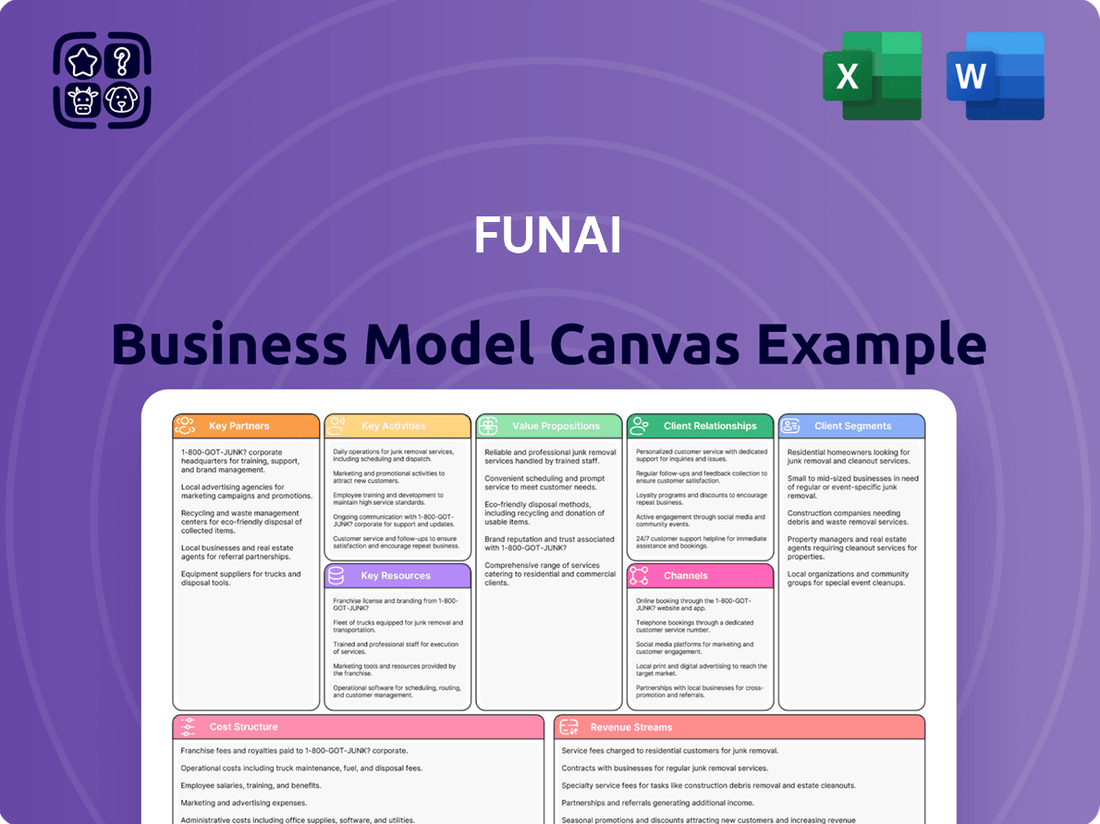

Funai Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Funai Bundle

Unlock the complete strategic blueprint behind Funai's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Funai Electric's history is deeply rooted in Original Equipment Manufacturing (OEM) for other companies. This strategy allowed them to utilize their extensive manufacturing infrastructure and expertise to produce goods for various brands, effectively broadening their market presence without the significant investment required for direct brand building.

These OEM relationships were the bedrock of Funai's operational stability, ensuring consistent production volumes and a reliable revenue stream. For instance, in the fiscal year ending March 2024, a substantial portion of Funai's revenue was derived from these manufacturing services, highlighting the ongoing importance of these strategic alliances in their business model.

Funai Electric's key partnerships with major electronics retailers, including Yamada Denki in Japan and prominent mass retailers across North America, were crucial for the widespread distribution of its Funai-branded and licensed products, such as Philips televisions. These established retail channels offered extensive market access and a direct connection to consumers.

These collaborations were instrumental in Funai's ability to reach a broad customer base, facilitating significant sales volumes. Even with evolving market dynamics, these retail relationships continue to be vital for current sales activities and any potential product liquidation strategies.

Funai Electric relies heavily on its technology and component suppliers to build its diverse product range. Key partnerships include those for crucial elements like LCD panels, which are fundamental to their display products, and specialized thermal inkjet technology for their printing solutions. These collaborations are vital for maintaining product quality and innovation.

Securing dependable supply chains is paramount, especially for specialized materials. For instance, Funai works with fluid manufacturers to ensure a consistent supply of high-quality industrial printing inks, a critical component for their printing business. These relationships are designed to guarantee both the performance and cost efficiency of the final products.

Licensing Partners

Funai Electric’s key partnerships often revolved around licensing established brands, a strategy particularly evident in its consumer electronics division. For instance, Funai secured licensing agreements with major players like Philips and Sanyo. These collaborations were instrumental in enabling Funai to enter and compete in markets such as North America, specifically for product categories like LCD TVs and Blu-ray players.

The strategic advantage of these licensing deals lay in leveraging the pre-existing brand equity and market recognition associated with Philips and Sanyo. This allowed Funai to bypass the significant investment and time typically required to build brand awareness from scratch. By associating its products with trusted names, Funai aimed to capture consumer confidence and accelerate market penetration.

- Philips Licensing: Funai held licenses for Philips, notably for LCD TVs and Blu-ray players in North America, enhancing its market entry and consumer trust.

- Sanyo Brand Association: Similar brand licensing with Sanyo further broadened Funai's reach and product portfolio within the consumer electronics sector.

- Market Penetration Strategy: These partnerships were a core element of Funai's go-to-market strategy, enabling it to quickly establish a presence by capitalizing on established brand loyalty.

- Reduced Brand Building Costs: Licensing significantly reduced the financial burden and time associated with developing and promoting its own brand identity in competitive markets.

Financial and Legal Advisors

Funai Electric's rehabilitation efforts in 2024 heavily rely on strategic alliances with financial and legal advisors. These partnerships are essential for navigating the intricate bankruptcy proceedings and restructuring processes. For instance, engaging specialized legal firms ensures compliance with all regulatory requirements and facilitates the negotiation of debt terms. This is crucial as Funai Electric seeks to stabilize its operations following significant financial challenges.

The collaboration extends to financial institutions that can provide liquidity or new capital, a vital component for any company undergoing rehabilitation. Experts in corporate restructuring are also key, offering guidance on asset management and potential divestitures to streamline operations. These advisors play a pivotal role in developing a viable path forward, aiming to restore financial health and ensure long-term sustainability for the company.

- Financial Advisors: Crucial for securing new financing and managing existing debt structures during rehabilitation.

- Legal Advisors: Essential for navigating bankruptcy laws, creditor negotiations, and compliance with legal frameworks.

- Restructuring Specialists: Provide expertise in operational efficiency, asset disposition, and strategic business model adjustments.

Funai Electric's key partnerships are multifaceted, encompassing OEM manufacturing agreements, retail distribution channels, component suppliers, and crucial brand licensing deals. These alliances have historically been fundamental to their operational model, enabling market access and product development.

In 2024, the company continued to leverage these relationships, particularly in its rehabilitation phase, relying on financial and legal advisors to navigate complex restructuring processes. The success of these partnerships directly impacts Funai's ability to stabilize operations and achieve long-term sustainability.

| Partnership Type | Key Partners | Strategic Importance | 2024 Relevance |

|---|---|---|---|

| OEM Manufacturing | Various electronics brands | Utilizes manufacturing capacity, generates revenue | Continued revenue stream |

| Retail Distribution | Yamada Denki, North American mass retailers | Market access for Funai-branded and licensed products | Facilitates sales and potential product liquidation |

| Component Supply | LCD panel manufacturers, fluid manufacturers | Ensures product quality and innovation, consistent supply of critical materials | Maintains product performance and cost efficiency |

| Brand Licensing | Philips, Sanyo | Leverages brand equity for market penetration, reduces brand building costs | Enhances consumer trust and market entry |

| Rehabilitation Advisors | Financial and legal firms, restructuring specialists | Navigates bankruptcy, secures financing, ensures compliance | Crucial for financial stabilization and future strategy |

What is included in the product

A detailed breakdown of Funai's strategic approach, outlining its customer segments, value propositions, and operational channels.

This model provides a clear, actionable framework for understanding Funai's business, suitable for strategic planning and stakeholder communication.

The Funai Business Model Canvas acts as a pain point reliver by providing a structured, visual framework that simplifies complex business strategies.

It streamlines the process of understanding and articulating a business model, reducing the pain of ambiguity and disorganization.

Activities

Funai's core activities revolve around the design and manufacturing of a diverse range of electronic products. This includes everything from televisions and VCRs to more modern offerings like Blu-ray players and printers, showcasing a history of adapting to technological shifts.

The company operates its own production facilities, emphasizing efficiency through systems like the Funai Production System (FPS). This focus on internal manufacturing allows for greater control over quality and cost.

Managing complex global supply chains is a critical part of Funai's manufacturing operations. This ensures that components are sourced effectively and that finished products can be delivered to market in a cost-efficient manner, maintaining high output standards.

Funai's commitment to ongoing Research and Development is a cornerstone of its business model. This focus drives the creation of innovative products and technologies, exemplified by their advancements in microfluidics, which find applications in industrial printing and the biomedical sector. This dedication to R&D is vital for Funai's strategic diversification into commercial and IT solutions, ensuring they remain competitive in evolving markets.

Funai Electric actively engages in sales and marketing by promoting its own FUNAI brand alongside licensed brands like Philips. This dual approach targets both consumer and business-to-business (B2B) markets, with a significant focus on North America and Japan. The company's strategy involves building robust distribution channels and implementing targeted marketing campaigns to reach its diverse customer base.

In 2024, Funai's sales and marketing efforts are crucial for driving revenue growth. For instance, the company's continued presence in the North American market, a key revenue driver, relies heavily on effective retail partnerships and digital marketing initiatives. Their commitment to brand visibility, both for FUNAI and licensed products, underpins their sales success.

OEM and B2B Solution Provision

Funai Electric's key activities revolve around its OEM and B2B solution provision, a strategic pivot to diversify revenue streams beyond consumer electronics. This involves leveraging its manufacturing prowess to produce goods for other brands, essentially acting as a contract manufacturer.

The company also actively develops and markets specialized B2B products. These include high-performance industrial ink cartridges, crucial for various printing applications, and advanced dental CT scanning devices, catering to the healthcare technology sector. Furthermore, Funai is a supplier of automotive components, highlighting its adaptability across different industrial landscapes.

- OEM Manufacturing: Funai provides manufacturing services for a range of products under other companies' brand names, utilizing its established production capabilities.

- B2B Product Development: The company designs and produces specialized solutions for business clients, such as industrial ink cartridges and dental CT scanners.

- Automotive Component Supply: Funai contributes to the automotive industry by manufacturing and supplying various components.

- Direct Business Sales: A significant part of this activity involves direct sales and relationship management with business customers who require these tailored solutions.

Business Restructuring and Legal Management

Funai's key activities have pivoted significantly due to recent financial headwinds. Navigating bankruptcy proceedings is now a primary focus, demanding meticulous legal and financial oversight to manage existing liabilities effectively. This critical phase involves strategic decision-making to define the company's future operational framework and address its distressed financial state.

The company's restructuring efforts in 2024 are heavily reliant on expert legal counsel to manage the complexities of insolvency and potential rehabilitation. This includes:

- Legal Counsel Engagement: Securing specialized legal expertise to guide through bankruptcy court procedures and compliance.

- Liability Management: Developing strategies to address and potentially renegotiate outstanding debts and creditor claims.

- Operational Restructuring: Identifying core profitable operations for potential continuation or sale, while divesting non-essential assets.

- Stakeholder Communication: Maintaining transparent communication with creditors, employees, and regulatory bodies throughout the process.

Funai's core activities now heavily involve navigating bankruptcy proceedings, a critical process requiring meticulous legal and financial management. This includes developing strategies for liability management and engaging expert legal counsel to guide them through complex insolvency procedures. Operational restructuring is also a key activity, focusing on identifying and potentially continuing profitable operations while divesting non-essential assets.

In 2024, Funai Electric's financial restructuring efforts are paramount. The company is actively managing its liabilities, aiming to address outstanding debts and creditor claims. This includes a strategic review of its asset portfolio, with a focus on divesting non-core or underperforming assets to streamline operations and improve financial health. Stakeholder communication remains a vital activity, ensuring transparency with creditors, employees, and regulatory bodies during this challenging period.

| Key Activity | Description | 2024 Focus |

|---|---|---|

| Bankruptcy Navigation | Managing legal and financial aspects of insolvency proceedings. | Legal counsel engagement, compliance with court orders. |

| Liability Management | Addressing and renegotiating outstanding debts and creditor claims. | Debt restructuring, creditor negotiations. |

| Operational Restructuring | Identifying core profitable operations for continuation or sale. | Divesting non-essential assets, streamlining operations. |

| Stakeholder Communication | Maintaining transparent communication with all parties involved. | Regular updates to creditors, employees, and regulators. |

Full Document Unlocks After Purchase

Business Model Canvas

The Funai Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you can confidently assess the structure, content, and professional formatting before committing. Upon completing your order, you will gain full access to this identical, ready-to-use Business Model Canvas, ensuring no surprises and immediate usability for your strategic planning.

Resources

Funai Electric operates a network of manufacturing facilities, leveraging its proprietary Funai Production System (FPS). This system is designed to optimize efficiency and maintain high quality standards in the production of electronic goods and specialized components. In 2024, Funai continued to focus on enhancing its production capabilities through these integrated physical assets and operational frameworks.

Funai Electric's deep knowledge in thermal inkjet technology, microfluidics, and optical systems is a cornerstone of its intellectual property. This expertise, honed through years of developing products like Blu-ray players and advanced backlight units, forms a significant competitive advantage.

This accumulated know-how directly fuels product innovation and allows Funai to explore diversification into emerging markets. For instance, their advancements in microfluidics could be leveraged in medical devices or advanced printing solutions, demonstrating the broad applicability of their core technological strengths.

Funai's brand licenses, particularly for Philips products, are crucial intangible assets. In 2024, these agreements continued to provide significant market access and consumer trust, especially within North America, a key revenue driver for the company.

Beyond licensed brands, Funai's own FUNAI brand also contributes to its portfolio value. This dual approach allows for diversification and caters to different market segments, leveraging established Philips recognition while building its independent brand equity.

Human Capital and Engineering Talent

Funai Electric's human capital, particularly its engineering and research talent, forms the bedrock of its operations. This skilled workforce, encompassing engineers, researchers, production specialists, and sales professionals, is instrumental in driving innovation and operational excellence.

Their collective expertise is particularly vital in Funai's pursuit of specialized markets, such as medical and industrial solutions. In 2024, the company continued to invest in training and development programs to enhance the capabilities of its approximately 23,000 employees globally, ensuring they remain at the forefront of technological advancements.

- Skilled Engineering Teams: Funai's engineers are key to developing and refining products, especially in high-precision sectors.

- Research and Development Capabilities: Dedicated R&D staff fuel the innovation pipeline, critical for competitive differentiation.

- Production Expertise: Experienced manufacturing personnel ensure efficient and high-quality output, a hallmark of Funai's operations.

- Sales and Marketing Acumen: Effective sales teams are crucial for market penetration and customer relationship management.

Global Sales and Distribution Networks

Funai Electric's global sales and distribution networks are a cornerstone of its business model, leveraging established relationships with mass retailers and distribution channels. These networks are particularly strong in key markets such as North America and Japan, ensuring broad product accessibility.

These extensive networks are critical for Funai's ability to reach both end-consumers and business-to-business clients efficiently. For instance, in 2024, Funai continued to rely on its partnerships with major electronics retailers across North America to distribute its consumer electronics products, a strategy that has historically driven significant revenue.

- Established Retail Partnerships: Funai maintains strong ties with major mass retailers in North America and Japan, facilitating widespread product availability.

- Efficient Distribution Infrastructure: The company utilizes robust logistics and distribution channels to ensure timely delivery to diverse customer segments.

- Market Penetration: These networks are instrumental in Funai's strategy to penetrate and maintain market share in its core geographic regions.

Funai Electric's key resources include its advanced manufacturing facilities powered by the proprietary Funai Production System (FPS), ensuring efficiency and quality. Its intellectual property, particularly in thermal inkjet, microfluidics, and optical systems, provides a significant competitive edge, driving innovation and diversification. The company also benefits from valuable brand licenses, notably for Philips products, which grant substantial market access and consumer trust, especially in North America, alongside its own FUNAI brand equity.

Funai's human capital, comprising skilled engineers, researchers, and production specialists, is fundamental to its operational excellence and innovation. These teams, numbering approximately 23,000 globally in 2024, are crucial for developing new technologies and penetrating specialized markets like medical and industrial solutions. Furthermore, its extensive global sales and distribution networks, particularly strong in North America and Japan, are vital for reaching consumers and business clients through established retail partnerships and efficient logistics.

| Key Resource Category | Specific Assets/Capabilities | 2024 Relevance/Data |

|---|---|---|

| Physical Assets | Manufacturing Facilities, Funai Production System (FPS) | Optimized for efficiency and quality in electronic goods production. |

| Intellectual Property | Thermal Inkjet, Microfluidics, Optical Systems Expertise | Drives innovation in areas like medical devices and advanced printing. |

| Intangible Assets | Philips Brand Licenses, FUNAI Brand Equity | Facilitates market access and consumer trust, especially in North America. |

| Human Capital | Skilled Engineering, R&D, Production, Sales Teams | Approx. 23,000 employees globally; crucial for innovation and market penetration. |

| Distribution Networks | Global Sales & Distribution Channels, Retail Partnerships | Strong presence in North America and Japan, ensuring broad product accessibility. |

Value Propositions

Funai historically excelled in delivering consumer electronics that balanced superior cost performance with robust functionality, particularly within the imaging device sector. This approach fostered significant customer trust by making advanced technology accessible to a wider audience.

In 2024, this commitment continues, with Funai focusing on providing reliable and affordable electronics. For instance, their range of printers and related consumables are designed to offer competitive pricing without compromising on essential performance, a strategy that resonates with budget-conscious consumers and small businesses alike.

Funai's reliable OEM manufacturing services offered other brands a dependable solution by leveraging its established production capabilities and inherent efficiency. This value proposition allowed partners to access high-quality manufacturing without the significant capital investment and operational complexities of building their own infrastructure.

In 2024, Funai continued to be a key player in OEM services, particularly in consumer electronics and related components. The company's ability to scale production and maintain stringent quality control standards made it an attractive partner for brands looking to outsource manufacturing. This focus on reliability and cost-effectiveness directly addressed a critical need in the market for efficient supply chain solutions.

Funai provides tailored print solutions for businesses and original equipment manufacturers (OEMs), focusing on specialized industrial and commercial applications. This includes advanced thermal inkjet technology for high-resolution printing, crucial for sectors with strict compliance requirements.

Their industrial ink cartridges are designed for demanding B2B environments, enabling precise and reliable marking and coding on a variety of materials. For instance, Funai's solutions are utilized in industries like pharmaceuticals and food and beverage, where traceability and legibility are paramount.

Advanced Medical and Automotive Components

Funai's advanced medical and automotive components represent a strategic diversification, offering specialized, high-tech solutions. For instance, in the medical field, they provide dental CT scanning devices, catering to a critical need for precise diagnostic imaging. This segment taps into the growing global dental equipment market, which was projected to reach over $10 billion by 2024.

In the automotive sector, Funai leverages its optical technology expertise to develop advanced components and modules. These are crucial for modern vehicles, supporting features like advanced driver-assistance systems (ADAS) and enhanced infotainment. The automotive sensor market, a key area for these components, was expected to see significant growth, with some estimates placing it above $40 billion globally in 2024.

- Dental CT Scanning Devices: Addressing high-precision diagnostic needs in the medical sector.

- Optical-Technology-Based Components: Enhancing automotive capabilities with advanced modules.

- Market Penetration: Targeting specialized, high-value segments within both industries.

- Technological Advancement: Driving innovation through optical and imaging solutions.

Adaptability and Diversification

Funai Electric's strategic shift from consumer electronics to commercial products, IT, and solutions highlights its adaptability. This pivot allows the company to tap into growing markets and leverage its manufacturing and technological expertise in new areas, ensuring continued relevance.

This diversification strategy is crucial for navigating evolving consumer preferences and technological advancements. By expanding into commercial sectors, Funai can mitigate risks associated with a single product category.

- Adaptability: Funai's move into IT solutions and commercial products showcases its ability to pivot in response to market shifts.

- Diversification: Expanding beyond traditional consumer electronics reduces reliance on a single market segment.

- Leveraging Core Competencies: The company applies its established strengths in manufacturing and technology to new, high-growth sectors.

- Market Responsiveness: This strategy demonstrates a proactive approach to meeting changing customer and industry demands.

Funai's value proposition centers on delivering cost-effective, high-performance electronics and leveraging its manufacturing prowess for OEM services. They also specialize in advanced industrial printing solutions and have strategically diversified into high-tech medical and automotive components, demonstrating adaptability and a focus on specialized, high-value markets.

| Value Proposition Area | Key Offering | Target Market | 2024 Relevance/Data Point |

|---|---|---|---|

| Cost-Effective Electronics | Reliable and affordable consumer electronics | Budget-conscious consumers, small businesses | Continued focus on competitive pricing for printers and consumables. |

| OEM Manufacturing | Dependable and efficient production for partners | Brands seeking outsourced manufacturing | Key player in consumer electronics manufacturing, offering scalability and quality control. |

| Industrial Print Solutions | Specialized printing for B2B applications | Industries requiring precise marking and coding (e.g., pharma, F&B) | High-resolution thermal inkjet technology for demanding environments. |

| Advanced Components | High-tech solutions in medical and automotive | Medical device manufacturers, automotive industry | Dental CT scanners (medical market > $10B in 2024); ADAS/infotainment components (automotive sensor market > $40B in 2024). |

| Strategic Diversification | Pivot to commercial products and IT solutions | Growing commercial and IT sectors | Mitigating risks and leveraging core competencies in new, high-growth areas. |

Customer Relationships

Funai Electric’s customer relationships with mass retailers, such as Yamada Holdings in Japan, are primarily transactional. This means the focus is on the exchange of goods for payment, emphasizing high sales volumes and a smooth, efficient flow of products through the retail channel.

These relationships are governed by standard business agreements that detail product supply, pricing, and promotional activities. For instance, in 2024, Funai’s sales to major electronics retailers are critical for achieving its revenue targets, with contracts often including provisions for marketing support and inventory management to ensure popular models are readily available to consumers.

Funai cultivates dedicated relationships with its business clients, particularly in its commercial, IT, and solutions divisions. This direct engagement ensures specialized sales support and technical assistance tailored to the unique needs of each enterprise. For instance, in 2024, Funai reported a significant increase in B2B client retention rates, attributing this success to their proactive support model.

Funai Electric's relationships with Original Equipment Manufacturer (OEM) clients are anchored in long-term contracts and a deep foundation of trust. These aren't just transactional engagements; they often involve joint product development efforts, where Funai leverages its manufacturing expertise to bring OEM designs to life, ensuring consistent quality and reliable supply. This collaborative approach fosters mutual business success.

Maintaining these critical OEM partnerships demands robust communication channels and an unwavering focus on shared objectives. For instance, in 2024, Funai continued to emphasize its role as a dependable manufacturing partner, a strategy that has historically yielded stable revenue streams. The company's ability to adapt to evolving OEM needs, from consumer electronics to industrial components, underscores the strength of these enduring relationships.

Crisis Management and Stakeholder Communication

Funai Electric is actively managing its customer relationships through transparent communication during its bankruptcy and rehabilitation. This includes keeping creditors, shareholders, and employees informed about the company's progress and challenges.

The company's strategy focuses on managing expectations and maintaining trust with all stakeholders. This is crucial for navigating the complex financial restructuring process and outlining a path forward.

- Creditor Relations: Funai is providing regular updates on asset recovery and repayment plans to its creditors, aiming to secure their cooperation for the rehabilitation process.

- Shareholder Engagement: Transparent disclosure of financial performance and restructuring milestones is key to managing shareholder confidence and expectations regarding future value.

- Employee Communication: Maintaining open dialogue with employees about operational changes and job security is vital for morale and continued business operations during this period.

- Public Relations: Funai is working to manage its public image by communicating its commitment to overcoming financial difficulties and its long-term vision for the company.

Customer Service and After-Sales Support

Funai Electric, despite ongoing restructuring, remains dedicated to robust customer service and after-sales support for its previously sold consumer electronics. This commitment is crucial for preserving brand loyalty and customer confidence, particularly for those who have already invested in Funai products. In 2024, maintaining these support channels is a key differentiator in a competitive market.

- Brand Reputation: Continued after-sales support directly impacts how customers perceive Funai's reliability and commitment, even as the company evolves.

- Customer Retention: Existing customers who receive good service are more likely to remain loyal and consider future Funai purchases.

- Partnership Support: Funai's retail partners also benefit from reliable after-sales service, strengthening their own customer relationships.

- Trust Building: Providing ongoing support for older products demonstrates a long-term value proposition, fostering deeper customer trust.

Funai Electric's customer relationships span various segments, from transactional dealings with mass retailers to deeply integrated partnerships with OEMs and dedicated support for business clients. The company also navigates crucial stakeholder communications during its rehabilitation, emphasizing transparency to maintain trust.

Channels

Major electronics retailers like Yamada Denki in Japan and prominent mass retailers across North America are key channels for Funai's consumer electronics, including televisions and Blu-ray players. These partnerships are crucial for achieving broad market reach and ensuring Funai's products are accessible to a wide customer base.

Funai leverages dedicated direct sales teams to engage with business clients for its commercial products, IT solutions, and manufacturing services. These teams are crucial for providing specialized consultations and tailored solutions to industries like automotive, medical, and general manufacturing.

This direct approach fosters deep client relationships, enabling Funai to understand specific needs and deliver customized offerings. For instance, in 2024, Funai's direct sales efforts in the automotive sector were instrumental in securing contracts for advanced display technologies, contributing to a significant portion of their B2B revenue.

Funai leverages the significant online presence of its mass retail partners, creating an indirect but crucial digital sales channel. These retailers, like Walmart and Amazon, offer a vast marketplace where consumers can readily purchase Funai-branded electronics and products featuring licensed brands. This strategy allows Funai to reach a broad online audience without the direct overhead of managing its own e-commerce infrastructure.

In 2024, online retail continued its dominance, with e-commerce sales projected to reach over $2.7 trillion globally. Funai's reliance on these established platforms means it benefits from their existing customer traffic and sophisticated digital marketing capabilities. For instance, a substantial portion of consumer electronics purchases in the US, estimated to be over 50% in 2024, occurs online, underscoring the importance of these indirect channels for Funai's sales volume.

Specialized Industry Trade Shows and Events

Specialized industry trade shows and events are crucial for Funai to directly engage with its B2B customer base. These platforms allow for the tangible demonstration of commercial and specialized solutions, fostering deeper understanding and interest among potential clients. For instance, in 2024, the Consumer Electronics Show (CES) saw significant investment from technology companies in showcasing their latest advancements, with many B2B solutions being highlighted alongside consumer products.

These events are invaluable for relationship building. Funai can meet face-to-face with key decision-makers, understand their specific needs, and position its offerings as tailored solutions. This direct interaction is far more impactful than purely digital marketing for complex B2B sales cycles. Industry reports from 2024 indicate that B2B technology spending at trade shows remains robust, with companies prioritizing in-person demonstrations for evaluating new solutions.

- Direct Engagement: Trade shows offer unparalleled opportunities for Funai to showcase its commercial and specialized solutions directly to a targeted B2B audience.

- Relationship Building: These events are vital for forging and strengthening relationships with potential clients, facilitating direct communication and understanding of needs.

- Technology Showcase: Funai can leverage these platforms to unveil new technologies and product innovations, generating buzz and interest within the industry.

- Market Insights: Participation provides valuable insights into competitor activities and emerging market trends, informing future business strategies.

Global Distribution Network

Funai Electric's global distribution network is a cornerstone of its business model, enabling efficient market access and supply chain management. This extensive network spans multiple continents, facilitating both the procurement of materials and the delivery of finished goods to a wide customer base.

The company's international footprint includes production facilities and sales operations strategically located to serve key markets. For instance, as of fiscal year 2023, Funai maintained a significant presence in Asia, North America, and Europe, allowing for localized production and responsive sales efforts. This global reach is crucial for navigating diverse consumer demands and regulatory environments.

- Global Reach: Funai operates production sites and sales offices across Asia, North America, and Europe, providing access to diverse consumer markets.

- Supply Chain Optimization: The international network allows for strategic sourcing of components and efficient logistics, reducing costs and lead times.

- Market Penetration: This distribution capability is vital for Funai's strategy to sell products like printers and electric components in various economic regions.

- Adaptability: Funai's global presence enables it to adapt to regional market trends and consumer preferences, a key factor in its competitive strategy.

Funai's channels are diverse, encompassing major electronics retailers for broad consumer reach and direct sales teams for specialized B2B engagement. Online retail through partners is critical, especially given the over 50% of US consumer electronics sales occurring online in 2024. Specialized trade shows are also vital for B2B relationship building and product showcases.

Customer Segments

Historically, Funai's mass market consumers were individuals and families looking for reliable, budget-friendly electronics. This segment prioritized value, seeking functional televisions, VCRs, and later Blu-ray players that offered good performance without a premium price tag. Their purchasing decisions were heavily influenced by affordability and widespread availability through major retail chains.

Original Equipment Manufacturer (OEM) clients represented a significant B2B customer base for Funai, with these companies relying on Funai's manufacturing prowess to produce their own branded electronics. These partnerships were crucial, leveraging Funai's established production lines and technical know-how to bring diverse electronic products to market.

In 2024, the contract manufacturing sector continued to be a vital component of the global electronics supply chain. Companies like Funai, with their extensive experience, were instrumental in enabling other brands to scale production efficiently. This segment thrives on reliability and cost-effectiveness, with OEMs carefully selecting partners based on quality control and manufacturing capacity.

Industrial and commercial businesses represent a key customer segment for Funai, particularly those with stringent printing requirements. This includes sectors like food and beverage, pharmaceuticals, and manufacturing, where precise, high-resolution coding on packaging is essential for compliance and traceability. For instance, the global industrial printing market was valued at approximately $58.4 billion in 2023 and is projected to grow, highlighting the demand for specialized solutions.

Funai addresses these needs by offering customized ink cartridges and advanced printing technologies designed for durability and accuracy in demanding environments. Companies in these industries rely on Funai's solutions to ensure product integrity and meet regulatory standards, such as those mandated by the FDA for pharmaceutical labeling.

Medical and Healthcare Providers

Funai Electric's expansion into the medical sector targets healthcare providers, offering specialized equipment such as advanced dental CT scanning devices. This strategic diversification leverages Funai's manufacturing expertise to address the critical needs of medical professionals.

The demand for high-precision and reliable medical technology is substantial. For instance, the global dental imaging market was valued at approximately USD 2.5 billion in 2023 and is projected to grow steadily, indicating a robust demand for devices like Funai's CT scanners.

- High Precision: Medical providers require equipment with exceptional accuracy for diagnostics and treatment planning.

- Reliability: Downtime in healthcare settings can have severe consequences, making dependable technology paramount.

- Regulatory Compliance: Medical devices must adhere to strict industry standards and certifications, a key consideration for Funai's offerings.

- Specialized Needs: Funai caters to niche medical equipment requirements, differentiating itself in the market.

Automotive Manufacturers

Automotive manufacturers represent a burgeoning customer segment for Funai, particularly those requiring advanced optical components and integrated modules. This strategic expansion leverages Funai's core competencies in optical technology to serve the evolving needs of the automotive industry.

Companies like Toyota, a major global automotive manufacturer, are increasingly incorporating sophisticated optical systems for advanced driver-assistance systems (ADAS), infotainment, and interior lighting. Funai's expertise in optical solutions positions it to supply critical components to such players, aligning with the trend towards more technologically integrated vehicles.

- Optical Components for ADAS: Supplying specialized lenses and optical sensors crucial for cameras used in adaptive cruise control, lane keeping assist, and autonomous driving features.

- Infotainment Displays: Providing optical films and modules that enhance the clarity, brightness, and touch responsiveness of in-car display systems.

- Vehicle Integration Modules: Developing and supplying integrated optical modules that combine multiple functionalities, simplifying assembly for automotive manufacturers.

Funai's customer base extends to businesses seeking reliable contract manufacturing for their electronic products. This B2B segment values Funai's established production capabilities and cost-efficiency in bringing various electronics to market.

Industrial and commercial clients represent a key segment, especially those needing specialized printing solutions for product coding and traceability. The global industrial printing market was valued at approximately $58.4 billion in 2023, underscoring the demand for such services.

The medical sector, particularly providers requiring high-precision dental CT scanning devices, is a growing area of focus. The global dental imaging market was valued at around USD 2.5 billion in 2023, indicating significant potential for Funai's specialized equipment.

Automotive manufacturers are increasingly important, seeking advanced optical components for ADAS and infotainment systems. Funai's expertise in optical technology positions it to supply critical parts to major players in this evolving industry.

Cost Structure

Manufacturing and production represent a substantial cost driver for Funai, encompassing the procurement of essential components like LCD panels, the labor involved in product assembly, and the general overheads of maintaining its worldwide production facilities. In 2024, the company continued to focus on optimizing these expenditures.

Funai's efficiency initiatives, such as the Funai Production System (FPS), are specifically designed to streamline manufacturing processes and reduce waste, thereby directly impacting the cost structure. This focus on operational excellence is crucial for maintaining competitiveness in the electronics market.

Funai Electric's commitment to innovation fuels significant Research and Development (R&D) expenses. These costs are crucial for developing new products and advancing existing technologies, such as their work in microfluidics, which enables precise fluid control for various applications. This investment is key to their strategy of diversifying into new business sectors and maintaining a competitive edge.

The company's R&D budget directly supports a team of highly skilled engineers and scientists, whose expertise is vital for groundbreaking discoveries. Furthermore, substantial capital is allocated towards state-of-the-art laboratories and specialized equipment necessary for cutting-edge research and product prototyping. For instance, Funai's reported R&D spending in fiscal year 2024 was approximately ¥15.3 billion, reflecting this ongoing dedication to technological advancement.

Funai Electric's cost structure heavily relies on expenses tied to promoting its products, nurturing relationships with retailers and business-to-business clients, and overseeing the intricate logistics of product distribution. These outlays are crucial for market penetration and customer retention.

Advertising campaigns, the salaries and commissions for the sales force, and the costs associated with shipping and warehousing are significant components of these sales, marketing, and distribution expenditures. For instance, in the fiscal year ending March 2024, Funai Electric reported operating expenses that included substantial investments in these areas to maintain its market presence and reach its customer base.

Administrative and Overhead Costs

Administrative and overhead costs are the bedrock supporting Funai's operations. These include essential general administrative expenses and the salaries for corporate staff, which are crucial for maintaining the company's structure. In 2024, companies across various sectors saw these fixed costs remain a significant portion of their budget, often representing a substantial percentage of total operating expenses, underscoring their importance in business stability.

The IT infrastructure, vital for data management, communication, and operational efficiency, also falls under this category. Beyond salaries and IT, other operational overheads like office rent, utilities, and professional services are necessary to keep the business functioning smoothly. These fixed expenses provide the consistent operational framework Funai relies upon.

- General administrative expenses: Covering day-to-day operational necessities.

- Corporate salaries: Compensation for essential management and administrative personnel.

- IT infrastructure: Investment in technology for data, communication, and operational support.

- Other operational overheads: Including rent, utilities, and professional services supporting overall business functions.

Restructuring and Legal Costs

Funai Electric's current financial situation necessitates substantial spending on restructuring and legal matters. These costs are directly tied to navigating bankruptcy proceedings and pursuing rehabilitation efforts.

Expenses include significant legal fees, advisory services for financial and operational restructuring, and potential costs associated with debt management or asset sales. For instance, during 2024, companies undergoing similar financial distress often allocate millions of dollars to external legal counsel and financial advisors to manage complex insolvency processes.

- Legal Fees: Costs incurred for lawyers specializing in bankruptcy and corporate restructuring.

- Advisory Costs: Expenses for financial advisors, turnaround consultants, and investment bankers.

- Restructuring Expenses: Potential costs for implementing new operational models or managing asset divestitures.

Funai's cost structure is significantly influenced by its manufacturing operations, research and development, sales and marketing efforts, and administrative overheads. The company also incurs costs related to restructuring and legal matters, particularly in light of its financial situation.

| Cost Category | Key Components | 2024 Relevance |

|---|---|---|

| Manufacturing & Production | Component procurement, assembly labor, facility overheads | Optimizing expenditures through initiatives like the Funai Production System (FPS). |

| Research & Development (R&D) | New product development, technological advancement (e.g., microfluidics), skilled personnel, lab equipment | Approximately ¥15.3 billion in fiscal year 2024, crucial for innovation and diversification. |

| Sales, Marketing & Distribution | Advertising, sales force compensation, shipping, warehousing | Significant investment to maintain market presence and customer reach. |

| Administrative & Overheads | General administration, corporate salaries, IT infrastructure, rent, utilities | Essential fixed costs providing operational stability; a substantial portion of total operating expenses. |

| Restructuring & Legal | Legal fees, advisory services, debt management, asset sales | Significant spending to navigate bankruptcy proceedings and rehabilitation efforts. |

Revenue Streams

Funai Electric historically generated significant revenue from selling consumer electronics like LCD TVs, Blu-ray players, and printers. These products were primarily distributed through retail channels, reaching a broad consumer base.

In 2024, Funai continues to leverage its brand partnerships, notably with Philips, to drive sales of televisions and audio equipment. The company's strategic focus remains on delivering quality products at competitive price points within the consumer electronics market.

Funai's OEM manufacturing services generate revenue by producing electronic goods for other companies, which are then marketed and sold under the client's brand name. This revenue stream is directly tied to the volume of production and the specific manufacturing fees negotiated with each client.

For instance, in fiscal year 2024, Funai Electric reported that its Original Equipment Manufacturer (OEM) business, which includes these manufacturing services, continued to be a significant contributor to its overall financial performance, reflecting ongoing demand for its production capabilities in the electronics sector.

Funai's revenue from commercial and industrial products is a key part of its diversified strategy. This segment includes the sale of specialized items like industrial ink cartridges, vital for various printing solutions used by businesses. For instance, in the fiscal year ending March 2024, Funai Electric reported total net sales of ¥241.6 billion, with a significant portion coming from its printing solutions business, which encompasses these industrial products.

Sales of Medical and Automotive Devices/Components

Funai's revenue streams are diversifying, with a growing emphasis on high-tech sectors. The company is seeing increased sales from its medical devices, particularly dental CT scanning equipment, which caters to a growing demand for advanced diagnostic tools in healthcare. This expansion into specialized medical technology represents a significant new avenue for revenue generation.

Furthermore, Funai is leveraging its optical technology expertise to supply components to the automotive industry. As vehicles become more sophisticated with advanced sensor systems and digital displays, the demand for high-quality optical components is on the rise. This strategic move into automotive supply chains is a key driver of Funai's evolving revenue model.

- Medical Devices: Sales of dental CT scanning devices are a new and growing revenue source.

- Automotive Components: Provision of optical technology-based components for vehicles.

- Sector Growth: These new business areas are contributing increasingly to overall revenue.

Licensing and Royalties (Historical/Potential)

Funai Electric, known for its electronics manufacturing, has historically leveraged its intellectual property. While not a primary disclosed revenue stream in recent reports, the potential for licensing its technology or established brands to other manufacturers remains a viable avenue. This could involve granting rights for components, manufacturing processes, or even brand usage on specific product lines, generating ongoing royalty payments.

For instance, in the past, companies like Funai have profited from licensing agreements in areas such as audio-visual technology. While specific 2024 figures for Funai's licensing revenue are not publicly detailed, the broader electronics industry saw significant activity. In 2023, for example, patent licensing deals in the semiconductor sector alone were valued in the billions, indicating the substantial financial potential of such arrangements for established technology firms.

- Potential for Technology Licensing: Funai could license its manufacturing expertise or specific technological innovations to third parties.

- Brand Licensing Opportunities: Leveraging its brand recognition, Funai might license its name for use on products manufactured by others.

- Royalty Generation: Successful licensing agreements would result in recurring royalty income based on sales of licensed products.

- Intellectual Property Monetization: This stream represents a way to monetize Funai's research and development investments.

Funai's revenue streams are a blend of traditional consumer electronics, OEM services, and expanding into higher-tech sectors like medical devices and automotive components. The company's fiscal year 2024 net sales reached ¥241.6 billion, demonstrating the scale of its operations across these diverse areas.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Consumer Electronics | Sales of TVs, audio equipment, and printers, often through brand partnerships like Philips. | Continues to be a core business, leveraging established distribution and brand recognition. |

| OEM Manufacturing | Producing electronic goods for other companies under their brand names. | A significant contributor, reflecting ongoing demand for Funai's production capabilities. |

| Commercial & Industrial Products | Includes items like industrial ink cartridges for business printing solutions. | A key part of diversification, with printing solutions forming a substantial portion of sales. |

| Medical Devices | Sales of specialized equipment such as dental CT scanning devices. | Represents a growing revenue avenue in the high-tech healthcare sector. |

| Automotive Components | Supplying optical technology-based components to the automotive industry. | Leveraging optical expertise to meet increasing demand for advanced vehicle systems. |

Business Model Canvas Data Sources

The Funai Business Model Canvas is informed by a blend of internal financial data, comprehensive market research, and strategic operational insights. These diverse sources ensure that each component of the canvas is grounded in factual information and reflects the current business landscape.