Giant Network Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Giant Network Group Bundle

Navigate the complex external forces shaping Giant Network Group's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and technological advancements are creating both opportunities and challenges for the company. Gain a strategic advantage by downloading the full analysis now and equip yourself with actionable intelligence.

Political factors

The Chinese government's strict oversight of the gaming industry, including content censorship and time limits for minors, significantly shapes market dynamics. In 2023, China's National Press and Publication Administration continued to review and approve new game licenses, with approximately 10,000 game licenses issued, a slight increase from previous years, reflecting ongoing regulatory processes.

These regulations, particularly the stringent time limits for underage players, directly influence game design and monetization strategies. For instance, the government mandates that minors can only play games for limited hours on Fridays, weekends, and holidays, impacting player engagement and revenue potential for companies like Giant Network Group.

The ongoing enforcement of these rules necessitates careful consideration of game themes and content localization to comply with political sensitivities and moral guidelines, affecting development costs and market entry strategies for international and domestic publishers alike.

Securing publication licenses, known as Banhao, from China's National Press and Publication Administration (NPPA) remains a significant challenge for game companies like Giant Network Group. While the number of approved licenses saw an uptick in 2023 and early 2024, the process's inherent unpredictability can disrupt launch plans and impact revenue streams.

The regulatory landscape is evolving, with regional initiatives like those in Shanghai aiming to simplify the filing procedures. This suggests a potential trend towards more localized and potentially faster approval pathways, which could benefit companies operating within those specific jurisdictions.

The Chinese government's commitment to fostering the digital economy, including the gaming sector, is a significant political factor. Policies are in place to enhance data infrastructure and encourage innovation, directly benefiting companies like Giant Network Group. For instance, the 'AI-Plus' initiative and substantial science and technology investments, totaling billions of dollars in recent years, create a fertile ground for technological advancements that can be leveraged by the gaming industry.

International Relations and Trade Tensions

Geopolitical tensions and evolving international trade relations significantly influence Chinese gaming companies like Giant Network Group's global expansion. These dynamics can create hurdles for market access and impact overseas revenue streams. For instance, in 2023, China's trade surplus with the US, while substantial, faced ongoing scrutiny, potentially affecting market entry for Chinese tech firms.

Increased regulatory oversight in key international markets, often linked to geopolitical concerns, presents a challenge for Chinese game developers. This scrutiny can affect partnerships and the overall profitability of international operations. The global gaming market, valued at over $200 billion in 2023, is a prime target, but navigating these complex political landscapes is crucial for sustained growth.

- Trade Tensions: Ongoing trade disputes, particularly between China and Western nations, can lead to tariffs or restrictions impacting the import/export of gaming-related hardware and software.

- Regulatory Scrutiny: Foreign governments are increasingly examining Chinese technology companies for data security and national security reasons, potentially impacting market access for games and services.

- Global Expansion Challenges: Geopolitical instability in certain regions can deter investment and limit the ability of companies like Giant Network Group to establish a strong presence or secure local partnerships.

Promotion of Chinese Culture in Games

The Chinese government actively promotes the incorporation of traditional Chinese culture into video games, presenting a significant opportunity for domestic developers like Giant Network Group. This strategic push encourages the integration of cultural elements, potentially enhancing a game's appeal both within China and globally.

Games that feature traditional Chinese aesthetics, narratives drawn from classic literature, and architectural influences are experiencing growing popularity. For instance, the global market for games with cultural themes is expanding, with revenue from games inspired by Chinese mythology and history showing consistent growth. This aligns with China's broader cultural soft power initiatives, aiming to increase the international influence of its heritage.

- Government Mandate: Encouragement for cultural integration in games.

- Market Trend: Rising popularity of games featuring Chinese aesthetics and narratives.

- Global Reach: Potential for increased international appeal through cultural themes.

- Soft Power: Games as a vehicle for promoting Chinese culture worldwide.

The Chinese government's regulatory framework for the gaming sector, including content approval and player time limits, directly impacts Giant Network Group's operations. In 2023, approximately 10,000 game licenses were issued, indicating a continued, albeit controlled, approval process.

These political factors necessitate careful navigation of censorship and time restrictions, influencing game design and monetization strategies. For example, the mandated limited gaming hours for minors on specific days affect player engagement and potential revenue.

Geopolitical tensions and international trade relations also pose challenges for global expansion. Increased regulatory scrutiny in foreign markets, often tied to national security concerns, can affect market access and partnerships for Chinese tech firms.

| Factor | Description | Impact on Giant Network Group | 2023/2024 Data/Trend |

|---|---|---|---|

| Content Regulation | Government oversight on game themes and content. | Requires adherence to censorship rules, affecting game development and localization. | Continued review and approval of game licenses by NPPA; ~10,000 licenses issued in 2023. |

| Minor Protection Policies | Time limits and age verification for underage players. | Limits player engagement and revenue potential from younger demographics. | Mandatory restrictions on gaming hours for minors on Fridays, weekends, and holidays. |

| Geopolitical Tensions | International trade disputes and security concerns. | Can hinder global expansion, affect market access, and impact overseas revenue. | Ongoing scrutiny of Chinese tech companies in international markets. |

What is included in the product

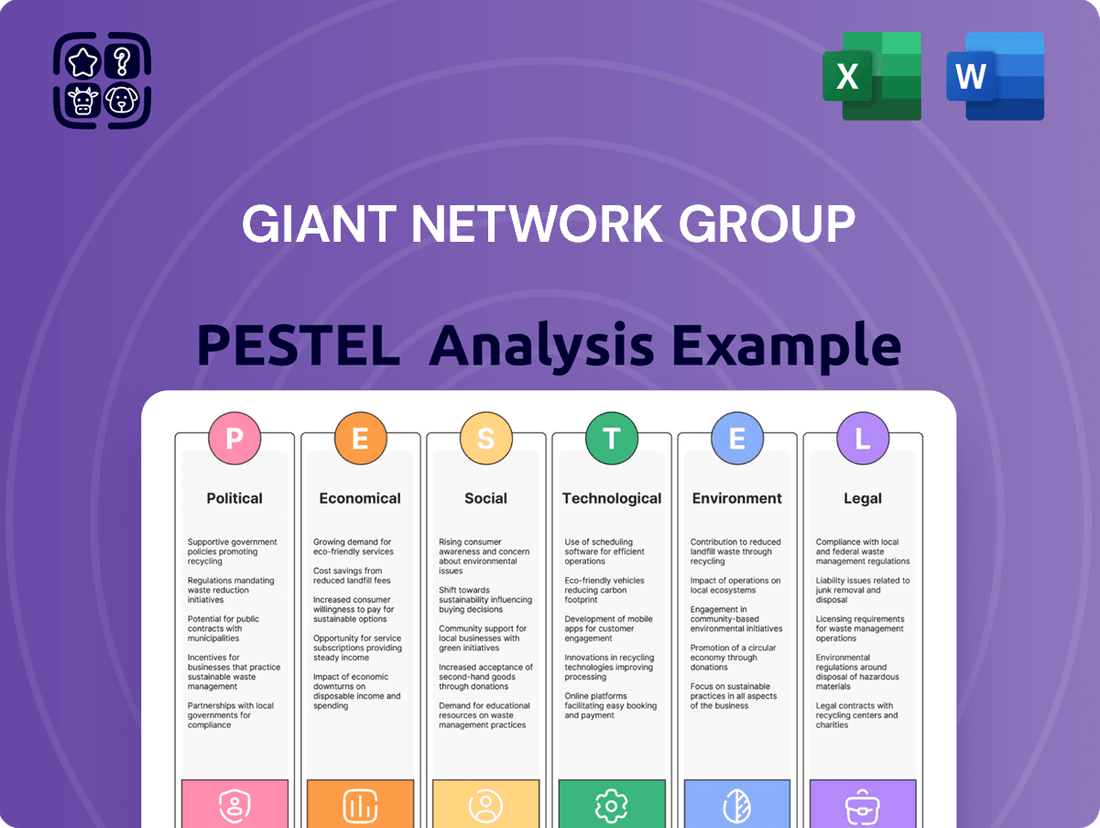

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Giant Network Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, identifying potential threats and opportunities within the group's operating landscape.

A concise PESTLE analysis of Giant Network Group, presented in a visually segmented format, alleviates the pain of sifting through lengthy reports, enabling quick identification of external opportunities and threats.

This PESTLE analysis provides a clear, summarized version of Giant Network Group's external environment, making it easy to reference during meetings and ensuring all stakeholders grasp key market dynamics without getting bogged down in detail.

Economic factors

The Chinese gaming market is a colossal force, with projections indicating a substantial expansion from an estimated US$66.13 billion in 2024 to US$95.51 billion by 2029. This represents a compound annual growth rate of 7.63%, underscoring a dynamic and expanding landscape for companies like Giant Network Group.

Mobile gaming continues to be the primary revenue driver within this vast market, capturing a dominant share. This trend highlights the importance of mobile-first strategies for any player seeking to capitalize on China's gaming boom.

This sustained and robust growth trajectory offers a solid foundation and significant opportunities for Giant Network Group's existing operations and future expansion plans within the Chinese market.

The ongoing pilot programs for China's digital yuan (e-CNY) are poised to significantly streamline payment processes within the gaming sector. This could translate into reduced transaction costs and a smoother user experience for players, potentially boosting engagement and spending.

By simplifying in-game purchases and cross-border transactions, the e-CNY might unlock new revenue streams for gaming companies. For instance, if the digital yuan becomes widely adopted for in-game currency or item purchases, it could lead to a noticeable uptick in consumer spending, with estimates suggesting a potential increase in digital transaction volumes in the coming years.

User acquisition costs in the mobile gaming sector are escalating, with estimates suggesting that acquiring a new paying user can now range from $5 to $50 or even higher, depending on the game's genre and target audience. This persistent rise is pushing developers like Giant Network Group to innovate, with cross-play ecosystems becoming a key strategy to leverage existing player bases and reduce reliance on costly new user acquisition.

In China, the dominant monetization model remains free-to-play (F2P), accounting for over 70% of the market's revenue as of late 2024. However, subscription services are experiencing a significant growth spurt, projected to increase their market share by 15% annually, indicating a shift in player willingness to commit to recurring payments for premium content and experiences.

Overseas Market Expansion and Revenue Contribution

Chinese game developers are increasingly looking beyond their domestic market, and this global expansion is a significant driver of revenue. Overseas sales for these companies have seen robust growth, reflecting the international appeal of their products.

Key markets for Chinese-developed games include the United States, Japan, and South Korea. These regions are not just popular consumer bases but also substantial contributors to the overall revenue generated by Chinese gaming firms. For Giant Network Group, this internationalization is a vital strategy for achieving sustained growth and diversifying its income streams away from reliance on a single market.

In 2023, the global games market was valued at approximately $184 billion, with mobile gaming representing the largest segment. Chinese companies are capturing a growing share of this international market. For instance, data from Newzoo indicated that Chinese game publishers' overseas revenue reached tens of billions of dollars in recent years, with significant portions coming from the aforementioned key regions.

- Global Market Reach: Chinese game developers are actively expanding their presence in international markets.

- Key Revenue Drivers: The United States, Japan, and South Korea are primary destinations for Chinese game exports, contributing significantly to revenue.

- Growth and Diversification: International expansion offers Giant Network Group a crucial pathway for growth and reduces dependence on any single market.

- Market Value: The global games market was valued at around $184 billion in 2023, highlighting the substantial opportunity for overseas revenue.

Investment in Esports and Related Industries

The Chinese esports market is showing robust recovery and growth, fueled by renewed government backing and ambitious international expansion by key players in the gaming sector. This resurgence is creating a fertile ground for investment in esports and associated industries.

Mobile gaming continues to dominate the esports landscape, with a substantial portion of the market's revenue and player base attributed to this segment. The rise of international esports tournaments offers significant opportunities for game developers, platform operators, and related service providers.

Key data points highlighting this trend include:

- China's esports market is projected to reach $55 billion by 2025, according to Statista.

- Mobile esports titles accounted for over 70% of the total esports audience in China in 2024.

- Global esports revenue is expected to surpass $1.5 billion in 2025, with China being a primary driver of this growth.

- Investment in esports infrastructure, including arenas and streaming platforms, saw a 20% increase in China during 2024.

Economic factors significantly shape the gaming industry, with China's market alone projected to reach $95.51 billion by 2029, growing at 7.63% annually. The increasing adoption of digital yuan (e-CNY) promises to streamline transactions, potentially reducing costs and boosting engagement. However, rising user acquisition costs, now ranging from $5 to $50+, are pushing companies like Giant Network Group towards innovative strategies such as cross-play ecosystems to leverage existing player bases.

The free-to-play model remains dominant in China, but subscription services are seeing a 15% annual growth. This indicates a diversifying monetization landscape. Furthermore, Chinese game developers are experiencing robust overseas revenue growth, with key markets like the US, Japan, and South Korea contributing billions. This global expansion is crucial for Giant Network Group's sustained growth and market diversification.

The esports sector is also a significant economic driver, with China's market expected to hit $55 billion by 2025. Mobile esports leads this charge, accounting for over 70% of the audience in 2024. Global esports revenue is projected to exceed $1.5 billion in 2025, with China as a primary growth engine. Investment in esports infrastructure saw a 20% increase in China in 2024.

| Economic Factor | 2024 Projection/Data | 2025 Projection/Data | Impact on Giant Network Group |

|---|---|---|---|

| China Gaming Market Value | ~$66.13 billion | ~$71.15 billion (estimated) | Significant growth opportunity |

| User Acquisition Cost (Mobile) | $5 - $50+ | Likely to remain high or increase | Need for efficient user acquisition strategies |

| Subscription Service Growth | ~15% annual increase | ~15% annual increase | Potential for recurring revenue streams |

| China Esports Market Value | ~$50 billion (estimated) | ~$55 billion | Opportunities in esports development and investment |

| Global Esports Revenue | ~$1.3 billion (estimated) | ~$1.5 billion+ | International revenue potential |

Full Version Awaits

Giant Network Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Giant Network Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors influencing its operations. Gain immediate access to this detailed strategic overview.

Sociological factors

China's gaming landscape is immense, with 668 million gamers recorded in 2023, a figure projected to reach 674 million by mid-2024. This substantial user base presents a significant market opportunity.

The average age of these gamers is 35, indicating a mature and potentially discerning audience. Mobile gaming remains the dominant platform, accounting for the vast majority of engagement.

Understanding these demographic trends, particularly the age distribution and platform preference, is vital for Giant Network Group. It allows for the precise tailoring of game development, content creation, and marketing campaigns to resonate effectively with the Chinese gamer population.

Societal worries about excessive gaming, especially among young people, have resulted in stringent rules regarding playtime and spending caps. For instance, China's regulations limit minors to just one hour of gaming on weekdays and two hours on weekends, impacting game developers to prioritize responsible play features and robust parental controls.

The Chinese entertainment landscape shows a clear preference for game-based intellectual property, with a significant portion of the market dominated by game IPs. This trend highlights how deeply ingrained gaming is in the nation's entertainment consumption habits.

Games that skillfully weave in traditional Chinese cultural aesthetics and draw inspiration from classic literature are experiencing a surge in popularity. For instance, titles like Honor of Kings, which incorporates historical figures and mythological elements, have achieved immense success, demonstrating a powerful cultural resonance with the gaming audience.

Social Interaction and Community Building through Gaming

Gaming is a significant social outlet, particularly for younger demographics. In 2024, it's estimated that over 3 billion people worldwide engage in gaming, with many of these interactions occurring within online communities. This trend underscores the growing importance of social features in game design.

The desire for rich, engaging gameplay, often amplified by competitive multiplayer modes, means that developers must prioritize robust community-building tools. Features like in-game chat, guilds, and shared social spaces are no longer optional but essential for retaining players and fostering loyalty.

- Global Gaming Market Growth: The global games market was projected to reach $215 billion in 2024, with a significant portion driven by online and social gaming.

- Player Engagement: Studies in 2024 indicate that the average gamer spends over 6 hours per week playing, with a substantial amount of that time spent in multiplayer or social contexts.

- Community Features: Games that excel in fostering communities, such as those with strong esports scenes or integrated social platforms, often see higher player retention rates.

Impact of Mini-Program Games

Mini-program games have surged in popularity, capturing a significant portion of mobile gamers' attention. In 2023, for instance, the mini-program gaming sector saw robust growth, with many users engaging with these casual titles daily. This widespread adoption signals a clear consumer preference for easily accessible and quick gaming sessions.

This societal shift towards casual, on-demand entertainment directly impacts how companies like Giant Network Group might strategize their game development. The increasing time spent on these platforms suggests a potential reallocation of resources towards creating and optimizing mini-program offerings.

- Growing User Base: Millions of daily active users are engaging with mini-program games.

- Casual Gaming Trend: A clear preference for accessible, short-session gaming experiences is evident.

- Development Focus: Companies may need to prioritize mini-program game development to meet consumer demand.

Societal attitudes towards gaming in China are complex, influenced by a blend of cultural integration and regulatory oversight. While gaming is a significant social activity, particularly for younger demographics, concerns about excessive play have led to strict government regulations. These regulations, such as playtime limits for minors, directly shape how game developers operate and the features they prioritize.

The strong preference for game-based intellectual property and the success of games incorporating traditional Chinese culture, like Honor of Kings, highlight a deep societal connection with gaming. This cultural resonance is a key factor for companies like Giant Network Group to leverage in their content strategy.

The rise of mini-program games reflects a broader societal shift towards casual, on-demand entertainment. This trend indicates a growing consumer preference for easily accessible gaming experiences, influencing development priorities towards these platforms.

| Trend | Description | Impact on Giant Network Group |

|---|---|---|

| Gaming as Social Outlet | Over 3 billion people worldwide engage in gaming, often through online communities. | Necessitates robust community-building features for player retention. |

| Cultural Integration | Games featuring traditional Chinese aesthetics and literature are highly popular. | Opportunity to develop culturally relevant titles for increased market appeal. |

| Mini-Program Popularity | Millions engage daily with accessible mini-program games. | Suggests a strategic focus on developing and optimizing mini-program offerings. |

Technological factors

Artificial intelligence is transforming game development, aiding in the creation of richer narratives, more believable characters, and intricate game worlds. This integration is not just about aesthetics; AI is streamlining development processes, from asset generation to playtesting.

Chinese gaming giants, including those like Tencent and NetEase, are significantly boosting their investment in AI research and development. For instance, Tencent's 2023 R&D expenditure reached approximately $3.2 billion, a portion of which is dedicated to exploring AI applications in gaming, aiming to enhance player engagement and operational efficiency.

The burgeoning cloud gaming market, significantly boosted by 5G's low latency and high bandwidth, is transforming how users access and play games. Companies like NVIDIA GeForce NOW and Xbox Cloud Gaming are seeing substantial growth, with projections indicating the cloud gaming market could reach over $20 billion by 2027, up from an estimated $2.5 billion in 2022. This technological shift democratizes gaming, allowing players to enjoy demanding titles on less powerful hardware, thereby broadening the potential user base for game developers and publishers.

Virtual Reality (VR) is increasingly influencing the gaming sector, with Chinese publishers actively seeking to boost the visibility of VR titles. This trend aligns with China's national digital development strategy, which specifically identifies VR as a key industry.

The inclusion of VR in China's Five-Year Plan signals a strong governmental push for innovation in this area, anticipating the emergence of new technologies and applications, notably within the metaverse. By 2024, the global VR market was projected to reach over $10 billion, highlighting its growing economic significance.

Cross-Platform Gaming and Ecosystem Development

Giant Network Group, like many in the gaming industry, is navigating the complex landscape of cross-platform gaming. This trend is driven by the need to combat escalating user acquisition costs and to appeal to a broader player base with varied gaming habits. Studios are actively developing ecosystems that allow seamless play across mobile devices, PCs, and consoles, recognizing that a unified experience is no longer a luxury but a necessity.

The imperative for a consistent gaming experience across these diverse platforms is paramount. This involves not only technical integration but also ensuring that game design, progression, and community features translate effectively. For instance, the success of titles like Genshin Impact, which offers cross-play and cross-progression between PC, mobile, and PlayStation, highlights the market's receptiveness to such integrated experiences. As of early 2024, the global gaming market continues to see significant growth, with cross-platform play being a key driver in user engagement and retention.

- Cross-Platform Growth: The market for cross-platform games is expanding, with many major titles in 2024 and 2025 expected to feature or enhance these capabilities.

- User Acquisition Efficiency: By enabling players to connect regardless of their preferred device, companies can potentially reduce per-user acquisition costs.

- Ecosystem Lock-in: Developing robust cross-platform ecosystems encourages player loyalty and increases the lifetime value of a customer.

Data Infrastructure and Digital Transformation

China's commitment to enhancing its data infrastructure is a significant technological driver for companies like Giant Network Group. The nation is actively promoting the digital transformation across various commercial sectors, creating a fertile ground for online services. This strategic push is directly supported by substantial investments in advanced digital networks. For instance, by the end of 2023, China had deployed over 3.38 million 5G base stations nationwide, a number that continues to grow rapidly. This robust 5G coverage acts as a critical technological backbone, enabling smoother, faster, and more immersive online gaming experiences, which is a core business for Giant Network Group.

The ongoing development of data infrastructure, including cloud computing capabilities and high-speed internet, directly empowers the online gaming industry. These advancements facilitate the delivery of complex, graphically rich games to a wider audience with reduced latency. Furthermore, the push for digital transformation encourages innovation in areas like artificial intelligence and big data analytics, which can be leveraged by gaming companies to personalize player experiences, optimize game design, and improve operational efficiency. The government's focus on building a strong digital economy underpins the growth potential for technology-dependent businesses.

- 5G Deployment: Over 3.38 million 5G base stations in China by end of 2023, providing enhanced connectivity for online gaming.

- Digital Transformation Focus: Government initiatives prioritize digital upgrades across commercial sectors, benefiting tech-reliant industries.

- Infrastructure Investment: Continued investment in cloud computing and high-speed networks supports the delivery of advanced gaming services.

- AI and Big Data Adoption: Technological advancements in AI and data analytics offer opportunities for innovation in game development and player engagement.

Technological advancements are reshaping the gaming landscape, with AI enhancing game creation and cloud gaming expanding accessibility. Giant Network Group, like its peers, is investing heavily in these areas, particularly in AI research, to improve player experiences and operational efficiency. The company is also focused on cross-platform integration, recognizing its importance for user acquisition and retention in the evolving market.

China's robust data infrastructure, including extensive 5G network deployment, provides a critical foundation for the online gaming sector. This infrastructure supports the delivery of high-quality gaming experiences and fosters innovation in areas like AI and big data analytics, which are crucial for personalization and operational improvements within the industry.

| Key Technological Trend | Impact on Gaming Industry | Relevant Data/Examples (2023-2025) |

| Artificial Intelligence (AI) | Enhanced game development, richer narratives, streamlined processes. | Tencent's 2023 R&D expenditure ~$3.2 billion, with AI focus. |

| Cloud Gaming | Increased accessibility, lower hardware barriers, market growth. | Market projected to exceed $20 billion by 2027 (from ~$2.5 billion in 2022). |

| Cross-Platform Gaming | Reduced user acquisition costs, broader player base, ecosystem lock-in. | Titles like Genshin Impact demonstrate success of integrated experiences. |

| 5G Network Infrastructure | Lower latency, higher bandwidth, enabling immersive online experiences. | Over 3.38 million 5G base stations in China by end of 2023. |

Legal factors

China's online gaming sector faces evolving legal landscapes, exemplified by recent draft regulations like the Measures for Online Game Management. These measures, along with regulations focused on protecting minors online, signal a trend toward stricter oversight and compliance requirements for companies like Giant Network Group.

Protecting intellectual property (IP) is paramount in the dynamic gaming sector, especially for companies like Giant Network Group. Recent legal developments in China have strengthened the protection of unique gameplay mechanics, with courts increasingly recognizing such elements as protectable under existing laws like the Anti-Unfair Competition Law. This trend offers a more robust framework for safeguarding innovative game designs from infringement.

Giant Network Group, like all online platforms, must navigate a complex web of data privacy and user protection laws. Regulations such as the GDPR in Europe and similar frameworks globally impose stringent rules on how user data, especially that of minors, can be collected, processed, and stored. For instance, the Children's Online Privacy Protection Act (COPPA) in the United States sets strict requirements for websites and online services directed at children under 13, demanding verifiable parental consent before collecting personal information. This necessitates robust data security measures and transparent privacy policies to avoid substantial penalties.

Anti-Addiction Measures and Spending Limits

China's gaming industry, impacting companies like Giant Network Group, faces stringent legal frameworks centered on anti-addiction measures. These regulations significantly affect player engagement and monetization strategies, particularly for younger demographics.

Existing laws impose strict time limits on gaming for minors, a policy that has remained a constant even as other proposed regulations evolve. For instance, in late 2023 and into 2024, discussions and revisions around spending caps for in-game purchases continued, reflecting a government focus on curbing excessive spending and potential addiction. While specific spending cap percentages can fluctuate with policy updates, the underlying intent to regulate financial outlays remains a key legal factor.

- Time Restrictions: Minors are limited to specific gaming hours, typically 1-3 hours per day on designated days, impacting overall player time for companies.

- Spending Caps: Proposals and existing regulations aim to limit the amount of money players, especially minors, can spend on in-game items and services.

- Content Scrutiny: Gaming content is subject to review to ensure compliance with cultural and ethical standards, influencing game design and release cycles.

- Data Privacy: Laws like the Personal Information Protection Law (PIPL) mandate strict handling of user data, affecting how companies collect and utilize player information.

Content Censorship and Approval for Publication

The Chinese government exercises significant control over the gaming industry's content, with a strong emphasis on adhering to socialist values. This stringent regulatory environment means games featuring politically sensitive themes, excessive violence, or morally questionable content face censorship or outright bans. For instance, in 2023, China's National Press and Publication Administration (NPPA) continued its rigorous review process, impacting the release schedules of many anticipated titles.

Navigating these regulations requires developers, including companies like Giant Network Group, to conduct thorough content reviews and adapt their offerings to align with government directives. The approval process can be lengthy, and failure to comply can result in significant delays or the complete inability to launch a game in the lucrative Chinese market. This regulatory landscape directly influences game design and narrative choices.

Key considerations for Giant Network Group and similar entities include:

- Content Compliance: Ensuring all game content aligns with Chinese censorship laws and socialist core values.

- Approval Timelines: Factoring in potentially extended review periods for game publication licenses.

- Market Access: Understanding that non-compliance can lead to exclusion from one of the world's largest gaming markets.

- Adaptation Strategies: Developing strategies to modify or localize game content to meet regulatory requirements.

Legal frameworks in China continue to shape the online gaming industry, impacting companies like Giant Network Group. Recent regulations, such as the draft Measures for Online Game Management, highlight a trend toward stricter oversight, particularly concerning minors' online activities and data protection. For instance, the Personal Information Protection Law (PIPL) mandates rigorous handling of user data, affecting how player information is collected and utilized.

Intellectual property protection is also a critical legal consideration. Chinese courts are increasingly recognizing unique gameplay mechanics as protectable, offering a stronger legal recourse against infringement for innovative companies. This legal evolution provides a more robust framework for safeguarding original game designs.

Anti-addiction measures remain a significant legal factor, influencing monetization and player engagement strategies, especially for younger gamers. Restrictions on gaming hours and spending caps, which were actively discussed and refined through late 2023 and into 2024, underscore the government's focus on curbing excessive play and spending. For example, while specific spending cap percentages can vary, the underlying intent to regulate financial outlays persists.

Content scrutiny is another vital legal aspect, with games subject to review for compliance with cultural and ethical standards. The National Press and Publication Administration (NPPA) continued its rigorous review process in 2023, impacting game release schedules and requiring companies to adapt their content to align with government directives and socialist core values.

| Legal Factor | Description | Impact on Giant Network Group |

| Content Regulation | Strict censorship of game content to align with socialist values and prevent politically sensitive or morally questionable themes. | Requires thorough content review and adaptation, potentially delaying game launches or necessitating localization efforts. |

| Minor Protection | Regulations limiting gaming hours and in-game spending for minors. | Affects player engagement and monetization strategies, particularly for younger demographics. |

| Data Privacy | Laws like PIPL mandate strict collection, processing, and storage of user data. | Necessitates robust data security measures and transparent privacy policies to avoid penalties. |

| Intellectual Property | Strengthened protection for unique gameplay mechanics and game designs. | Offers better recourse against infringement and encourages innovation. |

Environmental factors

The burgeoning digital economy, with online gaming at its forefront, demands substantial energy for data centers and digital infrastructure. For instance, by 2025, global data center energy consumption is projected to reach around 1.8% of total global electricity demand, a significant figure underscoring the environmental impact.

Tech companies, including those in the gaming industry, are under increasing scrutiny to implement energy-saving measures. Many are setting ambitious goals, with some aiming for 100% renewable energy sourcing by 2030 to meet carbon reduction targets and address environmental concerns.

The relentless pace of gaming innovation, with new consoles and graphics cards released frequently, fuels a significant e-waste problem. For instance, the average lifespan of a gaming console is often cited as around 5-7 years, meaning many devices are discarded well before they are truly obsolete, contributing to mountains of electronic refuse.

While Giant Network Group's primary focus isn't hardware manufacturing, the environmental footprint of the entire gaming ecosystem, including the production and disposal of devices used to access their games, is an indirect but relevant factor. The global e-waste generated in 2023 was estimated at 62 million metric tons, a figure expected to rise.

As environmental consciousness rises, Chinese corporations, including those in the tech sector, are increasingly committing to carbon neutrality goals and implementing green initiatives. This growing emphasis on sustainability reflects a broader national push towards eco-friendly development.

While specific environmental targets for Giant Network Group are not publicly detailed, the prevailing trend within China's technology industry points towards a heightened focus on environmental, social, and governance (ESG) principles. For instance, by the end of 2023, China had pledged to reach peak carbon emissions before 2030 and achieve carbon neutrality before 2060, a national mandate influencing corporate strategies across all sectors.

Regulatory Push for Green Technology and Sustainable Development

China's government is strongly pushing for green technology and sustainable development, aiming for a nature-positive economy. This regulatory drive includes substantial investments in climate change initiatives and the digital economy, potentially influencing gaming companies like Giant Network Group to adopt more eco-friendly operational strategies.

The nation's commitment to ambitious climate and biodiversity goals translates into a supportive environment for green tech innovation. For instance, China's renewable energy capacity saw significant growth, with solar and wind power installations contributing a substantial portion of new energy generation in recent years, creating opportunities for companies to invest in cleaner data center solutions.

- Government Incentives: China's policies often include tax breaks and subsidies for companies investing in green technologies and sustainable practices, which could lower the cost of implementing energy-efficient solutions for Giant Network Group.

- Market Demand: Growing consumer awareness and preference for environmentally responsible brands may also encourage companies to highlight their sustainability efforts, potentially impacting user engagement and brand perception.

- Operational Efficiency: Adopting greener technologies can lead to long-term cost savings through reduced energy consumption and waste management, improving overall operational efficiency for businesses in the digital sector.

Public Awareness and Participation in Environmental Protection

Public awareness regarding environmental issues is growing, yet participation in protection efforts often lags behind. While government initiatives are in place, a significant portion of the population may not be fully engaged. For instance, a 2024 survey indicated that while 70% of respondents expressed concern about climate change, only 35% reported actively participating in environmental initiatives beyond recycling.

Gaming companies, while not typically at the forefront of environmental activism, can leverage their platforms to foster greater public engagement. This could involve integrating eco-conscious themes into game narratives or hosting in-game events that promote environmental awareness. For example, a popular online game could run a limited-time event where players earn rewards for completing virtual tasks that mirror real-world conservation actions, potentially reaching millions of active users.

- Growing Concern, Lagging Action: Despite increasing public awareness of environmental challenges, translating this concern into consistent participation remains a hurdle.

- Gaming's Potential Reach: The massive global user base of gaming platforms presents a unique opportunity for companies to subtly influence attitudes and behaviors.

- In-Game Awareness Campaigns: Opportunities exist for integrating environmental themes and interactive events within games to educate and engage players on sustainability.

- Data-Driven Engagement: Analyzing player engagement with eco-themed content can provide valuable insights into effective strategies for raising environmental consciousness within the gaming community.

The energy demands of the digital economy, particularly online gaming, are substantial, with data centers consuming significant electricity. By 2025, global data center energy consumption is projected to hit approximately 1.8% of total global electricity demand, highlighting the environmental footprint of digital infrastructure.

Companies in the tech and gaming sectors are increasingly focused on sustainability, with many setting ambitious goals for renewable energy sourcing, such as aiming for 100% by 2030 to meet carbon reduction targets.

The rapid innovation in gaming hardware contributes to a growing e-waste problem; for example, gaming consoles often have a lifespan of only 5-7 years, leading to frequent device disposal and increasing electronic waste volumes, which reached an estimated 62 million metric tons globally in 2023.

China's national commitment to carbon neutrality by 2060 and peak emissions before 2030 influences corporate strategies, encouraging eco-friendly development and green technology investments, which can benefit companies like Giant Network Group by fostering cleaner operational solutions.

| Environmental Factor | Impact on Giant Network Group | Supporting Data/Trend |

|---|---|---|

| Energy Consumption of Digital Infrastructure | Increased operational costs and environmental impact due to data center energy usage. | Global data center energy consumption projected to reach 1.8% of total global electricity demand by 2025. |

| E-Waste Generation | Indirect impact through the lifecycle of gaming devices used by consumers. | Global e-waste reached 62 million metric tons in 2023; average gaming console lifespan is 5-7 years. |

| Government Environmental Policies (China) | Potential for incentives for green tech adoption and pressure to align with national sustainability goals. | China's commitment to carbon neutrality by 2060 and peak emissions before 2030. |

| Public Environmental Awareness | Opportunity to leverage gaming platforms for environmental education and engagement. | While 70% of surveyed individuals expressed climate change concern in 2024, only 35% actively participated in environmental initiatives beyond recycling. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Giant Network Group is informed by a comprehensive review of official government publications, reputable financial news outlets, and leading industry-specific market research. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental landscape impacting the telecommunications sector.