Giant Network Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Giant Network Group Bundle

Giant Network Group operates within a dynamic digital entertainment landscape, where the intensity of competition and the influence of various market forces significantly shape its strategic direction. Understanding these pressures is crucial for navigating its growth and profitability.

The complete report reveals the real forces shaping Giant Network Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of core game development engines, such as Unity and Unreal Engine, wield considerable bargaining power. Their dominance in the industry is substantial, and the costs involved in switching to a different platform are often quite high for developers.

While there are open-source options available, the established functionalities, comprehensive support, and robust ecosystems offered by these leading engines are essential for efficient game creation. For instance, Unity reported over 200,000 active users in 2024, highlighting its widespread adoption and the difficulty developers face in migrating complex projects.

The bargaining power of suppliers within Giant Network Group's talent acquisition and retention is notably high, especially for specialized roles. Skilled game developers, artists, designers, and marketing professionals are in high demand, and competition for these individuals can significantly drive up labor costs. For instance, the average salary for a senior game developer in major tech hubs could reach upwards of $150,000 annually in 2024, reflecting this intense competition.

Giant Network Group, like many in the gaming industry, must continuously invest in competitive compensation packages and fostering an appealing work culture to attract and retain the critical human capital needed for game development and marketing success. The burgeoning demand for AI and machine learning expertise within game development further amplifies this trend, with specialized AI engineers commanding even higher salaries, potentially exceeding $180,000 in 2024.

Giant Network Group's reliance on cloud infrastructure and server providers is substantial, as smooth online game operations depend entirely on this foundation. While the market offers choices, the stringent demands for low latency, constant availability, and robust data security, particularly within China's controlled internet landscape, grant considerable bargaining power to a select few leading providers.

The critical nature of this infrastructure for player experience and game stability means that disruptions or performance issues from providers can directly impact Giant Network Group's revenue and reputation. For instance, major cloud providers in China, such as Alibaba Cloud or Tencent Cloud, often dominate the market, allowing them to dictate terms due to the high switching costs and the specialized nature of gaming infrastructure requirements.

Payment Gateway and Distribution Platform Fees

Payment gateways and app store platforms are significant suppliers for game developers like those under Giant Network Group, wielding considerable bargaining power. These platforms, essential for monetization and distribution, charge transaction fees that directly impact developer profitability. For instance, major app stores often take a commission of 15-30% on in-app purchases, a standard practice that limits the revenue retained by developers.

The dependence of game developers on these distribution channels grants platforms leverage over revenue sharing and content policies. This means developers have limited options to negotiate these fees or platform terms without risking their access to a vast user base. In 2024, the ongoing dominance of these gatekeepers in the mobile gaming ecosystem underscores their continued supplier power.

- Transaction Fees: Platforms like Google Play and Apple App Store typically charge developers a commission, often around 15-30% on sales, directly impacting profit margins.

- Platform Policies: Suppliers dictate content guidelines, update release schedules, and promotional opportunities, influencing developer operations and market access.

- Distribution Monopoly: For many developers, these platforms represent the primary, and sometimes only, viable channel for reaching a global audience, creating a strong dependency.

- Limited Negotiation Power: Developers often have little room to negotiate fee structures or policy terms due to the high switching costs and the essential nature of these platforms for revenue generation.

Intellectual Property (IP) and Content Licensing

For games that rely on established intellectual property (IP), such as beloved characters or existing franchises, the IP owners wield considerable bargaining power. This can translate into higher licensing fees and stringent creative control stipulations, directly affecting Giant Network Group's development expenses and the ultimate market appeal of their games. For instance, in 2024, the global market for licensed video games continued to be a significant segment, with major entertainment IPs commanding premium licensing rates.

The bargaining power of suppliers in the context of IP and content licensing for Giant Network Group is a critical factor. When a game's success hinges on a well-known franchise, the licensor has leverage to dictate terms. This can include not only the financial cost of the license but also approvals on game design, marketing, and even release schedules. In 2024, reports indicated that major Hollywood studios and popular game franchises were increasingly selective about licensing their IP, often demanding higher revenue shares.

- IP Owner Leverage: Licensors can demand substantial upfront payments and ongoing royalties, impacting profitability.

- Creative Control: IP holders often retain significant control over how their characters and stories are depicted, potentially limiting developer creative freedom.

- Market Dependence: Games heavily reliant on popular IP are vulnerable to the licensor's terms, as the IP is a primary driver of sales.

- Licensing Costs in 2024: Industry analysis for 2024 showed that securing rights for top-tier entertainment IPs could cost tens of millions of dollars, plus a percentage of revenue.

Suppliers of core game development engines, like Unity and Unreal Engine, hold significant sway due to their advanced features and the substantial costs associated with switching, making them indispensable for efficient game creation.

The demand for specialized talent in game development, art, and marketing is high, leading to increased labor costs for companies like Giant Network Group, with senior game developers earning over $150,000 annually in 2024.

Cloud infrastructure providers, particularly in China's regulated market, possess considerable bargaining power due to the critical need for low latency and high availability in online gaming, with major players like Alibaba Cloud and Tencent Cloud dominating.

Payment gateways and app stores, such as Google Play and Apple App Store, exert strong influence by charging commissions of 15-30% on in-app purchases, limiting developer revenue retention and dictating platform policies.

Intellectual property owners for popular franchises can command high licensing fees and impose strict creative controls, with securing top-tier IPs in 2024 costing tens of millions of dollars plus revenue shares.

| Supplier Category | Bargaining Power | Key Factors | 2024 Impact/Data |

| Game Engines (Unity, Unreal) | High | Advanced features, high switching costs, robust ecosystems | Unity had over 200,000 active users in 2024 |

| Specialized Talent | High | High demand for skilled developers, artists, designers | Senior developer salaries exceeded $150,000 annually |

| Cloud Infrastructure | High | Critical for low latency, availability, security; market concentration | Major Chinese providers like Alibaba Cloud, Tencent Cloud dominate |

| App Stores/Payment Gateways | High | Essential for distribution and monetization; transaction fees | Commissions typically 15-30% on in-app purchases |

| IP Licensors | High | Value of IP, licensing fees, creative control stipulations | Top-tier IP licensing costs reached tens of millions + revenue share |

What is included in the product

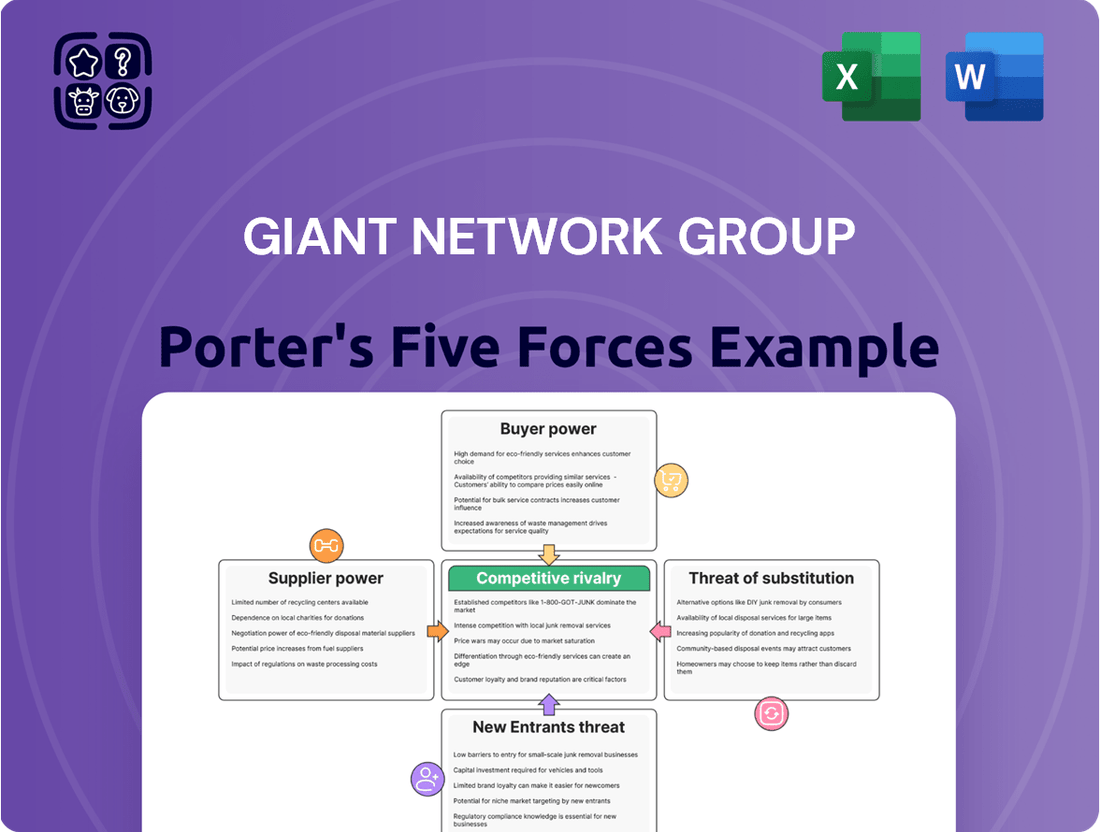

This analysis unpacks the competitive forces impacting Giant Network Group, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, enabling proactive strategy adjustments.

Customers Bargaining Power

The sheer volume of games available in China, a market boasting over 670 million gamers as of late 2023, significantly amplifies customer bargaining power. With an abundance of MMORPGs and mobile titles, players can readily find comparable or superior alternatives if they find Giant Network Group's products lacking in content, features, or pricing.

For many online and mobile games, the direct monetary cost of switching to a different game is low, especially for free-to-play titles. This low barrier to entry means players can easily explore new options without significant financial commitment.

While players may invest considerable time in a game, the widespread availability of new apps and online platforms makes it simple to abandon one experience for another. This ease of access significantly reduces player loyalty and strengthens their bargaining power, as they can readily seek out better gameplay or more engaging content elsewhere.

In 2024, the mobile gaming market saw continued growth, with new titles constantly emerging. This competitive landscape further amplifies the bargaining power of customers. For instance, the global mobile game market was projected to reach over $107 billion in 2024, indicating a vast array of choices available to consumers.

Customers, particularly in China's dominant mobile gaming sector, exhibit significant price sensitivity for in-game purchases. This means Giant Network Group must carefully consider pricing strategies to attract and retain players.

Regulatory oversight on monetization methods, such as loot boxes and daily login rewards, intensifies customer awareness of value for money. For instance, in 2023, China's National Press and Publication Administration continued to refine regulations impacting game monetization, directly influencing player spending habits and demanding greater transparency from developers like Giant Network Group.

Impact of User Reviews and Community Feedback

The bargaining power of customers for Giant Network Group is significantly amplified by the pervasive influence of online reviews and community feedback. Platforms like Douyin, Bilibili, and WeChat channels allow player opinions to spread with remarkable speed, directly shaping a game's perception and attracting or deterring new users. This collective voice grants customers substantial leverage, as negative sentiment can swiftly erode a game's player base.

For instance, in 2024, games that received overwhelmingly negative user reviews on platforms such as TapTap or Steam often experienced a sharp decline in daily active users within weeks. This rapid dissemination of opinion means that customer satisfaction is not just a metric but a powerful force that can dictate a game's commercial success. Giant Network Group must actively manage its online reputation and engage with its player communities to mitigate this powerful customer bargaining power.

- Online Platforms Amplify Customer Voice: Social media and gaming forums allow for rapid sharing of opinions, impacting game reputation.

- Rapid Spread of Negative Feedback: Deterrent effect on potential new players due to widespread negative reviews.

- Direct Impact on Player Base: Customer sentiment can quickly influence a game's active user numbers and revenue.

- Reputation Management is Crucial: Giant Network Group needs to actively monitor and respond to community feedback to maintain player loyalty.

Regulatory Protections for Minors and Consumers

Chinese regulations designed to curb gaming addiction and control in-game spending, especially for minors, significantly bolster consumer bargaining power. These rules, implemented by bodies like the National Press and Publication Administration (NPPA), mandate restrictions on gaming time and expenditure, forcing companies like Giant Network Group to adapt their business models.

These regulatory measures indirectly enhance customer leverage by compelling developers to adopt more responsible gaming practices. For instance, the NPPA's directives often limit gaming access for individuals under 18 to specific hours and impose spending caps, directly impacting revenue streams and encouraging a greater focus on player well-being.

- Consumer Empowerment: Regulations set clear limits on gaming duration and spending for minors, giving them and their guardians more control.

- Developer Adaptation: Companies must comply with these rules, influencing game design and monetization strategies to prioritize responsible play.

- Market Influence: The sheer number of gamers in China, coupled with these protective regulations, creates a powerful consumer bloc that developers must cater to.

The bargaining power of customers is substantial for Giant Network Group, driven by the vast and competitive Chinese gaming market. With over 670 million gamers in China by late 2023, and the mobile gaming market projected to exceed $107 billion in 2024, players have an abundance of choices. Low switching costs, especially for free-to-play games, mean players can easily move to alternatives if unsatisfied, further amplifying their leverage. This dynamic necessitates that Giant Network Group prioritize player satisfaction and competitive pricing.

| Factor | Description | Impact on Giant Network Group |

|---|---|---|

| Market Size | China: >670 million gamers (late 2023) | Increases customer choice and bargaining power. |

| Market Growth | Global Mobile Gaming Market: >$107 billion (2024 projection) | More competitors emerge, intensifying customer options. |

| Switching Costs | Low for free-to-play titles | Customers can easily switch to competing games. |

| Price Sensitivity | High for in-game purchases | Giant Network Group must offer competitive pricing. |

What You See Is What You Get

Giant Network Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for the Giant Network Group, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You will receive this exact, professionally formatted analysis immediately after purchase, providing you with actionable insights into the group's strategic positioning and the industry's dynamics.

Rivalry Among Competitors

The Chinese online gaming market is a battleground dominated by titans. Tencent and NetEase alone command over 50% of the market, creating a fiercely competitive environment. Giant Network Group finds itself in direct contention with these giants, alongside a multitude of other domestic and international game developers vying for player engagement and a slice of the market.

The Chinese gaming market's robust expansion, anticipated to climb from US$66.13 billion in 2024 to US$95.51 billion by 2029, acts as a powerful magnet for both new companies and established giants. This significant growth trajectory fuels aggressive investment and strategic maneuvering, directly escalating the intensity of competitive rivalry within the sector.

Giant Network Group faces intense rivalry driven by the relentless pace of product innovation and rapid content cycles in the gaming industry. To maintain a competitive edge, companies must consistently introduce novel game genres, compelling narratives, and leverage cutting-edge technologies such as AI and virtual reality. For instance, in 2024, the global gaming market saw significant investment in R&D for these advancements, with major publishers launching titles that heavily featured AI-driven NPCs and immersive VR experiences.

The constant demand for fresh content and updates, often supported by extensive cross-media marketing campaigns, fuels this aggressive competition. This cycle necessitates substantial marketing budgets and a continuous pipeline of new releases to capture and retain player attention. In 2023 alone, the top gaming companies collectively spent billions on marketing, highlighting the critical role of promotional efforts in driving player acquisition and engagement amidst fierce rivalry.

Aggressive User Acquisition and Marketing

Giant Network Group, like many in the gaming sector, faces fierce competition driven by aggressive user acquisition and marketing strategies. Companies pour substantial resources into advertising, promotions, and influencer collaborations to capture and keep players. This intense focus on growth significantly inflates operational costs and heightens the overall competitive landscape.

The drive for new users is particularly evident in the mobile gaming market. For instance, in 2024, the global mobile gaming market was projected to reach over $107 billion, a testament to the massive investment in attracting players. Companies leverage popular platforms, including short-form video apps, to reach wider audiences, further intensifying marketing spend.

- High Marketing Spend: Companies allocate significant portions of their budgets to user acquisition, often exceeding 50% of revenue in hyper-competitive segments.

- Platform Diversification: Marketing efforts span traditional channels, social media, and emerging platforms like TikTok and Douyin, demanding constant adaptation.

- Promotional Tactics: Frequent in-game events, limited-time offers, and referral bonuses are common to incentivize new player sign-ups and retention.

- Rising Customer Acquisition Cost (CAC): The escalating competition leads to higher CAC, making it crucial for companies to optimize their marketing spend for long-term profitability.

Regulatory Compliance as a Competitive Factor

The regulatory environment in China presents a significant competitive hurdle. Companies must navigate stringent rules for game licensing, content approval, and the implementation of anti-addiction measures. For instance, in 2023, China's National Press and Publication Administration continued to issue game licenses, but the process remains complex and subject to policy shifts, impacting the speed at which new products can enter the market.

Those that can adeptly manage and comply with these evolving regulations gain a distinct advantage. This includes developing robust internal compliance frameworks and staying ahead of policy changes. For example, companies with established relationships and a proven track record of compliance may find it easier to secure approvals for new titles compared to newer entrants.

- China's regulatory landscape requires constant adaptation for game developers and publishers.

- Efficient compliance with licensing, content approval, and anti-addiction measures is a key differentiator.

- Companies with strong regulatory navigation skills can achieve faster market entry and greater operational stability.

Competitive rivalry within the Chinese gaming market is exceptionally fierce, primarily driven by the dominance of giants like Tencent and NetEase, who together hold over half the market share. Giant Network Group competes directly with these behemoths and a wide array of other domestic and international developers, all vying for player attention in a rapidly expanding sector. The market's projected growth from US$66.13 billion in 2024 to US$95.51 billion by 2029 intensifies this competition, spurring aggressive investment and strategic plays.

| Key Competitor | Estimated Market Share (2024) | Key Competitive Strategy |

| Tencent | ~30-35% | Diversified portfolio, strong IP, extensive social integration |

| NetEase | ~20-25% | High-quality PC and mobile games, strong IP, international expansion |

| miHoYo | ~5-10% | High-fidelity graphics, gacha mechanics, strong global community |

| Giant Network Group | Varies by segment | Focus on specific genres, leveraging existing IP, potential M&A |

SSubstitutes Threaten

The threat of substitutes for Giant Network Group's online gaming services is significant, primarily from other digital entertainment platforms. Services like Douyin (TikTok in China), live streaming platforms, and social media compete fiercely for consumers' limited leisure time and attention. For instance, in 2023, the average daily time spent on short-form video platforms in China reached over 100 minutes, directly siphoning potential engagement away from gaming.

The rise of cloud gaming services presents a significant threat of substitutes for Giant Network Group. These platforms, like Xbox Cloud Gaming and GeForce NOW, allow players to stream high-quality games directly to various devices, bypassing the need for expensive consoles or powerful PCs.

This trend could reduce demand for the hardware and traditional game purchases that form a core part of Giant Network Group's business. For instance, by mid-2024, cloud gaming subscriptions are projected to see substantial growth, indicating a shift in consumer preference towards accessibility and convenience over ownership.

Beyond digital alternatives, traditional media like television, movies, and music, alongside offline leisure activities, still vie for consumer attention and spending. For instance, global box office revenue in 2024 is projected to reach approximately $85 billion, demonstrating the continued appeal of cinema.

Economic downturns or evolving lifestyle preferences could prompt consumers to shift their leisure time and budgets away from online gaming. In 2023, consumer spending on out-of-home entertainment, such as concerts and sporting events, saw a notable increase, indicating a potential reallocation of discretionary income.

Rise of Casual and Mini-Games

The increasing popularity of hyper-casual and mini-games presents a significant threat of substitutes for Giant Network Group. These games, often found within super-apps, offer a low barrier to entry and quick engagement, diverting user attention from more time-intensive titles like MMORPGs. For instance, the mobile game market saw substantial growth in 2024, with hyper-casual titles consistently ranking high in download charts, indicating a broad user base seeking easily accessible entertainment.

This trend means that Giant Network Group's core offerings, which often involve deeper engagement and longer playtimes, face competition from simpler, more immediate gaming experiences. The accessibility of these substitute games can fragment the market and capture a segment of potential players who might otherwise engage with Giant Network Group's more complex games.

- Growing Hyper-Casual Market: The global mobile game market, valued at over $90 billion in 2023, continues to see strong performance from hyper-casual games, which often require minimal commitment.

- Super-App Integration: Many super-apps are integrating mini-games, further increasing their accessibility and reach, potentially cannibalizing engagement from dedicated gaming platforms.

- Shifting Player Preferences: A segment of the gaming audience prioritizes short, rewarding play sessions, a demand directly met by substitute casual and mini-game offerings.

- User Acquisition Costs: The competition from these substitutes can drive up user acquisition costs for traditional mobile game developers like Giant Network Group.

Educational and Productivity Applications

The rise of readily accessible educational and productivity applications presents a significant threat of substitutes for traditional entertainment offerings. As digital literacy continues to climb, with global smartphone penetration reaching an estimated 70% by the end of 2024, consumers increasingly turn to their devices for self-improvement and practical utility during leisure time.

This trend is amplified by the growing emphasis on lifelong learning and skill development. For instance, platforms like Coursera and Udemy reported substantial user growth in 2024, with millions of new enrollments in courses ranging from coding to digital marketing. These applications directly compete with entertainment content by offering tangible benefits and personal advancement, diverting user attention and time away from purely recreational activities.

- Growing Digital Literacy: Global smartphone penetration is projected to exceed 70% by the end of 2024, increasing access to app-based alternatives.

- Demand for Skill Development: Online learning platforms saw millions of new enrollments in 2024, indicating a strong consumer preference for utility-driven digital content.

- Shift in Leisure Time Allocation: Users are increasingly choosing self-improvement apps over passive entertainment, representing a direct substitution effect.

The threat of substitutes for Giant Network Group's online gaming services is substantial, stemming from a wide array of digital and traditional entertainment options. Platforms like Douyin and other short-form video services are increasingly capturing user attention, as evidenced by over 100 minutes of average daily engagement in China during 2023. Cloud gaming also presents a growing alternative, promising high-quality experiences without hardware investment, with subscription growth projected throughout 2024. Even traditional media, like movies with a projected global box office revenue of $85 billion in 2024, and offline activities, continue to compete for leisure time and discretionary spending.

The rise of hyper-casual and mini-games, often integrated into super-apps, offers a low-barrier, quick-engagement alternative to Giant Network Group's more immersive titles. The mobile game market, valued over $90 billion in 2023, consistently features these simpler games, indicating a strong user preference for immediate gratification. Furthermore, the increasing popularity of educational and productivity apps, fueled by rising digital literacy and a demand for skill development, diverts user time and attention from purely entertainment-focused activities. Millions of new enrollments on platforms like Coursera in 2024 highlight this shift towards utility-driven digital content.

| Substitute Category | Key Competitor/Trend | 2023/2024 Data Point | Impact on Giant Network Group |

|---|---|---|---|

| Digital Entertainment | Short-form Video (Douyin) | Over 100 mins daily engagement (China, 2023) | Siphons leisure time and attention |

| Gaming Alternatives | Cloud Gaming | Projected substantial subscription growth (mid-2024) | Reduces demand for hardware/traditional purchases |

| Traditional Media | Movies | Projected $85 billion global box office revenue (2024) | Competes for discretionary spending |

| Casual Gaming | Hyper-casual/Mini-games | Mobile game market >$90 billion (2023) | Fragments market, captures attention for shorter sessions |

| Utility Apps | Online Learning (Coursera, Udemy) | Millions of new enrollments (2024) | Diverts time towards self-improvement |

Entrants Threaten

The threat of new entrants in the Chinese gaming market is significantly dampened by stringent regulatory hurdles and complex licensing requirements. Obtaining the necessary permits for game operation and content approval is a formidable challenge, particularly for foreign companies. In 2023, the National Press and Publication Administration (NPPA) continued its rigorous review process, with reports indicating that only a fraction of submitted games received approval, underscoring the difficulty for newcomers to gain market access.

Developing and operating successful MMORPGs and mobile games, especially those with AAA quality, demands significant capital. This includes substantial outlays for skilled development teams, cutting-edge technology, and extensive marketing campaigns. For instance, the development budget for a major AAA game can easily range from tens of millions to over a hundred million dollars.

This high capital requirement serves as a formidable barrier to entry for new companies, particularly those lacking substantial funding or established financial backing. Smaller, unfunded entities find it exceedingly difficult to compete with the resources of established players like Giant Network Group, effectively limiting the threat of new entrants.

Giant Network Group, like many established players in the gaming industry, benefits from deeply ingrained brand loyalty and strong recognition of its intellectual property (IP). For instance, their popular titles have cultivated a dedicated player base over years, making it challenging for newcomers to gain traction. This loyalty acts as a significant barrier, as new entrants must not only offer compelling gameplay but also overcome the established trust and emotional connection players have with existing brands.

Complex Distribution and Marketing Channels

Newcomers face significant hurdles in China's complex digital ecosystem, where numerous app stores and marketing platforms demand intricate navigation. Successfully building partnerships and securing visibility requires substantial investment and deep local market insights, making it difficult for new players to establish a foothold.

For instance, in 2024, the sheer volume of mobile applications available in China's leading app stores, such as Tencent's Myapp and Huawei's AppGallery, presents a crowded marketplace. Gaining prominence often necessitates considerable marketing spend and the development of strategic alliances with established local entities.

- Fragmented Distribution: China's app market is highly fragmented, with hundreds of app stores, each with its own user base and approval processes.

- High Marketing Costs: Acquiring users through advertising on popular Chinese social media and content platforms can be prohibitively expensive for new entrants, with costs per install often reaching several dollars.

- Partnership Dependence: Establishing trust and securing distribution through partnerships with telecom operators or major internet companies is crucial but challenging for unknown brands.

Technological Expertise and Infrastructure Requirements

The barrier to entry for new players in the online gaming sector, particularly for companies like Giant Network Group, is significantly elevated by the substantial technological expertise and infrastructure required. Developing and operating complex online games necessitates cutting-edge skills in areas such as server management, advanced anti-cheat systems, and sophisticated data analytics. For instance, in 2024, the global online gaming market was valued at over $100 billion, with a significant portion driven by games requiring continuous, high-performance online connectivity and complex backend systems.

New entrants face the daunting task of either building these intricate capabilities from scratch or acquiring them, both of which represent considerable financial and operational hurdles. This includes investing heavily in:

- High-performance server farms: Essential for seamless gameplay and low latency, requiring substantial capital outlay and ongoing maintenance costs.

- Advanced cybersecurity and anti-cheat software: Crucial for maintaining game integrity and player trust, demanding specialized development teams and continuous updates.

- Data analytics and AI capabilities: Needed for player behavior analysis, game optimization, and personalized experiences, requiring significant investment in talent and technology.

The threat of new entrants into the Chinese gaming market is considerably low due to substantial capital requirements for game development and marketing. For example, a AAA game development budget can easily exceed $100 million, a sum prohibitive for most startups. This high cost, coupled with the need for advanced technological infrastructure and skilled talent, creates a significant barrier.

Furthermore, established brand loyalty and intellectual property ownership by companies like Giant Network Group make it difficult for newcomers to capture market share. Navigating China's fragmented distribution channels and high marketing costs, potentially reaching several dollars per install in 2024, adds another layer of difficulty for new players seeking visibility.

Porter's Five Forces Analysis Data Sources

Our Giant Network Group Porter's Five Forces analysis is built upon a foundation of publicly available information, including the company's annual reports, investor presentations, and regulatory filings. We supplement this with industry-specific market research reports and data from reputable financial news outlets to capture a comprehensive view of the competitive landscape.