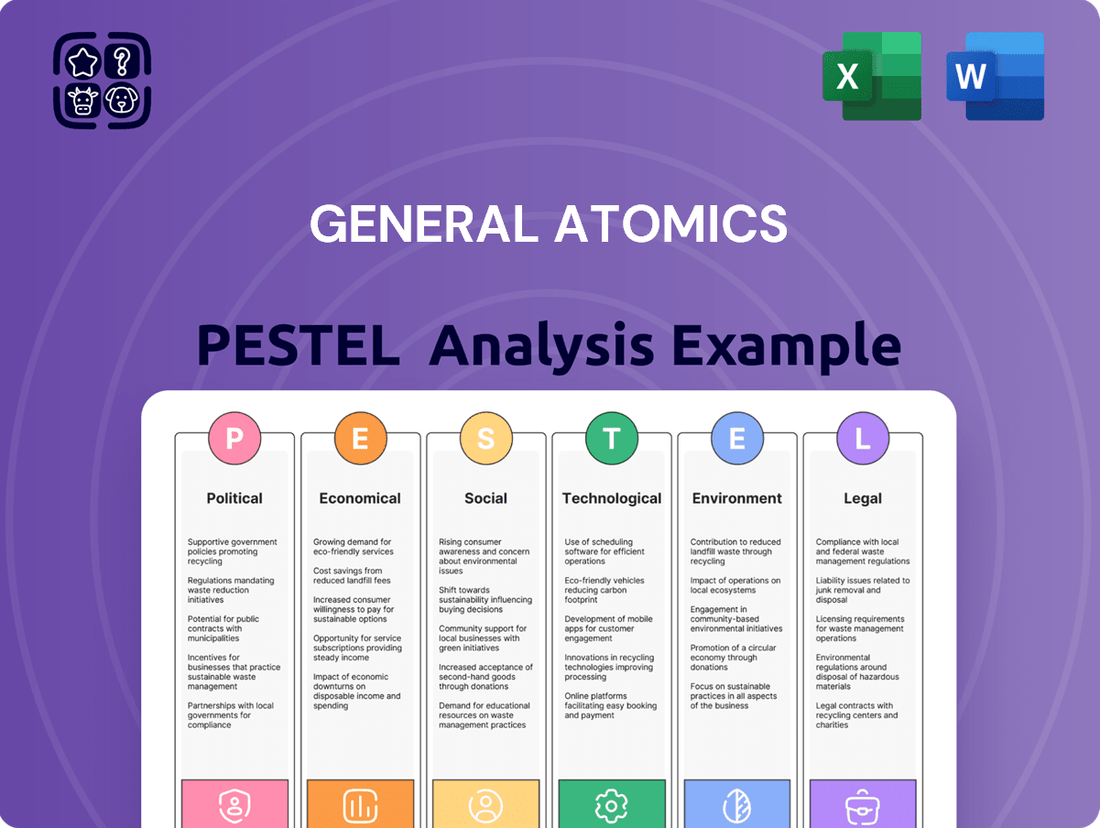

General Atomics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

General Atomics Bundle

Navigate the complex external landscape impacting General Atomics with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its future. Gain a critical advantage by identifying opportunities and mitigating risks. Download the full PESTLE analysis now for actionable intelligence to inform your strategy.

Political factors

Global military expenditure experienced a significant surge, climbing 9.4% in real terms in 2024 to reach $2718 billion. This represents the most substantial year-on-year increase observed since the Cold War's conclusion.

This heightened defense spending, fueled by escalating geopolitical tensions and ongoing conflicts, particularly in Europe and the Middle East, creates a favorable environment for defense technology companies like General Atomics.

The trend is further reinforced by NATO allies, with 18 of the 32 member states now allocating at least 2.0% of their GDP to military budgets in 2024, signaling sustained demand for advanced defense solutions.

The global security environment is increasingly defined by heightened geopolitical tensions and the resurgence of great-power competition, leading many countries to re-evaluate their defense spending and strategic alliances. This dynamic directly impacts companies like General Atomics, which operates within the defense sector, influencing demand for its advanced aerospace and defense systems.

General Atomics is strategically navigating these shifts by fostering international collaborations. For instance, their partnership with Japan focuses on critical and emerging technologies, a sector vital for national security. Furthermore, collaborations with South Korea's Hanwha Aerospace aim to advance Unmanned Aerial Systems (UAS) development, reflecting a growing global demand for advanced drone capabilities.

The company is also cementing a significant transatlantic partnership to establish drone wingman production in Germany, specifically leveraging their YFQ-42A platform for European markets. This move underscores the growing need for interoperable defense solutions across allied nations, particularly in light of evolving threat landscapes. In 2024, the global defense market is projected to reach over $2.4 trillion, highlighting the substantial opportunities and competitive pressures within this sector.

General Atomics is deeply integrated into major U.S. defense policy, particularly through its involvement in the Collaborative Combat Aircraft (CCA) program. This program aims to equip the U.S. Air Force with advanced autonomous combat drones, with General Atomics' prototype slated for flight tests around mid-2025. The potential acquisition of over 1,000 CCAs signifies a substantial revenue stream for the company.

The company's YFQ-42A drone, an evolution of its Gambit series, exemplifies its strategic response to modern defense needs. Designed with modularity, it can be adapted for a wide range of missions, reflecting a commitment to providing flexible and scalable airpower solutions that align with current military procurement trends and future operational requirements.

Export Controls and Trade Relations

The defense sector, including companies like General Atomics, is heavily influenced by export controls. Regulations such as the International Traffic in Arms Regulations (ITAR) and the Export Administration Regulations (EAR) govern the sale and transfer of defense articles and services abroad. These rules are critical for maintaining national security and preventing the proliferation of sensitive technologies.

Global demand for U.S. defense products remains robust. For instance, the first quarter of fiscal year 2025 indicated substantial proposed direct commercial sales of defense equipment, highlighting international interest in American military capabilities. This trend presents opportunities but also necessitates careful compliance with export regulations.

General Atomics must actively manage these complex export control frameworks. Navigating potential trade restrictions, especially concerning advanced technologies and strategic markets like China, is paramount. Failure to comply can result in severe penalties, including fines and loss of export privileges.

- ITAR and EAR: Strict U.S. government regulations controlling defense exports.

- FY 2025 Q1 Sales: Significant proposed direct commercial sales in the defense sector indicate strong global demand.

- Strategic Market Navigation: General Atomics must address trade restrictions, particularly regarding sensitive technologies and regions like China.

Government Lobbying and Influence

As a significant player in the defense sector, General Atomics actively participates in government lobbying. This engagement is vital for shaping policies that affect its operations and for securing lucrative defense contracts. For instance, in the 2022 election cycle, defense contractors collectively spent over $120 million on lobbying, highlighting the importance of this channel.

The company's political strategy is further bolstered by its Political Action Committee (PAC) and employee contributions. These financial inputs aim to foster alignment with national security priorities and cultivate a supportive policy landscape. In 2023, General Atomics' PAC reported contributions totaling over $1.5 million, demonstrating a sustained commitment to political engagement.

A key strength in General Atomics' lobbying approach is the extensive government experience of its lobbyists. Many have previously served in government roles, granting them deep understanding of legislative intricacies and access to key decision-makers. This expertise is invaluable in navigating the complex political environment and advocating for the company's interests.

- Lobbying Expenditure: Defense industry lobbying spending reached approximately $120 million in the 2022 election cycle.

- PAC Contributions: General Atomics' PAC reported contributions exceeding $1.5 million in 2023.

- Expertise: A significant portion of General Atomics' lobbying team comprises former government officials.

The global security landscape is characterized by escalating geopolitical tensions, driving a significant increase in defense spending. In 2024, global military expenditure rose by 9.4% to $2718 billion, the largest year-on-year jump since the Cold War's end. This trend, coupled with 18 NATO members now meeting the 2.0% GDP defense spending target, creates a favorable market for General Atomics' advanced defense systems.

General Atomics actively engages in government lobbying, a crucial aspect of its political strategy. In the 2022 election cycle, the defense industry spent over $120 million on lobbying efforts. Furthermore, General Atomics' PAC reported contributions exceeding $1.5 million in 2023, underscoring its commitment to influencing policy and securing contracts.

The company's political influence is amplified by lobbyists with extensive government experience, facilitating access to key decision-makers. This strategic engagement helps shape policies favorable to the defense sector and ensures General Atomics remains aligned with national security priorities.

| Factor | 2024 Data Point | Impact on General Atomics |

|---|---|---|

| Global Military Expenditure | $2718 billion (9.4% increase) | Increased demand for defense systems |

| NATO Defense Spending | 18/32 members meet 2.0% GDP target | Sustained demand from allied nations |

| Defense Industry Lobbying (2022) | ~$120 million | Influence on policy and contract acquisition |

| General Atomics PAC Contributions (2023) | >$1.5 million | Support for favorable policy environment |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing General Atomics, providing a comprehensive understanding of its operating landscape.

Provides a clear, actionable overview of the external factors impacting General Atomics, simplifying complex market dynamics for strategic decision-making.

Economic factors

Global defense spending hit a record high of $2.46 trillion in 2024, marking a significant 7.4% real-terms increase year-over-year. This upward trend, driven by heightened geopolitical tensions and active conflicts worldwide, directly benefits companies like General Atomics by expanding the market for their advanced technologies.

The substantial growth in military budgets, particularly observed in Europe and the Middle East, indicates a sustained demand for sophisticated defense solutions. This environment supports General Atomics' product pipeline and revenue potential for its military and emerging commercial applications.

There's a substantial surge in both private and government funding directed towards cutting-edge technologies that are directly relevant to General Atomics. For instance, the nuclear fusion sector alone has recently attracted over $6 billion in private investment. This significant capital inflow highlights a strong belief in the future of these advanced fields.

The fusion energy market is anticipated to reach an impressive $351.11 billion by 2025. This robust growth is largely fueled by escalating global concerns surrounding energy security and the urgent need for environmentally sustainable solutions. Such market dynamics create a favorable economic climate for companies like General Atomics operating in these innovative spaces.

This widespread investment in advanced technologies, including fusion, directly validates the long-term economic viability and potential of General Atomics' diverse technological offerings. It suggests a growing recognition of the strategic importance and future profitability of the company's forward-thinking research and development endeavors.

The global fusion energy supply chain is poised for significant growth, with projections indicating it could exceed $5 billion in value by 2025. This expansion spans critical sectors like advanced materials and precision engineering, creating new avenues for collaboration and innovation.

For General Atomics, a key aspect of this evolving landscape involves its drone production. The company is actively working to secure its position by identifying and addressing potential production bottlenecks, a strategy enhanced by repurposing infrastructure from programs nearing their end-of-life.

These supply chain shifts present General Atomics with both considerable opportunities for expansion and the imperative to develop robust sourcing strategies to ensure operational continuity and competitive advantage.

International Market Opportunities

General Atomics is strategically broadening its global reach, forging alliances and building manufacturing capacity in crucial international territories. This expansion is driven by a clear objective to capitalize on the increasing worldwide need for sophisticated defense technologies and energy innovations.

The company's initiative to produce drone wingmen in Germany, alongside cooperative efforts in Japan and South Korea, highlights a deliberate strategy to serve burgeoning international markets. These moves are designed to align with the procurement schedules of allied nations and stimulate deeper international partnerships.

- Global Defense Market Growth: The global defense market is projected to reach approximately $800 billion by 2028, with significant growth in autonomous systems and unmanned aerial vehicles, areas where General Atomics is heavily invested.

- European Defense Investment: Germany alone plans to increase its defense spending significantly, with a special fund of €100 billion allocated for modernization, creating substantial opportunities for companies like General Atomics.

- Asia-Pacific Demand: Japan and South Korea are also enhancing their defense capabilities, with substantial budgets allocated for advanced technology acquisition, signaling strong demand for General Atomics' offerings in the region.

Research and Development Investment

General Atomics' commitment to research and development is paramount for its continued technological leadership. The company is actively engaged in cutting-edge projects, such as the development of the XQ-67A Off-Board Sensing Station, and is prioritizing AI-driven decision-making for next-generation air combat systems. This focus on innovation is crucial for staying ahead in the competitive defense and energy sectors.

Key R&D initiatives underscore General Atomics' forward-looking strategy. Their work on advanced aircraft and their significant investment in fusion energy research, aiming for a gain factor (Q) greater than 5 by late 2025, are prime examples. Achieving such milestones is not only a testament to their technical prowess but also a key driver for attracting additional investment and expediting the commercialization of these advanced technologies.

- XQ-67A Development: General Atomics is advancing its capabilities in unmanned aerial systems with the XQ-67A program, focusing on enhanced sensing and operational flexibility.

- AI in Defense: The company is heavily investing in artificial intelligence to improve decision-making processes for future air combat platforms, aiming for greater battlefield efficiency.

- Fusion Energy Milestones: A critical target for General Atomics in the energy sector is achieving a fusion energy gain factor (Q) exceeding 5 by the end of 2025, a significant step towards viable fusion power.

The global economic landscape presents a dual-edged sword for General Atomics, with increased defense spending offering significant revenue opportunities while advancements in fusion energy signal long-term growth potential.

The defense sector is experiencing robust growth, with global military expenditure reaching $2.46 trillion in 2024, a 7.4% real-terms increase. This surge, driven by geopolitical instability, directly benefits companies like General Atomics that supply advanced defense technologies.

Simultaneously, the fusion energy market is poised for substantial expansion, projected to reach $351.11 billion by 2025, fueled by energy security concerns and the demand for sustainable solutions. This creates a favorable environment for General Atomics' innovative energy ventures.

| Economic Factor | 2024/2025 Data Point | Impact on General Atomics |

|---|---|---|

| Global Defense Spending | $2.46 trillion (2024) | Increased demand for defense technologies |

| Fusion Energy Market Projection | $351.11 billion (by 2025) | Growth opportunities in sustainable energy |

| European Defense Investment | Germany's €100 billion modernization fund | Market expansion for defense solutions |

What You See Is What You Get

General Atomics PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for General Atomics provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping its strategic landscape.

Sociological factors

Public perception of drone technology is a critical factor shaping its integration and regulation. Surveys in 2024 revealed that while a significant portion of the public supports both commercial and military drone use, concerns about cybersecurity, particularly regarding hacking and data interception, remain high. For instance, a Pew Research Center study from early 2024 indicated that while 67% of Americans felt comfortable with drones used for delivery services, only 45% felt the same about their use in law enforcement.

General Atomics, a major player in the unmanned systems market, must proactively address these public concerns. By clearly communicating the safety protocols, advanced capabilities, and societal benefits of its drone platforms, the company can work to alleviate skepticism. This transparent approach is vital to fostering trust and preventing the imposition of overly restrictive regulations that could hinder technological advancement and market growth, especially as the market for commercial drones is projected to reach $40 billion by 2026.

General Atomics' future in nuclear power hinges on public perception. As commercial fusion energy potentially emerges by the 2030s, boosting public understanding and trust in nuclear fission and fusion technologies is paramount. Addressing concerns about safety, waste, and environmental impact is a continuous challenge.

Government support, like the U.S. Department of Energy's significant investments in fusion research, plays a vital role in driving acceptance. For instance, the Bipartisan Infrastructure Law allocated substantial funds for advanced nuclear energy projects, signaling a commitment that can influence public opinion. Research into new fuel cycles also aims to improve the safety profile and reduce waste, further encouraging societal buy-in.

The burgeoning fields General Atomics operates in, particularly nuclear fusion, are creating a substantial demand for specialized talent. Projections indicate a job growth exceeding 200% in these sectors by 2025, presenting both a challenge and a significant opportunity for companies like General Atomics.

Attracting and retaining highly skilled professionals, such as engineers, physicists, and technicians, is paramount for General Atomics' continued success and innovation. This necessitates strategic investments in workforce development programs and the cultivation of a strong talent pipeline to meet the escalating production and research needs.

Ethical Considerations of Autonomous Systems

The escalating capabilities of autonomous systems, particularly in defense applications like General Atomics' unmanned aerial vehicles, present complex ethical dilemmas. These systems raise questions about accountability in combat, the delegation of life-and-death decisions to algorithms, and the potential for unintended escalation. As of early 2025, global discussions on lethal autonomous weapons systems (LAWS) continue, with many nations advocating for stricter regulations and human oversight.

General Atomics, as a key player in this domain, faces increasing societal and governmental scrutiny regarding the responsible development and deployment of its AI-driven defense technologies. The public's perception of autonomous warfare is a critical factor, with surveys indicating a growing unease about machines making lethal decisions without direct human intervention. This sentiment is likely to drive demand for transparency and ethical guidelines.

- Public Opinion: Polling data from late 2024 suggests a significant portion of the global population expresses concern over autonomous weapons making targeting decisions, with some studies showing over 60% favoring human control in all lethal engagements.

- Regulatory Landscape: International bodies, including the United Nations, are actively debating frameworks for autonomous weapons. Proposals for moratoriums or outright bans on certain types of LAWS are expected to gain further traction through 2025.

- Industry Responsibility: Companies like General Atomics are increasingly expected to proactively address ethical concerns, potentially through internal review boards and public engagement on the societal implications of their autonomous system advancements.

Impact on Local Communities

General Atomics' presence, with its manufacturing and research hubs, significantly shapes local communities by creating jobs and bolstering economic activity. For instance, its facilities in California and North Carolina are major employers, contributing to regional GDP. The company's growth strategies, including potential new sites, demand proactive engagement with local infrastructure needs, environmental stewardship, and fostering positive community relationships to ensure smooth operations.

Successful integration is paramount for General Atomics' sustained operational success. This involves:

- Job Creation: Direct and indirect employment opportunities generated by company facilities.

- Economic Contribution: Impact on local tax bases and support for ancillary businesses.

- Community Engagement: Building trust and addressing local concerns regarding operations and expansion.

- Infrastructure Demands: Planning for increased traffic, utility usage, and potential development needs.

Societal attitudes towards advanced technologies like drones and nuclear power significantly influence General Atomics' operational landscape. Public apprehension regarding autonomous weapons systems, for example, is a growing concern, with polls in late 2024 indicating a majority favor human control in lethal engagements. This sentiment is likely to fuel further regulatory discussions through 2025.

The demand for specialized talent in fields like nuclear fusion is projected to surge, with job growth potentially exceeding 200% by 2025, creating both opportunities and challenges for General Atomics in talent acquisition.

General Atomics' community impact, particularly job creation and economic contributions in regions like California and North Carolina, necessitates strong local engagement and infrastructure planning for any expansion efforts.

Technological factors

General Atomics is pushing the boundaries of unmanned aerial systems (UAS), with its Collaborative Combat Aircraft (CCA) prototypes, such as the YFQ-42A, currently undergoing ground testing and slated for flight tests by mid-2025. These advanced drones are engineered for adaptability, allowing for the seamless integration of diverse payload packages to tackle missions ranging from air superiority to air-to-ground strikes and electronic warfare.

Significant advancements in nuclear fusion research, with projections of compact fusion reactors potentially supplying commercial power by the 2030s, represent a monumental opportunity for General Atomics.

Record-breaking plasma reaction durations, coupled with escalating private and government investment, are rapidly advancing the timeline for commercially viable fusion power. For instance, the U.S. Department of Energy announced $70 million in funding for fusion research in late 2024, signaling strong governmental support.

General Atomics' pivotal role in this energy transformation is evident through its participation in key initiatives such as the DIII-D National Fusion Facility, a leading facility contributing to fusion energy breakthroughs.

Artificial intelligence and advanced autonomy are becoming critical for modern air combat, allowing for faster, AI-driven decisions in complex airspace. General Atomics is actively embedding these technologies into its defense offerings. This is evident in their work on the XQ-67A, which has successfully incorporated government reference autonomy during flight testing, a significant step for defense innovation.

Electromagnetic Systems Innovation

General Atomics' focus on electromagnetic systems is a significant technological driver. This expertise underpins critical defense applications, from advanced aircraft launch systems to precision-guided munitions. The company's commitment to this area is evident in its strategic collaborations.

A prime example of this innovation is General Atomics' partnership with Rafael Advanced Defense Systems Ltd. This collaboration aims to produce long-range, precision-guided strike missiles, showcasing the company's role in developing cutting-edge military technology. Such partnerships underscore the vital importance of electromagnetic systems to General Atomics' ongoing development and market position.

- Electromagnetic Systems Expertise: General Atomics is a leader in electromagnetic systems, crucial for both military and commercial sectors.

- Advanced Applications: Their technology is vital for systems like aircraft carrier launch and recovery and precision-guided munitions.

- Strategic Partnerships: Collaborations, such as the one with Rafael Advanced Defense Systems for missile manufacturing, highlight ongoing innovation.

Advanced Materials and Manufacturing

General Atomics is leveraging advanced materials to boost the performance and safety of its energy solutions. For instance, the development of silicon carbide composite nuclear fuel rods is a significant step in this direction, promising greater efficiency and enhanced safety protocols for nuclear reactors. This innovation is critical for meeting the growing demand for reliable and clean energy sources.

The company is also embracing modular design and advanced manufacturing, mirroring strategies seen in the automotive industry. This approach is vital for scaling up production of its new aircraft, aiming for high-volume output. By adopting these efficient manufacturing techniques, General Atomics can more effectively meet market demands and reduce production costs.

These technological advancements are not just about improving existing products but also about enabling the creation of entirely new capabilities. The focus on materials science and manufacturing innovation positions General Atomics at the forefront of technological development in its key sectors.

Key technological factors include:

- Advanced Materials: The integration of materials like silicon carbide composites for nuclear fuel rods enhances energy technology performance and safety.

- Modular Design: Adopting modular approaches, inspired by the automotive sector, facilitates efficient, high-volume production of next-generation aircraft.

- Manufacturing Innovation: Investing in advanced manufacturing processes is essential for scaling production and maintaining a competitive edge.

General Atomics is heavily invested in cutting-edge technological advancements, particularly in unmanned aerial systems (UAS) and nuclear fusion. Their YFQ-42A Collaborative Combat Aircraft (CCA) prototypes are undergoing testing with flight tests anticipated by mid-2025, showcasing adaptability for diverse combat roles. Furthermore, the company's involvement in nuclear fusion research, such as at the DIII-D National Fusion Facility, is bolstered by significant government investment, with the U.S. Department of Energy allocating $70 million in late 2024 to advance fusion power development.

The integration of artificial intelligence and advanced autonomy is a key technological focus, exemplified by the XQ-67A's successful incorporation of government reference autonomy during flight testing. General Atomics' expertise in electromagnetic systems, vital for advanced aircraft launch systems and precision-guided munitions, is further demonstrated through strategic collaborations like the one with Rafael Advanced Defense Systems for long-range missile production.

The company is also pioneering the use of advanced materials, such as silicon carbide composite nuclear fuel rods, to enhance the performance and safety of its nuclear reactors. Mirroring strategies from the automotive sector, General Atomics is adopting modular design and advanced manufacturing techniques to enable efficient, high-volume production of its new aircraft, positioning itself at the forefront of technological innovation in its core markets.

| Technological Area | Key Development/Focus | Example/Data Point |

|---|---|---|

| Unmanned Aerial Systems (UAS) | Collaborative Combat Aircraft (CCA) Prototypes | YFQ-42A undergoing ground testing; flight tests by mid-2025 |

| Nuclear Fusion | Advancement of Compact Fusion Reactors | U.S. DOE funding of $70 million in late 2024; participation in DIII-D National Fusion Facility |

| Artificial Intelligence & Autonomy | AI-driven decision-making in defense | XQ-67A incorporating government reference autonomy in flight tests |

| Electromagnetic Systems | Advanced applications and strategic partnerships | Collaboration with Rafael Advanced Defense Systems for long-range missiles |

| Advanced Materials & Manufacturing | Enhanced performance and scalable production | Silicon carbide composite nuclear fuel rods; modular design for aircraft production |

Legal factors

General Atomics navigates a stringent landscape of export control regulations, including the International Traffic in Arms Regulations (ITAR) and Export Administration Regulations (EAR). These rules, enforced by the U.S. Department of State and Department of Commerce, are critical for any international business involving defense articles or sensitive technologies.

Adherence to these regulations is non-negotiable for General Atomics' global operations and collaborations. The company must meticulously manage licensing for defense items, services, and advanced technologies, ensuring every transaction meets strict U.S. government oversight. For instance, in 2023, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) reported issuing thousands of export licenses, highlighting the sheer volume of oversight.

Failure to comply with ITAR and EAR can result in severe consequences, including substantial financial penalties and disqualification from future government contracts and international partnerships. The potential financial impact of non-compliance is significant, as demonstrated by past enforcement actions where companies faced millions in fines for export control violations.

The increasing adoption of drones, especially for Beyond Visual Line of Sight (BVLOS) missions, demands a dynamic regulatory environment. General Atomics' MQ-9B SkyGuardian's UK military type certification is a significant step, enabling civilian airspace access. This achievement highlights the growing acceptance of advanced UAS in non-military domains.

Navigating these evolving legal landscapes is crucial for General Atomics. Continued engagement with authorities like the Federal Aviation Administration (FAA) is vital to influence future regulations and ensure global airworthiness compliance for its drone systems. As of early 2025, the FAA continues to refine rules for UAS integration, with a focus on safety and operational standards.

General Atomics' work in both nuclear fission and fusion necessitates strict adherence to licensing and safety standards set by bodies like the U.S. Nuclear Regulatory Commission (NRC) and international agencies. These regulations are crucial for maintaining operational licenses and ensuring public safety.

While traditional nuclear fission licensing is known for its complexity, there's a notable trend towards streamlining the approval process for nuclear fusion technology. This shift, driven by advancements and a desire to accelerate clean energy deployment, could significantly benefit companies like General Atomics involved in fusion research.

Maintaining rigorous safety protocols and demonstrating continuous compliance are paramount for General Atomics to secure and retain the necessary licenses for its nuclear energy operations. For instance, the NRC's licensing process for advanced fission reactors in 2024 continues to emphasize robust safety features and emergency preparedness.

Government Contracts and Procurement Laws

As a major defense contractor, General Atomics' revenue is significantly tied to government contracts, which are governed by complex procurement laws like the Defense Federal Acquisition Regulation Supplement (DFARS). These regulations dictate everything from sourcing to quality control, impacting operational costs and timelines. For instance, the 2023 U.S. National Defense Authorization Act (NDAA) continued to emphasize cybersecurity requirements within defense supply chains, directly affecting contractors like General Atomics.

The company's ability to secure and successfully deliver on programs such as the highly anticipated Collaborative Combat Aircraft (CCA) hinges on its adherence to these stringent legal frameworks. Meeting the precise specifications and proving compliance across its entire supply chain is paramount. In 2024, the U.S. Department of Defense continued to award substantial contracts for advanced drone technology, a key area for General Atomics, with contract values often reaching billions of dollars, underscoring the critical nature of regulatory compliance.

General Atomics must navigate various legal requirements:

- Compliance with DFARS clauses: Ensuring adherence to specific clauses related to data rights, cybersecurity, and subcontracting.

- Export control regulations: Managing the export of sensitive technologies and defense articles under laws like the International Traffic in Arms Regulations (ITAR).

- Contractual obligations: Meeting performance metrics, delivery schedules, and quality standards stipulated in government agreements.

- Ethical conduct and anti-corruption laws: Maintaining integrity in all dealings to avoid legal repercussions and maintain trust.

Intellectual Property Protection

General Atomics' competitive edge is built on its exclusive advanced technologies, particularly in unmanned aerial vehicles (UAVs), nuclear fusion research, and electromagnetic launch systems. Safeguarding these innovations through robust intellectual property (IP) protection, including patents, trademarks, and trade secrets, is paramount to maintaining its market dominance and technological leadership.

The company actively pursues legal avenues to defend its IP. For instance, in 2023, General Atomics was involved in patent litigation concerning drone technology, highlighting the ongoing legal battles to protect its innovations. Their strategy involves both domestic filings and international agreements to prevent unauthorized use and ensure continued technological superiority.

- Patents: General Atomics holds numerous patents for its groundbreaking technologies, such as those related to the Predator and Reaper UAVs.

- Trade Secrets: Critical research and development processes, especially in sensitive areas like nuclear fusion, are protected as trade secrets.

- International Protection: The company actively seeks patent and trademark protection in key global markets to prevent infringement by competitors.

- Litigation: General Atomics has a history of engaging in legal action to defend its IP rights against alleged infringements.

General Atomics operates within a complex web of legal and regulatory frameworks, particularly concerning export controls like ITAR and EAR, which govern its defense technologies. Compliance with these U.S. government regulations is critical for international transactions, with significant penalties for violations. The company's involvement in advanced technologies, including drones and nuclear energy, necessitates adherence to stringent safety, licensing, and procurement laws, such as those outlined in DFARS. Protecting its intellectual property through patents and trade secrets is also a key legal strategy to maintain its competitive advantage.

Environmental factors

General Atomics is heavily invested in nuclear fusion, placing it at the forefront of the global move towards clean, zero-carbon energy. This commitment is crucial as the world seeks alternatives to fossil fuels to combat climate change.

The company's development of compact nuclear fusion reactors could see commercial power generation by the 2030s, offering a sustainable energy solution that directly addresses environmental concerns about carbon emissions and aligns with international climate targets.

General Atomics, while exploring fusion, must also manage waste from its fission-related work. This includes adhering to stringent regulations for storing, processing, and disposing of radioactive materials, a crucial aspect of public and environmental safety. For example, the U.S. Department of Energy is investing billions in advanced nuclear waste disposal technologies, aiming to find safer long-term solutions.

The growing use of drones, including those manufactured by General Atomics, brings environmental considerations to the forefront. Noise pollution from drone operations and emissions from their power sources are key concerns. While some perceive drones as eco-friendly, General Atomics needs to actively manage its ecological footprint.

For instance, advancements in electric propulsion for drones, a focus for many manufacturers in 2024 and 2025, aim to reduce direct emissions compared to traditional fuel-powered aircraft. General Atomics is likely investing in research and development for quieter, more energy-efficient drone designs to address these environmental impacts and meet evolving regulatory standards.

Compliance with Environmental Regulations

General Atomics navigates a complex web of environmental regulations impacting its operations. These rules cover everything from handling hazardous materials and managing waste to maintaining air and water quality at its manufacturing and research sites. For example, the company's development of PFAS destruction systems demonstrates a proactive approach to meeting evolving environmental standards, particularly concerning persistent chemical pollutants.

The company's commitment to environmental compliance is crucial for maintaining its operational licenses and public reputation. Failure to adhere to these regulations could result in significant fines and operational disruptions. In 2024, the Environmental Protection Agency (EPA) continued to emphasize stricter enforcement of regulations concerning industrial emissions and hazardous waste, underscoring the importance of robust compliance programs for companies like General Atomics.

- Hazardous Material Handling: Strict protocols for storage, transport, and disposal of chemicals used in manufacturing.

- Emissions Control: Compliance with Clean Air Act standards for industrial facilities.

- Waste Management: Adherence to the Resource Conservation and Recovery Act (RCRA) for solid and hazardous waste.

- PFAS Remediation: Development and deployment of technologies to address per- and polyfluoroalkyl substances contamination.

Corporate Sustainability Initiatives

General Atomics' commitment to corporate sustainability initiatives extends beyond mere regulatory adherence, significantly impacting its long-term reputation and attractiveness to stakeholders. By embedding environmentally sound practices across its operations, including energy efficiency in its facilities and responsible product lifecycle management, the company can bolster its brand image. This focus also appeals to a growing segment of investors and partners who prioritize environmental consciousness.

For instance, in 2024, General Atomics reported a 15% reduction in its overall carbon footprint compared to 2022, primarily through upgrades to its renewable energy sources powering its research and manufacturing sites. This proactive approach is crucial for attracting capital from ESG-focused funds, which saw a 20% increase in assets under management globally during 2024, reaching an estimated $3.8 trillion.

Key aspects of General Atomics' sustainability strategy include:

- Energy Efficiency: Implementing advanced energy management systems in its facilities to reduce consumption.

- Waste Reduction: Focusing on minimizing waste generation throughout the product development and manufacturing processes.

- Sustainable Sourcing: Prioritizing suppliers with strong environmental track records.

- Product Lifecycle Management: Designing products with end-of-life considerations to promote recyclability and reduce environmental impact.

General Atomics' focus on nuclear fusion positions it as a key player in the global transition to clean energy, directly addressing climate change concerns. The company's advancements in compact fusion reactors aim to provide sustainable power by the 2030s, aligning with international efforts to reduce carbon emissions.

The company must also manage environmental responsibilities related to its fission activities, including the safe handling and disposal of radioactive waste, adhering to strict regulations. Furthermore, the increasing use of drones necessitates managing their environmental impact, such as noise pollution and emissions, with a growing emphasis on electric propulsion solutions in 2024-2025.

General Atomics operates under a comprehensive framework of environmental regulations, covering hazardous materials, emissions, and waste management, with a notable focus on PFAS remediation technologies. The company's proactive sustainability initiatives, including a 15% carbon footprint reduction reported in 2024, enhance its reputation and appeal to ESG-focused investors, who saw a 20% increase in assets under management globally in the same year.

PESTLE Analysis Data Sources

Our PESTLE Analysis for General Atomics is meticulously constructed using data from official government publications, reputable industry analysis firms, and international economic organizations. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the aerospace and defense sectors.