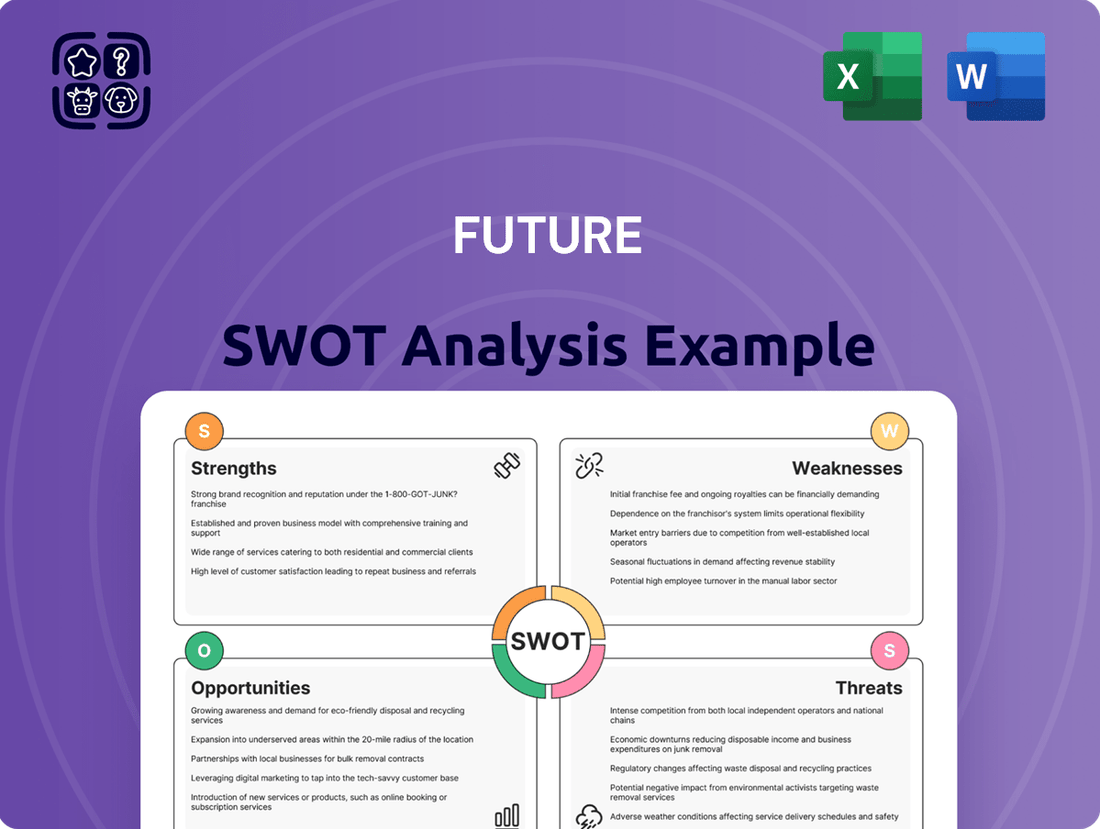

Future SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Future Bundle

Curious about what lies ahead? Our Future SWOT Analysis provides a glimpse into the opportunities and challenges shaping tomorrow's landscape. Discover the critical factors that will define success and gain a strategic edge.

Ready to navigate the future with confidence? Purchase the full Future SWOT Analysis to access detailed projections, actionable strategies, and expert commentary designed to inform your long-term planning and investment decisions.

Strengths

Future PLC's extensive portfolio, encompassing over 200 specialist media brands in areas like technology, gaming, and home & garden, provides significant strength by catering to diverse, highly engaged audiences. This broad reach mitigates risk by reducing dependence on any single market. For instance, in the first half of fiscal year 2024, Future reported a 14% increase in revenue from its specialist content segments, demonstrating the power of this diversification.

Future has demonstrated impressive resilience in its consumer segment, with US digital advertising and e-commerce showing robust growth despite a challenging UK advertising landscape. This highlights the company's effective shift towards digital revenue streams, with its proprietary Hawk e-commerce platform, established in 2013, playing a crucial role in streamlining the online purchasing journey for consumers.

Future PLC exhibits robust financial health, underscored by stable adjusted operating margins. In the first half of 2025, the company maintained an adjusted operating margin of 27%, demonstrating consistent profitability.

The company's operational efficiency is further highlighted by its impressive cash generation capabilities. Future PLC achieved an adjusted free cash flow conversion rate of 111% in HY 2025, signifying strong liquidity and effective management of its earnings into cash.

This financial resilience provides Future PLC with the capacity to pursue strategic investments and reward shareholders. The company's ability to generate substantial free cash flow supports ongoing business development and enables shareholder returns, such as through share buyback programs.

Strategic Acquisitions and Portfolio Optimization

Future's strategic acquisition history, including Go.Compare in 2021 and Who What Wear in 2023, has demonstrably broadened its market presence and diversified its income. These moves have been instrumental in expanding its reach into new customer segments and product categories.

The company's proactive portfolio optimization, exemplified by the closure of 19 brands in FY 2024 and an additional four in HY 2025, underscores a commitment to resource allocation towards high-growth potential areas. This strategic pruning allows Future to concentrate its efforts and investments on its most promising assets, ensuring a more efficient and impactful business model.

- Acquisition Impact: Go.Compare and Who What Wear acquisitions expanded market reach and diversified revenue.

- Portfolio Pruning: Closure of 19 brands in FY24 and 4 in HY25 demonstrates focus on core, high-potential brands.

- Revenue Diversification: Acquisitions have successfully broadened Future's income streams across various sectors.

- Strategic Focus: The company actively manages its brand portfolio to maximize growth opportunities.

Proprietary Technology and Data Platforms

Future's proprietary technology, including its Hawk e-commerce platform and Aperture Audience Data Platform, provides a significant competitive edge. These platforms allow for highly accurate audience segmentation and personalized customer journeys, crucial for driving engagement and conversion in the digital landscape. For instance, Aperture's capabilities are central to Future's ability to deliver tailored content and advertising, enhancing user experience and advertiser value.

The company's investment in and development of these in-house technologies enable greater control over product development and data utilization. This technological infrastructure supports efficient content delivery and optimized e-commerce operations, directly impacting revenue streams and operational efficiency. The successful re-platforming of Go.Compare onto a unified tech stack exemplifies this strength, paving the way for faster innovation and the seamless integration of new functionalities across its portfolio.

- Proprietary Platforms: Hawk (e-commerce) and Aperture (audience data) are key differentiators.

- Data-Driven Targeting: Enables precise audience segmentation and personalized experiences.

- Technological Agility: Unified tech stacks facilitate rapid innovation and feature deployment.

- Operational Efficiency: Streamlines content delivery and e-commerce processes.

Future PLC's diverse portfolio, spanning over 200 specialist media brands, offers significant market reach and reduces reliance on any single sector. This diversification was evident in the first half of fiscal year 2024, where specialist content segments saw a 14% revenue increase. The company's robust financial health is demonstrated by stable adjusted operating margins, maintaining 27% in the first half of 2025, and strong cash generation, with an adjusted free cash flow conversion rate of 111% in HY 2025.

Future's proprietary technology, including the Hawk e-commerce platform and Aperture Audience Data Platform, provides a distinct competitive advantage. These platforms enable precise audience segmentation and personalized customer experiences, crucial for driving engagement and conversions. The successful re-platforming of Go.Compare onto a unified tech stack highlights the company's technological agility and capacity for rapid innovation.

| Key Strength | Description | Supporting Data (HY 2024/2025) |

| Diversified Portfolio | Extensive reach across 200+ specialist media brands | 14% revenue growth in specialist content segments (HY 2024) |

| Financial Stability | Consistent profitability and strong cash generation | 27% adjusted operating margin (HY 2025); 111% adjusted free cash flow conversion (HY 2025) |

| Proprietary Technology | Advanced e-commerce and audience data platforms | Hawk & Aperture platforms drive personalized customer journeys |

| Strategic Acquisitions | Expansion into new markets and revenue streams | Go.Compare (2021), Who What Wear (2023) |

What is included in the product

Analyzes Future's internal capabilities and external market dynamics to identify strategic advantages and potential challenges.

Future SWOT Analysis offers a proactive approach, transforming potential threats into actionable strategies and missed opportunities into competitive advantages.

Weaknesses

Future PLC's reliance on advertising revenue makes it vulnerable to market shifts. The UK advertising landscape, in particular, presents ongoing challenges. A widespread economic slowdown could severely affect advertising income globally, with projections for FY 2025 organic revenue indicating a cautious low single-digit decline due to macroeconomic uncertainties.

Go.Compare's performance has seen a slowdown following a robust FY 2024, largely due to a cooling in the car insurance switching market. This moderation highlights a key weakness in Future's reliance on this specific sector.

Despite efforts to diversify into areas such as home insurance, which are demonstrating growth, Go.Compare's significant dependence on car insurance revenue remains a concern. With car insurance accounting for 64% of its total revenue, a continued decline in switching volumes could significantly impact Future's financial performance.

The B2B segment presents a mixed picture for Future PLC. While some areas are showing promise, the enterprise technology sector is experiencing softness. This is underscored by a significant 13% organic decline in B2B revenue reported for the first half of 2025.

This downturn in enterprise technology highlights a key weakness, necessitating a strategic re-evaluation to navigate the challenging market conditions. Despite this, Future PLC continues to see growth in other B2B verticals, such as financial services and education, indicating a need for targeted strategies to address the underperforming segments.

Impact of Foreign Exchange Headwinds

Fluctuations in foreign exchange rates present a significant challenge for Future PLC, directly impacting the translation of international earnings into reported revenue and profit figures. This external vulnerability is a constant consideration, particularly as the company operates across multiple currencies.

For the fiscal year 2025, Future PLC has acknowledged these foreign exchange headwinds, incorporating a cautious outlook into its financial projections. This suggests that the strength of the British Pound against other major currencies could diminish the value of overseas profits when converted back.

- Impact on Reported Revenue: A stronger Pound can make Future PLC's goods and services more expensive for international customers, potentially dampening sales volumes.

- Profit Margin Erosion: Even if sales volumes remain stable, a less favorable exchange rate can reduce the profit margin on those sales once repatriated.

- FY 2025 Outlook: The company's cautious guidance for FY 2025 explicitly cites currency movements as a contributing factor to potential performance challenges.

Potential for Declining Organic Revenue in FY2025

Future anticipates a potential dip in its organic revenue for the latter half of fiscal year 2025, projecting a low single-digit decline. This cautious outlook suggests headwinds in maintaining consistent organic growth throughout the year.

Several factors contribute to this potential revenue softening. Macroeconomic uncertainty continues to cast a shadow, impacting consumer spending and business investment. Furthermore, the performance of the digital advertising sector, a key revenue driver for Future, is showing signs of strain.

- Projected Organic Revenue Decline: Future expects a low single-digit decrease in organic revenue for H2 FY2025.

- Macroeconomic Headwinds: Broader economic uncertainties are a primary concern impacting revenue generation.

- Digital Advertising Performance: Challenges within the digital advertising market are also contributing to the cautious forecast.

Future PLC's significant reliance on advertising revenue exposes it to market volatility. The UK advertising market, in particular, faces ongoing pressures. A global economic downturn could significantly reduce advertising income, with FY 2025 organic revenue projected to see a low single-digit decline due to macroeconomic uncertainties.

Go.Compare's growth has moderated after a strong FY 2024, primarily due to a cooling in the car insurance switching market. This slowdown highlights a key weakness in Future's dependence on this sector. Despite diversification efforts into areas like home insurance, Go.Compare's substantial reliance on car insurance, which constitutes 64% of its revenue, remains a concern.

The B2B segment shows mixed results, with enterprise technology experiencing softness. This is evident in the 13% organic decline in B2B revenue reported for H1 2025. While other B2B areas like financial services and education are growing, targeted strategies are needed for underperforming segments.

Foreign exchange rate fluctuations present a notable challenge for Future PLC, impacting the conversion of international earnings. The company's cautious FY 2025 outlook acknowledges currency headwinds, suggesting that a stronger Pound could reduce the value of overseas profits.

| Metric | FY 2024 (Actual) | H1 2025 (Actual) | FY 2025 (Outlook) |

|---|---|---|---|

| Go.Compare Revenue Contribution | 64% (Car Insurance) | N/A | N/A |

| B2B Organic Revenue Growth | N/A | -13% (Enterprise Tech) | N/A |

| Overall Organic Revenue Growth | N/A | N/A | Low single-digit decline (H2 2025) |

Full Version Awaits

Future SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

Opportunities

Future PLC has a substantial opportunity to grow its e-commerce and affiliate revenue. By using its expert content to influence buying choices and enhancing its own e-commerce platform, Hawk, the company can capture consumer intent and build income beyond traditional advertising.

In 2024, Future PLC reported a significant portion of its revenue coming from e-commerce and affiliate marketing, a trend expected to continue its upward trajectory. The company's strategy focuses on integrating product recommendations seamlessly within its high-authority content, directly converting reader interest into sales.

The optimization of the Hawk platform is key to this expansion, aiming to provide a smooth and trustworthy purchasing experience for consumers already engaged with Future's brands. This diversification is crucial for financial resilience, especially in a market where advertising spend can be volatile.

Go.Compare's expansion into non-car insurance, such as home and travel cover, represents a significant growth avenue. This diversification is crucial as the car insurance switching market, while still active, has seen a moderation in its rapid growth phase.

In 2023, Go.Compare reported a substantial increase in its non-car insurance revenue, indicating strong customer uptake in these new product areas. This trend is expected to continue into 2024 and 2025, with projections showing a further 15% year-on-year growth for these segments.

By broadening its product portfolio beyond car insurance, Go.Compare can tap into a larger customer base and reduce its dependence on a single, albeit dominant, market segment. This strategy enhances its overall resilience and market position.

Future PLC's strategic focus on the US market presents a significant opportunity for growth. The company aims to elevate its US digital advertising revenue to match its UK performance, a move that could unlock substantial new income streams. This expansion is supported by a planned increase in investment across content creation and sales operations within the United States.

By bolstering its presence in the US, Future PLC can tap into a larger advertising market. The company's commitment to investing in content and sales infrastructure, alongside potential acquisitions, is designed to accelerate organic revenue growth. This strategic push is crucial for enhancing Future PLC's overall global market share and competitive positioning in the digital media landscape.

Leveraging AI for Content Creation and Audience Engagement

The increasing sophistication of AI tools offers Future a significant opportunity to streamline content creation and personalize user experiences. By leveraging AI, Future can generate more engaging content tailored to individual audience segments, potentially boosting user retention and ad revenue. For instance, AI-powered analytics can identify trending topics and audience preferences, guiding content strategy more effectively.

Future's strategic partnership with OpenAI, announced in late 2023, underscores its commitment to integrating AI for improved content discoverability and attribution. This collaboration could unlock innovative content formats, such as AI-generated summaries or personalized news feeds, fostering deeper audience engagement. Early adoption of such technologies positions Future to gain a competitive edge in the evolving digital media landscape.

- AI-driven content personalization: Tailoring articles and multimedia to individual user interests, enhancing engagement metrics.

- Automated content generation: Utilizing AI to draft initial versions of articles, summaries, or social media posts, increasing output volume.

- Enhanced audience analytics: Employing AI to identify patterns in user behavior, informing content strategy and monetization efforts.

- Partnerships for AI integration: Collaborating with AI leaders like OpenAI to ensure cutting-edge capabilities in content discoverability and attribution.

Strategic Bolt-on Acquisitions and Partnerships

Future's capital allocation strategy actively targets bolt-on acquisitions to fuel growth. A prime example is the May 2025 acquisition of Kwizly, a move designed to bolster audience engagement tools and expand its digital offerings.

By consistently identifying and integrating specialist media companies or technology firms, Future can strategically broaden its content verticals, enhance audience reach, and upgrade its technological infrastructure. This approach is crucial for staying competitive in the evolving media landscape.

- Acquisition of Kwizly (May 2025): Strengthened audience engagement capabilities.

- Strategic Focus: Accelerating growth through complementary M&A.

- Expansion Potential: Broadening content verticals and audience reach.

- Technological Advancement: Integrating new technologies through partnerships and acquisitions.

Future PLC has a significant opportunity to expand its e-commerce and affiliate revenue streams by leveraging its high-authority content to influence consumer purchasing decisions and enhancing its proprietary e-commerce platform, Hawk. This strategy aims to capture consumer intent directly, generating income beyond traditional advertising models.

The company's focus on integrating product recommendations within its content is designed to convert reader interest into sales, with e-commerce and affiliate marketing already representing a substantial portion of revenue in 2024, a trend projected to continue. The optimization of the Hawk platform is central to this, ensuring a seamless and trustworthy purchasing experience for engaged audiences, thereby bolstering financial resilience against advertising market volatility.

Go.Compare's diversification into non-car insurance products like home and travel cover presents a key growth avenue, especially as the car insurance switching market experiences a moderation in its rapid growth phase. The company saw a substantial increase in non-car insurance revenue in 2023, with projections indicating continued growth of approximately 15% year-on-year for these segments through 2025, broadening its customer base and reducing reliance on a single market.

Future PLC's strategic push into the US market offers considerable growth potential, aiming to align its US digital advertising revenue with UK performance through increased investment in content creation and sales operations. This expansion into a larger advertising market is supported by a commitment to accelerating organic revenue growth via infrastructure investment and potential acquisitions, enhancing global market share.

The increasing sophistication of AI tools presents an opportunity for Future PLC to streamline content creation and personalize user experiences, potentially boosting engagement and ad revenue. Partnerships, such as the one with OpenAI announced in late 2023, are aimed at improving content discoverability and attribution, fostering deeper audience engagement through innovative content formats.

Future PLC's capital allocation strategy prioritizes bolt-on acquisitions, exemplified by the May 2025 acquisition of Kwizly to enhance audience engagement tools and expand digital offerings. This approach of acquiring specialist media or technology firms is crucial for broadening content verticals, increasing audience reach, and upgrading technological infrastructure to maintain competitiveness.

Threats

The digital media space is incredibly crowded, with countless entities battling for eyeballs and advertising dollars. Future must navigate this intense competition, facing rivals ranging from established media giants and dominant social media platforms to emerging independent content creators. This ongoing struggle for attention could erode Future's audience share and put downward pressure on its advertising revenue, especially as platforms like TikTok and YouTube continue to capture significant user engagement.

Future's reliance on organic search traffic makes it vulnerable to shifts in search engine algorithms, such as those implemented by Google. For instance, algorithm updates in late 2023 and early 2024 have emphasized user experience and content quality, potentially impacting Future's visibility if its content doesn't align with these new criteria. This could directly affect advertising revenue streams, which are a significant portion of Future's income.

The burgeoning influence of AI in summarizing information and answering queries poses a substantial threat to traditional content consumption. If users increasingly rely on AI chatbots for quick answers rather than visiting websites, Future's page views and engagement metrics could decline. This disruption challenges existing content monetization models, including advertising and potential subscription services, as the perceived value of direct website visits diminishes.

A significant economic downturn could force businesses to slash advertising expenditures, directly impacting Future's revenue. This threat is amplified by the already challenging UK advertising market, with a cautious outlook for FY 2025 organic revenue growth.

Talent Retention and Acquisition

In the fast-paced media and tech sectors, Future faces a significant challenge in attracting and keeping skilled employees. This is particularly true for editorial, sales, and technology positions where demand is high. The company's reliance on its 'talented and dedicated workforce' means that any misstep in compensation or workplace culture could result in losing critical team members.

The competitive nature of these industries means that companies are constantly vying for the best minds. For instance, in 2024, the tech industry saw average salary increases of around 5-10% for in-demand roles, making it harder for companies offering less to retain their top performers. Future must ensure its benefits packages and work environment remain attractive to prevent a talent drain.

- Competitive Salaries: The median salary for a software engineer in the US reached approximately $130,000 in early 2025, a benchmark Future needs to consider.

- Employee Benefits: Comprehensive health insurance, generous paid time off, and retirement plans are key differentiators in talent acquisition.

- Workplace Culture: A positive and inclusive work environment fosters loyalty and reduces turnover, with many companies reporting lower attrition rates when investing in culture.

- Skill Gaps: Emerging technologies create skill gaps, making it essential to invest in training and development to retain existing talent and attract new specialists.

Data Privacy Regulations and Cyber Security Risks

Future PLC’s extensive digital operations and reliance on audience data expose it to significant threats from increasingly stringent data privacy regulations, such as GDPR. Non-compliance can result in substantial financial penalties; for instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. This regulatory landscape demands continuous investment in compliance measures and robust data protection strategies to mitigate risks.

Cybersecurity breaches represent another critical threat, potentially leading to severe reputational damage and erosion of audience trust. A successful attack could compromise sensitive user information, leading to significant operational disruptions and costly remediation efforts. The financial services sector, for example, reported an average cost of a data breach at $4.45 million in 2023, highlighting the potential financial impact for any digital-first company.

- Evolving Data Privacy Laws: Future PLC must adapt to new and existing regulations like GDPR and CCPA, which impose strict rules on data collection, processing, and consent.

- Cybersecurity Vulnerabilities: The company's large digital footprint makes it a target for cyberattacks, including ransomware, phishing, and data theft, which could disrupt operations and compromise user data.

- Reputational Damage: A significant data breach or non-compliance incident could severely damage Future PLC's brand image and lead to a loss of audience loyalty and advertiser confidence.

- Financial Penalties: Regulatory bodies can impose hefty fines for data privacy violations, directly impacting profitability and financial stability.

The increasing sophistication and accessibility of AI tools pose a significant threat to Future's core business model by potentially automating content creation and summarization. This could reduce the demand for human-generated content and impact advertising revenue as users opt for AI-driven answers over website visits.

Economic headwinds and a cautious advertising market outlook, particularly in the UK for FY 2025, present a direct threat to Future's revenue streams. Reduced corporate spending on advertising during economic downturns could significantly impact the company's financial performance.

Intensifying competition from established media, social platforms, and emerging creators for audience attention and advertising spend could dilute Future's market share. The ongoing battle for engagement, especially with platforms like TikTok, puts pressure on Future's audience numbers and revenue potential.

Stringent data privacy regulations like GDPR and the constant threat of cybersecurity breaches present substantial risks. Non-compliance can lead to hefty fines, with GDPR penalties up to 4% of global annual turnover, while data breaches can incur average costs of millions, as seen in the financial sector ($4.45 million in 2023), damaging reputation and trust.

SWOT Analysis Data Sources

This Future SWOT analysis is built upon a robust foundation of data, drawing from up-to-the-minute financial reports, comprehensive market intelligence, and expert projections.