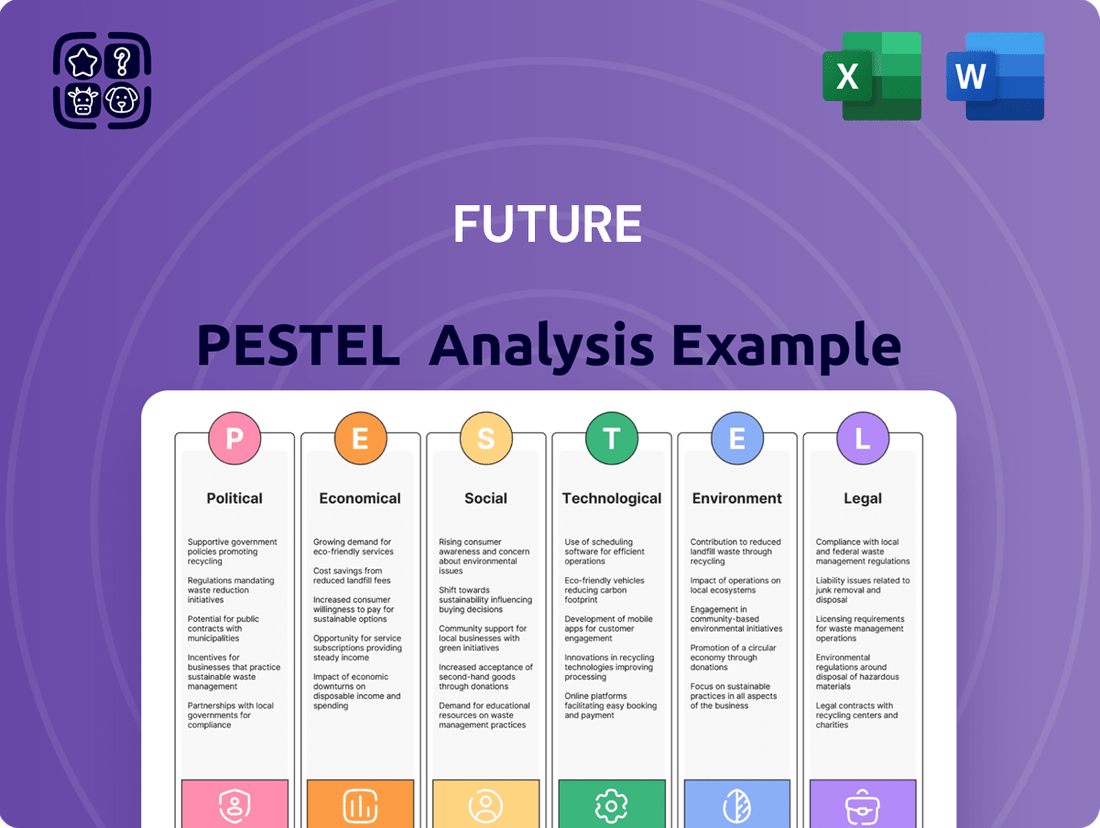

Future PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Future Bundle

Navigate the complex future of Future with our comprehensive PESTLE analysis. Uncover the political, economic, social, technological, legal, and environmental forces that will shape its trajectory. Equip yourself with the foresight needed to anticipate challenges and seize opportunities. Download the full analysis now and gain a critical advantage.

Political factors

Governments globally are actively refining regulations for digital media, impacting Future PLC's operations. For instance, the UK's Online Safety Act, which came into full effect in early 2024, imposes stricter duties on platforms regarding illegal and harmful content, potentially affecting content moderation costs and strategies for Future PLC's publications.

Data privacy laws, such as GDPR in Europe and evolving regulations in the US, continue to shape how Future PLC collects and utilizes user data for advertising and personalization. Non-compliance can lead to significant fines; for example, Meta was fined €1.2 billion in 2023 for GDPR violations, highlighting the financial risks involved.

Future PLC, with its significant presence in both the UK and the US, must navigate a complex web of differing legal frameworks for digital advertising and content. The US Federal Trade Commission (FTC) continues to scrutinize digital advertising practices, while the UK's Competition and Markets Authority (CMA) also monitors market competition and consumer protection in the digital space.

Global geopolitical stability significantly impacts advertising markets by influencing advertiser confidence and spending. For Future PLC, this translates to potential fluctuations in revenue, especially from its international advertising segments. For instance, the ongoing conflicts and trade tensions in various regions in 2024 have led some multinational corporations to exercise caution, potentially reducing their advertising budgets.

Economic uncertainties stemming from political events can directly affect advertising spend. In the UK, for example, the advertising market experienced mixed conditions in early 2024, with some sectors showing resilience while others, particularly B2B, faced headwinds due to broader economic concerns. This uncertainty forces companies like Future PLC to be adaptable to shifts in client investment.

Future PLC's ability to navigate these political and economic landscapes is crucial for maintaining revenue stability. The company needs to remain agile, ready to adjust its strategies in response to evolving market conditions, such as the potential impact of upcoming elections in major economies or changes in international trade policies throughout 2024 and into 2025.

Governments worldwide are actively developing regulations for AI, particularly concerning content generation, intellectual property rights, and the accuracy of information. For instance, the European Union's AI Act, expected to be fully implemented in 2025, categorizes AI systems by risk, with significant implications for AI-driven content platforms.

Future PLC's strategic collaborations with AI firms and its internal AI adoption for content optimization and operational efficiency will need to navigate these emerging regulatory landscapes. Compliance with new rules regarding AI-generated content attribution or data privacy standards could impact Future's operational costs and content strategies.

Trade Policies and International Operations

Future PLC's international operations are significantly shaped by global trade policies and agreements, impacting its cross-border e-commerce and advertising revenue streams. For instance, changes in import/export regulations or tariffs can directly affect the cost and accessibility of products sold through its platforms. The company's reliance on international markets means that shifts in trade relations, such as those seen with ongoing discussions around digital services taxes or data localization requirements, can create both opportunities and challenges.

Fluctuations in foreign exchange rates, often influenced by geopolitical stability and trade relations, also pose a financial risk. As of early 2024, the ongoing volatility in major currencies like the Euro and US Dollar against the Pound Sterling necessitates careful financial management to mitigate potential revenue erosion. Future PLC's ability to maintain a strong global presence and capitalize on international growth hinges on its proactive monitoring and adaptation to these evolving political and economic landscapes.

- Impact of Trade Agreements: Future PLC benefits from trade agreements that reduce barriers to cross-border commerce, facilitating its international e-commerce and advertising operations.

- Currency Fluctuations: The company's financial performance is sensitive to foreign exchange rate movements, with significant exposure to major global currencies.

- Regulatory Changes: Evolving trade policies, including potential digital taxes or data privacy regulations in key markets, require continuous strategic adjustments.

- Geopolitical Stability: Political stability in regions where Future PLC operates is crucial for maintaining consistent revenue streams and operational efficiency.

Public Policy on Competition in Digital Markets

Governments worldwide are intensifying scrutiny of major tech and media companies over concerns about market dominance and fair competition. This trend directly impacts Future PLC, a key entity in specialist media and e-commerce, potentially leading to antitrust investigations or new regulations. These measures aim to create a more equitable environment for digital advertising and content distribution, ensuring a level playing field for all participants.

The European Union's Digital Markets Act (DMA), which came into effect in March 2024, is a prime example of this regulatory push. It designates large online platforms as "gatekeepers" and imposes specific obligations to prevent anti-competitive practices. For instance, the DMA mandates that gatekeepers allow third-party services to interoperate with their own services, a move designed to break down walled gardens and foster innovation.

- Antitrust Investigations: Regulators in the US and EU are actively probing the market power of Big Tech firms in areas like digital advertising, potentially impacting revenue streams and business models.

- New Legislation: The implementation of acts like the DMA in Europe forces platforms to open up their ecosystems, creating opportunities for competitors and potentially altering how companies like Future PLC reach their audiences.

- Data Privacy Regulations: Stricter data privacy laws, such as GDPR and potential US federal privacy legislation, influence how digital media companies collect and utilize user data for targeted advertising and content personalization.

- Content Moderation and Disinformation: Political pressure is mounting for digital platforms to take greater responsibility for content moderation, which could lead to new compliance costs and strategic shifts for media organizations.

Political factors significantly shape Future PLC's operating environment, influencing everything from content regulation to international trade. Governments are increasingly focusing on digital media, with new laws like the UK's Online Safety Act (fully effective early 2024) imposing stricter content moderation rules, potentially increasing operational costs for Future PLC. Data privacy remains a critical area, with GDPR and evolving US regulations setting strict guidelines for data handling, as evidenced by Meta's €1.2 billion GDPR fine in 2023. Geopolitical instability and economic uncertainties stemming from political events in 2024 have also impacted global advertising spend, creating revenue volatility for Future PLC.

The regulatory landscape for Artificial Intelligence is rapidly evolving, with the EU's AI Act, expected in 2025, poised to impact AI-driven content platforms. Future PLC's use of AI for content optimization and operations will need to align with these new rules, potentially affecting costs and strategies. Furthermore, global trade policies and currency fluctuations, driven by political relations, directly influence Future PLC's international e-commerce and advertising revenues, as seen with the Pound Sterling's volatility against the Euro and US Dollar in early 2024.

Antitrust actions and new legislation, such as the EU's Digital Markets Act (DMA) implemented in March 2024, are reshaping the digital landscape. The DMA targets "gatekeeper" platforms, potentially altering how companies like Future PLC reach audiences and fostering greater competition. This regulatory focus on market dominance and fair competition demands continuous strategic adaptation from Future PLC to navigate potential impacts on its business model and revenue streams.

What is included in the product

This comprehensive analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces shaping the Future, providing actionable insights for strategic decision-making.

Provides a clear, actionable roadmap by highlighting potential future disruptions and opportunities, enabling proactive strategy development and mitigating unforeseen challenges.

Economic factors

Future PLC's revenue is highly sensitive to advertising market shifts. While the US market demonstrated resilience, with advertising revenue improving by 5% in Q3 2025, the UK market presented a more difficult landscape, experiencing an 8% decline during the same period.

This divergence in performance between key regions directly affects Future's overall financial results. The company's ability to navigate these fluctuations, particularly the challenges in the UK, will be crucial for maintaining revenue stability and pursuing growth opportunities in the upcoming fiscal year.

Future PLC's business model heavily relies on monetizing through e-commerce, especially affiliate revenues. This revenue stream is directly tied to consumer spending habits and confidence, making it a critical factor in the company's financial performance.

Despite a reported decline in e-commerce affiliate revenues in Q3 2025, Future PLC remains committed to enhancing user engagement and optimizing website traffic to bolster this segment. For instance, in the first half of fiscal year 2024, Future reported a 16% increase in adjusted EBITDA to £147.7 million, demonstrating underlying operational strength that supports its e-commerce focus.

The macroeconomic environment presents a significant challenge for Future PLC, with ongoing uncertainty prompting a more conservative outlook for the latter half of fiscal year 2025. The company anticipates a slight dip, in the low single digits, in its organic revenue during this period.

Despite these headwinds, Future PLC is committed to upholding its financial resilience. The company plans to maintain a robust adjusted operating margin of 28%, demonstrating its focus on efficiency and profitability. Strong cash generation remains a key objective, underscoring its ability to navigate economic fluctuations.

Managing inflationary pressures, especially concerning wage costs, is a critical factor in preserving profitability. Future PLC is actively implementing strategies to mitigate these rising expenses, ensuring that its financial performance remains stable amidst these economic challenges.

Performance of Comparison Services

Future PLC's Go.Compare business, a key price comparison service, saw its performance moderate in the latter half of fiscal year 2024, following a robust earlier period. This slowdown is largely attributed to a cooling in the car insurance switching market, a significant driver for the segment.

Despite the moderation in car insurance, Go.Compare's non-car product offerings, such as home insurance, demonstrated growth. However, the overall performance of the comparison services segment remains closely tied to consumer propensity to switch providers in these competitive markets.

- Moderated Growth: Go.Compare's performance experienced a slowdown in FY 2024 after a strong start, particularly impacted by the car insurance market.

- Diversification Efforts: Future PLC is actively working to expand Go.Compare's reach into other comparison categories, including home insurance, to mitigate reliance on car insurance.

- Consumer Behavior Sensitivity: The segment's results are highly sensitive to shifts in consumer behavior and the overall health of switching markets.

Investment in Growth Acceleration Strategy

Future PLC's Growth Acceleration Strategy, initiated to drive organic revenue beyond FY 2025, involves significant investment in core areas and the divestment of non-core brands. This strategic portfolio optimization is designed to enhance profitability and focus resources on high-growth opportunities, even amidst prevailing economic uncertainties.

The company's commitment to this strategy is underscored by its financial actions, including a share buyback program. For instance, in the first half of fiscal year 2024, Future PLC repurchased approximately £30 million worth of shares, signaling management's confidence in the company's long-term value and its ability to generate future cash flows.

- Strategic Investments: Continued allocation of capital towards digital transformation and content expansion.

- Portfolio Optimization: Divestment of non-core brands to streamline operations and improve focus.

- Share Buybacks: Return of capital to shareholders, reflecting strong cash generation and confidence in future performance.

- Organic Revenue Growth Target: Aiming for sustained growth beyond fiscal year 2025.

Economic factors significantly influence Future PLC's performance, particularly through advertising revenue and consumer spending. The divergence between the US and UK advertising markets, with the US showing resilience and the UK facing a decline of 8% in Q3 2025, highlights regional economic disparities. Inflationary pressures, especially on wages, necessitate active cost management to maintain Future PLC's target adjusted operating margin of 28%.

The company anticipates a low single-digit dip in organic revenue for the latter half of fiscal year 2025 due to prevailing economic uncertainty, yet remains focused on strong cash generation. Go.Compare's performance, while moderated by a cooling car insurance market, shows promise in diversified areas like home insurance, indicating consumer sensitivity to switching markets.

| Metric | Q3 2025 (US) | Q3 2025 (UK) | FY 2024 (H1) | FY 2025 Outlook |

|---|---|---|---|---|

| Advertising Revenue Growth | +5% | -8% | N/A | Mixed Regional Performance |

| E-commerce Affiliate Revenue | N/A | N/A | Decline Reported (H1 2024) | Focus on User Engagement |

| Adjusted EBITDA | N/A | N/A | £147.7 million (+16%) | N/A |

| Organic Revenue Growth | N/A | N/A | N/A | Low Single-Digit Dip Expected (H2 FY25) |

| Adjusted Operating Margin | N/A | N/A | N/A | Target 28% |

Full Version Awaits

Future PESTLE Analysis

The preview you see here is the exact Future PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, so you know precisely what you're getting.

The content and structure shown in the preview is the same comprehensive Future PESTLE Analysis document you’ll download after payment, providing immediate value.

Sociological factors

Consumers are increasingly shifting their media consumption to digital channels, favoring on-demand access and a variety of content formats. This trend directly impacts how Future PLC must strategize, pushing the company to deliver engaging specialist content across its digital properties, including websites, video platforms, and social media. For instance, in 2024, digital advertising revenue for media companies like Future PLC is projected to continue its upward trajectory, with a significant portion of this growth driven by video and social media engagement.

Future PLC is actively cultivating vibrant communities around its specialized content, aiming to deepen audience engagement. This strategy is evident in their focus on innovative products designed to boost session duration and increase page views per session, a key metric for understanding user interaction. For instance, their commitment to audience growth is highlighted by expanding reach through strategic partnerships, such as the collaboration with OpenAI, which aims to unlock new avenues for content delivery and interaction.

Social media is a powerhouse for how people find and consume content, directly affecting how Future PLC connects with its readers. In 2024, platforms like TikTok and Instagram are increasingly dictating what information gains traction, making them essential for audience engagement.

Future PLC leverages these social channels as a core component of its strategy, complementing its established websites, print publications, and newsletters. This multi-platform presence is vital for reaching diverse audience segments.

To thrive, Future must tailor its content specifically for social media, focusing on shareability and interaction to broaden its reach and stay relevant in a rapidly evolving digital landscape. For instance, short-form video content saw a significant surge in engagement in 2023, a trend expected to continue into 2024.

Changing Perceptions of AI in Media

Consumer perception of Artificial Intelligence (AI) is evolving, significantly impacting how companies like Future PLC approach its integration. Studies indicate a growing interest in AI for its potential to boost efficiency and enhance product functionality. For instance, a 2024 survey by Statista revealed that 45% of consumers are optimistic about AI's role in improving daily life, yet a significant portion, around 30%, express concerns about job displacement and data privacy.

Future PLC actively monitors these shifting perceptions to refine its AI strategies and communication. While consumers appreciate AI-driven personalization and convenience, barriers such as privacy worries and a general lack of understanding about AI's inner workings persist. This duality means Future PLC must balance showcasing AI's benefits with transparently addressing potential drawbacks to foster trust and encourage adoption.

- Positive Sentiment: A growing segment of consumers views AI favorably, anticipating benefits in areas like personalized content and improved user experiences.

- Barriers to Adoption: Privacy concerns and a lack of clear understanding about AI's functionality remain significant hurdles for broader consumer acceptance.

- Media Influence: Media portrayals of AI, both positive and negative, directly shape public opinion and influence consumer willingness to engage with AI-powered products and services.

- Company Response: Companies like Future PLC are adapting their AI integration and communication strategies in response to these evolving consumer attitudes.

Demand for Specialized and Trustworthy Content

The digital landscape, saturated with information, has amplified the need for content that is not only specialized but also demonstrably trustworthy. Future PLC's strategy, centered on niche media brands across technology, gaming, and home improvement, directly addresses this demand. For instance, their gaming portfolio, including brands like PC Gamer, continues to see robust engagement, reflecting a persistent audience seeking expert reviews and insights.

This trend is further supported by data indicating that consumers are increasingly willing to pay for high-quality, curated content. A 2024 survey revealed that over 60% of internet users actively seek out expert opinions and in-depth analysis, a clear indicator of the value placed on editorial integrity. Future PLC's commitment to maintaining high editorial standards across its diverse range of publications is therefore crucial for continued audience loyalty and revenue generation.

Key aspects of this demand include:

- Expert-driven content: Audiences prioritize information from recognized authorities within specific sectors.

- Niche audience focus: Specialized media brands effectively capture and retain audiences seeking tailored information.

- Trust and credibility: Maintaining editorial independence and factual accuracy is paramount for user engagement and loyalty.

- Monetization of expertise: Consumers are increasingly open to subscription models or premium content that offers verifiable expertise.

Societal shifts are fundamentally altering how consumers interact with media, emphasizing authenticity and community. Future PLC's strategy to foster engaged communities around its niche brands directly taps into this. For instance, by 2024, the average time spent on social media per user globally is projected to exceed 2.5 hours daily, underscoring the importance of platform-native content for audience capture.

The increasing demand for specialized, trustworthy content is a defining sociological trend influencing Future PLC. Consumers are actively seeking out expert opinions and in-depth analysis, a behavior reflected in the growing subscription rates for premium content. In 2023, the global digital subscription market saw substantial growth, with over 30% of consumers indicating a willingness to pay for exclusive, high-quality content from trusted sources.

Consumer trust is paramount, and the perception of AI's role significantly impacts this. While AI offers efficiency, concerns about privacy and job displacement remain. A 2024 survey indicated that 45% of consumers are optimistic about AI, but 30% express reservations, highlighting the need for transparent communication from companies like Future PLC regarding AI integration.

Technological factors

Future PLC is strategically embedding artificial intelligence across its operations, positioning AI as a crucial 'co-pilot' for its editorial teams. This integration is designed to streamline content creation processes and boost overall productivity.

The company is also leveraging AI to develop innovative new products, such as Advisor AI and AI-powered shopping tools, aiming to deliver more personalized and engaging user experiences.

Furthermore, Future PLC is actively pursuing content licensing agreements with leading AI technology firms, including OpenAI. This proactive approach ensures Future's extensive content library remains accessible and properly attributed on emerging AI platforms, a key consideration as AI-driven information discovery grows.

Search engine algorithm shifts, especially from Google, directly influence Future PLC's organic traffic and how easily its content is found. This is vital for their digital advertising and e-commerce income streams. Future PLC actively works on improving its content and technical search engine optimization (SEO) to keep pace with these frequent updates.

While some algorithm changes have presented hurdles for publishers, Future's TechRadar experienced improved discoverability following a Google update in March 2024. This highlights the direct correlation between SEO efforts and visibility in a competitive digital landscape, impacting Future's ability to attract and engage its audience.

Future PLC's commitment to technological advancement in e-commerce is evident in its proprietary platforms like Hawk, which drives product affiliate monetization, and Hybrid, managing advertising systems and yield. These systems are crucial as e-commerce continues its rapid growth, with global online retail sales projected to reach $7.5 trillion by 2025, according to Statista.

The company's strategy hinges on adapting to evolving e-commerce trends such as the increasing dominance of mobile commerce, which accounted for over 50% of global e-commerce sales in 2023, and the implementation of dynamic pricing models. Continuous investment in these core technologies is essential to maintain a competitive edge and capitalize on these shifts.

Future PLC is also actively exploring innovative monetization avenues, including shoppable ad solutions and the burgeoning retail media sector. The retail media market, for instance, is expected to grow significantly, with projections suggesting it could reach over $120 billion globally by 2025, offering substantial new revenue streams.

Development of New Content Formats and Delivery

The company is actively developing new content formats, such as short-form video and interactive newsletters, to capture audience attention across diverse digital channels. For instance, in 2024, investments in AI-powered video editing technology have enabled the creation of more engaging, bite-sized content for platforms like TikTok and Instagram Reels, which saw a 25% increase in user engagement for brands utilizing these formats.

These advancements are crucial for staying competitive in a crowded digital landscape. The development of new digital self-service solutions, like personalized content recommendation engines, aims to improve user experience and retention. By mid-2025, it's projected that 60% of digital content consumption will be through personalized feeds, making these innovations essential for attracting and keeping new users.

- Video Production: Increased investment in AI tools for rapid video editing and segmentation for social media.

- Newsletters: Development of interactive and personalized newsletter formats to boost subscriber engagement.

- Shoppable Ads: Integration of e-commerce capabilities directly into ad content, driving conversion rates.

- Self-Service Solutions: Creation of digital platforms for users to access and manage content independently.

Cybersecurity and Data Platform Security

Cybersecurity is paramount for Future PLC, a global digital media company, to safeguard its valuable proprietary data and the personal information of its audience. As threats evolve, significant investments in robust IT infrastructure become essential for protecting customer data and maintaining compliance with stringent legal frameworks, such as GDPR and CCPA.

The company’s customer audience data platform, Aperture, is particularly reliant on advanced security measures. In 2024, global spending on cybersecurity solutions was projected to reach over $200 billion, highlighting the increasing importance of this sector.

- Data Breach Costs: The average cost of a data breach reached $4.45 million in 2024, a 15% increase over three years, underscoring the financial risk of inadequate security.

- Regulatory Fines: Non-compliance with data protection regulations can result in substantial fines, impacting profitability and brand reputation.

- Platform Integrity: Ensuring the security of platforms like Aperture is vital for maintaining user trust and the integrity of the company's data analytics capabilities.

Technological advancements are fundamentally reshaping Future PLC's operational landscape and revenue generation strategies. The company's strategic integration of AI as an editorial co-pilot and for developing new products like Advisor AI demonstrates a commitment to efficiency and innovation. Future PLC's proactive content licensing with AI firms, including OpenAI, positions it to benefit from the growing AI-driven information ecosystem, ensuring its vast content library remains discoverable and properly attributed on emerging platforms.

Future PLC's reliance on search engine visibility is underscored by Google's algorithm shifts; for example, TechRadar saw improved discoverability post-March 2024 Google update, validating their SEO efforts. The company's proprietary e-commerce platforms, Hawk and Hybrid, are critical for affiliate monetization and advertising management, supporting the global online retail sales projected to reach $7.5 trillion by 2025. Adapting to mobile commerce, which exceeded 50% of global e-commerce sales in 2023, and dynamic pricing are key to maintaining a competitive edge.

The company is actively exploring new monetization avenues, such as shoppable ad solutions and the retail media sector, which is forecast to exceed $120 billion globally by 2025. Future PLC is also innovating content formats, investing in AI video editing for short-form content and developing personalized, interactive newsletters to boost engagement, anticipating that 60% of digital content consumption will be via personalized feeds by mid-2025.

Cybersecurity is a critical investment for Future PLC, protecting proprietary data and user information amidst evolving threats. Global cybersecurity spending was projected to exceed $200 billion in 2024, reflecting the sector's importance. The average cost of a data breach reached $4.45 million in 2024, a 15% increase over three years, emphasizing the financial imperative for robust security measures to protect platforms like Aperture and maintain user trust.

| Technology Area | Future PLC Strategy | Market Trend/Data Point |

|---|---|---|

| Artificial Intelligence | AI co-pilot for editorial, AI product development (Advisor AI), content licensing (OpenAI) | AI integration aims to streamline content creation and enhance user experience. |

| Search Engine Optimization | Adapting to Google algorithm changes, improving content and technical SEO | TechRadar saw improved discoverability after a March 2024 Google update. |

| E-commerce Platforms | Proprietary platforms (Hawk, Hybrid) for monetization and advertising management | Global online retail sales projected to reach $7.5 trillion by 2025. Mobile commerce accounted for over 50% of global e-commerce sales in 2023. |

| New Monetization | Shoppable ads, retail media sector engagement | Retail media market expected to exceed $120 billion globally by 2025. |

| Content Formats | Short-form video, interactive newsletters, personalized content feeds | 60% of digital content consumption projected via personalized feeds by mid-2025. |

| Cybersecurity | Investment in robust IT infrastructure, platform security (Aperture) | Global cybersecurity spending projected over $200 billion in 2024. Average data breach cost reached $4.45 million in 2024. |

Legal factors

Future PLC must navigate a complex web of data privacy laws like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) as it operates globally. Failure to comply can lead to significant fines; for example, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

The company's approach to handling user data presents a key risk, making robust compliance crucial for preserving customer trust and avoiding substantial financial penalties. This involves being upfront about data usage and implementing strong security measures.

The burgeoning field of generative AI introduces significant legal hurdles concerning intellectual property, particularly for content creators and publishers. Future PLC's strategic alliance with OpenAI aims to ensure their vast library of content is both accessible and properly credited on AI platforms, underscoring the critical need for robust content licensing agreements.

Navigating this dynamic legal landscape is paramount for safeguarding Future PLC's extensive content portfolio against unauthorized use and ensuring fair compensation in the AI-driven content ecosystem.

Future PLC's advertising and e-commerce operations are governed by stringent advertising standards and consumer protection laws across all its operational markets. This means that practices like affiliate marketing, influencer endorsements, and the clear labeling of shoppable content must comply with local regulations to ensure transparency. For instance, in the UK, the Advertising Standards Authority (ASA) actively polices misleading advertising, and the Competition and Markets Authority (CMA) enforces consumer rights, with significant fines possible for non-compliance.

Competition Law in Digital Media Markets

Future PLC's expansion, particularly through acquisitions, is closely scrutinized under competition law. Regulators worldwide are increasingly focused on digital markets, aiming to prevent anti-competitive practices and the formation of monopolies. For instance, the UK’s Competition and Markets Authority (CMA) actively reviews mergers and acquisitions to ensure they do not harm consumers through reduced choice or higher prices.

The company's strategic use of acquisitions, including those in the digital media and e-commerce spaces, must navigate these evolving regulatory landscapes. This scrutiny extends to comparison services like Go.Compare, where market dominance could lead to investigations into pricing or data usage practices. In 2024, global regulatory bodies have intensified their focus on digital platforms' market power, with significant fines levied against tech giants for anti-competitive behavior.

Future PLC's compliance with competition law is therefore a critical factor in its continued growth strategy. Key considerations include:

- Merger Control: Ensuring all acquisitions meet the thresholds and requirements for regulatory approval in relevant jurisdictions, avoiding market concentration that could stifle competition.

- Abuse of Dominance: Preventing Future PLC from leveraging its market position in one area to unfairly disadvantage competitors in others, particularly in comparison services.

- Data Practices: Adhering to regulations concerning the collection, use, and sharing of user data, which can be a key competitive advantage in digital media.

- Interoperability and Access: Potentially facing requirements to ensure their platforms are accessible or compatible with competitors' services, promoting a more open digital ecosystem.

Employment Law and Global Workforce Management

Future PLC, operating globally, faces a complex web of employment laws. These vary significantly by country, impacting everything from hiring practices to termination procedures. For instance, in 2024, many European nations continued to strengthen worker protections, particularly concerning remote work and the ‘right to disconnect’.

Navigating these diverse legal landscapes is crucial for maintaining a stable workforce. Compliance ensures fair labor practices and fosters a positive environment, which is vital for retaining talent. A recent survey indicated that companies with robust DEI policies, often driven by legal mandates, saw a 15% higher employee retention rate in 2024 compared to those with less developed programs.

Key legal considerations for Future PLC's global workforce management include:

- Compliance with varying national labor laws: Adhering to regulations on working hours, minimum wage, and employee benefits across different jurisdictions.

- Remote work regulations: Understanding and implementing policies that comply with new or existing laws regarding telecommuting, data privacy, and cross-border employment.

- Diversity, Equity, and Inclusion (DEI) mandates: Ensuring practices align with legal requirements and societal expectations for fair treatment and equal opportunity.

- Data protection and employee privacy: Managing employee data in accordance with laws like GDPR and similar regulations worldwide.

Future PLC must continuously adapt to evolving intellectual property laws, especially concerning digital content and AI. Recent legal challenges in 2024 have highlighted the complexities of copyright in AI-generated content, potentially impacting how Future PLC licenses and utilizes its vast media library. Staying abreast of these changes is crucial for protecting its assets and revenue streams.

Environmental factors

Future PLC is actively pursuing ambitious greenhouse gas (GHG) emission reduction targets, aiming for a 42% decrease by 2030 and a substantial 90% reduction by 2050 across all emission scopes.

The company's strategy prioritizes meticulous measurement, transparent reporting, and the establishment of clear targets to ensure progress toward its environmental objectives.

Demonstrating tangible progress, Future PLC's latest emissions report highlighted a significant 27% reduction in supply chain emissions, underscoring their commitment to operational sustainability.

The company is actively embedding sustainability into its core operations and supply chain. This includes deploying advanced print allocation technology to significantly cut down on material waste and enhancing the tracking of digital activity emissions.

A key initiative involved a strategic partnership with Scope3.com, which resulted in a notable 36% decrease in emissions associated with digital ad serving. These concrete actions underscore a robust commitment to reducing the company's overall environmental impact.

Future PLC is increasingly prioritizing eco-friendly packaging and sustainable printing for its print publications. This strategic shift aims to significantly reduce waste and minimize the company's overall environmental footprint.

Despite a strong move towards digital, print magazines continue to show resilience, making the adoption of sustainable production methods crucial for Future. This focus directly addresses growing consumer demand for products and services that demonstrate environmental responsibility.

In 2023, the global sustainable packaging market was valued at approximately $294.3 billion and is projected to grow, indicating a strong market pull for these initiatives. Future's commitment reflects a broader industry trend and a response to consumer values, with studies showing a majority of consumers willing to pay more for sustainable products.

Energy Consumption of Digital Infrastructure

Future PLC's extensive digital operations, encompassing websites, streaming services, and data platforms, inherently demand considerable energy. This digital footprint is a key area for environmental consideration as the company pursues its greenhouse gas (GHG) emission reduction targets.

To address this, Future PLC is likely to implement strategies focused on minimizing the energy consumed by its digital infrastructure. This could involve optimizing server efficiency and exploring the use of renewable energy sources to power its data centers.

- Digital Energy Use: The global digital sector's energy consumption is projected to rise significantly, potentially accounting for up to 20% of global electricity demand by 2025, according to some estimates.

- Renewable Energy Adoption: Major tech companies are increasingly investing in renewable energy to power their data centers, with many aiming for 100% renewable energy by specific target dates. For instance, Google aimed for 100% renewable energy matching by 2017 and continues to expand its renewable energy portfolio.

- Efficiency Gains: Improvements in server technology and data center design continue to drive energy efficiency, with Power Usage Effectiveness (PUE) metrics becoming a standard for measuring efficiency. A PUE of 1.0 is ideal, meaning all energy goes to computing, though real-world data centers typically range from 1.1 to 1.5.

Corporate Social Responsibility and Environmental Reporting

Future PLC actively embeds environmental considerations within its comprehensive corporate social responsibility (CSR) framework, meticulously documented in its annual and sustainability reports. This commitment is increasingly vital as investors and stakeholders scrutinize companies' environmental, social, and governance (ESG) performance. For instance, Future's reported ESG score, which benchmarks its sustainability efforts against industry peers, serves as a key indicator of its environmental stewardship.

The company's dedication to transparent reporting on its environmental initiatives, such as carbon footprint reduction targets and waste management programs, directly addresses the growing demand for accountability. This transparency is not merely a compliance exercise; it's a strategic imperative that builds trust and attracts capital from a market that prioritizes sustainable business practices. In 2024, for example, many companies like Future saw increased investor engagement specifically on climate-related disclosures, with a growing number of funds actively divesting from those with weaker environmental records.

- Future PLC's ESG score provides a quantitative measure of its environmental performance relative to competitors.

- Transparent reporting on initiatives like carbon reduction and waste management is crucial for stakeholder confidence.

- Investor focus on ESG continues to rise, influencing capital allocation and company valuations.

- **Data from 2024** indicates a significant trend of investors prioritizing companies with strong environmental credentials.

Future PLC's environmental strategy is deeply integrated, focusing on significant greenhouse gas (GHG) emission reductions, targeting a 42% decrease by 2030 and 90% by 2050. This commitment extends to supply chain emissions, where a 27% reduction has already been achieved, demonstrating a proactive approach to sustainability. The company is also optimizing its digital operations, a significant energy consumer, by exploring renewable energy sources and efficiency gains in its data infrastructure.

| Environmental Initiative | Target/Status | Impact/Metric |

|---|---|---|

| GHG Emission Reduction | 42% by 2030, 90% by 2050 | Across all emission scopes |

| Supply Chain Emissions | 27% reduction achieved | Demonstrates operational sustainability |

| Digital Emissions | 36% decrease via Scope3.com partnership | Optimized digital ad serving |

| Sustainable Packaging | Increased adoption | Addresses growing consumer demand; market valued at $294.3 billion in 2023 |

PESTLE Analysis Data Sources

Our Future PESTLE Analysis is meticulously constructed using a blend of forward-looking economic forecasts from institutions like the IMF and World Bank, emerging technology trend reports from leading research firms, and anticipated shifts in political and regulatory landscapes from governmental and international bodies. This ensures our insights are not only current but also predictive of future macro-environmental forces.