70% of the market in key regions, illustrating the low switching costs for consumers. This dynamic pressures GameStop’s pricing and retention strategies.

GameStop's trade-in program, a former loyalty driver, has seen its appeal diminish as the industry shifts towards digital media. This trend, evident in the continued decline of physical game sales through 2023, means fewer customers engage with trade-ins, weakening a key retention tool.

| Factor | Impact on GameStop | 2024 Data Point |

| Availability of Alternatives | High customer choice weakens GameStop's position. | Digital game spending projected over $180 billion globally. |

| Price Sensitivity | Customers seek best deals across channels. | Digital game sales > 70% in major markets. |

| Switching Costs | Minimal costs to move between retailers/platforms. | Ease of digital purchases reinforces low switching costs. |

| Trade-in Value | Declining physical media reduces trade-in appeal. | Physical game sales trended downwards in 2023. |

Preview the Actual Deliverable

GameStop Porter's Five Forces Analysis

The document you see here is the complete, professionally written Porter's Five Forces analysis for GameStop, including all detailed insights and strategic implications. You're previewing the final version—precisely the same document that will be available to you instantly after buying. This analysis meticulously breaks down the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the video game retail sector. What you're previewing is what you get—professionally formatted and ready for your needs, offering a comprehensive understanding of GameStop's competitive landscape.

Rivalry Among Competitors

GameStop confronts formidable rivalry from digital distribution platforms like the PlayStation Store, Xbox Store, Nintendo eShop, and Steam. These online marketplaces provide consumers with immediate access to game downloads and often bundled subscription services, directly challenging GameStop's traditional retail model.

The shift towards digital downloads is undeniable, with digital sales accounting for an overwhelming majority of the gaming market. In 2024, these digital sales represented over 95% of all video game transactions, highlighting the diminishing reliance on physical media and, consequently, brick-and-mortar retailers.

GameStop faces intense competition from e-commerce behemoths like Amazon, which offer a vast array of new games, consoles, and accessories. In 2023, Amazon's retail sales reached an estimated $575 billion, highlighting its immense market reach and ability to undercut prices. Similarly, general retailers such as Walmart and Best Buy, with their extensive physical footprints and robust online presences, directly challenge GameStop's market share.

The physical video game market is indeed shrinking, making the competition among remaining brick-and-mortar retailers fiercer. As fewer players are in the game, everyone is fighting harder for a smaller customer base.

This trend is clearly reflected in GameStop's strategic decisions. The company has been actively closing underperforming stores worldwide, a direct response to the challenging retail environment and the declining demand for physical game sales.

For instance, GameStop’s fiscal year 2023 saw a significant reduction in its store count. By the end of January 2024, the company operated approximately 3,637 stores, a notable decrease from previous years, highlighting the pressure from the shrinking physical market.

Rise of Subscription Services and Cloud Gaming

The increasing prevalence of subscription services and cloud gaming platforms significantly intensifies competitive rivalry for GameStop. Services like Xbox Game Pass and PlayStation Plus provide access to extensive game libraries for a monthly fee, directly challenging GameStop's core business of selling new and pre-owned physical game copies. This shift in consumer preference towards access over ownership directly impacts GameStop's sales volume and revenue streams.

Cloud gaming, with platforms such as Xbox Cloud Gaming and PlayStation Now, further disrupts the traditional market by allowing users to stream games without requiring powerful hardware or physical media. This innovation offers a convenient and often more affordable alternative for gamers, diminishing the need for physical game purchases and, by extension, GameStop's role in the distribution chain.

- Subscription Growth: As of late 2023, services like Xbox Game Pass boasted over 25 million subscribers, while PlayStation Plus offered tiered access to a large catalog of games, highlighting the growing consumer adoption of these models.

- Digital Dominance: Digital game sales continue to represent a significant and growing portion of the overall gaming market, with physical media sales, GameStop's primary revenue source, facing sustained pressure.

- Cloud Gaming Expansion: Major players are heavily investing in cloud gaming infrastructure, signaling a long-term trend towards game streaming as a primary consumption method for many players.

Diversification into Collectibles and Pre-owned Market

GameStop's strategic move into high-margin collectibles and its long-standing pre-owned game market provide a degree of separation, yet these areas are not immune to escalating rivalry. Many other retailers are also broadening their selection of collectible items, directly challenging GameStop's niche. Furthermore, the general downturn in physical video game sales directly affects the availability and therefore the competitive landscape of the pre-owned game segment.

- Diversification Strategy: GameStop's expansion into collectibles, such as Funko Pops and trading cards, aims to offset declining physical game sales.

- Pre-owned Market Challenges: The shrinking pool of physical games available for resale intensifies competition for these units.

- Retailer Expansion: Competitors like Amazon and Walmart are increasingly stocking a wider variety of collectibles, drawing customers away from GameStop's specialized offerings.

- Market Trends: A 2023 report indicated a continued shift towards digital game purchases, impacting the fundamental supply chain for GameStop's pre-owned business.

GameStop faces intense competition from digital storefronts and e-commerce giants, with digital game sales dominating the market. This shift directly impacts GameStop's traditional retail model, forcing store closures as physical game sales decline. While diversification into collectibles offers some buffer, these areas also see increased competition from broader retailers.

| Competitor Type | Key Competitors | Impact on GameStop | 2023/2024 Data Points |

|---|---|---|---|

| Digital Platforms | Steam, PlayStation Store, Xbox Store, Nintendo eShop | Shift to digital sales erodes physical media revenue. | Digital sales over 95% of gaming market in 2024. |

| E-commerce & General Retail | Amazon, Walmart, Best Buy | Offer wider selection, competitive pricing, and online convenience. | Amazon's 2023 retail sales: ~$575 billion. |

| Subscription Services | Xbox Game Pass, PlayStation Plus | Provide access over ownership, reducing demand for new purchases. | Xbox Game Pass: over 25 million subscribers (late 2023). |

| Collectibles Market | Amazon, Walmart, Specialty Stores | Increased competition in GameStop's diversification areas. | Continued shift towards digital game purchases impacting pre-owned market supply. |

SSubstitutes Threaten

Digital game downloads represent a powerful substitute for GameStop's traditional brick-and-mortar model. Players can now instantly purchase and access games online, bypassing the need for physical discs or cartridges altogether.

This shift is dramatic. By 2024, digital game sales have surged to account for over 95% of the total gaming market. This overwhelming dominance directly siphons revenue away from GameStop's core business of selling physical game copies.

The convenience and immediacy of digital downloads make them an incredibly attractive alternative for consumers. This fundamental change in how games are acquired poses a significant threat to GameStop's revenue streams and market position.

Gaming subscription services represent a significant threat of substitutes for GameStop. Services like Xbox Game Pass and PlayStation Plus offer vast libraries of games for a monthly fee, making them a compelling alternative to purchasing individual titles, whether new or pre-owned. This accessibility and cost-effectiveness directly challenge GameStop's traditional retail model.

In 2024, the continued growth of these subscription services means consumers have less need to visit physical stores or buy individual game discs. For example, Xbox Game Pass Ultimate offers hundreds of games, including day-one releases, for a fraction of the cost of buying those games separately. This directly erodes demand for GameStop's core product offerings.

Cloud gaming platforms like Xbox Cloud Gaming and NVIDIA's GeForce Now present a significant threat of substitution for GameStop. These services allow players to stream games directly to various devices, bypassing the need for dedicated gaming consoles or PCs and, crucially, physical game discs. This model directly competes with GameStop's core business of selling new and pre-owned games.

The convenience of accessing a vast library of games without upfront hardware investment or physical media is increasingly appealing. While the market is still developing, its growth trajectory suggests a future where game ownership is less about physical possession and more about subscription-based access. For instance, by mid-2024, cloud gaming subscriber numbers are expected to continue their upward trend, indicating a growing consumer preference for this alternative.

Mobile and PC Gaming

The rise of mobile and PC gaming presents a significant threat of substitutes for GameStop's traditional console-focused business model. These platforms frequently offer free-to-play or lower-cost digital entry points, directly competing for consumer entertainment budgets and leisure time that might otherwise be spent on console games and hardware. The sheer accessibility and convenience of gaming on smartphones and personal computers, often without the need for expensive console hardware, further amplifies this substitution effect.

Consider these key points regarding the threat of substitutes:

- Ubiquitous Access: Mobile devices are in the hands of billions globally, making mobile gaming the most accessible gaming platform.

- Digital Dominance: PC gaming heavily relies on digital distribution platforms like Steam, which offer vast libraries and frequent sales, bypassing physical retail entirely.

- Free-to-Play Growth: Many popular mobile and PC titles utilize free-to-play models, attracting a massive player base that might not invest in premium console games. For instance, mobile games like Genshin Impact and PC titles such as League of Legends generate substantial revenue through in-game purchases, demonstrating the financial viability of these substitute models.

- Consumer Spending Shift: In 2024, global mobile gaming revenue is projected to reach over $100 billion, showcasing a significant portion of consumer spending shifting away from traditional console purchases and towards these alternative platforms.

Entertainment Alternatives

Beyond video games, consumers have a vast array of entertainment options vying for their attention and money. Streaming services like Netflix and Disney+, social media platforms, and other digital content all compete directly with gaming for discretionary spending. This means that money spent on video games, and consequently at GameStop, is not essential and can easily be diverted elsewhere.

For instance, in 2024, the global digital gaming market continues to grow, but so do other entertainment sectors. The global video streaming market alone is projected to reach hundreds of billions of dollars, indicating significant consumer investment in alternative leisure activities. This broad competitive landscape highlights the threat of substitutes for GameStop's core offerings.

Here's a look at some key entertainment alternatives:

- Video Streaming: Services offer a wide variety of movies, TV shows, and original content, often at competitive subscription prices.

- Social Media & Digital Content: Platforms provide endless hours of free or low-cost engagement through short-form video, influencer content, and interactive experiences.

- Other Leisure Activities: Spending on dining out, travel, live events, and other hobbies also competes for the same disposable income that could otherwise be allocated to gaming.

The threat of substitutes for GameStop is substantial, primarily driven by the digital revolution in gaming. Digital game downloads and subscription services offer unparalleled convenience and often lower costs compared to physical purchases, directly undermining GameStop's core business model. By 2024, digital sales represent over 95% of the gaming market, a stark indicator of this shift.

Cloud gaming and the proliferation of mobile and PC gaming further fragment the market, offering accessible and often free-to-play alternatives that divert consumer spending and attention from console gaming. Global mobile gaming revenue alone is projected to exceed $100 billion in 2024, highlighting a significant diversion of disposable income.

Furthermore, GameStop competes not just with other gaming options but with the entire entertainment industry. Streaming services, social media, and other leisure activities vie for consumer discretionary spending, with the global video streaming market also reaching hundreds of billions of dollars. This broad competitive landscape means consumers can easily allocate their entertainment budgets away from GameStop's offerings.

| Substitute Category | Key Offerings | Impact on GameStop | 2024 Market Data/Projection |

|---|---|---|---|

| Digital Game Downloads | Instant access, no physical media | Reduces demand for new physical game sales | Over 95% of total gaming market sales |

| Gaming Subscription Services | Vast game libraries for a monthly fee | Decreases individual game purchases | Continued strong growth, e.g., Xbox Game Pass offering hundreds of titles |

| Cloud Gaming | Game streaming to various devices | Bypasses need for consoles and physical discs | Growing subscriber base, increasing accessibility |

| Mobile & PC Gaming | Free-to-play titles, lower entry cost | Captures entertainment budget and player time | Mobile gaming revenue projected over $100 billion |

| Broader Entertainment | Streaming services, social media, etc. | Competes for discretionary spending | Video streaming market in hundreds of billions |

Entrants Threaten

The significant capital required to establish a new physical retail chain akin to GameStop presents a formidable barrier to entry. This includes substantial outlays for prime retail leases, stocking a diverse inventory of games and accessories, developing efficient supply chain and logistics networks, and hiring and training a qualified workforce.

Considering the ongoing shift towards digital game distribution and the general decline in physical retail foot traffic, the financial risk associated with launching new brick-and-mortar gaming stores is exceptionally high. For instance, according to the National Retail Federation, retail sales growth has been modest, with many traditional retailers struggling to adapt. This economic climate makes new physical entrants highly improbable.

The threat of new entrants into the video game retail space is significantly dampened by the formidable established digital ecosystems and deep-rooted brand loyalty. Companies like Valve with its Steam platform, and console makers such as Sony with the PlayStation Store, have cultivated vast user bases and proprietary marketplaces. These platforms offer seamless digital distribution, extensive game libraries, and integrated social features that are difficult for newcomers to replicate.

For instance, Steam reported over 120 million monthly active users in 2023, showcasing the sheer scale of its ecosystem. New entrants would face immense challenges in attracting consumers away from these trusted and feature-rich environments. The cost and complexity of building comparable infrastructure, securing publisher partnerships, and fostering comparable brand recognition present substantial barriers.

The ongoing shift towards digital game sales significantly diminishes the attractiveness of entering the physical media retail market. As consumers increasingly opt for digital downloads, the overall market size for new physical game releases is shrinking, making it a less appealing landscape for potential new entrants. This trend creates substantial barriers to entry for any new business looking to establish itself solely on physical media. For example, in 2023, digital game sales accounted for a substantial majority of the market, a trend that continued to accelerate throughout 2024.

Supply Chain and Publisher Relationships

New entrants would find it incredibly difficult to replicate GameStop's established supply chain and publisher relationships. Major game publishers and console manufacturers, such as Sony and Microsoft, often prioritize working with established distributors like GameStop or utilize their own direct digital sales channels. This existing, though sometimes challenging, network provides GameStop with a significant advantage.

This barrier is particularly potent because securing favorable terms and access to new game releases requires a history of reliable distribution and sales volume. For instance, in 2024, the gaming industry continued its strong reliance on physical media for certain collector's editions and bundled offers, making these publisher relationships critical. New entrants would need substantial capital and time to build comparable distribution networks and convince major players to divert inventory away from established channels.

The threat of new entrants is therefore mitigated by the high switching costs and the entrenched nature of these supply chain partnerships. Building trust and securing contracts with entities like Nintendo, which still sees significant value in physical game sales, takes years. GameStop's existing infrastructure, even with its ongoing digital transition, represents a formidable hurdle for any newcomer attempting to enter the physical retail space.

- Publisher Exclusivity and Access: New entrants face significant hurdles in gaining direct access to new game releases and exclusive editions, which are often allocated based on established sales volumes and relationships.

- Console Manufacturer Partnerships: Securing partnerships with console manufacturers for authorized sales and distribution of new hardware and accessories requires a proven track record and significant investment, which new players lack.

- Physical Distribution Networks: The cost and complexity of establishing a nationwide physical distribution network capable of handling the logistics of game and console delivery are substantial deterrents.

- Digital Channel Dominance: While physical retail exists, the increasing dominance of digital downloads means new entrants must also compete with publishers' direct-to-consumer digital offerings, further fragmenting the market.

Intense Competition from Existing Players

The threat of new entrants for GameStop is significantly dampened by the entrenched strength of existing competitors. Large online retailers like Amazon and specialized digital storefronts already command substantial customer bases and robust distribution networks, making it exceedingly difficult for newcomers to carve out a meaningful presence. GameStop itself is actively diversifying into areas like collectibles and technology, further intensifying the existing competitive environment and raising the barrier to entry for any new player attempting to replicate its business model.

Consider these factors:

- Established Market Dominance: Major online retailers have already captured a significant portion of the video game and entertainment market, offering vast selections and competitive pricing that new entrants would struggle to match.

- Digital Platform Control: Digital distribution platforms for games are largely controlled by console manufacturers and PC storefronts, limiting direct access for new physical or digital game retailers.

- GameStop's Diversification: GameStop's strategic pivot towards collectibles, electronics, and its own digital initiatives creates a more complex and competitive landscape, requiring potential new entrants to offer highly differentiated products or services.

- High Initial Investment: Establishing the necessary infrastructure, inventory, and marketing presence to compete with established players would require substantial capital, posing a significant hurdle for many potential new entrants.

The threat of new entrants for GameStop is considerably low due to the substantial capital required for physical retail and the dominance of established digital ecosystems. Companies like Steam, with over 120 million monthly active users in 2023, present a massive hurdle for newcomers. Furthermore, the ongoing shift to digital sales, with digital game sales representing a significant majority of the market in 2023 and continuing this trend in 2024, makes physical retail a less attractive entry point.

New entrants also face significant challenges in replicating GameStop's supply chain and publisher relationships. Securing access to new releases and favorable terms, crucial in 2024's market where physical media still holds value for collector's editions, requires years of established distribution and sales volume. The cost and complexity of building comparable infrastructure and brand recognition are immense, further mitigating the threat.

The competitive landscape is further intensified by established online retailers like Amazon and GameStop's own diversification into collectibles and technology. This requires potential new entrants to offer highly differentiated products or services to compete, making the initial investment and market penetration extremely difficult.

| Factor | Barrier Level | Reasoning |

| Capital Requirements | High | Establishing physical stores, inventory, and logistics is costly. |

| Digital Ecosystems | High | Dominance of platforms like Steam (120M+ MAU in 2023) offers integrated experiences. |

| Shift to Digital Sales | High | Digital sales were the majority in 2023 and continue to grow, reducing physical market appeal. |

| Supply Chain & Publisher Relations | High | Building trust and securing access to new releases takes years and significant volume. |

| Brand Loyalty & Switching Costs | High | Consumers are entrenched in existing digital platforms and brand ecosystems. |

| Existing Competition | High | Established online retailers and GameStop's own diversification intensify competition. |

Porter's Five Forces Analysis Data Sources

Our GameStop Porter's Five Forces analysis leverages data from GameStop's official investor relations website, SEC filings, and industry analysis reports from firms like Statista and IBISWorld to assess competitive dynamics.