Funai PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Funai Bundle

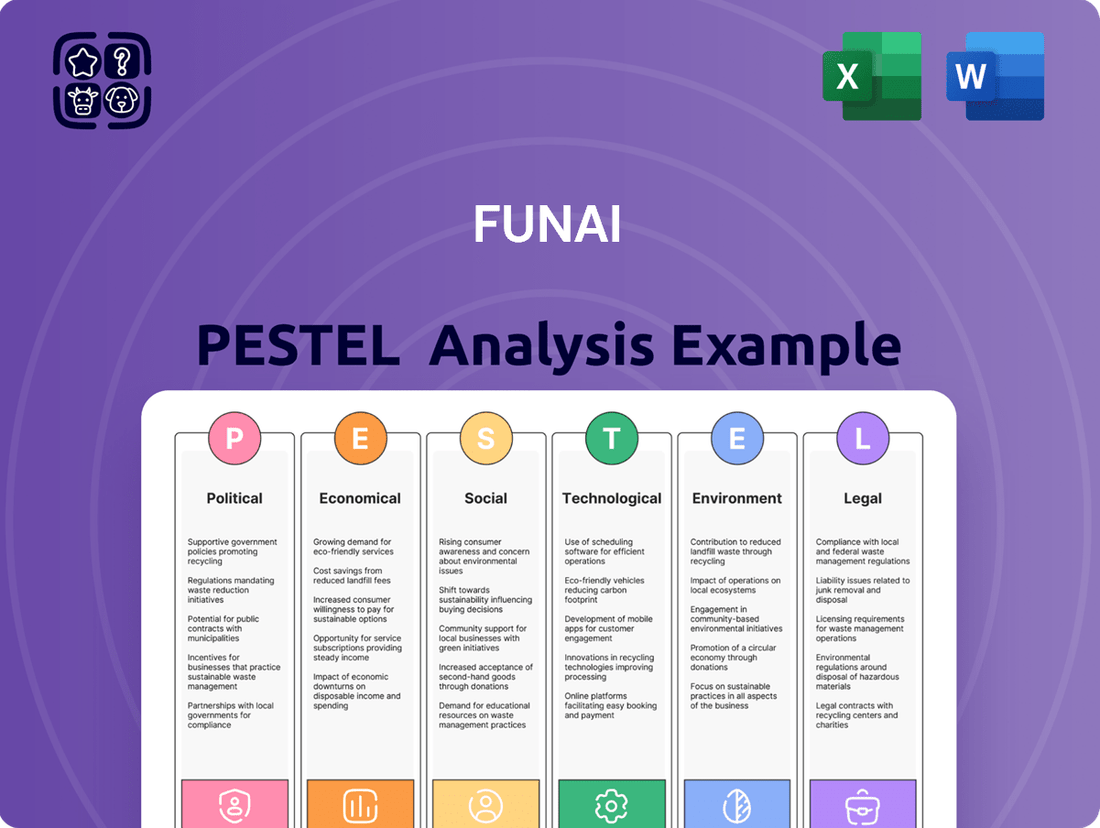

Navigate the complex external forces impacting Funai with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its market. This expert-crafted report provides actionable insights to inform your strategic decisions. Download the full version now and gain a critical competitive edge.

Political factors

Japanese government policies significantly shape the electronics manufacturing landscape, impacting companies like Funai. These policies encompass financial incentives such as subsidies aimed at boosting domestic production and R&D, alongside trade agreements that can either open or restrict market access for electronic components and finished goods. For instance, Japan's Ministry of Economy, Trade and Industry (METI) has been actively promoting investment in advanced manufacturing technologies and semiconductor production, with a notable ¥774 billion (approximately $5.2 billion USD as of early 2024) allocated for semiconductor industry support.

Regulations on production processes and supply chain management also play a critical role. Funai must navigate environmental regulations, such as those concerning hazardous substances in electronics (e.g., RoHS directives), and ensure compliance with labor laws and safety standards. Furthermore, government-backed initiatives to strengthen supply chain resilience, particularly in light of global disruptions, can influence sourcing strategies and operational costs for Funai's commercial products and IT solutions.

Global trade relations and the imposition of tariffs directly influence Funai's operational costs and market competitiveness. For instance, in 2024, ongoing trade tensions between major economies could lead to increased duties on electronic components Funai imports, potentially raising production expenses by an estimated 5-10% if new tariffs are enacted.

The dynamic nature of international trade agreements and the potential for unexpected tariff escalations, particularly involving key markets like the United States and China, introduce significant uncertainty. This necessitates robust strategic planning for Funai to build resilient supply chains and mitigate the financial impact of shifting trade policies.

Japan's Economic Security Act, enacted in 2022, significantly impacts companies like Funai by imposing stringent rules on technology transfer, particularly in sensitive sectors such as semiconductors. This legislation aims to safeguard critical Japanese intellectual property from foreign acquisition or leakage.

For Funai, a player in the information technology sector, compliance means carefully managing its supply chains, research collaborations, and personnel movements to prevent the unauthorized disclosure of proprietary technologies. This could involve enhanced due diligence on international partners and stricter internal protocols for handling sensitive data.

The act's focus on critical technologies means that Funai's operations involving advanced electronic components or semiconductor-related processes will face heightened scrutiny. Failure to comply could result in penalties, impacting its ability to innovate and compete globally.

Geopolitical Risks and Supply Chain Stability

Ongoing geopolitical tensions, such as the conflict in Ukraine and trade disputes between major economies, continue to pose significant risks to global supply chains. These disruptions directly impact the electronics manufacturing sector by affecting the availability and pricing of critical components and raw materials. For Funai, this translates to potential challenges in maintaining consistent production output and meeting delivery deadlines.

Monitoring these evolving geopolitical landscapes is crucial for Funai to proactively manage its supply chain. By understanding potential flashpoints and their ripple effects, the company can implement strategies to buffer against unforeseen interruptions. This includes diversifying supplier bases and exploring alternative sourcing options to ensure resilience.

The impact of these risks is substantial. For instance, in 2024, the semiconductor industry, a key supplier to electronics manufacturers like Funai, experienced continued supply chain vulnerabilities exacerbated by geopolitical factors. This led to price volatility and extended lead times for essential microchips, directly affecting production costs and schedules for many companies in the sector.

- Geopolitical Instability: Continued international conflicts and trade tensions create uncertainty in global markets.

- Supply Chain Vulnerability: Electronics manufacturing relies on complex global networks, making them susceptible to disruptions.

- Material Costs: Geopolitical events can drive up the cost of raw materials and components, impacting Funai's profitability.

- Production Delays: Supply chain disruptions can lead to significant delays in manufacturing and product delivery.

Government Support for Green Technologies

The Japanese government's commitment to carbon neutrality, aiming for net-zero emissions by 2050, creates a favorable environment for companies like Funai that can contribute to these goals. This policy direction offers opportunities for Funai to leverage government support for developing and implementing eco-friendly manufacturing processes and products.

Specific initiatives, such as subsidies for energy-efficient equipment or tax breaks for green R&D, can directly benefit Funai's operational costs and innovation efforts. For instance, the Green Growth Strategy, launched in 2021, targets significant investment in renewable energy and decarbonization technologies, which Funai could align with.

- Government Push for Sustainability: Japan's 2050 carbon neutrality goal encourages businesses to adopt green practices.

- Financial Incentives: Potential for subsidies, grants, and tax credits for environmentally conscious investments and innovations.

- Market Opportunities: Alignment with national sustainability targets can open doors to new markets and partnerships focused on green solutions.

Government policies in Japan significantly influence Funai's operations, from R&D incentives to trade regulations. For example, the Japanese government allocated approximately $5.2 billion USD in early 2024 to support the semiconductor industry, a key area for electronics manufacturers. Compliance with environmental and labor laws is also paramount, as is navigating international trade agreements and potential tariffs, which could increase production costs by an estimated 5-10% in 2024 due to ongoing trade tensions.

What is included in the product

This Funai PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the organization, offering a comprehensive understanding of its external landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making it easier to quickly identify and address external challenges impacting Funai.

Economic factors

The global consumer electronics market is showing signs of a rebound, with forecasts suggesting a modest recovery in 2025 following a period of slower growth. This trend is particularly relevant for companies like Funai, which has a history in this sector.

Key growth areas within consumer electronics, such as smartphones, gaming consoles, and the burgeoning smart home device segment, are expected to drive this recovery. Funai's strategic decisions and product innovation will need to align with these evolving consumer preferences and technological advancements to capitalize on the market's resurgence.

Easing inflation in major economies like the US and Eurozone, with the US CPI falling to 3.1% in January 2024 and the Eurozone HICP at 2.8% in February 2024, should support consumer spending. This trend is projected to continue, with forecasts suggesting US inflation might hover around 2.5% by end-2024 and the Eurozone around 2.0% by mid-2025, potentially boosting demand for durable goods.

Despite easing inflation, consumers are demonstrating a continued focus on value, with global retail sales growth moderating to an estimated 4.5% in 2024, down from 5.3% in 2023. This persistent value-consciousness means Funai must carefully balance pricing with promotional activities to capture market share, as consumers are likely to seek discounts and prioritize cost-effectiveness.

Fluctuations in currency and interest rates present a significant economic factor for Funai. Volatile exchange rates can directly impact the cost of imported raw materials and the profitability of Funai's international sales. For example, a weaker Japanese Yen, as seen in recent periods, can make Funai's products more attractive to overseas buyers, potentially boosting export volumes.

Changes in interest rates also play a crucial role, influencing the cost of borrowing for capital investments and affecting consumer spending on durable goods like Funai's electronics. Higher interest rates can dampen demand, while lower rates may stimulate it. Tracking these economic shifts is vital for Funai's financial planning and strategic decision-making.

Shift to Commercial and IT Solutions Market

Funai Electric's strategic pivot towards commercial and IT solutions directly links its economic fortunes to the B2B sector's performance. This move is designed to bolster overall group profitability and corporate value by lessening dependence on the often-unpredictable consumer AV market.

The global market for IT services and solutions experienced robust growth, with projected revenues in the trillions of dollars for 2024 and 2025. This expansion is fueled by increasing digital transformation initiatives across industries, demand for cloud computing, and the growing adoption of artificial intelligence and data analytics. Funai's focus on these areas positions it to capitalize on these significant economic trends.

- IT Services Market Growth: The global IT services market was valued at over $1.3 trillion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of approximately 8-10% through 2027, indicating substantial ongoing demand.

- Commercial Solutions Demand: Businesses are increasingly investing in integrated commercial solutions, including managed print services, digital signage, and business process automation, to improve efficiency and customer engagement.

- Economic Sensitivity: Funai's economic outlook in these segments will be influenced by corporate IT spending budgets, which can fluctuate with broader economic conditions and investment cycles.

Investment in Digital Transformation and AI

Global investment in digital transformation is accelerating, with a significant portion directed towards artificial intelligence. This surge fuels demand for the high-performance computing infrastructure that Funai’s IT and solutions segments can provide. For instance, the worldwide IT services market was projected to reach over $1.3 trillion in 2024, with AI integration being a key growth driver.

The rapid adoption of generative AI, in particular, is creating a substantial economic tailwind for companies supplying the necessary hardware and services. Funai's strategic focus on IT and solutions positions it to capitalize on this trend, potentially leading to increased revenue streams. Analysts estimate the global AI market could reach $1.5 trillion by 2030, underscoring the long-term economic potential.

- Increased demand for semiconductors: The AI boom requires advanced chips, a market where Funai could leverage its expertise.

- Growth in cloud computing services: Digital transformation necessitates robust cloud infrastructure, a service area for Funai.

- Expansion of IT consulting: Businesses need guidance to implement new digital strategies, creating opportunities for solution providers.

- Hardware upgrades: The computational needs of AI are driving significant investments in server and data center upgrades.

Easing inflation in major economies, with US CPI at 3.1% in January 2024 and Eurozone HICP at 2.8% in February 2024, is expected to support consumer spending, potentially benefiting Funai's electronics business. However, a continued focus on value means global retail sales growth is moderating to an estimated 4.5% in 2024, down from 5.3% in 2023, requiring careful pricing strategies.

Funai's strategic shift to commercial and IT solutions aligns with the robust growth in the IT services market, projected to exceed $1.3 trillion in 2024. This sector's expansion, driven by digital transformation and AI adoption, offers significant economic opportunities. Funai's performance in these segments will be tied to corporate IT spending, which is influenced by broader economic conditions and investment cycles.

| Economic Factor | 2024 Projection/Value | Impact on Funai |

|---|---|---|

| Global Consumer Electronics Market Growth | Modest recovery expected | Potential for increased sales if Funai aligns with key growth areas like smart home devices. |

| US Inflation (CPI) | Projected ~2.5% by end-2024 | Supports consumer spending on durable goods, potentially boosting demand for Funai's products. |

| Global Retail Sales Growth | Estimated 4.5% (down from 5.3% in 2023) | Highlights consumer value-consciousness, necessitating competitive pricing and promotions. |

| Global IT Services Market Value | Over $1.3 trillion (2024) | Significant opportunity for Funai's IT and solutions segments due to digital transformation and AI demand. |

Preview Before You Purchase

Funai PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Funai PESTLE analysis covers all key external factors impacting the company, providing valuable insights for strategic planning.

What you’re previewing here is the actual file—fully formatted and professionally structured. It details the Political, Economic, Social, Technological, Legal, and Environmental aspects relevant to Funai's operations and market position.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis for Funai is designed to be a practical tool for understanding its business environment.

Sociological factors

Consumer preferences are shifting, with a strong emphasis on value, cutting-edge innovation, and tailored experiences, particularly within established technology sectors. This trend means Funai must actively adjust its product development and marketing approaches to align with these evolving desires. For instance, the market saw a significant uptick in smart home device adoption in 2024, with many consumers actively seeking seamless integration across their electronics.

The demand for smart home integration and interconnected devices continues to surge, presenting both opportunities and challenges for companies like Funai. Meeting this demand requires not only technological advancement but also a deep understanding of how consumers want their devices to work together. By 2025, analysts predict that over 60% of new home electronics purchases will include some form of smart connectivity, underscoring the urgency for Funai to innovate in this space.

Consumers are increasingly prioritizing sustainability and ethical sourcing when buying electronics. This trend is reshaping market expectations, pushing companies like Funai to adapt. For instance, a 2024 survey indicated that over 60% of consumers consider a brand's environmental impact when making purchasing decisions.

Funai must showcase its dedication to eco-friendly manufacturing and responsible supply chains to capture this growing market segment. Demonstrating a commitment to reducing e-waste and using recycled materials is becoming a key differentiator, directly impacting brand perception and sales in the 2024-2025 period.

The increasing digital literacy across demographics, with a significant portion of the global population now online, directly influences the demand for Funai's IT and solutions. As more consumers and businesses become comfortable with technology, the market for advanced digital services, which Funai offers, expands considerably. For instance, by early 2025, projections indicate over 6.7 billion internet users worldwide, a substantial increase from previous years, highlighting a fertile ground for technology adoption.

Higher technology adoption rates translate into a greater appetite for sophisticated IT solutions and services that enhance efficiency and connectivity. Funai's ability to cater to this growing demand for advanced offerings, such as cloud computing, data analytics, and cybersecurity, is crucial for its market penetration and growth. In 2024, global IT spending was estimated to reach over $5 trillion, demonstrating the robust market for technology-driven solutions.

Impact of Hybrid Work Models on Technology Needs

The widespread adoption of hybrid work models significantly shapes technology demands, requiring robust solutions for seamless remote collaboration. This trend is driving increased sales of laptops, monitors, and communication software. For instance, in 2024, global spending on collaboration software was projected to reach $63.4 billion, underscoring the market's growth.

Funai can capitalize on this by offering devices and services optimized for flexible work environments, such as enhanced video conferencing equipment and secure cloud-based platforms. The market for enterprise collaboration tools saw substantial growth, with many companies investing heavily in upgrading their remote work infrastructure throughout 2024.

- Increased demand for personal computing devices: Laptops and tablets are essential for remote and in-office work, with sales remaining strong.

- Growth in collaboration and communication tools: Software enabling virtual meetings, project management, and instant messaging is crucial.

- Need for enhanced cybersecurity solutions: Protecting distributed workforces from cyber threats is a growing priority for businesses.

- Investment in home office peripherals: Monitors, webcams, and ergonomic accessories are becoming standard for many remote employees.

Aging Population and Healthcare Technology Demands in Japan

Japan's demographic landscape is characterized by a rapidly aging population, a trend that significantly influences consumer demand and technological innovation. By 2025, it is projected that over 30% of Japan's population will be aged 65 or older, creating a substantial market for healthcare-related products and services.

This societal shift presents a compelling opportunity for companies like Funai to leverage its expertise in electronics within the health-tech sector. The increasing need for advanced medical devices, remote patient monitoring systems, and user-friendly consumer health gadgets is a direct consequence of this demographic evolution. Funai could explore developing specialized electronic components or integrated solutions tailored to the needs of an older demographic.

The demand for consumerized medical devices, which are often designed for ease of use and integration into daily life, is expected to surge. This includes wearable health trackers, smart home medical equipment, and telehealth platforms. Funai's 'development and new businesses' segment could find fertile ground in these emerging markets, capitalizing on the growing necessity for accessible and innovative healthcare technology.

- Demographic Shift: Japan's population is aging rapidly, with projections indicating over 30% will be 65+ by 2025.

- Health-Tech Demand: This demographic trend is expected to drive significant growth in the health-technology market.

- Consumerized Devices: There's a rising demand for user-friendly, integrated medical devices for home use.

- Business Opportunity: Funai can explore developing specialized electronic products and solutions for this expanding health-tech sector.

Societal values are increasingly emphasizing sustainability and ethical consumption, influencing purchasing decisions across various sectors. Consumers are actively seeking products from companies that demonstrate environmental responsibility and fair labor practices, impacting brand loyalty and market share. A 2024 survey revealed that 65% of consumers consider a company's social impact when making purchasing decisions.

This societal shift necessitates that Funai integrate robust sustainability initiatives into its operations and communication strategies. Highlighting eco-friendly manufacturing processes, ethical sourcing, and waste reduction efforts can resonate strongly with this value-driven consumer base. By 2025, companies with strong ESG (Environmental, Social, and Governance) credentials are expected to see a 10-15% higher valuation compared to their peers.

The growing demand for personalized experiences and customized products is a significant sociological trend affecting the electronics market. Consumers expect brands to understand their individual needs and preferences, leading to a preference for adaptable and configurable products. Funai's ability to offer customizable options or leverage data analytics to provide tailored recommendations will be key to capturing this market segment.

Furthermore, the increasing global interconnectedness and exposure to diverse cultures are shaping consumer expectations for product design and functionality. Funai should consider how cultural nuances and global trends can inform its product development and marketing to appeal to a broader audience. For instance, the adoption of smart home technology, which facilitates easier living, is becoming a global norm, with market penetration expected to exceed 40% in developed nations by 2025.

Technological factors

The electronics sector is experiencing a significant shift driven by rapid AI advancements, especially in generative and edge AI. These technologies are reshaping how products are designed and how companies operate.

Funai, with its emphasis on IT and solutions, is well-positioned to capitalize on these trends. By integrating AI, Funai can create more intelligent products and streamline its operations, offering customers more advanced and responsive services. For example, the global AI market was projected to reach $200 billion in 2023 and is expected to grow substantially, with edge AI specifically seeing rapid adoption in consumer electronics for localized processing and enhanced privacy.

The ongoing rollout of 5G networks is significantly boosting connectivity speeds and reducing latency, creating fertile ground for the Internet of Things (IoT). By mid-2024, it's estimated that over 12 billion IoT devices will be in use globally, a number projected to climb to 29 billion by 2030, according to Statista. This expansion means more devices can communicate seamlessly and in real-time.

Funai can leverage this technological shift by embedding advanced 5G and IoT capabilities into its product lines and enterprise solutions. Imagine smart appliances that can communicate with each other for optimized energy usage or industrial monitoring systems that provide instant diagnostics. This integration enhances user experience through responsiveness and unlocks new possibilities for data-driven insights and automation.

The electronics sector is buzzing with advancements in materials like gallium nitride (GaN) and silicon carbide (SiC), which offer superior performance in power electronics compared to traditional silicon. For Funai's manufacturing operations, understanding and integrating these new materials is key to producing next-generation devices that are more energy-efficient and powerful. The global market for wide-bandgap semiconductors, including GaN and SiC, was projected to reach over $10 billion by 2024, highlighting the significant opportunity for manufacturers who can adapt.

Growth of Smart Home and Integrated Systems

The smart home sector is experiencing significant growth, driven by the increasing adoption of universal standards and a strong emphasis on AI-powered automation and energy efficiency. This trend is creating new avenues for companies like Funai, leveraging their consumer electronics background. For instance, the global smart home market was valued at approximately $100 billion in 2023 and is projected to reach over $200 billion by 2028, showcasing a robust compound annual growth rate (CAGR) of around 15%.

Funai's established expertise in consumer electronics provides a solid foundation for developing integrated smart home solutions. By repurposing this experience, Funai can tap into the escalating consumer demand for intuitive and responsive devices that seamlessly connect and manage various household functions. This strategic pivot could allow Funai to capture a share of this expanding market.

- Market Expansion: The smart home market is projected to exceed $200 billion by 2028, indicating substantial growth potential.

- AI Integration: A key driver is the increasing use of AI for automation and enhanced energy efficiency in homes.

- Funai's Opportunity: Funai can leverage its consumer electronics background to create integrated smart home systems.

- Consumer Demand: The market is fueled by a growing desire for user-friendly and responsive connected devices.

Developments in Printed Electronics and 3D Printing

Advancements in printed electronics and 3D printing are creating new avenues for manufacturing, particularly for flexible films and conductive inks. These innovations promise more economical and adaptable production methods. For instance, the global 3D printing market was valued at approximately $17.9 billion in 2023 and is projected to reach $75.9 billion by 2030, demonstrating significant growth potential.

Funai could strategically leverage these emerging technologies within its B2B and OEM divisions. Applications could include the development of more sophisticated industrial ink cartridges and printer components, potentially enhancing product performance and reducing manufacturing costs. The integration of printed electronics could lead to lighter, more integrated printer designs.

Key opportunities for Funai include:

- Developing flexible printed circuit boards for next-generation printer interfaces.

- Utilizing 3D printing for rapid prototyping of custom ink delivery systems.

- Exploring conductive inks for integrated sensor technology in printing equipment.

The rapid evolution of Artificial Intelligence, particularly generative and edge AI, is transforming the electronics sector, influencing product design and operational efficiencies. Funai's focus on IT and solutions positions it to benefit from these advancements, enabling the creation of smarter products and more responsive services. The global AI market, projected to exceed $200 billion in 2023, underscores the significant growth in this area, with edge AI seeing particular traction in consumer electronics for localized processing and enhanced data privacy.

The widespread implementation of 5G networks is dramatically improving connectivity, fueling the growth of the Internet of Things (IoT). With over 12 billion IoT devices expected by mid-2024, Funai can integrate 5G and IoT into its offerings for enhanced user experiences and new data-driven opportunities. New materials like gallium nitride (GaN) and silicon carbide (SiC) are also key, offering superior performance in power electronics, with the wide-bandgap semiconductor market projected to surpass $10 billion by 2024.

The smart home market, valued at approximately $100 billion in 2023 and expected to double by 2028, is driven by AI-powered automation and energy efficiency. Funai can leverage its consumer electronics expertise to develop integrated smart home solutions, meeting growing consumer demand for intuitive, connected devices.

| Technological Factor | Description | Market Data/Projections (2023-2025) | Funai Relevance |

| AI Advancements | Generative and Edge AI | Global AI market ~$200B (2023); Edge AI growth in consumer electronics | Smarter products, streamlined operations |

| 5G & IoT | Enhanced connectivity, real-time communication | 12B+ IoT devices (mid-2024); 5G rollout | Integrated smart home & industrial solutions |

| Advanced Materials | GaN, SiC for power electronics | Wide-bandgap semiconductor market >$10B (2024) | Energy-efficient, powerful next-gen devices |

| Smart Home Tech | AI automation, energy efficiency | Market ~$100B (2023), projected >$200B by 2028 | Leverage consumer electronics for integrated systems |

Legal factors

The global data privacy landscape is in constant flux, with significant developments expected in 2025. The United States will see numerous new state-level data privacy laws take effect, adding complexity for businesses operating across different jurisdictions. Japan's Digital Personal Data Protection Act (DPDP) 2025, for instance, signals a trend towards more comprehensive data protection mandates worldwide.

For Funai, a company deeply involved in IT solutions and data processing, adherence to these evolving regulations is paramount. Non-compliance can lead to substantial fines and reputational damage. For example, under the EU's GDPR, fines can reach up to 4% of annual global turnover or €20 million, whichever is higher, a benchmark many new laws are referencing.

Regulations concerning e-waste management are tightening globally. A significant development is the amendment to the Basel Convention, effective January 2025, which now classifies all e-waste as hazardous, requiring prior informed consent for transboundary movement. This means companies like Funai must navigate more complex international shipping and disposal protocols.

Funai, as an electronics producer, faces increased responsibility for the end-of-life management of its products. This necessitates adapting product design for easier recycling and investing in robust take-back and recycling programs to ensure compliance with these evolving legal frameworks and avoid potential penalties.

Japan's government is increasingly scrutinizing and tightening regulations on the export of advanced technologies, especially in sensitive sectors like semiconductors and related manufacturing equipment. This move is aimed at curbing the illicit transfer of critical know-how and preventing potential misuse of these technologies.

Funai, with its involvement in IT solutions and potentially advanced component sourcing or development, must closely monitor and adapt to these evolving export control measures. Non-compliance could lead to significant penalties, operational disruptions, and reputational damage.

For instance, Japan's Ministry of Economy, Trade and Industry (METI) has been actively updating its lists of controlled items and technologies, impacting companies that engage in international trade of high-tech goods. In 2023, METI expanded its export control list to include 23 new items, reflecting a broader effort to secure supply chains and national security.

Intellectual Property Rights and Patent Protection

Protecting intellectual property is paramount for a technology-driven company like Funai, particularly as it ventures into new business areas and develops innovative solutions. The legal landscape governing patents, trademarks, and copyrights provides the essential framework for safeguarding these creations and ensuring Funai maintains its competitive advantage in the market.

In 2024, global spending on research and development, a key area for IP generation, was projected to reach over $2.5 trillion, highlighting the increasing importance of robust IP protection. Funai's ability to secure and defend its patents directly impacts its market exclusivity and potential for licensing revenue, crucial for recouping R&D investments.

- Patent Filings: Funai's patent portfolio is a critical asset, with recent trends showing increased patent applications in areas like advanced materials and digital technologies.

- Trademark Strength: The distinctiveness and recognition of Funai's brand trademarks are legally protected, preventing dilution and ensuring brand integrity in a crowded marketplace.

- Copyrighted Content: Software, documentation, and creative works developed by Funai are protected by copyright law, restricting unauthorized reproduction and distribution.

- Enforcement: Effective legal strategies for enforcing IP rights are vital to deter infringement and secure damages when violations occur, supporting Funai's financial stability.

Product Safety and Compliance Standards

Funai Electric must navigate a complex web of product safety and compliance standards across its global markets. These regulations are crucial for ensuring product quality, mitigating potential liabilities, and fostering consumer confidence. For instance, in 2024, the European Union's General Product Safety Regulation (GPSR) reinforces the obligation for manufacturers to place only safe products on the market. This includes adherence to standards for electrical safety, material composition, and even packaging, impacting everything from their consumer electronics to their appliance components.

Funai's commitment to these standards is demonstrated through ongoing product testing and certification processes. Failure to comply can result in significant penalties, product recalls, and damage to brand reputation. For example, in 2023, various electronics manufacturers faced fines and market withdrawals due to non-compliance with electromagnetic compatibility (EMC) directives in key regions. Funai actively invests in ensuring its products meet these evolving requirements.

Key areas of compliance for Funai include:

- Electrical Safety: Adherence to standards like IEC 62368-1 for audio/video, information and communication technology equipment.

- Material Composition: Compliance with regulations such as RoHS (Restriction of Hazardous Substances) which limits the use of certain hazardous materials in electronics.

- Environmental Standards: Meeting requirements for energy efficiency and end-of-life disposal, like the EU's Ecodesign Directive.

- Regional Certifications: Obtaining necessary approvals such as CE marking in Europe, FCC certification in the United States, and PSE mark in Japan.

Funai must navigate an increasingly stringent global regulatory environment concerning data privacy and cybersecurity. New laws like Japan's DPDP 2025 and evolving US state-level regulations necessitate robust compliance frameworks to avoid significant penalties, potentially reaching up to 4% of global turnover as seen with GDPR.

E-waste management is another critical legal area, with amendments to the Basel Convention in January 2025 classifying all e-waste as hazardous. This requires Funai to manage transboundary movements and product end-of-life with greater care, impacting design and disposal strategies.

Export controls on advanced technologies are tightening, particularly from Japan, impacting companies like Funai involved in IT solutions and component sourcing. Non-compliance can lead to severe penalties and operational disruptions, as demonstrated by METI's expansion of controlled items in 2023.

Intellectual property protection remains vital, with global R&D spending projected to exceed $2.5 trillion in 2024. Funai's ability to secure and defend its patents and trademarks is crucial for market exclusivity and recouping R&D investments.

Environmental factors

The global surge in electronic waste (e-waste) is a pressing concern, with the United Nations reporting over 53 million metric tons generated in 2019, a figure projected to reach 74 million metric tons by 2030. This escalating volume, fueled by shorter product lifecycles and increased consumer demand for new devices, directly impacts companies like Funai.

Funai must prioritize robust e-waste management strategies. This includes investing in eco-design principles to create more durable and repairable products, alongside supporting and expanding recycling programs. By taking these steps, Funai can mitigate its environmental impact and align with growing consumer and regulatory expectations for sustainability.

Japan's ambitious goal of achieving carbon neutrality by 2050, coupled with a target to slash greenhouse gas emissions by 50% by 2030 compared to 2013 levels, creates a significant impetus for companies like Funai Electric. This national directive translates into increasing pressure for Funai to integrate sustainable practices throughout its operations and value chain.

Funai must actively work towards reducing its carbon footprint, which includes scrutinizing and minimizing emissions generated across its entire supply chain, from raw material sourcing to product end-of-life. Furthermore, the company is being nudged to explore and implement green energy solutions, potentially investing in renewable energy sources for its manufacturing facilities and offices.

The increasing scarcity of critical metals, like copper, is prompting governments to act. For instance, Japan is developing e-waste recycling hubs to recover these valuable materials domestically, a trend that will likely accelerate globally.

Funai can strategically position itself within this evolving landscape by prioritizing product designs that facilitate reuse and by actively incorporating recycled content into its manufacturing processes. This approach not only addresses resource constraints but also aligns with growing consumer and regulatory demand for sustainable products.

Energy Efficiency in Manufacturing and Products

The drive for energy efficiency is a significant environmental factor impacting manufacturers like Funai. This focus stems from both escalating energy costs and a heightened awareness of environmental impact. For instance, in 2024, global energy prices remained volatile, with crude oil prices fluctuating around $80-$90 per barrel, directly influencing manufacturing operational expenses.

Funai has a clear opportunity to leverage this trend. By innovating and producing electronic products that consume less power, and by integrating energy-saving technologies into its own manufacturing facilities, the company can differentiate itself. The European Union’s Ecodesign Directive, for example, continues to set stringent energy performance standards for various product categories, pushing companies towards more efficient designs.

Key areas for Funai to consider include:

- Product Design: Developing electronics with lower standby power consumption and improved operational energy usage.

- Manufacturing Processes: Implementing energy-efficient machinery and optimizing production workflows to reduce overall energy intensity.

- Supply Chain: Partnering with suppliers who also prioritize energy efficiency in their operations.

- Consumer Education: Highlighting the energy-saving benefits of Funai products to attract environmentally conscious consumers.

Supply Chain Environmental Responsibility

Funai, like many global corporations, faces growing pressure to ensure environmental responsibility extends across its entire supply chain. This means not only focusing on its own operations but also demanding ethical sourcing and sustainable production from its suppliers and partners. For instance, by 2024, over 60% of consumers reported being willing to pay more for products from brands committed to sustainability, a trend that directly impacts supply chain expectations.

Funai's Corporate Social Responsibility (CSR) framework and environmental initiatives must therefore be actively integrated into its supplier relationships and procurement processes. This involves setting clear environmental standards for material sourcing, manufacturing processes, and logistics. In 2025, the global supply chain sustainability market is projected to reach over $20 billion, highlighting the significant financial and reputational implications of environmental performance.

- Ethical Sourcing: Funai needs to verify that raw materials are obtained without environmental degradation or human rights abuses.

- Sustainable Production: Partners should be encouraged or mandated to adopt energy-efficient manufacturing, waste reduction, and responsible water usage.

- Logistics Optimization: Reducing the carbon footprint of transportation and warehousing throughout the supply chain is crucial.

- Supplier Audits: Implementing regular environmental audits of key suppliers can ensure compliance and identify areas for improvement.

Environmental concerns, such as the escalating generation of e-waste and the global push for carbon neutrality, directly influence Funai's operational strategies and market positioning. Japan's commitment to reducing greenhouse gas emissions by 50% by 2030 is a key driver for companies like Funai to adopt greener manufacturing and supply chain practices.

The increasing scarcity of critical metals necessitates a focus on resource recovery and the incorporation of recycled materials into product design. Funai must also prioritize energy efficiency in both its products and manufacturing processes to manage rising energy costs and meet evolving regulatory standards, such as those set by the EU's Ecodesign Directive.

Funai's supply chain sustainability is paramount, with consumers increasingly favoring brands committed to environmental responsibility. By 2024, over 60% of consumers were willing to pay more for sustainable products, underscoring the financial imperative for Funai to ensure ethical sourcing and eco-friendly production from its partners.

The company's environmental strategy must encompass product lifecycle management, from eco-design to end-of-life recycling, aligning with global trends in resource management and waste reduction.

PESTLE Analysis Data Sources

Our Funai PESTLE Analysis is meticulously constructed using data from official government publications, reputable financial institutions, and leading industry research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting Funai.