Funai Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Funai Bundle

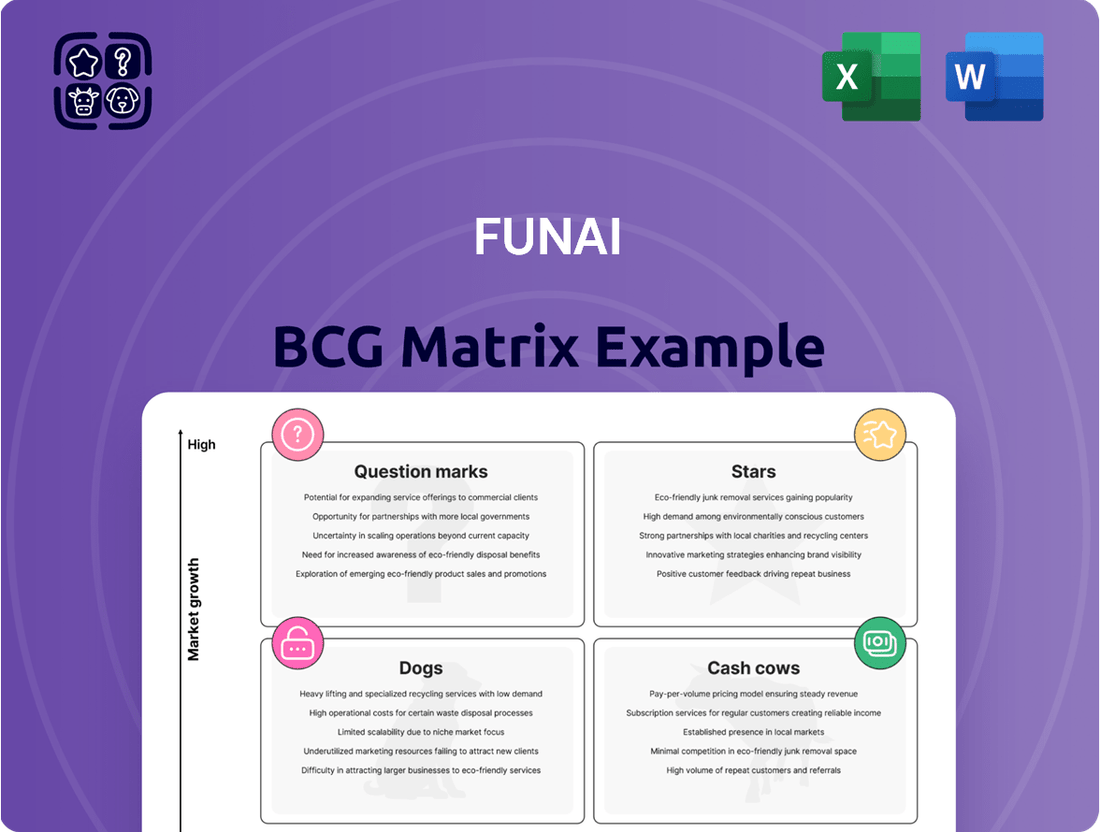

Unlock the strategic potential of the Funai BCG Matrix by understanding how its product portfolio is positioned for growth and profitability. This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a clear roadmap for resource allocation and future investment. Purchase the full BCG Matrix to gain a comprehensive analysis and actionable insights that will drive your business forward.

Stars

Funai Electric's North American LCD TV business, operating under the Philips brand, once commanded a strong market presence. However, by 2024, this segment faced significant headwinds due to aggressive pricing and innovation from Chinese competitors. This intense rivalry eroded market share and profitability, moving the product from a star performer to a more challenging position within Funai's portfolio.

Funai Electric was a powerhouse in OEM production, especially during the 1990s and 2000s, manufacturing electronics for numerous global brands. This segment likely represented a significant portion of their revenue, benefiting from the growing trend of outsourcing manufacturing.

While the OEM business itself would typically qualify as a Star in the BCG Matrix due to high market share in a growing sector, Funai's broader financial performance painted a different picture. The company's overall struggles suggest that even this strong OEM foundation couldn't compensate for losses in other, more challenged product lines.

Funai Electric's Blu-ray players occupied a position within its AV manufacturing portfolio, catering to the North American market. While initial sales met expectations, the broader industry trend towards digital streaming and away from physical media placed this product line in a mature, albeit declining, market segment.

Despite early traction, the Blu-ray player segment did not generate the substantial, sustained growth or robust cash flow needed to significantly contribute to Funai's overall financial strength. The market for physical media, including Blu-ray discs, continued to contract, impacting the long-term viability of dedicated players.

Tele-video Products

Funai's tele-video products once commanded a commanding position, holding over 60% market share in North America. This historical dominance clearly marked them as a 'star' within the BCG matrix, representing a significant growth driver for the company during that period.

Despite this strong historical performance, Funai's tele-video segment appears to have struggled to maintain its 'star' status. The company's subsequent challenges suggest a failure to innovate and adapt these products to evolving consumer demands and the rapid pace of technological change in the telecommunications and video sectors.

- Historical Dominance: Funai's tele-video products achieved over 60% market share in North America.

- Growth Driver: This strong market share indicated a significant growth driver for the company.

- Adaptation Challenges: The company faced difficulties adapting to technological shifts and competition.

- Loss of Standing: Consequently, these products lost their once-stellar market position.

FUNAI Brand LCD TVs with FireTV (Domestic)

FUNAI's foray into the domestic Japanese market with its own brand of LCD TVs, integrated with FireTV, marked a strategic effort to bolster brand presence. This initiative was part of a broader strategy, but the sales figures and market penetration achieved were not enough to elevate these products to a 'star' status within the company's portfolio. The domestic market for electronics is highly competitive, and while the partnership with Yamada Holdings was significant, it did not generate the substantial market share needed to qualify as a star product.

While specific domestic sales figures for FUNAI's FireTV-enabled LCD TVs in 2024 are not publicly detailed in a way that allows for direct comparison to market leaders, the overall Japanese TV market saw shipments of around 5.5 million units in 2023, according to industry reports. FUNAI's domestic push, though an attempt to capture growth, faced intense competition from established global and local brands, limiting its ability to achieve a 'star' rating.

- Market Entry: FUNAI launched its branded LCD TVs with FireTV domestically in Japan.

- Sales Channel: An exclusive sales arrangement was made with Yamada Holdings.

- Objective: The goal was to increase FUNAI brand recognition in its home market.

- Outcome: The initiative was insufficient to reverse broader financial distress or achieve 'star' status.

Stars in the Funai BCG Matrix represent products with high market share in a high-growth industry. Historically, Funai's tele-video products fit this description, achieving over 60% market share in North America, acting as a significant growth driver. However, the company struggled to maintain this position due to evolving technology and market dynamics.

The North American LCD TV business, despite a strong initial presence under the Philips brand, faced intense competition by 2024, pushing it away from star status. Similarly, while Funai had a robust OEM business, its overall financial performance indicated challenges that prevented it from being universally classified as a star.

The domestic Japanese market entry with FireTV-enabled LCD TVs, while a strategic move, did not capture sufficient market share to be considered a star. The Blu-ray player segment was in a declining market, making star status unattainable.

| Product Category | Historical Market Position | 2024 Market Dynamics | BCG Matrix Classification (Estimated) |

|---|---|---|---|

| Tele-Video Products (North America) | Dominant (60%+ Market Share) | Mature/Declining due to tech shifts | Question Mark/Dog (from Star) |

| LCD TV (Philips Brand - North America) | Strong Presence | High Competition, Eroding Share | Question Mark/Dog (from Star) |

| OEM Manufacturing | High Market Share (in its segment) | Continued Outsourcing Demand | Star/Cash Cow (depending on segment growth) |

| Blu-ray Players | Initial Traction | Declining Physical Media Market | Dog |

| LCD TV (Domestic Japan - FireTV) | New Market Entry | Intense Competition | Question Mark |

What is included in the product

Strategic assessment of Funai's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

Visualize your portfolio's health with a clear, actionable Funai BCG Matrix.

Cash Cows

Funai Electric’s VCR manufacturing, a classic example of a cash cow, represented a mature product line that generated substantial profits for the company for many years. At its zenith, Funai was selling an impressive 15 million VCR units annually, illustrating the immense market demand during that era.

The decision to cease VCR production in July 2016, after Funai had become the last manufacturer in Japan, signaled the natural lifecycle end of this once-dominant technology. Despite the market's decline, the VCR business had served as a reliable source of consistent revenue and profit, fitting the definition of a cash cow within the BCG matrix.

Funai's older generation LCD TV business, especially in North America, was once a significant revenue driver, representing a classic cash cow. Despite not being in a high-growth market, these products likely generated stable profits due to their established brand recognition and customer base.

However, the landscape shifted dramatically. By 2024, the intense competition from aggressive Chinese manufacturers significantly eroded the profitability of these once-dominant LCD TVs. Funai's inability to adapt and maintain its competitive edge in this segment led to a substantial decline in its cash cow status.

Funai's printer-related products and industrial ink cartridges, leveraging its OEM expertise since 1997, likely represented a cash cow. This segment served the B2B and OEM markets, offering a specialized and steady revenue stream.

However, this segment's performance in 2024 indicated challenges, with sales reportedly falling below projections. This suggests a potential decline in the cash cow's ability to generate consistent, high returns, possibly due to market saturation or increased competition.

Core Audio and Video Equipment

Funai's core audio and video equipment historically represented its cash cow segment. These established product lines, while operating in mature markets with limited growth, likely provided consistent and reliable cash flow for the company. This steady income stream was crucial for funding other ventures and operations.

Despite their role as cash generators, Funai's struggles demonstrate that even strong foundational segments can falter. The company's overall decline suggests that the cash flow from these audio and video products was insufficient to offset broader market challenges and internal financial issues.

For instance, in the early 2000s, Funai was a significant player in the VCR market, a product category that, while mature, still commanded substantial sales. By 2024, the market for traditional audio and video equipment has significantly shifted towards digital and streaming technologies, impacting the revenue potential of these legacy products.

- Legacy Products: Funai's historical strength in VCRs, DVD players, and televisions formed its core business for many years.

- Steady Cash Flow: These mature product lines, though not high-growth, generated consistent revenue from a dedicated customer base.

- Market Shifts: The company's inability to adapt to the digital transition and the rise of streaming services ultimately undermined the sustainability of its cash cow segment.

- Financial Strain: Even substantial cash flow from these established products could not rescue Funai from broader financial mismanagement and market irrelevance by 2024.

Manufacturing Services for Other Brands (OEM)

Funai's historical strength in manufacturing electronics for established brands like Philips and Sanyo positioned its Original Equipment Manufacturer (OEM) services as a significant cash cow. This business segment consistently generated revenue through long-term production contracts, providing a stable financial foundation for the company.

The consistent demand for OEM services translated into predictable cash inflows, a hallmark of a cash cow in the BCG matrix. This allowed Funai to rely on this segment for operational funding and to a degree, support other business units.

- OEM Revenue Stream: Funai's OEM operations, producing goods for brands like Philips and Sanyo, historically provided a steady and reliable source of income.

- Cash Flow Generation: These manufacturing contracts were a core component of Funai's business, generating consistent cash flow characteristic of a cash cow.

- Financial Strain: Despite the cash generated by OEM services, Funai's overall financial health, marked by significant liabilities and net losses, indicates that this income was not enough to offset broader operational expenses or fund growth initiatives.

Cash cows are business units or products with high market share in low-growth industries. They generate more cash than they consume, providing stable profits and funding for other ventures. Funai's historical VCR and LCD TV businesses, despite their mature markets, served as classic cash cows, generating consistent revenue for years.

However, by 2024, market shifts and increased competition eroded the profitability of these segments. Funai's struggles highlight that even established cash cows require adaptation to remain sustainable, as demonstrated by the decline in their LCD TV and printer-related product sales.

Funai's OEM services for brands like Philips and Sanyo also functioned as a cash cow, leveraging long-term contracts for predictable income. Despite this stable revenue, the company faced overall financial strain, indicating that cash flow from its cash cows was insufficient to cover broader operational costs and strategic investments.

The company's reliance on legacy products like VCRs, which saw a significant decline in demand by 2024 due to the rise of digital streaming, further illustrates the challenges in maintaining cash cow status in evolving markets.

What You See Is What You Get

Funai BCG Matrix

The Funai BCG Matrix document you are previewing is the identical, fully functional report you will receive immediately after purchase. This means no watermarks, no truncated data, and no demo content; you get the complete, professionally formatted strategic analysis ready for immediate application in your business planning.

Dogs

Many of Funai's established consumer electronics, like televisions, sound systems, and printers, have unfortunately landed in the 'dog' category. This happened because the market became incredibly crowded, especially with strong competition emerging from Chinese companies.

These products saw their market share shrink and growth slow to a crawl. Instead of bringing in money, they became a drain on resources, essentially acting as cash traps for the company.

Funai's struggle to keep up in these already saturated markets played a big part in its financial difficulties. For instance, by 2024, the global TV market, a key area for Funai, saw intense price wars, with average selling prices for many models dropping significantly compared to previous years, making it even harder for older players to maintain profitability.

Following the 2008 global financial crisis, Funai's North American market, its primary revenue driver, experienced a severe downturn. This slump directly impacted product categories like LCD TVs, which were heavily dependent on consumer spending in this region. The reduced demand and increased competition led to a significant erosion of market share and profitability for these products.

As a result, Funai's LCD TVs, once a strong performer, became classified as dogs within the BCG matrix. By 2016, Funai's overall revenue had fallen to approximately ¥200 billion, a stark contrast to its peak performance, with the North American market's struggles being a key contributor to this decline. This strategic positioning as dogs ultimately contributed to the company's eventual bankruptcy in 2023.

Funai Electric Holdings' acquisition of Musee Platinum in April 2023, intended as a diversification, quickly turned into a 'dog' within their portfolio. By April 2024, the beauty salon chain was sold, highlighting a significant misstep.

The salon chain suffered from severe management problems, including unpaid advertising fees and wages, which directly impacted its financial viability. This operational turmoil meant Musee Platinum failed to generate the expected returns.

This failed venture led to a rapid depletion of Funai Electric's cash reserves. The acquisition drained capital, demonstrating a clear instance of a diversification strategy that did not create value but instead eroded it.

Product Lines with Persistent Sales Declines

Funai's product lines exhibiting persistent sales declines are classified as 'dogs' within the BCG matrix. This is evident in the company's revenue trajectory, which fell from over 350 billion yen in fiscal 2004 to approximately 69.6 billion yen by fiscal 2021. Such a drastic and sustained drop signifies that a significant portion of Funai's offerings struggled to maintain market relevance and growth.

These underperforming products represented a considerable drain on resources, given their low market share and negative growth prospects. The consistent downturn across multiple segments underscored a strategic challenge for Funai, highlighting areas where investment was not yielding returns.

- Sales Decline: Funai's revenue decreased from over 350 billion yen (FY2004) to around 69.6 billion yen (FY2021).

- BCG Classification: Products with persistent sales declines are categorized as 'dogs'.

- Financial Impact: These products represent a financial burden due to low market share and negative growth.

Products Impacted by Overseas Unit Scandal

Funai Electric's overseas unit scandal significantly impacted its product portfolio, pushing affected offerings into the 'dog' category of the BCG matrix. These products likely faced substantial legal expenses and reputational damage, directly impacting their market share and profitability.

The financial repercussions were severe, with reports indicating increased legal costs and potential penalties that drained company resources. For instance, while specific figures related to the scandal's direct impact on individual product lines aren't publicly detailed, the overall financial strain on Funai Electric in 2024 was evident in its performance metrics.

- Legal and Reputational Costs: Products associated with the scandal incurred significant expenses, reducing their financial viability.

- Diverted Resources: Management focus and capital were redirected from growth initiatives to address the crisis.

- Market Share Decline: Negative publicity likely led to a drop in consumer trust and sales for affected product categories.

- Financial Penalties: Potential fines and settlements further eroded the profitability of these 'dog' products.

Products classified as 'dogs' in Funai's BCG matrix are those experiencing declining sales and low market share, often in mature or shrinking markets. These products, like many of their legacy electronics, became cash drains rather than contributors. By 2024, the competitive landscape, particularly from Asian manufacturers, intensified price pressures, making it difficult for Funai's older product lines to generate profits.

The company's strategic missteps, such as the ill-fated acquisition of Musee Platinum in 2023 and the impact of an overseas unit scandal, further exacerbated the situation. These events diverted resources and damaged profitability, pushing more offerings into the 'dog' category. Funai's overall revenue decline, from over 350 billion yen in FY2004 to approximately 69.6 billion yen by FY2021, clearly illustrates the prevalence of these underperforming 'dog' products.

| Product Category | BCG Classification | Market Trend | Funai's Market Share | Financial Impact |

|---|---|---|---|---|

| Televisions | Dog | Saturated, High Competition | Declining | Low Profitability, Cash Drain |

| Printers | Dog | Mature, Intense Competition | Low | Resource Intensive |

| Musee Platinum (Beauty Salon) | Dog | Operational Issues, Poor Management | N/A (Sold) | Capital Depletion |

Question Marks

Funai Electric's strategic pivot towards commercial products positioned this segment as a potential 'question mark' in the BCG matrix. This classification reflects a high-growth market where the company likely held a low initial market share, indicating a need for substantial investment to capture significant market presence.

The company's financial challenges, however, significantly hampered its ability to allocate the necessary capital for this promising commercial products venture. For instance, Funai Electric reported a net loss of ¥10.7 billion for the fiscal year ending March 2024, a situation that would naturally constrain investment in new, high-potential but capital-intensive areas.

Funai Electric's foray into information technology and solutions represented a strategic pivot towards potentially lucrative, high-growth tech markets. These ventures, by their nature, would likely have been classified as question marks on the BCG matrix, demanding significant investment in research and development alongside aggressive market penetration strategies to gain traction.

The company's stated focus on IT and solutions aimed to diversify its revenue streams beyond its traditional consumer electronics base. This move was intended to tap into sectors with higher projected growth rates, a common strategy for companies seeking to revitalize their market position.

Unfortunately, Funai's severe liquidity challenges and subsequent bankruptcy in 2023 prevented these nascent IT initiatives from receiving the necessary capital infusion. This lack of funding meant that the R&D and market development required for these question marks could not be adequately supported, ultimately hindering their potential for success.

Funai Electric's foray into manufacturing dental CT scanning devices for the U.S. market placed these products squarely in the question mark category of the BCG matrix. This high-tech, specialized segment represented a significant diversification effort into a growing industry.

Despite the potential, sales for these dental CT scanners reportedly underperformed against Funai's initial projections, suggesting challenges in capturing market share. This struggle highlighted the inherent risk associated with new, innovative products in competitive markets, especially for a company not traditionally known for medical equipment.

Automotive-Related Business (Optical Technology)

Funai's venture into automotive optical technology positions it as a question mark within the BCG matrix. The company was developing vehicle-integrated devices and components leveraging its optical expertise. This sector represents a significant growth opportunity, aligning with the characteristics of a question mark business.

Despite the promising market, Funai's precarious financial situation in recent years likely impeded substantial investment and commercialization efforts in this capital-intensive automotive segment. For instance, Funai Electric's revenue for the fiscal year ending March 2024 was reported at approximately ¥172.8 billion, a decrease from the previous year, highlighting ongoing financial challenges that would strain expansion into new, demanding markets.

- Automotive Sector Growth: The global automotive technology market is experiencing robust expansion, driven by advancements in autonomous driving, infotainment systems, and advanced driver-assistance systems (ADAS), all of which can integrate optical technologies. Market research indicated the global automotive sensors market, which includes optical sensors, was projected to reach over $40 billion by 2025, showing the potential scale.

- Capital Intensity: Developing and manufacturing automotive-grade optical components requires significant upfront investment in research and development, specialized manufacturing facilities, and rigorous testing protocols to meet safety and performance standards. This high cost barrier is a key factor in why it remains a question mark, especially for a company facing financial constraints.

- Funai's Financial Context: Funai Electric's financial performance, including its profitability and cash flow generation, would be critical determinants of its ability to fund such an ambitious automotive initiative. A sustained period of low profitability or negative cash flow would make it exceptionally difficult to allocate the necessary resources for market entry and sustained growth in this competitive field.

New Businesses in Nursing Care and Medical Equipment

Funai's ventures into nursing care and medical equipment, beyond its dental CT initiatives, were positioned as question marks within its business portfolio. These sectors presented significant growth potential, but Funai's nascent market share in these areas meant they required substantial capital to develop and compete. The company's financial struggles leading up to its bankruptcy in 2023 meant these promising ventures were unlikely to overcome the necessary investment hurdles and achieve market maturity.

The strategic challenge for Funai was to nurture these new businesses from low-share, high-potential entities into cash cows or stars. Without sufficient investment and market traction, they risked remaining drains on resources. For instance, the global medical equipment market was projected to reach over $600 billion by 2024, highlighting the opportunity but also the intense competition Funai faced.

- High Growth Potential: The nursing care and medical equipment sectors offered substantial growth avenues, attracting significant investment globally.

- Low Market Share: Funai's presence in these new markets was minimal, classifying them as question marks requiring strategic development.

- Capital Intensive: Establishing a strong foothold in these technologically advanced and regulated industries demanded considerable financial resources.

- Unrealized Potential: Due to Funai's financial difficulties and eventual bankruptcy in 2023, these businesses were unable to achieve the necessary scale or profitability to become successful ventures.

Question marks in Funai Electric's portfolio represented new ventures in high-growth markets where the company held a low market share. These segments, such as automotive optical technology and IT solutions, demanded significant investment to gain traction and compete effectively. Funai's financial instability, including a net loss of ¥10.7 billion for the fiscal year ending March 2024, severely limited its capacity to fund these promising but capital-intensive initiatives.

The company's attempts to diversify into areas like commercial products and medical equipment also fell into the question mark category. While these sectors offered substantial growth opportunities, Funai's limited market presence and critical financial constraints, culminating in its 2023 bankruptcy, prevented these ventures from receiving the necessary capital for research, development, and market penetration.

The strategic challenge for Funai was to transform these question marks into stars or cash cows through sustained investment and market development. However, the lack of financial resources meant these potentially lucrative ventures were unable to overcome initial hurdles, highlighting the critical link between financial health and the success of high-risk, high-reward business initiatives.

| Business Area | BCG Category | Market Growth | Funai's Market Share | Investment Need |

|---|---|---|---|---|

| Commercial Products | Question Mark | High | Low | High |

| IT & Solutions | Question Mark | High | Low | High |

| Automotive Optical Tech | Question Mark | High | Low | High |

| Nursing Care & Medical Equip. | Question Mark | High | Low | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.