General Atomics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

General Atomics Bundle

Uncover the strategic positioning of General Atomics' product portfolio with our comprehensive BCG Matrix. See which innovations are poised for growth and which are generating steady returns.

This preview offers a glimpse into General Atomics' market standing. Purchase the full BCG Matrix for detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your investments and product development strategies.

Stars

The MQ-9B SkyGuardian/SeaGuardian UAS from General Atomics is a clear star in the BCG matrix, boasting robust demand and substantial market expansion. Its acquisition by nations like Denmark, the UK, Poland, Belgium, Canada, and Japan underscores its critical role in maritime patrol, surveillance, and security, particularly in vital regions such as the Arctic and North Atlantic.

The SeaGuardian variant's advanced capabilities, including in-flight targeting and multi-domain ISR&T as an internal payload, position it as a highly versatile and cost-effective solution for contemporary naval forces. This strong market performance and technological edge solidify its status as a high-growth, high-market-share asset.

General Atomics is a significant participant in the U.S. Air Force's Collaborative Combat Aircraft (CCA) program, securing contracts for the initial prototype development. Their YFQ-42A, building on the Gambit drone lineage and the XQ-67A demonstrator, is slated for flight testing by mid-2025, signaling a substantial investment in this rapidly expanding autonomous combat drone sector. This program is crucial for future air combat capabilities, with General Atomics showcasing advanced autonomy and datalink integration.

General Atomics Electromagnetic Systems (GA-EMS) is experiencing significant growth in its Optical Communication Terminals (OCTs) business, evidenced by multiple contracts from the Space Development Agency and U.S. Space Force. These OCTs are crucial for secure, high-capacity space-to-space communication, operating across various orbital regimes. The market for these advanced terminals is expanding rapidly, with a key Phase 2 contract awarded in 2025 focusing on lab demonstrations and design refinement.

Nuclear Thermal Propulsion for Space Missions

General Atomics Electromagnetic Systems (GA-EMS) has made significant strides in nuclear thermal propulsion (NTP) reactor technology, a critical component for future space exploration. These advancements are geared towards enabling efficient cislunar transportation and ambitious deep space missions, including human expeditions to Mars.

This high-growth sector within space exploration promises to revolutionize long-duration missions by offering substantially improved propulsion capabilities. The successful completion of key tests in early 2025 solidifies General Atomics' position as a frontrunner in developing this vital technology.

- Market Potential: The global space exploration market is projected to reach $1.7 trillion by 2030, with advanced propulsion systems like NTP being a key driver.

- Technological Advancement: GA-EMS's NTP reactor design has demonstrated successful testing of key components, indicating readiness for further development.

- NASA Collaboration: Partnerships with NASA underscore the strategic importance and potential funding avenues for this technology.

- Competitive Landscape: While still emerging, NTP is a focus for several international space agencies and private companies, highlighting its strategic value.

Advanced Autonomous Software and AI for Drones

General Atomics is heavily investing in advanced autonomous software and AI for its drones, positioning itself as a leader in this rapidly evolving field.

Recent demonstrations in June 2025 highlighted the MQ-20 Avenger’s impressive autonomous capabilities, including sophisticated midair station-keeping and simulated air-to-air combat maneuvers, all powered by government-provided reference autonomy software.

This focus on AI-driven decision-making and autonomous operations is critical for the future of aerial warfare and ensuring air superiority for military forces.

- AI Integration: General Atomics is developing AI for enhanced situational awareness and real-time decision-making in unmanned systems.

- Autonomous Operations: Demonstrations show drones performing complex tasks like midair station-keeping and simulated combat without direct human control.

- Market Growth: The demand for AI-powered autonomous capabilities in defense is a high-growth sector, crucial for maintaining a technological edge.

- Future Combat: These advancements are fundamental to the evolution of air combat, aiming to provide superior air superiority.

The MQ-9B SkyGuardian/SeaGuardian UAS is a prime example of a Star in General Atomics' portfolio. Its widespread adoption by multiple nations, including significant orders from Canada and Japan in 2024, highlights its strong market share and the growing demand for advanced maritime surveillance and strike capabilities. The platform's versatility across various operational domains, from Arctic patrol to counter-piracy, positions it for continued growth.

General Atomics' investment in the Collaborative Combat Aircraft (CCA) program, with its YFQ-42A drone entering flight testing in mid-2025, signifies a strategic move into the high-growth autonomous combat drone market. This initiative, coupled with advancements in AI and autonomous software demonstrated by the MQ-20 Avenger in June 2025, further solidifies its Star status. The company's focus on integrating advanced AI for real-time decision-making is a key differentiator in this rapidly expanding sector.

The Optical Communication Terminals (OCTs) business within GA-EMS, bolstered by substantial contracts from the Space Development Agency in 2024 and a key Phase 2 contract in 2025, represents another significant Star. These terminals are crucial for the burgeoning satellite communication market, which is experiencing exponential growth. GA-EMS's leadership in this area, driven by demand for secure, high-capacity space-to-space links, ensures its continued prominence.

General Atomics' development of Nuclear Thermal Propulsion (NTP) technology is a forward-looking Star, addressing the critical need for advanced propulsion in space exploration. With successful key component tests completed in early 2025 and a projected global space exploration market of $1.7 trillion by 2030, this venture is poised for substantial expansion. The company's collaboration with NASA further validates its strategic importance and market potential in this high-growth area.

| Product/Technology | BCG Category | Market Growth | Market Share | Key Developments (2024-2025) |

|---|---|---|---|---|

| MQ-9B SkyGuardian/SeaGuardian | Star | High | High | Significant orders from Canada and Japan; expanded operational use in Arctic and North Atlantic. |

| Collaborative Combat Aircraft (CCA) / YFQ-42A | Star | Very High | Growing | Prototype development contracts; flight testing initiated mid-2025. |

| Optical Communication Terminals (OCTs) | Star | High | High | Multiple contracts from Space Development Agency; Phase 2 contract awarded in 2025. |

| Nuclear Thermal Propulsion (NTP) | Star | Very High | Emerging | Successful component testing; collaboration with NASA; projected market growth in space exploration. |

What is included in the product

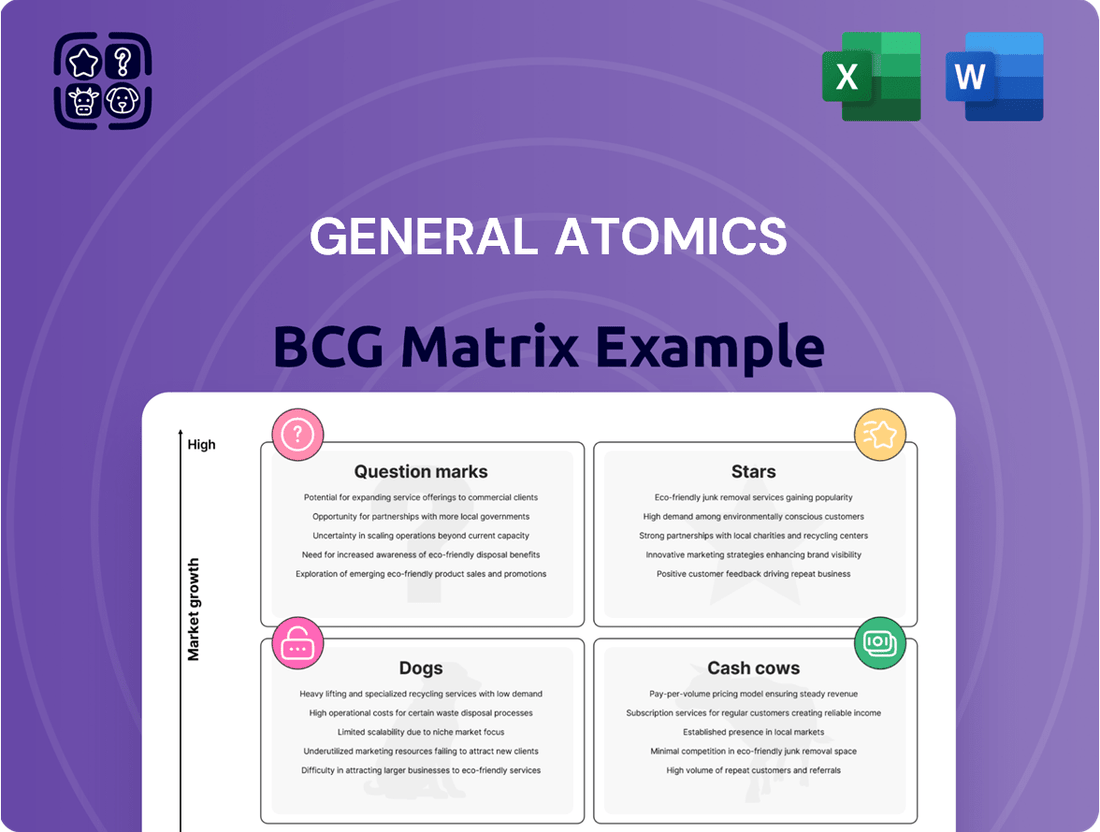

This matrix categorizes business units by market growth and share, guiding strategic decisions on investment, divestment, or harvesting.

A clear BCG Matrix visualizes General Atomics' portfolio, easing the pain of strategic resource allocation decisions.

Cash Cows

The Legacy Predator/Reaper Series drones, including the MQ-9A Reaper and MQ-1C Gray Eagle, are firmly positioned as Cash Cows within General Atomics' portfolio. These veteran platforms, with over 30 years of service and a cumulative 8 million flight hours, command a significant market share in the remotely piloted aircraft sector.

Their established presence translates into a steady stream of revenue. Sustainment contracts, comprehensive training programs, and ongoing operational support for these proven systems continue to be reliable income generators, underscoring their Cash Cow status.

General Atomics plays a pivotal role in the ITER project, supplying essential components like the advanced corrugated waveguides crucial for plasma heating. This long-term commitment underscores their stable, high-market share in the specialized field of fusion research infrastructure.

With ITER's first plasma targeted for 2025, General Atomics' continued delivery of high-precision magnets and other vital systems solidifies their position in a foundational, albeit slow-growth, market. Their expertise is instrumental in paving the way for future commercial fusion power plants.

General Atomics' DIII-D National Fusion Facility is a prime example of a Cash Cow within the BCG Matrix. Its long-term operation, funded significantly by the U.S. Department of Energy, ensures a stable and predictable revenue stream through research grants and collaborations.

The facility holds a dominant market share in magnetic fusion energy research, a testament to its consistent performance and scientific contributions. As of recent reports, DIII-D has achieved over 200,000 plasma shots, underscoring its extensive operational history and ongoing impact on fusion science advancement.

Nuclear Fuel Cycle Services (SiGA Cladding)

General Atomics Electromagnetic Systems (GA-EMS) is solidifying its position in the nuclear energy sector with its SiGA® silicon carbide (SiC) composite cladding technology. This advancement, supported by a Department of Energy contract, targets enhanced nuclear fuel efficiency and safety for both existing and future reactors. The company's significant market share in this established but developing industry segment positions SiGA Cladding as a cash cow.

The ongoing development of a 'Nuclear Fuel Digital Twin' by GA-EMS further boosts efficiency and cuts down on development expenses. This technological edge, coupled with its strong market presence, reinforces SiGA Cladding's status as a reliable revenue generator for General Atomics.

- Market Position: High market share in the mature yet evolving nuclear energy sector.

- Technological Advancement: SiGA® silicon carbide (SiC) composite cladding improves fuel efficiency and safety.

- Cost Reduction: Development of a 'Nuclear Fuel Digital Twin' enhances efficiency and reduces costs.

- Financial Status: Positioned as a cash cow due to strong market presence and technological leadership.

Electromagnetic Systems (EMALS/AAG)

General Atomics Electromagnetic Systems (GA-EMS) has secured a strong position with its EMALS and AAG technologies, vital for modern naval aviation. These systems are deployed on the latest U.S. Navy aircraft carriers, demonstrating a significant market share in a niche but critical defense segment. Their established presence ensures ongoing revenue streams from production, integration, and long-term sustainment contracts.

The EMALS and AAG are considered cash cows due to their essential role and the high barriers to entry in this specialized field. The U.S. Navy's commitment to these advanced launch and recovery systems, as seen in programs like the Ford-class carriers, provides a stable demand. For instance, the Gerald R. Ford (CVN 78) and the upcoming John F. Kennedy (CVN 79) are equipped with these GA-EMS technologies, underscoring their continued importance.

- Market Dominance: GA-EMS holds a near-monopoly in advanced electromagnetic launch and recovery systems for naval aircraft.

- Stable Revenue: Long-term sustainment and upgrade contracts for existing deployments provide consistent income.

- Critical Infrastructure: These systems are integral to the operational capability of major naval assets, ensuring continued demand.

- Limited Competition: The high technological and capital investment required creates a significant barrier for potential competitors.

General Atomics' legacy Predator and Reaper drone series continue to be significant revenue generators, acting as true cash cows. These platforms, with millions of flight hours accumulated over decades, maintain a dominant market share in the remotely piloted aircraft sector, ensuring consistent income from sustainment and training.

The DIII-D National Fusion Facility, a long-standing research asset funded by the Department of Energy, also represents a stable income stream. Its extensive operational history, marked by over 200,000 plasma shots, solidifies its position in magnetic fusion research, contributing reliably to General Atomics' financial stability.

General Atomics Electromagnetic Systems' SiGA® silicon carbide composite cladding technology for nuclear reactors is another strong cash cow candidate. Supported by government contracts and enhanced by a developing Nuclear Fuel Digital Twin, this technology offers improved efficiency and safety, securing a solid market share in the nuclear energy sector.

Furthermore, the EMALS and AAG systems for naval aviation, deployed on U.S. Navy carriers like the Gerald R. Ford (CVN 78) and John F. Kennedy (CVN 79), are vital cash cows. Their critical role and the high barriers to entry in this specialized defense market guarantee long-term revenue from production and sustainment.

| General Atomics Cash Cows | Market Position | Key Features | Revenue Stream | Example Deployment |

| Predator/Reaper Series Drones | High Market Share (Remotely Piloted Aircraft) | 30+ Years Service, 8M+ Flight Hours | Sustainment, Training, Support Contracts | Global Military Operations |

| DIII-D National Fusion Facility | Dominant Market Share (Magnetic Fusion Research) | 200,000+ Plasma Shots | DOE Funding, Research Grants | U.S. Department of Energy |

| SiGA® Cladding Technology | Significant Share (Nuclear Energy Sector) | Enhanced Fuel Efficiency & Safety, Digital Twin | DOE Contracts, Reactor Sales | Existing and Future Nuclear Reactors |

| EMALS & AAG Systems | Near-Monopoly (Naval Electromagnetic Launch/Recovery) | Critical Naval Aviation Infrastructure | Production, Integration, Sustainment Contracts | Ford-Class Aircraft Carriers (CVN 78, CVN 79) |

Delivered as Shown

General Atomics BCG Matrix

The preview you are currently viewing is the exact General Atomics BCG Matrix report you will receive immediately after completing your purchase. This comprehensive document, meticulously prepared by industry experts, offers a clear and actionable framework for evaluating your business portfolio. You can be confident that the file you see is the final, unwatermarked, and fully formatted version, ready for your strategic planning and decision-making processes.

Dogs

Older, less advanced drone models, such as early Predator and Reaper variants that haven't undergone significant upgrades, are likely positioned in the 'Dogs' quadrant of the General Atomics BCG Matrix. Their market share is declining as newer, more capable platforms like the MQ-9B SkyGuardian/SeaGuardian emerge, driven by technological obsolescence and reduced demand.

Within General Atomics' diverse portfolio, some commercial products or less prominent product lines, not central to their defense or energy core, could be categorized as Dogs. These represent areas with low market share and limited growth potential, consuming resources without generating substantial returns.

Identifying specific discontinued or low-demand commercial products is challenging without granular internal data. However, these would be ventures where the company has not prioritized significant investment for revival, effectively managing them for minimal resource drain.

Within General Atomics' diverse engineering portfolio, certain niche services, while perhaps stable, fall into the Dogs category of the BCG Matrix. These are specialized offerings that don't directly support the company's primary strategic thrusts like advanced unmanned aerial systems or fusion energy research. For instance, legacy systems support or highly specific, non-scalable consulting might fit here.

These niche services often possess a low market share in their respective, often shrinking, segments and face minimal growth prospects. While they might cover their costs, contributing little to overall profitability, they also don't demand significant investment, thus avoiding substantial losses. Their inclusion in the portfolio is often for historical reasons or to maintain a broader, albeit less impactful, service offering.

Outdated or Low-Demand Legacy Technologies

Outdated or low-demand legacy technologies within General Atomics' portfolio would fall into the Dogs quadrant of the BCG Matrix. These are systems or products that, despite their historical significance, now face declining market interest and minimal new contract acquisition. For instance, older radar systems or certain legacy aircraft components, while once critical, may have been superseded by more advanced, cost-effective, or capable alternatives.

These legacy offerings typically exhibit low market share and low growth potential. General Atomics would likely allocate minimal resources to their development or marketing, focusing instead on their more promising Stars and Cash Cows. The strategic approach here is often to divest or phase out these products to free up capital and personnel for more strategic initiatives.

- Low Market Share: Legacy technologies often struggle to compete with newer, more efficient solutions, resulting in a diminished customer base.

- Low Growth Potential: The demand for outdated systems is typically stagnant or declining, offering little opportunity for expansion.

- Minimal Investment: General Atomics would likely limit further R&D or sales efforts on these products, focusing on maximizing existing value before discontinuation.

- Potential for Divestment: Companies often consider selling off or licensing these technologies to other entities that might find niche value in them.

Unsuccessful Experimental Projects with Limited Commercial Viability

General Atomics, a leader in advanced technologies, has likely explored numerous experimental projects throughout its history. Some of these ventures, while technically innovative, may not have translated into widespread commercial success. These projects, if they continue to drain resources without a clear path to profitability, would be categorized as Dogs in the BCG Matrix.

For instance, consider a hypothetical advanced drone system developed for a niche agricultural application. While the technology might be sound, if the market adoption remains low and the cost of production high, it wouldn't generate significant revenue. Such a project would represent a Dog, consuming capital with little expectation of future returns.

- Resource Drain: Projects in the Dog category consume valuable research and development funds and personnel time without contributing to overall profitability.

- Low Market Share: These ventures typically have a low share in their respective markets, indicating a lack of customer demand or competitive disadvantage.

- Limited Growth Potential: The future prospects for these projects are often dim, with little to no anticipated growth in revenue or market penetration.

Within General Atomics' extensive portfolio, certain legacy technologies and less successful commercial ventures likely reside in the 'Dogs' quadrant of the BCG Matrix. These are products or services characterized by low market share and minimal growth prospects, often consuming resources without generating substantial returns. For example, older, less advanced drone variants that have been superseded by newer models, or niche commercial products that haven't gained significant traction, would fit this classification. The company's strategy for these 'Dogs' typically involves minimizing investment and potentially divesting them to reallocate resources to more promising areas.

| Category | Market Share | Market Growth | General Atomics Example | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low | Low | Legacy drone variants (e.g., early Predator models), discontinued commercial ventures, niche legacy systems support. | Minimize investment, divest or phase out to free up capital and focus on Stars and Cash Cows. |

Question Marks

General Atomics' eVinci microreactor project is positioned as a Star in the BCG matrix. This advanced microreactor technology targets the burgeoning market for small, modular nuclear power, a sector anticipated to experience substantial growth. The company has invested heavily, with reports indicating significant capital allocation towards its development and regulatory approval processes.

General Atomics is indeed a major player in fusion research, notably with its involvement in ITER and the DIII-D tokamak. However, the path to commercial fusion power is still a long one, with many companies exploring different approaches beyond these large-scale international projects.

Companies like Pacific Fusion Corporation are focusing on specific components, such as pulser modules, for potential commercial fusion reactors. This segment of the fusion energy market, while holding immense future growth potential as technology matures, currently represents a very small market share for these specialized suppliers. Significant and ongoing investment is critical to navigate the complex scientific and engineering hurdles that remain.

General Atomics is actively investing in Quantum Information Science (QIS), focusing on areas like quantum algorithms and advancements in quantum hardware, such as ion traps. This positions them within a field poised for substantial growth, though their current market presence in the emerging quantum computing sector is minimal.

The company’s commitment to R&D in QIS is crucial for developing marketable quantum solutions and securing a competitive advantage. For instance, investments in quantum hardware are essential as the global quantum computing market is projected to reach $1.1 billion in 2024, with expectations to grow significantly in the coming years.

Hypersonic Technologies

General Atomics operates within the advanced defense sector, a field characterized by significant technological innovation and substantial government investment. While specific, granular details regarding General Atomics' current hypersonic programs are not extensively published in recent public statements, the broader market for hypersonic technologies is recognized as a high-growth area within defense spending.

If General Atomics is indeed actively engaged in developing hypersonic capabilities, these initiatives would likely be classified as 'Stars' or 'Question Marks' within the BCG Matrix framework. This classification stems from the considerable research and development (R&D) expenditures necessary to pioneer such advanced systems, coupled with the nascent stage of market adoption and potentially low current market share in this specialized domain.

- High Growth Market: The global hypersonic missiles market was valued at approximately $5.1 billion in 2023 and is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 10% through 2030.

- R&D Intensity: Developing hypersonic technology demands immense capital for advanced materials, propulsion systems, and testing infrastructure, often requiring billions in investment over extended periods.

- Early Adoption Phase: While several nations are investing heavily, widespread operational deployment and market penetration of mature hypersonic systems are still in their early stages, meaning market share for any single player may be limited.

- Strategic Importance: Hypersonic technologies are considered a critical component of future military capabilities, driving intense competition and substantial government funding for development programs.

Advanced Materials (Non-Defense/Energy Applications)

General Atomics' ventures into advanced materials for non-defense and non-energy sectors could position them in potentially high-growth commercial markets. These areas, however, often require significant upfront investment in research, development, and marketing to establish a foothold and demonstrate commercial viability.

For instance, the global advanced materials market, excluding defense and energy, is projected to reach substantial figures. Reports from 2024 indicate the market for advanced composites alone is expected to grow significantly, with some estimates placing its value in the tens of billions of dollars annually and continuing to expand.

This strategic move would likely place these advanced materials initiatives in the 'question mark' category of the BCG matrix. They represent opportunities with high potential but also carry considerable risk due to the nascent nature of their market penetration and the need for substantial capital to nurture their growth.

- Market Entry Challenges: Entering new commercial markets for advanced materials often involves overcoming established competitors and demonstrating superior performance or cost-effectiveness.

- Investment Requirements: Significant capital is typically needed for scaling production, building distribution channels, and extensive marketing campaigns to build brand awareness and customer trust.

- Technological Maturity: While the materials themselves may be advanced, their application and acceptance in diverse commercial sectors might still be in early stages, requiring further validation and adaptation.

- Growth Potential: Successful penetration into sectors like aerospace, automotive, or consumer electronics could yield substantial returns, justifying the initial investment and risk.

General Atomics' exploration into new commercial applications for advanced materials, beyond defense and energy, places these ventures in the 'Question Mark' category of the BCG matrix. These initiatives possess high growth potential but also significant risk due to their early market stage and substantial capital requirements for development and market penetration.

The company's investment in these areas is crucial for future diversification. For instance, the global advanced composites market, a subset of advanced materials, was projected to be a multi-billion dollar market in 2024, highlighting the potential upside.

These 'Question Marks' require careful management, demanding significant investment to nurture their growth and move them towards becoming 'Stars'. Failure to secure adequate funding or achieve market traction could lead to their decline.

The success of these ventures hinges on overcoming market entry challenges and achieving technological maturity for broader commercial adoption.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.