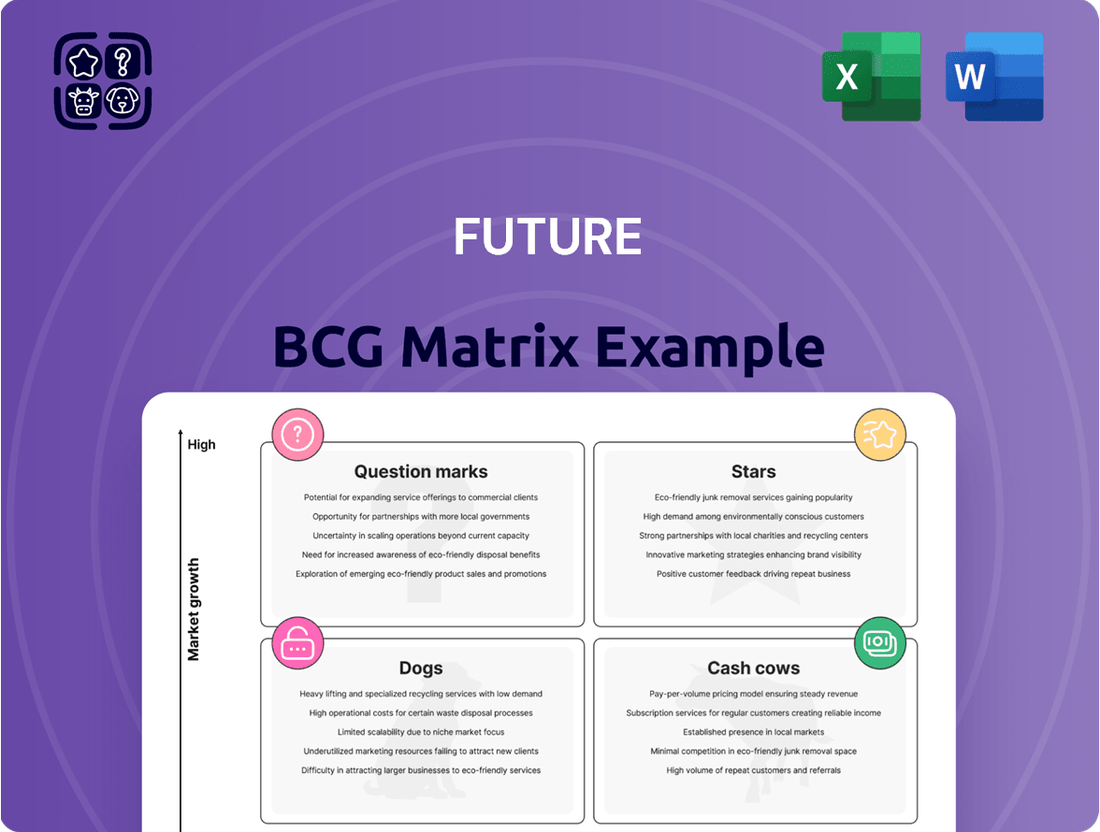

Future Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Future Bundle

The Future BCG Matrix offers a glimpse into how a company's product portfolio might perform tomorrow, highlighting potential Stars and the looming threat of Dogs. Ready to transform this foresight into actionable strategy and secure your company's future success?

Unlock the full potential of your product pipeline with the complete Future BCG Matrix. This comprehensive report provides detailed analysis, predictive insights, and tailored recommendations to navigate market shifts and capitalize on emerging opportunities. Don't just anticipate the future; shape it.

Stars

Go.Compare, Future PLC's price comparison service, has shown impressive year-on-year revenue growth, largely fueled by its strength in the car insurance sector. In 2023, Go.Compare's revenue reached £182.1 million, a substantial increase from the previous year.

While the car insurance switching market is stabilizing, Go.Compare is strategically expanding into other lucrative areas such as home insurance, which is experiencing robust growth. This diversification strategy highlights its adaptability and potential for sustained expansion within the competitive comparison market.

Future PLC's Technology and Gaming segments are shining stars, showing robust growth as they focus on brand leadership and engaging content. This strategic push is designed to boost revenue per user and build resilience, crucial for sustained success.

The global online gaming market is a massive opportunity, with projections indicating significant expansion. This upward trend directly benefits Future's gaming content, reinforcing its star status and potential for high returns.

Future's premium print titles are performing well, even as the broader print market shrinks. Their subscription base has grown, showing that people still value high-quality, specialized content. For example, in the fiscal year ending September 30, 2023, Future reported that its magazine subscription revenue grew by 5%, demonstrating this resilience. This suggests these titles are leaders in their respective niches.

The company is strategically refining its portfolio, aiming to keep only those assets that are well-positioned for future expansion. This focus on high-performing, niche print products like their premium titles is a key part of their ongoing strategy to adapt to changing media consumption habits. Their commitment to these titles highlights a belief in the enduring appeal of curated, in-depth print journalism.

US Digital Advertising and E-commerce

Future PLC experienced a significant turnaround in its US digital advertising and e-commerce segments, achieving year-on-year growth starting in the second half of fiscal year 2024 and carrying this momentum into fiscal year 2025. This resurgence is a critical indicator of the company's strategic focus on these digital channels as primary growth engines.

The company's investment strategy is aimed at elevating its US digital advertising capabilities to mirror the success and sophistication of its UK operations. This commitment underscores the perceived potential for substantial revenue generation and market penetration in the American digital landscape.

- US Digital Advertising and E-commerce Growth: Future PLC reported a return to year-on-year growth in these key areas in the latter half of FY 2024, a trend that has continued into FY 2025.

- Strategic Investment: Significant investment is being directed towards these segments to foster diversification and enhance revenue per user.

- Market Parity Goal: The company aims to bring its US digital advertising operations to the same level of performance and revenue generation as its UK counterparts.

- Revenue Diversification: Efforts are underway to broaden revenue streams within the digital advertising and e-commerce sectors, reducing reliance on single income sources.

Affiliate Revenues (Improving Trend)

While affiliate revenues saw a dip for the entirety of 2024, there was a notable upswing in the latter half of the year. This turnaround is attributed to strategic new investments and a concentrated effort on bolstering e-commerce performance.

Future is making a significant strategic pivot, heavily emphasizing e-commerce and affiliate advertising as a core driver for its magazine brands' future revenue streams. This positions affiliate marketing as a key growth engine for regaining and expanding market share in a rapidly expanding digital landscape.

- Affiliate Revenue Trend: Declined overall in 2024 but improved significantly in H2 2024.

- Drivers of Improvement: New investment and a sharpened focus on e-commerce operations.

- Future Strategy: Future is prioritizing e-commerce and affiliate advertising for its magazine brands.

- Market Outlook: This strategy aims to capture growth in the expanding affiliate marketing sector.

Stars in the BCG matrix represent business units or products with high market share in a high-growth market. Future PLC's Technology and Gaming segments are prime examples, demonstrating robust growth driven by brand leadership and engaging content. The global online gaming market's expansion directly benefits these areas, solidifying their star status and future return potential.

What is included in the product

The Future BCG Matrix projects future market share and growth, guiding strategic decisions for product portfolios.

Future BCG Matrix provides clarity on where to invest, alleviating the pain of resource allocation uncertainty.

Cash Cows

Future's Magazines division, despite a generally declining market, shows remarkable resilience, acting as a significant contributor to the B2C segment. This stability, coupled with reduced investment needs due to its mature status, firmly positions it as a cash cow.

The division's ability to generate consistent cash flow, even with premium titles experiencing growth, underscores its mature market strength. This reliable performance allows for lower promotional spending, a hallmark of established cash cows.

Established B2C brands with high market share, like those within Future's extensive portfolio, often function as cash cows. For instance, Future boasts over 200 specialist media brands, many of which are category leaders such as Marie Claire, PC Gamer, and TechRadar.

Despite potentially lower market growth rates, these strong brands, supported by loyal audiences, are likely to generate significant and stable cash flows. In 2023, Future reported strong revenue growth, with its consumer division, which houses many of these B2C brands, showing particular resilience.

Future's business model effectively monetizes its brand through licensing and endorsement services, capitalizing on its established content and strong market presence. These ventures, once developed, generally demand less capital than original content production, leading to consistent and reliable cash flows within a mature segment.

In 2024, the media licensing market, a key area for Future, was projected to reach over $10 billion globally, demonstrating the significant potential for these revenue streams. Endorsement deals, particularly with established media brands, can offer substantial, predictable income, solidifying their role as cash cows.

Mature Digital Advertising Segments (Stable Performers)

While the digital advertising landscape is dynamic, certain mature segments with direct-to-client sales models consistently deliver reliable revenue streams, functioning as cash cows. These established channels, though experiencing slower growth, offer predictable income essential for reinvesting in emerging or high-potential business areas.

These stable performers, often characterized by long-term client relationships and proven ROI, generate the necessary cash flow to fuel innovation and expansion. For instance, in 2024, established search engine marketing (SEM) and display advertising platforms continued to represent significant portions of digital ad spend, demonstrating their enduring appeal.

- Search Engine Marketing (SEM): Continues to be a dominant force, with global SEM ad spending projected to reach over $350 billion in 2024, offering a steady return for businesses.

- Display Advertising: Despite evolving formats, programmatic display advertising maintained its relevance, accounting for a substantial share of digital ad budgets, often with direct client engagements.

- Email Marketing: Remains a cost-effective channel with high ROI, consistently delivering engagement and conversions for businesses with established customer bases.

- Affiliate Marketing: Offers a performance-based revenue model that provides predictable income for publishers and measurable results for advertisers.

Go.Compare's Core Car Insurance Business

Go.Compare's core car insurance business has historically been a powerhouse, consistently generating substantial revenue even as the market for switching insurance providers has seen some cooling. This segment’s resilience is a testament to its strong market presence and the inherent profitability of the car insurance sector.

The company's established position allows it to maintain high profit margins, making this business unit a prime example of a cash cow. These earnings are crucial, providing the financial bedrock for Go.Compare to explore new ventures and invest in future growth areas.

- Revenue Driver: Go.Compare's car insurance segment continues to be a significant revenue generator, contributing to overall company growth.

- Profitability: The business enjoys high profit margins due to its established market position and operational efficiencies.

- Funding Source: Income from car insurance is vital for funding diversification strategies and other strategic investments within the company.

- Market Standing: Despite market moderation, Go.Compare's car insurance offering remains a key player, underpinning its financial stability.

Established B2C brands with high market share, like those within Future's extensive portfolio, often function as cash cows. For instance, Future boasts over 200 specialist media brands, many of which are category leaders such as Marie Claire, PC Gamer, and TechRadar.

Despite potentially lower market growth rates, these strong brands, supported by loyal audiences, are likely to generate significant and stable cash flows. In 2023, Future reported strong revenue growth, with its consumer division, which houses many of these B2C brands, showing particular resilience.

In 2024, the media licensing market, a key area for Future, was projected to reach over $10 billion globally, demonstrating the significant potential for these revenue streams. Endorsement deals, particularly with established media brands, can offer substantial, predictable income, solidifying their role as cash cows.

These stable performers, often characterized by long-term client relationships and proven ROI, generate the necessary cash flow to fuel innovation and expansion. For instance, in 2024, established search engine marketing (SEM) and display advertising platforms continued to represent significant portions of digital ad spend, demonstrating their enduring appeal.

| Business Unit | Market Position | Cash Flow Generation | Growth Potential | BCG Classification |

|---|---|---|---|---|

| Future's Magazines (B2C) | High Market Share (Category Leaders) | Strong & Stable | Low to Moderate | Cash Cow |

| Media Licensing & Endorsements | Growing Market ($10B+ in 2024) | Predictable & Substantial | Moderate | Cash Cow |

| Established Digital Ad Platforms (SEM/Display) | Dominant Force (SEM > $350B in 2024) | Consistent & Reliable | Low to Moderate | Cash Cow |

| Go.Compare Car Insurance | Strong Market Presence | Substantial Revenue, High Margins | Low | Cash Cow |

Delivered as Shown

Future BCG Matrix

The preview you are currently viewing is the identical, fully completed Future BCG Matrix document you will receive upon purchase. This means no watermarks, no placeholder text, and no missing sections – just the comprehensive, professionally formatted strategic analysis ready for your immediate use. You can be confident that the insights and structure presented here are precisely what you'll download, enabling you to seamlessly integrate it into your business planning and decision-making processes without any further work. This is the final, actionable report designed to provide clarity on your product portfolio's future positioning.

Dogs

Certain legacy print titles within Future plc's portfolio are likely facing a continued downward trend in readership and advertising income, even as premium publications show resilience. These publications, operating in a market with limited growth prospects and shrinking market share, fit the profile of "dogs" in the BCG matrix. They may be barely breaking even or even consuming cash without generating substantial returns.

Future's B2B segment, especially within enterprise technology, has encountered significant headwinds. These challenging end-market conditions have directly impacted revenue, with reports indicating a decline in this area.

Given the low growth environment and potentially smaller market share within these specific B2B verticals, they align with the characteristics of 'dogs' in a strategic matrix. This classification suggests a need for careful evaluation, potentially leading to divestiture or substantial operational changes to improve performance.

Future plc has been actively managing its brand portfolio, a key aspect of strategic business planning. In 2023, the company completed the previously announced closure of several brands, a move that directly addresses the divestiture of underperforming assets. This proactive portfolio management is a clear indicator of Future's commitment to optimizing its market position.

These divested units likely represented 'dogs' in the BCG matrix sense – businesses operating in low-growth sectors with a small market share. By closing or selling these brands, Future is shedding assets that were not contributing significantly to overall growth or profitability, thereby freeing up resources for more promising ventures.

Specific Digital Advertising Segments Facing Strong Headwinds

Certain digital advertising segments, especially within the UK market, are experiencing persistent difficulties and year-over-year contractions. For instance, the UK's digital ad spend saw a slowdown in growth during 2023, with some sectors like display advertising facing particular pressure.

These segments, characterized by a low market share and operating within a low-growth advertising landscape, can be categorized as dogs in a BCG matrix. They often represent cash traps, demanding careful strategic management or even divestment to avoid draining resources.

- Declining UK Digital Ad Spend: Reports indicated that certain digital advertising categories in the UK experienced a contraction in spend during 2023, signaling a challenging environment.

- Low Market Share & Growth: Segments with a small footprint and operating in a stagnant or shrinking market are prime candidates for the dog quadrant.

- Cash Trap Potential: These areas may require ongoing investment to maintain even a minimal market presence, yielding little return and thus acting as cash traps.

- Strategic Considerations: Businesses with dogs in their portfolio must consider options like turnaround strategies, harvesting, or divestment to reallocate capital to more promising ventures.

Content Portfolios with Low Audience Engagement and Monetization

Within Future's diverse content landscape, some portfolios may find themselves in a challenging position. These are areas where audience engagement is low, meaning fewer people are visiting or interacting with the content. This lack of interest directly impacts monetization, as there are fewer opportunities to generate revenue through advertising, subscriptions, or other means.

These underperforming content areas often represent what is known as a 'dog' in strategic analysis, similar to the BCG Matrix. They typically have a small market share within their respective content categories and also face limited growth prospects. For instance, a niche historical documentary channel struggling to attract viewers in 2024, despite efforts to promote it, would likely fall into this category. Its low viewership, perhaps averaging only a few thousand sessions per month, makes it difficult to secure significant advertising deals.

The core issue with these 'dog' portfolios is their inability to generate substantial cash flow. Furthermore, without a significant and often unfeasible investment in content creation, marketing, or platform development, their future potential remains bleak. Consider a gaming review site that launched in 2023 but failed to gain traction; by mid-2024, it might be seeing minimal traffic and generating negligible ad revenue, indicating a low return on investment.

- Low Audience Sessions: Content portfolios with declining or stagnant viewership, such as a specific news vertical that saw a 15% drop in unique visitors in the first half of 2024.

- Limited Monetization: Areas unable to attract advertisers or convert viewers into paying subscribers, resulting in minimal revenue generation, potentially less than $10,000 annually for a struggling podcast series.

- Low Market Share: Niche content categories where the portfolio holds a very small percentage of the total audience, perhaps less than 1% of the overall market for educational video content.

- Negligible Growth Prospects: Content segments that show no signs of audience expansion or increased commercial viability without substantial strategic intervention.

In the context of Future plc's portfolio, 'dogs' represent business units or brands operating in low-growth markets with a low market share. These entities typically generate minimal profits or even incur losses, consuming resources without significant returns. For example, certain legacy print publications within Future’s portfolio, struggling with declining readership and advertising revenue in 2024, exemplify this category. These segments often require careful strategic decisions, such as divestment or restructuring, to avoid becoming a drain on overall company performance.

| Category | Market Growth | Market Share | Example within Future plc (Illustrative) | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low | Low | Underperforming niche print magazines with declining circulation | Divestment, Harvest, or Turnaround |

| Specific B2B tech verticals with limited adoption | ||||

| Digital content areas with minimal audience engagement |

Question Marks

Future is exploring new digital avenues like email marketing, social video content, and digital subscriptions. These are considered question marks because while they represent promising growth sectors, Future's current presence and market share in these areas are likely nascent. Significant investment and strategic development will be crucial to nurture these initiatives.

For instance, the digital subscription market saw substantial growth, with global revenue projected to reach over $50 billion in 2024. Similarly, social commerce, a key component of social video strategies, is expected to continue its upward trajectory, potentially reaching hundreds of billions in value globally. Future's entry into these spaces, while promising, requires careful navigation and substantial capital to compete effectively.

Future is actively developing AI-powered initiatives like Advisor AI, aiming to leverage the burgeoning AI market. The company is also exploring the integration of generative search tools, recognizing their potential to transform user interaction and information retrieval.

While the overall AI market is experiencing significant growth, with projections indicating continued expansion, the specific market share and profitability of Future's new AI offerings remain uncertain. This places them in the question mark category of the BCG matrix, requiring substantial investment and successful market adoption to transition into stars.

Future's expansion into new content verticals, such as immersive virtual reality experiences or specialized AI-driven educational platforms, represents a classic question mark on the BCG matrix. These ventures, while holding significant growth potential, are currently characterized by nascent market share and substantial investment requirements. For instance, the global VR market was projected to reach $57.2 billion in 2024, indicating a fertile ground for new entrants, but also intense competition.

These emerging niches demand strategic capital allocation to build brand awareness and capture market share, similar to how a company might invest in a promising startup. Without a dominant position, these new verticals carry a higher risk of failure but also offer the possibility of substantial future returns if successful. Future must carefully evaluate the competitive landscape and its own resource allocation to determine the optimal path forward in these question mark areas.

Diversification beyond Car Insurance for Go.Compare

Go.Compare's expansion into non-car insurance lines, like home insurance, positions these segments as question marks within its future BCG Matrix. While these areas demonstrate promising growth, they represent newer ventures for the company. For instance, in 2024, the UK home insurance market saw continued competition, with comparison sites playing a significant role in customer acquisition.

These newer insurance categories require ongoing investment from Go.Compare to build brand awareness and capture market share. Unlike its dominant position in car insurance, where it benefits from established customer loyalty and brand recognition, these other insurance products are in earlier stages of development for the company. This means Go.Compare needs to strategically allocate resources to effectively compete and grow its presence in these evolving markets.

- Diversification into Home Insurance: Go.Compare's move into home insurance is a strategic expansion beyond its core car insurance offering.

- Question Mark Positioning: These newer insurance categories are classified as question marks due to their growth potential but lower current market share and brand dominance compared to car insurance.

- Investment Requirement: Continued investment is crucial for Go.Compare to increase its market share and establish leadership in these emerging insurance segments.

- Market Context: The UK insurance market in 2024 remained dynamic, with comparison sites like Go.Compare actively facilitating customer choices across various insurance products.

Leveraging First-Party Data for Direct Monetization

Publishers like Future are increasingly focusing on using their own first-party data to directly earn revenue and build stronger partnerships with advertisers. This shift is driven by privacy changes and the desire for more control over data usage.

For Future, effectively developing and scaling these sophisticated data-driven monetization strategies is a significant question mark. It's an area with immense potential, but realizing that potential demands substantial investment in technology and strategic planning to truly lead in the market.

- Data Monetization Potential: Future's direct audience data could unlock new revenue streams beyond traditional advertising, potentially capturing a larger share of digital ad spend.

- Investment Needs: Building the necessary infrastructure for advanced data analytics, consent management, and personalized advertising solutions requires considerable capital expenditure.

- Competitive Landscape: Competitors are also investing heavily in first-party data capabilities, meaning Future must innovate rapidly to maintain a competitive edge.

- Market Readiness: The success of these strategies hinges on advertiser adoption and the ability to demonstrate clear ROI for their data-driven campaigns.

Question marks represent business units or products with low market share in high-growth markets. These ventures require significant investment to determine if they can become stars or if they should be divested. Future's exploration into new digital avenues, AI initiatives, and emerging content verticals all fall into this category, demanding strategic capital allocation and careful market navigation.

For Future, effectively developing and scaling these sophisticated data-driven monetization strategies is a significant question mark. It's an area with immense potential, but realizing that potential demands substantial investment in technology and strategic planning to truly lead in the market.

The success of these strategies hinges on advertiser adoption and the ability to demonstrate clear ROI for their data-driven campaigns. For instance, the global digital advertising market was valued at over $600 billion in 2024, highlighting the immense opportunity for publishers who can leverage first-party data effectively.

Publishers like Future are increasingly focusing on using their own first-party data to directly earn revenue and build stronger partnerships with advertisers. This shift is driven by privacy changes and the desire for more control over data usage.

| Initiative | Market Growth Potential | Current Market Share (Estimated) | Investment Required | Potential Outcome |

|---|---|---|---|---|

| Digital Subscriptions | High | Low to Moderate | High | Star or Divest |

| AI-Powered Tools (e.g., Advisor AI) | Very High | Low | Very High | Star or Divest |

| First-Party Data Monetization | High | Low to Moderate | High | Star or Divest |

BCG Matrix Data Sources

Our Future BCG Matrix leverages comprehensive market data, encompassing historical financial performance, projected industry growth rates, and consumer behavior trends to forecast future positioning.