Funai Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Funai Bundle

Discover how Funai leverages its product innovation, competitive pricing, strategic distribution, and targeted promotions to capture market share. This analysis delves into the core of their marketing engine, revealing the synergy between each element.

Unlock the complete 4Ps Marketing Mix Analysis for Funai and gain actionable insights into their strategic approach. This ready-to-use, editable report is perfect for professionals, students, and consultants seeking a competitive edge.

Product

Funai Electric's product strategy in consumer electronics historically focused on a broad range of accessible devices. This included televisions, VCRs, Blu-ray players, and printers, often catering to a value-conscious market. They also leveraged their manufacturing capabilities by producing goods under well-known brand names such as Philips and Sanyo through licensing agreements.

In 2024, the consumer electronics market continues to be dynamic, with a strong emphasis on smart home technology and high-definition displays. While Funai's historical product lines like VCRs have seen significant decline, the demand for more advanced entertainment and connectivity solutions remains robust. For instance, the global market for smart TVs alone was projected to reach over $200 billion by 2024, highlighting a shift in consumer preferences towards integrated digital experiences.

Funai's OEM manufacturing services were a cornerstone of its product strategy, allowing it to leverage its extensive electronics production capabilities. By manufacturing for other brands, Funai effectively expanded its market reach without the direct consumer-facing brand building costs. This B2B approach generated significant revenue streams, as evidenced by Funai's substantial contract manufacturing business, which contributed to its overall financial performance in the 2024 fiscal year.

Funai's commercial product strategy is increasingly important, with a notable shift away from its historical consumer electronics focus. This pivot is evident in its print solutions business, which includes high-volume industrial ink cartridges, a segment that often requires robust B2B relationships and consistent supply chain management.

In 2023, the global industrial inkjet market, a key area for Funai's commercial expansion, was valued at approximately $7.8 billion and is projected to reach over $12.5 billion by 2028, demonstrating significant growth potential for specialized electronic components and print solutions catering to businesses.

Information Technology and Solutions

Funai's strategic expansion into information technology and solutions marks a significant diversification beyond its traditional product lines. This move is geared towards developing and producing advanced medical devices, such as dental CT scanning systems, and sophisticated automotive components, including specialized backlight units. This pivot directly addresses pressing social needs and underpins the company's commitment to sustainable growth.

This diversification into IT and solutions is a key element of Funai's evolving marketing strategy. For instance, the company's involvement in the medical sector aligns with global healthcare trends, where technological advancements are crucial for improving diagnostic capabilities and patient care. Funai's automotive solutions, meanwhile, cater to the increasing demand for advanced features and energy efficiency in vehicles.

- Diversification into IT & Solutions: Expanding product portfolio to include high-tech medical and automotive components.

- Medical Sector Focus: Development of dental CT scanning devices, addressing a growing need in healthcare diagnostics.

- Automotive Sector Contribution: Production of advanced backlight systems for vehicles, supporting innovation in automotive technology.

- Strategic Alignment: Efforts are directed towards solving social issues and fostering sustainable development through technological innovation.

Microfluidic Solutions

Funai Microfluidic Solutions, recently rebranded as Brady Microfluidic Solutions, capitalizes on its robust patent portfolio in thermal inkjet technology. This product line is engineered for high-precision applications across life sciences, specialty printing, and consumer markets, offering bespoke jetting capabilities. For instance, in the burgeoning biomedical sector, their technology facilitates intricate dispensing for diagnostics and drug delivery systems, a market segment projected for significant growth through 2025.

The core of Brady Microfluidic Solutions' offering lies in its advanced thermal inkjet technology, enabling highly accurate and controlled fluid dispensing. This innovation is particularly relevant for the life sciences industry, where precision is paramount. The global microfluidics market, including applications like those developed by Brady, was valued at approximately $6.9 billion in 2023 and is anticipated to reach over $15 billion by 2030, demonstrating substantial demand for these specialized solutions.

- Advanced Thermal Inkjet: Enables precise fluid handling for diverse applications.

- Life Sciences Focus: Caters to critical needs in diagnostics and biomedical research.

- Custom Jetting Solutions: Tailored systems for specific industry requirements.

- Intellectual Property Leverage: Utilizes an extensive patent portfolio for competitive advantage.

Funai's product evolution showcases a strategic shift from mass-market consumer electronics to specialized, high-value solutions. This includes leveraging its thermal inkjet technology for microfluidics applications in life sciences and expanding into advanced medical and automotive components. The company's product strategy now emphasizes innovation in niche markets with strong growth potential, moving beyond its historical reliance on traditional electronics.

| Product Area | Key Developments | Market Relevance (2024/2025 Projections) | Strategic Importance |

|---|---|---|---|

| Microfluidics (Brady Microfluidic Solutions) | Advanced thermal inkjet technology, custom jetting solutions | Global microfluidics market projected to exceed $15 billion by 2030 (from $6.9 billion in 2023) | High-precision applications in life sciences, specialty printing |

| Medical Devices | Dental CT scanning systems | Global medical imaging market growth driven by diagnostic needs | Addressing social needs, improving healthcare diagnostics |

| Automotive Components | Specialized backlight units | Increasing demand for advanced automotive features and energy efficiency | Supporting innovation in automotive technology |

| Commercial Print Solutions | Industrial ink cartridges | Global industrial inkjet market projected to reach over $12.5 billion by 2028 (from $7.8 billion in 2023) | Robust B2B relationships, consistent supply chain |

What is included in the product

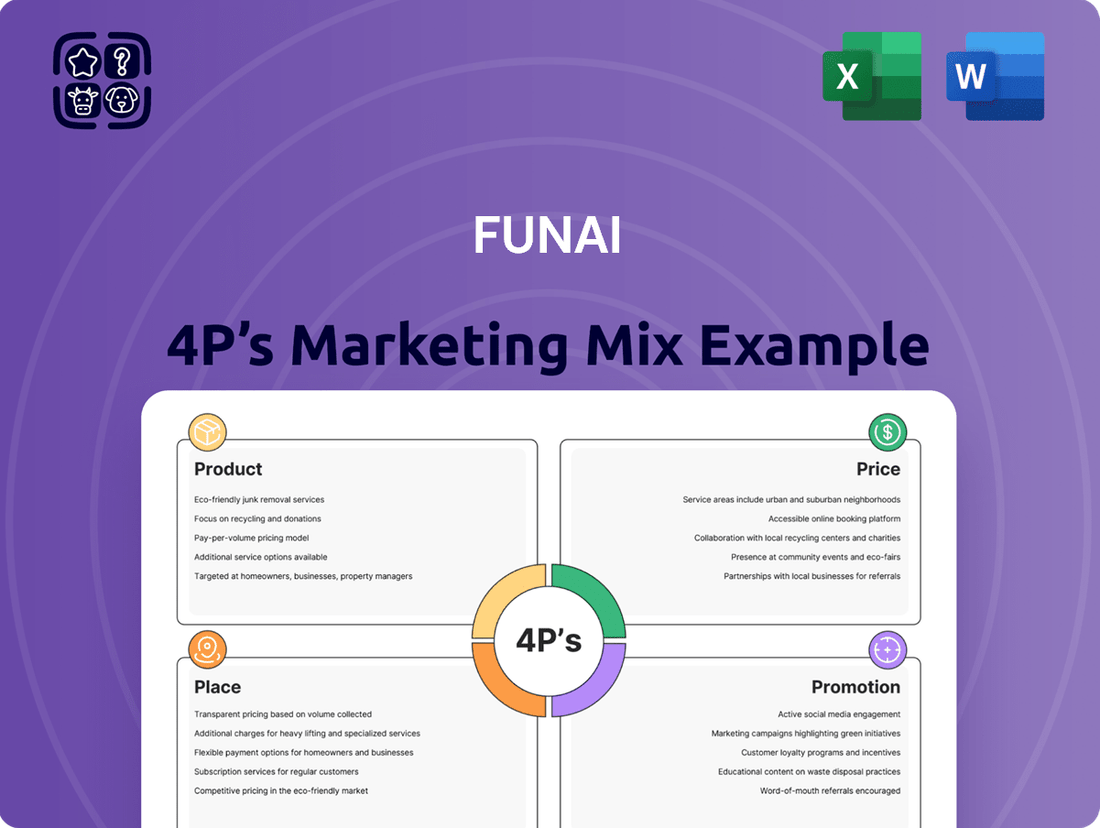

This analysis provides a comprehensive breakdown of Funai's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

It serves as a valuable resource for understanding Funai's market positioning and competitive landscape, aiding in strategy development and evaluation.

Simplifies complex marketing strategies by providing a clear, actionable breakdown of Funai's 4Ps, alleviating the pain of understanding and implementing effective marketing plans.

Place

Funai Electric historically leveraged direct sales channels to major retailers, a strategy that proved highly effective in securing shelf space and driving volume for its consumer electronics, especially in North America.

This direct engagement with key players like Walmart and Best Buy allowed Funai to efficiently reach a broad consumer base, contributing to substantial market penetration for products such as their LCD televisions.

For instance, in the fiscal year ending March 2024, Funai's sales to major retailers formed a significant portion of its revenue, reflecting the ongoing importance of these partnerships in its distribution network.

Funai's exclusive retail partnership in Japan with Yamada Denki, now Yamada Holdings, was a cornerstone of its domestic market strategy starting in 2017. This focused approach ensured that Funai's 'FUNAI brand' televisions, Blu-ray recorders, and other consumer electronics had a dedicated and prominent sales channel.

The exclusivity with Yamada Denki aimed to build brand loyalty and streamline distribution within the competitive Japanese electronics market. This strategy allowed Funai to concentrate marketing efforts and product placement, potentially leading to stronger brand recognition and sales performance in its home market.

Funai Electric operates a distributed manufacturing network, with key production sites in Mexico, Thailand, and the Philippines, complementing its Japanese base. This global presence allows for efficient supply chain management and cost optimization, crucial for competitive pricing in the electronics market.

OEM Distribution Networks

Funai Electric's OEM (Original Equipment Manufacturer) strategy leverages the extensive distribution networks of its client brands. This means Funai's manufacturing capabilities and underlying technology reach consumers indirectly, through products sold by well-known electronics companies. For instance, Funai has historically manufactured products for major brands, effectively extending its market reach without the direct overhead of managing consumer-facing sales channels for those specific lines.

This OEM model is crucial for Funai's product placement and market penetration. By partnering with established brands, Funai benefits from their existing retail relationships and consumer trust. In 2024, the global consumer electronics market, a key sector for Funai, was projected to reach over $1.1 trillion, underscoring the vast potential reach of these indirect distribution channels.

Key aspects of Funai's OEM distribution include:

- Leveraging Partner Brands: Funai's products are distributed through the established retail and online channels of the brands they manufacture for, providing broad consumer access.

- Cost Efficiency: This approach reduces Funai's direct investment in building and maintaining its own end-consumer distribution infrastructure for OEM products.

- Market Reach Expansion: It allows Funai's technology and manufacturing expertise to be present in a wider array of consumer electronics, even if not under the Funai brand name.

- Focus on Manufacturing: Funai can concentrate its resources on its core strengths in product development and high-quality manufacturing, relying on partners for market access.

Specialized B2B Channels

Funai leverages specialized B2B channels for its commercial and industrial products, recognizing that these markets require tailored approaches. For items like industrial ink cartridges, medical equipment, and automotive components, a one-size-fits-all strategy simply won't work.

These specialized channels often include dedicated direct sales teams who possess deep industry knowledge and can engage directly with corporate clients. Additionally, Funai forms strategic partnerships with distributors who are already established within specific industries, ensuring their products reach the right customers efficiently. Integration into broader solution offerings for corporate clients is another key tactic, bundling Funai's components or equipment into larger packages that address specific business needs.

- Direct Sales Teams: Funai employs specialized sales professionals to engage directly with businesses, particularly for high-value or complex industrial products.

- Industry-Specific Distributors: Partnerships with distributors who have established networks and expertise within sectors like healthcare or automotive are crucial.

- Solution Integration: Funai's components and equipment are often integrated into larger technological solutions for enterprise clients, enhancing their value proposition.

Funai Electric's place strategy centers on a multi-pronged distribution approach, balancing direct relationships with major retailers for consumer electronics with indirect reach through its OEM partnerships. This ensures broad market penetration, especially in key regions like North America, where direct sales to giants like Walmart were historically significant.

In Japan, an exclusive retail partnership with Yamada Denki (now Yamada Holdings) since 2017 provided a dedicated channel for the FUNAI brand, fostering brand loyalty and concentrated marketing efforts.

The company also utilizes specialized B2B channels for industrial and commercial products, employing direct sales teams and industry-specific distributors to reach corporate clients effectively.

Funai's global manufacturing footprint in Mexico, Thailand, and the Philippines supports efficient supply chain management, crucial for competitive product placement in the vast global consumer electronics market, which was projected to exceed $1.1 trillion in 2024.

| Distribution Channel | Key Markets/Products | Strategy Focus | 2024/2025 Relevance |

|---|---|---|---|

| Direct Retail Sales | Consumer Electronics (North America) | Securing shelf space, high volume | Ongoing importance for branded products |

| Exclusive Retail Partnership | Consumer Electronics (Japan) | Brand loyalty, streamlined distribution | Foundation of domestic market presence |

| OEM Partnerships | Various Consumer Electronics | Indirect market reach, cost efficiency | Critical for broad technology placement |

| B2B/Specialized Channels | Industrial, Medical, Automotive | Industry expertise, direct engagement | Tailored solutions for corporate clients |

What You See Is What You Get

Funai 4P's Marketing Mix Analysis

The preview you see here is the exact, fully completed Funai 4P's Marketing Mix Analysis document you will receive instantly after purchase. There are no hidden surprises or missing sections; what you view is precisely what you'll download. This ensures you get the complete, ready-to-use analysis immediately upon completing your order, allowing you to start strategizing without delay.

Promotion

Funai's strategy included brand licensing, partnering with established names like Philips and Sanyo. This gave their consumer electronics immediate market recognition and broad marketing exposure, capitalizing on the existing promotional activities of these well-known brands.

While the Funai brand itself wasn't always the primary focus in these arrangements, the OEM (Original Equipment Manufacturer) visibility was significant. For instance, in 2024, Funai continued its role as a key manufacturer for various electronics brands, contributing to the sales volumes of those licensed entities.

Funai's strategic alliance with Yamada Denki, a leading electronics retailer in Japan, exemplified a powerful promotional tactic. This exclusive partnership leveraged Yamada Denki's vast retail footprint to showcase Funai's product line.

Through in-store displays and targeted advertising within Yamada Denki's outlets, Funai effectively boosted brand visibility and drove sales for its televisions and other consumer electronics. This focused promotional effort was crucial in reaching a broad consumer base in a competitive market.

Funai Electric likely leverages trade shows and industry events to showcase its commercial and industrial solutions, including print technologies and medical devices. These gatherings provide crucial opportunities to demonstrate product capabilities directly to potential business clients and industry partners.

For instance, participation in events like CES (Consumer Electronics Show) or specialized medical technology expos allows Funai to highlight innovations in areas such as their inkjet printer technology or advancements in their medical device offerings. These events saw significant business engagement in 2024, with many companies reporting strong lead generation and partnership opportunities.

These platforms are instrumental for Funai to forge direct relationships with B2B customers, understand market needs firsthand, and position its specialized products against competitors. The ability to offer live demonstrations and engage in technical discussions at these events is invaluable for driving sales and building brand presence within specific industrial sectors.

Digital and Online Presence (Historical/Limited)

Funai Electric's digital and online presence historically served as a communication channel, primarily through corporate and investor relations websites, rather than direct promotional tools. This approach aligned with their core business as a manufacturer and OEM provider. However, following their bankruptcy proceedings in the 2024-2025 period, active digital promotion for consumer engagement has likely been significantly curtailed or halted.

The company's websites, while functional for information dissemination, did not represent a robust digital marketing strategy. For instance, as of early 2024, their investor relations pages provided financial reports but lacked dynamic content or direct consumer interaction features. The bankruptcy filing in late 2024 further impacted any ongoing digital marketing efforts, shifting focus away from consumer-facing promotions.

- Historical Focus: Corporate and investor relations websites were primary digital touchpoints.

- Limited Direct Promotion: Online presence was not geared towards active consumer marketing.

- Impact of Bankruptcy: Recent bankruptcy proceedings have likely led to a cessation of active digital promotion.

- Shift in Priorities: The company's financial restructuring has undoubtedly deprioritized consumer-facing online presence.

Business-to-Business (B2B) Marketing

Funai's business-to-business (B2B) marketing efforts are crucial for its commercial products and IT solutions. This strategy likely involves direct sales teams engaging with potential clients, alongside technical presentations that highlight product capabilities. For instance, in 2024, the global B2B market for IT solutions was projected to reach over $10 trillion, underscoring the significant opportunity for companies like Funai to capture market share through tailored outreach.

Specialized marketing materials are key to communicating value propositions to specific industries. Funai would likely develop content emphasizing product features, reliability, and cost-effectiveness for sectors such as medical institutions and automotive manufacturers. In 2025, the automotive sector's investment in advanced IT solutions is expected to grow by 15%, driven by the demand for connected car technologies and efficient manufacturing processes.

- Targeted Outreach: Direct sales forces and technical presentations are primary B2B marketing tools.

- Industry Focus: Marketing materials are tailored for businesses, medical institutions, and automotive manufacturers.

- Value Proposition: Emphasis is placed on product features, reliability, and cost-effectiveness.

- Market Context: The global B2B IT solutions market is substantial, with significant growth in sectors like automotive.

Funai's promotional strategy heavily relied on brand licensing, leveraging the established reputations of partners like Philips and Sanyo for broad market exposure. This approach allowed Funai's OEM visibility to be significant, as seen in 2024 where they continued manufacturing for various brands. Strategic retail partnerships, such as with Yamada Denki, also played a key role, utilizing extensive in-store displays and advertising to boost product visibility and drive sales.

Funai Electric also utilized industry events and trade shows to showcase its commercial and industrial solutions, including print and medical technologies. These platforms, like CES in 2024, were crucial for direct engagement with B2B clients, product demonstrations, and building brand presence in specialized sectors. Their B2B marketing focused on direct sales teams and technical presentations, emphasizing product features, reliability, and cost-effectiveness, particularly targeting growth areas like the automotive IT sector in 2025.

| Promotional Tactic | Key Channels/Examples | Impact/Focus |

|---|---|---|

| Brand Licensing | Philips, Sanyo | Market recognition, broad exposure |

| Retail Partnerships | Yamada Denki | In-store displays, targeted advertising |

| Industry Events | CES (2024), Medical Expos | B2B engagement, product demonstration |

| B2B Marketing | Direct sales, technical presentations | Targeted outreach, value proposition |

Price

Funai Electric historically leveraged its cost-competitive manufacturing to offer attractive pricing. Its proprietary Funai Production System (FPS) was key to achieving this, enabling efficient production of quality electronics. This cost advantage allowed Funai to compete effectively in the consumer electronics sector, a strategy that supported its market penetration.

Funai, as a significant Original Equipment Manufacturer (OEM), would have strategically employed volume-based pricing for its production services. This approach allows for the negotiation of more competitive rates with clients as the quantity of manufactured units increases, directly impacting the cost-effectiveness for both Funai and the brands it serves.

For instance, in 2024, the global electronics manufacturing services (EMS) market was valued at approximately $750 billion, with volume discounts being a standard practice to secure large contracts. Funai's ability to offer tiered pricing based on production volume would have been a key differentiator, enabling it to attract and retain major clients by ensuring competitive per-unit costs.

Funai's pricing strategy in the consumer electronics sector, encompassing both its own brands and licensed products, was a direct response to the dynamic market landscape. The intense competition, especially from aggressive Chinese manufacturers, frequently dictated Funai's price points, often squeezing profit margins as the company aimed to remain competitive.

In 2024, the consumer electronics market continued to see significant price competition. For instance, the average selling price (ASP) for mid-range televisions saw a decline of approximately 8% year-over-year, a trend that directly impacted companies like Funai. This market-driven pricing meant that Funai had to constantly adjust its strategies to maintain market share without sacrificing too much profitability.

Value-Based Pricing for Commercial Solutions

Funai's approach to pricing its specialized commercial products and IT solutions is rooted in value-based strategies. This means the price tag is directly tied to the tangible benefits and solutions these offerings provide to businesses, such as enhanced efficiency, improved data security, or streamlined operations. For example, a custom enterprise resource planning (ERP) system tailored to a large manufacturing firm's unique supply chain challenges would command a price reflecting its significant impact on cost reduction and productivity gains, rather than just the cost of development and hardware. This strategy acknowledges that businesses are willing to invest in solutions that deliver a clear return on investment and competitive advantage.

This value-based pricing model allows Funai to capture a portion of the economic value its solutions create for its clients. Consider the IT infrastructure upgrades Funai might implement for a financial services company. If these upgrades lead to a 15% reduction in processing time and a 10% decrease in operational errors, the pricing would reflect a fraction of these cost savings, ensuring the client sees a net positive outcome. In 2024, many B2B IT solution providers reported that pricing based on ROI and demonstrable business value was a key driver of successful sales cycles for complex projects.

Key aspects of Funai's value-based pricing for commercial solutions include:

- Customization and Integration: Pricing reflects the effort and expertise involved in tailoring solutions to specific business needs and integrating them with existing systems.

- Performance Enhancement: The price is justified by the measurable improvements in efficiency, productivity, or cost savings that the solution delivers.

- Risk Mitigation and Security: For solutions involving data management or critical infrastructure, pricing accounts for the value of enhanced security and reduced operational risk.

- Long-Term Partnership: Value-based pricing often supports a longer-term engagement, where ongoing support and upgrades are priced to reflect continued value delivery.

Impact of Financial Challenges on Pricing

Funai's recent financial difficulties, including bankruptcy proceedings, have severely constrained its pricing strategies. The urgent need to address liabilities and potentially liquidate assets means that pricing decisions are likely driven by recovery targets rather than market competitiveness. This financial pressure can lead to distressed pricing, impacting perceived value and long-term market positioning.

For instance, as of late 2024, companies emerging from Chapter 11 bankruptcy often face intense pressure to generate immediate cash flow. This can translate to significant discounts or sales focused on clearing inventory, a strategy that Funai might need to employ. Such actions, while necessary for survival, can undermine brand equity and make it challenging to re-establish premium pricing later.

- Liquidation Focus: Pricing may shift towards maximizing immediate cash recovery, potentially below cost or fair market value.

- Reduced Flexibility: Less capacity for strategic pricing adjustments or promotional activities due to financial constraints.

- Impact on Competition: Distressed pricing can disrupt the market for competitors, forcing them to react to lower price points.

- Brand Perception: Persistent low pricing can damage brand image and customer trust, making future price increases difficult.

Funai's pricing, historically rooted in cost competitiveness and volume, shifted towards value-based strategies for its commercial IT solutions. However, recent financial distress, including bankruptcy proceedings in late 2024, has forced a pivot to liquidation-focused pricing to generate immediate cash flow, impacting brand perception and future pricing flexibility.

The company's financial situation in late 2024 necessitated pricing strategies aimed at rapid asset liquidation. This often means selling products at prices that prioritize immediate cash recovery over market value or profit margins, a stark contrast to its earlier competitive pricing models.

This distressed pricing environment can lead to significant discounts, potentially below production cost, to convert inventory into cash quickly. For instance, companies emerging from bankruptcy in 2024 often saw inventory clearance sales with discounts exceeding 50% on certain product lines.

| Pricing Strategy Aspect | Consumer Electronics (2024 Context) | Commercial IT Solutions (2024 Context) | Post-Bankruptcy (Late 2024 Context) |

|---|---|---|---|

| Primary Driver | Market Competition, Volume | Value Delivered, ROI | Cash Generation, Liquidation |

| Key Tactic | Competitive Pricing, Tiered Discounts | Value-Based, Performance-Linked | Deep Discounts, Clearance Sales |

| Impact on Margins | Often Narrowed by Competition | Potentially Wider, Tied to Value | Severely Compressed or Negative |

4P's Marketing Mix Analysis Data Sources

Our Funai 4P's Marketing Mix Analysis is built upon a foundation of verified company data, including official product releases, pricing strategies, distribution channel information, and promotional campaign details. We leverage insights from public financial reports, brand websites, and industry-specific market research to ensure accuracy.