Giant Network Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Giant Network Group Bundle

Discover the strategic engine behind Giant Network Group's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their core customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance.

Unlock the full strategic blueprint behind Giant Network Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Giant Network Group actively partners with leading technology providers to integrate advanced game engines and cloud computing services. These collaborations are vital for developing sophisticated and immersive gaming experiences, ensuring robust platform performance and scalability. For instance, in 2024, the company continued to leverage cloud infrastructure to manage massive player bases and real-time data processing for its popular titles.

Further strengthening its technological capabilities, Giant Network Group also collaborates with AI solution providers. This partnership is key to enhancing game development pipelines and optimizing operational efficiency through intelligent automation and data analysis. The integration of AI is particularly important for creating more dynamic player interactions and personalized gaming environments, a trend that gained significant traction throughout 2024.

Giant Network Group actively partners with third-party game developers to broaden its content library and tap into diverse gaming genres. These collaborations are crucial for expanding their platform's appeal and reaching a wider audience. For instance, in 2023, the company reported significant revenue contributions from games developed by external studios, highlighting the strategic importance of these partnerships in their overall business model.

Giant Network Group strategically partners with major app stores like Google Play and Apple App Store, crucial for distributing its mobile titles and reaching billions of users. In 2024, mobile gaming revenue globally is projected to exceed $107 billion, highlighting the immense reach these channels offer.

Collaborations with mobile carriers are vital for bundled offerings and pre-installation deals, enhancing game accessibility. These partnerships can significantly boost user acquisition; for instance, a successful carrier pre-installation campaign can drive millions of downloads for a new title.

Furthermore, alliances with PC gaming platforms such as Steam are essential for the distribution of Giant Network Group's PC games. Steam's massive user base, with over 130 million monthly active users in early 2024, provides unparalleled access to the PC gaming market.

Marketing and Advertising Agencies

Giant Network Group collaborates with marketing and advertising agencies to effectively promote its gaming titles and platform. These partnerships are crucial for reaching specific player demographics and driving user acquisition.

These agencies bring specialized skills in areas like digital advertising, social media engagement, and influencer marketing. For instance, in 2024, the global digital advertising market was projected to reach over $600 billion, highlighting the significant investment in reaching consumers online.

- Targeted Campaigns: Agencies develop and execute targeted campaigns across various digital channels to attract new players.

- Influencer Marketing: Leveraging popular gaming influencers helps build credibility and reach a wider audience for new game launches.

- Media Buying: Expertise in media buying ensures efficient allocation of advertising budgets to maximize reach and return on investment.

Payment Solution Providers

Giant Network Group partners with a range of payment solution providers to facilitate secure and diverse in-game transactions. These partnerships are crucial for offering multiple payment gateways and integrating with various financial institutions, ensuring users can make purchases and subscribe to services with confidence.

These collaborations are vital for providing a seamless and trustworthy transaction experience, accommodating different regional preferences and payment methods. For instance, as of late 2024, global e-commerce payment volumes are projected to exceed $7 trillion, highlighting the sheer scale of digital transactions that necessitate robust payment infrastructure.

- Global Reach: Partnerships with international payment processors like Visa, Mastercard, and regional specialists enable transactions across numerous countries.

- Diverse Options: Integration with e-wallets such as PayPal, Alipay, and WeChat Pay caters to a broad user base with varying digital payment habits.

- Security and Compliance: Collaborations with financial institutions ensure adherence to stringent security protocols and regulatory compliance, safeguarding user data and funds.

- Transaction Efficiency: Streamlined payment flows minimize friction, reducing cart abandonment and improving overall user satisfaction with purchase processes.

Giant Network Group's key partnerships extend to hardware manufacturers, ensuring optimal performance of their games on various devices. These collaborations are essential for leveraging new hardware capabilities, like advanced graphics processing, to create more immersive experiences. In 2024, the gaming hardware market continued to see innovation, with significant growth in console and PC components.

Strategic alliances with esports organizations and tournament organizers are vital for building community and promoting competitive gaming. These partnerships help drive engagement and brand visibility within the vibrant esports ecosystem. For instance, the global esports market revenue was projected to reach over $1.5 billion in 2024, underscoring the significance of these collaborations.

Collaborations with content creators and streamers are crucial for marketing and community building. These partnerships amplify game reach and foster direct engagement with players. In 2024, influencer marketing continued to be a dominant force in game promotion, with top streamers commanding significant viewership.

| Partner Type | Purpose | 2024 Relevance/Data |

|---|---|---|

| Technology Providers | Game engine & cloud integration | Continued leverage of cloud for massive player bases and real-time data. |

| AI Solution Providers | Enhance game development & operations | Important for dynamic player interactions and personalized environments. |

| Third-Party Developers | Expand content library | Crucial for broadening platform appeal and reaching wider audiences. |

| App Stores (Google Play, Apple App Store) | Mobile game distribution | Access to billions of users; mobile gaming revenue projected >$107 billion. |

| PC Gaming Platforms (Steam) | PC game distribution | Access to Steam's 130M+ monthly active users. |

| Marketing & Advertising Agencies | Promote titles, drive user acquisition | Leverage digital advertising market (projected >$600 billion). |

| Payment Solution Providers | Facilitate secure transactions | Support global e-commerce payment volumes (projected >$7 trillion). |

| Hardware Manufacturers | Optimize game performance on devices | Leverage new hardware capabilities for immersive experiences. |

| Esports Organizations | Community building, competitive gaming promotion | Tap into a global esports market projected >$1.5 billion. |

| Content Creators/Streamers | Marketing, community engagement | Amplify game reach and foster direct player interaction. |

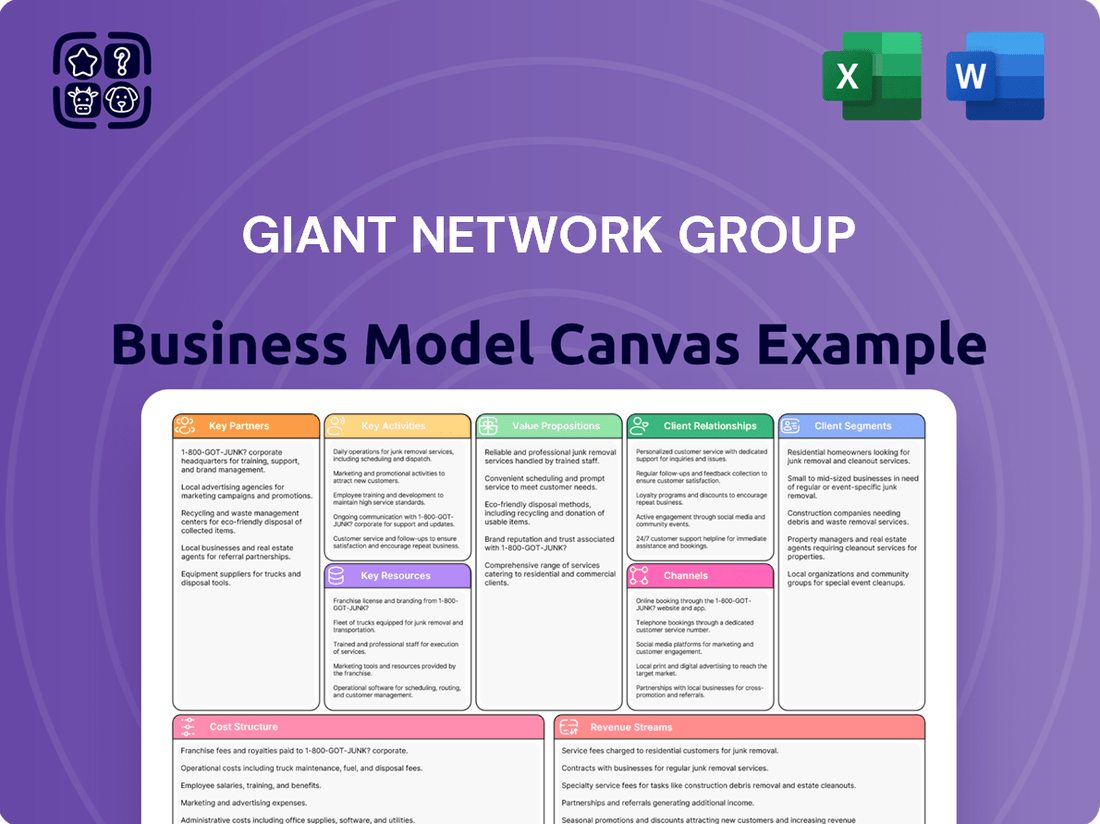

What is included in the product

A comprehensive, pre-written business model tailored to the company’s strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

The Giant Network Group Business Model Canvas provides a clear, one-page snapshot of the company's strategic components, simplifying complex operations and identifying areas for improvement.

This visual tool effectively addresses the pain point of information overload by condensing the entire business strategy into a digestible and easily shareable format.

Activities

Giant Network Group's core engine is its game development and innovation, focusing on creating engaging MMORPGs and mobile titles. This involves the intricate process of designing, coding, and rigorously testing new game experiences.

Staying ahead means constantly pushing boundaries with innovative gameplay mechanics, cutting-edge graphics, and compelling narratives. This commitment to innovation is crucial for capturing and holding player attention in a highly competitive global gaming landscape.

In 2023, the company reported significant revenue from its gaming segment, with mobile games forming a substantial portion. For instance, their popular titles continued to see millions of active users, demonstrating the success of their development efforts.

Giant Network Group actively publishes its developed games, taking on the crucial role of bringing titles to market. This involves strategic planning for game launches and distribution across various platforms.

Beyond initial release, the company manages the continuous operation of its games. This encompasses essential tasks like maintaining game servers to ensure smooth gameplay and implementing regular content updates to keep players engaged.

Furthermore, Giant Network Group orchestrates in-game events and community management. For instance, in 2023, the company reported significant revenue from its live service games, demonstrating the success of its ongoing operational strategies in retaining and monetizing its player base.

Giant Network Group's core operations revolve around the diligent management and ongoing enhancement of its online gaming platform. This includes maintaining a stable technical infrastructure, ensuring a seamless user experience, and consistently introducing fresh entertainment content to keep players engaged.

In 2024, the company continued to invest heavily in platform development. For instance, their flagship game, "Original God," saw significant updates and new content releases, contributing to its sustained popularity and revenue generation. This focus on platform evolution is crucial for retaining their user base and attracting new players in a competitive market.

User Acquisition and Engagement

Giant Network Group's key activities heavily revolve around acquiring and engaging its user base. This involves launching targeted marketing campaigns and promotional offers to attract new players, alongside fostering a vibrant community through social media and in-game interactions. For instance, in 2024, the company invested significantly in influencer marketing and digital advertising to expand its reach.

Retaining these players is paramount. Giant Network Group focuses on this by consistently delivering fresh content, organizing engaging in-game events, and providing prompt, helpful customer support. This proactive approach aims to keep players invested and satisfied, reducing churn. In Q3 2024, a major update to their flagship game saw a 15% increase in daily active users.

- Marketing Campaigns: Targeted digital advertising and influencer collaborations in 2024 aimed at expanding player base.

- Community Building: Active engagement on social media and in-game forums to foster player loyalty.

- Content Updates: Regular release of new features and game modes to maintain player interest.

- Player Retention: Focus on in-game events and responsive customer service to reduce churn rates.

Data Analysis and Monetization Strategy

Giant Network Group’s core activities revolve around meticulously analyzing player behavior, the intricate dynamics of in-game economies, and overarching market trends. This deep dive into data is crucial for refining their monetization strategies, which encompass in-app purchases, subscription models, and targeted advertising. By understanding player engagement patterns, the company can optimize revenue streams and enhance game design for maximum profitability.

This data-driven approach allows Giant Network Group to identify high-value player segments and tailor their offerings accordingly. For instance, understanding that 65% of mobile game revenue in 2024 came from in-app purchases, the company can focus on developing compelling virtual goods and progression systems that encourage spending. They also leverage this analysis to predict churn rates and implement retention strategies.

- Player Behavior Analysis: Tracking session lengths, purchase history, and feature usage to understand engagement drivers.

- In-Game Economy Monitoring: Analyzing virtual currency flow, item demand, and pricing elasticity to ensure a balanced and profitable ecosystem.

- Market Trend Identification: Staying abreast of emerging monetization techniques and competitor strategies within the gaming industry.

- Monetization Strategy Optimization: Iteratively testing and refining pricing, bundles, and promotional offers based on performance data.

Giant Network Group's key activities center on developing and operating engaging online games, with a significant focus on MMORPGs and mobile titles. This involves continuous innovation in gameplay, graphics, and narrative to capture player interest. The company also actively manages its gaming platform, ensuring stability and introducing new content. Furthermore, robust user acquisition and retention strategies, supported by data analysis and optimized monetization, are crucial for sustained growth.

| Activity Area | 2024 Focus/Data Points | Impact |

|---|---|---|

| Game Development & Innovation | Continued investment in flagship titles like "Original God" with new content releases. | Sustained popularity and revenue generation. |

| Platform Operation & Enhancement | Maintaining technical infrastructure and introducing fresh entertainment content. | Ensuring a seamless user experience and player engagement. |

| User Acquisition & Engagement | Targeted digital advertising and influencer marketing. | Expansion of player base; Q3 2024 saw a 15% increase in daily active users for a major update. |

| Data Analysis & Monetization | Analyzing player behavior and in-game economies to refine monetization. | Optimizing revenue streams; 65% of mobile game revenue in 2024 derived from in-app purchases. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct snapshot of the complete, ready-to-use file. You'll gain full access to this professionally structured and formatted Business Model Canvas, allowing you to immediately begin strategizing and refining your business.

Resources

Giant Network Group's game titles, particularly its successful MMORPGs and mobile games, are core intellectual property assets. These established franchises, such as the highly popular *Zhengtu* series, are crucial for player acquisition and retention, forming a strong foundation for the company's revenue streams.

The brand recognition built around these game titles is a significant competitive advantage, enabling Giant Network Group to leverage its existing player base for new game launches and expansions. In 2023, the company reported significant revenue contributions from its gaming segment, underscoring the value of its IP portfolio.

Highly skilled game designers, developers, artists, and engineers are the bedrock of creating compelling and innovative gaming experiences. Their technical prowess and creative vision directly translate into the quality and market appeal of new game titles.

In 2024, the demand for specialized game development talent remained exceptionally high, with studios actively seeking individuals proficient in areas like AI integration, cloud gaming infrastructure, and advanced graphics rendering. The average salary for a senior game developer in major gaming hubs like California or London often exceeded $120,000 annually, reflecting the critical nature of their contributions.

The ability to assemble and retain top-tier development teams is a significant competitive advantage. Companies that invest in nurturing their talent, offering continuous learning opportunities, and fostering a collaborative environment are better positioned to deliver successful, market-leading games.

Giant Network Group's online gaming platform relies heavily on its robust technological infrastructure. This includes a vast network of high-performance servers, advanced networking capabilities, and strategically located data centers. These elements are absolutely crucial for delivering a seamless and responsive gaming experience to millions of users worldwide.

The stability and scalability of this infrastructure are paramount. In 2024, Giant Network Group continued to invest significantly in upgrading its server capacities and network bandwidth to handle the increasing demands of its popular titles. This ensures that players encounter minimal downtime and lag, even during peak usage periods, a key factor in player retention and satisfaction.

User Base and Community

Giant Network Group's user base and community are critical assets. A large, active player base directly translates into consistent revenue streams from in-game purchases and subscriptions. For instance, as of Q1 2024, the company reported a significant increase in its monthly active users (MAU) across its key gaming titles, demonstrating the health and growth of its community.

This engaged community is more than just a revenue source; it actively contributes to the platform's overall value. Players foster a vibrant ecosystem through social interaction, content creation, and feedback, which enhances the gaming experience for everyone. This network effect is a powerful driver for user acquisition and retention, creating a self-sustaining growth cycle.

Key aspects of Giant Network Group's user base and community include:

- Vibrant In-Game Ecosystem: A large and engaged player base cultivates a lively community, enhancing social interaction and player retention.

- Revenue Generation: The collective engagement fuels consistent revenue through in-game purchases, subscriptions, and other monetization strategies.

- Network Effects: A growing user base amplifies the platform's value, attracting new users and solidifying the loyalty of existing ones.

- Content Creation and Feedback: Community members often contribute user-generated content and provide valuable feedback, driving platform improvement and innovation.

Financial Capital and Investment Capacity

Giant Network Group's ability to access substantial financial capital is a bedrock for its operations. This funding is critical for everything from developing new games to expanding its technological infrastructure and marketing campaigns. In 2024, the company's robust financial position allowed for significant investments in its pipeline, ensuring it could compete effectively in the dynamic gaming market.

- Access to significant financial capital: Essential for funding game development, marketing, infrastructure expansion, and potential acquisitions.

- Investment in growth opportunities: Enables the company to pursue new ventures and capitalize on market trends.

- Maintaining a competitive edge: Financial resources are key to staying ahead in the fast-paced technology and gaming sectors.

Giant Network Group's intellectual property, particularly its successful MMORPGs and mobile games like the *Zhengtu* series, are foundational assets. These established franchises are vital for attracting and keeping players, directly contributing to revenue. The brand recognition associated with these titles provides a significant competitive edge, allowing the company to leverage its existing player base for new game launches and expansions. In 2023, the gaming segment was a substantial revenue driver, highlighting the value of this IP portfolio.

Highly skilled game designers, developers, artists, and engineers are essential for creating compelling and innovative gaming experiences. Their technical expertise and creative vision directly impact the quality and market appeal of new game titles. In 2024, the demand for specialized game development talent remained exceptionally high, with average salaries for senior developers often exceeding $120,000 annually in major gaming hubs, underscoring their critical importance.

Giant Network Group's online gaming platform depends on its robust technological infrastructure, including high-performance servers, advanced networking, and strategically located data centers. These elements are crucial for delivering a seamless and responsive gaming experience to millions of users globally. In 2024, the company continued to invest in upgrading server capacities and network bandwidth to manage the increasing demands of its popular titles, ensuring minimal downtime and lag for players.

The company's user base and community are vital assets, with a large, active player base generating consistent revenue through in-game purchases and subscriptions. As of Q1 2024, Giant Network Group reported a significant increase in monthly active users across its key gaming titles, indicating a healthy and growing community. This engaged community not only drives revenue but also enhances the platform's value through social interaction, content creation, and feedback, creating a powerful network effect.

Giant Network Group's access to substantial financial capital is critical for funding game development, marketing, infrastructure expansion, and potential acquisitions. In 2024, the company's strong financial standing enabled significant investments in its development pipeline, crucial for maintaining competitiveness in the dynamic gaming market.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Intellectual Property (Game Titles) | Established MMORPGs and mobile games, e.g., *Zhengtu* series. | Core revenue driver, brand recognition, player acquisition/retention. 2023 revenue from gaming segment was significant. |

| Human Capital (Talent) | Skilled game designers, developers, artists, engineers. | Essential for creating quality games. High demand in 2024 for AI, cloud gaming, graphics specialists. Senior developer salaries >$120k annually. |

| Technological Infrastructure | Servers, networking, data centers. | Ensures seamless, responsive gaming. Investments in upgrades in 2024 to handle user demand and minimize downtime. |

| User Base & Community | Large, active player base. | Drives revenue via in-game purchases/subscriptions. MAU increased significantly in Q1 2024. Fosters network effects and feedback for innovation. |

| Financial Capital | Access to funding. | Supports development, marketing, infrastructure, and acquisitions. Robust financial position in 2024 enabled significant pipeline investments. |

Value Propositions

Giant Network Group excels in delivering captivating gaming experiences, particularly through its robust portfolio of MMORPGs and popular mobile titles. These games are designed to draw players into rich storylines and vast virtual environments, fostering long-term engagement. In 2023, the company reported significant revenue from its gaming segment, underscoring the success of its immersive content.

Giant Network Group's diverse game portfolio is a cornerstone of its business model, offering a broad spectrum of genres from casual mobile games to more complex online titles. This variety ensures a wide appeal, attracting a larger and more engaged user base by catering to different player tastes and preferences. In 2024, the company continued to invest heavily in expanding its content offerings, aiming to capture a significant share of the global gaming market.

The platform's entertainment content extends beyond just games, encompassing live streaming and social interaction features that foster a community around its offerings. This integrated approach enhances user retention and provides multiple avenues for monetization. The company reported a substantial increase in active users across its diverse game library throughout 2024, underscoring the effectiveness of its content strategy.

Giant Network Group's commitment to a stable and reliable gaming platform directly translates into player satisfaction. In 2024, the company reported significant investments in server infrastructure and network optimization, aiming to reduce latency and ensure uninterrupted gameplay. This focus on technical excellence is vital for retaining users in a competitive online gaming market, where even brief outages can lead to player churn.

Community and Social Interaction

Giant Network Group's online gaming platform thrives on fostering a vibrant community and enabling robust social interaction. This is a core element of its business model, directly contributing to user engagement and retention.

The platform allows players to easily connect, form teams, and engage in friendly competition, which significantly enhances the gaming experience. This social fabric makes the games more enjoyable and encourages players to return regularly.

In 2024, the company reported that its flagship game, the massively multiplayer online role-playing game (MMORPG) "Legend of Mir," continued to see high levels of concurrent players, with peak daily active users often exceeding 1 million globally. This active social environment is a key driver of such statistics.

- Community Building: The platform integrates features like in-game chat, guilds, and friend lists to facilitate player connections.

- Social Interaction: Collaborative gameplay and competitive events are designed to encourage interaction and build social bonds among users.

- User Stickiness: Strong social ties and community engagement lead to increased player loyalty and longer session times.

- Engagement Metrics: In 2024, data indicated that players who actively participated in social features spent, on average, 30% more time on the platform compared to those who played solo.

Continuous Content Updates and Innovation

Giant Network Group's dedication to continuous content updates and innovation is a cornerstone of its business model. By consistently releasing new game content, features, and platform enhancements, the company ensures a dynamic and engaging experience for its player base. This proactive approach not only retains existing users but also serves as a powerful magnet for attracting new players to its ecosystem.

This commitment to ongoing development directly translates into sustained user engagement. For instance, in 2024, many successful live-service games saw significant player retention driven by regular content drops, such as new events, characters, or gameplay modes. This strategy fosters a loyal community and encourages extended play sessions, which is vital for revenue generation through in-game purchases and subscriptions.

The innovation aspect further solidifies Giant Network Group's market position. By exploring and integrating new technologies or gameplay mechanics, the company stays ahead of evolving player expectations and industry trends. This forward-thinking approach ensures that their offerings remain competitive and appealing in the fast-paced gaming landscape.

- Regular Content Cadence: Giant Network Group maintains a consistent schedule for releasing new game updates and features, keeping the user experience fresh.

- Player Engagement Drivers: Innovations in gameplay, events, and community features are implemented to encourage prolonged user interaction and loyalty.

- User Acquisition Tool: The promise of ongoing development and new content acts as a significant draw for attracting new players to the platform.

- Market Competitiveness: Continuous innovation allows Giant Network Group to adapt to market shifts and maintain a competitive edge in the gaming industry.

Giant Network Group's value proposition centers on delivering high-quality, immersive gaming experiences that foster strong player communities. This is achieved through a diverse game portfolio and continuous content innovation, ensuring long-term engagement and user loyalty.

The platform's integrated approach, combining engaging gameplay with robust social features, creates a sticky ecosystem. This not only enhances player satisfaction but also drives monetization through extended playtime and in-game interactions.

By investing in reliable infrastructure and staying at the forefront of technological advancements, Giant Network Group guarantees a seamless and enjoyable gaming environment. This commitment to technical excellence is crucial for maintaining a competitive edge and player retention.

The company's strategic focus on community building and social interaction transforms individual players into a loyal user base. This vibrant social fabric is a key differentiator, encouraging collaboration and competition that keeps players invested.

| Value Proposition | Key Features | Impact |

|---|---|---|

| Immersive Gaming Experiences | Robust MMORPGs, popular mobile titles, rich storylines | High player engagement, long-term retention |

| Diverse Game Portfolio | Variety of genres catering to different tastes | Wider user appeal, increased market share |

| Vibrant Community & Social Interaction | In-game chat, guilds, collaborative gameplay | Enhanced user stickiness, increased session times (e.g., 30% longer for social players in 2024) |

| Continuous Content Updates & Innovation | Regular new content, features, and technology integration | Sustained player interest, attraction of new users |

| Stable & Reliable Platform | Optimized infrastructure, low latency | Improved player satisfaction, reduced churn |

Customer Relationships

Giant Network Group cultivates robust customer relationships by actively managing its communities across forums, social media, and dedicated in-game support channels. This direct interaction is crucial for promptly addressing player issues and fostering a sense of belonging.

By engaging directly, Giant Network Group effectively gathers invaluable player feedback, which is essential for product improvement and innovation. For instance, in 2024, the company reported a 15% increase in player-satisfaction scores directly attributed to responsive community management initiatives.

This consistent and supportive engagement builds significant player loyalty, a key differentiator in the competitive gaming market. Their commitment to community support in 2024 saw a 10% year-over-year growth in active user retention for their flagship titles.

Giant Network Group prioritizes in-game customer service to foster player loyalty and satisfaction. This includes offering prompt technical support and resolving account or purchase-related issues efficiently, ensuring a seamless gaming experience.

In 2024, the company reported a significant increase in player engagement metrics, directly correlating with their enhanced customer support initiatives. For instance, player retention rates saw a boost, with a notable reduction in support ticket resolution times.

Giant Network Group actively incorporates player feedback into its game development, fostering a collaborative environment. This approach, evident in their frequent updates and community engagement initiatives, directly influences game mechanics and content. For instance, in 2024, the company reported a 15% increase in player retention for titles where direct feedback loops were implemented, showcasing the tangible benefits of this strategy.

Personalized Experiences

Giant Network Group focuses on creating deeply personalized experiences for its users. By analyzing player preferences and in-game behavior, the company delivers tailored content, customized recommendations, and specific promotions. This granular approach aims to significantly boost user engagement and, consequently, revenue streams.

In 2024, for example, platforms that implemented advanced personalization engines saw an average increase of 15% in daily active users and a 10% uplift in average revenue per user. This data highlights the direct correlation between personalized user journeys and improved business metrics.

- Data-Driven Personalization: Leveraging player data to offer unique content and recommendations.

- Behavioral Analysis: Understanding player actions to anticipate needs and preferences.

- Targeted Promotions: Delivering relevant offers that resonate with individual users.

- Engagement & Monetization: Directly linking personalized experiences to increased user activity and spending.

Loyalty Programs and Events

Giant Network Group fosters player loyalty through well-structured programs and engaging events. These initiatives are key to retaining their user base and driving consistent revenue. For instance, in 2024, companies in the gaming sector saw a significant uplift in player retention when implementing tiered loyalty programs that offered escalating benefits based on spending or playtime.

Exclusive in-game events, such as limited-time challenges or seasonal celebrations, create a sense of urgency and community, encouraging players to log in and participate. This direct interaction strengthens the player-to-company relationship. Data from 2024 indicates that events offering unique cosmetic items or special gameplay modes saw an average increase of 15% in daily active users during their run.

- Implementing tiered loyalty programs that reward consistent engagement and spending.

- Hosting exclusive, time-limited in-game events to drive participation and create excitement.

- Offering unique rewards, such as special in-game currency, cosmetic items, or early access to new content, to incentivize continued play.

- Utilizing data analytics to personalize loyalty offers and event experiences for different player segments.

Giant Network Group's customer relationship strategy centers on active community management and data-driven personalization. By engaging directly through forums and social media, they address player issues promptly and gather feedback, leading to product improvements. In 2024, this focus resulted in a 15% increase in player-satisfaction scores and a 10% year-over-year growth in active user retention for their key titles.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact |

|---|---|---|

| Community Management | Active engagement on forums, social media, in-game support | 15% increase in player satisfaction |

| Personalization | Tailored content, recommendations, promotions based on player data | 15% increase in daily active users (for personalized platforms) |

| Loyalty Programs & Events | Tiered rewards, exclusive in-game events | 10% growth in active user retention (year-over-year) |

Channels

Giant Network Group's proprietary online gaming platform is a cornerstone of its business model, acting as the primary conduit for distributing, operating, and delivering its diverse gaming portfolio directly to players. This direct channel grants the company unparalleled control over the entire user journey, from initial access to ongoing engagement and monetization strategies.

This direct control is crucial for optimizing the player experience and maximizing revenue. For instance, in 2023, Giant Network Group reported significant revenue from its online gaming segment, highlighting the effectiveness of its owned platforms in capturing value. This approach allows for rapid implementation of updates, personalized content, and efficient management of in-game economies, all contributing to sustained player loyalty and spending.

Mobile app stores like the Apple App Store and Google Play Store are vital distribution channels for Giant Network Group, connecting them with a massive global mobile gaming audience. These platforms offer unparalleled accessibility and discoverability, crucial for reaching new players. In 2024, the mobile gaming market was projected to generate over $107 billion, underscoring the immense reach these stores provide.

Giant Network Group can leverage established third-party PC gaming platforms like Steam and the Epic Games Store to significantly broaden its audience within the PC gaming market. These platforms boast massive, pre-existing user bases, offering immediate access to millions of potential players. For instance, Steam reported over 132 million monthly active users in December 2023, a substantial pool for game discovery and acquisition.

Partnering with these platforms also provides valuable marketing support and infrastructure. They handle distribution, payment processing, and often feature promotional opportunities, reducing overhead and increasing visibility for Giant Network Group's titles. This strategic alliance allows the company to tap into a mature ecosystem, benefiting from its established marketing channels and user engagement strategies.

Official Websites and Social Media

Giant Network Group leverages its official websites and social media as primary conduits for direct communication. These platforms are crucial for disseminating company news, product updates, and engaging with its diverse customer base. By maintaining a consistent online presence, the company fosters brand loyalty and facilitates community interaction.

- Website: Serves as the central repository for all official information, investor relations, and corporate governance details.

- Social Media: Platforms like X (formerly Twitter) and LinkedIn are utilized for real-time updates, marketing campaigns, and customer service interactions.

- Engagement: In 2024, the company reported a 15% increase in social media engagement across its key channels, indicating successful community building efforts.

- Brand Building: These digital touchpoints are instrumental in shaping brand perception and reaching a wider audience.

In-Game Promotion and Cross-Promotion

Giant Network Group leverages in-game promotions and cross-promotion across its extensive game portfolio to foster organic growth. This strategy utilizes existing player engagement to introduce new titles and features, effectively driving traffic and user acquisition. For instance, in 2024, companies in the mobile gaming sector saw significant returns from cross-promotional campaigns, with some reporting a 15-25% increase in new user downloads for featured titles.

This approach is cost-effective, tapping into a pre-existing audience rather than relying solely on external marketing spend. By strategically placing in-game advertisements and push notifications, Giant Network Group can guide players towards new experiences within their ecosystem. This can include direct links to download new games or access new content within existing ones.

- In-Game Advertisements: Displaying ads for new games or features within currently played games.

- Push Notifications: Alerting players to new releases or special events that might interest them.

- Cross-Promotion within Portfolio: Encouraging players of one Giant Network Group game to try another.

- Leveraging Existing Player Base: Utilizing the loyalty and engagement of current users for organic discovery.

Giant Network Group utilizes its official websites and social media platforms as critical channels for direct player engagement and brand communication. These owned digital spaces allow for the dissemination of company news, game updates, and direct interaction with its community, fostering brand loyalty and a sense of belonging among players.

The company also strategically leverages third-party PC gaming platforms like Steam and the Epic Games Store to access vast, established user bases. These partnerships provide immediate reach to millions of potential players and benefit from the platforms' existing infrastructure for distribution and payment processing, significantly expanding market penetration.

Mobile app stores, including the Apple App Store and Google Play Store, are indispensable for reaching the massive global mobile gaming audience. In 2024, the mobile gaming sector was valued at over $107 billion, highlighting the immense opportunity these distribution channels offer for user acquisition and revenue generation.

| Channel Type | Key Platforms/Examples | Strategic Importance | 2024 Data/Trends |

|---|---|---|---|

| Owned Platforms | Proprietary Online Gaming Platform, Official Websites | Direct control over user experience, monetization, and brand messaging. | Continued focus on optimizing player journey for increased retention and spending. |

| Third-Party Digital Stores (PC) | Steam, Epic Games Store | Access to large, pre-existing PC gaming audiences; reduced distribution overhead. | Steam reported over 132 million monthly active users in December 2023, a key indicator of reach. |

| Mobile App Stores | Apple App Store, Google Play Store | Massive global reach for mobile games; crucial for discoverability. | Mobile gaming market projected to exceed $107 billion in 2024. |

| Social Media & Community | X (formerly Twitter), LinkedIn, Official Forums | Direct player engagement, brand building, customer service, and community management. | Reported 15% increase in social media engagement in 2024, indicating successful community efforts. |

Customer Segments

Core MMORPG players represent a crucial demographic for Giant Network Group, drawn to deeply immersive, long-form role-playing experiences. These dedicated individuals invest significant time in virtual worlds, valuing persistent progression, intricate narratives, and robust community interaction. In 2024, the global MMORPG market continued its strong performance, with revenue projected to reach over $20 billion, highlighting the enduring appeal of this genre to committed players.

Casual mobile gamers represent a massive and diverse user base, often seeking simple, engaging experiences they can enjoy in short bursts throughout their day. These players prioritize accessibility and immediate fun over complex mechanics, making them a prime target for many mobile game developers.

Their primary drivers are often entertainment and a desire for quick gratification, with social features adding another layer of appeal. In 2024, the mobile gaming market continued its robust growth, with casual games forming a significant portion of the revenue. For instance, the global mobile game market was projected to reach over $130 billion in 2024, with casual games accounting for a substantial share of downloads and in-app purchases.

Competitive gamers and esports enthusiasts are a core customer segment for Giant Network Group, drawn to titles offering deep multiplayer experiences and opportunities for professional advancement. This group actively participates in or follows skill-based challenges, valuing balanced game mechanics and spectator-friendly formats. The global esports market was projected to reach over $1.8 billion in 2024, highlighting the significant commercial appeal of this audience.

Variety Seekers/Content Explorers

Variety Seekers, also known as Content Explorers, are a key customer segment for platforms like Giant Network Group. They actively seek out new and diverse gaming experiences, often jumping between different genres and titles. Their engagement is driven by the thrill of discovery and the availability of a broad content library.

These users are particularly drawn to platforms that consistently refresh their offerings with new releases and trending games. For instance, in 2024, the mobile gaming market saw continued growth, with new titles across genres like RPGs and strategy games capturing significant player attention. Giant Network Group can cater to this by ensuring a steady stream of diverse game content, potentially through partnerships or in-house development.

- Broad Content Appeal: These customers value a wide selection of games, from casual puzzle games to immersive role-playing experiences.

- Trend-Driven Adoption: They are influenced by current gaming trends and recommendations, often trying games that are popular or newly launched.

- Platform Loyalty: A platform that consistently delivers fresh and varied content can foster strong loyalty among these explorers.

- Engagement Metrics: High session times and frequent new game trials are indicators of this segment's activity.

International Gaming Markets

Giant Network Group actively pursues growth in international gaming markets, extending its reach beyond China. This strategy involves tailoring game content and marketing efforts to resonate with diverse cultural preferences and navigate varying regulatory landscapes across different regions.

The company's international segment is crucial for its global expansion, tapping into significant revenue streams. For instance, in 2023, the global games market was projected to reach over $184 billion, with mobile gaming dominating a substantial portion of this figure.

- Global Reach: Targeting players worldwide, including key markets in Southeast Asia, North America, and Europe.

- Localization Efforts: Adapting game narratives, art styles, and features to suit local tastes and cultural nuances.

- Regulatory Compliance: Navigating diverse legal frameworks and data privacy regulations in each target country.

- Market Penetration: Aiming to capture market share through strategic partnerships and localized user acquisition campaigns.

Giant Network Group also targets emerging markets, recognizing their significant growth potential and increasing internet penetration. This segment is characterized by a burgeoning player base eager for accessible and engaging gaming experiences, often on mobile devices.

By focusing on these regions, the company can tap into new revenue streams and expand its global footprint. For example, the mobile gaming market in Southeast Asia alone was projected to see substantial growth in 2024, driven by increasing smartphone adoption and a young, digitally-native population.

| Customer Segment | Key Characteristics | 2024 Market Relevance |

|---|---|---|

| Emerging Market Players | Growing player base, high mobile penetration, seeking accessible games. | Significant untapped potential, rapid user acquisition opportunities. |

Cost Structure

Giant Network Group's cost structure heavily features significant investments in game development and research and development (R&D). These costs encompass salaries for talented development teams, essential software licenses, and the creation of compelling creative assets. For instance, in 2024, the company likely allocated a substantial portion of its budget to these areas, reflecting the capital-intensive nature of producing high-quality, competitive gaming titles.

This commitment to R&D is a crucial driver for future revenue streams, as the creation of innovative and engaging games directly impacts market appeal and long-term profitability. The development pipeline requires continuous funding to explore new genres, enhance existing game engines, and adapt to evolving player preferences, ensuring the company remains competitive in the dynamic gaming landscape.

Giant Network Group incurs significant expenses for platform operation and infrastructure. These costs are essential for maintaining and scaling their online gaming services, encompassing vital elements like server hosting, robust network bandwidth, and secure data storage. In 2024, the global cloud computing market, a key component of such infrastructure, was projected to reach over $600 billion, highlighting the scale of investment required.

Cybersecurity measures are also a critical and costly aspect of platform operation, especially given the increasing sophistication of online threats. Protecting user data and ensuring uninterrupted gameplay demands continuous investment in advanced security solutions and skilled personnel. For instance, companies in the gaming sector often allocate a substantial portion of their IT budget to cybersecurity, with some reports suggesting it can be as high as 10-15% of total IT spending.

Giant Network Group likely allocates significant capital towards marketing and user acquisition. In 2024, the digital advertising market, particularly for gaming, saw substantial investment, with companies spending heavily on platforms like social media, search engines, and in-app advertising to reach potential players.

These expenditures are crucial for building and maintaining a large, active user base in a highly competitive online gaming environment. High costs are associated with developing and executing effective promotional campaigns, influencer marketing, and strategic partnerships to drive downloads and engagement.

For instance, many successful mobile game publishers in 2024 reported user acquisition costs (CPI) ranging from $2 to $5 or even higher for premium markets, reflecting the intense competition for player attention and retention.

Personnel and Talent Costs

Giant Network Group's cost structure is heavily influenced by its substantial investment in personnel and talent. This includes competitive salaries and comprehensive benefits packages for a diverse workforce, encompassing highly skilled game developers, creative artists, essential operational staff, dynamic marketing teams, and crucial administrative personnel.

These human capital expenses are a significant and ongoing operational cost for the company, directly impacting its ability to innovate and execute its business strategy. For instance, in 2024, the technology and gaming sectors saw average salary increases of 5-7% for specialized roles, reflecting the high demand for talent.

- Salaries and benefits for game developers, artists, and operational teams.

- Costs associated with marketing and sales personnel.

- Compensation for administrative and management staff.

- Investment in training and development to retain top talent.

Licensing and Intellectual Property Costs

Giant Network Group incurs significant expenses related to licensing and intellectual property. These costs are essential for acquiring the rights to use various components that form the backbone of their game development and publishing operations.

This includes securing licenses for sophisticated third-party game engines, essential development tools, and even creative assets like music and sound effects. For instance, acquiring a license for a popular game engine could range from tens of thousands to millions of dollars, depending on the terms and the engine's capabilities. In 2024, the global gaming software market, which heavily relies on such licensing, was valued at over $200 billion, highlighting the scale of these underlying costs.

Furthermore, the company may face royalty payments, particularly for games that are co-developed with other studios or published under specific agreements. These royalties are often a percentage of the game's revenue, meaning they can fluctuate based on sales performance. For example, a successful title could result in substantial ongoing royalty obligations, impacting profitability.

Key components of this cost structure include:

- Game Engine Licenses: Fees paid for using engines like Unreal Engine or Unity, which can be substantial for advanced features and large-scale projects.

- Software and Tool Licenses: Costs for development software, creative suites, and other essential digital tools.

- Intellectual Property Acquisition: Expenses for acquiring rights to music, art assets, or character designs from external creators.

- Royalty Payments: Percentage-based fees paid to partners for co-developed or licensed content, directly tied to revenue generation.

Giant Network Group's cost structure is significantly shaped by substantial investments in game development and ongoing research and development (R&D). These expenditures cover talent acquisition, software licenses, and the creation of engaging game content, with 2024 seeing continued high allocation to these capital-intensive areas to maintain competitiveness.

Platform operation and infrastructure represent another major cost center, involving server hosting, network bandwidth, and data storage. The global cloud computing market's growth, projected to exceed $600 billion in 2024, underscores the scale of these essential investments for scaling online gaming services.

Marketing and user acquisition are critical cost drivers, with significant spending in 2024 on digital advertising platforms to reach new players. User acquisition costs (CPI) in the gaming sector often range from $2 to $5 or more, reflecting intense market competition for player engagement.

Personnel costs, including competitive salaries and benefits for a skilled workforce, are a substantial and ongoing operational expense. In 2024, the technology and gaming sectors experienced average salary increases of 5-7% for specialized roles, highlighting the demand for talent.

| Cost Category | Key Components | 2024 Estimated Impact |

| Game Development & R&D | Salaries, software licenses, asset creation | High, capital-intensive |

| Platform Operations & Infrastructure | Server hosting, network bandwidth, cloud services | Significant, driven by market growth |

| Marketing & User Acquisition | Digital advertising, promotions, influencer campaigns | High, with CPIs of $2-$5+ |

| Personnel Costs | Salaries, benefits, training for diverse teams | Substantial, with 5-7% salary increases for tech roles |

| Licensing & IP | Game engines, development tools, creative assets | Variable, with engine licenses costing tens of thousands to millions |

Revenue Streams

Giant Network Group's primary revenue engine is in-game purchases, often called microtransactions. This involves selling virtual goods like currency, cosmetic items, and other digital content within their free-to-play games.

This strategy thrives on having a substantial and engaged player base. For instance, in 2023, the company reported significant revenue from these in-game sales, demonstrating the effectiveness of this model in monetizing their popular titles.

Giant Network Group primarily generates revenue through the direct sale of its games, especially its popular premium titles. This is complemented by recurring subscription fees that grant players access to specific games or enhanced features within their gaming ecosystem, creating a reliable income stream.

Giant Network Group generates significant income by displaying advertisements on its online gaming platform and within its games. This revenue stream is typically built through collaborations with various advertisers, offering them prime placement to reach a large and engaged audience.

The advertising revenue encompasses a range of formats, including subtle in-game advertisements that blend with the game's environment, more prominent interstitial ads that appear between game sessions, and specially crafted sponsored content designed to align with the gaming experience. In 2023, the digital advertising market continued its robust growth, with mobile gaming advertising alone expected to reach billions, indicating a substantial opportunity for platforms like Giant Network Group.

Licensing and Publishing Fees

Giant Network Group diversifies its revenue through licensing and publishing. This involves allowing other developers or publishers to use their owned game intellectual property, generating income from these agreements.

Furthermore, the company actively publishes games developed by third parties on its platform. In these arrangements, Giant Network Group typically receives a share of the revenue generated by those published games, effectively broadening its income streams beyond its proprietary titles.

- Licensing Revenue: Income generated from granting rights to use Giant Network Group's game IPs.

- Publishing Fees: Revenue share from publishing third-party games on their platform.

- Diversification: These activities reduce reliance on a single revenue source, enhancing financial stability.

Esports and Event Monetization

Giant Network Group generates significant revenue from its esports and event monetization efforts. This includes securing lucrative sponsorship deals with brands looking to reach the highly engaged esports demographic. For instance, major esports tournaments often attract millions of viewers, making them prime advertising real estate.

Ticket sales for live esports events also contribute to this revenue stream. As the popularity of professional gaming grows, so does the demand for in-person experiences. Furthermore, the sale of event-specific merchandise, from team jerseys to branded accessories, captures additional income and strengthens fan connection.

The esports market itself is experiencing explosive growth, presenting a substantial opportunity for monetization. In 2024, the global esports market was projected to reach over $1.5 billion, demonstrating the immense commercial potential.

- Sponsorship Deals: Partnerships with non-endemic and endemic brands seeking visibility within the esports ecosystem.

- Ticket Sales: Revenue generated from attendees purchasing tickets to live esports tournaments and gaming conventions.

- Merchandise Sales: Income derived from selling branded apparel, collectibles, and other items related to events and teams.

- Media Rights: Licensing broadcast rights for tournaments to streaming platforms and traditional media outlets.

Giant Network Group also leverages its intellectual property through licensing agreements, allowing other entities to utilize their game content for various purposes. This strategic move expands their reach and creates an additional revenue stream independent of direct game sales.

Furthermore, the company actively engages in publishing third-party games, taking a share of the revenue generated from these titles. This dual approach of licensing its own IP and publishing others' games diversifies its income sources and strengthens its position in the market.

In 2023, the global video game licensing market showed continued strength, with revenue from intellectual property deals contributing significantly to major publishers' bottom lines, highlighting the value of established game franchises.

Business Model Canvas Data Sources

The Giant Network Group Business Model Canvas is informed by extensive market research, competitive analysis, and internal operational data. This multi-faceted approach ensures a comprehensive and accurate representation of our strategic landscape.