Giant Network Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Giant Network Group Bundle

Giant Network Group is poised for significant growth, leveraging its robust infrastructure and expanding service offerings. However, understanding the competitive landscape and potential regulatory hurdles is crucial for sustained success.

Want the full story behind Giant Network Group’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Giant Network Group benefits from its established presence in China, the world's largest gaming market. This market is projected to grow from US$66.13 billion in 2024 to US$95.51 billion by 2029, offering a massive opportunity for the company.

As a domestic leader, Giant Network Group possesses invaluable insights into the preferences and cultural nuances of Chinese gamers. This deep understanding is a significant advantage in a market with 668 million gamers as of 2023, ensuring strong user engagement and retention.

Giant Network Group's strategic focus on massively multiplayer online role-playing games (MMORPGs) and mobile games positions it advantageously in high-growth market segments. The mobile gaming sector, particularly in China, represents a substantial opportunity, accounting for 66% of all game spending and projected to hit $105.7 billion globally by 2025.

Furthermore, the MMORPG market is experiencing robust expansion, with an anticipated valuation of $28.06 billion in 2025. This segment is expected to maintain a strong compound annual growth rate (CAGR) of 10.75% between 2025 and 2030, underscoring the long-term potential of Giant Network Group's specialized genre.

Giant Network Group's integrated business model, encompassing game development, publishing, and platform operation, allows for complete control over its value chain. This means they manage everything from creating the games to getting them to players and making money from them. This end-to-end approach is a significant strength, enabling them to streamline operations and capture more value.

By operating its own online gaming platform, Giant Network Group cultivates a direct connection with its player base. This direct relationship is invaluable, facilitating the collection of crucial user data. In 2023, the company reported a significant portion of its revenue derived from its gaming segment, underscoring the importance of this ecosystem in its financial performance.

Proven Development and Operational Expertise

Giant Network Group's proven development and operational expertise as a leading online game developer and operator is a significant strength. Their success in creating and managing popular titles, particularly within the competitive Chinese market, highlights a deep understanding of game design, robust technical infrastructure, and effective player engagement. This extensive experience is crucial for navigating evolving market trends and fostering player loyalty.

The company's operational prowess is underscored by its ability to consistently deliver high-quality gaming experiences. For instance, in Q1 2024, Giant Network Group reported strong revenue growth, demonstrating their ongoing capacity to monetize their game portfolio effectively. Their operational efficiency allows them to adapt quickly to new technologies and player preferences, a key advantage in the dynamic gaming industry.

Key aspects of their expertise include:

- Game Design Innovation: A track record of creating engaging and commercially successful games.

- Technical Infrastructure: The ability to manage large-scale, high-performance online gaming platforms.

- Player Engagement Strategies: Proven methods for building and retaining active player communities.

- Market Adaptability: Demonstrated skill in responding to and capitalizing on shifts in the gaming landscape.

Financial Stability and Revenue Contribution from Core Products

Giant Network Group benefits from robust financial stability, largely driven by consistent revenue streams from its core mobile and PC online gaming segments. Mobile online games, in particular, have emerged as a significant revenue contributor in fiscal year 2024, underscoring the company's strength in this dynamic sector.

The company's sustained presence as a major player in the profitable online gaming market indicates a solid underlying financial health. Analyst projections for Q2 2025 further support this, with an expected revenue of 837.08 million CNY, representing a notable 14.55% year-over-year increase.

- Consistent Revenue: Demonstrated by ongoing contributions from both mobile and PC online games.

- Mobile Game Dominance: Mobile online games were a primary revenue driver in FY 2024.

- Projected Growth: Q2 2025 revenue forecast of 837.08 million CNY, up 14.55% year-over-year.

- Market Position: Strong standing in the lucrative online gaming industry suggests financial resilience.

Giant Network Group's deep understanding of the Chinese gaming market, which boasted 668 million gamers in 2023, is a significant strength. This allows them to cater effectively to local preferences, driving user engagement.

The company's strategic focus on MMORPGs and mobile games aligns with high-growth segments; mobile gaming alone is projected to reach $105.7 billion globally by 2025.

Giant Network Group's integrated business model, controlling game development to platform operations, ensures efficient value chain management and greater profit capture.

Their proven expertise in game design, technical infrastructure, and player engagement, evidenced by consistent revenue growth in FY 2024, solidifies their market leadership.

Financial stability is a key strength, with Q2 2025 revenue projected at 837.08 million CNY, a 14.55% year-over-year increase, highlighting strong performance in the online gaming sector.

What is included in the product

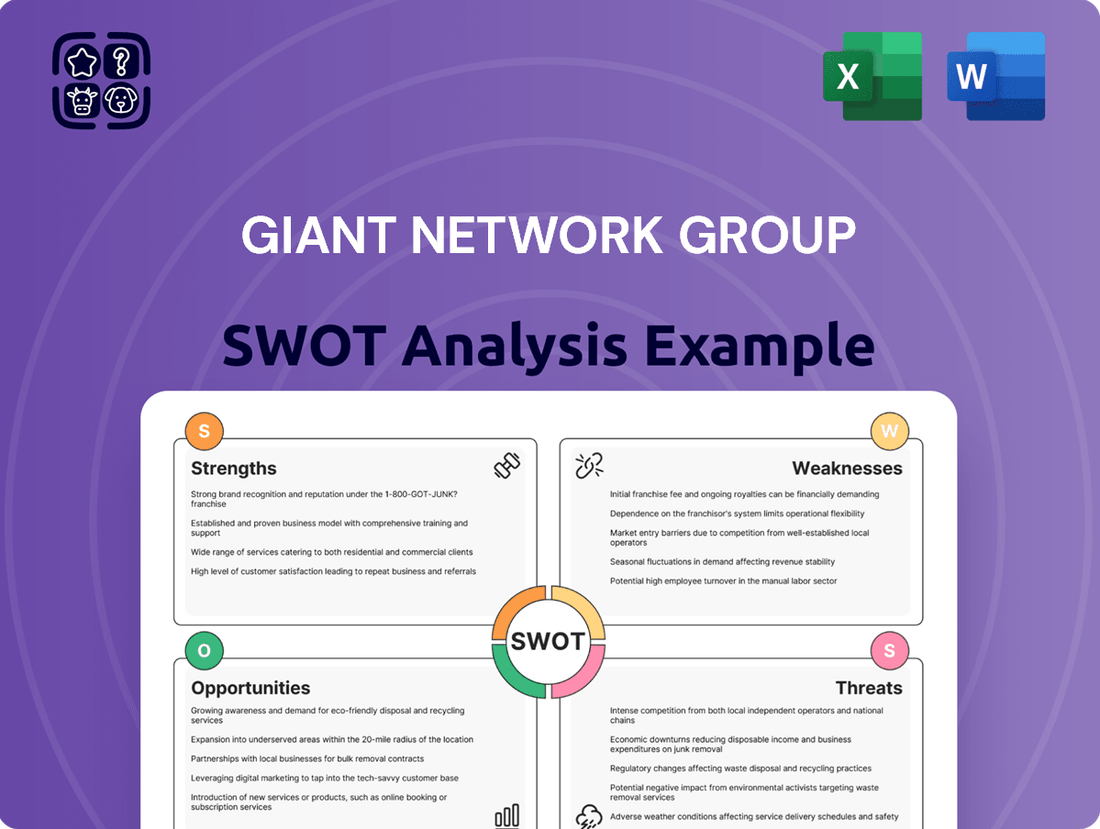

This SWOT analysis provides a comprehensive overview of Giant Network Group's internal capabilities and external market dynamics, highlighting key strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Offers a clear, actionable framework to identify and address competitive threats and internal weaknesses, thereby alleviating strategic uncertainty.

Weaknesses

Giant Network Group's significant reliance on the Chinese domestic market, while benefiting from its size, presents a notable weakness. This concentration exposes the company to the full impact of China's evolving regulatory landscape, which has historically included game license moratoriums and stringent regulations on youth gaming. For instance, the 2018 freeze on game approvals significantly disrupted the industry, highlighting the potential for swift and impactful government intervention.

This deep integration within a single market means that any unfavorable policy shifts or increased competition within China can disproportionately affect Giant Network Group's overall financial performance and growth trajectory. The intense competition within the Chinese gaming sector, with numerous domestic players vying for market share, further amplifies this vulnerability.

Giant Network Group operates in a Chinese gaming market heavily dominated by Tencent and NetEase, who together capture over 50% of domestic computer and mobile game revenue. These giants possess vast game libraries, substantial financial backing, and established global presences. Consequently, Giant Network faces significant challenges in acquiring market share and attracting top talent against these entrenched leaders.

Giant Network Group's strong reliance on MMORPGs and mobile games, as evidenced by their continued focus on titles like the 'Zhengtu' series, presents a potential weakness. While these genres have been successful, a lack of clear diversification into other popular gaming categories or newer entertainment formats could limit their market appeal if player tastes evolve.

The company might face challenges adapting if player preferences shift away from traditional MMORPGs or if emerging gaming trends, such as the metaverse or blockchain-based gaming, gain significant traction. For instance, in 2023, the global mobile gaming market saw substantial growth, but also increased competition across diverse genres, highlighting the need for broader offerings.

To counter this, continuous innovation and the introduction of fresh content are crucial. Without this, Giant Network Group risks player fatigue within their existing popular titles, potentially impacting long-term engagement and revenue streams. The ability to pivot and embrace new game mechanics and platforms will be key to sustained success.

Vulnerability to Regulatory Unpredictability

Giant Network Group's operations are inherently susceptible to shifts in regulatory policy, particularly within China's dynamic digital landscape. Despite recent gestures towards a more accommodating stance from Beijing, the potential for sudden policy changes remains a significant concern. This unpredictability creates an unstable foundation for strategic planning and future investments.

The history of abrupt regulatory interventions, such as the 2021 gaming crackdown that significantly impacted industry players, underscores this vulnerability. Such past actions have demonstrated the capacity for rapid shifts in market conditions, directly affecting revenue streams and operational scope. For Giant Network Group, this translates to ongoing uncertainty regarding game approvals, content moderation, and the overall stability of its business model.

- Regulatory Uncertainty: Past crackdowns have created a precedent for unpredictable policy shifts, impacting market stability.

- Operational Risks: Ongoing scrutiny poses continuous risks to game approvals and content guidelines, affecting operational continuity.

- Planning Challenges: The unpredictable regulatory environment makes long-term strategic planning and investment decisions difficult for Giant Network Group.

- Market Volatility: Sudden policy changes can lead to significant market volatility, directly affecting the company's financial performance and valuation.

Challenges in International Market Penetration

Giant Network Group faces challenges in expanding its global reach, as its international presence isn't as prominent as some other major Chinese game developers. Successfully entering diverse overseas markets demands significant resources for adapting games to local languages and cultures, alongside robust marketing campaigns. This presents a notable obstacle to achieving substantial growth beyond its strong domestic market.

The competitive landscape in international gaming is fierce, requiring substantial investment in localization and marketing to resonate with varied cultural preferences. For instance, the global games market was projected to reach $212.9 billion in 2024, according to Newzoo, highlighting the intense competition. Giant Network Group must allocate considerable capital to overcome these barriers and establish a stronger foothold abroad.

- Intense Global Competition: The global games market is highly saturated, making it difficult for any single company to gain significant traction without substantial investment and a differentiated product.

- Localization Costs: Adapting games for different regions, including translation, cultural nuances, and platform-specific requirements, can be extremely expensive, impacting profitability.

- Marketing and Brand Building: Establishing brand recognition and trust in new international markets requires extensive and targeted marketing efforts, which are costly and time-consuming.

- Understanding Diverse Consumer Preferences: What appeals to gamers in one region may not in another, necessitating in-depth market research and flexible development strategies.

Giant Network Group's heavy reliance on the Chinese domestic market makes it vulnerable to regulatory shifts and intense local competition from giants like Tencent and NetEase. Its focus on MMORPGs and mobile games, while successful, risks alienating players if tastes evolve away from these genres without significant diversification into newer entertainment formats.

The company's international expansion is hampered by the high costs of localization and marketing in a fiercely competitive global gaming market. This limits its ability to achieve substantial growth beyond its established domestic base.

Same Document Delivered

Giant Network Group SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report on Giant Network Group’s SWOT. This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

Giant Network Group can capitalize on the growing global appetite for Chinese games, which already represent 47% of worldwide mobile gaming revenue. This international expansion offers a prime chance to diversify income and lessen dependence on the Chinese market.

Key markets like the United States, Japan, and South Korea present substantial growth opportunities, with Chinese games seeing significant traction in these regions. By strategically entering these territories, Giant Network Group can tap into new player bases and revenue streams, enhancing its overall market position.

Giant Network Group can capitalize on the gaming industry's technological evolution. The global cloud gaming market is projected to reach $11.1 billion by 2027, and VR/AR adoption is steadily increasing. By integrating AI into ad creatives and in-game experiences, the company can boost player engagement and unlock new monetization streams.

The mobile gaming sector in China continues its strong trajectory, expected to hit $105.7 billion in revenue by 2025, making it a crucial area for expansion. This sustained growth, coupled with the rising prominence of esports, presents a significant opportunity for Giant Network Group. Their established proficiency in both mobile platforms and massively multiplayer online role-playing games (MMORPGs) aligns perfectly with the competitive nature of many popular games, positioning them advantageously to leverage these market dynamics.

Potential for Strategic Partnerships and Acquisitions

The gaming landscape is dynamic, with significant merger and acquisition activity. Giant Network Group can leverage this trend by seeking strategic alliances with global game developers or acquiring smaller studios possessing cutting-edge technology or valuable intellectual property. This expansion would broaden their offerings and market presence.

Such moves can also be instrumental in navigating diverse regulatory environments and securing access to new player bases. For instance, the global gaming market was projected to reach over $200 billion in 2024, highlighting the immense value in strategic expansion.

- Expand IP Portfolio: Acquire studios with proven game franchises or unique intellectual property.

- Technology Integration: Partner with or acquire firms specializing in emerging technologies like AI-driven game development or advanced graphics.

- Market Access: Forge partnerships to enter new geographic regions or tap into underserved player segments.

Diversification of Game Genres and Content

Giant Network Group can significantly broaden its appeal by venturing beyond its established MMORPG dominance. Exploring genres like casual mobile games, which saw global revenue reach an estimated $100 billion in 2024, presents a substantial growth avenue. This expansion could also encompass adjacent entertainment content, potentially leveraging their existing user base. Such diversification not only taps into new market segments but also reduces reliance on a single game category, enhancing overall business resilience.

The company has an opportunity to develop new intellectual properties (IPs) or license existing popular franchises to diversify its content portfolio. For instance, the mobile gaming market, projected to grow by 8% annually through 2028, offers fertile ground for new casual or hypercasual titles. By strategically acquiring or developing IPs that resonate with a wider demographic, Giant Network Group can attract a larger and more varied player base, mitigating the inherent risks of over-specialization in the competitive gaming landscape.

- Expand into casual and hypercasual mobile game genres, a market projected to reach over $130 billion by 2027.

- Develop new intellectual properties (IPs) or license popular existing ones to diversify content offerings.

- Explore non-gaming entertainment content to attract a broader audience and create new revenue streams.

- Mitigate risks associated with over-specialization in MMORPGs by broadening the content portfolio.

Giant Network Group can strategically expand its reach by tapping into the global demand for Chinese games, which accounted for a significant portion of worldwide mobile gaming revenue. This international push is a key opportunity to diversify revenue and reduce reliance on the domestic market.

Key growth markets like the United States and Japan offer substantial potential, with Chinese games already gaining traction. By entering these territories, Giant Network Group can access new player bases and revenue streams, bolstering its market position.

The company can also leverage technological advancements in gaming, such as cloud gaming, projected to reach $11.1 billion by 2027, and the increasing adoption of VR/AR. Integrating AI into game development and marketing can further enhance player engagement and monetization.

Furthermore, the robust growth of China's mobile gaming sector, expected to reach $105.7 billion by 2025, alongside the rise of esports, presents a prime opportunity. Giant Network Group's expertise in mobile platforms and MMORPGs aligns well with these trends, allowing them to capitalize on the competitive gaming landscape.

Strategic acquisitions or partnerships with global game developers can also broaden Giant Network Group's portfolio and market presence. The global gaming market, valued at over $200 billion in 2024, offers ample opportunities for such expansion and consolidation.

| Opportunity Area | Market Projection/Data | Strategic Action |

|---|---|---|

| Global Gaming Market Expansion | Global gaming market projected over $200 billion in 2024 | International expansion into key markets (US, Japan) |

| Casual & Hypercasual Games | Market projected over $130 billion by 2027 | Diversify into casual and hypercasual mobile game genres |

| Intellectual Property (IP) Development | Mobile gaming market growing 8% annually through 2028 | Develop new IPs or license popular existing ones |

| Emerging Technologies | Cloud gaming market to reach $11.1 billion by 2027 | Integrate AI, cloud gaming, VR/AR technologies |

Threats

The Chinese gaming industry faces significant threats from intensified regulatory scrutiny and policy changes. In 2023, China's National Press and Publication Administration (NPPA) continued to issue game licenses, but the overall environment remains unpredictable. For instance, past crackdowns on gaming addiction among minors, including playtime limits and real-name verification, demonstrated the government's willingness to intervene, potentially impacting user engagement and monetization strategies for companies like Giant Network Group.

These regulatory shifts can directly affect revenue streams. New policies restricting certain game content, advertising methods, or in-game purchase models could curtail Giant Network Group's profitability. The ongoing balancing act by Chinese authorities between fostering economic growth in the gaming sector and addressing social concerns means that future policy adjustments, though not always predictable, pose a constant risk to established business models.

The Chinese gaming market is incredibly crowded, with giants like Tencent and NetEase already holding significant sway. This makes it tough for Giant Network Group to break through and capture a larger audience, especially with new, innovative games constantly emerging. Acquiring new players becomes more expensive, and keeping profit margins healthy is a constant battle.

The persistent threat of player churn and game fatigue looms large for MMORPGs, demanding constant innovation. Giant Network Group must continually refresh its offerings with new content and engaging events to combat this. Failure to do so risks players seeking more dynamic experiences elsewhere, impacting revenue streams.

Global Economic Slowdown and Impact on Consumer Spending

Economic uncertainties, both globally and within China, pose a significant threat by potentially reducing consumer spending on entertainment. A slowdown could directly impact Giant Network Group's revenue, especially from its free-to-play games that depend on in-app purchases.

For instance, if global GDP growth forecasts for 2024-2025 are revised downwards, it could signal weaker consumer confidence. This translates to less disposable income available for discretionary spending like online gaming. In 2023, China's economic growth, while recovering, faced headwinds, impacting domestic consumption patterns which are crucial for companies like Giant Network Group.

- Reduced Discretionary Spending: Economic downturns often lead consumers to cut back on non-essential purchases, including in-game items and virtual goods.

- Impact on Free-to-Play Models: Giant Network Group's reliance on microtransactions in its popular titles makes it vulnerable to shifts in consumer purchasing power.

- Lowered Revenue Projections: A sustained global economic slowdown could force the company to revise its revenue and profit forecasts downwards for the 2024-2025 period.

Rapid Technological Evolution and Industry Disruption

The gaming industry is incredibly dynamic, with new technologies and player tastes changing at a breakneck pace. Giant Network Group must stay ahead of these shifts, as emerging platforms like advanced cloud gaming, which saw significant investment and user growth in 2024, or innovative game mechanics could quickly make current offerings obsolete. For instance, the rise of AI-powered game development tools could dramatically alter production cycles and competitive landscapes.

Failure to quickly adapt to these technological advancements, such as the increasing integration of AI in game design and player engagement, poses a significant threat. By late 2024, many major studios were experimenting with generative AI for content creation, a trend expected to accelerate. If Giant Network Group doesn't embrace these innovations, it risks losing market share to more agile competitors.

- Technological Obsolescence: New hardware, software, or gameplay paradigms can quickly diminish the value of existing game portfolios.

- Shifting Player Preferences: Evolving tastes in game genres, monetization models, and social interaction features require constant market monitoring and adaptation.

- Disruptive Business Models: Innovations like subscription services or blockchain-integrated gaming could challenge traditional revenue streams if not proactively addressed.

Intensified regulatory scrutiny in China remains a significant threat, with the government's focus on content control and player protection potentially leading to unforeseen policy changes. Economic headwinds, both domestic and global, also pose a risk, as they can dampen consumer discretionary spending on entertainment, directly impacting Giant Network Group's revenue from in-app purchases. Furthermore, the rapid evolution of gaming technology and player preferences necessitates constant adaptation, with failure to innovate risking obsolescence against more agile competitors.

| Threat Category | Specific Risk | Potential Impact on Giant Network Group | Relevant Data/Context (2024-2025 Focus) |

|---|---|---|---|

| Regulatory Environment | Unpredictable policy shifts and content restrictions | Reduced game approvals, altered monetization strategies, compliance costs | China's NPPA continued issuing licenses in 2023, but the regulatory landscape remains dynamic. Past crackdowns on minor gaming highlight government intervention capabilities. |

| Economic Conditions | Global and domestic economic slowdowns | Decreased consumer spending on in-game purchases, lower revenue projections | Global GDP growth forecasts for 2024-2025 may signal weaker consumer confidence. China's 2023 economic recovery faced headwinds impacting domestic consumption. |

| Market Competition | Intense competition and market saturation | Increased customer acquisition costs, difficulty gaining market share | Giants like Tencent and NetEase dominate the Chinese market, making it challenging for new entrants to gain traction. |

| Technological Advancements | Rapid pace of technological change and evolving player tastes | Risk of technological obsolescence, need for continuous innovation | The rise of cloud gaming and AI in game development by late 2024 suggests a need for rapid adaptation to remain competitive. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate assessment of Giant Network Group's strategic position.