Future Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Future Bundle

This brief snapshot only scratches the surface of the competitive landscape Future operates within. Unlock the full Porter's Five Forces Analysis to explore Future’s competitive dynamics, market pressures, and strategic advantages in detail, empowering you to make informed decisions.

Suppliers Bargaining Power

Future PLC's reliance on content creators, including journalists and writers, means these suppliers hold significant sway. Highly sought-after or specialized creators can negotiate higher rates, particularly for unique content that resonates deeply with Future's readership. For instance, in 2023, specialist tech journalists with established followings saw demand increase, reflecting their ability to command premium fees.

For a multi-platform media company like Future plc, the bargaining power of technology and software providers is a significant factor. These suppliers are critical for everything from content management systems to e-commerce platforms, directly impacting operational efficiency and online presence. The leverage these providers hold often hinges on the uniqueness and indispensability of their solutions.

If Future relies on a proprietary software solution that is fundamental to its core business, such as a specialized content management system or a unique advertising technology, the supplier can exert considerable influence. For instance, in 2024, the global market for digital advertising technology alone was valued at over $200 billion, indicating the substantial investment media companies make in these essential tools, and the potential power of the companies providing them.

Advertising technology platforms are critical suppliers for Future, as they facilitate the monetization of its content through advertising. The concentration of power among a few major ad tech players can grant them significant leverage, potentially impacting Future's advertising revenue and its access to valuable user data. For instance, in 2024, the digital advertising market continues to be dominated by giants like Google and Meta, who control substantial portions of ad spend and technology infrastructure, highlighting the supplier power within this ecosystem.

Future's strategy to diversify its advertising revenue across various platforms and ad formats is a key tactic to reduce its reliance on any single ad tech supplier. This diversification not only spreads risk but also enhances Future's negotiation position, as it can shift ad inventory to platforms offering more favorable terms or better performance. By not being overly dependent on one channel, Future can better manage the bargaining power exerted by dominant ad tech providers.

Print and Distribution Services

Future PLC, despite its robust digital footprint, maintains a significant magazine division. This necessitates reliance on print and distribution services, where supplier bargaining power is a key consideration. The volume of print runs directly influences the leverage these suppliers hold, as larger orders can command better terms.

The availability of alternative print and distribution providers within Future PLC's operational regions also shapes supplier power. A fragmented market with numerous competitors generally reduces individual supplier leverage. However, consolidation within the print industry, a trend observed in recent years, can shift this balance, potentially increasing the bargaining power of fewer, larger service providers.

For instance, in 2024, the UK’s print sector experienced ongoing consolidation. Companies like Reach plc, a major newspaper and magazine printer, continued to optimize their operations, potentially leading to fewer independent printing partners available for media groups. This trend means that Future PLC might face fewer options for its print needs, thereby strengthening the position of the remaining suppliers.

- Print Volume: Larger print runs for Future PLC's popular titles like Radio Times or Country Life provide suppliers with economies of scale, potentially giving Future more negotiating power.

- Supplier Concentration: A limited number of specialized print and distribution firms capable of handling Future's specific requirements in key markets can increase supplier bargaining power.

- Cost-Effectiveness: Suppliers who can demonstrate lower operational costs and efficient distribution networks are better positioned to negotiate favorable contracts.

- Industry Consolidation: As the print industry consolidates, remaining players may gain increased leverage due to reduced competition, impacting Future's ability to secure competitive pricing.

E-commerce Partners and Retailers

Future's reliance on e-commerce partners and retailers for monetization means these entities can wield significant bargaining power. If Future primarily partners with a few dominant online retailers or brands offering highly sought-after products, these suppliers can negotiate more favorable commission rates or demand preferential placement, directly impacting Future's revenue streams. For instance, if a major electronics retailer that represents a substantial portion of Future's affiliate income decides to reduce commission payouts by 5% in 2024 due to increased competition, this would directly squeeze Future's profitability.

The bargaining power of suppliers in Future's e-commerce ecosystem is influenced by several factors:

- Supplier Concentration: A market dominated by a few large e-commerce platforms or unique product suppliers increases their leverage.

- Switching Costs: If it's difficult or costly for Future to find alternative partners, existing suppliers gain power.

- Product Differentiation: Retailers offering exclusive or highly in-demand products have more sway over commission terms.

- Supplier's Forward Integration: If suppliers can easily establish their own direct-to-consumer channels, they have less need to rely on platforms like Future.

The bargaining power of suppliers is a critical element in Future PLC's operational landscape. For instance, in 2024, the media industry's reliance on specialized content creators, particularly those with niche expertise, allows these individuals to negotiate higher fees. This is amplified when these creators possess unique skills or established audiences that are vital for Future's specific content verticals.

Technology and software providers also hold significant leverage, especially those offering proprietary solutions essential for Future's digital operations. The global digital advertising technology market, valued at over $200 billion in 2024, underscores the substantial investments media companies make, giving dominant ad tech players considerable power.

Future's print and distribution suppliers, while facing industry consolidation, can still exert influence based on print volumes and the availability of alternatives. The ongoing consolidation in the UK print sector in 2024, for example, means fewer independent printing partners, potentially strengthening the position of remaining suppliers.

In the e-commerce sphere, dominant online retailers and suppliers of unique products can negotiate more favorable terms, impacting Future's affiliate revenue. If a key e-commerce partner reduces commission rates, as seen in potential scenarios in 2024, it directly affects Future's profitability.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Future PLC | 2024 Data/Trend Example |

|---|---|---|---|

| Content Creators | Uniqueness of skills, established audience, demand for niche expertise | Higher content acquisition costs, potential for talent retention challenges | Increased demand for specialist tech journalists commanding premium fees |

| Technology & Software Providers | Proprietary nature of solutions, indispensability, market concentration | Potential for increased licensing fees, dependence on specific platforms | Dominance of major ad tech players in a $200B+ global market |

| Print & Distribution Services | Print volume, industry consolidation, availability of alternatives | Negotiating power on print costs and delivery terms | UK print sector consolidation leading to fewer independent partners |

| E-commerce Partners/Retailers | Supplier concentration, product differentiation, switching costs | Impact on affiliate revenue through commission rates and placement terms | Potential for commission rate reductions by major retailers |

What is included in the product

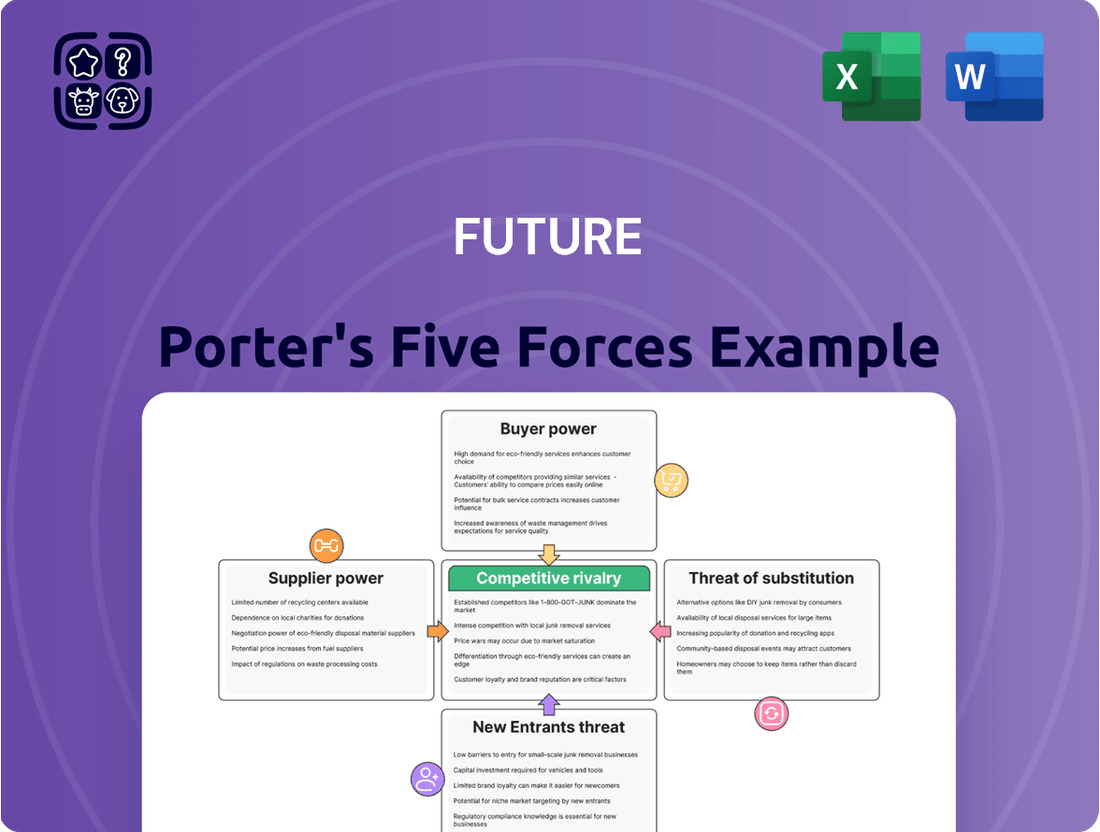

Future Porter's Five Forces Analysis provides a comprehensive examination of the competitive environment impacting Future, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Proactively identify and address potential competitive threats before they impact profitability.

Customers Bargaining Power

Individual content consumers wield significant bargaining power, driven by an abundance of free and paid digital content. Future must differentiate itself by providing exceptionally specialized and engaging material to capture and keep user attention, as switching to competing platforms is effortless for consumers if their expectations aren't met.

In 2024, the digital content landscape is saturated, with platforms like YouTube and TikTok offering vast free libraries, intensifying the need for Future to deliver unique value. For instance, the global digital advertising market, a key revenue stream for content providers, was projected to reach over $600 billion in 2024, underscoring the reliance on audience engagement over direct consumer pricing.

Advertisers, particularly major brands and advertising agencies, wield considerable bargaining power over Future. Their primary focus is on achieving extensive reach and a clear, measurable return on their advertising spend. Future's success in attracting and retaining these advertisers, and consequently commanding premium rates, hinges on its capacity to showcase highly engaged and precisely targeted audiences across its specialized media verticals.

E-commerce shoppers wield significant influence due to readily available price comparisons and an abundance of product options across numerous online stores, making it simple for them to switch providers. This high degree of choice and transparency means retailers must constantly compete on price and value.

Future's strategy to guide these shoppers through content, such as reviews and comparisons, is crucial for building trust and driving sales. In 2024, the global e-commerce market was projected to reach over $6.3 trillion, highlighting the immense scale of this consumer power and the competitive landscape.

Subscription Holders

For Future's subscription-based content, customers wield moderate bargaining power. While they are locked into recurring payments, their expectation for consistently high-quality and exclusive content, coupled with a flawless user experience, is significant. If the perceived value declines, subscribers can easily churn, particularly given the intensifying competition from a growing array of subscription services.

- Subscriber Churn: Future aims to maintain low churn rates, with industry benchmarks for digital subscriptions often falling between 5-10% annually, though this can vary by niche.

- Content Value Proposition: The company must continually invest in and innovate its content offerings to justify ongoing subscription fees and prevent customers from seeking alternatives.

- Competitive Landscape: With numerous media outlets and content creators offering subscription models, customers have more choices than ever, increasing their leverage.

B2B Clients

Future's B2B clients, often substantial corporations, wield considerable bargaining power. This stems from the sheer volume of business they represent and their specific needs for customized solutions and clear returns on investment. For instance, in 2023, Future's B2B segment, which includes lead generation and specialist content for businesses, contributed significantly to its overall revenue, highlighting the importance of retaining these key accounts.

These large corporate clients can demand competitive pricing and highly tailored service packages. Future must continuously demonstrate the unique value and effectiveness of its offerings to justify its rates and secure long-term partnerships. The ability of these clients to switch providers or develop in-house solutions if Future's value proposition weakens is a constant consideration.

- Client Volume: Large B2B clients can represent a substantial portion of Future's revenue, giving them leverage in negotiations.

- Customization Demands: Businesses require specialized content and lead generation strategies, increasing the cost and complexity of service delivery.

- ROI Expectations: Clients demand demonstrable return on investment, pushing Future to prove the efficacy of its B2B services.

- Alternative Solutions: The availability of in-house capabilities or competing service providers limits Future's pricing flexibility.

Customers' bargaining power significantly impacts Future's revenue streams, particularly in advertising and e-commerce. The sheer volume of digital content available in 2024, with platforms like YouTube and TikTok offering extensive free libraries, means Future must continually innovate to retain user attention. This intense competition means that if Future's content doesn't meet expectations, users can easily switch to alternatives, limiting Future's ability to dictate terms.

Advertisers, a crucial B2B segment for Future, hold substantial sway due to their focus on reach and measurable returns. In 2024, the global digital advertising market was projected to exceed $600 billion, highlighting the competitive environment for capturing ad spend. Future's success in commanding premium advertising rates depends on its ability to demonstrate highly engaged and precisely targeted audiences across its specialized media verticals to these clients.

In the e-commerce sector, shoppers' power is amplified by ubiquitous price comparison tools and a vast array of online retailers. The global e-commerce market was expected to surpass $6.3 trillion in 2024, underscoring the intense competition retailers face. Future's role in guiding consumers through content like reviews and comparisons is vital for building trust and facilitating sales within this environment.

Same Document Delivered

Future Porter's Five Forces Analysis

The document you see here is the complete, ready-to-use Future Porter's Five Forces Analysis. What you're previewing is exactly what you'll receive—a professionally formatted and comprehensive strategic tool designed to help you understand future industry competitive forces.

Rivalry Among Competitors

The digital media arena is incredibly fragmented, a vast ecosystem of websites, blogs, social platforms, and individual creators all battling for eyeballs. This means Future isn't just up against a few big players; it's a constant struggle against a multitude of diverse content sources for audience engagement and advertising dollars.

In 2024, the sheer volume of digital content continues to explode. For instance, YouTube creators upload over 500 hours of video every minute, illustrating the immense competition for viewer attention. This intense fragmentation directly impacts Future's ability to capture and retain market share, as audiences can easily drift to countless alternative platforms.

Future Plc operates in specialized content areas such as technology, gaming, and home & garden. Within these niches, it faces intense competition from a multitude of players, including established media giants and nimble, focused digital platforms. For instance, in the technology sector, Future competes with companies like IDG Communications and TechRadar, alongside countless specialized tech review sites and forums.

Social media platforms and content aggregators are significantly altering how audiences consume news, directly impacting traditional publishers like Future. In 2024, platforms such as TikTok and Instagram continued to grow as primary news sources, especially for younger demographics, siphoning away valuable advertising revenue that once flowed to established media outlets. This shift necessitates a strategic pivot for Future to effectively utilize these channels for content distribution while simultaneously reinforcing direct engagement with its own digital properties.

Traditional Print Publishers

Future plc, while heavily invested in digital, maintains a substantial print magazine business. This segment contends with established print publishers, many of whom are also navigating digital transformations, intensifying the competitive landscape.

The ongoing decline in print advertising revenue and circulation presents a significant challenge for Future's print operations. For instance, the UK magazine market saw a notable dip in advertising spend in recent years, impacting traditional players.

- Print Advertising Pressure: Declining ad revenues in print publications put pressure on profit margins for all traditional publishers.

- Circulation Trends: Stagnant or declining print circulation figures mean fewer readers, directly affecting revenue streams.

- Digital Transition Costs: Competitors are also investing heavily in digital platforms, creating a costly arms race for market share.

In-house Content Creation by Brands

Brands are increasingly producing their own content, a trend that directly impacts Future's traditional advertising and affiliate revenue. For instance, in 2024, many direct-to-consumer brands allocated significant portions of their marketing budgets to in-house content studios, aiming to build direct relationships and bypass intermediaries. This shift means less reliance on platforms like Future for consumer reach, intensifying rivalry.

This in-house content creation directly challenges Future's monetization model by diminishing the need for third-party advertising and affiliate services. As brands build their own content capabilities, they reduce their dependency on external publishers for audience engagement and sales generation. This competitive pressure is a key factor in Future's strategic pivot towards B2B content and diversified revenue streams.

- Increased Brand Content Studios: Many major retailers and brands expanded their in-house content creation teams in 2024, focusing on video, social media, and editorial content.

- Reduced Ad Spend on Third Parties: This trend correlates with a projected decrease in digital ad spending on traditional media outlets and affiliate networks, as brands prioritize owned channels.

- Future's Strategic Response: Future has actively diversified its revenue by focusing on B2B content solutions and subscription models, aiming to mitigate the impact of this competitive shift.

The competitive rivalry in the digital media space is fierce, with Future Plc facing a multitude of rivals across its diverse content verticals. This landscape is characterized by intense fragmentation, where a vast array of websites, blogs, and social platforms vie for audience attention and advertising revenue, making it challenging for any single entity to dominate.

In 2024, the sheer volume of digital content available means Future is constantly competing against a broad spectrum of players, from established media conglomerates to niche digital-native publishers. For instance, in the technology sector alone, Future contends with numerous specialized review sites and forums, in addition to major players like TechRadar.

The rise of social media as a primary content consumption channel, particularly for younger demographics, has intensified competition by diverting advertising spend. Platforms like TikTok and Instagram are increasingly becoming destinations for news and entertainment, impacting traditional publishers' ability to capture ad revenue.

| Competitive Factor | Impact on Future Plc | 2024 Data/Trend |

|---|---|---|

| Content Fragmentation | Dilutes audience attention and ad market share. | YouTube creators upload over 500 hours of video per minute. |

| Niche Competitors | Challenges Future's dominance in specialized verticals. | Competition from IDG Communications and numerous tech review sites. |

| Social Media Dominance | Siphons advertising revenue and audience engagement. | TikTok and Instagram growing as primary news sources for younger users. |

| Brand In-house Content | Reduces reliance on third-party publishers for marketing. | Brands expanding content studios, potentially reducing external ad spend. |

SSubstitutes Threaten

The proliferation of free online content, encompassing everything from news articles and product reviews to entertainment on platforms like YouTube and TikTok, presents a substantial threat of substitutes for Future. Consumers can readily access information and entertainment that mirrors or even rivals Future's premium offerings without incurring any cost. This accessibility forces Future to continually demonstrate the unique value and necessity of its paid content and subscription services to retain its customer base.

The rise of direct-to-consumer (DTC) information sources presents a significant threat. Companies and experts now bypass traditional media like Future by publishing directly via blogs, newsletters, and social media. For instance, in 2024, the creator economy saw continued growth, with platforms like Substack reporting millions of paid subscribers for independent newsletters, demonstrating consumers’ willingness to access information directly from trusted voices.

The proliferation of ad-blocking software presents a significant threat to Future's revenue. In 2024, it's estimated that over 200 million internet users in the US alone employ ad blockers, directly impacting the visibility and effectiveness of Future's advertising placements, a core monetization strategy.

Furthermore, growing consumer concern over data privacy, amplified by regulations like GDPR and CCPA, empowers users to limit tracking and data collection. This trend directly undermines Future's ability to deliver targeted advertising and personalize e-commerce experiences, potentially reducing ad yields and conversion rates.

The combined impact of these trends forces Future to actively seek and develop alternative revenue streams beyond traditional advertising and e-commerce, such as subscription models or sponsored content, to maintain financial stability and growth.

Emerging Technologies (e.g., AI-generated Content)

The increasing sophistication of AI-generated content, including text, images, and video, poses a significant threat of substitution for traditional content creation. Companies like OpenAI have made substantial advancements, with their models demonstrating impressive capabilities in producing creative outputs.

While Future is actively exploring collaborations with AI firms, the widespread availability and improving quality of AI-generated content could directly impact the demand for human-produced media. For instance, the market for stock imagery and basic written content could see a notable shift as AI tools become more accessible and cost-effective.

Consider the following implications:

- Reduced Demand for Certain Creative Roles: As AI becomes adept at generating content, roles focused on producing routine or formulaic content may face reduced demand.

- Cost Efficiencies for Businesses: Companies might opt for AI-generated content for marketing materials, internal communications, or basic news reporting due to lower costs compared to hiring human creators.

- Shifting Content Quality Benchmarks: The continuous improvement of AI content generation could raise consumer expectations for speed and volume, potentially pressuring traditional creators to adapt or innovate.

- Market Penetration of AI Tools: By mid-2024, it's estimated that over 30% of businesses are experimenting with generative AI for content creation, indicating a growing adoption trend that could accelerate substitution.

Alternative Entertainment and Information Consumption Habits

Consumers are increasingly turning to diverse digital platforms for entertainment and information, diverting attention from traditional media. Streaming services like Netflix and Disney+, alongside gaming platforms and podcasts, offer compelling alternatives that directly compete for audience engagement. This shift means Future's content faces significant pressure from a widening array of substitute offerings, impacting its ability to capture and retain viewers.

The proliferation of these substitutes directly threatens Future's revenue streams, particularly advertising and subscription models. For instance, in 2024, global digital ad spending reached an estimated $600 billion, with a significant portion flowing to platforms offering highly targeted content and user experiences that may prove more attractive than Future's offerings. This intense competition for consumer attention can erode Future's market share and advertising effectiveness.

- Growing Digital Entertainment Market: The global video streaming market alone was valued at over $200 billion in 2023 and is projected to continue strong growth, indicating a substantial diversion of consumer spending and time away from traditional media.

- Podcast Listenership Surge: By 2024, podcast listenership has become mainstream, with hundreds of millions of active listeners worldwide, many of whom dedicate significant time to this audio-first medium.

- Gaming Dominance: The video game industry continues to expand, with global revenues expected to surpass $200 billion in 2024, showcasing a powerful substitute for other forms of entertainment.

- Interactive Content Appeal: The rise of interactive streaming and gaming experiences offers a level of engagement that traditional linear content may struggle to match, posing a direct challenge to Future's content consumption models.

The increasing availability of free and low-cost digital alternatives for information and entertainment poses a significant threat of substitutes for Future. Consumers can access a vast array of content, from news and educational material to entertainment, through various online platforms, many of which are free or offer affordable subscription tiers. This accessibility forces Future to continuously innovate and highlight the unique value proposition of its premium offerings to retain user engagement and loyalty.

| Substitute Category | Examples | 2024 Market Data/Trend |

|---|---|---|

| Free Online Content | YouTube, TikTok, Blogs, News Aggregators | Over 200 million US internet users employed ad blockers in 2024, impacting ad revenue for platforms. |

| Direct-to-Consumer (DTC) Information | Substack Newsletters, Creator Economy Platforms | Substack reported millions of paid subscribers in 2024, showcasing demand for direct creator access. |

| Streaming Services | Netflix, Disney+, HBO Max | Global video streaming market valued over $200 billion in 2023, with continued strong growth projected. |

| Podcasts | Spotify Podcasts, Apple Podcasts | Podcast listenership became mainstream by 2024, with hundreds of millions of active listeners globally. |

| Gaming | Xbox, PlayStation, PC Gaming | Global video game industry revenues expected to surpass $200 billion in 2024. |

| AI-Generated Content | AI text generators, AI image generators | By mid-2024, over 30% of businesses were experimenting with generative AI for content creation. |

Entrants Threaten

The digital landscape for content creation presents a significant threat of new entrants. In many sectors, the financial investment required to start a blog, a YouTube channel, or a podcast is remarkably low. For instance, a basic website can be launched for under $100 annually, and content creation tools are often available for free or at minimal cost.

This accessibility means that individuals or small groups can quickly establish themselves as competitors, often with fresh perspectives or niche expertise. Consider the creator economy, which saw substantial growth in 2023, with platforms like TikTok and Instagram enabling millions of new creators to emerge. This rapid influx of new players can dilute market share and drive down advertising rates, forcing established companies to adapt.

The ease with which new content creators can emerge means that established players must continuously focus on innovation and differentiation. For example, in the online news sector, new digital-first publications can pop up overnight, challenging established media giants. The threat is that these newcomers can capture audience attention and advertiser budgets by offering specialized content or more engaging user experiences, putting pressure on existing revenue streams.

New entrants, particularly niche content startups, pose a significant threat by targeting specialized or underserved segments of the market. These agile companies can quickly gain traction by offering unique content formats or community experiences that cater precisely to specific audience needs, potentially siphoning off Future's market share in its core verticals.

Large technology firms like Meta and Google, with their vast user bases and substantial financial backing, are increasingly venturing into content creation and distribution. For instance, Meta's investment in original video content and Google's expansion of YouTube's creator ecosystem demonstrate this trend. These tech giants possess the infrastructure and audience reach to significantly disrupt traditional content models, posing a considerable threat to companies like Future.

Disruptive Business Models

Disruptive business models pose a significant threat. New entrants could leverage personalized content feeds, a strategy that has seen success in other digital media sectors, potentially diverting Future's audience. For instance, platforms offering highly tailored news or entertainment experiences could capture user attention more effectively than Future's current offerings.

Innovative monetization strategies are also a concern. Think about micro-subscriptions for premium content or direct fan support models, which bypass traditional advertising revenue. By 2024, the creator economy has demonstrated substantial growth, with many platforms enabling direct monetization, potentially challenging Future's established revenue streams.

- Personalized Content: Competitors offering curated feeds could erode Future's audience share.

- New Monetization: Micro-subscriptions and fan support models offer alternative revenue paths.

- Community Building: Innovative engagement tactics could attract and retain users more effectively.

- Digital Media Trends: The shift towards direct-to-consumer models continues to reshape the industry.

Capital Investment in Digital Media

While the initial barrier to entry for individual content creation in digital media might seem low, the reality for establishing a significant new media company involves substantial capital. This investment is crucial for acquiring top-tier talent, developing unique proprietary technology, and executing aggressive marketing campaigns to gain market share. For instance, in 2024, major digital media companies continued to pour billions into AI development and content acquisition, demonstrating the scale of investment required to compete effectively.

Well-capitalized startups can rapidly scale their operations, quickly becoming formidable competitors. By leveraging significant funding, they can outbid established players for talent and secure prime advertising slots. For example, a new streaming service launching in 2024 might need to allocate hundreds of millions of dollars for content licensing and marketing alone to make a meaningful impact.

- Talent Acquisition: High upfront costs to attract and retain skilled content creators, editors, and technologists.

- Technology Development: Investment in proprietary platforms, AI tools for content generation or curation, and robust distribution infrastructure.

- Marketing and Brand Building: Significant expenditure on advertising, public relations, and social media campaigns to build brand awareness and user base.

- Content Licensing and Production: Substantial capital required for acquiring rights to existing content or producing original material to differentiate from competitors.

The threat of new entrants in the digital content space remains considerable, driven by low initial investment barriers for individual creators. However, building a significant media company requires substantial capital for talent, technology, and marketing. For instance, in 2024, major digital media firms invested billions in AI and content acquisition, highlighting the scale needed to compete effectively.

Well-funded startups can quickly scale, outbid for talent, and secure advertising. A new streaming service in 2024 might need hundreds of millions for content and marketing to gain traction. This dynamic means established players must constantly innovate to retain their audience and revenue streams against agile newcomers and tech giants.

| Key Investment Areas for New Media Entrants | Estimated Capital Needs (Illustrative) | Impact on Competition |

| Talent Acquisition | $5M - $50M+ | Drives quality and differentiation, potentially poaching top talent. |

| Technology Development (AI, Platforms) | $10M - $100M+ | Enables personalized experiences and efficient operations. |

| Marketing & Brand Building | $20M - $200M+ | Crucial for user acquisition and market penetration. |

| Content Licensing/Production | $50M - $500M+ | Essential for attracting and retaining audiences. |

Porter's Five Forces Analysis Data Sources

Our Future Porter's Five Forces analysis is built upon a foundation of forward-looking data, including industry trend reports, expert forecasts, patent filings, and emerging technology assessments. This ensures our insights reflect potential shifts in competitive dynamics.