General Atomics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

General Atomics Bundle

General Atomics operates in a complex landscape shaped by powerful industry forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of substitutes and new entrants is crucial for strategic success. This brief overview highlights key pressures, but the full analysis delves into the nuanced dynamics that truly define General Atomics's competitive environment.

Ready to move beyond the basics? Get a full strategic breakdown of General Atomics’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

General Atomics' reliance on highly specialized components, especially for its advanced drone and nuclear research programs, significantly influences supplier bargaining power. The unique nature of these inputs often means a limited pool of qualified suppliers, giving those suppliers more leverage.

This situation is amplified by potential supply chain disruptions and geopolitical considerations impacting the availability of critical materials. For instance, rare earth elements, crucial for many defense technologies, have seen price volatility and supply concerns in recent years, directly affecting companies like General Atomics.

When suppliers possess proprietary technologies or intellectual property that are essential for General Atomics' advanced products, their bargaining power increases significantly. This is particularly evident in specialized sectors like AI for autonomous systems or unique materials for nuclear applications, where finding readily available alternatives is challenging.

For General Atomics, switching suppliers in the defense and advanced technology sectors often comes with significant financial and operational hurdles. These can include lengthy requalification processes, complex integration of new components into existing systems, and the risk of project delays that can cost millions. For instance, a single component change in an advanced aerospace system might require extensive re-testing and certification, a process that can take months or even years and cost upwards of $1 million per iteration, depending on the complexity.

Regulatory and Compliance Requirements

Suppliers to the defense sector, a key area for General Atomics, face significant regulatory hurdles. Meeting mandates like the Cybersecurity Maturity Model Certification (CMMC) or navigating complex export control laws requires specialized expertise and investment. This compliance burden can limit the pool of qualified suppliers.

Suppliers who have already invested in and demonstrated compliance with these stringent requirements, such as those adhering to ITAR (International Traffic in Arms Regulations) or DFARS (Defense Federal Acquisition Regulation Supplement), hold a distinct advantage. Their established processes and understanding of the defense landscape enhance their value proposition, granting them increased bargaining leverage with companies like General Atomics.

- Compliance as a Differentiator: Suppliers meeting CMMC Level 2 or higher, for instance, are better positioned to secure contracts.

- Reduced Risk for Buyers: Companies like General Atomics prefer suppliers with a proven track record in regulatory adherence, minimizing their own compliance risks.

- Barriers to Entry: The cost and complexity of meeting defense-specific regulations act as a significant barrier for new entrants, consolidating power among existing compliant suppliers.

Limited Supplier Base in Niche Markets

In specialized fields like nuclear fusion and advanced electromagnetic systems, General Atomics faces a limited supplier base. The extremely high technical requirements and significant entry barriers mean only a few companies possess the necessary expertise and capabilities.

This scarcity of specialized suppliers grants them substantial bargaining power. For instance, in the realm of high-temperature superconducting magnets crucial for fusion research, only a handful of global manufacturers can meet the stringent specifications and production volumes required by projects like the ITER program. General Atomics, therefore, must often accept supplier-dictated terms, impacting cost and timelines.

- Limited Expertise: The technical complexity of General Atomics' core products, such as advanced propulsion systems or directed energy weapons, restricts the pool of potential suppliers to those with highly specialized knowledge and infrastructure.

- High Barriers to Entry: The significant capital investment, regulatory hurdles, and intellectual property protection in these niche sectors create substantial barriers, further reducing the number of viable suppliers.

- Supplier Leverage: Consequently, these few capable suppliers can command premium pricing and dictate contract terms, directly impacting General Atomics' cost of goods sold and project profitability.

The bargaining power of suppliers for General Atomics is considerable due to the highly specialized nature of components required for its advanced defense and energy projects. This specialization often results in a limited number of qualified suppliers, giving them significant leverage.

For example, in the defense sector, suppliers adhering to stringent regulations like ITAR and CMMC have a competitive edge, as General Atomics prioritizes compliance to mitigate its own risks. This adherence can lead to premium pricing from these established vendors.

The scarcity of suppliers with expertise in areas like high-temperature superconducting magnets for fusion research, or proprietary AI for autonomous systems, further amplifies supplier power. These few capable suppliers can dictate terms, impacting General Atomics' costs and project timelines, with switching costs often running into millions due to requalification processes.

| Supplier Characteristic | Impact on General Atomics | Example Data/Scenario |

|---|---|---|

| Limited Supplier Pool (Specialized Tech) | Increased Leverage, Higher Costs | Few global manufacturers can produce high-temperature superconducting magnets for fusion projects. |

| Proprietary Technology/IP | Supplier Control, Limited Alternatives | Essential AI algorithms for autonomous drone systems may be held by only a few firms. |

| Regulatory Compliance (Defense) | Supplier Advantage, Reduced Buyer Risk | Suppliers with CMMC Level 2 compliance are preferred, potentially commanding higher prices. |

| High Switching Costs | Supplier Retention, Contractual Constraints | Requalifying a single aerospace component can cost over $1 million and take months. |

What is included in the product

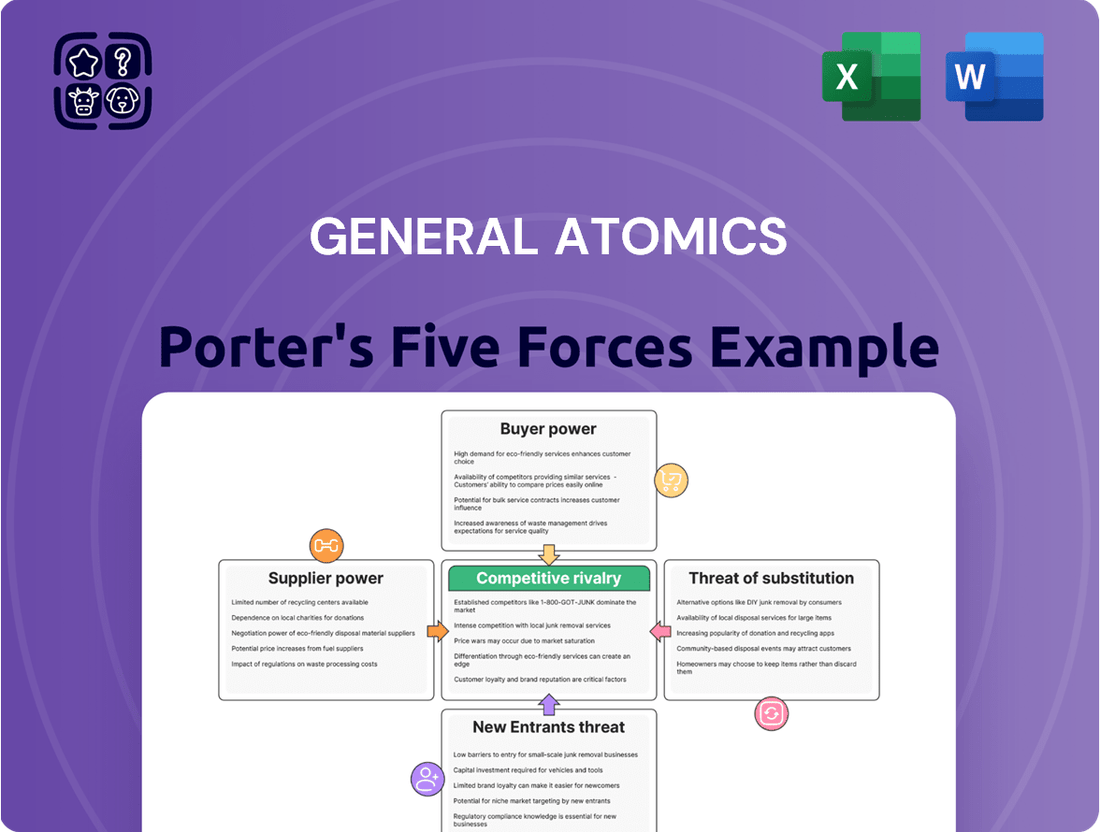

General Atomics' Porter's Five Forces analysis reveals the competitive intensity within the defense and energy sectors, examining threats from new entrants, the bargaining power of buyers and suppliers, and the impact of substitute products.

Easily identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

General Atomics' primary customers are government entities, notably defense departments like the U.S. Department of Defense and international military branches. These powerful clients wield considerable bargaining influence due to their substantial order volumes and capacity to dictate rigorous specifications for highly specialized defense systems.

The U.S. Department of Defense, for instance, represents a significant portion of defense spending. In fiscal year 2024, the proposed defense budget was around $886 billion, highlighting the immense purchasing power of such government bodies.

This concentration of demand means that government customers can negotiate favorable terms, often acting as the sole procurer for advanced technologies, which amplifies their bargaining leverage over suppliers like General Atomics.

Government procurement cycles are notoriously lengthy and susceptible to shifts in political priorities and budget allocations. This extended timeline, often spanning years, grants significant leverage to customers, particularly in large-scale defense contracts. For instance, the U.S. Department of Defense, a major client for companies like General Atomics, navigates complex budgeting processes where program funding can be revised, leading to potential delays or renegotiations of terms.

These budgetary constraints and the inherent unpredictability of defense spending, which saw global military expenditure reach an estimated $2.44 trillion in 2023 according to the Stockholm International Peace Research Institute (SIPRI), empower customers. They can leverage these factors to negotiate more favorable pricing, payment schedules, or contract modifications. This can directly impact General Atomics' revenue predictability and its ability to forecast sales accurately, as major programs may face funding reviews or re-prioritization.

Customers in the defense industry, especially NATO allies, frequently require standardization and interoperability across their complex systems. This demand can constrain General Atomics' ability to create highly differentiated products, as compliance with established technical standards becomes paramount. For instance, the push for common communication protocols and data links among allied forces means General Atomics must design its offerings to seamlessly integrate with existing infrastructure, thereby amplifying customer leverage.

In-house Capabilities and Competitive Bidding

While General Atomics provides sophisticated defense and energy solutions, governments, as key customers, can exert significant bargaining power. This leverage often stems from their ability to develop or maintain in-house capabilities for certain technologies, reducing their reliance on external suppliers like General Atomics. For instance, in 2024, many nations continued to invest in domestic defense industrial bases, aiming for greater technological sovereignty.

Furthermore, the presence of competitive bidding processes, even among a limited number of large defense contractors, amplifies customer power. This competition forces suppliers to offer more favorable terms and pricing to secure contracts. In the defense sector, where contracts can be worth billions, this dynamic is particularly pronounced, allowing governments to negotiate effectively for better value.

- Government In-house Capabilities: Nations are increasingly investing in domestic R&D and manufacturing for critical defense technologies, potentially reducing reliance on companies like General Atomics.

- Competitive Bidding: The defense procurement landscape often involves competitive bidding among a few major players, giving governments considerable negotiation leverage.

- Supplier Concentration: While limited, competition among large defense contractors can still create opportunities for customers to drive down prices and improve contract terms.

- Technological Advancement: As governments acquire more advanced in-house expertise, their ability to critically assess and negotiate for external solutions strengthens.

Performance and Reliability Requirements

For General Atomics, the performance and reliability requirements of its customers, particularly in military and advanced technology sectors, are exceptionally stringent. These customers demand unwavering dependability and cutting-edge functionality, making any lapse in these areas a significant concern.

The critical nature of these applications means customers possess considerable bargaining power. If General Atomics falters in meeting these high performance and reliability benchmarks, customers are likely to explore and switch to competitors who can better satisfy their needs.

- High Stakes Applications: Military and advanced technology programs often involve life-or-death scenarios or mission-critical operations, amplifying the need for flawless performance.

- Customer Leverage: Shortcomings in reliability or performance directly translate to customer leverage, as they can threaten to seek alternative suppliers for vital systems.

- General Atomics' Reputation: Maintaining a reputation for superior performance and reliability is paramount for General Atomics to mitigate this customer bargaining power.

General Atomics' primary customers, predominantly government defense entities, possess substantial bargaining power. This leverage is amplified by their significant order volumes and the ability to impose strict specifications on highly specialized systems, as seen with the U.S. Department of Defense's substantial budget. The concentration of demand allows these clients to negotiate favorable terms, often acting as the sole procurers for cutting-edge technologies.

Government procurement cycles are lengthy and subject to political shifts, granting customers leverage to renegotiate terms, especially given global military expenditure reaching an estimated $2.44 trillion in 2023. Furthermore, the demand for standardization among allies can limit General Atomics' product differentiation, strengthening customer influence. Many nations are also investing in domestic defense capabilities in 2024, reducing their reliance on external suppliers and enhancing their negotiation stance.

| Customer Type | Bargaining Power Factors | Impact on General Atomics |

| Government Defense Departments (e.g., U.S. DoD) | Large order volumes, strict specifications, sole procurer status | Ability to negotiate favorable pricing, payment terms, and contract specifications. |

| International Military Branches (e.g., NATO allies) | Demand for standardization and interoperability, potential for in-house capabilities | Constrains product differentiation, increases reliance on meeting established technical standards. |

Preview Before You Purchase

General Atomics Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of General Atomics provides an in-depth examination of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. What you're previewing is the final version, precisely the same document that will be available to you instantly after buying.

Rivalry Among Competitors

General Atomics faces formidable competition from established global defense giants like Lockheed Martin, Boeing, and Airbus Helicopters. These titans possess vast financial resources, broad product lines, and deep-rooted government ties, creating a highly competitive landscape for lucrative defense contracts.

In 2024, the global defense industry continues to see significant spending, with major players like Lockheed Martin reporting substantial revenues. For instance, Lockheed Martin's 2023 total sales reached $69.6 billion, highlighting the scale of resources these competitors can deploy against General Atomics.

The defense sector thrives on substantial, multi-year contracts, which naturally fuels intense competition for each significant award. Companies like General Atomics pour considerable resources into research and development, alongside strategic lobbying efforts, to win these lucrative deals. This dynamic locks in market share for years, making the fight for each contract a high-stakes, protracted battle.

General Atomics' commitment to cutting-edge technologies, including unmanned aerial systems (UAS), nuclear fission, and fusion energy research, fuels an intense innovation race within the defense and energy sectors. This relentless pursuit of technological advancement means competitors are also pouring significant resources into areas like artificial intelligence, autonomous operations, and novel materials, compelling General Atomics to consistently push the boundaries of innovation to sustain its market position.

Global Defense Spending Trends

Global defense spending is on the rise, creating a more competitive landscape. In 2023, global military expenditure reached an estimated $2.44 trillion, a 6.8% increase in real terms from 2022, according to the Stockholm International Peace Research Institute (SIPRI). This growth, particularly noticeable in Europe and the Middle East, means more opportunities but also more companies vying for contracts. This heightened spending environment naturally intensifies rivalry as both established defense giants and emerging players aggressively seek to capture a larger share of these expanding defense budgets.

The increasing defense budgets translate into more procurement opportunities, attracting a wider array of competitors. This dynamic encourages established companies to innovate and secure existing contracts, while also paving the way for new entrants to challenge incumbents with specialized technologies or more competitive pricing. The race to secure these lucrative deals fuels aggressive strategies across the industry.

- Rising Global Defense Budgets: Global military expenditure hit $2.44 trillion in 2023, up 6.8% from 2022.

- Geographic Growth Areas: Europe and the Middle East are key regions experiencing significant increases in defense spending.

- Increased Competition: Higher spending attracts more players, intensifying rivalry for market share.

- Strategic Pursuit of Opportunities: Both established and new companies are aggressively pursuing market opportunities in this expanding sector.

Consolidation and Strategic Partnerships

The defense sector, including areas where General Atomics operates, has witnessed significant consolidation. For instance, major players frequently merge or acquire smaller firms to enhance their capabilities and market share. These moves are often driven by the need to offer more comprehensive solutions and achieve economies of scale. General Atomics itself has engaged in strategic partnerships, notably for European combat aircraft programs, demonstrating a proactive approach to strengthening its competitive position.

These alliances can create formidable competitors, pooling resources and expertise to a degree that makes it challenging for unaligned companies to compete effectively. The formation of these larger, integrated entities can reshape market dynamics, leading to intensified rivalry for those operating outside these collaborative networks.

- Consolidation trends in the aerospace and defense sector aim to create larger, more capable entities.

- General Atomics' collaborations, such as those in European combat aircraft, exemplify this strategic partnership approach.

- These alliances can concentrate market power, increasing competitive pressure on independent firms.

- The strategic imperative is to build scale and technological breadth to meet evolving defense requirements.

The competitive rivalry for General Atomics is intense, driven by deep-pocketed global defense giants like Lockheed Martin and Boeing, who possess extensive resources and established government relationships. These established players leverage their scale and market presence to secure lucrative, long-term defense contracts, creating a challenging environment for General Atomics.

In 2024, the global defense market continues to be characterized by significant spending, with companies like Lockheed Martin reporting revenues in the tens of billions, such as their $69.6 billion in total sales for 2023. This financial muscle allows competitors to invest heavily in research, development, and lobbying, directly impacting the competitive landscape for General Atomics.

The pursuit of multi-year defense contracts intensifies rivalry, as companies commit substantial resources to win these high-stakes awards. General Atomics' focus on advanced technologies like unmanned aerial systems (UAS) and energy research places it in direct competition with rivals also investing heavily in AI and autonomous operations, necessitating continuous innovation.

| Competitor | 2023 Revenue (Approx.) | Key Areas of Competition |

|---|---|---|

| Lockheed Martin | $69.6 billion | UAS, advanced combat systems, intelligence, surveillance, and reconnaissance (ISR) |

| Boeing | $77.8 billion | UAS, fighter aircraft, advanced avionics |

| Airbus Helicopters | (Part of Airbus SE, $70 billion aerospace revenue) | UAS, rotorcraft, advanced aerospace technologies |

SSubstitutes Threaten

While drones, or unmanned aerial systems (UAS), are rapidly advancing, traditional manned aircraft remain viable substitutes for certain missions. These include situations requiring immediate human judgment or a physical presence on site, such as complex search and rescue operations or highly sensitive reconnaissance where an onboard pilot is preferred. For instance, in 2024, military budgets continued to allocate significant funds to both manned and unmanned platforms, reflecting a dual-track approach in defense strategy.

However, the economic and operational benefits of UAS are increasingly pushing them to the forefront. The cost of operating a drone is often a fraction of that for a manned aircraft, and crucially, they eliminate the risk to human pilots. This cost-effectiveness is a major driver for adoption across various sectors, from defense to commercial surveying, as companies seek to optimize spending and reduce operational hazards.

The threat of substitutes for General Atomics' nuclear fission and fusion endeavors is significant, primarily stemming from the growing accessibility and declining costs of alternative energy sources. Renewable energy, particularly solar and wind, continues to gain market share. In 2024, global renewable energy capacity additions are projected to reach record levels, driven by supportive policies and technological advancements.

Fossil fuels, despite increasing environmental scrutiny, remain a dominant and often cheaper substitute in many regions, especially for baseload power generation. Furthermore, advancements in other nuclear technologies, such as small modular reactors (SMRs), present a different kind of substitute by offering potentially more flexible and scalable nuclear solutions compared to traditional large-scale plants.

Advanced cyber warfare and electronic countermeasures present a growing threat of substitution for certain physical defense systems. For instance, sophisticated cyberattacks could disrupt or disable enemy command and control networks, potentially negating the need for some traditional electronic warfare or drone-based interdiction capabilities. The global cyber warfare market was valued at approximately $10 billion in 2023 and is projected to grow significantly, indicating increasing investment in these non-physical disruptive technologies.

Low-Cost, Off-the-Shelf Commercial Drones

The threat of substitutes for General Atomics' advanced drone systems is growing, particularly from low-cost, off-the-shelf commercial drones. These readily available platforms, often augmented with artificial intelligence capabilities, can perform certain intelligence, surveillance, and reconnaissance (ISR) missions effectively. For instance, in 2024, the global commercial drone market was valued at approximately $10.5 billion, with significant growth projected, indicating a widening availability of these alternatives.

These commercial drones, sometimes equipped with AI-enhanced 'strike kits,' present a viable substitute for specific applications. This is especially true for non-state actors or in scenarios where the sophisticated capabilities of military-grade drones are not strictly necessary or are cost-prohibitive. The increasing sophistication and affordability of these systems mean that for less demanding tasks, they can fulfill the role of more expensive, specialized platforms.

- Emerging AI Integration: Commercial drones are increasingly incorporating AI for enhanced autonomy and analytical capabilities, making them more competitive for ISR tasks.

- Cost-Effectiveness: The lower price point of commercial drones compared to military-grade systems makes them an attractive substitute for budget-conscious entities.

- Market Growth: The global commercial drone market's expansion, projected to reach over $40 billion by 2030, underscores the increasing accessibility and capability of these alternative solutions.

Traditional Ground or Naval Systems

While drones and electromagnetic systems offer distinct advantages, traditional ground or naval intelligence, surveillance, and targeting (ISTAR) systems can still perform similar tasks. However, these legacy systems often come with significant drawbacks. For instance, deploying ground troops for reconnaissance inherently carries a higher risk to personnel compared to employing an unmanned aerial vehicle. Similarly, naval ISTAR platforms might require closer proximity to a target area, increasing exposure. In 2024, the global defense spending reached an estimated $2.44 trillion, with a significant portion allocated to modernizing existing platforms and developing new capabilities that often integrate or compete with drone technology.

The efficiency and range of traditional systems can also be a limiting factor. A single drone sortie can cover vast areas and provide persistent surveillance, a feat that might require multiple ground patrols or specialized naval assets. This difference in operational tempo and coverage is a key consideration for military planners. For example, the U.S. Air Force’s MQ-9 Reaper drone, a widely deployed platform, can loiter for over 27 hours, a duration difficult to match with manned ground or naval patrols without substantial logistical support.

- Efficiency Disparity: Drones often provide more persistent and wider-area surveillance than traditional ground or naval ISTAR, reducing the need for frequent manned patrols.

- Personnel Risk: Utilizing unmanned systems significantly lowers the risk to human lives in dangerous reconnaissance or targeting missions compared to deploying ground troops or manned naval assets.

- Range Limitations: Traditional systems may have a more restricted operational range or require closer proximity to targets, whereas drones can often operate at greater distances and for longer durations.

The threat of substitutes for General Atomics' core technologies, particularly in defense and energy, is multifaceted. In the defense sector, while advanced drones offer unique capabilities, traditional manned aircraft and even sophisticated cyber warfare tools can serve as substitutes for certain mission profiles. For example, the global defense market saw significant investment in 2024, with nations balancing procurement of both manned and unmanned systems, highlighting that manned platforms are not yet fully obsolete.

In the energy sector, General Atomics' nuclear fission and fusion research faces substantial substitution threats from rapidly advancing renewable energy sources like solar and wind. Global renewable energy capacity is projected to hit new records in 2024, driven by falling costs and policy support. Additionally, advancements in other nuclear technologies, such as small modular reactors (SMRs), offer alternative nuclear solutions that could compete with large-scale projects.

| Technology Area | General Atomics' Offering | Key Substitutes | 2024 Data/Trend |

|---|---|---|---|

| Defense Systems | Advanced Drones (UAS) | Manned Aircraft, Commercial Drones with AI, Cyber Warfare | Global defense spending nearing $2.5 trillion; commercial drone market valued at ~$10.5 billion. |

| Energy | Nuclear Fission/Fusion | Solar, Wind, Small Modular Reactors (SMRs), Fossil Fuels | Record renewable energy capacity additions; continued reliance on fossil fuels for baseload power. |

Entrants Threaten

Entering the defense and advanced technology sectors, where General Atomics thrives, demands substantial capital for research, development, and sophisticated manufacturing. For instance, developing a new advanced drone system can easily cost hundreds of millions, if not billions, of dollars. This high financial threshold acts as a formidable barrier, deterring many potential new competitors from even attempting to enter the market.

New companies entering the defense and nuclear sectors, where General Atomics operates, face significant barriers due to extensive regulatory hurdles and mandatory certifications. These include complex requirements like the International Traffic in Arms Regulations (ITAR), Cybersecurity Maturity Model Certification (CMMC), and Federal Risk and Authorization Management Program (FedRAMP). For instance, achieving CMMC compliance, which became mandatory for many Department of Defense contractors in late 2023 and early 2024, can involve substantial investments in cybersecurity infrastructure and processes, potentially costing millions.

The lengthy and expensive nature of obtaining these critical certifications acts as a powerful deterrent for potential new entrants. Many smaller or less capitalized firms simply cannot afford the time and resources required to navigate this intricate compliance landscape, effectively limiting the threat of new competition for established players like General Atomics. This regulatory moat ensures that only well-resourced and committed entities can realistically consider entering these highly specialized markets.

Newcomers face a significant hurdle due to the exceptionally long sales cycles inherent in securing government defense contracts. These processes often span years, demanding extensive vetting and proven reliability, something new entrants haven't had the opportunity to demonstrate.

Established players like General Atomics have cultivated deep, trust-based relationships with defense agencies over decades. This existing rapport, built on a track record of performance, creates a formidable barrier to entry for any new company attempting to break into the market.

In 2024, the U.S. defense budget, a key indicator of market activity, was projected to be around $886 billion. Navigating this complex landscape requires not just technological innovation but also the established credibility and connections that incumbents possess, making it difficult for new entrants to gain a foothold.

Need for Specialized Expertise and Talent

The development of cutting-edge technologies, such as those General Atomics specializes in like unmanned aerial systems and nuclear fusion, requires a deep pool of highly specialized scientific and engineering talent. This expertise is inherently scarce, making it difficult for new entrants to quickly assemble the necessary knowledge base. For instance, the global shortage of cybersecurity professionals, a critical component in advanced defense systems, highlights this challenge. In 2024, the demand for AI and machine learning engineers, crucial for autonomous systems, continued to outstrip supply, with average salaries for senior roles exceeding $180,000 annually in the US.

Attracting and retaining this elite talent presents a significant hurdle for any new competitor aiming to enter General Atomics' markets. Established companies often have strong employer branding, competitive compensation packages, and existing research and development infrastructures that are hard for startups to replicate. The cost of acquiring and keeping top-tier engineers and scientists can be prohibitive for new ventures, directly impacting their ability to innovate and compete effectively.

- Scarce Specialized Talent: Fields like advanced aerospace engineering and fusion science have limited pools of qualified professionals.

- High Recruitment Costs: New entrants face significant expenses in attracting and onboarding highly sought-after engineers and scientists.

- Retention Challenges: Established companies often offer better career progression and research environments, making it difficult for new firms to retain talent.

Intellectual Property and Patent Barriers

General Atomics and other established players in advanced aerospace and defense technologies possess a formidable arsenal of intellectual property and patents. This extensive IP portfolio acts as a significant barrier, deterring potential new entrants. Developing competing technologies would necessitate either costly licensing agreements or substantial investment in groundbreaking research and development to create novel, non-infringing solutions.

The sheer volume and complexity of existing patents in areas like advanced propulsion systems, unmanned aerial vehicle (UAV) technology, and directed energy weapons create a challenging landscape for newcomers. For instance, the global defense market, where General Atomics is a key player, saw significant R&D spending in 2024, with major defense contractors investing billions to maintain their technological edge and secure new patents.

- Extensive Patent Portfolio: General Atomics holds numerous patents covering critical aspects of its core technologies, including UAV design, sensor integration, and advanced materials.

- High R&D Investment: New entrants would need to match or exceed the substantial R&D expenditures of established firms, a daunting financial undertaking.

- Legal and Licensing Costs: Circumventing existing intellectual property often involves lengthy and expensive legal battles or the negotiation of licensing agreements, further increasing the cost of entry.

The threat of new entrants for General Atomics is low, primarily due to the immense capital required for research, development, and manufacturing in its specialized sectors like advanced aerospace and nuclear technologies. For example, developing a new complex defense system can easily cost billions, a financial barrier that deters most potential competitors.

Stringent regulatory requirements and the need for extensive certifications, such as ITAR and CMMC, further solidify this barrier. Achieving compliance, which can cost millions as seen with CMMC implementation in 2023-2024, demands significant investment and time, effectively limiting entry to well-resourced entities.

The scarcity of specialized talent, coupled with high recruitment and retention costs, also presents a formidable challenge for new players. In 2024, the demand for AI and machine learning engineers, crucial for autonomous systems, continued to outstrip supply, with average senior salaries exceeding $180,000 annually in the US, making it difficult for newcomers to build a competitive team.

General Atomics' extensive intellectual property portfolio, encompassing patents in UAV technology and advanced materials, acts as another significant deterrent. The high R&D investment by established firms and the potential for costly legal battles or licensing agreements further increase the cost and complexity of market entry.

| Barrier Type | Description | Impact on New Entrants | Example Data/Context (2024) |

| Capital Requirements | High investment needed for R&D and manufacturing. | Deters new companies due to prohibitive costs. | Developing advanced drone systems can cost hundreds of millions to billions. |

| Regulatory Hurdles | Complex certifications and compliance (ITAR, CMMC). | Requires significant time and financial resources to navigate. | CMMC compliance costs can run into millions; mandatory for many DoD contractors from late 2023/early 2024. |

| Talent Scarcity | Shortage of highly specialized engineers and scientists. | Difficult for new entrants to attract and retain key personnel. | AI/ML engineer salaries exceed $180,000 annually for senior roles in the US. |

| Intellectual Property | Extensive patent portfolios in core technologies. | Requires costly licensing or significant innovation to circumvent. | Billions invested in R&D by defense contractors in 2024 to secure new patents. |

Porter's Five Forces Analysis Data Sources

Our General Atomics Porter's Five Forces analysis is built upon a foundation of robust data, including company annual reports, industry-specific market research, and public financial filings. This comprehensive approach ensures a thorough understanding of competitive dynamics.